Bond market needs a friend, not parent

Policies seem to be working at cross-purposes

Vinita Nair, Senior Partner | corplaw@vinodkothari.com

The need to promote bond markets is almost cliched, and does not require elaboration. However, when one observes the regulatory and fiscal developments concerning bond markets in recent times, one wonders whether there is a clear and unified sense of direction. The role of policymaker may be supporting, reformative, protective, promotional, etc. Sometimes, protective regulation may also be intended to play a promotional role – for example, if investors’ interest is better protected, it may promote investor confidence and hence, appetite. However, it is hard to see a clear theme in the spate of changes concerning bond markets in the recent past.

Fiscal measures:

As regards fiscal measures, there are several changes in the Budget 2023 that may be directly or indirectly affecting the bond markets. The Budget saw market-linked debentures[1], a bit controversial development, as a case of fiscal arbitrage, and killed the same, resulting in the death of the instrument. The exemption from withholding tax exemption in case of listed bonds was taken away – which will be difficult to understand as the theoretical justification for withholding tax is the possibility of tax leakage in case of destination-based tax. The case for the leakage is difficult to make, as listed bonds are issued in demat format, and hence, all transactions take place through regular banking channels. If the intent of policymakers was to promote retail investment in bonds, this is certainly antithetical to that objective.

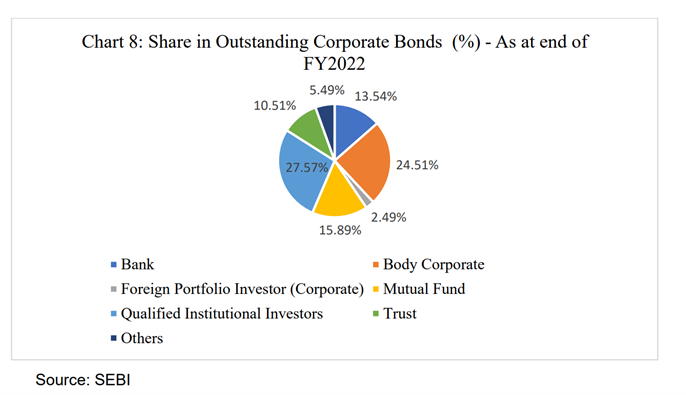

Another fiscal change, which may have a long-term negative impact, is the denial of long-term capital gain treatment to investment in debt mutual funds[2]. Debt mutual funds were also responsible for the demand-side of corporate bonds. Mutual fund’s share in the outstanding corporate bonds as at the end of FY 2022 stood at 15.85%[3]

Listed bond issuance during period April 1, 2022 to February 28, 2023 aggregated to Rs. 671,234.98 crore[4]. As per the statistics available on SEBI’s website[5], the net AUM for the period April 1, 2022 to February 28, 2023 for Corporate Bond Fund alone, an open ended scheme, stood at Rs. 1,14,844.95 crore as on February 28, 2023. If we include the investments pursuant to other hybrid schemes or debt oriented close ended schemes, the quantum will be higher. Approximately 20% of the amounts raised during the period came from mutual funds. However, this may not continue to be the case next year onwards.

Debt mutual funds have not only been shorn of their tax advantage, in fact, they have been put to disadvantage even to a direct investment in fixed income instruments. This is because even if the holding period of a debt mutual fund is more than 3 years, it will qualify as a short term capital asset. The change will surely make debt oriented schemes less popular among investors, in view of the tax implications.

SEBI Regulations mandating a minimum bond issuance by large corporate borrowers:

5 years back, the budget for FY 2018-19 proposed mandating entities to meet one-fourth of their financing needs from the debt market by beginning with large entities. Thus, effective April 1, 2019, entities that classified as a ‘Large Corporate Borrower’[6] (‘LCB’) were required to raise 25% of their incremental borrowings[7] by issue of debt securities. The same was implemented on a comply-or-explain basis for first two financial years and thereafter, was required to be met by an LCB over a block of two years, first block being FY 21-22 and FY 22-23, failing which a penalty of 0.2% of the shortfall in the borrowed amount to be levied. By use of the word “incremental”, one may get a feeling that the borrowing base of the LCB has gone up during the year – however, this is not how the expression is actually defined. Even if the aggregate base of long-term funds has effectively come down, if there are any borrowings of over 12 months maturity during a financial year, the entity will still be regarded to have had incremental borrowings. Naturally, this put pressure on LCBs. For some LCBs, the amount of required bond issuance was too small to warrant a capital market exercise and therefore, a costly exercise. For many, they would say that they did not need funds at all. For some, the so-called incremental borrowing was taking car loans, which obviously couldn’t have been taken to the bond market. In short, the application of a mandated bond issue rule was fraught with several impracticalities.

And yet, as the end of the second year in the block of 2 FYs was coming, companies would still use some device or the other to avoid the 20 basis points penalty.

No one would have waited till the 30th of March, the penultimate working day of the year, for SEBI to have announced, in its board meeting of that date, a further relaxation of the requirement by one year.

Important question – is this “stick” approach at all required? If companies have to be attuned to using the bond market, what the regulator needs to do is to streamline the processes, remove bottlenecks, clear inefficiencies, and then leave the freedom of choice to the market participants. After all, the Indian bond market has gained reasonable maturity, with a wide variety of domestic and international, institutional and individual, large and small investors showing interest in debt investments. Why do companies have to be forced to choose one mode of funding, and not the other? Was it at all a good idea to just defer the issue, rather than admit on the face of it that this was not a workable idea, and therefore, it is to be shelved?

Asset cover for unsecured bonds: A self-contradicting requirement later removed

SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015 provided the requirement of maintaining an asset cover for kinds of debt securities irrespective of whether it was secured, unsecured or subordinated. Every listed entity was required to maintain 100% asset cover sufficient to discharge the principal amount at all times for the NCDs issued. There was a carve out for unsecured debt securities issued by regulated financial sector entities eligible for meeting capital requirements as specified by respective regulators, however, the same was also deleted in October 8, 2020.

The requirement was aligned with the actual purpose of maintaining ‘security cover’ and made applicable only in case of secured debentures, effective from April 11, 2022. Until then, companies continued to report asset cover for all debt securities issued by them.

While course correction has been done in this case, however, it illustrates the point that we are still subjecting bond markets to overly ambitious requirements, at times impractical.

Stricter corporate governance norms for High Value debt issuers

One of the possible reasons for not being able to meet the target by LCB could also have been a deliberate attempt to avoid crossing the threshold of Rs. 500 crore of listed issuance

SEBI rolled out the concept of ‘High Value Debt Listed Entity’ (‘HVDLE’) effective from September 7, 2021 covering all debt listed entities with outstanding listed debt of Rs. 500 crore and above as on March 31, 2021 and placed them at par with an equity listed entity for complying with stringent corporate governance norms. The requirement was initially applicable on a comply-or-explain basis till March 31, 2023 and was to become mandatory effective from April 1, 2023. Several HVDLEs revised the composition of its Board, appointed IDs, drew up policies and constituted committees in order to be ready to comply with the requirement. Again, in view of market representations, SEBI in its board meeting held on March 29, 2023 deferred the effective date to April 1, 2024 by permitting HVDLEs to continue on a comply-or-explain basis for FY 23-24. Here again, the pain is that companies couldn’t have waited till 30th March, just 2 days before a regulatory regime became applicable.

CG norms were extended to HVDLEs just 6 months after the relaxation extended by MCA became effective[8]. SEBI’s move nullified the MCA exemption as bond holders faced disproportional compliances merely on account of having raised Rs. 500 crore by way of listed bonds[9]. The move blurred the distinction between equity and bond listing as SEBI intended to protect the interest of retail investors that indirectly invested in bonds through the institutional investors investing in the privately placed debt. As a result, private companies and closely held public companies were made to meet the several irreconcilable compliance requirements, which were otherwise not applicable for the unlisted equity or even with huge bank borrowings.

Starting from complete overhaul of board composition, constitution of 4 committees of board[10] with IDs forming part of it, increase in the number of matters requiring shareholders approval (prior approval reqt. in most cases), mandate of group governance, it extended to related party transactions of such entities requiring approval of minority shareholders. RPT approval norms resulted in deadlock for closely held HVDLEs and in order to address the same, SEBI proposed extending the right to object the proposal to the debt holders[11]. The amendment is still awaited, however, the HVDLEs have an additional obligation of getting all its RPTs approved by only independent directors of the Audit Committee.

Possible approach for future

When a market becomes reasonably mature, the regulator has to show support by staying away from the market regulation rather than intruding too much into what company should do and what company should not do. Policy makers need to evaluate the likely impact of each of the proposed amendments and review the existing norms periodically, if the same is meeting the desired intent.

The role of a regulator is akin to that of a parent. The following Sanskrit shloka, giving the wisdom of ages, may also provide the right approach for the regulator. Given that the bond market today is reasonably mature, the role of the regulator should mainly be to guide and facilitate the corporate bond market.

लालयेत् पंच वर्षाणि दश वर्षाणि ताडयेत्।

प्राप्ते तु षोडशे वर्षे पुत्रे मित्रवदाचरेत्॥

Till the son is five years old, one should pamper him. Thereafter, next 10 years, he should be disciplined. Once he turns 16, he should be treated like a friend

[1] Read our articles on bonds and MLDs on the Budget page.

[3] Source: Keynote address delivered by Shri T Rabi Sankar, Deputy Governor on August 24, 2022

[4] Rs. 662508.77 cr by way of private placement and Rs. 8726.21 cr by way of public issue.

[5] https://www.sebi.gov.in/statistics/mutual-fund/mf-investment-objectives.html

[6] a) that have their specified securities or debt securities or non-convertible redeemable preference shares, listed on a recognised stock exchange(s) in terms of SEBI LODR Regulations, 2015; and b)have an outstanding long term borrowing of Rs. 100 crore or above, where outstanding long-term borrowings shall mean any outstanding borrowing with original maturity of more than one year and shall exclude external commercial borrowings and inter-corporate borrowings between a parent and subsidiary(ies); and c) have a credit rating of “AA and above”, where credit rating shall be of the unsupported bank borrowing or plain vanilla bonds of an entity, which have no structuring/ support built in.

[7] borrowing done during a particular financial year, of original maturity of more than one year, excluding external commercial borrowings and inter-corporate borrowings between a parent and subsidiary(ies).

[8] Effective April 1, 2021 companies that had only listed their debt by way of private placement ceased to be regarded as a ‘listed company’ for the purpose of Companies Act, 2013.

[10] Audit Committee, Nomination and Remuneration Committee, Risk Management Committee and Stakeholders Relationship Committee

Leave a Reply

Want to join the discussion?Feel free to contribute!