Understanding the budding concept of green securitization

- Awaiting standardization and widespread adoption

– Payal Agarwal, Senior Executive ( payal@vinodkothari.com) Amidst the upward trends in green financing and developing complex securitization structures, the evolution of green securitization comes naturally and inevitably. While the concept may not be very familiar in the country at present, in view of the increasing attention on the need of sustainability and demands for sustainable financing, both from the corporates and the investors, green securitization is likely to witness a successful market in India. In this article, we try to develop an idea on green securitization with its present position throughout the world and the potential future of green securitization.

Meaning

Green securitization, as the name suggests, would mean securitization of green financial assets. Though there is no universally acceptable definition of green securitization, green securitization may be defined as such arrangements in which either the collateral on the loans are on green assets, or the cash flows are generated from a pool of assets or projects that are either green themselves or proceeds from this pool are earmarked to finance green projects.

Types of green securitisation[1]

As defined above, green securitization may satisfy the “green” criteria in either of the three ways –

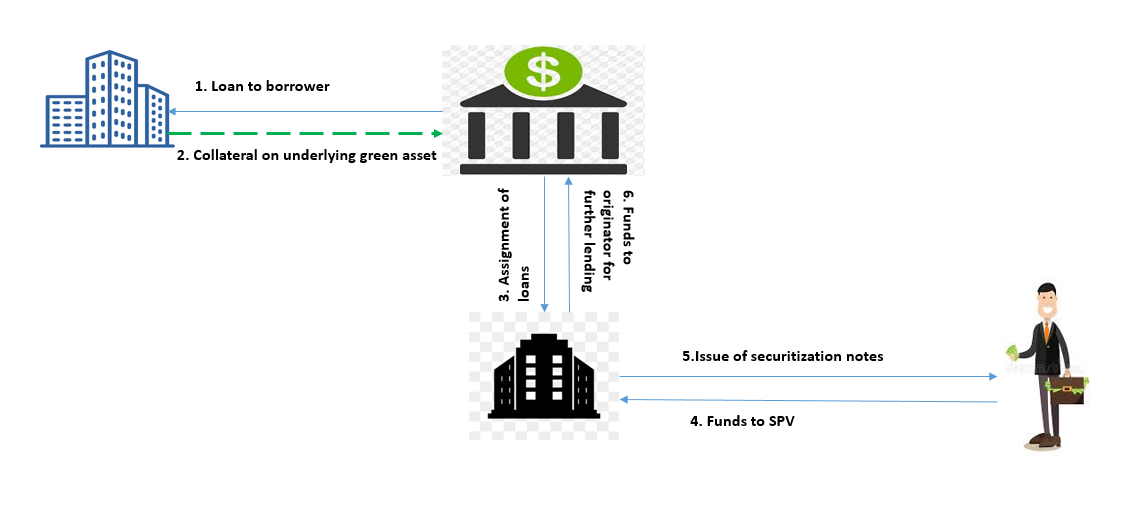

- Securitisation with green collaterals

In this type of green securitization, the assets on which security is created are green assets, that is, low carbon assets. These may include asset-backed security (ABS) such as electric vehicle loans/leases, solar leases and SME loans to fund environmental projects etc, or mortgage backed security (MBS) such as mortgage on green buildings, energy-efficient homes etc. 2. Loans are utilized for green projects

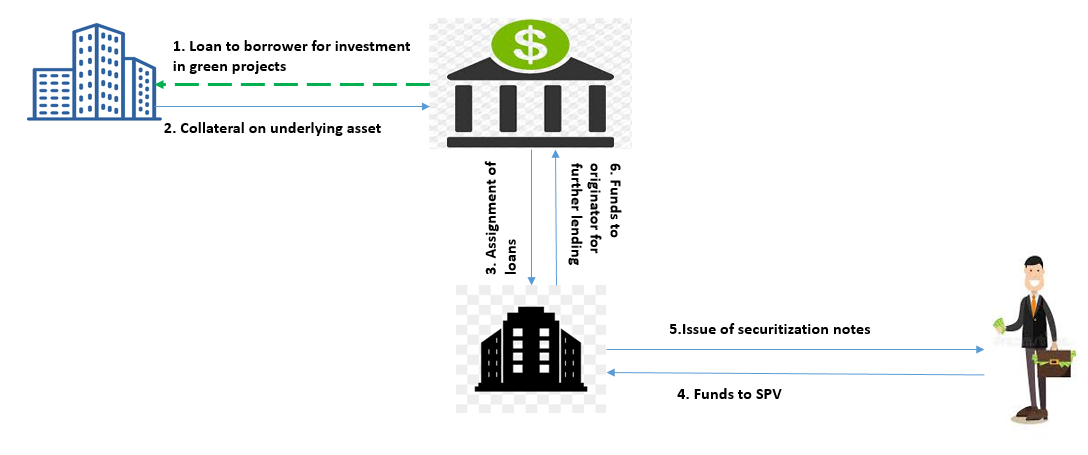

In this type of green securitization, the assets on which security is created are green assets, that is, low carbon assets. These may include asset-backed security (ABS) such as electric vehicle loans/leases, solar leases and SME loans to fund environmental projects etc, or mortgage backed security (MBS) such as mortgage on green buildings, energy-efficient homes etc. 2. Loans are utilized for green projects  Under this type of green securitization, the loans (which are pooled for the purpose of securitization) disbursed by the originator to the borrowers are to be utilized for the development of green projects. 3. Note proceeds are used to invest in green projects

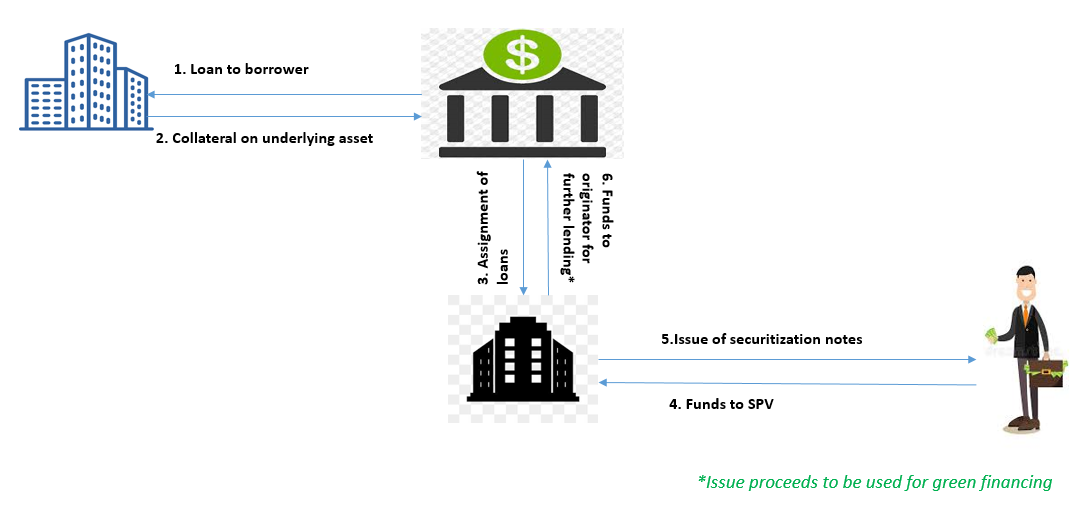

Under this type of green securitization, the loans (which are pooled for the purpose of securitization) disbursed by the originator to the borrowers are to be utilized for the development of green projects. 3. Note proceeds are used to invest in green projects  This type of green securitization requires the originator to utilize the proceeds out of securitization notes in financing of green projects, either through direct investment or by providing green loans. Green securitization may also include securitization of green bonds under the Collateralized Debt Obligations (CDO).

This type of green securitization requires the originator to utilize the proceeds out of securitization notes in financing of green projects, either through direct investment or by providing green loans. Green securitization may also include securitization of green bonds under the Collateralized Debt Obligations (CDO).

Present position and development in green securitization market

A report on green securitization released by FitchRatings in April this year states that the green securitization issuance has shown an increase in the last five years, and there has been a material increase in its volume in China, France, the Netherlands and the US. Here, let us study the present position and recent developments in the securitization market across the world with respect to green securitization.

European Union (EU) and UK

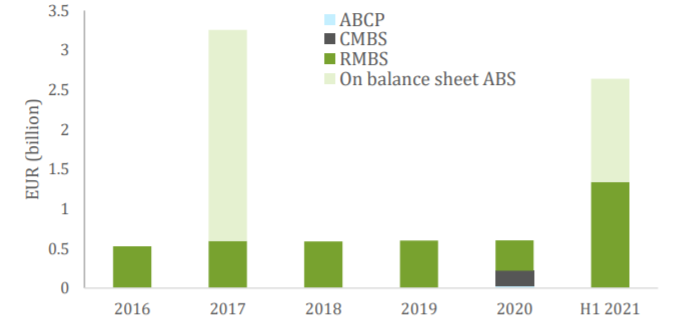

Regulation (EU) 2017/2402 of the EU provides a regulatory framework for securitization in EU. A consultation paper has also been released in July, 2021 in order to invite public comments and recommendations on developing the securitization framework including consideration to a sustainable securitization. Similar contribution is also been sought by the Call for Evidence document released by HM Treasury of the UK in June, 2021. Para 4 of Article 22 of the Regulations, which deals with requirements relating to transparency, obligates the originator and sponsor, in case of securitisation where the underlying exposures are residential loans or auto loans or leases, to publish the available information related to the environmental performance of the assets financed by the residential loans or auto loans or leases. The ESG Finance Report on the European Sustainable Finance published for the Q2 of 2021 demonstrates some motivating figures for sustainable securitization. The Report states that ESG securitisation issuance in H1 2021 reached EUR 5.2bn on two social RMBS deals, two green RMBS deals, and an on-balance sheet ABS. This represents a substantial increase from EUR 0.2 bn issued in 2020FY.  A remarkable rise in the green securitization can be noticed from the chart, which shows that the figures for the H1 2021 outperforms the consolidated figures for previous year 2020. European Green Securitisation Issuance by asset class Source – ESG Finance Report Q2 2021

A remarkable rise in the green securitization can be noticed from the chart, which shows that the figures for the H1 2021 outperforms the consolidated figures for previous year 2020. European Green Securitisation Issuance by asset class Source – ESG Finance Report Q2 2021

China

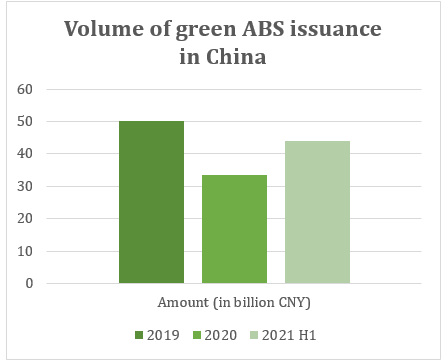

Securitization in China is not governed by one consolidated framework and is fragmented into various common laws applicable to securitizations as well. The Climate Bonds Initiative and the International Institute for Sustainable Development (IISD), in the year 2016, published four discussion papers, one of them being on the ‘Roadmap for China: Using green securitisation, tax incentives and credit enhancements to scale green bonds’. The Report discussed on the development of green securitization and green ASB as a subset of the securitisation in China. Green ASB issuance in China dates back to 2005, though the same may not have been labelled as such at the time of such issuance. China’s first labelled green ABS was issued by Industrial Bank of China in 2016 through the securitisation of a small pool of just 42 green loans. By 2019, green ABS worth CNY 50.1 billion were issued for the year. Issuance dropped in 2020 to CNY 33.5 billion amid the Covid-19 pandemic, but has picked up in 2021 with an aggregate of CNY 44.1 billion in the HY1[2]. The developments in 2021 include first green auto loan ABS issued by SAIC Finance, and the first internationally rated green ABS issued by BYD Auto Finance. This also shows that the green-ABS in China is mostly based on NEVs as on date. Overall, the proportion of green ABS increased from 1.7 percent of total green bond issuance in 2016 to 11 percent in 2020. The Financial Services Special Report on China’s Green Finance Market, published in late 2018, also witnesses China’s commitment to developing a strong green finance market with green securitization as an evolving component, among all.

Sustainable Development (IISD), in the year 2016, published four discussion papers, one of them being on the ‘Roadmap for China: Using green securitisation, tax incentives and credit enhancements to scale green bonds’. The Report discussed on the development of green securitization and green ASB as a subset of the securitisation in China. Green ASB issuance in China dates back to 2005, though the same may not have been labelled as such at the time of such issuance. China’s first labelled green ABS was issued by Industrial Bank of China in 2016 through the securitisation of a small pool of just 42 green loans. By 2019, green ABS worth CNY 50.1 billion were issued for the year. Issuance dropped in 2020 to CNY 33.5 billion amid the Covid-19 pandemic, but has picked up in 2021 with an aggregate of CNY 44.1 billion in the HY1[2]. The developments in 2021 include first green auto loan ABS issued by SAIC Finance, and the first internationally rated green ABS issued by BYD Auto Finance. This also shows that the green-ABS in China is mostly based on NEVs as on date. Overall, the proportion of green ABS increased from 1.7 percent of total green bond issuance in 2016 to 11 percent in 2020. The Financial Services Special Report on China’s Green Finance Market, published in late 2018, also witnesses China’s commitment to developing a strong green finance market with green securitization as an evolving component, among all.

USA[3]

Just like China, USA does not have a defined green securitization framework. However, the volume of green securitization is very high in US as compared to various other developing countries[4]. A large proportion of such ABS issuance in US consists of Property Assessed Clean Energy (PACE) model of US, which has been designed to finance energy efficiency and renewable energy improvements. As on 1st quarter of 2018, the PACE issuance in Europe aggregates to USD4.3bn. Further, 89% of Solar ABS by deal volume have been issued in the US, as of March, 2018 with 2017 being the peak year of solar ABS issuance in the world. Some of the major developments in green securitisation in the US relate to solar energy and electric vehicle. For instance, Mosaic, a leading financing platform for U.S. residential solar and energy-efficient home improvements, completed $221 million Solar Loan Securitization in October, 2021, which is 11th such project in row, the first one being in 2012.[5] Similarly, Ford Motor Company and its financing subsidiary, Ford Motor Credit Company, has also introduced a sustainable financing framework which will cover a variety of both unsecured and securitization funding transactions, including ESG bonds issued by Ford and Ford Credit to finance environmental and social projects. The proceeds are committed to be utilised for clean transportation, clean manufacturing, making lives better and community revitalisation.[6]  Source – Climate Bonds Initiative Sustainable Debt Market Summary, H1 2021 The above figure demonstrates how USA clearly leads the world in its green issuance. Further, undoubtedly, US has been capturing the largest securitization market in the world. Therefore, green securitization is sure to witness unprecedented growth in the US.

Source – Climate Bonds Initiative Sustainable Debt Market Summary, H1 2021 The above figure demonstrates how USA clearly leads the world in its green issuance. Further, undoubtedly, US has been capturing the largest securitization market in the world. Therefore, green securitization is sure to witness unprecedented growth in the US.

Benefits of green securitization

Green securitization contains the benefits of both “green” and “securitization”.

- Contributes to sustainable securitization – Green securitization, as a subset of securitization contribute to the inclusion of sustainability in securitization. The same may therefore also prove beneficial for countries around the world in satisfying their commitments towards environment and climate change (Paris Agreement etc).

- Introduces liquidity in green finance – It helps in freeing up funds of the originator that provides green finance and therefore helps in the liquidity of green finance.

Challenges and potential solutions in developing green securitization

- Absence of a standard eligibility criteria – Unlike the issuance of green bonds and green loans, which are usually guided by the Green Bond Principles and Green Loan Principles of ICMA respectively, green securitization presently does not have any specific eligibility criteria and trigger points as to what constitutes a green securitization and what not. This leads to varying differences among the practices prevalent around the world.

- Absence of specific regulations – Presently, green securitization is governed by the extant securitization regulations of respective countries. Considering the need of specific regulations in this behalf, efforts may be made to specify some special regulatory provisions applicable to green securitization. This may be ensured through a dedicated chapter or provisions on green securitization in the extant securitization regulations.

- Lack of incentives – In order to support the growth of green securitization, the present regulatory regime needs to be supplemented with some incentives and relaxations for green securitization, which may be in the form of tax incentives, relaxations in networth and liquidity ratio requirements etc.

- Disclosure and reporting requirements – Besides the usual financial performance indicators, green securitization should require the originator to make disclosures on environmental and sustainability fronts.

- Need for third party review – The lender may not be competent enough to review and verify the green component in a deal, and therefore, third party reviews are required to verify the greenery of a securitization deal.

- Use of green securitization to finance non-green assets – As already discussed above, the green element in the green securitization may exist in any one of the three stages – collateral for loans, use of loans by borrower or use of freed up funds by originator. Therefore, it is seen that while the collateral is created on green assets, the loan proceeds are used for non-green /high carbon assets. This may result in defeating the main intent of green securitization, and may ultimately lead to the creation of high carbon assets on the remains of green assets.

Concluding remarks

The regulatory framework needs a lot of developments to ensure effectiveness and efficiency of green securitization. However, the idea of green securitization will no doubt, prove beneficial to a country in terms of economic and environmental aspects. The impact investors are the driving force behind green securitization, who have huge funds to be disposed for the impact creation. Further, with the institutional investors increasingly recognizing impact creation, beyond wealth creation in their investment decisions, green securitization is expected to have a long way to go. For a country like India, which is showing a consistent upward shift in the issuance of green and sustainable bonds and green financing, green securitization will definitely prove to be of great relevance and importance.

Our resource center on Business Responsibility and Sustainable Reporting can be accessed here –

[1]https://www.hoganlovells.com/-/media/hogan-lovells/pdf/2020-pdfs/2020_02_21_italy-insights_dcm_spring_2020.pdf [2] https://www.regulationasia.com/china-abs-market-a-magnet-for-global-investors/ [3] The data mostly pertains to the year 2018 and efforts have been made to complement them with the recent data, so far as available publically. [4] https://www.climatebonds.net/files/reports/green_securitisation_cbi_conference_final.pdf [5] https://www.prnewswire.com/news-releases/mosaic-completes-221-million-solar-loan-securitization-with-another-record-setting-green-bond-offer-301403799.html [6] https://www.greencarcongress.com/2021/11/20211105-ford1.html

Leave a Reply

Want to join the discussion?Feel free to contribute!