Securitisation: Indian market grows amidst global volume contraction

Timothy Lopes, Manager

Global Securitisation Volumes, 2022

The global securitisation market in 2022[1] saw a decline in volumes as compared to record issuance volumes seen in the year 2021. The decline was mainly driven by 24% year-on-year decline in volumes in the United States, obviously because of inflation, general economic conditions and low level of business confidence, coupled with supply chain disruptions and uncertainty caused by the Russia-Ukraine conflict[2].

Source: S&P Global Ratings: Global Structured Finance 2023 Outlook

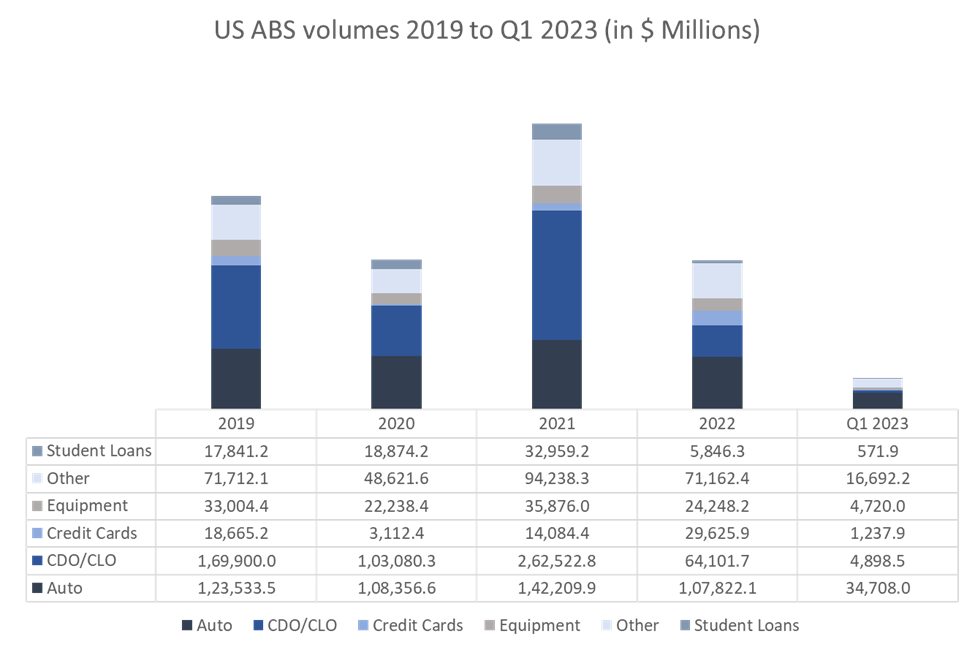

The ABS volumes in the US over time has been presented below –

Source: SIFMA USA ABS data[3]

Further, the S&P Global Ratings: Global Structured Finance 2023 Outlook has projected that 2023 volumes would also decline down to $1019 billion, a 7% drop year-on-year. The drop may only turn to be optimistic, as the volumes of ABS issuance reported on SIFMA’s website show a drop of about 33% in YTD volumes (upto March, 2023), compared to the same period in 2022. Note that the US ABS issuance data does not typically include RMBS issuance.

Considering the prevailing situation, investors’ interest in structured finance securities may remain subdued. Default rates on retail lending have also been on a high pitch.

Indian securitisation market 2022

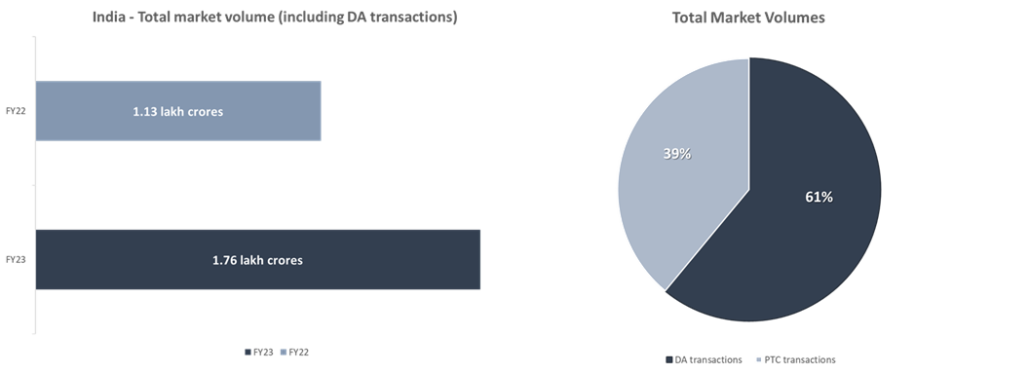

Contrasted with the global scenario, the Indian securitisation market continues to grow, as the market volume in 2023 exceeded Rs. 1.76 lakh crores according to a report by CARE Ratings (‘CARE Ratings Report’)[4]. This reflects a substantial increase in FY23 compared to Rs. 1.13 lakh crores in FY22. Data is presented in the graphic below.

Source: CARE Ratings Report

Further, Direct Assignment transactions captured a major portion of total market volumes in comparison to securitisation transactions as shown in the chart above.

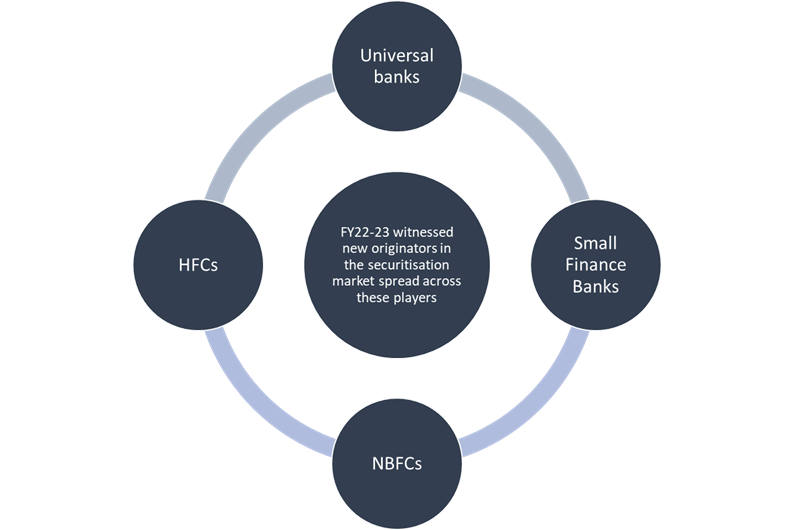

New originators have entered the market, marking a 30% growth in the number of originators as per the CARE Ratings Report.

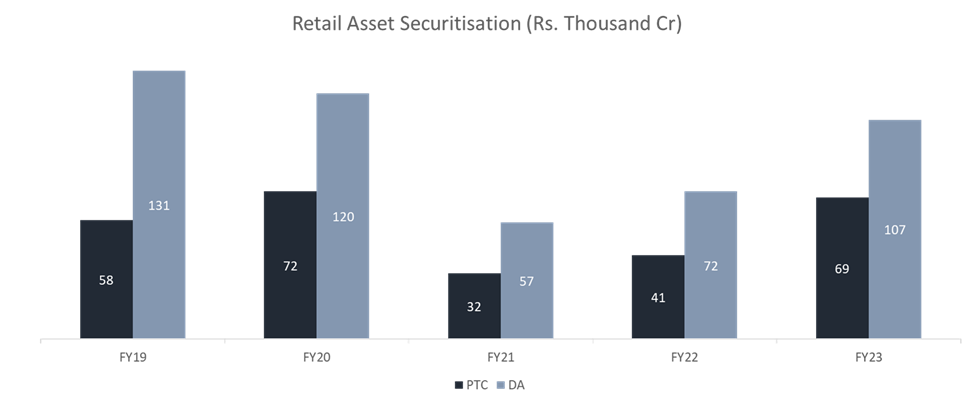

Source: CARE Ratings Report

The volume data for the past 5 years shows that securitisation and direct assignment have recovered and are near their pre-COVID levels.

Source: Based on CARE Ratings Report

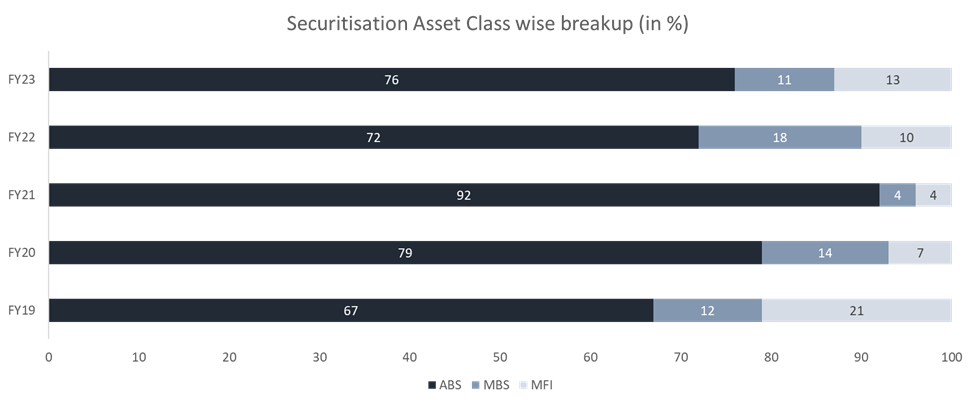

In terms of asset class data, Asset Backed Securitisation (ABS) was the dominant asset class with 76% of the securitisation specific volumes being from ABS pools. The remaining consisted of Mortgage Backed Securitisation and MFI loan securitisation as shown below.

Source: Based on CARE Ratings Report

Note: MBS in the Indian context includes Loan Against Properties, which is a general purpose loan secured by a mortgage of properties.

Conclusion

Though in the global outlook there seems to be a forecasted decline in volumes, in India, the securitisation market volumes would largely depend on the domestic outlook. Further, co-lending has also been gaining rising popularity, which could have an impact on the securitisation market.

See our resources on similar topics here-

- Our dedicated page on securitisation – https://vinodkothari.com/sechome/

- Our articles on securitisation – https://vinodkothari.com/category/securitisation/

- Global Securitisation Markets in 2021: A Robust Year for Structured Finance

- After 15 years: New Securitisation regulatory framework takes effect

[1] Global volumes are typically available for CY basis; Indian volumes are available on FY (April to March) basis.

[2] S&P Global Ratings: Global Structured Finance 2023 Outlook – https://www.spglobal.com/_assets/documents/ratings/research/101571302.pdf

[3] https://www.sifma.org/resources/research/us-asset-backed-securities-statistics/

[4] Care Ratings report on securitisation in FY23 – https://www.careratings.com/uploads/newsfiles/1680875360_Retail%20Securitisation%20at%20Rs%201.76L%20cr%20-%20up%20by%2056%20per%20cent%20in%20FY23.pdf

Leave a Reply

Want to join the discussion?Feel free to contribute!