SEBI to provide debenture holders the right to object material related party transactions

Complicates approval process for closely held High Value Debt Listed Entities

– Vinita Nair, Senior Partner | vinita@vinodkothari.com

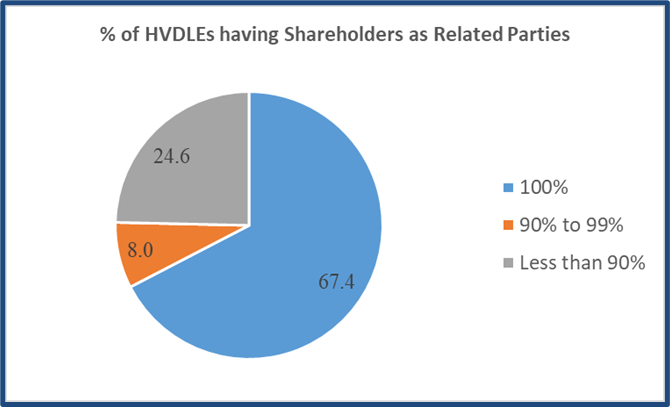

SEBI continues to tighten the regulatory regime for debt listed entities as it aims to promote corporate bond market. After equating debt listed entities with outstanding value of listed non-convertible debt securities of Rs. 500 crore and above with equity listed entities for the purpose of corporate governance norms, SEBI proposes a stricter approval regime for Related Party Transactions (‘RPTs’) under Reg. 23 of SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015 (‘LODR’) vide Consultation paper on review of Corporate Governance norms for a High Value Debt Listed Entity (‘HVDLE’)[1]. This has been rolled out just before the corporate governance provisions become applicable on a mandatory basis effective from April 1, 2023. The composition of 138 HVDLEs, in terms of shareholding pattern, as on March 31, 2022 was as under:

Existing approval regime for Material RPTs in case of HVDLEs

Transactions with a related party during a financial year is considered as material if the transaction(s), to be entered into individually or taken together with previous transactions during a financial year, exceeds Rs. 1000 crore or 10% of the annual consolidated turnover of the listed entity as per the last audited financial statements of the listed entity. In terms of Reg. 23 (4) of LODR, Material RPTs and subsequent material modification to such Material RPTs require prior approval of the shareholders of the listed entity. The exemption from approval requirement exists for following Material RPTs:

(a) transactions entered into between two government companies;

(b) transactions entered into between a holding company and its wholly owned subsidiary whose accounts are consolidated with such holding company and placed before the shareholders at the general meeting for approval;

(c) transactions entered into between two wholly-owned subsidiaries of the listed holding company, whose accounts are consolidated with such holding company and placed before the shareholders at the general meeting for approval.

Further, no related party is permitted to vote to approve such resolutions, in case the related party is a shareholder. This resulted in a deadlock situation for closely held HVDLEs. A debt listed entity may be a subsidiary of a holding company. The holding company, being a “related party”, will be excluded from voting. If the related parties are to be excluded from voting at the general meeting of a private company or a closely held public company, it is quite likely that there will be no shareholders whose votes may be counted! SEBI acknowledged this issue in the informal guidance given to India Infradebt Limited[1] by allowing it to ‘not comply and explain’ in view of the impossibility.

This situation did not arise under Section 188 of Companies Act, 2013 (‘CA, 2013’) in view of an express carve out for companies in which 90% or more members, in number, are relatives of promoters or are related parties. The expectation from SEBI was to introduce a similar carve out for HVDLEs. However, the proposal comes with a twist as it gives the debenture holders right to object such proposal.

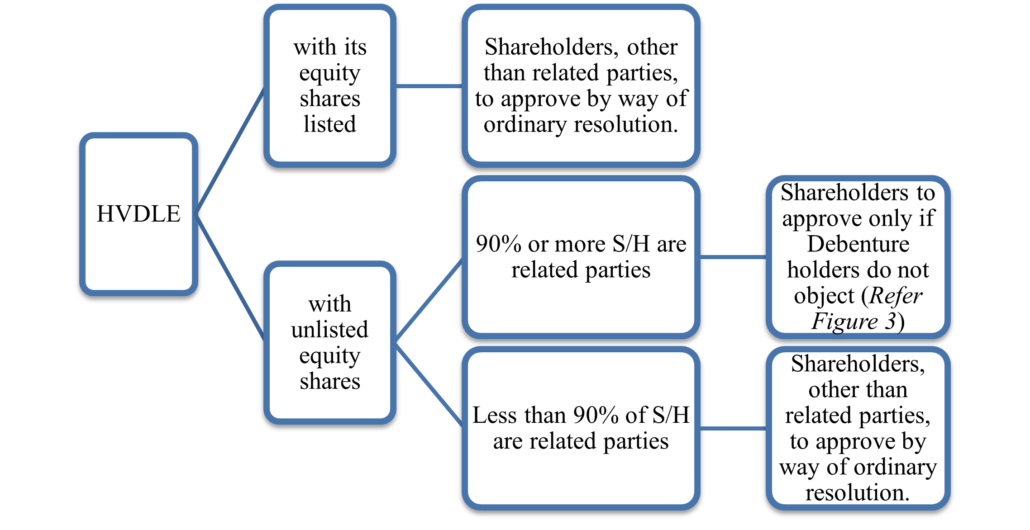

Applicability of the proposed regime

The approval regime has been proposed in view of the shareholding pattern of the HVDLE. As evident from Figure 1 almost 75% of the HVDLEs as on March 31, 2022 are closely held companies, where 90% or more of the shareholders are related parties. Accordingly, the approval regime has been proposed for HVDLEs having (i) only listed non-convertible debt securities and (ii) 90% or more of the shareholders in number are related parties. HVDLEs that are equity listed entities or have less than 90% of its shareholders as related parties, are expected to comply with the existing provision i.e. related parties cannot vote to approve material RPTs (Refer Figure 2.)

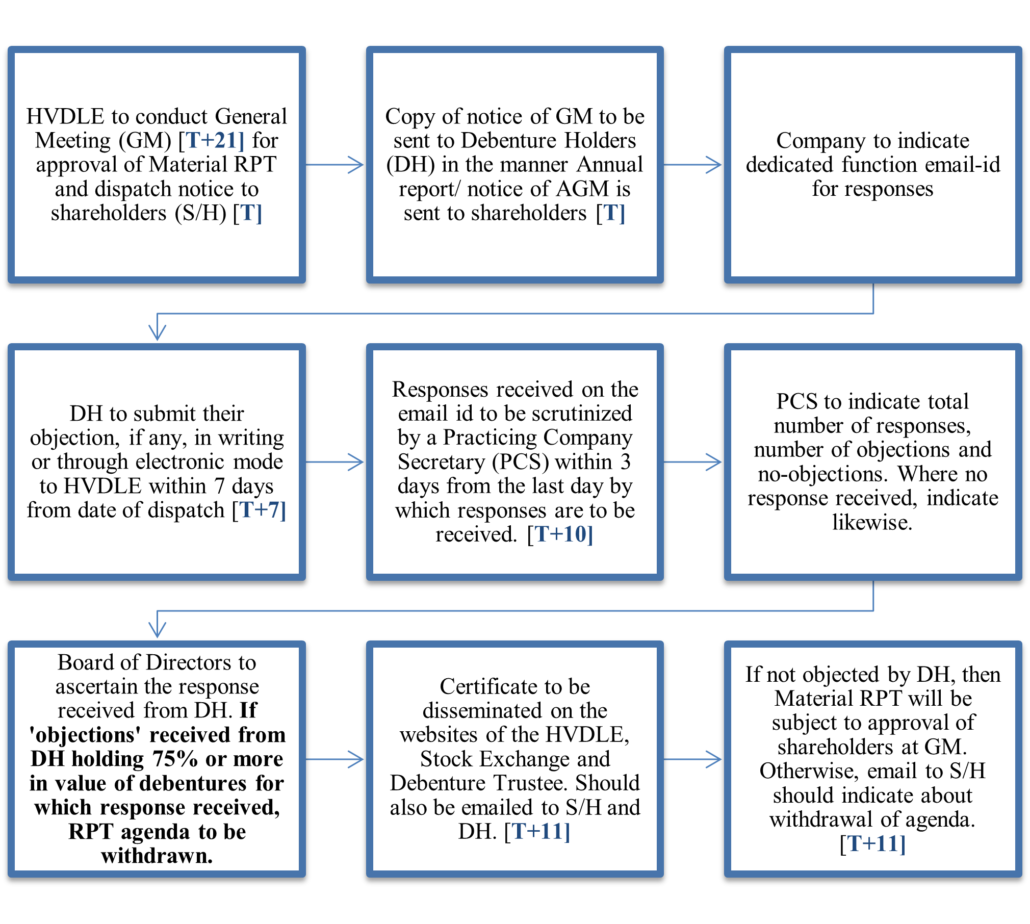

Debenture holders’ right to object Material RPTs

This seems to be one of a kind of proposal for RPT approval where a debenture holder will have a right to object by participating in the ordinary course of business of the listed entity, even in the absence of an event of default or breach of covenant. In terms of Section 186 of Companies Act, 2013 prior approval of public financial institution is not required for making of invesments or giving of loan, guarantee or security if it is within the limits specified under Section 186 (2) and there is no default in repayment of loan installments or payment of interest thereon as per the terms and conditions of such loan to the public financial institution

The proposed amendment surely doesn’t confer voting rights to debenture holders, as that is not permitted under Section 71 (2) of Companies Act, 2013. The intent is to provide the debenture holders with a right (and not an obligation) to object in case the Material RPT seems inappropriate. It could be pursuant to the fact that in case of closely held HVDLEs, shareholders’ approval is a farce as all related parties are eligible to vote. In case of equity listed entities or widely held HVDLEs, the proposal will still be approved by the shareholders who are not related parties.

No-response from the debenture holder is deemed no-objection and therefore, the objections received should be measured as a percentage to the total debentures and not just those who have submitted their response. However, the illustration in the consultation seems to provide otherwise, which should be reconsidered by SEBI. If the total value of outstanding debentures is Rs. 1000 crore, in that case the material RPT should be withdrawn only if objection is received from debenture holders holding debentures of value of Rs. 750 crore or more. The concept of present and voting is not applicable in this case.

Impact of the proposed amendment

Prior to this amendment, so long the debt was continued to be serviced and the terms and conditions of borrowing was met, the debenture holders were not required to intervene in the regular operations of the company. If there was a covenant to that effect in the debenture subscription agreement or Debenture Trust Deed or terms of isse, in that case, irrespective of whether the RPT is material or immaterial, the borrowing entity was required to comply.

With this amendment, if notified, the debenture holders will also have a say in corporate governance, especially in case of material RPTs pursuant to a provision of law. Other lenders extending term loan and other facilities, and who have a larger exposure on such companies, will not have this opportunity.

It may be argued that companies raise debt for general corporate purpose and to meet working capital requirements and in the absence of a specific end use, there is no deviation in the use of proceeds. If there is a default, the Debenture Trustee will be required to nominate a person on the Board of the listed entity in terms of Reg. 15 (1) (e) of SEBI (Debenture Trustees) Regulations, 1993 and accordingly, will be able to protect the interest of the debenture holders. However, the intent here seems to provide a right to govern and object in exceptional cases. This also comes with a risk that closely held HVDLEs may stand to lose as debenture holders may object proposals which may seem unclear to them. One will have to wait and watch the impact of this amendment, once notified.

Read our other writes ups on related topics:

- Comments on SEBI consultation paper on CG norms in HVDLEs

- SEBIs Consultation Paper on review of CG norms for a High Value Debt Listed Entities

- SEBI’s informal guidance offers temporary escape from impossibility

- ‘High value’ debt listed entities under full scale corporate governance requirements

- Presentation on Corporate Governance for Debt Listed Entities

- FAQs on LODR amendment on ‘High Value’ debt listed entities

[1] Open for public comments till February 22, 2023

[2] https://vinodkothari.com/2021/12/sebis-informal-guidance-offers-temporary-escape-from-impossibility/

Leave a Reply

Want to join the discussion?Feel free to contribute!