About the Summit

Banks and non-banking finance companies (NBFCs) are showing ever-more complementarity, making the most of their respective capabilities. While bank finance to NBFCs is on a record high, there are several ways in which banks extend their outreach through NBFCs – securitisation, direct assignments, loan sourcing, co-lending, etc. Securitisation markets have clearly matured to grow beyond the priority-sector lending confines, with new asset classes attracting yield-searching investors. There is a clearly surging international interest in India’s financial markets – securitisation seems to be the key to that.

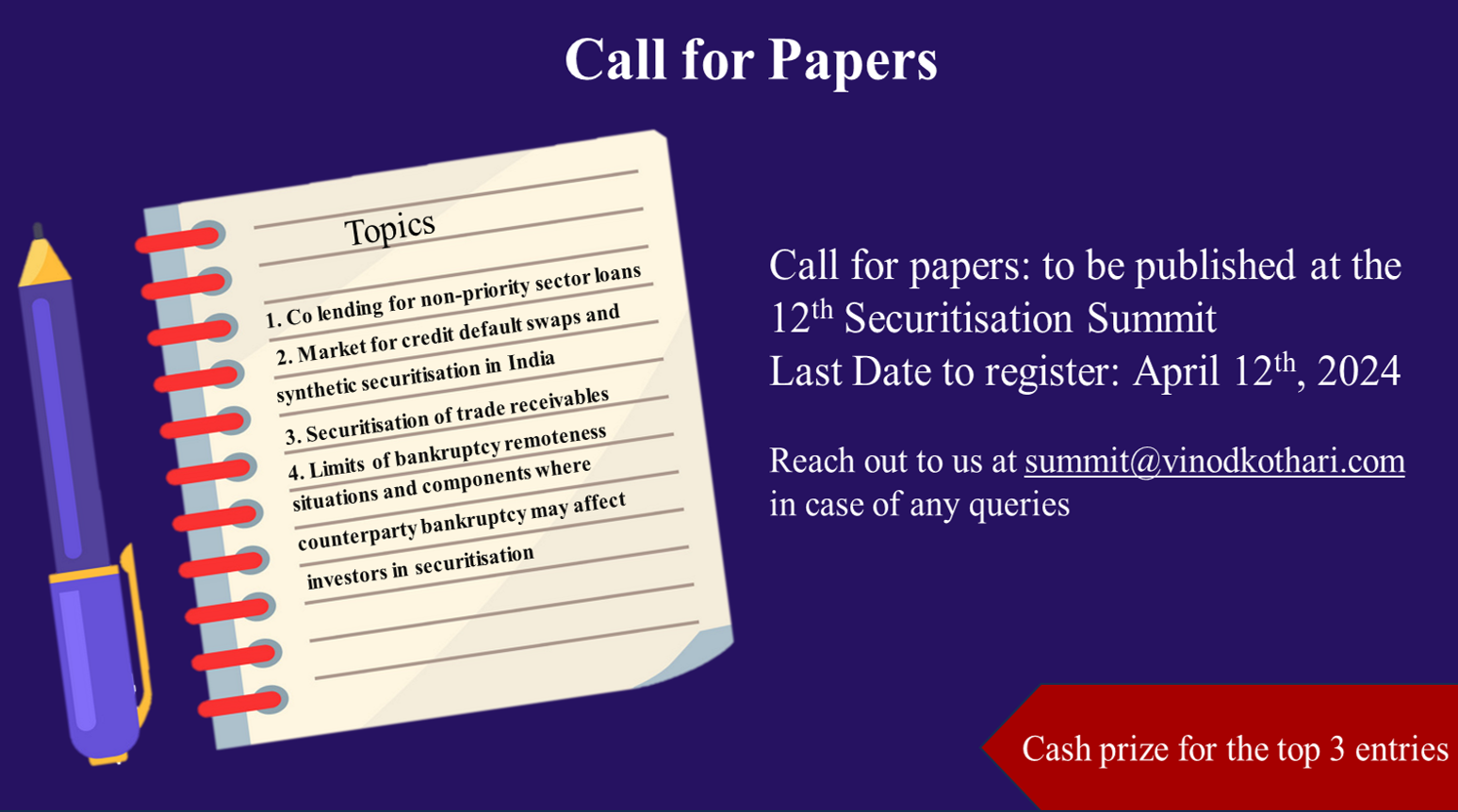

India Securitisation Summit, by Indian Securitisation Foundation and Vinod Kothari Consultants, is unquestionably the most sought-after Industry forum. We are happy to present the 12th edition of the Summit. Celebrating innovation, inclusion, and integration.

As every year, the Summit shall bring together all relevant stakeholders – issuers, investors, consultants, analysts, rating agencies, market markers, regulators, law firms, and all else who matter.

Watch this space for more developments!

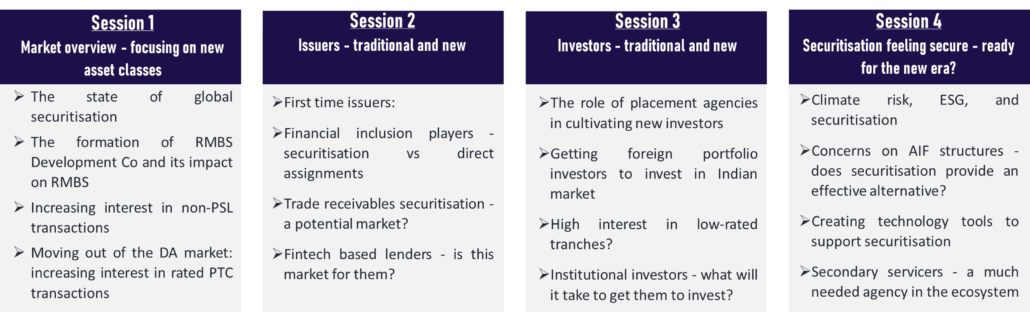

Agenda

Pre-Summit Workshop- May 14, 2024

Publications launched during the 11th Summit

Link: https://vinodkothari.com/2023/05/publication-11th-securitisation-summit/

Our recent publications

Guide to Structured Finance

[details]

Securitisation & Transfer of Loan Exposures

– A Comprehensive Guide [details]

Our resources on new Securitisation and Transfer of Loan Directions

- Lecture on basics of Securitisation available on YouTube

- Securitisation Primer

- Evolution of securitisation – Genesis of MBS

- Global Securitisation Markets in 2021: A Robust Year for Structured Finance

- Securitisation Glossary

- After 15 years: New Securitisation regulatory framework takes effect

- One stop RBI norms on transfer of loan exposures

- Loan Participations: The Rising Star of Loan Markets

- FAQs on Securitisation of Standard Assets

- FAQs on Transfer of Loan Exposure

- Legal Issues in Securitization

- Has the cover fallen off Covered Bonds?

- Security Token Offerings & their Application to Structured Finance

- Resurgence of synthetic securitisations: Capital-relief driven transactions scale new peaks

- Understanding the budding concept of green securitization

Reach us:

Qasim Saif | qasim@vinodkothari.com | +91-7987691533

Kaushal Shah | kaushal@vinodkothari.com | +91-9769069336