‘High value’ debt listed entities under full scale corporate governance requirements

SEBI move nullifies MCA exemption; bond issuers face disproportional compliances

Vinod Kothari & Vinita Nair | Vinod Kothari & Company

Giving bond markets in the country a push is an admitted policy objective; so much so that “large borrowers” are mandated to move a part of their incremental funding compulsorily to the bond markets. Just when privately placed bond issuance was looking very promising, augured by low interest rates and increasing investors’ confidence, SEBI’s recent move of notifying SEBI (Listing Obligations and Disclosure Requirements) (Fifth Amendment) Regulations, 2021 (‘2021 Amendment’)to extend corporate governance requirements, largely equivalent to that applicable to equity listed entities, comes as an enigma. These new norms, incorporated in the post-listing corporate governance requirements imbibed in SEBI ( Listing Obligations and Disclosure Requirements) Regulations, 2015 (‘Listing Regulations’) become effective immediately on a “comply or explain” basis, and become binding from 1st April, 2023.

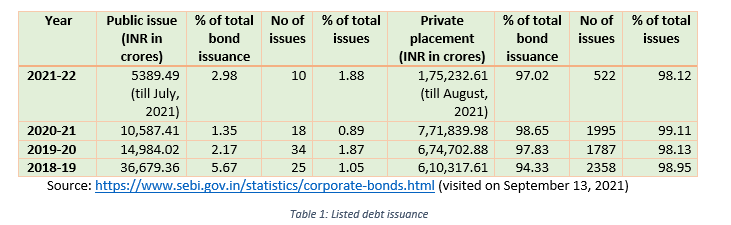

What is surprising is that the capital market regulator has thought of equating a debt listed entity with an equity listed one; potentially disregarding the essential difference between equity listing and bond listing. Equity listing is achieved by a public offer, which underlies widely dispersed retail investors’ interest. Bond listing, to the extent of 98%, is by way of private placement, which definitely means that bonds are placed with knowledgeable qualified institutional buyers. Also, it is a known fact that a large number of listed bond issuers are private limited companies, which are close corporations, with strictly private holding of capital. In light of these facts, extension of substantially the same regime for debt listed entities as that applicable to equity listing creates several irreconcilable compliance requirements, some of which are detailed out in this article. At a time when the need to push the country’s bond markets to new heights, ahead of a potential inclusion of India in global bond indices, is unquestionable, this regulatory move is both surprising as prejudicial. Surprising, because many of SEBI’s regulatory exercises, there was no public comments for these amendments.

The key to the potential prejudice that the regulatory move may cause to bond markets is the definition of “high value debt listed entities”, picking up a threshold of Rs. 500 crores. If the total value of listed bonds outstanding, purely from the corporate sector, is over Rs. 36 lakh crores[1], the amount of Rs. 500 crores is infinitesimal, less than 0.014% of the bond market, and therefore, the basis for taking this value as “high value” is seriously flawed.

Let us start with some facts. India’s bond market is largely a private placement, comprised of bespoke bond issues with limited number investors, majority of them being Qualified Institutional Buyers (QIBs). While technically, these bonds may be sourced through an electronic platform, the avowed fact is that bond issues by even the most frequent bond issuers are negotiated over the counter. Public issue of bonds is activity rarity. This is evident from Table 1: Listed debt issuance, by way of private placement vis-à-vis public issuance during last 3 years.

Regulatory regime before:

Regulation is always proportional to the regulatory concern: the regulatory concern in this case, obviously, is investor protection. Securities regulator is neither the prudential regulator for the bond issuers, nor does it lay the operational safeguards in working of companies. The key objective of the securities regulator is to ensure that the corporate governance does not entail risks to investors’ interest.

Further, the regulatory regime that existed hitherto is as follows: Once the debt securities are listed, companies were required to comply with Listing Regulations mainly Chapter II (dealing with principles relating to disclosures), Chapter III (dealing with common obligations for all listed entities and Chapter V (dealing with disclosure requirements on website, to debenture trustees, stock exchanges, submission of financial results and structure and terms of debt securities). Provisions relating to corporate governance were not applicable to debt listed entities.

It is also notable that debt listed entities were earlier only required to prepare half yearly financial statements, as opposed to quarterly financial statements applicable to equity listed entities.

The rest of the labyrinth of corporate governance provisions, dealing with composition of board of directors, non-executive chairperson, independent directors, constitution of the several board committees, shareholders’ approval for related party transactions, etc. were not applicable to debt listed entities.

Present amendment

SEBI, in its Board meeting held on August 06, 2021 approved amendments to the Listing Regulations and notified 2021 Amendment with effect from September 8, 2021[2]. The amendments may be classed into (i) those applicable to a “high value” debt listed entity and (ii) those applicable to every entity having its non-convertible securities listed[3].

The 2021 Amendment has made corporate governance related provisions applicable to a listed entity which has listed its non-convertible debt securities and has an outstanding value of listed non-convertible debt securities of Rs. 500 crore and above as on March 31, 2021 (‘HVD entity’). Further, once the provisions become applicable, it will continue to apply even if subsequently the outstanding value falls below the threshold.

Given the details of bonds issuance and present outstanding indicated above, there would be several entities that would be regarded as an HVD entity. In view of SEBI’s requirements under Large Corporate Borrower framework, entities with any of its securities listed, having an outstanding long term borrowing of Rs. 100 crores or above and with credit rating of ‘AA and above’[4], will have to mandatorily raise 25% of its incremental borrowing by ways of issuance of debt securities or pay monetary penalty/fine of 0.2% of the shortfall in the borrowed amount at the end of second year of applicability[5].

Given the details of bonds issuance and present outstanding indicated above, there would be several entities that would be regarded as an HVD entity. In view of SEBI’s requirements under Large Corporate Borrower framework, entities with any of its securities listed, having an outstanding long term borrowing of Rs. 100 crores or above and with credit rating of ‘AA and above’[4], will have to mandatorily raise 25% of its incremental borrowing by ways of issuance of debt securities or pay monetary penalty/fine of 0.2% of the shortfall in the borrowed amount at the end of second year of applicability[5].

If one were to argue it is the mere size of debt funding that brings in corporate governance requirements, then even a company that borrows from banks and financial institutions to the extent of Rs. 500 crores should, a priori, have been subjected to similar requirements. If moving from loans to bonds attracts severe corporate governance requirements, not applicable otherwise, there is a clear disincentive to moving bond markets, which is conflicting directly with SEBI’s own requirement of a “large borrower framework”.

We discuss some of the new requirements imposed on HVD entities, and demonstrate how some of these are completely non-reconciling with the type of entities to which they would apply.

Complete overhaul of Board composition

The Board of an HVD entity should comprise of prescribed number of independent directors (‘IDs’) depending on the nature of office of the Chairperson. Appointment of IDs in case of private companies and wholly owned public limited companies will require inducting requisite number of external persons on its Board. In case of a promoter Chairperson, half of its Board should comprise of IDs. A private company is a private matter, in terms of its shareholding. It cannot have an “independent” shareholder. Hence, boards of private companies, as per law, may only have 2 directors. SEBI, on the contrary, mandates 6 directors. Regrettably, the very “privacy” of a private company is compromised with the mandated presence of independent directors. Indeed, there are external investors who contributed to the debt of the entity, but they did with the explicit understanding that the corporate governance of a private company is remarkably different from that of a widely held company. If a private company has to behave and be governed almost like a widely held public company, then there may be a very strong disincentive for such companies to access bond markets.

The requirement of IDs is not merely getting some guests into the boardroom: IDs are required to be independent of management, should meet the eligibility criteria and are responsible to protect the interest of the minority shareholders. In case of several HVD entities there would be no minority shareholders whatsoever: therefore, the IDs would be left wondering as to how the IDs discharge the very same obligations as applicable to an entity with a few lakh shareholders.

The procedure to be followed by a listed entity for appointment of an ID under Listing Regulations is also very elaborate. The Nomination and Remuneration Committee (‘NRC’) is required to prepare a description of the needed capabilities and skill sets after doing a gap analysis, identify candidates basis the prepare description, justify to the Board and shareholders how the proposed incumbent meets the criteria and then recommend their appointment.

The listed entities are not only required to obtain declaration of independence from the IDs but also assess the veracity of the same. Further, the provisions stipulate conducting familiarization programme periodically, obtain Directors and Officer’s insurance for the IDs (otherwise applicable only to top 500 equity listed entities w.e.f. Jan 1, 2022), and ensure that a separate meeting of IDs are carried out.

Need to constitute 4 Committees

The HVD entity, irrespective whether a private company or a closely held company, is required to have an Audit Committee, NRC, Risk Management Committee (otherwise applicable only to top 1000 listed entities based on market capitalization, but strangely applicable to the entire population of HVD entites) and even a Stakeholder’s Relationship Committee (‘SRC’).

Section 178 of CA, 2013 also mandates constituting SRC only where there are 1000 shareholders, debenture holders, deposit-holders and any other security holders at any time during a financial year. And there are quite a few debt listed entities that have not triggered this requirement even after 8 years of enforcement of CA, 2013.

Under Listing Regulations as well, the role of SRC is mainly to resolve investor grievances, oversee steps taken by the listed entity to reduce quantum of unclaimed dividend, effective exercise of voting rights, monitoring adherence to service standards by RTA, which may not be even relevant to HVD entities that are private companies or closely held public companies. Strangely, the requirement of having SRC will be applicable to debt listed entities having a handful of debt investors, and purely in-house shareholders.

Remuneration related approvals

Requirement to seek shareholder’s approval by way of special resolution is applicable in case of continuing with directorship of a non-executive director (‘NED’) of 75 years and above, or remunerating one NED to the extent of more than 50% of annual remuneration of all NEDs in a financial year, or paying of remuneration to the promoter directors serving in executive capacity in case (i) the annual remuneration payable to such executive director exceeds Rs. 5 crore or 2.5 per cent of the net profits of the listed entity, whichever is higher; or (ii) where there is more than one such director, the aggregate annual remuneration to such directors exceeds 5 per cent of the net profits of the listed entity.

And it will not be a case of wide shareholder participation with institutional shareholders exercising voting rights basis the guidance from proxy advisors etc. as several of HVD entities could be private companies or closely held public limited companies.

Further, prior approval of public shareholders is required in case any employee including key managerial personnel or director or promoter of a listed entity enters into any agreement for himself /herself or on behalf of any other person, with any shareholder or any other third party with regard to compensation or profit sharing in connection with dealings in the securities of such listed entity.

Formulation of codes and policies

Code of conduct for Board and senior management personnel, policy for determination of material subsidiary, policy for determination of materiality of and dealing with related party transactions, archival policy for website are some of the additional codes and policies that HVD entities will have to frame.

Paradoxical regulation: Related Party Transactions (‘RPTs’) to require minority shareholder approvals

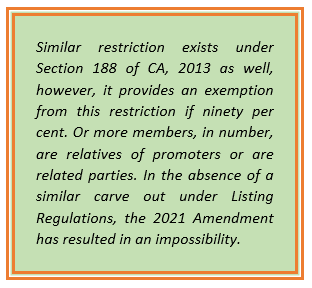

While framing a policy for determination of materiality of and dealing with RPTs and half yearly disclosure of RPTs to stock exchange might seem feasible, the 2021 Amendment also stipulates only IDs in the Audit Committee to approve RPTs. Further, in case of material RPTs, at the time of seeking shareholder’s approval all related parties are prohibited from voting to approve the RPT i.e. either they may vote against or abstain from voting altogether.

This is completely paradoxical. A debt listed entity may be a subsidiary of a holding company. The holding company, being a “related party”, will be excluded from voting. If the related parties are to be excluded from voting at the general meeting of a private company, it is quite likely that there will be no shareholders whose votes may be counted!

Subsidiary related governance

An HVD Entity will be required to ascertain material subsidiary, induct an ID on the board of super material subsidiary (that contribute 20% of consolidated income or net worth), place details of significant transactions undertaken by unlisted subsidiary before its Board, place the financials of unlisted subsidiaries before its Audit Committee and seek prior approval of shareholders in case of disposal of shares resulting in losing of control over the entity by the HVD entity or selling/leasing/ disposing 20% of the assets of such material subsidiary in a financial year.

Group governance may be more relevant for entities where the listed entity is answerable for creation of shareholder value. In case of a debt listed entity, the expectation of the investors is not creation of shareholder value but ability to timely service the debt and redeem the principal.

Conclusion

Will this be a deterrent for new issuers or small players from opting for the listed debenture route? Whether these enhanced corporate governance norms provide greater comfort and assurance to the investors in securing timely repayment of their monies? Will it increase trading in debt securities in the secondary market? It is assumed that SEBI must have considered these before enforcing the 2021 Amendment and only time could reveal the effectiveness of these provisions.

[1] The total corporate bond outstanding as on June, 2021[1] is about 36,27,667.18 crores represented by 26,350 outstanding instruments of 3903 issuers. The actual number of issuers, instruments and outstanding amount will be higher, if one were to include unlisted debt issuance as well.

[2] https://www.sebi.gov.in/legal/regulations/sep-2021/securities-and-exchange-board-of-india-listing-obligations-and-disclosure-requirements-fifth-amendment-regulations-2021_52488.html

[3] As per SEBI (Issue and Listing of Non-convertible Securities) Regulations, 2021 means debt securities, non-convertible redeemable preference shares, perpetual non-cumulative preference shares, perpetual debt instruments and any other securities as specified by the Board;

[4] As per para 2.2 of https://www.sebi.gov.in/legal/circulars/nov-2018/fund-raising-by-issuance-of-debt-securities-by-large-entities_41071.html

[5] a listed entity identified as a LC, as on last day of FY “T-1”, shall have to fulfil the requirement of incremental borrowing for FY “T”, over FY”T” and “T+1”.

Our other resources on related topics –

- https://vinodkothari.com/2021/09/high-value-debt-listed-entities-under-full-scale-corporate-governance-requirements/

- https://vinodkothari.com/2021/09/presentation-on-lodr-fifth-amendment-regulations-2021/

- https://vinodkothari.com/2021/09/debt-listed-entities-under-new-requirement-of-quarterly-financial-results/

- https://vinodkothari.com/2021/09/full-scale-corporate-governance-extended-to-debt-listed-companies/

YouTube:

https://www.youtube.com/channel/UCgzB-ZviIMcuA_1uv6jATbg

Other write-up relating to corporate laws:

http://vinodkothari.com/category/corporate-laws/

Our our Book on Law and Practice Relating to Corporate Bonds and Debentures, authored by Ms. Vinita Nair Dedhia, Senior Partner and Mr. Abhirup Ghosh, Partner can be ordered though the below link:

Leave a Reply

Want to join the discussion?Feel free to contribute!