Global Securitisation Markets in 2021: A Robust Year for Structured Finance

-Subhojit Shome, Executive | finserv@vinodkothari.com

Overview

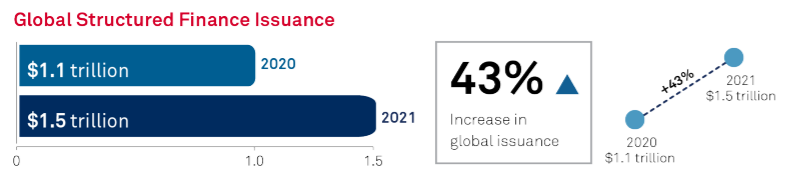

The structured finance space exhibited robust growth during 2021, as the world entered the COVID-19 endemic period. This growth was largely driven by supportive regulatory and policy initiatives aimed at overcoming the negative economic effects of the pandemic, the emergence of green finance initiatives and a general rise in economic activity.

Securitisation in the USA

Agency and non-agency RMBS

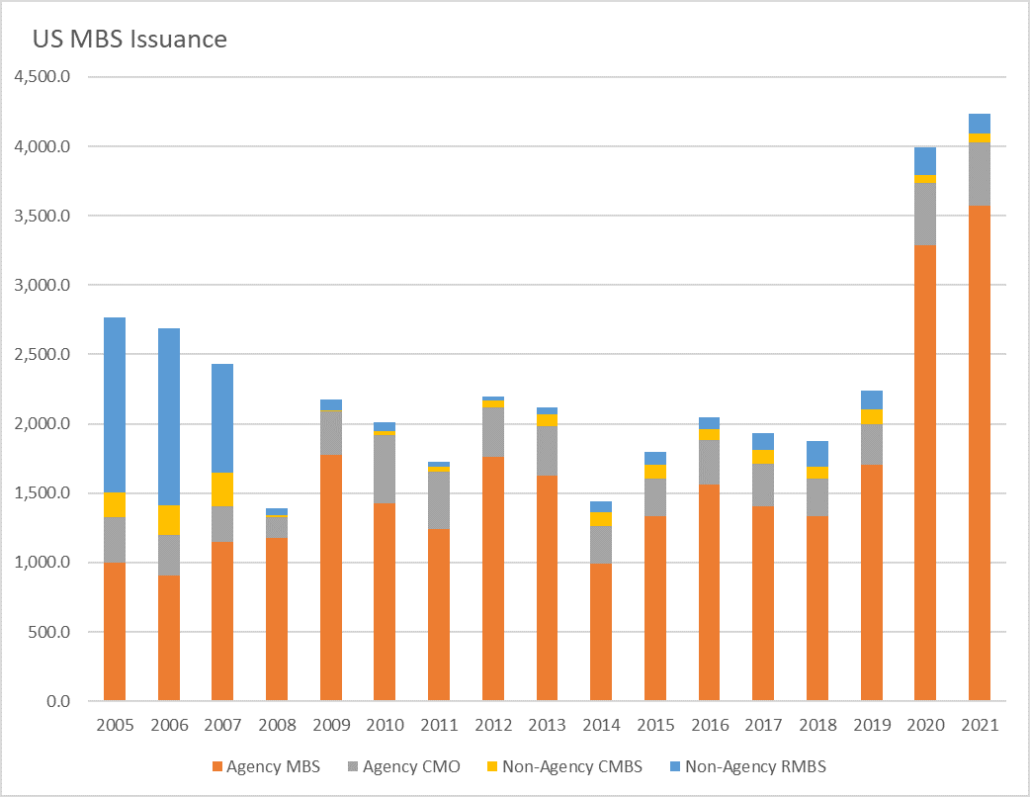

As has been the case since the subprime mortgage crisis, Agency MBS continues to be the major constituent of the market and after a major spike in 2019-20 and experiencing significant growth in the Q4 2019-20, the YoY growth rate in January 2022 found itself deep in negative territory (-30% for MBS and -22% for CMO).

Growth in non-agency RMBS was off the charts in Q2 2020-21 but also entered negative territory from October 2021. Compared to 2020 issue volumes in the CMBS space witnessed moderate growth in 2021, however, securities backed by residential mortgages saw a significant dip.

Although the housing market was strong in the US with low mortgage rates, rise in home prices and millennials pushing up demand the dip in growth rates of issuances towards the end of 2021 was can be attributed to originators being wary of floating new offerings with high inflation rates, the FED announcing a gradual end to its quantitative easing regime[2] and anticipation of rate hikes in early 2022.

Electronic / digital mortgages

2021 continued to see the rise of digital mortgages leveraging the concept of ENotes.[4] Key performance indicators Closing rates and time-to-close statistics were favourable as reported in the Origination Insight Report[5] by ICE Mortgage Technology. Bank of America reported that 81% of its mortgage originations were made through its bespoke digital experience platform.[6]

Asset-backed securities

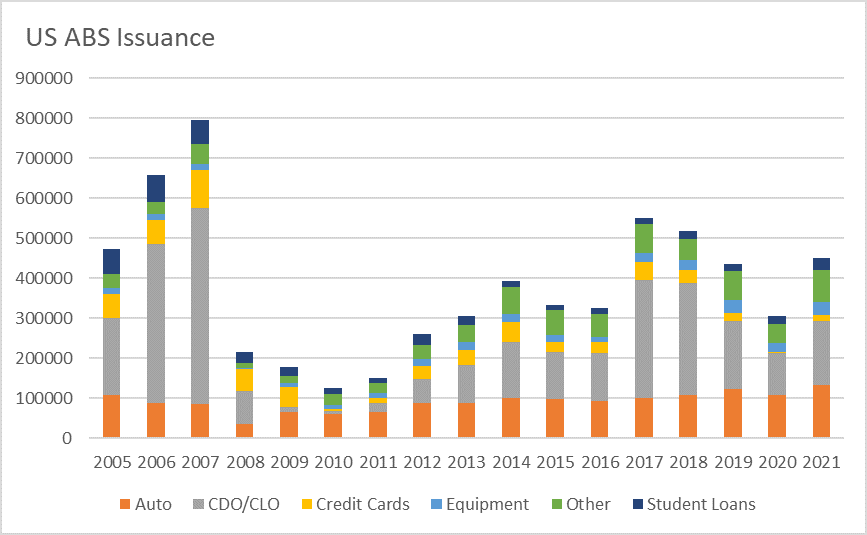

The issuance volumes in the equipment and the other assets backed securities witnessed high growth while that in the auto loan ABS showed moderate growth. Issuance of student loan backed securities, however, fell significantly as government stimulus, forbearance and other borrower support tapered off and as delinquency rates were expected to rise.[7]

LIBOR transition

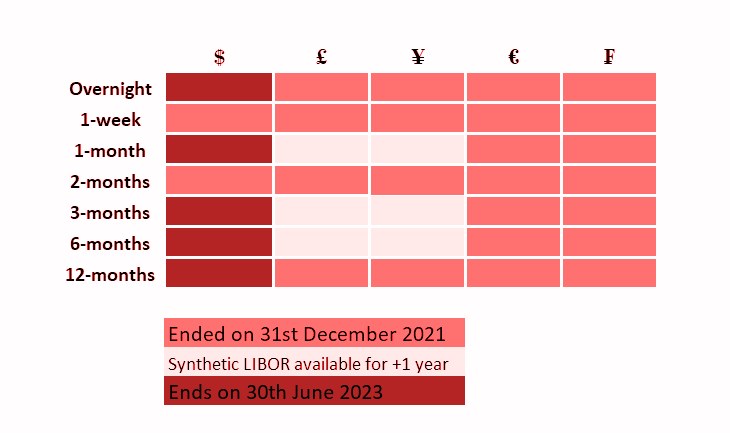

The overall securitisation market in the US was also affected by the uncertainty surrounding the LIBOR transition.

Recent securitisations in the US market have adopted the Secured Overnight Financing Rate (SOFR) as the alternative benchmark rate or contain pre-specified terms and conditions providing for the LIBOR transition, however, a major chunk of the legacy instruments do not contain such replacement rate provisions.

Making contractual amendments to the terms and conditions are expected to be a Herculean task given the sheer number of legacy instruments in the market, the improbability of unanimous security holder consent and there being a high likelihood of disputes and litigations disrupting the market.

Help is on the way in the form of legislative intervention with the Adjustable Interest Rate (LIBOR) Act, 2021 (H.R. 4616)[10] getting passed in the US House of Representatives on the 8th of December 2021; which now awaits Senate approval. There is uncertainty (which will continue till a new benchmark gets put into place) in the securitisation market, especially with regard to the pricing of new issues, as to which existing benchmark (LIBOR Swap Curve, on-the-run U.S. Treasuries, U.S. Treasuries interpolated J-curve or the SOFR-based futures contract swap curve) should be used and till a consensus is reached there will be a reduced supply of liquidity in the market.

Early signals of volumes growth in 2022

US structured finance figures for February 2022 provided an early signal of growth as we approach 2022 with new issuance totalling $66 billion across the CMBS, RMBS, CLO and ABS securitisation classes as per S&P Global’s Credit Brief.[11]

Securitisation in Europe

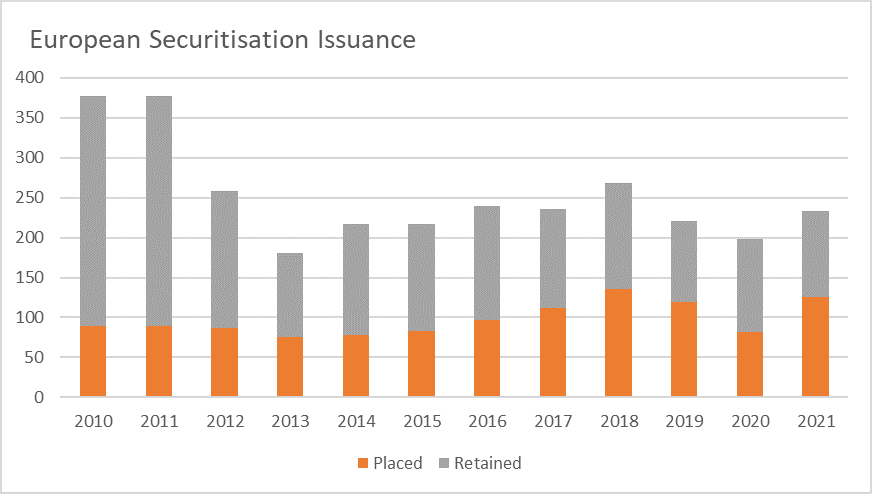

As per data prepared by AFME, with new issuances of securitised products worth €233.1 billion in 2021, Europe saw moderate growth of 17.6% in its securitisation market compared to 2020.[12] With Pan-European CLOs, UK RMBS and German Auto ABS forming the major chunk of the market.

As per an S&P Global Report[13] certain smaller sectors, like CMBS and consumer ABS, witnessed significant growth rates (especially compared to 2020 pandemic related dips) and new issuances were backed by collateral spread across 8 countries. Issue diversity metric, in terms of country and collateral, however, witnessed a contraction with CLO and U.K. RMBS sectors posting above-average growth figures and accounting for more than half of European issuance.

The growth may be attributed to M&A deals, CLO refinancing and reset activity, support by the European Central Bank (ECB) and the Bank of England in terms of cheap fund financing as part of their monetary policy response to the COVID-19 pandemic. Bank-originated structured finance, however, saw a fall with strong deposit growth, fuelled by a slowdown in household and corporate spending.

Europe saw an uptick in Sustainable Finance – in the CLO sector, exclusion language based on ESG factors for underlying assets becoming common.[14]

STS framework for synthetic securitisations

February 2022 saw reportedly the first credit risk-sharing transaction based on the new EU STS standard for synthetic securitisation with PGGM and Alecta entering into a Credit Risk Sharing (CRS) agreement with BNP Paribas with an 8-billion-euro loan portfolio as the underlying.[18]

Under the Securitisation Regulation, synthetic securitisations were excluded from the STS framework and did not enjoy the favourable regulatory capital treatment extended to traditional securitisation. To cater for the synthetic STS framework, section 2a – “Requirements for simple, transparent and standardised on-balance-sheet securitisations” has been inserted into the STS framework.[19] Technical reporting standards for synthetic securitisations have been submitted by ESMA to the European Commission for endorsement. Currently, entities are only voluntarily required to use (interim) STS synthetic notification templates for the purposes of reporting.

The framework now affords synthetic securitisations (credit protection agreements) the same favourable regulatory conditions that have been provided to traditional securitisation. The revised framework, however, prescribes additional requirements for such securitisation agreements including risk retention ratios, the appointment of a third-party verification agent to carry out a review of certain aspects of the credit protection when a credit event is triggered, conditions on the use of synthetic excess spread and high-quality credit protection (collateral).

BREXIT

Brexit has seen the onshoring of the securitisation legislation in the UK – with the UK Transparency Regulatory Technical Standards (RTS) being applied in the UK since 31 December 2020. Transitional provisions currently in place in the UK allow that any transaction listed by ESMA as STS for EU purposes will also receive STS treatment. The reverse, however, is not true. Transactions that achieve STS status under the UK STS regime do not benefit from any transitional relief and will not be treated as STS by the EU. [20] Temporary Transitional provisions for securitisation, like the above, are only currently available and scheduled to be discontinued from 31st March, 2022.[21]

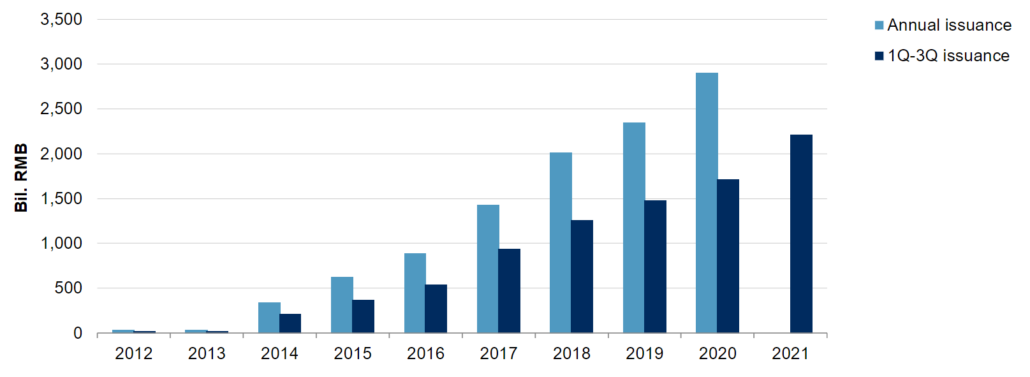

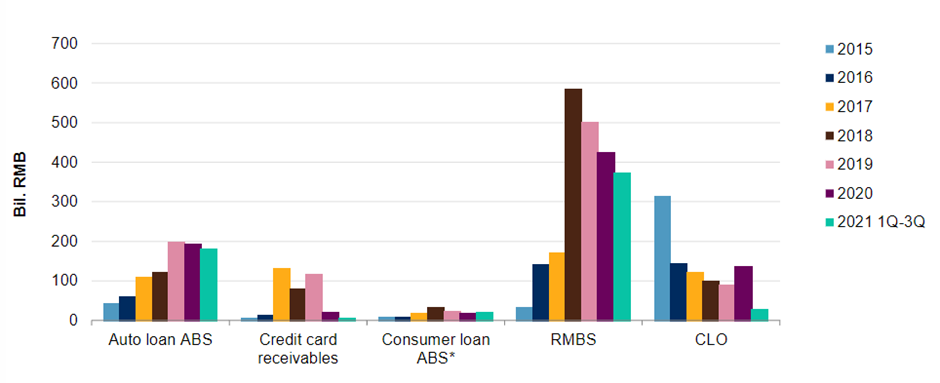

Securitisation in China

The securitisation market in China displayed modest growth with new deals valued at RMB 783 billion in Q3, 2021, a growth rate of 5% year-on-year.[22] Issuance rates across asset classes continued to be stable.

2021 saw momentum in the sustainable finance space. On November 4th, 2021, the International Platform on Sustainable Finance (IPSF), an EU and China joint initiative released Common Ground Taxonomy-Climate Change Mitigation (the CGT) [25]at its annual event held on the sidelines of the UN COP 26 in Glasgow. The People’s Bank of China (PBoC) issued the 2021 edition of the Green Bond Endorsed Projects Catalogue.[26] Green asset-backed securities (ABS) made their appearance against such a backdrop of supportive government policies.

2021 was also marked by China’s property crisis and China Evergrande Group was officially declared in default by S&P Global after the property missed a bond repayment in December 2021.[27] S&P Global, in an earlier report,[28] had stated that the RMBS space would be shielded against such default.

Securitisation in Japan

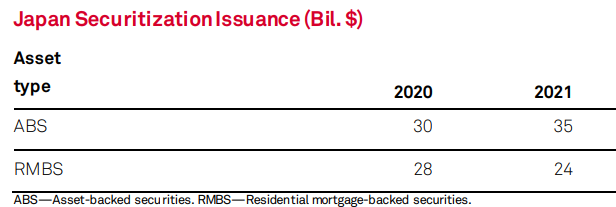

Per S&P Global Report[29], ABS and RMBS dominated structured finance issuance in Japan. It made up more than 95% of total issuance. Within the ABS sector, the major asset class was consumer loans such as auto loans and mobile phone instalments. Within the RMBS sector, issuance from Japan Housing Finance Agency accounted for about a quarter of overall Japanese structured finance issuance for the year.

COVID-19 infection rates in Japan have decreased significantly since autumn 2021 and remained low until around the end of the year. However, the situation is fluid as

Negative Interest rate

According to a Reuters news story,[30] Banks saw a surge in retail deposits reducing their funding needs significantly. The balance of deposits at major banks was estimated to be around 446 trillion ¥ in January 2022, a 14% hike from pre-pandemic levels in early 2020. The rise is attributed to the National Diet’s COVID-19 amelioration policies including substantial cash payouts to Japanese households.

Japan’s largest bank – MUFG Bank – was charged negative rates in January 2022 on deposits parked with the Bank of Japan – the first time since the policy[31] was first announced in 2016.

Securitisation in India

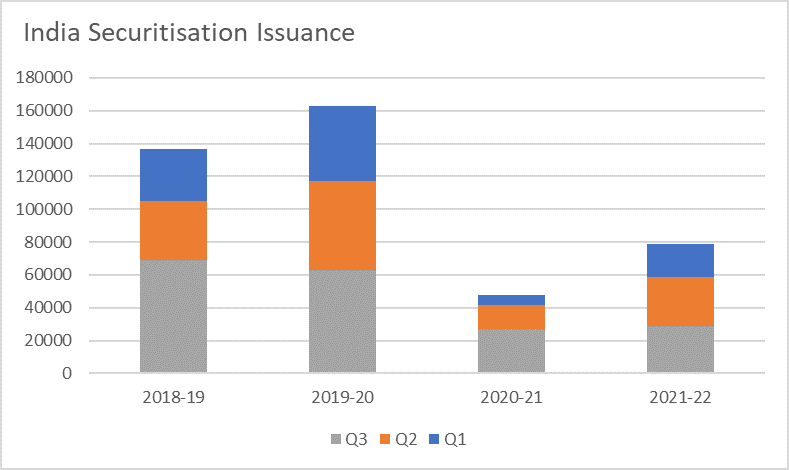

Growth in Indian securitisation deals continued to be subdued in 2021 with volumes in Q3 tapering off to 8%.The slow growth rate was attributed by the CRISIL report[32] to a rise in risk aversion with uncertainty around the COVID-19 third wave.

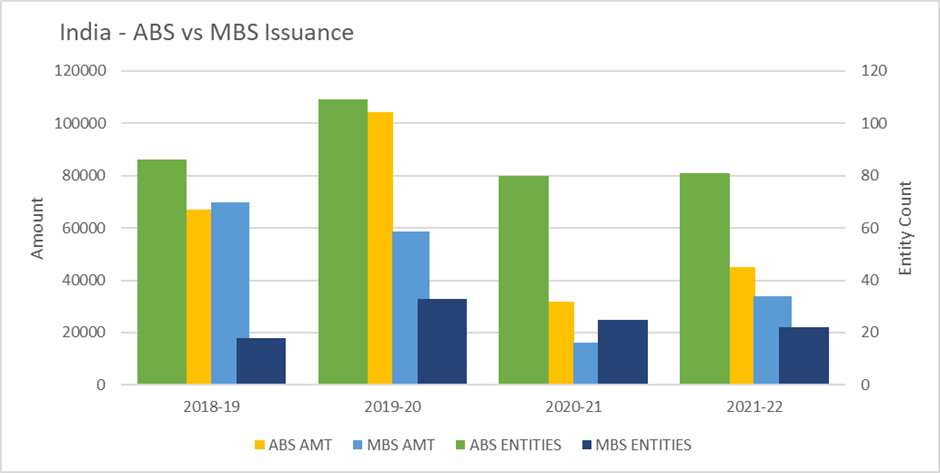

MBS assets which are viewed as more resilient in terms of credit risks comprised a large chunk of the overall volume. The number of players in the market dropped and the fall can be attributed to many microfinance and unsecured loan providers staying away from the market.

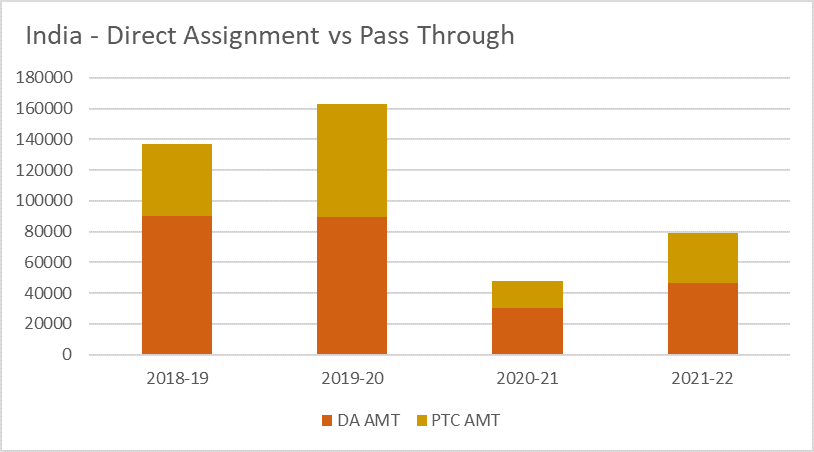

Bilateral portfolio transfers called direct assignment (which forms part of the Indian securities space) continued to dominate the market.

Under the new Securitisation regulatory framework issued by the RBI on 24th September 2021,[33] direct assignments continued to be subjected to regulatory prescriptions of no credit enhancement nor liquidity facility, adherence to minimum holding period (MHP), etc.; however, risk-retention criteria have been removed except where the buyer does not perform due diligence for all the loans they buy.[34]

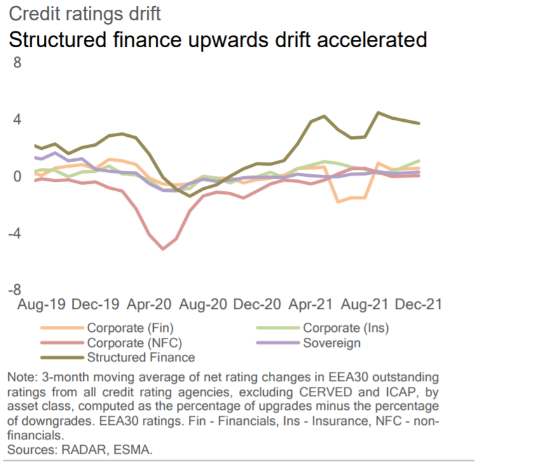

Debt Market Rating activity

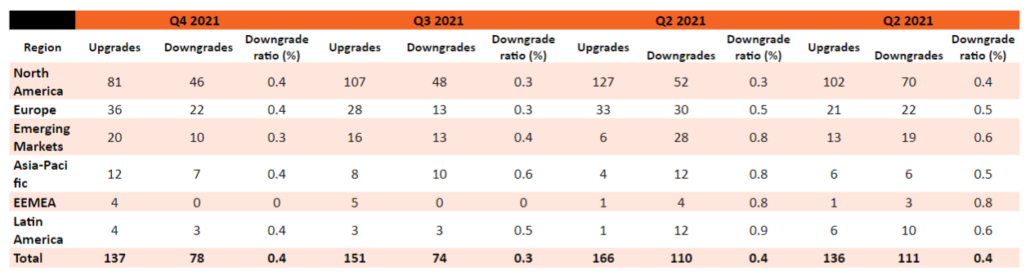

Rating actions in the Debt Market across the globe continued their favourable momentum from 2020 as economic and market conditions continued to improve.

In its Credit Outlook Report 2022,[36] Moody’s reported that credit quality improved across the board in 2021 with a sharp decline in defaults. It, however, expects overall defaults to rise modestly in 2022 with global speculative-grade defaults to fall to 1.5% in the second quarter and then gradually rise to 2.4% by the end of the year. [Note: The quoted Report predates the 2022 Russo Ukrainian war]

[1] https://www.spglobal.com/_assets/documents/ratings/research/100993747.pdf

[2] https://www.reuters.com/markets/us/fed-prepares-stiffen-inflation-response-post-transitory-world-2021-12-15/

[3] https://www.sifma.org/resources/research/us-mortgage-backed-securities-statistics/

[4] Electronic Mortgages: Towards a new trend in paperless mortgage lending – Vinod Kothari Consultants –

[5] The Origination Insight Report, August 2021 – ICE Mortgage Technology – https://static.elliemae.com/pdf/origination-insight-reports/ICE_OIR_AUG2021.pdf

[6] https://www.businessinsider.com/bank-of-america-sees-success-with-digital-mortgages-2022-2?IR=T

[7] https://www.fitchratings.com/research/structured-finance/us-student-loan-abs-defaults-to-normalize-in-2h21-01-07-2021

[8] https://www.sifma.org/resources/research/us-asset-backed-securities-statistics/

[9] S&P Global ratings – https://www.spglobal.com/_assets/documents/ratings/research/100993747.pdf

[10] Adjustable Interest Rate (LIBOR) Act of 2021 – https://www.congress.gov/bill/117th-congress/house-bill/4616

[11] https://www.spglobal.com/ratings/en/research/articles/220302-sf-credit-brief-u-s-structured-finance-issuance-totaled-66b-in-february-119b-year-to-date-up-25-year-ov-12296461

[12] https://www.afme.eu/Publications/Data-Research/Details/AFME-Securitisation-Data-Snapshot-Q4-2021-and-2021-Full-Year

[13] https://www.spglobal.com/_assets/documents/ratings/research/100993747.pdf

[14] https://www.spglobal.com/_assets/documents/ratings/research/100292825.pdf

[15] Understanding the Budding Concept of Green Securitisation – Vinod Kothari Consultants – https://vinodkothari.com/2021/11/understanding-the-budding-concept-of-green-securitization/

[16] https://www.afme.eu/Portals/0/DispatchFeaturedImages/AFME%20Securitisation%20Data%20Snapshot%20Q4%202021-2.pdf

[17] https://www.esma.europa.eu/sites/default/files/library/esma50-165-2058_trv_1-22_risk_monitor.pdf

[18] https://www.pggm.nl/en/press/pggm-and-alecta-share-risk-in-8-billion-euro-loan-portfolio-bnp-paribas/

[19] https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:32021R0557&from=EN

[20] https://www.natlawreview.com/article/end-temporary-transitional-power-securitisation-reporting

[21] https://www.bankofengland.co.uk/eu-withdrawal/temporary-transitional-power

[22] https://www.spglobal.com/ratings/en/research/articles/211115-china-securitization-performance-watch-3q-2021-government-policies-give-green-securitization-a-push-12182529

[23] https://www.spglobal.com/ratings/en/research/articles/211115-china-securitization-performance-watch-3q-2021-government-policies-give-green-securitization-a-push-12182529

[24] https://www.spglobal.com/ratings/en/research/articles/211115-china-securitization-performance-watch-3q-2021-government-policies-give-green-securitization-a-push-12182529

[25] http://www.pbc.gov.cn/en/3688006/3995557/4382112/index.html

[26] http://www.pbc.gov.cn/en/3688006/3995557/4342420/2021091617202747332.pdf

[27] https://www.reuters.com/world/china/sp-dumps-chinese-property-giant-evergrande-into-default-2021-12-17/#:~:text=LONDON%2C%20Dec%2017%20(Reuters),bond%20payment%20earlier%20this%20month

[28] https://www.spglobal.com/ratings/en/research/articles/211007-china-rmbs-shielded-from-evergrande-events-12139294

[29] https://www.spglobal.com/_assets/documents/ratings/research/100993747.pdf

[30] https://www.reuters.com/markets/asia/japans-covid-payouts-strain-lenders-expose-boj-policy-flaws-2022-02-09/

[31] https://www.boj.or.jp/en/announcements/release_2022/k220118a.pdf

[32] https://www.crisil.com/en/home/newsroom/press-releases/2022/01/securitisation-volume-growth-slows-to-8-percent-in-third-quarter.html

[33] After 15 years: New securitisation regulatory framework takes effect – Vinod Kothari Consultants – https://vinodkothari.com/2021/09/rbi-master-directions-on-securitisation-of-standard-assets-and-transfer-of-loan-exposures/

[34] One stop RBI norms for transfer of loan exposures – Vinod Kothari Consultants – https://vinodkothari.com/2021/09/rbi-norms-on-transfer-of-loan-exposures/

[35] https://www.spglobal.com/ratings/en/research/articles/210427-global-actions-on-corporations-sovereigns-international-public-finance-and-project-finance-to-date-in-2021-11936727

[36] https://www.moodys.com/researchdocumentcontentpage.aspx?docid=PBC_1318994

Leave a Reply

Want to join the discussion?Feel free to contribute!