Participation in loan exposure by lenders

Anita Baid | anita@vinodkothari.com

Introduction

The Reserve Bank of India (RBI) has issued the new guidelines, viz. Master Directions- Reserve Bank of India (Transfer of Loan Exposures) Directions, 2021 and Master Directions- Reserve Bank of India (Securitisation of Standard Assets) Directions, 2021, on September 4, 2021, that replaces and supersedes the existing regulations on securitisation and direct assignment (DA) of loan exposures. The new directions have been made effective immediately which introduces several new concepts and compliance requirements.

The TLE Directionshave consolidated the guidelines with respect to the transfer of standard assets as well as stressed assets by regulated financial entities in one place. Further, the scope of TLE Directions covers any “transfer” of loan exposure by lenders either as transferer or as transferees/acquirers. In fact, the scope contains an outright bar on any sale or acquisition other than under the TLE Directions, and outside permitted transferors and transferees, apart from securitisation transactions.

Notably, the TLE Directions refer to all types of loan transfers, including sale, assignment, novation and loan participation. While the loan market in India is quite familiar[1] with assignments and novations, ‘loan participation’ to some, might appear to be an innovation by TLE Directions. However, loan participation is not a new concept, and is quite popular in international loan markets, as we discuss below.

This article discusses the general concept of loan transfer and specifically delves into the ‘loan participation as a mode of such transfer.

Loan Transfers: Assignment vs. Novation vs. Loan Participation

One of the important amendments under the TLE Directions has been the insertion of the definition of “transfer”, which is reproduced herein below-

“transfer” means a transfer of economic interest in loan exposures by the transferor to the transferee(s), with or without the transfer of the underlying loan contract, in the manner permitted in these directions;

Explanation: Consequently, the transferee(s) shall “acquire” the loan exposures following a loan transfer.

This definition is customised to suit the objectives of the TLE Directions – that is, the TLE Directions would cover all forms of transfers where “economic interest” is transferred, but the legal ownership may or may not be transferred. This definition is specific to these Directions intended essentially to cover the transfer of economic interest, and is different from the common law definition of ‘transfer’.

The provisions of TLE Directions are applicable to all forms of transfer of loans, irrespective of whether the loan exposures are in default or not. However, the TLE Directions limit the mode of transfer of stressed assets. Novation and assignment are the only ways of transferring stressed assets, whereas, in case of loans not in default, loan participation is also a mode of transfer. The said modes of loan transfers that have been permitted are not new and have existed even before.

By inclusion of “loan participation” in the TLE Directions for the transfer of loans not in default means that the loans could be transferred by transferring an economic interest even without the transfer of legal title. However, in cases of loan transfers other than loan participation, legal ownership of the loan has to mandatorily be transferred.

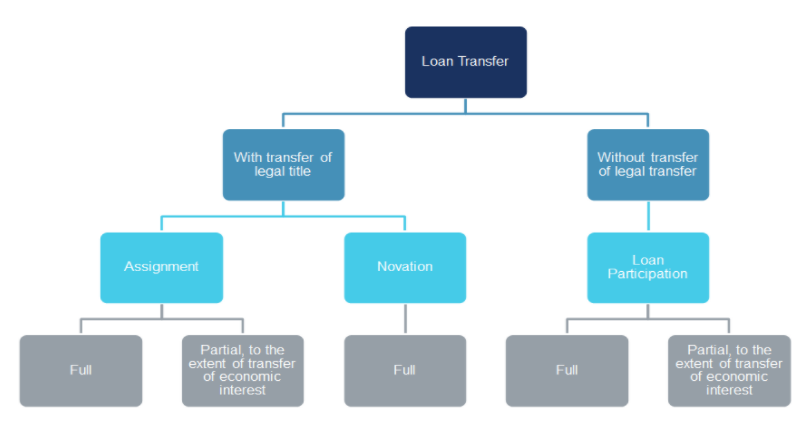

The graphic below summarises the various modes permissible mode of transfer of loans not in default, as per the TLE Directions:

In the case of assignments and novations, the assignee or transferee becomes the lender on record either by virtue of the assignment agreement (along with notice to the borrower) or by becoming a party to the underlying agreement itself. On the contrary, in the case of loan participation, the transfer is solely between the originator and the participant or transferee and thus creates no privity between the participant and the ultimate borrower. Under the participation arrangement, it is an understanding that the originator or lender on record passes to the participant whatever amount it receives from the borrower. Hence, by virtue of the transfer of the economic interest, there is a trust relationship created between the originator and the participant.

The concept of Loan Participation

It is important to understand participation as a mode of transfer of economic interest under the TLE Directions. TLE Directions define loan participation as –

“loan participation” means a transaction through which the transferor transfers all or part of its economic interest in a loan exposure to transferee(s) without the actual transfer of the loan contract, and the transferee(s) fund the transferor to the extent of the economic interest transferred which may be equal to the principal, interest, fees and other payments, if any, under the transfer agreement;

Provided that the transfer of economic interest under a loan participation shall only be through a contractual transfer agreement between the transferor and transferee(s) with the transferor remaining as the lender on record.

Provided further that in case of loan participation, the exposure of the transferee(s) shall be to the underlying borrower and not to the transferor. Accordingly, the transferor and transferee(s) shall maintain capital according to the exposure to the underlying borrower calculated based on the economic interest held by each post such transfer. The applicable prudential norms, including the provisioning requirements, post the transfer, shall be based on the above exposure treatment and the consequent outstanding.

Based on the aforesaid definition, it is essential to note the following-

- A loan exposure can be said to consist of two components- economic interest and legal title

- The economic interest in a loan exposure is not dependent on the legal title and can be transferred without a change in the lender on record

- In case of transfer of economic interest without legal title, the borrower interface shall be maintained entirely with the lender on record- hence, one of the benefits of loan participation would be that any amendments to the terms of the loan or restructuring could be done by the lender on record without involving the transferee

- The loan participation cannot be structured with priorities since the same may lead to credit enhancement- which is prohibited

- To the extent of loan participation based on the economic interest held post the transfer, income recognition, asset classification and provisioning must be done by the transferor and transferee, respectively

Note also, that para 12 of TLE Directions states that in loan participations, “by design”, the legal ownership remains with the originator (referred to as ‘grantor’ under TLE Directions), while whole or part of economic interest is passed on to the transferee (referred to as “participant” under TLE Directions).

The following is therefore understood as regards loan participation –

- Legal ownership is necessarily retained by the grantor, while it is only the ‘economic interest’ or a part of it, which is transferred to the participant.

- As such, the originator remains the ‘face’ for the borrower, and is, therefore, called “lender on record”.

- The TLE Directions do not prescribe any proportion (maximum/minimum) for which participation can happen. Though the Directions say that “all or part” of economic interest can be transferred. Also, the law seems flexible enough not to put any kind of restrictions on the categories or limits of economic interest which can be transferred. For instance, economic interest involves the right to receive repayments of principal as well as payments of interest (among others). The grantor can simply delineate these rights and grant participation for one but retain the other.

- The participant shall fund the grantor only to the extent of economic interest transferred in the former’s favour and nothing more.

- The participation has to be backed by a formal arrangement (agreement) between the parties

Post the “transfer”, the participant has no recourse on the grantor for the transferred interest. The recourse of both the grantor and the participant lies on the underlying borrower. Both these parties are required to maintain capital accordingly.

Essentially, the loan participation agreement, setting forth in detail the arrangement between the original lender and the participant, should specify the following-

- that the transaction is a purchase of a specified percentage of a loan exposure by the participant,

- the terms of the purchase of such participation,

- the rights and duties of both parties,

- the mechanism of holding and disbursing funds received from the borrower,

- the extent of information to be shared with the participant,

- the extent of right on collateral in the participated loan provided by the borrower, and

- procedures for exercising remedies and in the event of insolvency by any party, and clarification that the relationship is that of seller/purchaser as opposed to debtor/creditor

Is Loan Participation a True Sale?

The essential feature of loan participation is that the lender originating the loan remains in its role as the nominal lender and continues to manage the loan notwithstanding the fact that it may have sold off most or even all of its credit exposure. True Sale means that a sale truly achieves the objective of a sale, and being respected as such in bankruptcy or a similar situation. Securitisation and direct assignment transactions have inherently been driven by financing motives but they are structured as sale transactions.

Essentially, the TLE Directions are entirely based on this crucial definition of ‘transfer’ which is stressing on the transfer of an economic interest in a loan exposure. Accordingly, even without transferring the legal title, the loan exposure could be transferred. Hence, the age-old concept of ensuring true sale in case of direct assignment transaction seems to have been done away with.

However, the question that arises is whether in the case of secured loans, loan participation arrangements would transfer the right to collateral with the original lender or is it merely creating a contractual right against the originator towards proceeds of the collateral. This issue of the characterization of loan participation and when participations are true sales of loan interests has been discussed by the Iowa Supreme Courtin the case of Central Bank and Real Estate Owned, L.L.C. v. Timothy C. Hogan, as Trustee of the Liberty and Liquidating Trust et. al., 891 N.W.2d 197 (Iowa 2017).

In this case, Liberty Bank extended loans between 2008 and 2009 to Iowa Great Lakes Holding, L.L.C. secured by the real estate and related personal property of a resort hotel and conference center. Liberty entered into participation agreements with five banks covering an aggregate of 41% (approximately) of its interest in these loans. The participation agreements were identical in terms; each provided that Liberty sold and the participant purchased a “participation interest” in the loans. It was held that Liberty had transferred an undivided interest in the underlying property, including the mortgage created on the property, pursuant to the participation agreements. The court ruled against Liberty Bank, reasoning that the participation agreements transferred “all legal and equitable title in Liberty’s share of the loan and collateral” to the participating banks. The participants were given undivided interests in the loan documents. In addition, the court noted that the default provisions emphasized that the participants shared in any of the collateral for the loan.

Based on the discussion, the court suggested that participants should use the language of ownership, undivided fractional interest and trust, as well as avoid risk dilution devices to ensure that their interest is treated as an ownership and not a mere loan.

Loan Participation in US and UK

In the international financial market, loan participation has been a predominant component for a long time. The reason for favouring loan participation is that it allows participants to limit its exposure upto a particular credit and enable diversification of a portfolio without being involved in the servicing of loans.

The English law (prevalent in the UK) has widely adopted the Loan Market Association (LMA) recommendation that states- the lender of record (or grantor of the participation) must undertake to pay to the participant a percentage of amounts received from the borrower. This explicitly provides that the relationship between the grantor and the participant is that of debtor and creditor, provided the right of the participant to receive monies would be restricted to the extent of the assigned portion of any money received from any obligor. Hence, in case the grantor becomes insolvent, the participant would not enjoy any preferred status as a creditor of the grantor with respect to funds received from the borrower than any other unsecured creditor of the grantor. There are methods to structure transactions that enable participants to mitigate the risk of insolvency of the guarantor, as provided in the LMA’s paper ‘Funded Participations – Mitigation of Grantor Credit Risk’, however, these methods add complexity to what many regard as routine trades and are not generally adopted.

In US banking parlance, these instruments are known simply as “participations”. The Loan Syndications and Trading Association (LSTA) had proposed that the relationship between grantor and participant shall be that of seller and buyer. Neither is a trustee or agent for the other, nor does either have any fiduciary obligations to the other. This Agreement shall not be construed to create a partnership or joint venture between the Parties. In no event shall the Participation be construed as a loan from participant to grantor. There have also been cases to draw a distinction between ‘true participation’ and ‘financing’. In a true participation, the participant acquires a beneficial ownership interest in the underlying loan. This means that the participant is entitled to its share of payments from the borrower notwithstanding the insolvency of the grantor (so the participant does not have to share those payments with the grantor’s other creditors) even though the beneficial ownership does not create privity between the participant and the borrower. On the other hand, a participation that is characterised as financing would have the same consequences as discussed above, which is to be considered at par with any other unsecured creditor of the grantor.

The following four factors typically indicate that a transaction is a financing rather than true participation:

- the grantor guarantees repayment to the participant; failure by a participant to take the full risk of ownership of the underlying loan is a crucial indication of financing rather than a true participation

- the participation lasts for a shorter or longer-term than the underlying loan that is the subject of the participation;

- there are different payment arrangements between the borrower and the grantor, on the one hand, and the grantor and the participant, on the other hand; and

- there is a discrepancy between the interest rate due on the underlying loan and the interest rate specified in the participation.

Apart from the similarity in the basic structure and business impetus for participation, the legal characterisation of these arrangements and some of their structural elements are different under UK and US law.

Conclusion

The recognition of this concept of loan participation would expand the scope for direct assignment arrangements and hence, there seems a likely increase in the numbers as well. However, it must be ensured that such arrangements are structured with care and keeping in mind the learnings from precedents in the markets outside India, to avoid any discrepancies and disputes in the future between the originator and the participant.

________________________________________________________________________________________________________________________________

[1] In India, during Q1 2020-21, DA transactions were around Rs.5250 crore, which was 70% of the total securitisation and DA volumes. With a growth of 2.3 times in the total volume of securitisation and DA transactions (due to the pandemic the number may be an outlier), in Q1 2021-22, the DA transactions aggregated to Rs.9116 crores, with a reduced share of 53% [Source: ICRA Research]

We invite you all to join us at the Indian Securitisation Summit, 2021. You are sure to meet the who’s-who of the Indian structured finance space – the originators, investors, rating agencies, legal counsels, accounting experts, global experts, and of course, regulators. The details can be accessed here

Leave a Reply

Want to join the discussion?Feel free to contribute!