Loan Penal Charges: Accounting and GST implications

Abhirup Ghosh, Qasim Saif & Aanchal Kaur Nagpal | finserv@vinodkothari.com

Background

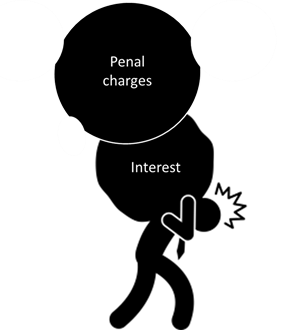

Levying of penal charges or late payment charges are claimed as ‘just’, owing to the underlying breach of contract under the Contract Act, 1972. A breach or a non-performance by one party entitles the other party to receive compensation for any loss or damage suffered due to such breach. Penalties may not only be compensatory; they also have a deterrent element.

In order to ensure compliant behaviour, lenders charge penalties to their borrowers for various ‘events of default’; the predominant ones being penalty for delayed payments (in the form of charges or interest) and prepayment penalties. However, such charges stopped being ‘just’ and ‘reasonable’ when lenders started maneuvering such penalties as revenue enhancement tools, rather than as a deterrent measure and compensation for a breach. Such unreasonable penalties coupled with non-disclosures, compounding of penal interest, etc. were highly prejudicial to consumer interest and accordingly, caught the eye of the regulator.

The RBI introduced guidelines to the lenders to ensure reasonableness and transparency in the disclosure of penal interest vide its Circular on ‘Fair Lending Practice – Penal Charges in Loan Accounts’(RBI Guidelines on penal charges’) dated August 18, 2023. Our article and FAQs[1] on the same may be read here[2].Our YouTube video discussing the guidelines may be viewed here.

However, charging penal interest also raises several practical questions for lenders, mainly indirect taxation and accounting of penal charges, which will be discussed in detail in this article.

Read more →