One stop RBI norms on transfer of loan exposures

– Financial Services Division (finserv@vinodkothari.com)

[This version dated 24th September, 2021. We are continuing to develop the write-up further – please do come back]

The RBI has consolidated the guidelines with respect to transfer of standard assets as well as stressed assets by regulated financial entities under a common regulation named Reserve Bank of India (Transfer of Loan Exposures) Directions, 2021 (“Directions”).

The Directions divided into five operative chapters- the first one specifying the scope and definitions, the second one laying down general conditions applicable on all loan transfers, the third one specifying the requirements in case of transfer of loans which are not in default, that is standard assets, the fourth one provides the additional requirement for transfer of stressed assets and the fifth chapter is on disclosure and reporting requirements.

Under the said Directions, the following entities are permitted as transferor and transferee to transfer loans-

| Permitted Transferors | Permitted Transferees |

| Scheduled Commercial Banks; | Scheduled Commercial Banks; |

| All India Financial Institutions Th(NABARD, NHB, EXIM Bank, and SIDBI); | All India Financial Institutions (NABARD, NHB, EXIM Bank, and SIDBI); |

| Small Finance Banks; | Small Finance Banks; |

| All Non Banking Finance Companies (NBFCs) including Housing Finance Companies (HFCs); | All Non Banking Finance Companies (NBFCs) including Housing Finance Companies (HFCs) |

| Regional Rural Banks;

(only for stressed loans under Chapter IV) |

Asset Reconstruction Companies registered with the Reserve Bank of India under Section 3 of the Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002;

(only for stressed loans under para 58) |

| Primary (Urban) Co-operative Banks/State Co-operative Banks/District Central Co-operative Banks;

(only for stressed loans under Chapter IV) |

A company, as defined in sub-section (20) of Section 2 of the Companies Act, 2013 other than a financial service provider as defined in sub-section (17) of Section 3 of the Insolvency and Bankruptcy Code, 2016. Acquisition of loan exposures by such companies shall be subject to the relevant provisions of the Companies Act, 2013

(only for stressed loans under para 58) |

| An entity incorporated in India or registered with a financial sector regulator in India and complying with the other conditions under clause 58

(only for stressed loans under para 58) |

Coverage

The Directions state that no lender shall undertake any loan transfers or acquisitions other than those permitted and prescribed under the Directions and the provisions of Reserve Bank of India (Securitisation of Standard Assets) Directions, 2021. Therefore, loans originated by the Transferor (mentioned above) cannot be transferred outside the purview of the aforesaid guidelines. Accordingly, the loans cannot be transferred to anyone, other than the transferee mentioned above, hence, this would now prohibit any loan transfers that happened outside the purview of the Directions. This in turn would also restrict covered bonds transactions wherein the loan pool was assigned to an SPV- unless the same is specifically permitted by the RBI. However, if the transfer does not result in transfer of economic interest, the same shall not be considered as a ‘transfer’ per se. Hence, covered bonds transactions that are structured in a way that the legal title is transferred, however, the economic interest is retained by the originator, the same shall be considered as ‘loan transfer’.

At the time of occurence of default, the actual loan transfer happens and the same shall be

Further, the Directions shall be applicable even in case of sale of loans through novation or assignment, and loan participation.

In cases of loan transfers other than loan participation, legal ownership of the loan shall be mandatorily transferred to the transferee(s) to the extent of economic interest transferred.

Meaning of the word ‘Transfer’

The term transfer has been defined to mean a transfer of economic interest in loan exposures by the transferor to the transferee(s), with or without the transfer of the underlying loan contract, in the manner permitted in the Directions.

It is to be noted that loan participation transaction have also been recognised under the Directions (for transfer of standard loans) wherein the transferor transfers all or part of its economic interest in a loan exposure to transferee(s) without the actual transfer of the loan contract, and the transferee(s) fund the transferor to the extent of the economic interest transferred which may be equal to the principal, interest, fees and other payments, if any, under the transfer agreement.

General Conditions on all loan transfers

The Directions lays down some generic requirements on all loan transfers. Some of the crucial ones are as follows:

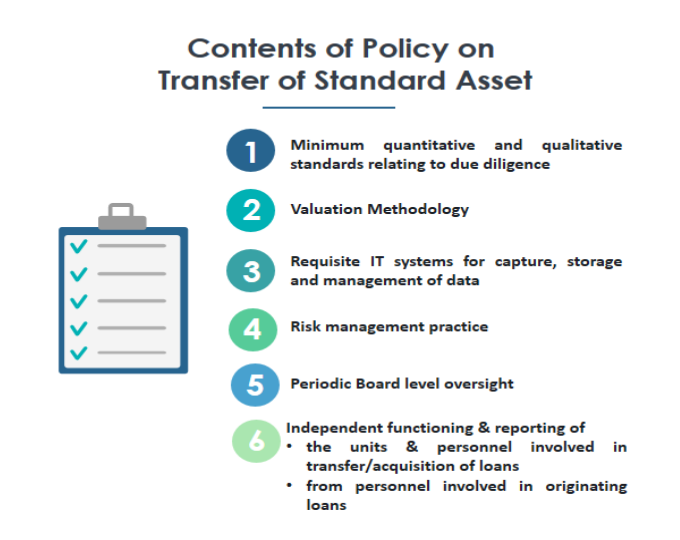

- Having a board approved policy

- Must result in transfer of economic interests without resulting in a change in underlying terms and conditions of the loan contract.Must result in transfer of economic interests without resulting in a change in underlying terms and conditions of the loan contract.

- Clearly delineated roles and responsibilities of the transferor and the transferee

- No credit enhancement or liquidity facilities in any form

- Transferor cannot reacquire, except as a part of Resolution Plan

- Immediate separation of the transferor from the risks and rewards associated with loans

- For retained exposure- the loan transfer agreement should clearly specify the distribution of the principal and interest income from the transferred loan between the transferor and the transferee(s)

- Transferee to get right to transfer or dispose off the loans transferred

- Rights of obligors not to be affected Immediate separation of the transferor from the risks and rewards associated with loans

- For retained exposure- the loan transfer agreement should clearly specify the distribution of the principal and interest income from the transferred loan between the transferor and the transferee(s)

- Transferee to get right to transfer or dispose off the loans transferred

- Rights of obligors not to be affected

- Monitor on an ongoing basis and in a timely manner performance information on the loans acquired, including through conducting periodic stress tests and sensitivity analyses, and take appropriate action required, if any.

The aforesaid clauses are applicable on all loan transfers under the Directions- this should not include the ones exempted from the purview of the Directions. The transactions that are specified under the exclusion list should be exempted from the applicability of the entire guidelines. However, the language is suggesting that the aforesaid general conditions including the requirement of not having any form of credit enhancement is applicable, even if the transaction is exempt from purview of Chapter III regulations on Transfer of Standard Assets.

Transferor as a service provider

As allowed under the existing guidelines as well, the transferor may act as servicing facility provider for the loans transferred. While appointing a servicing facility provider, following conditions must be fulfilled:

- Execution of written agreement outlining:

- nature and purpose and extent of services,

- standards of performance

- duration (limited to amortisation of loans, payment of all claims of transferee or termination by parties)

- Right of transferee to appoint other facility provider

- No obligation on facility provider, being transferor, to transfer funds until they are received;

- Facility provider, being transferor, must hold cashflows in trust for transferee and avoid commingling

- Facility to be on arm’s length basis;

- Fee must not be subject to deferral, waiver or non-payment clauses; Also, no recourse to servicing facility provider beyond contractual obligations;

Transfer of Standard Loans

Transfer of all standard loans, except the following, shall be covered under the Directions:

|

Exclusion List: ● transfer of loan accounts of borrowers by a lender to other lenders, at the request/instance of borrower; ● inter-bank participations covered by the circular DBOD.No.BP.BC.57/62-88 dated December 31, 1988 as amended from time to time; ● sale of entire portfolio of loans consequent upon a decision to exit the line of business completely; ● sale of stressed loans; and ● any other arrangement/transactions, specifically exempted by the RBI |

Minimum Risk Retention

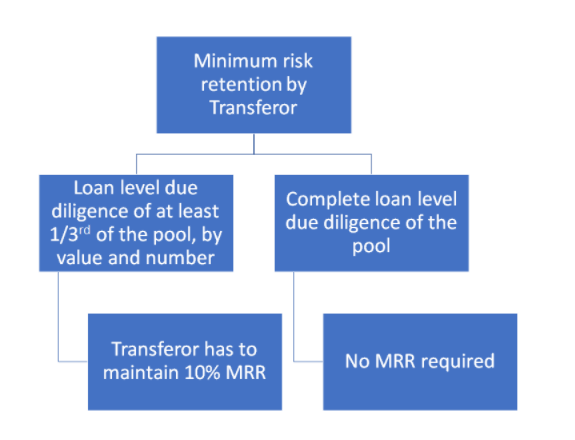

The Directions specifically require that the due diligence in respect of the loans cannot be outsourced by the transferee(s) and should be carried out by its own staff, at the level of each loan, with the same rigour and as per the same policies as would have been done for originating any loan.

However, in case of loans acquired as a portfolio, in case a transferee is unable to perform due diligence at the individual loan level for the entire portfolio, the transferor has to retain at least 10% of economic interest in the transferred loans. In such a case as well, the transferee shall perform due diligence at the individual loan level for not less than one-third of the portfolio by value and number of loans in the portfolio and at the portfolio level for the remaining.

In case of multiple transferees, the MRR would still be on the entire amount of transferred loan, even if any one of the transferees is unable to perform the DD at individual level.

The following graphic summarises the position of MRR in case of transfer of loan exposures:

Minimum Holding Period

Under the erstwhile framework, there were three blocks of minimum holding periods, however under the new Directions there are two major brackets – one for loans with original maturity less than 2 years and one with more than 2 years. The table below summarises the MHP requirements for different classes of loans:

| Secured Loans

|

Unsecured Loans | Project loans | Acquired Loans | |

| Loan Tenor | MHP | MHP | MHP | MHP |

| Upto 2 years | 3 months from the date of registration of the underlying security interest | 3 months from the date of first repayment of the loan | 3 months from the date of commencement of commercial operations of the project being financed | Six months from the date on which the loan was taken into the books of the transferor |

| More than 2 years | 6 months from the date of registration of the underlying security interest | 6 months from the date of first repayment of the loan | 6 months from the date of commencement of commercial operations of the project being financed | |

| MHP requirement is not applicable to loans transferred by the arranging bank to other lenders under a syndication arrangement | ||||

The intent of having a MHP is to ensure that the loan has been seasoned in the books of the originator for a certain specified time period. However, in case of secured loans, the MHP is being counted from the date of creation of security interest- this does not seem to be in sync with the intent of having a MHP.

Accounting of transfer of loans

If the transfer of loans result in loss or profit, which is realised, should be accounted for accordingly and reflected in the Profit & Loss account of the transferor for the accounting period during which the transfer is completed. However, unrealised profits, if any, arising out of such transfers, shall be deducted from CET 1 capital or net owned funds for meeting regulatory capital adequacy requirements till the maturity of such loans.

Borrower-wise accounts will have to be maintained for the loans transferred and retained by the transferee and the transferor, respectively.

The income recognition, asset classification, and provisioning norms will be followed by the transferor and the transferee with respect to their share of holding in the underlying account(s).

Transfer of Stressed Loans

The transfer of stressed loans can be done through assignment or novation only; loan participation is not permitted in the case of stressed loans. .In general, lenders shall transfer stressed loans, including through bilateral sales, only to permitted transferees and ARCs

| Contents of the Board approved policies on Transfer and / or acquisition of Stressed Loans:

● Norms and procedure for transfer or acquisition of such loans; ● Manner of transfer- including e-auctions; ● Valuation methodology to be followed to ensure that the realisable value of stressed loans, including the realisability of the underlying security interest, if available, is reasonably estimated; ● Delegation of powers to various functionaries for taking decision on the transfer or acquisition of the loans; ● Stated objectives for acquiring stressed assets; ● Risk premium to be applied considering the asset classification, for discounting the cashflows to arrive at the difference between the NPV of the cashflows estimated while acquiring the loan and the consideration paid for acquiring the loan; ● Process of identification of stressed loans beyond a specified value; ● Price discovery and value maximization approach; |

The Directions also restrict the transferor to not assume any operational, legal or any other type of risks relating to the transferred loans including additional funding or commitments to the borrower / transferee(s) with reference to the loan transferred. Any fresh exposure on the borrower can be taken only after a cooling period laid down in the respective Board approved policy, which in any case, shall not be less than 12 months from the date of such transfer.

Transfer of stressed loans undertaken by way of a resolution plan

In case of transfer of stressed loans undertaken as a resolution plan under the RBI (Prudential Framework for Resolution of Stressed Assets) Directions, 2019 resulting in an exit of all lenders from the stressed loan exposure, such transfer is permitted to the prescribed class of entities, including a corporate entity, that are permitted to take on loan exposures in terms of a statutory provision or under the regulations issued by a financial sector regulator, a

However, in case such transferee(s) are neither ARCs nor permitted transferees, the transfer shall be additionally subject to the following conditions:

- The transferee entity should be incorporated in India or registered with a financial sector regulator in India (Securities and Exchange Board of India, Insurance Regulatory and Development Authority of India, Pension Fund Regulatory and Development Authority, and International Financial Services Centres Authority).

- The transferee should not be classified as a non-performing account (NPA) by any lending institution at the time of such transfer;

- The transferee(s) should not fund the loan acquisition through loans from Permitted Transferors.

- Permitted transferors should not grant any credit facilities apart from working capital facilities (which are not in the nature of term loans) to the borrower whose loan account is transferred, for at least three years from the date of such transfer.

- Further, for at least three years from the date of such transfer, the Permitted Transferors should not grant any credit facilities to the transferee(s) for deployment, either directly or indirectly, into the operations of the borrower.

Accounting treatment in the books of the transferee

Treatment of stressed loan in the books of the transferee for the purpose of prudential requirements such as asset classification, capital computation, income recognition shall be as follows-

| Pool of stressed loans acquired on a portfolio basis shall be treated as a single asset provided that the pool consists of homogeneous personal loans.

Homogeneity should be assessed on the basis of common risk drivers, including similar risk factors and risk profiles. |

In all other cases, the stressed loans acquired shall be treated as separate assets |

Additional requirement for Transfer of NPAs

| For Transferor | For Transferee |

| Continue to pursue the staff accountability aspects as per the existing instructions in respect of the NPAs transferred | Cash flows in excess of the acquisition cost, if any, can be recognised as profit only after amortising the funded outstanding in the books, in respect of the loans |

| If classified as standard upon acquisition, assign 100% risk weight to the NPA

If classified as NPA, risk weights as applicable to NPA shall be applicable |

Additional requirement for Transfer to ARCs

The following stressed loans may be transferred to ARCs:

- loans in default for more than 60 days

- classified as NPA

- Including loans classified as fraud as on the date of transfer- along with proceedings related to such complaints shall also be transferred to the ARC

The Directions provide for sharing of surplus between the ARC and the transferor, in case of specific stressed loans. The Directions, however, do not specify what kinds of stressed loans these will be.

Further, the Directions also allow repurchase of the accounts from ARCs where the resolution plan has been successfully implemented.

The Directions also allow ARCs to take over loans only for the purpose of recovery (as recovery agents), without the same being removed from the Originator’s books. In such cases, the loans shall be treated as existing in the books of the Originator only.

Swiss Challenge Method[1]

Swiss Challenge method would be mandatory in the following cases:

- In case of a bilateral transfer of stressed loans on a bilateral basis, if the aggregate exposure (including investment exposure) of lenders to the borrower/s whose loan is being transferred is Rs.100 crore or more

- In case of transfer of stressed loans undertaken as a resolution plan under the Reserve Bank of India (Prudential Framework for Resolution of Stressed Assets) Directions, 2019 with the approval of signatories to the intercreditor agreement (ICA) representing 75% by value of total outstanding credit facilities (fund based as well non-fund based) and 60% of signatories by number, for the exit of all signatories to the ICA from the stressed loan exposure, irrespective of any exposure threshold.

Disclosure and Reporting Requirement

Appropriate disclosures shall be made in the financial statements, under ‘Notes to Accounts’, relating to the following

- total amount of loans not in default / stressed loans transferred and acquired to / from other entities as prescribed under the Directions, on a quarterly basis starting from the quarter ending on December 31, 2021

- quantum of excess provisions reversed to the profit and loss account on account of sale of stressed loans

- distribution of the SRs held across the various categories of Recovery Ratings assigned to such SRs by the credit rating agencies

Additionally, transferors must maintain a database of loan transfer transactions with adequate MIS concerning each transaction till a trade reporting platform is notified by the RBI.

[1] Refer our write-up on Swiss Challenge Method- https://vinodkothari.com/wp-content/uploads/2017/03/sale_stressed_assets-1.pdf

Refer our write-up on revised securitisation guidelines here- https://vinodkothari.com/2021/09/rbi-master-directions-on-securitisation-of-standard-assets-and-transfer-of-loan-exposures/

What is maximum days in which the transferor bank should comply with all formalities related to security transfer

Transfer of Stressed Loan to other entities implied to sell to recovery agency too

Sir,

What is the definition of SCB.

Does it mean that foreign branches of SCB are allowed take role of transferor and transferee.

Ravi