[Revised March 2021]

Even as the pandemic disrupted life and economies across the globe, securitisation activity in different countries scaled new highs, at least in certain asset classes.

Securitisation in USA

Agency and non-agency RMBS

Agency RMBS was the star performer, at least in terms of new issuance volumes. Data available till Nov 2020 suggests that the new issuance volumes for 2020 will be about double of what it was in 2019, and the highest ever achieved in history. There are two reasons primarily responsible, of which the first one is quite obvious – historically low mortgage rates, particularly for refinancing activity. Second reason is that during the pandemic, there was extensive use of technology in mortgage origination and documentation, which led to far faster and simpler turnarounds for the borrowers.

Non-agency RMBS, however, is expected to end about 40% lower than 2019 volumes. Origination levels were halted because of shut-downs and the prevailing economic situation. Lenders put caution on the forefront as 30-day delinquencies continued to soar up.

Figure 1: US RMBS Issuance [By author, based on SIFMA data]

As may be clear, the issuance of agency MBS in 2020 was almost double of last year, whereas as non-agency securities were 45% lower or almost half of the number in 2019.

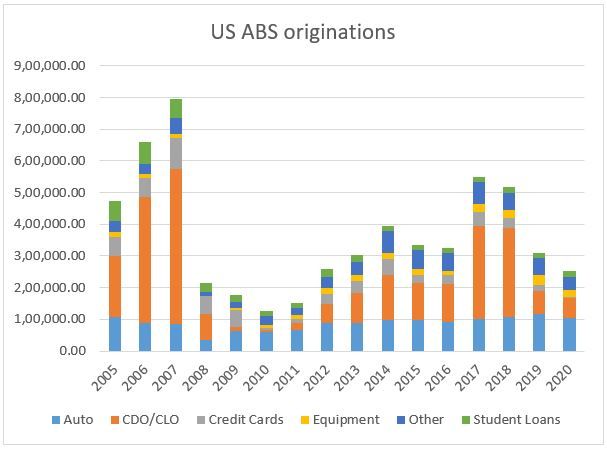

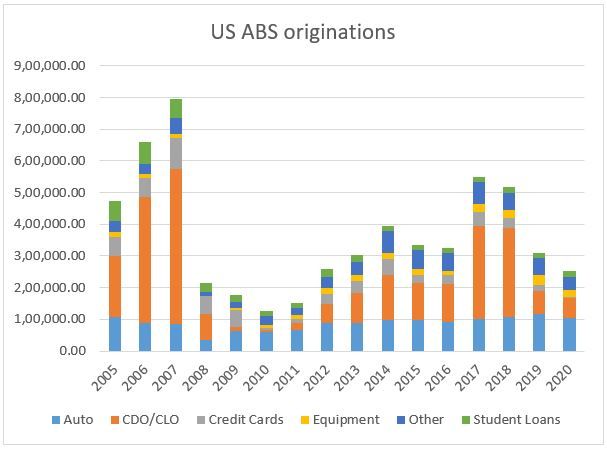

Asset-backed securities

The issuance volumes across all other classes of asset backed securities were down – from about 6% in case of auto-ABS to about 90% in case of credit cards ABS.

Figure 2: ABS issuance in USA

The CLO market was among the asset classes very badly affected, with the 2020 issuance less than 40% of the number in 2019. The decline in origination volumes of asset classes like credit cards is attributed to tighter lending standards by banks, and of course, lesser spending by individuals on travel or amusement, due to lock down.

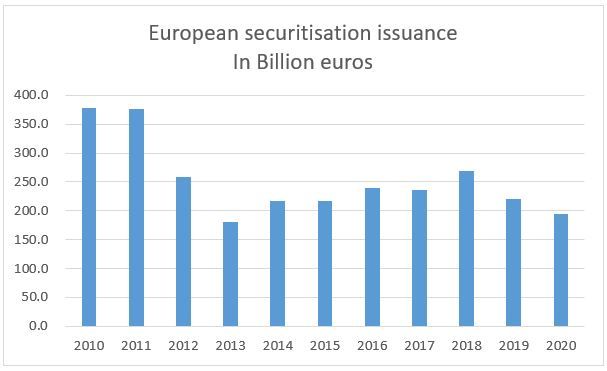

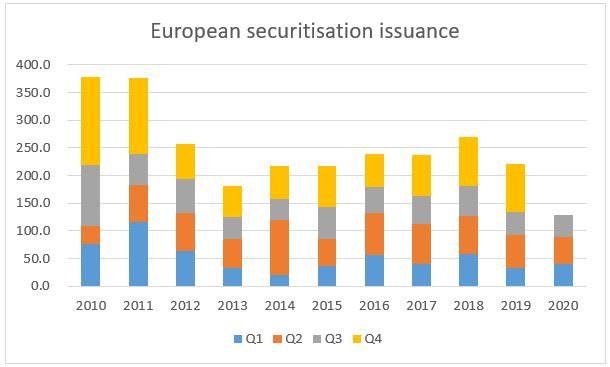

Securitisation in Europe

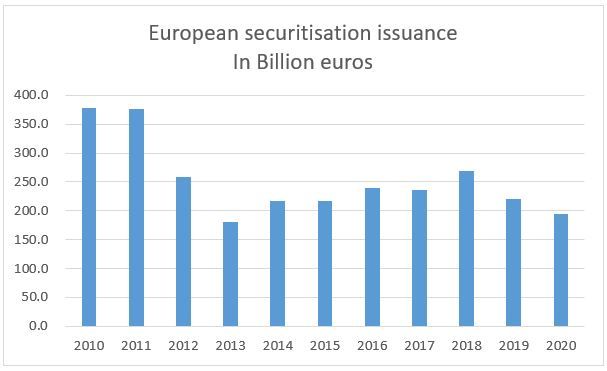

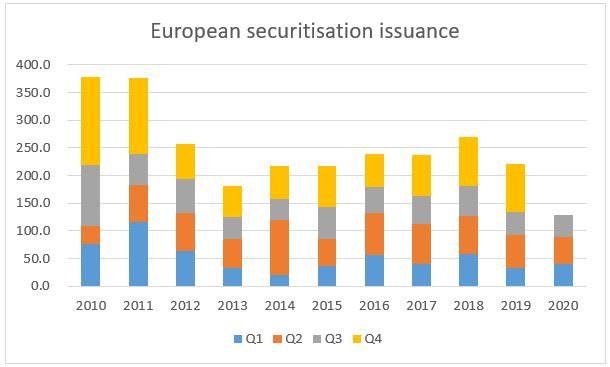

Euro area will end with a GDP contraction estimated at 7.7% in 2020[1].

As per data prepared by AFME, new issuance in 2020 in Europe was down by about 11.9% compared to 2019[2].

EU regulators proposed some amendments to securitisation regulations, by amending Capital Requirements Regulations. “Securitisation can play an important role in enhancing the capacity of institutions to support the economic recovery, providing for an effective tool for funding and risk diversification for institutions. It is therefore essential in the context of the economic recovery post COVID-19 pandemic to reinforce that role and help institutions to be able to channel sufficient capital to the real economy.”[3] Accordingly, three amendments are proposed to securitisation regulatory framework: more risk-sensitive treatment for STS on-balance-sheet securitisation; removal of regulatory constraints to the securitisation of non-performing exposures; and recognition of credit risk mitigation for securitisation positions.

Figure 3: European securitisation issuance

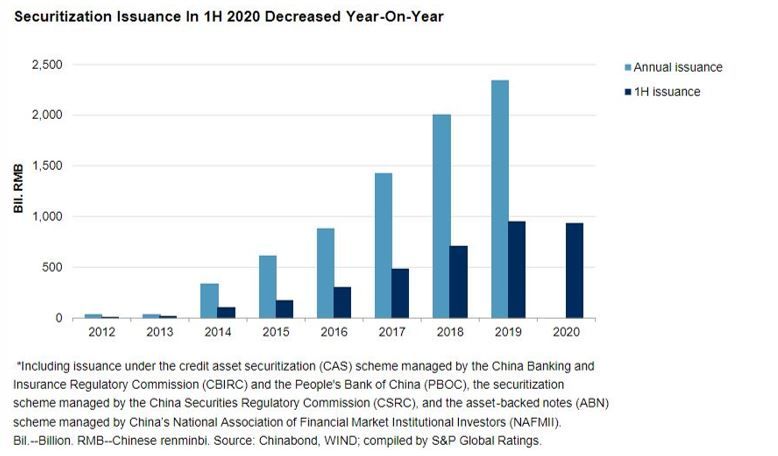

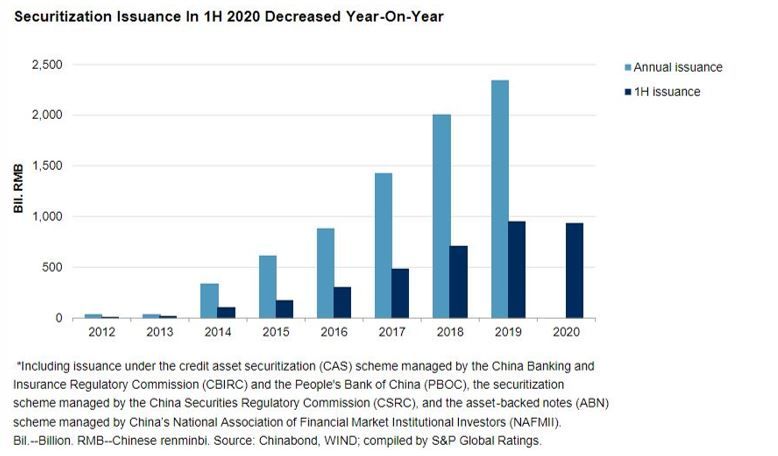

Securitisation in China

Securitisation in China is expected to be about 10-15% lower than the volumes in 2019. A report from S&P recorded first half of 2020 to be almost the same as first half of 2019, but given the concerns and tightened lending by banks, it is expected that lower RMBS issuance will keep overall issuance levels low in 2020[4].

Figure 4: Securitisation Issuance in China – from S&P report

Securitisation in India

Indian securitisation statistics are typically collated on April-March basis. For Q2, Q3 and Q4 of calendar year 2020, securitisation activity [in Indian parlance, securitisation also includes bilateral portfolio transfers, called direct assignment] was highly subdued, as shadow-banking entities which are the major originators of transactions had stopped lending due to the prevailing lock-down. In addition, there were moratoriums imposed by the RBI whereby payments under existing loans were permitted to be withheld for a period of 5 months.

However, once the lockdowns have gradually been lifted, there is a very strong resurgence of economic activity. The Govt. had provided a sovereign guarantee for an additional 20% lending on existing lending facilities, subject to limits. While the non-banking financial entities are not needing significant funding by way of securitisation, there is a strong investor appetite.

This period has also been associated with defaults or credit events by some of the originators, and sale of the ABS investments held by some mutual funds. Hence, the market has seen servicer transitions, as also tested the (il)liquidity of investments in securitisation transactions.

Rating activity

As may be expected, there have been major rating actions during the year as performance of most asset classes was disrupted due to the pandemic. Rating agency S&P reported 2551 structured finance rating actions, which included 1950 downgrades owing to the impact of the pandemic[5]. Moody’s, in a report, states that once Covid-led payment holidays abate, there will be increasing pressures on retail-focused ABS transactions. RMBS transactions, consumer ABS etc are likely to see rising delinquencies.

Moody’s also forecasts the default rates in non-investment grade corporates to increase to 9.7% (trailing average of 12 months) by March, 2021. This will be the highest default rate after 2009. This will result into substantial pressure on CLOs.[6]

[1] Moody’s estimate

[2] https://www.afme.eu/Publications/Data-Research/Details/AFME-Securitisation-Data-Report-Q4-2020

[3] https://oeil.secure.europarl.europa.eu/oeil/popups/printficheglobal.pdf?id=716379&l=en

[4] https://www.spglobal.com/ratings/en/research/articles/200811-china-securitization-performance-watch-2q-2020-the-worst-may-have-passed-11604587

[5] https://www.spglobal.com/ratings/en/research/articles/201218-covid-19-activity-in-global-structured-finance-as-of-dec-11-2020-11782903

[6] https://www.moodys.com/researchdocumentcontentpage.aspx?docid=PBS_1249099

Link to related articles: