Posts

SEBI proposals to ease trading plans by company insiders

/0 Comments/in Corporate Laws, SEBI /by Anushka Vohra-Consultation paper proposes to rationalise the existing framework under insider trading

Anushka Vohra | Senior Manager

corplaw@vinodkothari.com

Background

The concept of trading plan was introduced for the first time in the SEBI (Prohibition of Insider Trading) Regulations, 2015 (‘PIT Regulations’). The rationale for introducing the same, as indicated in the Report of the High Level Committee constituted for the purpose of reviewing the erstwhile 1992 Regulations, chaired by Mr. N.K. Sodhi, was that there may be certain persons in a company who may perpetually be in possession of UPSI, which would render them incapable of trading in securities throughout the year. The concept of trading plan would enable compliant trading by insiders without compromising the prohibitions imposed in the PIT Regulations.

Trading plan means a plan framed by an insider (and not just a designated person) for trades to be executed at a future date. Trading plan is particularly suitable for those persons within the organization, who may by way of their position, seniority or any other reason, be in possession of UPSI at all times. Since, the PIT Regulations prohibit trading when in possession of UPSI, trading plans are an exemption to such prohibition. In order to ensure that the insiders while formulating the trading plan do not have possession to UPSI, cooling-off period of 6 months has been prescribed in the PIT Regulations. As per Reg. 5(1) of the PIT Regulations, the trading plan has to be presented before the compliance officer of the company for approval. As per sub-regulation (3), the compliance officer has to review the trading plan and assess for any violation of the PIT Regulations. If at the time of formulation of trading plan, there was no UPSI or later on a new UPSI was generated, then the trading can be carried out as per the trading plan, even if the new UPSI has not been made generally available.

When the trades are executed as per trading plan, certain provisions of the PIT Regulations are exempted viz. trading window restrictions, pre-clearance of trades and contra trade restrictions.

SEBI has issued a Consultation Paper on November 24, 2023 for inviting public comments on the recommendations of the Working Group (‘Report’) to review provisions related to trading plans.

This article discusses the proposed amendments to the framework of the trading plan as mentioned in the Consultation Paper.

Challenges in the present framework

The Report discusses that during the last 5 years only 30 trading plans have been submitted annually by the insiders, which indicates that the trading plans are not very popular.

The year wise data on trading plans as mentioned in the Report is given below:

The data w.r.t. number of listed companies and DPs during FY 2022-23 is also given below:

The above clearly shows that during FY 2022-23, the number of designated persons among the listed companies was around 2,56,878 and there were only infinitesimal trading plan received by the exchange(s).

Further, the five features of the trading plan as highlighted in the Report are as under:

(i) can be executed only after 6 (six) months from its public disclosure;

(ii) are required to cover a period of at least 12 (twelve) months;

(iii) must be disclosed to the stock exchanges prior to its implementation (i.e., actual trading);

(iv) are irrevocable; and

(v) cannot be deviated from, once publicly disclosed.

As evident from above, while the concept has been into existence since 2015, trading plans have not been very popular owing to certain restrictive conditions viz. mandatory execution of the same even if the market prices are unfavorable for an insider, inability to trade for a reasonable period around the declaration of financial results and mandatory cooling off period of 6 months etc.

Proposed amendments

- Cooling-off period

Cooling-off period means gap between the formulation and public disclosure of the plan and actual execution of the plan. Reg. 5(2) of the PIT Regulations presently provides a cooling-off period for 6 months as the period of 6 months was considered reasonable for the UPSI that may be in the possession of the insider while formulating the trading plan to become generally available or any new UPSI to come into existence.

This period is proposed to be reduced to 4 months. The Report states that as per the current requirement, the insiders have to plan their trade 6 months ahead which may not be favorable, considering the volatility in the markets. It was proposed to either reduce the period or to do away with it.

The Report classifies UPSI into two types; short-term UPSI and long-term UPSI to ascertain the time within which the UPSI is expected to become generally available.

The Report further highlights that in case of short-term UPSI, a period of 4 months would be sufficiently long for it to become generally available.

In case of long-term UPSI, the Report refers back to proviso to Reg. 5(4) according to which the insider cannot execute the trading plan if the UPSI does not become generally available.

The Report also gives reference to the cooling-off period for trading plans in the US, where SEC introduced the cooling-off period only in December 2022.

- Minimum coverage period

Reg.5(2)(iii) states that a trading plan shall entail trading for not less than 12 months. A period of 12 months was specified to avoid frequent announcements of trading plans. This again provides a very long period for insider to execute their trading. This period is proposed to be reduced to 2 months.

- Black-out period

As per Reg 5(2)(ii), trading plan cannot entail trades for the period between the twentieth trading day prior to the last day of any financial period for which results are required to be announced by the issuer of the securities and the second trading day after the disclosure of such financial results. This period is known as the black-out period.

The Report states that this period forms a significant part of the year, considering 4 quarters and hence it is proposed to omit the same.

The Report also discusses the potential concerns that may arise on removing the black-out period. The Working Group noted that the same is addressed by the cooling-off period and non alteration of plan once approved and disclosed.

- Price limit

As per Reg. 5(2)(v) of the PIT Regulations, the insider can set out either the value of trades to be effected and the number of securities to be traded along with the nature of the trade, intervals at, or dates on which such trades shall be effected.

The Working Group noted that there was no price limit that the insider could mention. The Report recommends a price limit of 20%, up or down of the closing price on the date of submission of the trading plan.

- Irrevocability

As per Reg. 5(4), the trading plan once approved shall be irrevocable and the insider will have to mandatorily implement the plan without any deviation from it. This puts the insider in a disadvantageous position as he has to execute the trades (buy / sell) even when the price is not favorable.

As per the proposed amendment, where the price of the security is outside the price limit set by the insider, the trade shall not be executed. The plan will be irrevocable only where no price limit is opted for.

- Exemption from contra-trade restrictions

As per Reg. 5(3) of the PIT Regulations, restrictions on contra trade are not applicable on trades carried out in accordance with an approved trading plan.

The Working Group deliberated that it is difficult to envisage a reasonable and genuine need for any insider to plan two opposite trades with a gap of less than 6 months. The Report states that the insider may misuse the exemption for undertaking a contra position. Therefore, the exemption is proposed to be omitted.

- Disclosure of trading plan: timeline & content

As per Reg. 5(5), upon approval of the trading plan, the compliance officer has to notify the plan to the stock exchange(s). However, presently there is no specific timeline indicated. The Working Group recommends disclosure within 2 trading days of the approval of the plan. Further, it recommends disclosure of the price limit as well.

While the format of the trading plan will be rolled out basis discussion with the market participants, the Consultation Paper, basis the recommendations of the Working Group on protecting the privacy of the insiders by masking the personal details, discussed three alternatives of disclosure, as under:

It was discussed that disclosing personal details of the insiders publicly may raise privacy and safety concerns for senior management and insiders and not disclosing personal details to the stock exchange(s) would lead to misuse / abuse of trading plans by other insiders. That is, a trading plan submitted by one person may instead be used by someone else.

Having discussed the above, the Consultation Paper suggests alternative 3 i.e. making two separate disclosures of the trading plan; (i) full (confidential) disclosure to the stock exchange and (ii) disclosure without personal details to the public through stock exchange. Further, these separate disclosures may have a unique identifier for reconciliation purposes.

Concluding remarks

The proposed amendments indicate a welcome change as it attempts to plug the gaps prevalent in the erstwhile framework and offers flexibility to the insiders. At the same time, the Compliance officer will have to remain mindful of any scope for potential abuse by the insiders, while approving the same.One will have to await the actual amendment, basis the receipt of public comments, to ascertain if trading plans are all set to become popular and more frequent.

Our resources on the topic:

Link to our PIT resource centre: https://vinodkothari.com/prohibition-of-insider-trading-resource-centre/

Workshop on Recent regulatory developments for listed entities: critical changes under LODR and PIT Regulations

/0 Comments/in Corporate Laws, LODR, PIT, SEBI /by Team Corplaw| Register here: https://forms.gle/dmzuWFjxp8sL3VR4A |

Loading…

Loading…

CSR spending in the Indian sports sector

/1 Comment/in Companies Act 2013, Corporate Laws /by Staff-Shreya Salampuria | corplaw@vinodkothari.com

Background

Corporate social responsibility (CSR) spending in India, as is well known, is focused on certain statutorily recognised social activities, of which sports is one. Schedule VII, clause (vii) deals with activities related to “training to promote rural sports, nationally recognised sports, paralympic sports and olympic sports”.

Most of the attention under the schedule is taken away by contribution on activities connected with healthcare followed by education.

Khelo India, Kheloge toh Khiloge, an attempt to improve the performance of our vast country in sports, however, can we tap csr funds for the same?

When it comes to choosing or prioritizing the sports related activities, the outlook of the Indian companies cannot be said to be very impressive, however, there has been an increment on the CSR spending under the sports sector.

Read more →SEBI rationalizes the framework for Large Corporates

/0 Comments/in Bond Market, Corporate Laws, NCS, SEBI /by Team CorplawIncreased threshold, new incentive-disincentive framework instead of penalty

Sharon Pinto, Senior Manager & Palak Jaiswani, Asst. Manager (corplaw@vindokothari.com)

Updated on October 26, 2023

Background

With an intent to promote the Corporate Bond market, SEBI had introduced the framework for borrowing by Large Corporates (‘LCs’) framework with effect from April 1, 2019 by way of circular issued on November 26, 2018. Under the said framework, certain listed entities[1] who satisfied the prescribed criteria with respect to their long term borrowings, were mandated to raise 25% of their incremental borrowings by way of issuance of debt securities. Incremental borrowings were defined to include borrowings of original maturity of more than 1 year excluding external commercial borrowings and inter-corporate borrowings between a parent and subsidiary(ies). This portion of incremental borrowings was required to be raised by way of debt securities on an annual basis For FY2020 and FY2021 and over a block of 2 years which was then extended to 3 years from FY 2022 onwards. Failure to meet the same would attract a penalty of 0.2% of the shortfall amount.

Around 1/3rd of the eligible LCs were unable to raise the required amount through debt securities in FY 21-22 on account of:

- raising of debt becoming costlier due to tightening liquidity and hike in the benchmark rate;

- non-availability of interest subsidy benefits from Central and State Governments in case of certain issuers and the resultant impact on viability of the projects undertaken;

- cost of debt resulting in higher tariff rates to the ultimate consumers in case of power sector entities, etc.

On the other hand, the investors like insurers, pension, and provident funds are required to invest a particular percentage of their incremental receipts in corporate bonds and therefore, continuous issuance of debt securities was necessary.

Recently, SEBI amended the SEBI (Issue and Listing of Non-Convertible Debt Securities) Regulations, 2021 (‘NCS Regulations’) introducing Chapter V B effective from July 06, 2023 that provides the requirement for LCs under Reg. 50B to comply with requirements stipulated by SEBI.

While it has been more than 4 years since the introduction of the concept of LCs, issuers are still struggling to comply with the mandatory requirements. Therefore, SEBI decided to review the LCs framework and issued a Consultation Paper dated August 10, 2023, for public comments. Thereafter, basis the comments received from the public and suggestions of the Corporate Bond and Securitisation Advisory Committee (‘CoBoSAC’), SEBI approved the revised framework, as detailed herein in its Board meeting held on September 21, 2023 (‘SEBI BM’).

Revised framework as per the Present Circular

The revised framework has been notified by SEBI vide Circular dated October 19, 2023 (‘Present Circular’) and is applicable w.e.f. April 1, 2024 for LCs (criteria for identification discussed in the latter part) following April-March as their financial year and from January 1, 2024 for entities following January-December as their financial year. Thus, the revised framework is applicable for entities which would be identified as LCs as on March 31, 2024 or December 31, 2023, as the case may be.

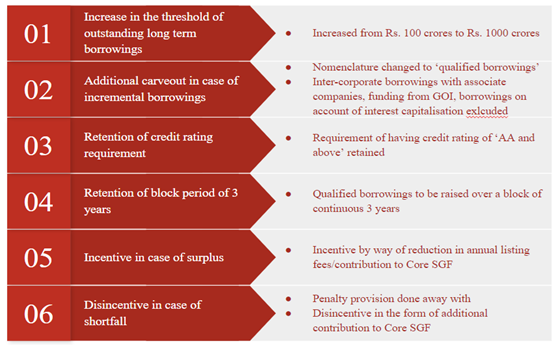

Key features of the revised framework are as follows:

Key features of the revised framework[2]

This article discusses the amendments made in the LCs framework by way of the Present Circular including the rationale provided in the CP, relevant points discussed in the SEBI Board meeting in this regard and transition related requirement for ongoing block of 3 years for existing LCs.

Increase in the threshold of outstanding long-term borrowings

| Existing Provisions | Proposed Changes in CP | SEBI’s rationale for proposed change |

| Outstanding long-term borrowings[3] of Rs. 100 crore or above | Outstanding long-term borrowing of Rs. 500 crore or above. | To align the criteria for LCs with the ‘High Value Debt Listed Entity’ or ‘HVDLEs’ as provided under the Listing Regulations. |

Brief of public comments received and SEBI’s response:

While a major portion of public comments were in favour of the increase in the limit to Rs. 500 crore, a common remark raised by the public suggested applying the LC framework based on outstanding listed debt instead of outstanding long-term borrowings. SEBI disagreed as it will increase the burden for entities that have already tapped the debt market and will not help in reducing the burden on the banking system. There were few comments seeking exemption from the applicability in case of loss making companies and NBFCs, which was also dismissed by SEBI indicating that it has no nexus with profit or loss made by an entity and that NBFCs being the largest borrowers cannot be excluded.

SEBI BM decision

Increase the limit from existing Rs. 100 crores to Rs. 1000 crores, basis which, around 170 entities would qualify as LCs (as opposed to 482 entities in case of limit of Rs. 500 crore proposed).

Provisions under the Present Circular

The threshold limit of outstanding long term borrowings has been increased to Rs. 1000 crores.

Our Remarks

Classification as an HVDLE is on account of outstanding listed debt securities. On the contrary, an entity may not have any of its debt securities listed but may still be classified as an LC if it has its equity listed and borrowing from banks/ financial institutions exceeding the prescribed threshold. Increase of limit to Rs. 1000 crore is a welcome change.

Scope of outstanding long-term borrowings and incremental borrowings

| Existing Provisions | Proposed Changes in CP | SEBI’s rationale for proposed change |

| Includes: any outstanding borrowing with an original maturity of more than 1 year Excludes: (i) External Commercial Borrowings (ii) Inter-corporate borrowings between a holding and subsidiary | Term ‘incremental borrowings’ to be replaced with ‘qualified borrowings’. Includes: any outstanding borrowing with an original maturity of more than 1 year Excludes: (i) External Commercial Borrowings (ii) Inter-Corporate Borrowings between its holding and/or subsidiary and /or associate companies; (iii) Grants, deposits, or any other funds received as per the guidelines or directions of the Government of India (‘GOI’); (iv) Borrowings arising on account of interest capitalization | To cover associate companies, on which the holding company has significant influenceThe end use of grants received from the Government is restricted to the purposes specified by Government and cannot be deviated fromInterest capitalized on the loan amount cannot be considered as borrowings. |

Brief of public comments received and SEBI’s response:

All the public comments were in favor of the proposal. Few comments were received to additionally exclude borrowings for the purpose of refinancing which was not accepted by SEBI as it would defeat the intent of the framework. The suggestion to exclude borrowings made for mergers, acquisitions and takeovers was accepted by SEBI given those are not routine occurrences in the life-cycle of an entity.

SEBI BM decision

Incremental borrowings to be termed as qualified borrowings. Borrowings for mergers, acquisitions and takeovers to be further excluded from the scope of qualified borrowings.

Provisions under the Present Circular

The nomenclature ‘incremental borrowings’ has been revised to ‘qualified borrowings’ and the exclusions proposed in the CP i.e. inter-corporate borrowings involving associate companies, any funding received from the GOI, borrowings on account of interest capitalisation have been given effect to. Additionally, as per the public comments received, borrowings for the purpose of scheme of arrangement as stated above have also been excluded.

Retention of credit rating requirement as a criterion for LC identification

| Existing Provisions | Proposed Changes in CP | SEBI’s rationale for proposed change |

| Have a credit rating of “AA and above” | Remove the requirement. | Entities with long-term outstanding borrowings of Rs. 500 Cr or above would generally fall under the bracket of credit rating of ‘AA and above’ |

Brief of public comments received and SEBI’s response:

Most of the public comments were against the proposal as entities with low rated debt may not find investors at all, which was accepted by SEBI.

SEBI BM decision

The criteria of a minimum credit rating to be retained as per existing norm.

Provisions under the Present Circular

SEBI has retained the existing requirement prescribing a minimum credit rating of “AA”/“AA+”/AAA under the revised framework.

Our Remarks

The proposal in the CP to drop the requirement altogether was inappropriate. An outstanding borrowing of Rs. 500 crore may not be necessarily indicative of the credit quality of the borrower. While regulations may force or incentivize the issuers to come up with debt issuance pursuant to this framework, however, it cannot force the investors to invest. An investor in debt security will rely on the credit quality which is fairly indicated through the credit rating of the debt security. The requirement of having a credit rating is one of the prerequisites for listing a debt security under NCS Regulations (Reg. 10). Even for determining the list of eligible issuers of debt securities for the purpose of contribution to Core Settlement Guarantee Fund (‘Core SGF’), the issuer should have long term debt rating of the eligible securities of AAA, AA+, AA and AA- (excluding AA- with negative outlook). Decision to retain the erstwhile requirement is a welcome move.

Retention of block period of three years

| Existing Provisions | Proposed Changes in CP | SEBI’s rationale for proposed change |

| FY 2020 & FY 2021 – On an annual basis FY 2022 onwards – On a block of 3 years | On an annual basis | To simplify the process of raising debt securities and to eliminate the complex process of tracking all the issuances during the block years. |

Brief of public comments received and SEBI’s response:

Most of the public comments were against the proposal, which was accepted by SEBI.

SEBI BM decision

SEBI to retain the requirement of the continuous block of 3 years in the framework.

Provisions under the Present Circular

It has been prescribed that atleast 25% of the qualified borrowings will be required to be raised by way of issuance of debt securities over a continuous block of 3 years.

Since, the framework is applicable w.e.f. FY 2025, entities identified as LCs as on the last day of ‘T-1’ [i.e. March 31, 2024 / December 31, 2023, as the case may be], will be required to raise the requisite quantum of qualified borrowings of FY ‘T’ [FY 2025] through issuance of debt over a block of 3 years i.e. over ‘T’ [FY 2025], ‘T+1’ [FY 2026] and ‘T+2’ [FY 2027].

Our Remarks

The proposal in the CP to make it an annual requirement was inappropriate. For the purpose of this framework, the interest of such issuers who do not issue debt securities frequently is also to be kept in mind. While frequent issuers of debt securities may not find it difficult to borrow funds by issuance of further debt securities, it may not be feasible for non-frequent issuers to raise the entire quantum of prescribed incremental borrowings within a period of 1 year. Issuers are to be given certain flexibility and the timelines need not be made more stringent. Decision to retain the erstwhile requirement is a welcome move.

Incentive for exceeding the mandatory limit

| Existing Provisions | Proposed Changes | SEBI’s rationale for proposed change |

| – | In case of a surplus, a certain quantum of the annual listing fees to be reduced; Reduction in the contribution to be made to the core SGF. | To promote ease of doing business and to encourage LCs to raise funds by incentivizing them. |

Brief of public comments received and SEBI’s response:

All public comments were in favour of the proposal. One of the recommendations was to provide incentive in the form of reduction in the contribution to be made to the Recovery Expense Fund[4], which was not approved by SEBI given it is a refundable deposit and meant to meet recovery expenses in case of any default.

SEBI BM decision

SEBI decided to introduce the incentive structure. With respect to the proposal for reduced contribution to Core SGF, SEBI approved to permit carry forward of incentive till utilisation or set off within 6 years of obtaining the incentive.

Provisions under the Present Circular

The incentive scheme proposed has been notified. A benefit of reduction in the annual listing fees pertaining to listed debt securities or non-convertible redeemable preference shares ranging between 2% to 10% computed in the following manner would be available in case of surplus borrowings raised through issuance of debt:

| Sr. No. | % of surplus borrowing as on last day of FY “T+2” for the block starting FY “T” | % of reduction in annual listing fees payable to the Stock Exchanges by the LCs for FY “T+2” |

| 1 | 0-15% | 2% of annual listing fees |

| 2 | 15.01% – 30% | 4% of annual listing fees |

| 3 | 30.01% – 50% | 6% of annual listing fees |

| 4 | 50.01% – 75% | 8% of annual listing fees |

| 5 | Above 75% | 10% of annual listing fees |

Further, a credit in the form of reduction in the contribution to be made to the Core SGF of LPCC would also be available in the following manner:

| Sr. No. | % of surplus borrowing for the block starting FY “T” as on last day of FY “T+2” | Quantum of Credit |

| 1 | 0-15% | 0.01% |

| 2 | 15.01% – 30% | 0.02% |

| 3 | 30.01% – 50% | 0.03% |

| 4 | 50.01% – 75% | 0.04% |

| 5 | Above 75% | 0.05% |

The Present Circular further mentions that in case of entities classified as ‘eligible issuers’ by the LPCC, the incentive would be permissible to be carried forward for a period of 6 years of obtaining the same as approved in the SEBI BM. Further, in case of an entity which is not an eligible issuer, the incentive may be carried forward until it is classified as an eligible issuer. Thereafter, the incentive would be available for the purpose of utilisation for a period of 6 years from year of such classification.

Manner of computation

Let us consider the following example to understand the computation of credit:

Company ‘X’ is identified as an eligible issuer requiring to contribute Rs. 2 crores to the Core SGF. It has complied with the requirements of raising the requisite qualified borrowings in the following manner:

| Sr. No. | Particulars | Amount (in Rs. Cr) |

| 1 | Borrowings that should have been made from the debt market by the LC for FY “T” (A) | 200 |

| 2 | Actual borrowings in “Block of three years” (B) | 250 |

| 3 | Surplus borrowings (B-A) (C) | 50 |

| 4 | % of surplus borrowing (C/A*100) | 25% |

| 5 | Quantum of credit (% of quantum of credit as per the table above*C) | 0.01 (i.e. 50*0.02%) |

| 6 | Actual contribution required to be made to the SGF [Actual contribution required to be made – Quantum of credit] | 1.99 (i.e. 2-0.01) |

Our Remarks

Contribution to Core SGF:

The benefit of reduced listing fee can be availed by the listed entity for listed debt securities or non-convertible redeemable preference shares. However, the relaxation in the form of reduced contribution to Core SGF will be an incentive only to an ‘eligible issuer’ as per the list rolled out annually by AMC Repo Clearing Limited (‘ARCL’), recognised as Limited Purpose Clearing Corporation (‘LPCC’) by SEBI, on the basis of prescribed parameters. In case of an LC which has not been identified as an ‘eligible issuer’, the credit in contribution to the Core SGF would not serve as an incentive and may get lapsed. It may even be the case for an issuer identified as ‘eligible issuer’ in year 1 however, not identified in the subsequent year. ARCL vide Circular dated September 29, 2023 rolled out a list of 125 eligible issuers who will be required to contribute to Core SGF for the eligible issuance as per the eligible list issued on or after 01st October 2023 till 30th September, 2024. In the light of this, SEBI’s decision to allow carrying it forward till 6 years is a welcome change.

Mandatory Listing:

In case an LC which is a debt listed entity and raises further debt pursuant to the LC framework post January 1, 2024, it will be mandatorily required to list every such issuance pursuant to Reg. 62A of the SEBI Listing Regulations, inserted vide the SEBI (Listing Obligations and Disclosure Requirements) (Fourth Amendment) Regulations, 2023. On the other hand, in case an LC is not a debt listed entity, however, lists any particular issuance of debt securities issued pursuant to the LCB framework any time post January 1, 2024, as per the afore-mentioned provision, it will be mandatorily required to list all issuances done post January 1, 2024 within a period of 3 months from the date of listing.

As a result of such mandatory listing, the LCs may cross the threshold of having outstanding listed debt securities amounting to Rs. 500 crores, thereby classifying the entities as a ‘High Value Debt Listed Entity’ or an ‘HVDLE’. Consequently, the entity will be required to comply with the corporate governance provisions stipulated under Reg. 16 to Reg. 27 of the SEBI Listing Regulations. We have further analysed the same in our article which can be accessed here.

Disincentive for not meeting the mandatory limit

| Existing Provisions | Nature of amendment proposed | Proposed Changes | SEBI’s rationale for the proposed change |

| Monetary penalty/ fine of 0.2% of the shortfall in the borrowed amount is levied in case of shortfall | Doing away with the penalty and introducing an incentive/ disincentive structure | In case of a shortfall, an amount equivalent to 0.5 basis points of such shortfall shall be made by the LC to the core Settlement Guarantee Fund (‘SGF’) as set up by the Limited Purpose Clearing Corporation (LPCC). | To promote ease of doing business and to encourage LCs to raise funds by incentivizing them. |

Brief of public comments received and SEBI’s response:

While majority of the comments were in favour of the proposal, it was recommended that:

(a) the disincentive should be applicable if there is a non-compliance for a continuous block of 2/3 years;

(b) further reduction in the quantum; and

(c) applicability only to entities required to contribute to Core SGF.

SEBI BM decision

SEBI confirmed (a) and disagreed for (b). In case of (c). SEBI clarified that Core SGF requirement will be made applicable to all issuers to ensure uniformity.

Provisions under the Present Circular

SEBI has done away with the penalty provision and notified the disincentive structure. The said structure will apply in case of shortfall in raising the requisite quantum at the end of the block of 3 years, i.e. as on the last day of ‘T+2’. The disincentive scheme is in the form of additional contribution to be made to the Core SGF in the following manner:

| Sr. No. | % of surplus borrowing for the block starting FY “T” as on last day of FY “T+2” | Quantum of additional contribution |

| 1 | 0-15% | 0.015% |

| 2 | 15.01% – 30% | 0.025% |

| 3 | 30.01% – 50% | 0.035% |

| 4 | 50.01% – 75% | 0.045% |

| 5 | Above 75% | 0.055% |

Manner of computation

Let us consider the following example to understand the computation of disincentive:

Company ‘X’ is identified as an eligible issuer requiring to contribute Rs. 2 crores to the Core SGF. It has complied with the requirements of raising the requisite qualified borrowings in the following manner:

| Sr. No. | Particulars | Amount (in Rs. Cr) |

| 1 | Borrowings that should have been made from the debt market by the LC for FY “T” (A) | 200 |

| 2 | Actual borrowings in “Block of three years” (B) | 150 |

| 3 | Shortfall in borrowings (X-Y) (C) | 50 |

| 4 | % of shortfall in borrowing (C/A*100) | 25% |

| 5 | Quantum of additional borrowing (% of quantum of additional borrowing as per the table above*C) | 0.0125 (i.e. 50*0.025%) |

| 6 | Actual contribution required to be made to the SGF [Actual contribution required to be made + Quantum of additional borrowing] | 2.0125 (i.e. 2+0.0125) |

Dispensation for LCs identified basis erstwhile criteria

The entities which have been identified as LCs under the erstwhile LC framework are required to comply with the requirement over a block of 3 years in the following manner:

| FY in which the entity was identified as LC i.e. ‘T-1’ | Block of 3 years over which the LC was required to raise the requisite quantum of long term borrowings i.e. ‘T’, ‘T+1’, ‘T+2’ | Remaining period of the block as on March 31, 2023 prior to Present Circular | Remaining period as per the Present Circular |

| FY 2021 | FY 2022, FY 2023, FY 2024 | 1 year i.e. FY 2024 | 1 year i.e. FY 2024 |

| FY 2022 | FY 2023, FY 2024, FY 2025 | 2 years i.e. FY 2024 & FY 2025 | 1 year i.e. FY 2024 |

| FY 2023 | FY 2024, FY 2025, FY 2026 | 3 years from FY 2024 to FY 2026 | 1 year i.e. FY 2024 |

The erstwhile LCs are required to endeavour to comply with the requirement of raising 25% of their incremental borrowings done during FY 2022, FY 2023 and FY 2024 respectively by way of issuance of debt securities till March 31, 2024, failing which, such LCs are required to provide a one-time explanation in their Annual Report for FY 2024.

The Present Circular additionally amends the Chapter XII of NCS Master Circular to the following effect:

- Deletion of penalty related provision in Clause 2.2(d) of Chapter XII; and

- Deletion of format of annual disclosure to be submitted within 45 days from end of the financial year by an identified LC providing details of incremental borrowing and mandatory borrowing, as provided in Clause 3.1 (b) of Chapter XII.

Conclusion

The changes in the framework vide the Present Circular attempt to tackle the hindrances which are being faced by entities classified as LCs, including removal of the penal provisions on shortfall, etc. Thus, these changes seem positive and would help LCs in complying with the LCs framework. However, while the framework aims to deepen the bond market by mandating debt issuance, one cannot disregard the other recent amendments in the legal framework governing debt securities, which seem to be a deterrent for companies from approaching the capital markets, for instance, provisions relating to mandatory listing of debt securities, requirement to obtain approval of all holders in case of voluntary delisting, etc. While the framework would be relevant for entities who have already tested the equity markets and wish to enter the debt market, the recent amendments relating to mandatory listing, no selective delisting etc. would impact issuers who intend to list their debt securities.

[1] Criteria under the erstwhile framework was as follows and was applicable to all listed entities except Scheduled Commercial Banks:

- having listed specified securities or debt or non-convertible redeemable preference shares on a recognised stock exchange; and

- having outstanding long term borrowing of Rs. 100 crore or above; and

- having a credit rating of ‘AA and above’.

[2] About Core SGF: In terms of SEBI Circular SEBI/HO/DDHS/DDHS-RACPOD1/CIR/P/2023/56 dated April 13, 2023, eligible issuers are required to contribute 0.5 basis points (0.005%) of the issuance value of debt securities per annum based on the maturity of debt securities. The issuers need to make full contribution upfront prior to the listing of debt securities.The Core SGF contribution is applicable for all public issue or private placement of debt securities under the SEBI (Issue and Listing of Non-convertible Securities) Regulations, 2021 of eligible issuer except for a) Tier I & Tier II bonds issued by Banks, NBFCs & other institutions; b) Perpetual Debt; c) Floating rate bonds; d) Market linked bonds; e) Convertible bonds (Optional or Compulsorily); f) Securities other than long term debt rating of the eligible securities shall be AAA, AA+, AA and AA- (excluding AA- with negative outlook).

[3] Outstanding long term borrowings indicate borrowings which have original maturity of more than 1 year with certain exclusions as detailed further herein.

[4] Recovery Expense Fund is a refundable fund to be deposited with the stock exchanges at the time of listing. The purpose of the fund is recovery in case of default.

Succession planning: failing to plan is planning to fail

/0 Comments/in Companies Act 2013, Corporate Laws /by Anushka Vohra-Anushka Vohra | Manager | anushka@vinodkothari.com

| The article was also published in the CRA E-Bulletin and can be viewed here |

Background

Passing the torch, lighting the way – an expression that can be used to refer to succession planning. Be it a household, business organization or institution, succession planning is needed everywhere. In a household, as the family possessions and culture are passed on, it is simply termed as continuing the legacy. In an HUF, according to HUF laws, after the Karta (head of the HUF) dies, the senior most coparcener becomes the head of the HUF. In corporates, the larger the scale and complexity of business, the need for succession planning becomes much more important. Unlike in the case of a household, corporates involve the livelihood and interests of thousands of people, i.e., the shareholders, vendors, customers and other stakeholders. The intent of succession planning is not to oust the leader from his / her position but to prepare the next generation to become the future leaders. Succession planning is required to ensure smooth running of business. The torch bearer (leader here), has to groom his / her successor to take over his role.

In an organization, succession planning is an important element of corporate governance. In this write-up, the author has tried to emphasize on the need and importance of succession planning.

Read more →FAQs on Purpose and Effect test for RPTs

/0 Comments/in Companies Act 2013, Corporate Laws, LODR, SEBI /by Team Corplaw-Team Vinod Kothari and Company | corplaw@vinodkothari.com

Loading…

Loading…

For further reading on the topic –

Workshop on Purpose and Effect Test for RPTs

/0 Comments/in Corporate Laws, LODR, SEBI, Training & Workshops /by Team CorplawFor understanding the intricacies, laying systems and implementing

| Register here: https://forms.gle/uX6cFio1UVjxCcsW8 |

Loading…

Loading…

Read our related resources

SEBI to provide debenture holders the right to object material related party transactions

/0 Comments/in Corporate Laws, LODR, SEBI /by Vinita Nair DedhiaComplicates approval process for closely held High Value Debt Listed Entities

– Vinita Nair, Senior Partner | vinita@vinodkothari.com

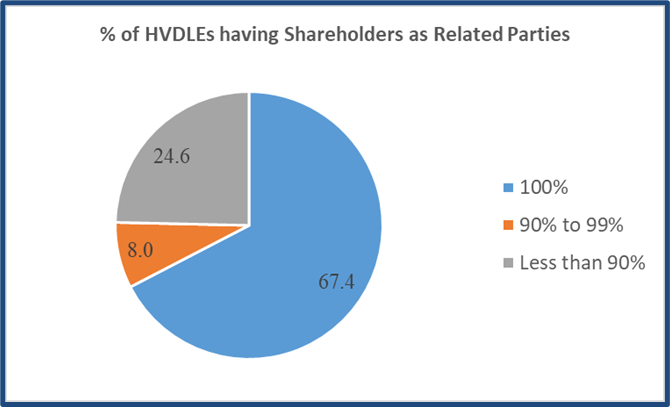

SEBI continues to tighten the regulatory regime for debt listed entities as it aims to promote corporate bond market. After equating debt listed entities with outstanding value of listed non-convertible debt securities of Rs. 500 crore and above with equity listed entities for the purpose of corporate governance norms, SEBI proposes a stricter approval regime for Related Party Transactions (‘RPTs’) under Reg. 23 of SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015 (‘LODR’) vide Consultation paper on review of Corporate Governance norms for a High Value Debt Listed Entity (‘HVDLE’)[1]. This has been rolled out just before the corporate governance provisions become applicable on a mandatory basis effective from April 1, 2023. The composition of 138 HVDLEs, in terms of shareholding pattern, as on March 31, 2022 was as under:

National financial information repository: One more or one for all?

/0 Comments/in Banks, Budgetary Publications, FEMA, Financial Services, RBI, SARFAESI, Securitisation /by Lovish Jain– Lovish Jain, Executive | lovish@vinodkothari.com

Some days ago, Mr. Vinod Kothari had commented on a LinkedIn post :

“Do we realise how many places does a lender (NBFC, Bank) register information about a loan? There are 4 credit information companies (such as CIBIL) where the credit data, including performance history, is uploaded. If the exposure is Rs 5 crores or above, in the aggregate over the banking system, information goes on CRILC too.

RBI has recently written to NBFCs reminding them of the obligation to register details with NeSL, an information utility under IBC, irrespective of whether the provisions of Code apply (for example in case of individuals), or whether the lender in question is at all contemplating resorting to IBC as a remedy (for example, consumer loans).

If the loan is a secured loan, the details need to be filed with CERSAI. If the secured loan borrower is a company, details need to be filed with RoC too. If the security interest is on immovable property, one needs to file particulars with land registry. If the security interest is on motor vehicles, the hypothecation is registered with Vahan portal too.

Read more →