Checklist for change in share transfer agent

Anushka Vohra, Senior Manager & Ankit Singh Mehar, Executive | corplaw@vinodkothari.com

Loading…

Loading…

Anushka Vohra, Senior Manager & Ankit Singh Mehar, Executive | corplaw@vinodkothari.com

Loading…

Loading…

Sanya Agrawal | corplaw@vinodkothari.com

Loading…

Loading…

Our detailed article on the topic can be read here

Link to our PIT resource centre: https://vinodkothari.com/prohibition-of-insider-trading-resource-centre/

-Consultation paper proposes to rationalise the existing framework under insider trading

Anushka Vohra | Senior Manager

corplaw@vinodkothari.com

The concept of trading plan was introduced for the first time in the SEBI (Prohibition of Insider Trading) Regulations, 2015 (‘PIT Regulations’). The rationale for introducing the same, as indicated in the Report of the High Level Committee constituted for the purpose of reviewing the erstwhile 1992 Regulations, chaired by Mr. N.K. Sodhi, was that there may be certain persons in a company who may perpetually be in possession of UPSI, which would render them incapable of trading in securities throughout the year. The concept of trading plan would enable compliant trading by insiders without compromising the prohibitions imposed in the PIT Regulations.

Trading plan means a plan framed by an insider (and not just a designated person) for trades to be executed at a future date. Trading plan is particularly suitable for those persons within the organization, who may by way of their position, seniority or any other reason, be in possession of UPSI at all times. Since, the PIT Regulations prohibit trading when in possession of UPSI, trading plans are an exemption to such prohibition. In order to ensure that the insiders while formulating the trading plan do not have possession to UPSI, cooling-off period of 6 months has been prescribed in the PIT Regulations. As per Reg. 5(1) of the PIT Regulations, the trading plan has to be presented before the compliance officer of the company for approval. As per sub-regulation (3), the compliance officer has to review the trading plan and assess for any violation of the PIT Regulations. If at the time of formulation of trading plan, there was no UPSI or later on a new UPSI was generated, then the trading can be carried out as per the trading plan, even if the new UPSI has not been made generally available.

When the trades are executed as per trading plan, certain provisions of the PIT Regulations are exempted viz. trading window restrictions, pre-clearance of trades and contra trade restrictions.

SEBI has issued a Consultation Paper on November 24, 2023 for inviting public comments on the recommendations of the Working Group (‘Report’) to review provisions related to trading plans.

This article discusses the proposed amendments to the framework of the trading plan as mentioned in the Consultation Paper.

Challenges in the present framework

The Report discusses that during the last 5 years only 30 trading plans have been submitted annually by the insiders, which indicates that the trading plans are not very popular.

The year wise data on trading plans as mentioned in the Report is given below:

The data w.r.t. number of listed companies and DPs during FY 2022-23 is also given below:

The above clearly shows that during FY 2022-23, the number of designated persons among the listed companies was around 2,56,878 and there were only infinitesimal trading plan received by the exchange(s).

Further, the five features of the trading plan as highlighted in the Report are as under:

(i) can be executed only after 6 (six) months from its public disclosure;

(ii) are required to cover a period of at least 12 (twelve) months;

(iii) must be disclosed to the stock exchanges prior to its implementation (i.e., actual trading);

(iv) are irrevocable; and

(v) cannot be deviated from, once publicly disclosed.

As evident from above, while the concept has been into existence since 2015, trading plans have not been very popular owing to certain restrictive conditions viz. mandatory execution of the same even if the market prices are unfavorable for an insider, inability to trade for a reasonable period around the declaration of financial results and mandatory cooling off period of 6 months etc.

Cooling-off period means gap between the formulation and public disclosure of the plan and actual execution of the plan. Reg. 5(2) of the PIT Regulations presently provides a cooling-off period for 6 months as the period of 6 months was considered reasonable for the UPSI that may be in the possession of the insider while formulating the trading plan to become generally available or any new UPSI to come into existence.

This period is proposed to be reduced to 4 months. The Report states that as per the current requirement, the insiders have to plan their trade 6 months ahead which may not be favorable, considering the volatility in the markets. It was proposed to either reduce the period or to do away with it.

The Report classifies UPSI into two types; short-term UPSI and long-term UPSI to ascertain the time within which the UPSI is expected to become generally available.

The Report further highlights that in case of short-term UPSI, a period of 4 months would be sufficiently long for it to become generally available.

In case of long-term UPSI, the Report refers back to proviso to Reg. 5(4) according to which the insider cannot execute the trading plan if the UPSI does not become generally available.

The Report also gives reference to the cooling-off period for trading plans in the US, where SEC introduced the cooling-off period only in December 2022.

Reg.5(2)(iii) states that a trading plan shall entail trading for not less than 12 months. A period of 12 months was specified to avoid frequent announcements of trading plans. This again provides a very long period for insider to execute their trading. This period is proposed to be reduced to 2 months.

As per Reg 5(2)(ii), trading plan cannot entail trades for the period between the twentieth trading day prior to the last day of any financial period for which results are required to be announced by the issuer of the securities and the second trading day after the disclosure of such financial results. This period is known as the black-out period.

The Report states that this period forms a significant part of the year, considering 4 quarters and hence it is proposed to omit the same.

The Report also discusses the potential concerns that may arise on removing the black-out period. The Working Group noted that the same is addressed by the cooling-off period and non alteration of plan once approved and disclosed.

As per Reg. 5(2)(v) of the PIT Regulations, the insider can set out either the value of trades to be effected and the number of securities to be traded along with the nature of the trade, intervals at, or dates on which such trades shall be effected.

The Working Group noted that there was no price limit that the insider could mention. The Report recommends a price limit of 20%, up or down of the closing price on the date of submission of the trading plan.

As per Reg. 5(4), the trading plan once approved shall be irrevocable and the insider will have to mandatorily implement the plan without any deviation from it. This puts the insider in a disadvantageous position as he has to execute the trades (buy / sell) even when the price is not favorable.

As per the proposed amendment, where the price of the security is outside the price limit set by the insider, the trade shall not be executed. The plan will be irrevocable only where no price limit is opted for.

As per Reg. 5(3) of the PIT Regulations, restrictions on contra trade are not applicable on trades carried out in accordance with an approved trading plan.

The Working Group deliberated that it is difficult to envisage a reasonable and genuine need for any insider to plan two opposite trades with a gap of less than 6 months. The Report states that the insider may misuse the exemption for undertaking a contra position. Therefore, the exemption is proposed to be omitted.

As per Reg. 5(5), upon approval of the trading plan, the compliance officer has to notify the plan to the stock exchange(s). However, presently there is no specific timeline indicated. The Working Group recommends disclosure within 2 trading days of the approval of the plan. Further, it recommends disclosure of the price limit as well.

While the format of the trading plan will be rolled out basis discussion with the market participants, the Consultation Paper, basis the recommendations of the Working Group on protecting the privacy of the insiders by masking the personal details, discussed three alternatives of disclosure, as under:

It was discussed that disclosing personal details of the insiders publicly may raise privacy and safety concerns for senior management and insiders and not disclosing personal details to the stock exchange(s) would lead to misuse / abuse of trading plans by other insiders. That is, a trading plan submitted by one person may instead be used by someone else.

Having discussed the above, the Consultation Paper suggests alternative 3 i.e. making two separate disclosures of the trading plan; (i) full (confidential) disclosure to the stock exchange and (ii) disclosure without personal details to the public through stock exchange. Further, these separate disclosures may have a unique identifier for reconciliation purposes.

The proposed amendments indicate a welcome change as it attempts to plug the gaps prevalent in the erstwhile framework and offers flexibility to the insiders. At the same time, the Compliance officer will have to remain mindful of any scope for potential abuse by the insiders, while approving the same.One will have to await the actual amendment, basis the receipt of public comments, to ascertain if trading plans are all set to become popular and more frequent.

Our resources on the topic:

Link to our PIT resource centre: https://vinodkothari.com/prohibition-of-insider-trading-resource-centre/

Anushka Vohra | Senior Manager

corplaw@vinodkothari.com

The SEBI (Prohibition of Insider Trading) Regulations, 2015 (‘PIT Regulations’) impose certain restrictions and obligations on the DPs, one of which is contra trade restriction.

The DPs and their immediate relatives are restricted from entering into contra trade which refers to opposite trades executed viz. buy / sale within a shorter period of time usually within a period of 6 months with an intent to book short term profits. Where contra – trade is executed in violation of the restriction, the profit earned is to be disgorged for remittance to the IPEF.

In case of an individual DP (promoters / directors / etc. as recognized by the listed company), the immediate relatives also have certain obligations under the Regulations as their trades may be said to be influenced by the DPs. Similarly, in case of non-individual DPs (promoters), there may be other promoters and persons belonging to the promoter group who may act in concert with a particular non-individual promoter.

Having said that, it is important to understand the intent of contra trade, whether the same would apply individually on DPs based on trades executed against their PAN or the same would apply jointly on DPs and their immediate relatives or the entire promoter group inter-se. The same has been a matter of discussion in various Informal Guidance (‘IG’) of SEBI. We discuss the same briefly along with other illustrations.

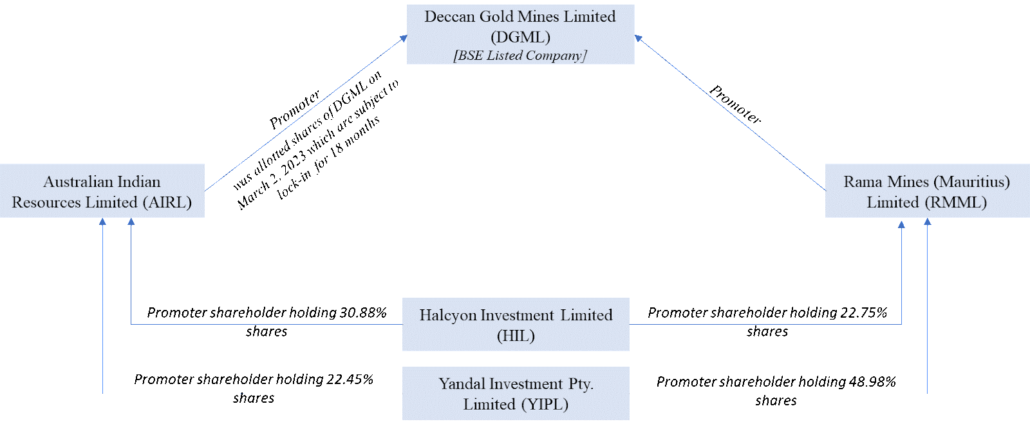

Generally, the concept of Persons Acting in Concert (‘PACs’) is used in the Takeover Code and under the PIT Regulations, the perspective so far has been PAN based. In the recent IG in the matter of Deccan Gold Mines Ltd[1], SEBI in its interpretative letter has given the view that contra trade restrictions would apply on the promoter group jointly, given the case in hand. The facts of the case have been represented diagrammatically below.

We see that the listed company is being held by two corporate promoters, which in turn are held by common shareholders. Here, RMML intended to sell its shareholding in open-market within 6 months of the allotment made to AIRL.

Since there is common control in both the promoter entities, it was stated that contra-trade restriction would apply jointly on both.

The intent of contra trade, as also mentioned above is to ensure that the persons who are privy to UPSI do not make short term profits in the securities of the listed company. For instance, if a DP has bought a security of the listed company in anticipation of a rise in prices that might be caused by the UPSI, such DP cannot sell such security within 6 months of the purchase. While trades can be executed by different DPs having different PAN, however where a single person is the “driving force” (as cited by the SAT in Shubhkam Ventures (I) Private Limited v. SEBI[2], it cannot be said that the persons acted in their individual capacity.

There have been instances in the past where SEBI has given the view that contra trade restrictions apply individually on DPs. The view seems to be supported by the interpretation of clause 10 of Schedule B of the Regulations, which states that:

The code of conduct shall specify the period, which in any event shall not be less than six months, within which a designated person who is permitted to trade shall not execute a contra trade. XXX

Previously, in 2020, in the matter of Raghav Commercial Ltd[3], SEBI in its interpretative letter took the view that the contra trade restrictions apply to trades made by promoters individually and not the entire promoter group.

Taking the case of individual DPs, in the matter of Star Cement Limited[4], while answering the question on applicability of contra trade restrictions – whether individually or to the entire promoter group, SEBI cited the above clause 10 stating that the same applies individually.

Reference of the above case was taken in 2019 in the matter of Arvind Limited[5], where contra trade restrictions were said to apply individually on DP through PAN, disregarding who took the trading decision. Our detailed article on the same can be read here.

The current case makes it quite clear that the facts of the case have to be considered to analyze whether there is a single person taking trading decision.

Let us take several other examples to understand the intent of contra trade.

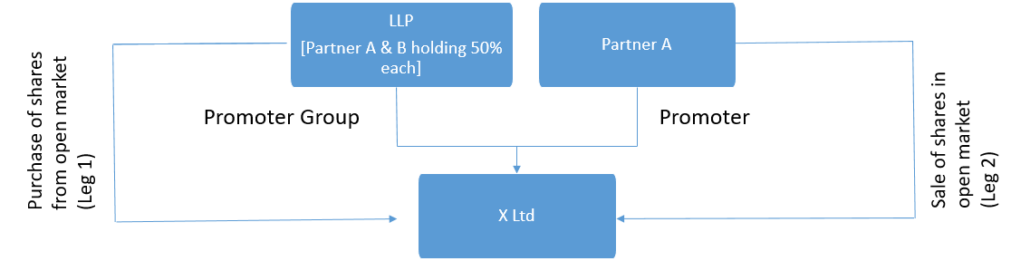

1.

Whether Leg 2 will be contra to Leg1? Here we see that significant stake i.e. 50% is being held by Partner A (promoter of X Ltd) in the LLP. The trades of LLP can be said to be influenced by the decision of Partner A. This can be a case of common control and therefore Leg 2 becomes contra to Leg 1.

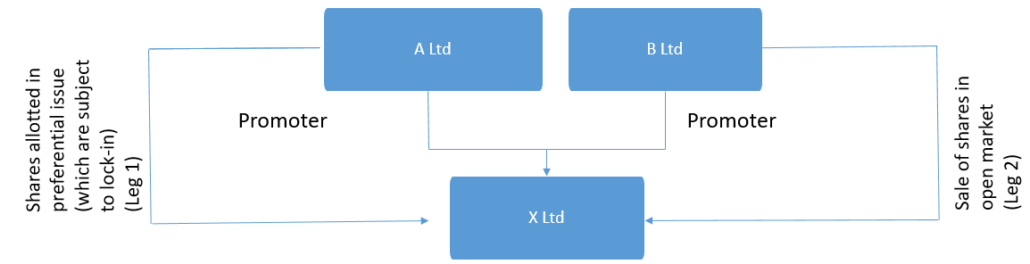

2.

In this case, we will have to see who is behind A Ltd and B Ltd. If both A Ltd and B Ltd are held by the same set of shareholders, Leg 2 would become contra to Leg 1.

Further, there are certain exemptions w.r.t. contra-trade restrictions that have been prescribed in the PIT Regulations and also in SEBI FAQs.

As per PIT Regulations, contra trade shall not apply for trades pursuant to exercise of stock options. SEBI Faqs further elaborate on the same stating that, in respect of ESOPs, subscribing, exercising and subsequent sale of shares, so acquired by exercising ESOPs (hereinafter “ESOP shares”), shall not attract contra trade restrictions.

Further trades pursuant to any non- market transaction is exempted (SEBI Faqs).

The rationale behind exemption is that for stock options and non-market transactions, the exercise price / purchase price is predetermined. The selling transaction pursuant to exercise of stock options or pursuant to acquisition of shares in non-open market is not influenced by purchases made basis some UPSI. The exercise price / acquisition price is already decided by the company.

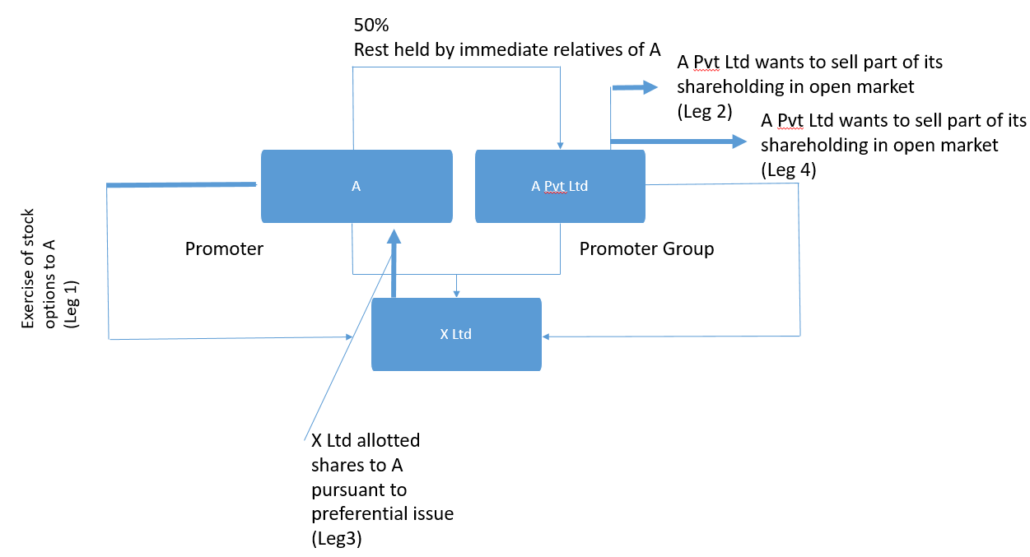

Let us understand another example.

3.

In the above case, it is evident that A is the decision maker for A Pvt Ltd. Here, Leg 2 is not contra to Leg 1.Leg 4 is contra to Leg 3 as there is no exemption provided.

Often, it is also interpreted that contra-trade is applicable share wise. To take an example, suppose; first – stock options are acquired by a DP, second – open market purchase is done, third – stock options are sold (all three within a period of 6 months). Here, it is interpreted that third would not be contra to first and second. This is a wrong interpretation, as the moment the DP makes any open market purchase or already has the company’s shares in portfolio, the immunity w.r.t. selling shares acquired pursuant to exercise of stock options is lost. One cannot differentiate between the shares as what is important to establish for contra-trade is the intention to make short term profits. Such intention, also, is evident when trading decisions are made by a single person, irrespective of the different individuals executing trades.

Contra-trade is understood by different names in other jurisdictions. It is referred to as short swing in the US and reversal trade in some jurisdictions.

Section 16(b) deals with prohibition on short-swing trades by beneficial owner, director, or officer of the companies. The section reads as under:

“For the purpose of preventing the unfair use of information which may have been obtained by such beneficial owner[7], director, or officer by reason of his relationship to the issuer, any profit realized by him from any purchase and sale, or any sale and purchase, of any equity security of such issuer (other than an exempted security) or a security-based swap agreement involving any such equity security within any period of less than six months, unless such security or security-based swap agreement was acquired in good faith in connection with a debt previously contracted, shall inure to and be recoverable by the issuer, irrespective of any intention on the part of such beneficial owner, director, or officer in entering into such transaction of holding the security or security based swap agreement purchased or of not repurchasing the security or security-based swap agreement sold for a period exceeding six months.XXX”

Article 41 and 42 deals with contra trade restrictions. It reads as under:

Article 41 A shareholder that holds five percent of the shares issued by a company limited by shares shall, within three days from the date on which the number of shares held by him reaches this percentage, report the same to the company, which shall, within three days from the date on which it receives the report, report the same to the securities regulatory authority under the State Council. If the company is a listed company, it shall report the matter to the stock exchange at the same time.

Article 42 If the shareholder described in the preceding article sells, within six months of purchase, the shares he holds of the said company or repurchases the shares within six months after selling the same, the earnings so obtained by the shareholder shall belong to the company and be recovered by the board of directors of the company. However, a securities company that has a shareholding of not less than five percent due to purchase of the remaining shares in the capacity of a company that underwrites as the sole agent shall not be subject to the restriction of six months when selling the said shares.

If the company’s board of directors fails to comply with the provisions of the preceding paragraph, the other shareholders shall have the right to require the board of directors to comply.

If the company’s board of directors fails to comply with the provisions of the first paragraph and thereby causes losses to the company, the directors responsible therefore shall bear joint and several liabilities for the losses.

We had earlier in our article (supra) given the view that contra-trade should be seen jointly and not individually, considering the intent. To establish violation of PIT Regulations, one has to go beyond tracking trades based on PAN. It is important to know the decision maker behind the trades, in order to establish a clear nexus. It would be important to see whether such a view was taken by SEBI because of the case in hand or is it reflective of a new trend i.e. position of common control.

Link to our PIT Resource centre: Click here

[1] https://www.sebi.gov.in/enforcement/informal-guidance/oct-2023/in-the-matter-of-rama-mines-mauritius-ltd-under-sebi-prohibition-of-insider-trading-regulations-2015_78308.html

[2] https://www.sebi.gov.in/satorders/subhkamventures.pdf

[3] https://www.sebi.gov.in/sebi_data/commondocs/sep-2020/SEBI%20let%20Raghav%20IG_p.pdf

[4] https://www.sebi.gov.in/sebi_data/commondocs/jul-2018/StarCementGuidanceletter_p.pdf

[5] https://www.sebi.gov.in/sebi_data/commondocs/nov-2019/Inf%20Gui%20letter%20by%20SEBI%20Arvind_p.pdf

[6] https://www.govinfo.gov/content/pkg/COMPS-1885/pdf/COMPS-1885.pdf

[7] Every person who is directly or indirectly the beneficial owner of more than 10% of any class of any equity security (other than exempted security) [Ref. 16(a)(1)]

[8] http://www.npc.gov.cn/zgrdw/englishnpc/Law/2007-12/11/content_1383569.htm#:~:text=Article%201%20This%20Law%20is,of%20the%20socialist%20market%20economy.

Middle and Upper Layer NBFCs also part of the system

Team Finserv, finserv@vinodkothari.com (updated as on March 30,2024)

The Reserve Bank of India on September 21, 2023 has issued the Draft Master Directions on Treatment of Wilful Defaulters and Large Defaulters (‘Proposed Directions’). The Directions, when finalized, will replace the existing Master circulars (referred below). The draft Directions are largely consolidating in nature, with some significant differences. Importantly, NBFCs of middle and upper layer have been brought into the framework, and additionally, as was clear from the recent circular on compromise/settlements, the tag of willful defaulter may be removed if the borrower does a compromise settlement with the lender. However, a mere sale of the loan will not cause removal of the tag, as the tag will pass on to the buyer. The draft Directions also assimilate the provisions about large defaulters, which was earlier a CIC filing requirement, and make it a part of these Directions.

Read more →Hari Dwivedi | corplaw@vinodkothari.com

SEBI, the regulatory body overseeing various intermediaries in primary and secondary markets, such as merchant bankers, portfolio managers, research analysts, debentures trustees, underwriters, stock brokers, sub brokers, bankers to an issue, investment advisors, registered custodians, and more, has registered over 33,000 intermediaries as per SEBI’s recognized intermediaries data. Among them, there are 1331 Investment Advisors (referred to as “IA”) as on 24th September, 2023. In this article, we will discuss the role of IA in the securities market and outline some important do’s and don’ts for them, given their significant role.

IA plays a pivotal role in facilitating prudent financial decision-making for both individuals and institutions. Their expertise, customized strategies, and risk management proficiency are instrumental in aiding clients to realize their financial objectives and navigate the intricacies of financial markets. This client-advisor relationship hinges on a foundation of trust, invoking a stringent fiduciary obligation upon IA. They are ethically and legally mandated to prioritize the best interests of their clients, entailing the provision of transparent and candid counsel, the avoidance of conflicts of interest, and meticulous disclosure of any potential conflicts. In fulfilling these responsibilities, it is imperative for IA to meticulously adhere to the regulatory provisions, observing both the prescribed protocols and constraints. This not only safeguards against penalties but also upholds client satisfaction, fostering a harmonious and productive relationship.

But before we delve into the do’s and don’ts for an IA, let’s first understand who is an IA under the applicable legal provisions.

Our other related and relevant write ups on similar issues can be read below:

Vinod Kothari | vinod@vinodkothari.com

Schemes to crowdfund real assets (that is, assets other than financial assets) continue to proliferate. Known by various names as fractionalisation, tokenisation, fractional property shares, etc., these schemes invite multiple retail investors to become fractional owners of assets. The assets in question may consist of properties, solar assets, leased equipment, etc. The assets, in turn, are deployed by some asset manager, who produces returns from these assets. These returns are earned by the investors.

A money-for-money transaction is essentially an investment contract. The meaning of money-for-money transaction is one where a person puts in money, and is promised money in return. That is to say, the essence of the activity is producing monetary returns by investing a certain sum of money. This is opposed to a shared property ownership or business where money is invested for acquiring stake in an asset. The asset, in turn, may be deployed for a common good, but the key question to ask is: have the investors been promised returns by the manager of the scheme? That is, do investors acquire equity in the asset, exposing themselves to the risks/returns of the asset, or do investors have been promised, explicitly or implicitly, a fixed rate of return? In the latter case, it is clearly an investment transaction, and being a pooled investment vehicle, it may be termed as “collective investment scheme”.

There are stringent regulations in India for Collective Investment Schemes i.e. the SEBI (Collective Investment Scheme) Regulations, 1999, and India is not unique in this respect. We have earlier discussed the law regarding fractional ownership of properties, and the ingredients that distinguish between a participated ownership, versus a collective investment scheme.

Read more →| Register here: https://forms.gle/dmzuWFjxp8sL3VR4A |

Loading…

Loading…

Avinash Shetty, Assistant Manager | corplaw@vinodkothari.com