Penal charges not a cash-cow for lenders

RBI issues draft guidelines on fair lending practices for penal charges

– Aanchal Kaur Nagpal, Manager and Dayita Kanodia, Executive | finserv@vinodkothari.com

Introduction

Levying of penal interest/ charges is a punitive measure adopted by lenders on borrowers defaulting in making repayments and/ or breaching any terms and conditions mutually agreed in the loan agreement. The Reserve Bank of India also allows lenders to charge such rates as long as the same are communicated to the borrower and are in accordance with the Board approved policy framed in this behalf.

However, lenders, cashing in on such autonomy and flexibility, have adopted varied practices which are often prejudicial to the borrower. These include charging exorbitant rates, capitalisation of penal charges, charging of penal interest on the loan amount and not the defaulted portion etc.

The RBI, in its Statement on Developmental and Regulatory Policies dated February 08, 2023[1], announced policy measures for introduction of guidelines for regulating the penal charges levied by financial institutions[2]. Pursuant to the same, RBI, on April 12, 2023 has issued a draft circular on Fair Lending Practice – Penal Charges in Loan Accounts (‘Draft Circular’) to persuade lenders to use penal charges for their true compensatory nature and not as a revenue enhancement tool.

While the Draft Circular comes with good intentions, there are certain provisions that may seem ambiguous and contradictory, and the final guidelines would need to provide sufficient clarity to achieve the desired execution.

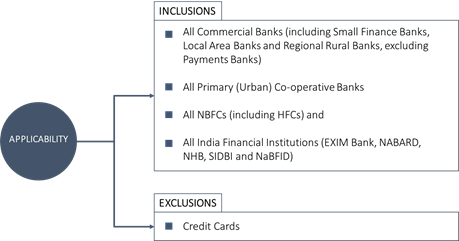

Effective date and applicability

These Draft Circular shall come into effect from a date to be indicated in the final circular and lenders shall carry out appropriate revisions in their existing policy framework and ensure implementation from the effective date.

Is there any grandfathering clause?

The Draft Circular shall require change to the existing practices of lenders but a question that arises is whether the amended practices shall apply to the already executed loan agreements. There is no express stipulation making the provisions applicable to only new agreements, and therefore, the Draft Circualr shall be applicable to new as well as executed agreements, in letter and in spirit. It, accordingly, becomes important to understand the manner of application of the instructions, how the same would be effectuated and communicated to the borrower? We discuss the same later in the article.

Meaning of penal charges

Penal charges is a penalty levied on borrowers by lenders in case of delay or default in payment of principal and/ or interest as well as in case of non-compliance with the agreed terms and conditions. Such charges may either be standardized across all loans and borrowers or may depend upon the type of loan, level of credit risk, and the terms and conditions as mutually agreed by the borrower and the lender.

In general, lenders impose penal charges on:

- Not meeting repayment timelines;

- Cheque or NACH bounce;

- Failure to create security or register charges;

- Breache of important or material representations and warranties;

- Covenant breaches, such as late reporting, failure to submit the requisite documents/ information etc.

Current regulations and current practices and need for change

The RBI Guidelines for both banks[3] and NBFCs[4] do not prescribe any particular amount/ rate or a threshold w.r.t penal charges. Lenders are only required to intimate penal charges upfront to ensure transparency and are subject to general fetters such as not being ‘excessive’ or ‘exorbitant’. Further, the amount of penal charges are subject to a Board-approved Policy which is also framed at the lender’s behest.

Penal charges may be levied either on ad-hoc basis, wherein the charges are levied separately upon the event of default as for example each event of default/delay by the borrower shall attract a penal charge of ‘x’ amount, or on interest overdue basis wherein the default in the payment of interest or the instalment attracts further interest in addition to the existing interest rate, as for example the delay in payment shall attract an additional interest of 1% on the overdue amount.

As mentioned above, the concept of penal interest/charges was brought to instill a sense of credit discipline among borrowers. However,currently there are divergent practices amongst lenders with regard to levy of penal interest/charges leading to customer grievances and disputes. Further, the penal charges are not meant to be used as a revenue enhancement tool over and above the contracted rate of interest.

RBI prescriptions through the Draft Circular

The RBI, through the Draft Circular, has provided the following provisions with respect to penal charges. It is to be noted that the circular is still in the draft stage and final guidelines are awaited.

Lenders to levy penal charges and not penal interest

The Draft Circular provides that penalty, if charged, shall be treated as ‘penal charges’ and shall not be levied in the form of ‘penal interest’ that is added to the rate of interest charged on the advances.

The Dreft Circular prescribes for penal charge and not penal interest.

Penal interest as stated above is an interest on the interest charged on the loan whereas penal charges are separately levied and collected at a specified rate on the defaulted amount. Penal interest is usually added to the rate of interest being charged on the loan. For example, ‘penal interest’ will be charged over and above the rate of interest on loans in case of defaults i.e., if the loan carries an interest of 10%, additional penal interest of 2% will be charged on the EMI amounts.

No capitalisation of penal charges

There are some lenders who also capitalise penal charges Capitalization of penal charges refers to the amount of penal charge being added to the principal, and then interest is charged on such aggregated amount.

Capitalization of penal charges refers to the amount of penal charge being added to the principal, and then interest is charged on such aggregated amount. For instance, say an EMI of Rs. 10000 has become overdue, and the lender is entitled to impose penal charge at 1% per month on the amount overdue. In the present case, for the first month, the amount of penal charge will be Rs. 100 (Rs. 10000 x 1%). Assuming this default continues and moves to the second month, the lender will continue to impose penal charge, on the overdue amount, excluding the penal charge of the first month. That is, amount will be Rs. 100 (Rs. 10000 x 1%) and not Rs. 101 (Rs. 10100 x 1%), as the draft circular prohibits capitalisation of the penal charges.

Change in interest rate due to change in credit profile

It is to be noted that rate of interest on a loan includes appropriate credit risk premium reflecting the credit risk profile of the borrower. Usually, lenders reserve a right in the loan agreement, to alter the terms of the loan, including the credit risk premium in case there is a change in the credit profile of the borrower, however, the same should be backed by sufficient justification.

The Draft Circular also provides that if the credit risk profile of the borrower undergoes a change, REs will be free to alter the credit risk premium as per the contracted terms and conditions, in terms of extant instructions.

This means that credit risk premium can only be increased only if the same is allowed by the loan agreement. However, as provided above, lenders usually reserve a general right to modify the terms of the loan, subject to consent of the borrower.

This seems to be in contradiction to the actual intent of the Draft Circular. In case the default or non-compliance by the borrower is treated as an event changing the its credit profile, the lender may increase the credit risk premium thereby increasing the existing rate of interest. However, a change in credit profile may be a permanent phenomenon leading to a permanent increase in the interest rate whereas default or delay are temporary in nature and are charged only till the default persists.

Therefore, lenders should not employ the above mechanism in lieu of penal charges resulting in a long term impact by change in the interest rate.

No discrimination with individual borrowers

The Draft Circular provides that the penal charges in case of loans sanctioned to individual borrowers, for purposes other than business, shall not be higher than the penal charges applicable to non-individual borrowers.

While the intent is to ensure parity between the penal charges across the various categories of borrowers- individuals as well as non-individuals, it will become important to see how the same shall be ensured. For instance, where a lender levies penal charges on an absolute basis, i.e. Rs. 500 per default/ breach, and the same amount is charged to a 5,000 rs. loan to an individual and to a 50 lakh rs. loan to a company, whether the same would be considered as non-discrimination. Here, even though the amount of penal charges is the same, the proportional impact shall obviously differ.

Disclosure of penal charges

Lenders shall be required to disclose penal charges and the conditions precedents therefor to the customers in the loan agreement and in the MITC or Key Fact Statement (KFS) as applicable, in addition to displaying on the website under ‘Interest rates and Service Charges’.

Annualisation of penal charges i.e. DL guidelines and event based penal charges

The RBI Digital Lending Guidelines[5] (‘RBI DL Guidelines’) also require REs to ensure that the penal interest/charges levied, if any, on the borrowers shall be based on the outstanding amount of the loan. Further, the rate of such penal charges are to be disclosed upfront on an annualised basis to the borrower in the KFS.

Howevrer, the Draft Circular does not provide for annualised penal charges. Practically as well, in circumstances where the penal charges are levied on occurrence of a non-compliance i..e on an event-basis, it may not be possible to disclose them at an annualised rate.

Formulating a Board policy

Similar to current pratice and requirements, lenders are required to ensure that there is a clearly laid down Board approved policy on penal charges or similar charges on loans. This need not necessarily be adopted as a separate policy but could be included as a part of the existing interest rate policy itself.

Dislcosure during reminders

The Draft Circular has stated that whenever reminders for payment of instalments are sent to borrowers, the applicable penal charges, shall also be communicated.

The concept of reminder would mean that the borrower is cautioned about the repayment date, hence, the same should be sent before the due date. Disclosing the consequential penal charges as a part of the reminder would act as a warning to deter the borrower from defaulting.

Penal charges to be proportional to the defaults/ non-compliance of material terms and conditions of loan contract beyond a threshold

It has been provided that the quantum of penal charges shall be proportional to the defaults/ non-compliance of material terms and conditions of loan contract beyond a threshold. However, this threshold is to be determined by the REs in such a manner that it shall not be discriminatory within a particular loan / product category.

The threshold could either be stated in terms of amount or time, that is to say the defaulted amount or the number of days for whcih the default continues. For instance, the delay in payment would attract penal charges in case the same continues beyond the grace period of 3 days or such time limit specified by the lender. Or the same may also be charged in the form of amount of default or gravity of the default/ breach. This may lead to different rates/ amounts of penal charges dependent on the type of breach.

Impact on existing agreements

The impact of the existing loan products would vary on a case to case basis. Several lenders only levy penal interest and there is no penal charges, and there are some who are levying both. REs will be required to carry out appropriate revisions in their policy framework and ensure implementation from the effective date. Considering that this will be a change due to regulatory amendments, it seems that the loan agreement need not necessarily be amended instead a website disclosure should suffice, only if the same is to the benefit of borrower

However, it must be taken care that any change in the existing practices/ terms is not detrimental to the interest of the borrower otherwise, consent of the borrower shall be necessairly taken.

GST on Penal Interest[6]

The GST Council came up with a circular on “Clarification regarding applicability of GST on additional / penal interest” on 28th June, 2019 to provide for GST implications on penal interest. As per the the clarification, penal charges in case of delayed payment of instalment of a money to money transaction will be included in the value of supply as per section 15(2) (d) of the CGST Act. The same shall be exempt through serial no 27 of the notification No. 12/2017-Central Tax (Rate) dated 28th June 2017. Therefore penal charges in this case shall not be taxable under GST. For instance, ABC Co sells a car to Mr. A where the selling price of the car is ₹6,00,000. Mr A has an option to avail a car loan at an interest of 12% per annum for purchasing the car from XYZ Co. The term of the loan from XYZ Co allows A, a period of 24 months to repay the loan and an additional /penal interest @1% per annum for every day of delay in payment. Here the transaction between XYZ co and Mr. A is that of money to money transaction. The penal interest charged will be covered under serial no 27 of notification no 12/2017 Central Tax (Rate) dated the 28.06.2017 “services by way of (a) extending deposits, loans or advances in so far as the consideration is represented by way of interest or discount (other than interest involved in credit card services)”is exempted. Accordingly, in this case, the “penal interest” charged thereon on transaction between XYZ Co and Mr. A would not be subject to GST.

Conclusion

The Draft Circular may put an end to unfair practices by lenders detrimental to borrowers and shall compel lenders to use penal charges for their true purpose i.e. as a deterrent to borrower defaults. However, it is also important to also achieve a balance between bona fide defaults due to the borrower’s genuine difficulty and to provide a disincentive to borrowers from defaulting.

[1] https://rbi.org.in/Scripts/BS_PressReleaseDisplay.aspx?prid=55179

[2] Our writeup on ‘the Statement providing for guidelines on penal charges’ may be viewed here – https://vinodkothari.com/2023/02/the-dos-and-donts-of-penal-charges/

Master Direction – Reserve Bank of India (Interest Rate on Advances) Directions, 2016 (Updated as on June 10, 2021) – https://www.rbi.org.in/Scripts/BS_ViewMasDirections.aspx?id=10295

[4] Master Direction – Non-Banking Financial Company – Systemically Important Non-Deposit taking Company and Deposit taking Company (Reserve Bank) Directions, 2016 – https://rbidocs.rbi.org.in/rdocs/notification/PDFs/45MD01092016B52D6E12D49F411DB63F67F2344A4E09.PDF

[5] https://rbidocs.rbi.org.in/rdocs/notification/PDFs/GUIDELINESDIGITALLENDINGD5C35A71D8124A0E92AEB940A7D25BB3.PDF

[6] Our writeup on the same may be viewed at https://vinodkothari.com/2019/07/applicability-of-gst-on-penal-charges/

THANKS FOR AN EXCELLENT WRITE UP.