Fifty years of global securitisation – list of chapters

List of chapters for the anthology on fifty years of global securitisation –

Go back to fifty years of securitisation page.

List of chapters for the anthology on fifty years of global securitisation –

Go back to fifty years of securitisation page.

– Vinod Kothari

Some people love it; some love to hate it, and some just live it. No matter which one of the clubs one belongs to, but there is no doubt that securitization is a major financial phenomenon.

Year 2020 marks 50 years of the inaugural mortgage-backed pass-through transaction done in 1970 by Ginnie Mae. Securitization has turned fifty.

The world is not in exactly right environment to do either a champagne party or otherwise – however, one should not gloss over the massive change that securitization has made, to the financial landscape of the world, over these five decades. Irrespective of the jury verdict on whether it was responsible for the Global Financial Crisis, the fact is that it had such a major impact that its short-lived absence from the scene could put world’s financial system into doldrums. And now, there are regulators’ reports looking at this very instrument with optimism to lead the recovery out of the COVID disruption.

To commemorate 50 years of securitization, we propose to bring an anthology of write-ups by senior securitization professionals, particularly those who have seen its boom and bust. The write-ups may be along the following lines:

For a work-in-progress list of Chapters, see here.

The anthology is proposed to be a compilation in e-book form. We will be in touch with some publishers to seek interest in publication.

The anthology will be collaborative effort of several leading authors, experts, researchers and practitioners from all over the world. Each of the contributors are leading luminaries in their own field. So while substantial discretion will be used by the contributors, some pointers for contributors are as follows:

Needless to say, it is a massive project – it has to be collaborative. We need the support of scholars, authors, stakeholders – those who have been practising, teaching, consulting or regulating securitization over the years. Hence, if you are one such contributor, or you know one who may be such a contributor, your contribution/assistance is most welcome.

For interest in contribution to the anthology, please do write to timothy@vinodkothari.com. Please indicate your background, proposed contents, length of the article, etc. After hearing from us positively, you may start writing your article, for submissions by end of August, 2020.

From our side, this project is completely non-pecuniary. We just felt that we can steer this effort which may be valuable for a long time.

However, this project will involve massive research effort, editing, and production. Hence, there may be substantial expense.

If you want to sponsor in any manner, or want to put up a befitting advertisement about your company/products, the same is welcome. Please feel free to discuss with finserv@vinodkothari.com.

Tentatively, we may put the e-publication in public domain by November, 2020.

Data shows that the European securitisation market never rebounded after the 2008 crisis, even after the implementation of STS framework. Securitisation however, plays a key role in boosting the capital markets. This role has been recognised by the High Level Forum (EU) in its final report released on 10th June, 2019.

Seven recommendations were made by the HLF with respect to securitisation. The intent is to ultimately boost securitisation markets and help it pick up in the years to come.

In this write up, the author attempts to explain in brief the recommendations with respect to securitisation of the High Level Forum.

Our related research on the similar topics may be viewed here –

Abhirup Ghosh

– Updated as on 16th June, 2020

On 8th June, 2020, RBI issued the Draft Framework for Securitisation of Standard Assets taking into account existing guidelines, Basel III norms on securitisation by the Basel Committee on Banking Supervision as well the Report of the Committee on the Development of Housing Finance Securitisation Market chaired by Dr. Harsh Vardhan.

With this, one of the main areas of concern happens to be capital relief for securitisation. The concerns arise not just for new exposures but also existing securitisation exposures, as Chapter VI (dealing with Capital Requirements) shall come into immediate effect, even for the existing securitisation exposures.

Earlier, due to the implementation of Ind-AS, concerns arose with respect to capital relief treatment as most of the securitisation exposures did not qualify for derecognition under Ind-AS. However, on March 13, 2020, RBI came out with Guidance on implementation of Ind-AS, which clarified the issue by stating that securitised assets not qualifying for derecognition under Ind AS due to credit enhancement given by the originating NBFC on such assets shall be risk weighted at zero percent. However, the NBFC shall reduce 50 per cent of the amount of credit enhancement given from Tier I capital and the balance from Tier II capital.

Once again, the issue of capital relief arises as the draft guidelines may cause an increase in capital requirements for existing exposures.

The Draft Framework lays down qualitative as well as quantitative criteria for determining capital requirements. As per Para 70, lenders are required to maintain capital against all securitisation exposure amounts, including those arising from the provision of credit risk mitigants to a securitisation transaction, investments in ABS or MBS, retention of a subordinated tranche, and extension of a liquidity facility or credit enhancement. For the purpose of capital computation, repurchased securitisation exposures must be treated as retained securitisation exposures.

The general provisions for measuring exposure amount of off-balance sheet exposures are laid down under para 71-78 of the Draft Framework.

The quantitative conditions are however, laid down in paragraphs 79 (a) and (b). The intention here is to delve into the impact of the quantitative conditions only, keeping aside the qualitative conditions for the time being.

The first condition (79(a)) is that significant credit risk associated with the underlying exposures of the securities issued by the SPE has been transferred to third parties. Here, significant credit risk will be treated as having transferred if the following conditions are satisfied:

Taking each of the two points at a time.

The first clause contemplates a securitisation structure with at least three tranches – the senior, the mezzanine and the equity. Despite the presence of three tranches, the condition for risk transfer has been pegged with the mezzanine tranche only, however, nothing has been discussed with respect to the thickness of the mezzanine tranche (though the draft Directions has prescribed a minimum thickness for the first loss tranche).

If the language of the draft Directions is retained as is, qualifying for capital relief will become very easy. This can be explained with the help of the following example.

Suppose a securitisation transaction has three tranches, the composition and proportion of which has been provided below:

| Tranche | Rating | Proportion as a part of the total pool | Retention by the Originator | Effective retention of interest by the Originator |

| Senior Tranche – A | AAA | 85% | 0% | 0% |

| Mezzanine Tranche – B | AA+ | 5% | 50% | 2.5% |

| Equity/ First Loss Tranche – C | Unrated | 10% | 100% | 10% |

| 12.5% |

As may be noticed, both the senior and mezzanine are fairly highly rated as the junior most tranche has a considerable amount of thickness and represents a first loss coverage of 10%. Additionally, it also retains 50% of the Mezzanine tranche. Therefore, effectively, the Originator retains 12.5% of the total pool, yet it will qualify for the capital relief, by virtue of holding upto 50% of the Mezzanine tranche, despite retaining 10% in the form of first loss support.

The second clause contemplates a situation where there are only two tranches – that is, the senior tranche and the equity tranche. The clause says that in absence of a mezzanine tranche, the retention of first loss by the Originator should not be more than 20% of the total first loss tranche.

Given the current market conditions, it will be practically impossible to find an investor for the first loss tranche, hence, the entire amount will have to be retained by the Originator. Also, it is very common to provide over-collateral or cash collateral as first loss supports in case of securitisation transactions, even in such cases a third party’s participation in the first loss piece is technically impossible.

Also, there is a clear conflict between this condition and para 16 of the draft Directions, which gives an impression that the first loss tranche has to be retained by the originator itself, in the form of minimum risk retention.

Therefore, in Indian context, if one were to take a holistic view on the conditions, they are two different extremes. While, in the first case, capital relief is achievable, but in the second case, the availing capital relief is practically impossible. This will make the second condition almost redundant.

In order to understand the rationale behind these conditions, please refer to the discussion on EU Guidelines on SRT below.

As noted earlier, this part of the draft Directions shall be applicable on the existing transactions as well. Here it is important to note that currently, most of the transaction structures in India either have only one or two tranches of securities, and only a fraction would have a mezzanine tranche. In all such cases, the entire first loss support comes from the Originator. Therefore, almost none of the transactions will qualify for the capital relief.

In the hindsight, the originators have committed a crime which they were not even aware of, and will now have to pay a price.

The moment, the Directions are finalised, the loans will have to be risk-weighted and capital will have to be provided for.

This will have a considerable impact on the regulatory capital, especially for the NBFCs, which are required to maintain a capital of 15%, instead of 9% for banks.

This requirement states that the minimum first loss tranche should be the product of (a) exposure (b) weighted maturity in years and (c) the average slippage ratio over the last one year.

The slippage ratio is a term often used by banks in India to mean the ratio of standard assets slipping to substandard category. So, if, say 2% of the performing loans in the past 1 year have slipped into NPA category, and the weighted average life of the loans in the pool is, say, 2.5 years (say, based on average maturity of loans to be 5 years), the minimum first loss tranche should be [2% * 2.5%] = 5% of the pool value.

In India, currently the thickness of the first loss support depends on the recommendations of the credit rating agencies (CRAs). Typically, the thresholds prescribed by the CRAs are thick enough, and we don’t foresee any challenge to be faced by the financial institutions with respect to compliance with this point.

The guidelines for evidencing significant risk transfer, as provided in the draft Guidelines, are inspired from the EU’s Guidelines on Significant Risk Transfer. The EU Guidelines emphasizes on significant risk transfer for capital relief and states that a high level, the capital relief to the originator, post securitisation, should commensurate the extent of risk transferred by it in the transaction. One such way of examining whether the risk weights assigned to the retained portions commensurate with the risk transferred or not is by comparing it with the risk weights it would have provided to the exposure, had it acquired the same from a third party.

Where the Regulatory Authority is convinced that the risk weights assigned to the retained interests do not commensurate with the extent of risk transferred, it can deny the capital relief to the originator.

Under three circumstances, a transaction is deemed to have achieved SRT and they are:

In case, the originator wishes to achieve SRT with the help of 1 & 2, the same has to be notified to the regulator. If as per the regulator, the risk weights assigned by the originator does not commensurate with the risks transferred, the firms will not be able to avail the reduced risk weights.

The underlying assumptions behind the SRT conditions have been elucidated in the EU’s Discussion Paper on Significant Risk Transfer in Securitisation.

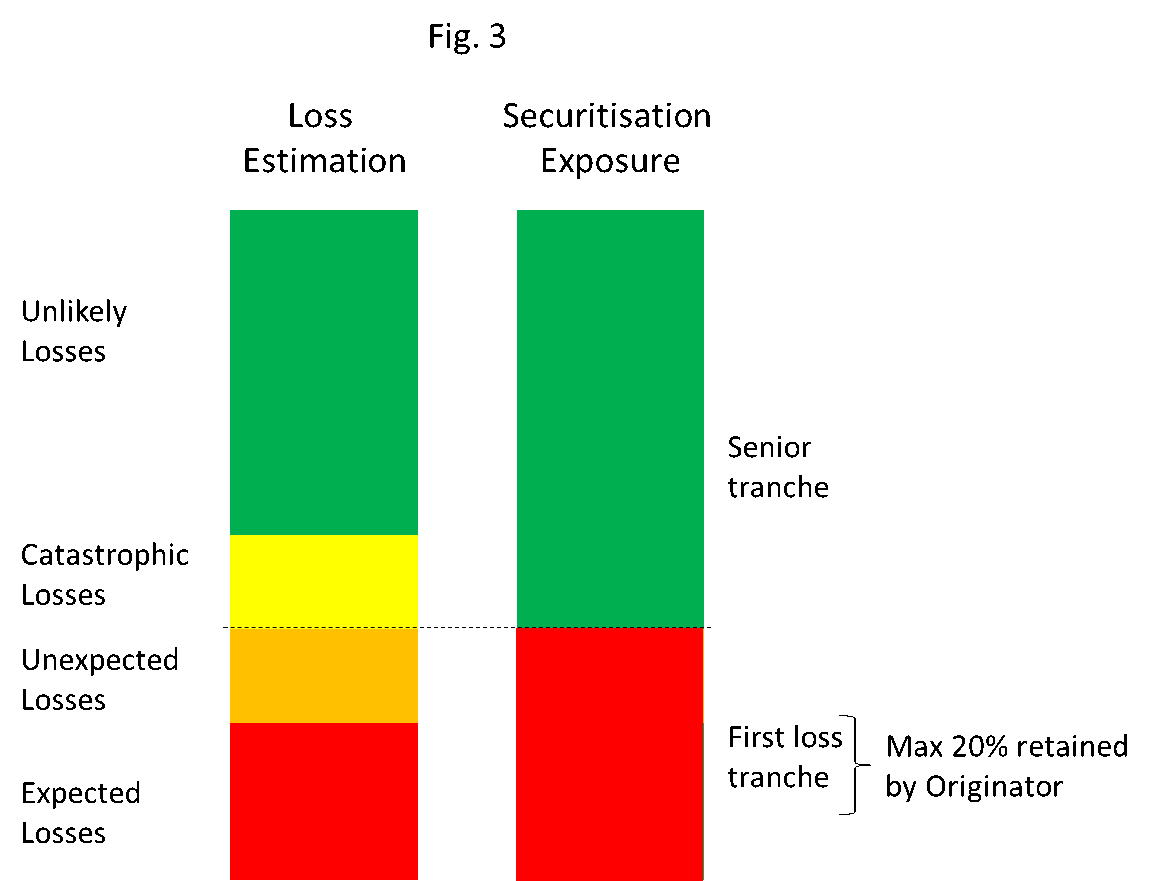

The following graphics will illustrate the conditions better:

In figure 1, the mezzanine tranche is thick enough to cover the entire unexpected losses. If in the present case, 50% of the total unexpected losses are transferred to a third party, then the transaction shall qualify for capital relief.

Unlike in case of figure 1, in figure 2, the mezzanine tranche does not capture the entire unexpected losses. The thickness of the tranche is much less than what it should have been, and the remaining amount of unexpected losses have been included in the first loss tranche itself.

Unlike in case of figure 1, in figure 2, the mezzanine tranche does not capture the entire unexpected losses. The thickness of the tranche is much less than what it should have been, and the remaining amount of unexpected losses have been included in the first loss tranche itself.

In the present case, even if the mezzanine tranche does not commensurate with the unexpected losses, the transaction will still qualify for capital relief, because, if the first loss tranche is retained by the originator, it will have to be either deducted from CET1/ assign risk weights of 1250%

In figure 3, there is no mezzanine tranche. In the present case, the first loss tranche covers the entire expected as well as the unexpected losses. In order to demonstrate a significant risk transfer, the originator can retain a maximum of 20% of the securitisation exposure.

In figure 3, there is no mezzanine tranche. In the present case, the first loss tranche covers the entire expected as well as the unexpected losses. In order to demonstrate a significant risk transfer, the originator can retain a maximum of 20% of the securitisation exposure.

Currently, the draft Directions do not provide any logic behind the conditions it inserted for the purpose of capital relief, neither are they as elaborate as the ones under EU Guidelines. Some explicit clarity in this regard in the final Directions will provide the necessary clarity.

Also, with respect the mezzanine test, in the Indian context, the condition should be coupled with a condition that the first loss tranche, when retained by the originator, must attract 1250% risk weights or be deducted from CET 1. Only then, the desired objective of transferring significant risks of unexpected losses, will be achieved.

Further, as pointed out earlier in the note, there is a clear conflict in the conditions laid down in the para 16 and that in the first loss test in para 79, which must be resolved.

Timothy Lopes, Executive, Vinod Kothari Consultants

Measures to maintain and strengthen credit flow to consumers is an important part of regulatory initiatives to contain the effects of the COVID crisis. Asset-backed securities and structured finance instrument are recognised as important instruments that connect capital market resources with the market for loans and financial assets. Underscoring the relevance of securitization to the flow of credit to consumers, the US Federal Reserve has set up a USD 100 billion loan facility, called Term Asset-backed Securities Loan Facility, 2020 [TALF] for lending against asset backed securities, issued on or after 23rd March, 2020.

Note that equivalent of TALF 2020 was set up post the Global Financial Crisis (GFC) as well, in 2008[1].

It is also notable that global financial supervisors have attempted to help financial intermediaries stay firm, partly by helping structured finance transactions. The example of the Australian regulators setting up a Structured Finance Support Fund (SFSF)[2] is one such regulatory measure. Another example is the Canada Mortgage Bond Purchase Program initiated by the Bank of Canada[3].

Timothy Lopes, Executive, Vinod Kothari Consultants

The global financial credit crisis of 2007-08 was a result of severe financial distress arising out of high level of sub-prime mortgage lending. Top Credit Rating Agencies (CRA) downgraded majority securitization transactions, slashing ‘AAA’ ratings to ‘Junk’.

Sub-prime borrowers could not repay, lenders were weary of lending further, investors investments in Mortgage Backed Securities (MBS) were stagnant and not reaping any return.

All these factors led to one of the worst financial crisis that affected global economies and not just the US alone. Recovering from such a crisis takes ample amount of time and efforts in the form of policy measures and financial stimulus / bail out packages of the government.

The rapid spread and depth of Coronavirus (COVID-19) outbreak has had severe impact across the globe in a matter of months. Stock markets are witnessing a global sell off. Countries have imposed complete lockdowns countrywide in order to mitigate the impact of this pandemic. Securitisation volumes are likely to witness a drop in light of the pandemic.

Daily, the situation only seems to be getting worse due to the unprecedented outbreak of COVID-19 and its rapid spread. There is absolutely no doubt that the impact on the financial sector and on economies worldwide is / will be a negative one.

As stated by the RBI Governor, in his nationwide address on 27th March, 2020 –

“The outlook is now heavily contingent upon the intensity, spread and duration of the pandemic. There is a rising probability that large parts of the global economy will slip into recession”

The question here is, “Are we headed for another global financial crisis?” We try to analyse this question in this write up, in light of the present scenario.

Abhirup Ghosh

In response to the stress caused due to the pandemic COVID-19, the regulatory authorities around the world have been coming out relaxations and bailout packages. Reserve Bank of India, being the apex financial institution of the country, came out a flurry of measures as a part of its Seventh Bi-Monthly Policy[1][2], to tackle the crisis in hand.

One of the measure, which aims to pass on immediate relief to the borrowers, is extension of moratorium on term loans extended by banks and financial institutions. We have in a separate write-up[3] discussed the impact of this measure, however, in this write-up we have tried to examine its impact on the securitisation and direct assignment transactions.

Securitisation and direct assignment transactions have been happening extensively since the liquidity crisis after the failure of ILFS and DHFL, as it allowed the investors to take exposure on the underlying assets, without having to take any direct exposure on the financial intermediaries (NBFCs and HFCs). However, this measure has opened up various ambiguities in the structured finance industry regarding the fate of the securitisation or direct assignment transactions in light of this measure.

The originators, will be expected to extend this moratorium to the borrowers, even for the cases which have been sold the under securitisation. The question is, do they have sufficient right to extend moratorium in the first place? The answer is no. The moment an originator sells off the assets, all its rights over the assets stands relinquished. However, after the sale, it assumes the role of a servicer. Legally, a servicer does not have any right to confer any relaxation of the terms to the borrowers or restructure the facility.

Therefore, if at all the originator/ servicer wishes to extend moratorium to the borrowers, it will have to first seek the consent of the investors or the trustees to the transaction, depending upon the terms of the assignment agreement.

On the other hand, in case of the direct assignment transactions, the originators retain only 10% of the cash flows. The question here is, will the originator, with 10% share, be able to grant moratorium? The answer again is no. With just 10% share in the cash flows, the originator cannot alone grant moratorium, approval of the assignee has to be obtained.

As discussed above, extension of moratorium in case of account sold under direct assignment or securitisation transactions, will be possible only with the consent of the investors. Once the approval is placed, what will happen to the transactions, as very clearly there will be a deferral of cash flows for a period of 3 months? Will this lead to a deterioration in the quality of the securitised paper, ultimately leading to a rating downgrade? Will this lead to the accounts being classified as NPAs in the books of the assignee, in case of direct assignment transactions?

Before discussing this question, it is important to understand that the intention behind this measure is to extend relief to the end borrowers from the financial stress due to this on-going pandemic. The relief is not being granted in light of any credit weakness in the accounts. In a securitisation or a direct assignment, the transaction mirrors the quality of the underlying pool. If the credit quality of the loans remain intact, then there is no question of the securitisation or the direct assignment transaction going bad. Similarly, we do not see any reason for rating downgrade as well.

The next question that arises here is: what about the loss of interest due to the deferment of cash flows? The RBI’s notification states that the financial institutions may provide a moratorium of 3 months, which basically means a payment holiday. This, however, does not mean that the interest accrual will also be suspended during this period. As per our understanding, despite the payment suspension, the lenders will still be accruing the interest on the loans during these 3 months – which will be either collected from the borrower towards the end of the transaction or by re-computing the EMIs. If the lenders adopt such practices, then it should also pass on the benefits to the investors, and the expected cash flows of the PTCs or under the direct assignment transactions should also be recomputed and rescheduled so as to compensate the investors for the losses due to deferment of cash flows.

Another question that arises is – can the investors or the trustee in a securitisation transaction, instead of agreeing to a rescheduling of cash flows, use the credit enhancement to recover the dues during this period? Here it is important to note that credit enhancements are utilised usually when there is a shortfall due to credit weakness of the underlying borrower(s). Using credit enhancements in this case, will reduce the extent of support, weaken the structure of the transaction and may lead to rating downgrade. Therefore, this is not advisable.

We were to imagine an extreme situation – can the investors force the originators to buy back the PTCs or the pool from the assignee, in case of a direct assignment transaction? In case of securitisation transactions, there are special guidelines for exercise of clean up calls on PTCs by the originators, therefore, such a situation will have to be examined in light of the applicable provisions of Securitisation Guidelines. For any other cases, including direct assignment transactions, such a situation could lead up to a larger question on whether the original transaction was itself a true sale or not, because, a buy-back of the pool, defies the basic principles of true sale. Hence, this is not advisable.

[1]https://rbidocs.rbi.org.in/rdocs/Content/PDFs/GOVERNORSTATEMENT5DDD70F6A35D4D70B49174897BE39D9F.PDF

[2] https://www.rbi.org.in/Scripts/NotificationUser.aspx?Id=11835&Mode=0

[3] http://vinodkothari.com/2020/03/moratorium-on-loans-due-to-covid-19-disruption/