Sustainability linked derivatives: An instrument with a potential

/0 Comments/in Capital Markets, Financial Services, Sustainability, Sustainability /by Vinod Kothari– Vinod Kothari, vinod@vinodkothari.com

Sustainability-linked loans and bonds have been surging globally. While there has been a dip in the recent periods (Q3 and Q4 of 2023) owing to tightening of regulatory conditions, the global volumes of sustainability-linked loans stood at around $ 400 billion[1].

However, there is another instrument – a derivative, which also has a linkage with sustainability targets, and that is making a global buzz. ISDA, having named this Sustainability Linked Derivatives or SLDs, is creating proper documentation basis to take this market forward. As of now, the market for SLDs is neither large nor highly standardised, but as credit defaults rose from nowhere and from a purely OTC product into being in the very thick of the global financial crisis, SLDs also merit close attention.

What is an SLD?

Think of usual derivatives in financial business – it will be an interest rate swap, or cross currency swap/FX forward. An SLD adds a sustainability-linked overlay on a typical IRS or FX hedge transaction.

For instance, assume Borrower X has taken a floating rate loan of $ 100 million, say at SOFR + 100 bps. X now hedges interest rate risk by entering into an IRS with Bank A, whereby Bank swaps this for a fixed rate of 4.5%.

Here, if we add an SLD overlay, Bank A will agree to provide a discount of, say 5 bps if X is able to meet certain specified sustainability KPIs. On the contrary, if X fails to meet the KPIs, then X pays a penalty of equal or a different amount. Depending on the agreement, the discount or penalty, or bonus/malus, may either be exchanged between the counterparties or by spent by either counterparty by way of a donation for a sustainability cause.

Read more →Contra trade restrictions – traversing out of PAN to common control

/0 Comments/in Capital Markets, PIT, SEBI /by Anushka VohraAnushka Vohra | Senior Manager

corplaw@vinodkothari.com

Introduction

The SEBI (Prohibition of Insider Trading) Regulations, 2015 (‘PIT Regulations’) impose certain restrictions and obligations on the DPs, one of which is contra trade restriction.

The DPs and their immediate relatives are restricted from entering into contra trade which refers to opposite trades executed viz. buy / sale within a shorter period of time usually within a period of 6 months with an intent to book short term profits. Where contra – trade is executed in violation of the restriction, the profit earned is to be disgorged for remittance to the IPEF.

In case of an individual DP (promoters / directors / etc. as recognized by the listed company), the immediate relatives also have certain obligations under the Regulations as their trades may be said to be influenced by the DPs. Similarly, in case of non-individual DPs (promoters), there may be other promoters and persons belonging to the promoter group who may act in concert with a particular non-individual promoter.

Having said that, it is important to understand the intent of contra trade, whether the same would apply individually on DPs based on trades executed against their PAN or the same would apply jointly on DPs and their immediate relatives or the entire promoter group inter-se. The same has been a matter of discussion in various Informal Guidance (‘IG’) of SEBI. We discuss the same briefly along with other illustrations.

Informal Guidance

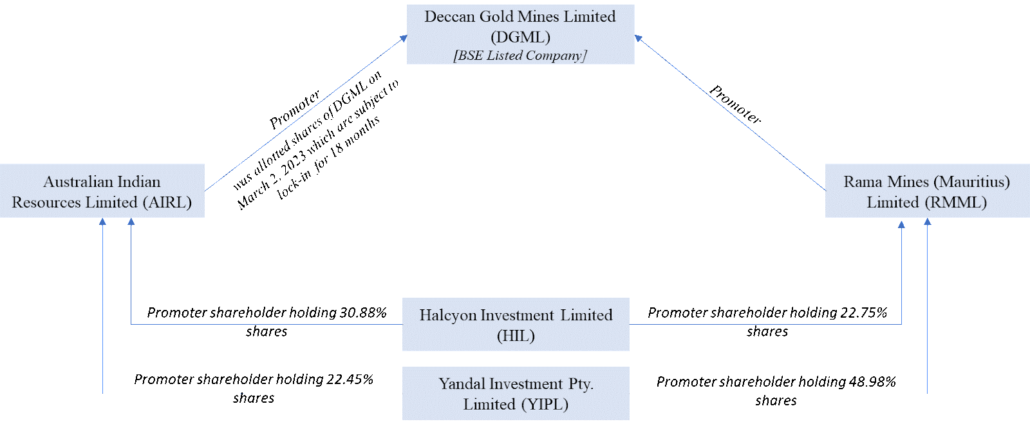

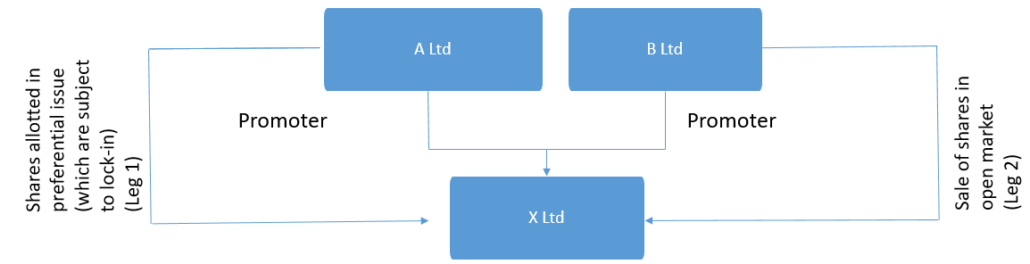

Generally, the concept of Persons Acting in Concert (‘PACs’) is used in the Takeover Code and under the PIT Regulations, the perspective so far has been PAN based. In the recent IG in the matter of Deccan Gold Mines Ltd[1], SEBI in its interpretative letter has given the view that contra trade restrictions would apply on the promoter group jointly, given the case in hand. The facts of the case have been represented diagrammatically below.

We see that the listed company is being held by two corporate promoters, which in turn are held by common shareholders. Here, RMML intended to sell its shareholding in open-market within 6 months of the allotment made to AIRL.

Since there is common control in both the promoter entities, it was stated that contra-trade restriction would apply jointly on both.

Intent of contra-trade

The intent of contra trade, as also mentioned above is to ensure that the persons who are privy to UPSI do not make short term profits in the securities of the listed company. For instance, if a DP has bought a security of the listed company in anticipation of a rise in prices that might be caused by the UPSI, such DP cannot sell such security within 6 months of the purchase. While trades can be executed by different DPs having different PAN, however where a single person is the “driving force” (as cited by the SAT in Shubhkam Ventures (I) Private Limited v. SEBI[2], it cannot be said that the persons acted in their individual capacity.

There have been instances in the past where SEBI has given the view that contra trade restrictions apply individually on DPs. The view seems to be supported by the interpretation of clause 10 of Schedule B of the Regulations, which states that:

The code of conduct shall specify the period, which in any event shall not be less than six months, within which a designated person who is permitted to trade shall not execute a contra trade. XXX

Previously, in 2020, in the matter of Raghav Commercial Ltd[3], SEBI in its interpretative letter took the view that the contra trade restrictions apply to trades made by promoters individually and not the entire promoter group.

Taking the case of individual DPs, in the matter of Star Cement Limited[4], while answering the question on applicability of contra trade restrictions – whether individually or to the entire promoter group, SEBI cited the above clause 10 stating that the same applies individually.

Reference of the above case was taken in 2019 in the matter of Arvind Limited[5], where contra trade restrictions were said to apply individually on DP through PAN, disregarding who took the trading decision. Our detailed article on the same can be read here.

The current case makes it quite clear that the facts of the case have to be considered to analyze whether there is a single person taking trading decision.

Let us take several other examples to understand the intent of contra trade.

1.

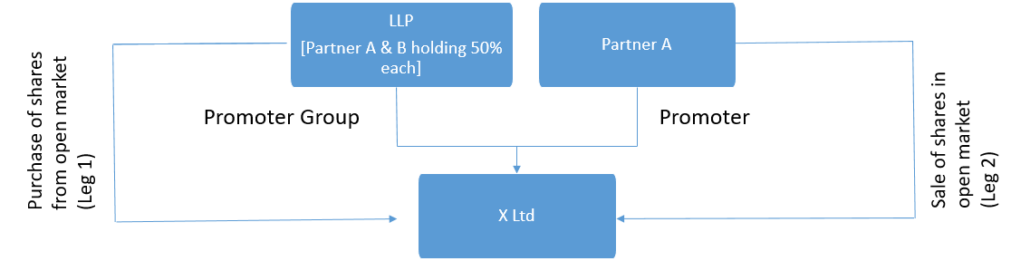

Whether Leg 2 will be contra to Leg1? Here we see that significant stake i.e. 50% is being held by Partner A (promoter of X Ltd) in the LLP. The trades of LLP can be said to be influenced by the decision of Partner A. This can be a case of common control and therefore Leg 2 becomes contra to Leg 1.

2.

In this case, we will have to see who is behind A Ltd and B Ltd. If both A Ltd and B Ltd are held by the same set of shareholders, Leg 2 would become contra to Leg 1.

Further, there are certain exemptions w.r.t. contra-trade restrictions that have been prescribed in the PIT Regulations and also in SEBI FAQs.

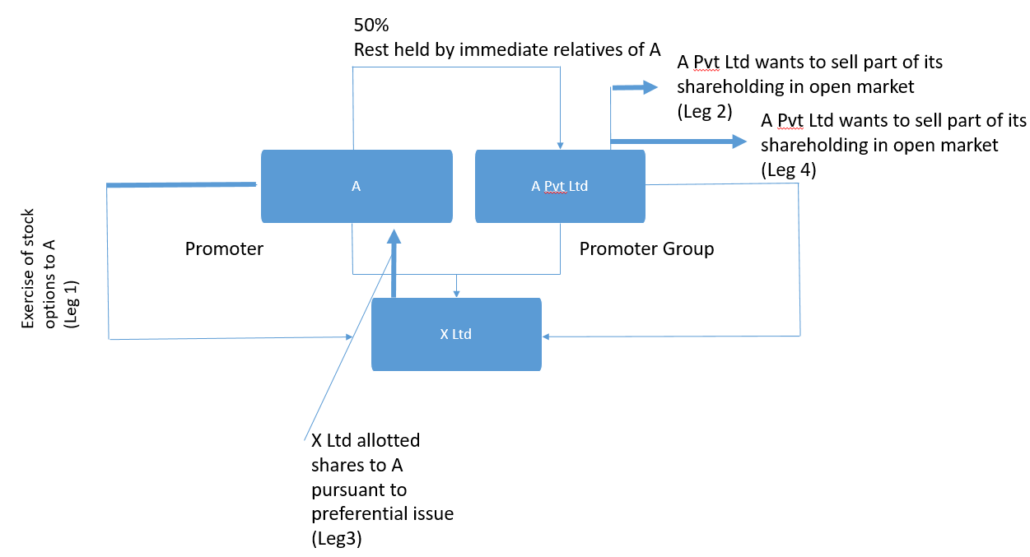

As per PIT Regulations, contra trade shall not apply for trades pursuant to exercise of stock options. SEBI Faqs further elaborate on the same stating that, in respect of ESOPs, subscribing, exercising and subsequent sale of shares, so acquired by exercising ESOPs (hereinafter “ESOP shares”), shall not attract contra trade restrictions.

Further trades pursuant to any non- market transaction is exempted (SEBI Faqs).

The rationale behind exemption is that for stock options and non-market transactions, the exercise price / purchase price is predetermined. The selling transaction pursuant to exercise of stock options or pursuant to acquisition of shares in non-open market is not influenced by purchases made basis some UPSI. The exercise price / acquisition price is already decided by the company.

Let us understand another example.

3.

In the above case, it is evident that A is the decision maker for A Pvt Ltd. Here, Leg 2 is not contra to Leg 1.Leg 4 is contra to Leg 3 as there is no exemption provided.

Often, it is also interpreted that contra-trade is applicable share wise. To take an example, suppose; first – stock options are acquired by a DP, second – open market purchase is done, third – stock options are sold (all three within a period of 6 months). Here, it is interpreted that third would not be contra to first and second. This is a wrong interpretation, as the moment the DP makes any open market purchase or already has the company’s shares in portfolio, the immunity w.r.t. selling shares acquired pursuant to exercise of stock options is lost. One cannot differentiate between the shares as what is important to establish for contra-trade is the intention to make short term profits. Such intention, also, is evident when trading decisions are made by a single person, irrespective of the different individuals executing trades.

Global scenario

Contra-trade is understood by different names in other jurisdictions. It is referred to as short swing in the US and reversal trade in some jurisdictions.

- United States – Securities Exchange Commission Act, 1934[6]

Section 16(b) deals with prohibition on short-swing trades by beneficial owner, director, or officer of the companies. The section reads as under:

“For the purpose of preventing the unfair use of information which may have been obtained by such beneficial owner[7], director, or officer by reason of his relationship to the issuer, any profit realized by him from any purchase and sale, or any sale and purchase, of any equity security of such issuer (other than an exempted security) or a security-based swap agreement involving any such equity security within any period of less than six months, unless such security or security-based swap agreement was acquired in good faith in connection with a debt previously contracted, shall inure to and be recoverable by the issuer, irrespective of any intention on the part of such beneficial owner, director, or officer in entering into such transaction of holding the security or security based swap agreement purchased or of not repurchasing the security or security-based swap agreement sold for a period exceeding six months.XXX”

- China – Securities Law of the People’s Republic of China[8]

Article 41 and 42 deals with contra trade restrictions. It reads as under:

Article 41 A shareholder that holds five percent of the shares issued by a company limited by shares shall, within three days from the date on which the number of shares held by him reaches this percentage, report the same to the company, which shall, within three days from the date on which it receives the report, report the same to the securities regulatory authority under the State Council. If the company is a listed company, it shall report the matter to the stock exchange at the same time.

Article 42 If the shareholder described in the preceding article sells, within six months of purchase, the shares he holds of the said company or repurchases the shares within six months after selling the same, the earnings so obtained by the shareholder shall belong to the company and be recovered by the board of directors of the company. However, a securities company that has a shareholding of not less than five percent due to purchase of the remaining shares in the capacity of a company that underwrites as the sole agent shall not be subject to the restriction of six months when selling the said shares.

If the company’s board of directors fails to comply with the provisions of the preceding paragraph, the other shareholders shall have the right to require the board of directors to comply.

If the company’s board of directors fails to comply with the provisions of the first paragraph and thereby causes losses to the company, the directors responsible therefore shall bear joint and several liabilities for the losses.

Concluding remarks

We had earlier in our article (supra) given the view that contra-trade should be seen jointly and not individually, considering the intent. To establish violation of PIT Regulations, one has to go beyond tracking trades based on PAN. It is important to know the decision maker behind the trades, in order to establish a clear nexus. It would be important to see whether such a view was taken by SEBI because of the case in hand or is it reflective of a new trend i.e. position of common control.

Link to our PIT Resource centre: Click here

[1] https://www.sebi.gov.in/enforcement/informal-guidance/oct-2023/in-the-matter-of-rama-mines-mauritius-ltd-under-sebi-prohibition-of-insider-trading-regulations-2015_78308.html

[2] https://www.sebi.gov.in/satorders/subhkamventures.pdf

[3] https://www.sebi.gov.in/sebi_data/commondocs/sep-2020/SEBI%20let%20Raghav%20IG_p.pdf

[4] https://www.sebi.gov.in/sebi_data/commondocs/jul-2018/StarCementGuidanceletter_p.pdf

[5] https://www.sebi.gov.in/sebi_data/commondocs/nov-2019/Inf%20Gui%20letter%20by%20SEBI%20Arvind_p.pdf

[6] https://www.govinfo.gov/content/pkg/COMPS-1885/pdf/COMPS-1885.pdf

[7] Every person who is directly or indirectly the beneficial owner of more than 10% of any class of any equity security (other than exempted security) [Ref. 16(a)(1)]

[8] http://www.npc.gov.cn/zgrdw/englishnpc/Law/2007-12/11/content_1383569.htm#:~:text=Article%201%20This%20Law%20is,of%20the%20socialist%20market%20economy.

REIT and InvIT unitholders with 10% aggregate holding get Board nomination rights

/0 Comments/in Alternative investment Vehicles, Capital Markets, Corporate Laws, SEBI /by Team CorplawAvinash Shetty, Assistant Manager | corplaw@vinodkothari.com

The basics of bringing an IPO

/0 Comments/in Capital Markets, Corporate Laws, IPO, IPOs and listing /by mahakagarwalMahak Agarwal | corplaw@vinodkothari.com

The Indian IPO market is currently booming. The performance of the Indian markets is a testament to the growth potential that it has for investors as well as the issuers. The markets are at an all time high in almost all sectors hitting new peaks everyday, giving companies an opportunity to hit the ‘jackpot’ with their issues. A 2023 Report by EY[1] on IPO trends in India bears witness to the impressive positive outlook for IPO activity in India. The India Stock Exchanges have ranked 1st in the world in terms of the number of IPOs during 2023 and in the times to come, a fresh and significant momentum is anticipated in the Indian IPO markets encompassing both, the Main Board and the SME Board.

Having discussed the above, companies looking to bring an IPO may often find themselves bogged down by several basic questions including the ‘what’ of everything. This article proposes to answer such questions and capture the basics of bringing an IPO.

Read more →Framework for voluntary delisting of debt securities notified

/0 Comments/in Bond Market, Corporate Laws, LODR, SEBI /by Team Corplaw– Sharon Pinto, Senior Manager & Palak Jaiswani, Asst. Manager | corplaw@vinodkothari.com

Loading…

Loading…

Our resources related to the topic:-

- Mandatory listing for further bond issues

- Bond market needs a friend, not parent

- Recent amendments relating to Corporate Bonds

- SEBI proposes rationalising Large Corporate Borrower Framework

- SEBI amends NCS Regulations – DT nominated director | Green Debt Securities | Public issue offer period

Our YouTube Videos on the related topics:

SEBI rationalizes the framework for Large Corporates

/0 Comments/in Bond Market, Corporate Laws, NCS, SEBI /by Team CorplawIncreased threshold, new incentive-disincentive framework instead of penalty

Sharon Pinto, Senior Manager & Palak Jaiswani, Asst. Manager (corplaw@vindokothari.com)

Updated on October 26, 2023

Background

With an intent to promote the Corporate Bond market, SEBI had introduced the framework for borrowing by Large Corporates (‘LCs’) framework with effect from April 1, 2019 by way of circular issued on November 26, 2018. Under the said framework, certain listed entities[1] who satisfied the prescribed criteria with respect to their long term borrowings, were mandated to raise 25% of their incremental borrowings by way of issuance of debt securities. Incremental borrowings were defined to include borrowings of original maturity of more than 1 year excluding external commercial borrowings and inter-corporate borrowings between a parent and subsidiary(ies). This portion of incremental borrowings was required to be raised by way of debt securities on an annual basis For FY2020 and FY2021 and over a block of 2 years which was then extended to 3 years from FY 2022 onwards. Failure to meet the same would attract a penalty of 0.2% of the shortfall amount.

Around 1/3rd of the eligible LCs were unable to raise the required amount through debt securities in FY 21-22 on account of:

- raising of debt becoming costlier due to tightening liquidity and hike in the benchmark rate;

- non-availability of interest subsidy benefits from Central and State Governments in case of certain issuers and the resultant impact on viability of the projects undertaken;

- cost of debt resulting in higher tariff rates to the ultimate consumers in case of power sector entities, etc.

On the other hand, the investors like insurers, pension, and provident funds are required to invest a particular percentage of their incremental receipts in corporate bonds and therefore, continuous issuance of debt securities was necessary.

Recently, SEBI amended the SEBI (Issue and Listing of Non-Convertible Debt Securities) Regulations, 2021 (‘NCS Regulations’) introducing Chapter V B effective from July 06, 2023 that provides the requirement for LCs under Reg. 50B to comply with requirements stipulated by SEBI.

While it has been more than 4 years since the introduction of the concept of LCs, issuers are still struggling to comply with the mandatory requirements. Therefore, SEBI decided to review the LCs framework and issued a Consultation Paper dated August 10, 2023, for public comments. Thereafter, basis the comments received from the public and suggestions of the Corporate Bond and Securitisation Advisory Committee (‘CoBoSAC’), SEBI approved the revised framework, as detailed herein in its Board meeting held on September 21, 2023 (‘SEBI BM’).

Revised framework as per the Present Circular

The revised framework has been notified by SEBI vide Circular dated October 19, 2023 (‘Present Circular’) and is applicable w.e.f. April 1, 2024 for LCs (criteria for identification discussed in the latter part) following April-March as their financial year and from January 1, 2024 for entities following January-December as their financial year. Thus, the revised framework is applicable for entities which would be identified as LCs as on March 31, 2024 or December 31, 2023, as the case may be.

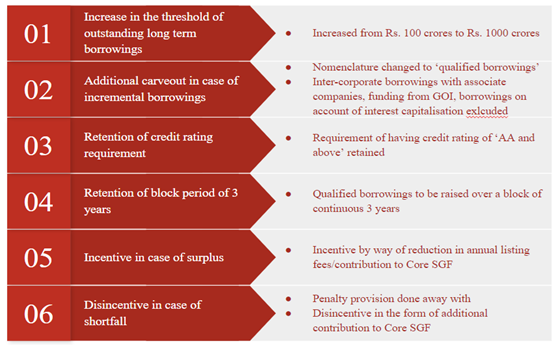

Key features of the revised framework are as follows:

Key features of the revised framework[2]

This article discusses the amendments made in the LCs framework by way of the Present Circular including the rationale provided in the CP, relevant points discussed in the SEBI Board meeting in this regard and transition related requirement for ongoing block of 3 years for existing LCs.

Increase in the threshold of outstanding long-term borrowings

| Existing Provisions | Proposed Changes in CP | SEBI’s rationale for proposed change |

| Outstanding long-term borrowings[3] of Rs. 100 crore or above | Outstanding long-term borrowing of Rs. 500 crore or above. | To align the criteria for LCs with the ‘High Value Debt Listed Entity’ or ‘HVDLEs’ as provided under the Listing Regulations. |

Brief of public comments received and SEBI’s response:

While a major portion of public comments were in favour of the increase in the limit to Rs. 500 crore, a common remark raised by the public suggested applying the LC framework based on outstanding listed debt instead of outstanding long-term borrowings. SEBI disagreed as it will increase the burden for entities that have already tapped the debt market and will not help in reducing the burden on the banking system. There were few comments seeking exemption from the applicability in case of loss making companies and NBFCs, which was also dismissed by SEBI indicating that it has no nexus with profit or loss made by an entity and that NBFCs being the largest borrowers cannot be excluded.

SEBI BM decision

Increase the limit from existing Rs. 100 crores to Rs. 1000 crores, basis which, around 170 entities would qualify as LCs (as opposed to 482 entities in case of limit of Rs. 500 crore proposed).

Provisions under the Present Circular

The threshold limit of outstanding long term borrowings has been increased to Rs. 1000 crores.

Our Remarks

Classification as an HVDLE is on account of outstanding listed debt securities. On the contrary, an entity may not have any of its debt securities listed but may still be classified as an LC if it has its equity listed and borrowing from banks/ financial institutions exceeding the prescribed threshold. Increase of limit to Rs. 1000 crore is a welcome change.

Scope of outstanding long-term borrowings and incremental borrowings

| Existing Provisions | Proposed Changes in CP | SEBI’s rationale for proposed change |

| Includes: any outstanding borrowing with an original maturity of more than 1 year Excludes: (i) External Commercial Borrowings (ii) Inter-corporate borrowings between a holding and subsidiary | Term ‘incremental borrowings’ to be replaced with ‘qualified borrowings’. Includes: any outstanding borrowing with an original maturity of more than 1 year Excludes: (i) External Commercial Borrowings (ii) Inter-Corporate Borrowings between its holding and/or subsidiary and /or associate companies; (iii) Grants, deposits, or any other funds received as per the guidelines or directions of the Government of India (‘GOI’); (iv) Borrowings arising on account of interest capitalization | To cover associate companies, on which the holding company has significant influenceThe end use of grants received from the Government is restricted to the purposes specified by Government and cannot be deviated fromInterest capitalized on the loan amount cannot be considered as borrowings. |

Brief of public comments received and SEBI’s response:

All the public comments were in favor of the proposal. Few comments were received to additionally exclude borrowings for the purpose of refinancing which was not accepted by SEBI as it would defeat the intent of the framework. The suggestion to exclude borrowings made for mergers, acquisitions and takeovers was accepted by SEBI given those are not routine occurrences in the life-cycle of an entity.

SEBI BM decision

Incremental borrowings to be termed as qualified borrowings. Borrowings for mergers, acquisitions and takeovers to be further excluded from the scope of qualified borrowings.

Provisions under the Present Circular

The nomenclature ‘incremental borrowings’ has been revised to ‘qualified borrowings’ and the exclusions proposed in the CP i.e. inter-corporate borrowings involving associate companies, any funding received from the GOI, borrowings on account of interest capitalisation have been given effect to. Additionally, as per the public comments received, borrowings for the purpose of scheme of arrangement as stated above have also been excluded.

Retention of credit rating requirement as a criterion for LC identification

| Existing Provisions | Proposed Changes in CP | SEBI’s rationale for proposed change |

| Have a credit rating of “AA and above” | Remove the requirement. | Entities with long-term outstanding borrowings of Rs. 500 Cr or above would generally fall under the bracket of credit rating of ‘AA and above’ |

Brief of public comments received and SEBI’s response:

Most of the public comments were against the proposal as entities with low rated debt may not find investors at all, which was accepted by SEBI.

SEBI BM decision

The criteria of a minimum credit rating to be retained as per existing norm.

Provisions under the Present Circular

SEBI has retained the existing requirement prescribing a minimum credit rating of “AA”/“AA+”/AAA under the revised framework.

Our Remarks

The proposal in the CP to drop the requirement altogether was inappropriate. An outstanding borrowing of Rs. 500 crore may not be necessarily indicative of the credit quality of the borrower. While regulations may force or incentivize the issuers to come up with debt issuance pursuant to this framework, however, it cannot force the investors to invest. An investor in debt security will rely on the credit quality which is fairly indicated through the credit rating of the debt security. The requirement of having a credit rating is one of the prerequisites for listing a debt security under NCS Regulations (Reg. 10). Even for determining the list of eligible issuers of debt securities for the purpose of contribution to Core Settlement Guarantee Fund (‘Core SGF’), the issuer should have long term debt rating of the eligible securities of AAA, AA+, AA and AA- (excluding AA- with negative outlook). Decision to retain the erstwhile requirement is a welcome move.

Retention of block period of three years

| Existing Provisions | Proposed Changes in CP | SEBI’s rationale for proposed change |

| FY 2020 & FY 2021 – On an annual basis FY 2022 onwards – On a block of 3 years | On an annual basis | To simplify the process of raising debt securities and to eliminate the complex process of tracking all the issuances during the block years. |

Brief of public comments received and SEBI’s response:

Most of the public comments were against the proposal, which was accepted by SEBI.

SEBI BM decision

SEBI to retain the requirement of the continuous block of 3 years in the framework.

Provisions under the Present Circular

It has been prescribed that atleast 25% of the qualified borrowings will be required to be raised by way of issuance of debt securities over a continuous block of 3 years.

Since, the framework is applicable w.e.f. FY 2025, entities identified as LCs as on the last day of ‘T-1’ [i.e. March 31, 2024 / December 31, 2023, as the case may be], will be required to raise the requisite quantum of qualified borrowings of FY ‘T’ [FY 2025] through issuance of debt over a block of 3 years i.e. over ‘T’ [FY 2025], ‘T+1’ [FY 2026] and ‘T+2’ [FY 2027].

Our Remarks

The proposal in the CP to make it an annual requirement was inappropriate. For the purpose of this framework, the interest of such issuers who do not issue debt securities frequently is also to be kept in mind. While frequent issuers of debt securities may not find it difficult to borrow funds by issuance of further debt securities, it may not be feasible for non-frequent issuers to raise the entire quantum of prescribed incremental borrowings within a period of 1 year. Issuers are to be given certain flexibility and the timelines need not be made more stringent. Decision to retain the erstwhile requirement is a welcome move.

Incentive for exceeding the mandatory limit

| Existing Provisions | Proposed Changes | SEBI’s rationale for proposed change |

| – | In case of a surplus, a certain quantum of the annual listing fees to be reduced; Reduction in the contribution to be made to the core SGF. | To promote ease of doing business and to encourage LCs to raise funds by incentivizing them. |

Brief of public comments received and SEBI’s response:

All public comments were in favour of the proposal. One of the recommendations was to provide incentive in the form of reduction in the contribution to be made to the Recovery Expense Fund[4], which was not approved by SEBI given it is a refundable deposit and meant to meet recovery expenses in case of any default.

SEBI BM decision

SEBI decided to introduce the incentive structure. With respect to the proposal for reduced contribution to Core SGF, SEBI approved to permit carry forward of incentive till utilisation or set off within 6 years of obtaining the incentive.

Provisions under the Present Circular

The incentive scheme proposed has been notified. A benefit of reduction in the annual listing fees pertaining to listed debt securities or non-convertible redeemable preference shares ranging between 2% to 10% computed in the following manner would be available in case of surplus borrowings raised through issuance of debt:

| Sr. No. | % of surplus borrowing as on last day of FY “T+2” for the block starting FY “T” | % of reduction in annual listing fees payable to the Stock Exchanges by the LCs for FY “T+2” |

| 1 | 0-15% | 2% of annual listing fees |

| 2 | 15.01% – 30% | 4% of annual listing fees |

| 3 | 30.01% – 50% | 6% of annual listing fees |

| 4 | 50.01% – 75% | 8% of annual listing fees |

| 5 | Above 75% | 10% of annual listing fees |

Further, a credit in the form of reduction in the contribution to be made to the Core SGF of LPCC would also be available in the following manner:

| Sr. No. | % of surplus borrowing for the block starting FY “T” as on last day of FY “T+2” | Quantum of Credit |

| 1 | 0-15% | 0.01% |

| 2 | 15.01% – 30% | 0.02% |

| 3 | 30.01% – 50% | 0.03% |

| 4 | 50.01% – 75% | 0.04% |

| 5 | Above 75% | 0.05% |

The Present Circular further mentions that in case of entities classified as ‘eligible issuers’ by the LPCC, the incentive would be permissible to be carried forward for a period of 6 years of obtaining the same as approved in the SEBI BM. Further, in case of an entity which is not an eligible issuer, the incentive may be carried forward until it is classified as an eligible issuer. Thereafter, the incentive would be available for the purpose of utilisation for a period of 6 years from year of such classification.

Manner of computation

Let us consider the following example to understand the computation of credit:

Company ‘X’ is identified as an eligible issuer requiring to contribute Rs. 2 crores to the Core SGF. It has complied with the requirements of raising the requisite qualified borrowings in the following manner:

| Sr. No. | Particulars | Amount (in Rs. Cr) |

| 1 | Borrowings that should have been made from the debt market by the LC for FY “T” (A) | 200 |

| 2 | Actual borrowings in “Block of three years” (B) | 250 |

| 3 | Surplus borrowings (B-A) (C) | 50 |

| 4 | % of surplus borrowing (C/A*100) | 25% |

| 5 | Quantum of credit (% of quantum of credit as per the table above*C) | 0.01 (i.e. 50*0.02%) |

| 6 | Actual contribution required to be made to the SGF [Actual contribution required to be made – Quantum of credit] | 1.99 (i.e. 2-0.01) |

Our Remarks

Contribution to Core SGF:

The benefit of reduced listing fee can be availed by the listed entity for listed debt securities or non-convertible redeemable preference shares. However, the relaxation in the form of reduced contribution to Core SGF will be an incentive only to an ‘eligible issuer’ as per the list rolled out annually by AMC Repo Clearing Limited (‘ARCL’), recognised as Limited Purpose Clearing Corporation (‘LPCC’) by SEBI, on the basis of prescribed parameters. In case of an LC which has not been identified as an ‘eligible issuer’, the credit in contribution to the Core SGF would not serve as an incentive and may get lapsed. It may even be the case for an issuer identified as ‘eligible issuer’ in year 1 however, not identified in the subsequent year. ARCL vide Circular dated September 29, 2023 rolled out a list of 125 eligible issuers who will be required to contribute to Core SGF for the eligible issuance as per the eligible list issued on or after 01st October 2023 till 30th September, 2024. In the light of this, SEBI’s decision to allow carrying it forward till 6 years is a welcome change.

Mandatory Listing:

In case an LC which is a debt listed entity and raises further debt pursuant to the LC framework post January 1, 2024, it will be mandatorily required to list every such issuance pursuant to Reg. 62A of the SEBI Listing Regulations, inserted vide the SEBI (Listing Obligations and Disclosure Requirements) (Fourth Amendment) Regulations, 2023. On the other hand, in case an LC is not a debt listed entity, however, lists any particular issuance of debt securities issued pursuant to the LCB framework any time post January 1, 2024, as per the afore-mentioned provision, it will be mandatorily required to list all issuances done post January 1, 2024 within a period of 3 months from the date of listing.

As a result of such mandatory listing, the LCs may cross the threshold of having outstanding listed debt securities amounting to Rs. 500 crores, thereby classifying the entities as a ‘High Value Debt Listed Entity’ or an ‘HVDLE’. Consequently, the entity will be required to comply with the corporate governance provisions stipulated under Reg. 16 to Reg. 27 of the SEBI Listing Regulations. We have further analysed the same in our article which can be accessed here.

Disincentive for not meeting the mandatory limit

| Existing Provisions | Nature of amendment proposed | Proposed Changes | SEBI’s rationale for the proposed change |

| Monetary penalty/ fine of 0.2% of the shortfall in the borrowed amount is levied in case of shortfall | Doing away with the penalty and introducing an incentive/ disincentive structure | In case of a shortfall, an amount equivalent to 0.5 basis points of such shortfall shall be made by the LC to the core Settlement Guarantee Fund (‘SGF’) as set up by the Limited Purpose Clearing Corporation (LPCC). | To promote ease of doing business and to encourage LCs to raise funds by incentivizing them. |

Brief of public comments received and SEBI’s response:

While majority of the comments were in favour of the proposal, it was recommended that:

(a) the disincentive should be applicable if there is a non-compliance for a continuous block of 2/3 years;

(b) further reduction in the quantum; and

(c) applicability only to entities required to contribute to Core SGF.

SEBI BM decision

SEBI confirmed (a) and disagreed for (b). In case of (c). SEBI clarified that Core SGF requirement will be made applicable to all issuers to ensure uniformity.

Provisions under the Present Circular

SEBI has done away with the penalty provision and notified the disincentive structure. The said structure will apply in case of shortfall in raising the requisite quantum at the end of the block of 3 years, i.e. as on the last day of ‘T+2’. The disincentive scheme is in the form of additional contribution to be made to the Core SGF in the following manner:

| Sr. No. | % of surplus borrowing for the block starting FY “T” as on last day of FY “T+2” | Quantum of additional contribution |

| 1 | 0-15% | 0.015% |

| 2 | 15.01% – 30% | 0.025% |

| 3 | 30.01% – 50% | 0.035% |

| 4 | 50.01% – 75% | 0.045% |

| 5 | Above 75% | 0.055% |

Manner of computation

Let us consider the following example to understand the computation of disincentive:

Company ‘X’ is identified as an eligible issuer requiring to contribute Rs. 2 crores to the Core SGF. It has complied with the requirements of raising the requisite qualified borrowings in the following manner:

| Sr. No. | Particulars | Amount (in Rs. Cr) |

| 1 | Borrowings that should have been made from the debt market by the LC for FY “T” (A) | 200 |

| 2 | Actual borrowings in “Block of three years” (B) | 150 |

| 3 | Shortfall in borrowings (X-Y) (C) | 50 |

| 4 | % of shortfall in borrowing (C/A*100) | 25% |

| 5 | Quantum of additional borrowing (% of quantum of additional borrowing as per the table above*C) | 0.0125 (i.e. 50*0.025%) |

| 6 | Actual contribution required to be made to the SGF [Actual contribution required to be made + Quantum of additional borrowing] | 2.0125 (i.e. 2+0.0125) |

Dispensation for LCs identified basis erstwhile criteria

The entities which have been identified as LCs under the erstwhile LC framework are required to comply with the requirement over a block of 3 years in the following manner:

| FY in which the entity was identified as LC i.e. ‘T-1’ | Block of 3 years over which the LC was required to raise the requisite quantum of long term borrowings i.e. ‘T’, ‘T+1’, ‘T+2’ | Remaining period of the block as on March 31, 2023 prior to Present Circular | Remaining period as per the Present Circular |

| FY 2021 | FY 2022, FY 2023, FY 2024 | 1 year i.e. FY 2024 | 1 year i.e. FY 2024 |

| FY 2022 | FY 2023, FY 2024, FY 2025 | 2 years i.e. FY 2024 & FY 2025 | 1 year i.e. FY 2024 |

| FY 2023 | FY 2024, FY 2025, FY 2026 | 3 years from FY 2024 to FY 2026 | 1 year i.e. FY 2024 |

The erstwhile LCs are required to endeavour to comply with the requirement of raising 25% of their incremental borrowings done during FY 2022, FY 2023 and FY 2024 respectively by way of issuance of debt securities till March 31, 2024, failing which, such LCs are required to provide a one-time explanation in their Annual Report for FY 2024.

The Present Circular additionally amends the Chapter XII of NCS Master Circular to the following effect:

- Deletion of penalty related provision in Clause 2.2(d) of Chapter XII; and

- Deletion of format of annual disclosure to be submitted within 45 days from end of the financial year by an identified LC providing details of incremental borrowing and mandatory borrowing, as provided in Clause 3.1 (b) of Chapter XII.

Conclusion

The changes in the framework vide the Present Circular attempt to tackle the hindrances which are being faced by entities classified as LCs, including removal of the penal provisions on shortfall, etc. Thus, these changes seem positive and would help LCs in complying with the LCs framework. However, while the framework aims to deepen the bond market by mandating debt issuance, one cannot disregard the other recent amendments in the legal framework governing debt securities, which seem to be a deterrent for companies from approaching the capital markets, for instance, provisions relating to mandatory listing of debt securities, requirement to obtain approval of all holders in case of voluntary delisting, etc. While the framework would be relevant for entities who have already tested the equity markets and wish to enter the debt market, the recent amendments relating to mandatory listing, no selective delisting etc. would impact issuers who intend to list their debt securities.

[1] Criteria under the erstwhile framework was as follows and was applicable to all listed entities except Scheduled Commercial Banks:

- having listed specified securities or debt or non-convertible redeemable preference shares on a recognised stock exchange; and

- having outstanding long term borrowing of Rs. 100 crore or above; and

- having a credit rating of ‘AA and above’.

[2] About Core SGF: In terms of SEBI Circular SEBI/HO/DDHS/DDHS-RACPOD1/CIR/P/2023/56 dated April 13, 2023, eligible issuers are required to contribute 0.5 basis points (0.005%) of the issuance value of debt securities per annum based on the maturity of debt securities. The issuers need to make full contribution upfront prior to the listing of debt securities.The Core SGF contribution is applicable for all public issue or private placement of debt securities under the SEBI (Issue and Listing of Non-convertible Securities) Regulations, 2021 of eligible issuer except for a) Tier I & Tier II bonds issued by Banks, NBFCs & other institutions; b) Perpetual Debt; c) Floating rate bonds; d) Market linked bonds; e) Convertible bonds (Optional or Compulsorily); f) Securities other than long term debt rating of the eligible securities shall be AAA, AA+, AA and AA- (excluding AA- with negative outlook).

[3] Outstanding long term borrowings indicate borrowings which have original maturity of more than 1 year with certain exclusions as detailed further herein.

[4] Recovery Expense Fund is a refundable fund to be deposited with the stock exchanges at the time of listing. The purpose of the fund is recovery in case of default.

Mandatory listing for further bond issues

/0 Comments/in Bond Market, Corporate Laws, LODR, SEBI /by Vinita Nair Dedhia“Listed once, always go for listing” to apply for new bond issues; optional for existing unlisted issuances

Vinita Nair | Vinod Kothari & Company | corplaw@vinodkothari.com

June 29, 2023 (updated on September 21, 2023)

Background

SEBI approved the proposal for mandatory listing of debentures/ NCDs, in its Board meeting held on June 28, 2023, for all listed entities having outstanding listed NCDs as on December 31, 2023. Effective Jan. 1, 2024, such listed entities will have to now mandatorily list each of its subsequent issuance of NCDs on the stock exchanges.

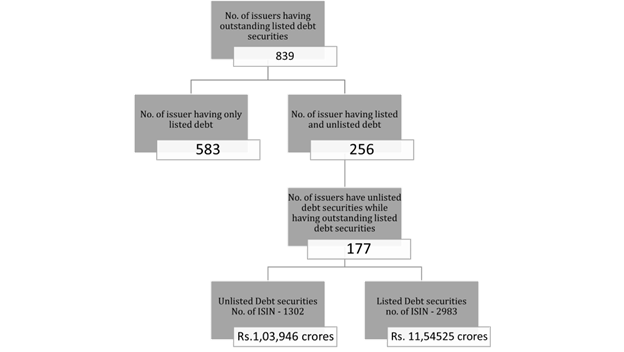

Aimed at better information flow and liquidity considerations, the move is said to be inspired by data analysis carried out by SEBI, as discussed in its Consultation Paper dated February 09, 2023, basis the information obtained from the depositories. Succinctly, the snapshot of unlisted bond issues by listed companies (it seems that the data of unlisted bond issuances by unlisted companies is not available), as on January 31, 2023, is as follows:

This would mean roughly 8% of all bond issuances by listed companies are outstanding, excluding bond issues by completely unlisted entities, which may be insignificant for the purpose of analysis.

Read more →Financing transition from “brown” to “green”

/0 Comments/in Bond Market, Capital Markets, Corporate Laws, NCS, NCS, SEBI, Sustainability, Sustainability /by StaffSEBI prescribes additional requirements for transition bonds

– Mahak Agarwal, Executive | corplaw@vinodkothari.com

Need for transition finance

As climate change and its impacts continue to remain one of the major concerns of any economy, transition finance is a step towards effectively transforming carbon emissions and combating climate change.

‘Transition Bonds’, as the word speaks for itself, are debt instruments that facilitate transition of a carbon-intensive business into decarbonizing business and eventually achieving the Net Zero emissions targets.

While it is true that change is the only constant, it cannot be denied that the same can often be challenging. Similar is the case with enterprises looking to metamorphosize their activities into a sustainable form. A huge amount of finance is required for carbon-intensive sectors to decarbonize and it is here that transition bonds find their application.

Read more →Continuing Disclosures by listed entities: Regulation 30 of SEBI LODR

/0 Comments/in Capital Markets, Corporate Laws, LODR, SEBI /by Vinod Kothari– Vinod Kothari | corplaw@vinodkothari.com

Loading…

Loading…

Our article on Reg 30 of LODR Regulations can be viewed here