Mandatory listing for further bond issues

“Listed once, always go for listing” to apply for new bond issues; optional for existing unlisted issuances

Vinita Nair | Vinod Kothari & Company | corplaw@vinodkothari.com

June 29, 2023 (updated on September 21, 2023)

Background

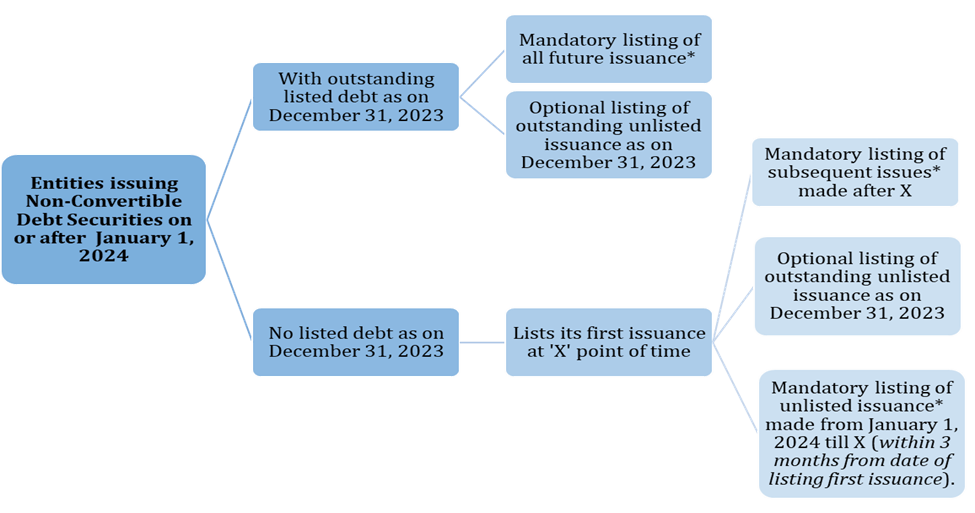

SEBI approved the proposal for mandatory listing of debentures/ NCDs, in its Board meeting held on June 28, 2023, for all listed entities having outstanding listed NCDs as on December 31, 2023. Effective Jan. 1, 2024, such listed entities will have to now mandatorily list each of its subsequent issuance of NCDs on the stock exchanges.

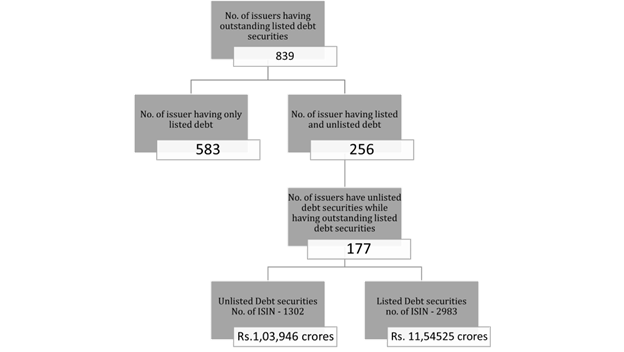

Aimed at better information flow and liquidity considerations, the move is said to be inspired by data analysis carried out by SEBI, as discussed in its Consultation Paper dated February 09, 2023, basis the information obtained from the depositories. Succinctly, the snapshot of unlisted bond issues by listed companies (it seems that the data of unlisted bond issuances by unlisted companies is not available), as on January 31, 2023, is as follows:

This would mean roughly 8% of all bond issuances by listed companies are outstanding, excluding bond issues by completely unlisted entities, which may be insignificant for the purpose of analysis.

On account of parallel issuance of unlisted debt by listed issuers, SEBI highlighted following concerns:

- Undesirable opacity in the bond market due to information asymmetry;

- Exit related difficulty, liquidity risk;

- No recourse to investor grievance redress mechanism;

- Confusion for investor at ISIN level, difficulty in comparing;

- Possibility of mis-selling;

- Trading outside settlement mechanism prone to counterparty risk;

- Disparity in continuous listing requirements.

This article discusses about SEBI (Listing Obligations and Disclosure Requirements) (Fourth Amendment) Regulations, 2023 (‘Present Amendment’) notified on September 20, 2023 inserting Regulation 62A in SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015 (‘Listing Regulations’) and the impact of this step on potential issuers of NCDs. Read our other articles relating to the bond market here.

Present Amendment for listing of subsequent NCD issuance

Regulation 62A of Listing Regulations mandate listing of NCD issuance in the following manner:

* Not applicable in case of exempted issuance.

Scope and applicability

In terms of SEBI (Issue and Listing of Non-Convertible Securities) Regulations, 2021 (‘ILNCS Regulations’), “debt securities” means non-convertible debt securities with a fixed maturity period which create or acknowledge indebtedness and includes debentures, bonds or any other security whether constituting a charge on the assets/ properties or not, but excludes security receipts, securitized debt instruments, money market instruments regulated by the Reserve Bank of India, and bonds issued by the Government or such other bodies as may be specified by SEBI.

The applicability of the present amendment is for issuance of debt securities (NCDs) and not non-convertible securities as it is wider term and includes non-convertible redeemable preference shares, perpetual non-cumulative preference shares and perpetual debt instruments. SEBI has further clarified in the SEBI BM agenda that the requirement will not apply to issuance made under Chapter V of ILNCS Regulations i.e. non-equity regulatory capital instruments issued as per RBI guidelines.

Entities which do not list any of its NCD issuance will not be covered by the requirement. Issuers having no outstanding listed NCDs or only unlisted NCDs shall continue to have the discretion to come into the listed space or not.

SEBI’s rationale is that an issuer has the option to enter the listed space. Once the listed ISINs mature, the issuer has a choice to contemplate listing further issues. The regulatory framework also provides for the manner of delisting all ISINs, where required.

Exempted issuance: Scope and conditions

(i) Bonds issued under section 54EC of the Income Tax Act, 1961

Capital gain tax exemption bonds issued under the aforesaid provisions by eligible issuers notified by Central Government, for e.g. Indian Railway Finance Corporation Limited, Power Finance Corporation Limited, National Highways Authority of India, Rural Electrification Corporation etc. with a fixed maturity of 5 years and subject to lock in.

(ii) NCDs issued pursuant to an agreement entered into between the listed entity of such securities and multilateral institutions;

(iii) NCDs issued pursuant to an order of any court or Tribunal or regulatory requirement as stipulated by a financial sector regulator viz. SEBI, RBI, IRDA or PFRDA.

The NCDs shall remain locked in and be held till maturity. Further, these will have to remain unencumbered.

For every issuance of NCD covered in (i) to (iii) above, all the key terms of such securities, including embedded options, security offered, interest rates, charges, commissions, premium (by any name called), period of maturity and such other details prescribed by SEBI will be required to be disclosed to the stock exchange.

While the SEBI BM agenda specified about exempting issuance by a holding company to its subsidiary or vice-versa subject to the condition on interest rate offered (not be lower than the prevailing interest rate for Government Securities closest to the tenure of such NCDs), lock-in requirement, to be held till maturity and remain unencumbered, it did not find place in the present amendment.

Further, in terms of SEBI BM agenda, the requirement of lock-in, keeping it unencumbered and holding till maturity, was not applicable in case of NCDs issued pursuant to an order of any court or Tribunal or regulatory requirement as stipulated by a financial sector regulator viz. SEBI, RBI, IRDA or PFRDA.

Impact on Large Corporate Borrowers (LCB)

SEBI followed the stick approach in case of LCB[1] by mandating them to raise 25% of their incremental borrowing[2] by issue of debentures over a block of 2 years, failing which a penalty of 0.2% of the shortfall was to be imposed effective from the first block ending March 31, 2023. As entities struggled to meet the requirement, SEBI extended the block by one more year vide circular dated March 31, 2023 thereby having the first block of 3 years ending on March 31, 2024.

The LCB framework was silent on whether the bonds issued to meet the incremental borrowing requirement are to be listed or not. With the present decision of SEBI, the LCB will have to compulsorily list every debt issuance in case it has outstanding listed debt.

Pursuant to issuance and compulsory listing, as the LCBs will cross the threshold of Rs. 500 crore of outstanding listed debt during the financial year, the framework of High Value Debt Listed Entities (‘HVDLE’) will become applicable and such entity will be required to comply with corporate governance norms as applicable to an equity listed entity within a period of 6 months from the date of such trigger. Our resource material on SEBI proposing a revised framework for LCB via consultation paper dated August 10, 2023 can be seen here.

Author’s remark

Listing of debt should not be mandatory. The mandate should be pursuant to the agreement between issuer and subscriber and not pursuant to a provision of law. The concern of information asymmetry or opacity may be addressed by way of implementing disclosure requirements with respect to unlisted debt instruments issued by the issuer. In the case of equity, it is different. The reason to mandate listing of every subsequent issue of equity is two-fold:

- In case of equity, there are only 2 categories – 1. Equity of the same class and 2. SR equity shares (that too come with a sunset clause of 5 years).

- The trading price of equity will get impacted if there are listed and unlisted shares.

Debenture is a contractual obligation between the issuer and the subscriber. Unlike equity shares, two series of Debentures are distinct in terms of coupon, price, maturity, embedded options, nature of security etc. Therefore, Debenture issuance cannot be equated with the requirement and rationale under Reg. 28 of LODR.

Investors of one series of debentures will track the covenants and requirements under the said series. Mere availability of information of all debt issuances of the issuer, will not provide the necessary transparency. In case, the investors prefer having recourse to the grievance redressal mechanism of SEBI and stock exchange, or options for seeking timely exit by way of transfer, it can mandate the issuer to list the issuance.

Impact

This step of making listing mandatory may also demotivate a lot of the issuers (existing or first time) to access bond market, owing to the regulatory requirement, the cost of listing (especially where the quantum of issuance is small and only to meet the LCB obligation) and continual compliances especially where the issuer becomes an HVDLE. Voluntary delisting of existing issuance will require consent of 100% of the debt security holders (refer our resource here) which will make it more challenging.

The carve out has not been provided for issuance between holding company and subsidiary. Therefore, intra-group issuance will also be required to be listed for issuance made on or after January 1, 2024.

Further, the requirement of lock-in, holding till maturity and keeping the NCDs unencumbered, especially in case of NCDs issued pursuant to Scheme of Arrangement or as part of a resolution plan (approved by way of order of Tribunal), issue of NCDs pursuant to a bilateral arrangement with multilateral institutions viz. IFC, ADB etc. and issue of sub-debt, PDIs etc (issued pursuant to regulatory requirements of financial sector regulator) may make it challenging and the issuers would opt for listing to avoid these restrictions.

[1] a) that have their specified securities or debt securities or non-convertible redeemable preference shares, listed on a recognized stock exchange(s) in terms of SEBI LODR Regulations, 2015; and b)have an outstanding long term borrowing of Rs. 100 crore or above, where outstanding long-term borrowings shall mean any outstanding borrowing with original maturity of more than one year and shall exclude external commercial borrowings and inter-corporate borrowings between a parent and subsidiary(ies); and c) have a credit rating of “AA and above”, where credit rating shall be of the unsupported bank borrowing or plain vanilla bonds of an entity, which have no structuring/ support built in.

[2] borrowing done during a particular financial year, of original maturity of more than one year, excluding external commercial borrowings and inter-corporate borrowings between a parent and subsidiary(ies).

Leave a Reply

Want to join the discussion?Feel free to contribute!