Lost in Layers: lower threshold for subsidiaries under ODI norms raises concern

Vinita Nair, Senior Partner | Vinod Kothari & Company | corplaw@vinodkothari.com

It is quite common for entities to have subsidiaries in India and outside India in order to undertake business activities. The norms for incorporating a subsidiary in India is mainly governed by provisions of Companies Act, 2013 (‘CA, 2013’) and also the FDI norms for investment in the non-debt instruments, where the investment is being made by a person resident outside India. Similarly, the norms for incorporating a subsidiary outside India is mainly governed by provisions of CA, 2013 and also ODI norms for investment in the non-debt instruments. Additionally, there is a concept of restriction on layers of subsidiaries, prescribed under CA, 2013 and also under the new regime, which has raised cause of concern as well as confusion among India Inc., which is intended to be addressed by the author in this article.

RBI, effective from August 22, 2022 notified norms on Overseas Investment (‘OI’) in the form of OI Rules, OI Regulations and OI Directions. Read our article on the overview of the OI norms here. Our presentation can be accessed here.

Concept of subsidiary: Other laws v/s OI norms

Meaning of the word ‘subsidiary’ is different under different contexts. The meaning under CA, 2013 is linked with controlling the composition of the Board of Directors; or exercising or controlling more than 50% of the total voting power, either at its own or through one or more of its subsidiaries. IND-AS 110 defines subsidiary as an entity that is controlled by another entity and the meaning of control is linked with the ability to affect the variable returns through its power over the investee entity. The framework under competition law deals with combination of the acquirer and the enterprise, whose control, shares, voting rights or assets have been acquired or are being acquired such that it exceeds the prescribed threshold. Similarly, takeover code stresses on acquisition of control in a target company, which is similar to the control under CA, 2013.

FEMA (Transfer or issue of Foreign Security) Regulations, 2004 (‘erstwhile regime’) did not define the term ‘subsidiary’. However, it stressed on the requirement of holding 51% or more of the subsidiary in various regulations. Under OI rules, a subsidiary or step down subsidiary (‘SDS’) is an entity in which foreign entity has control. Therefore, it is necessary to understand the meaning of control under OI Rules.

Control with a shareholding of 10% – How OI Rules differ from corporate laws and practice

The definition of control under CA, 2013 as well as takeover code provides for exercise of control evident from the right to appoint majority of directors or to control management or policy decisions. This right may be exercised by a person or persons acting individually or in concert. It may be direct or indirect. The mode of exercising the right in the entity could be in any manner including i) by virtue of their shareholding or ii) management rights or iii) shareholder agreements or iv) voting agreements or v) in any other manner. The means of exercising control could be anything, including any of the five modes, however, the fact of exercising control should be evident either from the right to appoint majority of directors or to control management or policy decisions. That is the end intended to be met in order to be able to exercise control through any of the means.

Control was not defined under the erstwhile regime. However, OI Rules define control in a similar manner with the only deviation that in case the voting agreements entitle the party to 10% or more of voting rights, it will be regarded as a case of control. This makes the definition of control under OI norms very unique. The note under Para 20 (2) of OI Directions also refer to exercise of control in case of holding stake of 10% of more in an entity

In the author’s view, this is not the correct interpretation. The end to achieve in case of control is the right to appoint a majority of directors or control management or policy decisions and holding 10% or more stake is just a means to achieve the end, and not the end itself. If 10% becomes the revised threshold for determining control, companies will now have several SDS pursuant to holding of stake by existing JV/WOS.

This will result in two modes of determining the subsidiary, an Indian entity investing in a foreign entity will apply the test under CA, 2013 for determining whether the foreign entity is a subsidiary (similarly for the subsidiaries set up by the foreign entity), while the foreign entity will apply the 10% voting power test under OI norms to determine its subsidiary and SDS.

If the definition given in the OI Rules is compared with that in sec. 2 (27) of the CA, 2013, every other word is the same as in the latter definition, except for the 10% numerical threshold in case of voting agreements. This means, the insertion was with discretion; what was the rationale behind inserting the threshold of 10% voting rights is difficult to understand. Certainly, it is quite out of place with the upfront indicia of control, viz., right to appoint majority of directors, or control over management. To say that a 10% shareholder is, at best, a significant minority, and can, in no real situation, exercise voting or management control, is to say the obvious. If the intent of RBI was to simply specify an exposure limit and prescribe certain compliance requirement around it, in that case, a separate term could have been prescribed instead of combining the same with the definition of control.

Consequence of establishment of control

Once control is established, the entity over which the foreign entity exercises the same will be regarded as a subsidiary of the foreign entity or an SDS. Most importantly, the structure of the subsidiary/ SDS has to comply with the structural requirements of a foreign entity i.e. SDS should be entities with limited liability, formed or registered or incorporated outside India or in an IFSC, and in case of unincorporated entities, with core activities in the strategic sector. The OI norms prescribe reporting requirements applicable to the Indian entity acquiring control through the foreign entity. Every financial commitment to the SDS is required to be reported in Section B of Form FC. Further, the Indian entity is required to report the details regarding acquisition or setting up or winding up or transfer of a step down subsidiary or alteration in the shareholding pattern in the foreign entity during the reporting year in the Annual Performance Report. In case the SDS has investment in India, it will also trigger the restrictions on layers of subsidiaries as discussed below.

Round Tripping: Background on restrictions on FDI-ODI structure

In the past, as provided in a FEMA compounding order of 2016, receipt of FDI under an ODI transaction was regarded as violation of Regulation 6 (2) (ii) of erstwhile FEMA (Transfer or Issue of any Foreign Security) Regulations, 2004 as that was not regarded as a bona fide business activity. In another compounding order of 2019, RBI regarded the ODI-FDI structure in contravention of Regulation 5 (1) of erstwhile FEMA (Transfer or Issue of any Foreign Security) Regulations, 2004 as the investment was not in accordance with the Regulations and made without RBI approval.

Around May 2019 RBI had inserted a critical requirement in its FAQs on ODI that prohibited an India Party to set up an Indian subsidiary(ies) through its foreign WOS or JV and also prohibited an Indian Party to acquire a WOS or invest in JV that already had direct/indirect investment in India under the automatic route. This was debatable even back then for reasons as discussed in our article which can be read here.

This was also debated in the Report of the High Level Advisory Committee constituted by the Ministry of Commerce and Industry, Department of Commerce, Government of India in view of the stringent regulations and controls related to capital inflows and outflows to prevent round-tripping. One of the hurdles discussed was the prohibition under the existing norms that did not regard FDI through ODI as a bona fide business activity and how it stifled legitimate and bona fide business purposes. It was remarked that the baggage of round-tripping cannot be used to stifle a major sector any more using the risk of a traffic accident to stop construction of a key highway and that technology, KYC and international coordination could help alleviate concerns on such issues. It suggested thresholds permitting ODI-FDI structure and also certain exemptions for listed entities.

The draft OI Rules proposed dilution of the restriction by prohibiting financial commitment by a PROI in a foreign entity that has then invested or invests in India, directly or indirectly, which was designed for the purpose of tax evasion/ tax avoidance. Only in that case, it was to be considered as a contravention of serious/ sensitive nature. That means, it was proposed to have no restriction on bona fide business transactions resulting in FDI ODI structure.

Confusion on FDI-ODI structure under revised regime

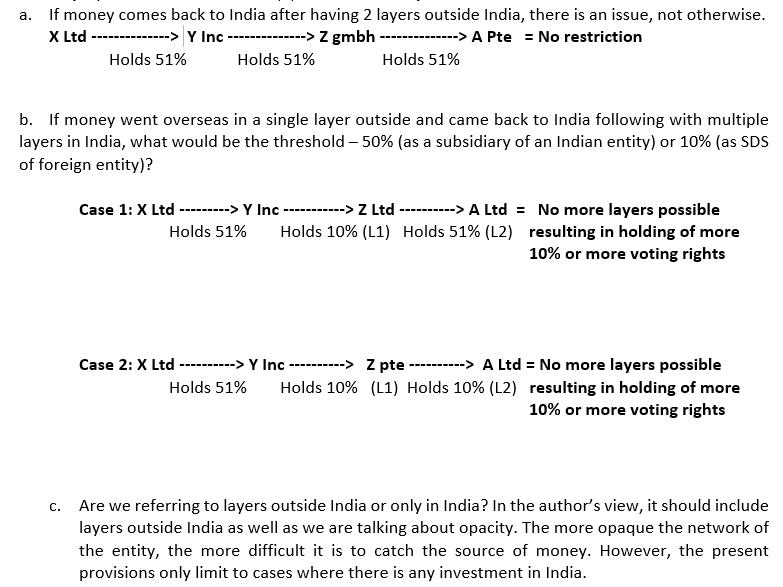

Under the final rules, the prohibition is applicable only where it results in a structure with more than two layers of subsidiaries. The exemption is provided to the entities covered under Rule 2 (2) of Companies (Restriction on Number of Layers) Rules, 2017. From which level the layer is to be considered has not been expressly provided, however, it seems the entity after the foreign entity will be the first layer. This results in several confusions and has certain shortcomings, as detailed below:

- Applicability of the definition of subsidiary and SDS under new rules to apply only to an overseas subsidiary or even to a subsidiary of foreign entities in India. The money invested outside India may move through different layers outside India resulting in SDS due to the 10% threshold, however, will not attract the restriction until an investment is made in India. Only then, it is a case of round-tripping. What all kinds of investment is covered has not been provided in the rules. Whether it is limited to investment in equity capital or any kind of financial commitment, is not clear. If the intent is to restrict the FDI-ODI structure, then investments made in equity instruments as per FEMA (Non-Debt Instruments) Rules, 2019 should only be covered.

- The threshold for determining subsidiaries under CA, 2013 is 50% while for that of a foreign entity, it is 10% {as per the Note to Para 20 (2) of OI Directions}. Few cases to explain the reason for confusion:

- Lastly, the reason for restricting only in case of round-tripping and not in case of one-directional trip is not clear. If the money travels through various jurisdictions and stays there, will it not be a cause of concern?

Concluding remarks

Lowering the threshold for determining step down subsidiaries will have far reaching implications. In addition to increasing the number of SDS under an Indian entity, there will be higher risk of breaching the restriction on layers of subsidiaries. The end parameter of control i.e. right to appoint majority of directors or control the management or policy decisions will lose its significance and what will remain is the huge compliance burden and unanswered questions. As the new norms are already effective, RBI should immediately look into it and issue guidance or carry out amendments to address this.

Leave a Reply

Want to join the discussion?Feel free to contribute!