Social stock exchanges: philanthropy on the bourses

– Payal Agarwal, Senior Executive | payal@vinodkothari.com

This version: 30th December, 2022

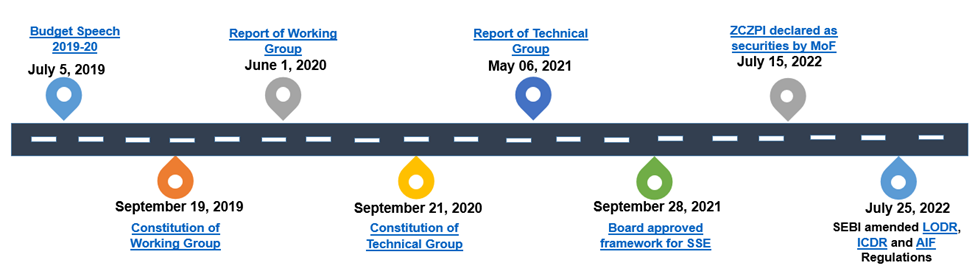

History

The discussions around the concept of social stock exchanges (“SSEs”) were first initiated in India with the 2019-20 Budget Speech[1] of the Finance Minister, followed by the Working Group Report of SEBI dated 1st June, 2020 (“WG Report”) and Technical Group Report dated 6th May, 2021 (“TG Report”), and public comments thereon. On the basis of the WG Report and TG Report, SEBI in its meeting held on 28th September, 2021 approved a broad framework for establishment of SSEs in India (“SSE Framework”), and an updated status on the action matrix was also released in the meeting held on February, 2022. The concept of SSEs has been incorporated in the rulebook vide the notification of SEBI (Issue of Capital and Disclosure Requirements) (Third Amendment) Regulations, 2022 (“ICDR Amendment Regulations”), SEBI (Listing Obligations and Disclosure Requirements) (Fifth Amendment) Regulations, 2022 (“LODR Amendment Regulations”) and SEBI (Alternative Investment Fund)(Third Amendment) Regulations, 2022 (“AIF Amendment Regulations”), respectively (see timeline below).

In this write-up, we focus on understanding the basic concept of SSEs in India, how the Indian version of SSEs is different from the global counterparts, whether SSEs will be used for investing by impact investors or for those searching for avenues of responsible philanthropy, and what are the potential benefits of listing and participation in SSEs.

Global evolution and present status of SSEs

The concept of SSEs was not born in India. It was/ is in existence in many countries throughout the world. However, the operating mechanism of SSEs differs from country to country. While some countries have adopted SSEs as a separate matchmaking platform altogether or as an impact investment instrument as a part of their existing stock exchanges, the concept of SSEs in India operates differently as also discussed in the WG Report. Let us quickly glance through the SSEs operating in various international jurisdiction. Out of the ones mentioned below, only Jamaica, Singapore and Canada are currently functional, the rest have become extinct due to financial and other structural challenges such as low number of users resulting in inability to attain economies of scale, lack of training and awareness etc.

| Country | Exchange name | Established | Operating model[3] | Data/ statistics |

| Brazil | Brazil’s Socio-Environmental Impact Exchange (BVSA) | 2003 (discontinued – 2018) | Only for non-profits Publicity of listed projectsInvestment in the form of “social shares” | Raised R$ 19 million (~$3.6 million USD) for more than 188 projects in its 15 years of operation |

| UK | Social Stock Exchange (SSX) | 2013 | Directory of verified businesses having social impactOnly for profit companies eligible Annual review of impact report[4]No trading | 400 million euros raised till 2015 |

| Canada | Social Venture Connexion (SVX) | 2013 | Primary offering platform (secondary trading not allowed)Networking platform Returns include social/ environmental and financial returns | Mobilized capital aggregating to around $350 millions with a network of around 500+ organizations and 1200+ investors |

| Singapore | Impact Investment Exchange (IIX) | 2013 | FPEs and NPOs Marketing of social projects social/ environmental returns along with financial returns | |

| South Africa | SASIX | 2006 | NPOs and social business[5]Tax benefits to investorssocial/ financial returnsImpact investment exchange | Funds raised – 2.7 million dollars with 15 listed projects as on 2009 |

| Jamaica | Jamaica SSE | 2018 | Available for NPOs only Crowdsourcing platformNo financial returns[6]Audit and reporting requirements | USD 2,40,103 as on 2020 |

| Portugal | Bolsa de Valores Sociais (BVS) | 2009 2015 | Only for NPOsSocial shares Only social returns Listing of projects for donations | Raised 2 mn euros by 2012 and had 26 registered projects in 2015 |

Concept of SSEs in India

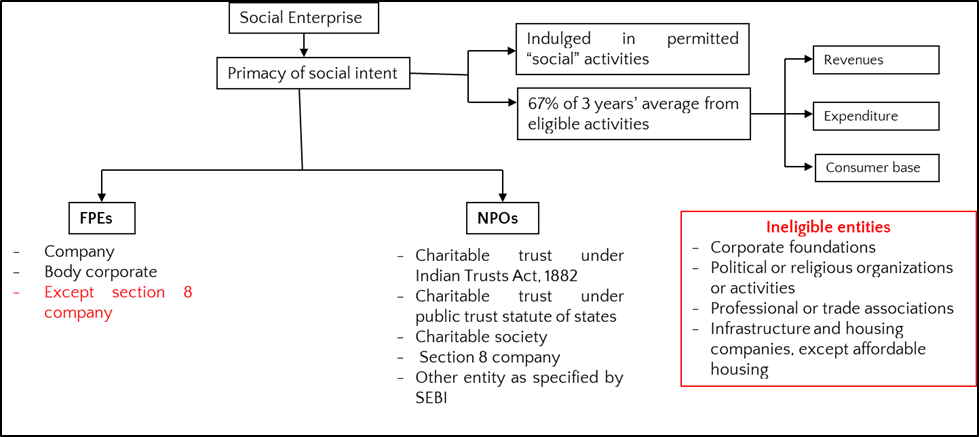

The model of SSEs approved in India is that of a “donation” based funding platform with a feature of trading the “donations” by linking them with a “security instrument” (see below – Zero Coupon Zero Principal bonds). These SSEs will operate as a separate segment within the existing stock exchanges, and entities permitted to be listed within the SSEs are “Social Enterprise” (“SE”). At present, both BSE and NSE have received in-principle approval for introducing SSE as a separate segment on the stock exchange. The Social Enterprise can be either a for-profit enterprise (“FPE”) or a not-for-profit organization (“NPO”). The ICDR Amendment Regulations further provides the eligibility criteria for an entity – FPE/ NPO to be registered as a SE with the SSEs (see Figure 2). In addition to the same, SEBI released a circular on the Framework on Social Stock Exchange on 19th September, 2022. While the same is mostly in the nature of clarification or elaboration to the conditions prescribed under the ICDR Amendment Regulations, it additionally specifies the minimum fund flow requirements to be met by entities seeking to list as SEs. According to the same, the minimum annual spending in the past FY shall be atleast Rs. 50 lacs, and funding in the past FY shall be at least Rs. 10 lacs. Further, the NPO shall have a track record of atleast 3 years, in order to be eligible for registration.

While FPEs will only be entitled to get the identification as SEs and will not be able to source any funding on the SSE, NPOs will have both identification and access to funding.

Modes of fund raising on SSEs

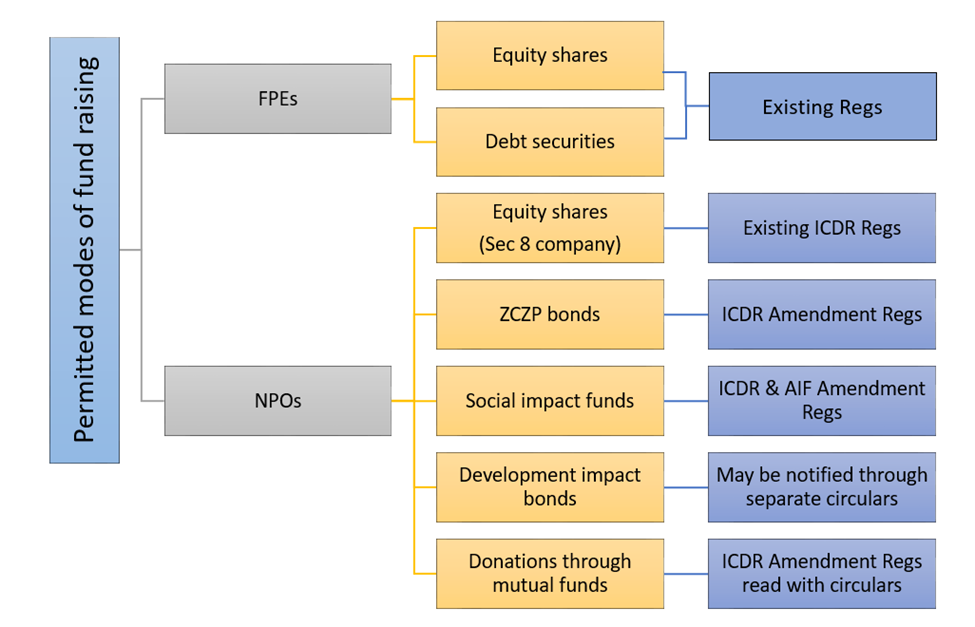

The SSE Framework approved by SEBI provides for various modes of raising funds by the NPOs and FPEs registered as SE (see Figure 3). However, the current ICDR Amendment Regulations do not facilitate the fund raising through all these permitted sources. Reg 292G specifies the modes in which funds may be raised by an NPO/ FPE registered with the SSEs, however, a flexibility is embedded within the Regulations itself by means of inclusion of a clause – “any other means as may be specified by the Board from time to time.”

Zero Coupon Zero Principal Bonds (“ZCZP bonds”)

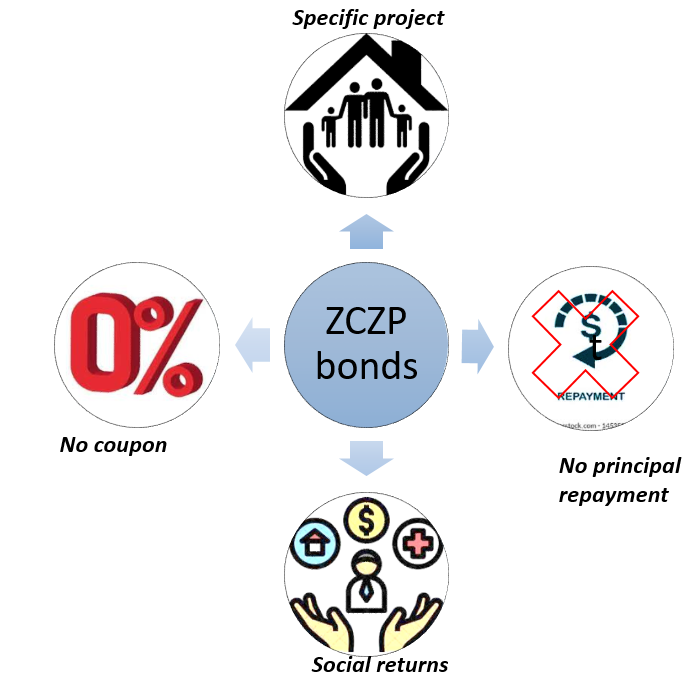

ZCZP bonds are a permitted instrument, and currently the only instrument, for raising funds by the NPOs on the SSEs, and has been recognised as “securities” in terms of Securities Contracts (Regulation) Act, 1956 vide a MoF notification dated 15th July, 2022. ZCZP bonds have been defined as follows –

“zero coupon zero principal instrument” means an instrument issued by a Not for Profit Organisation which shall be registered with Social Stock Exchange segment of a recognised Stock Exchange in accordance with the regulations made by the Securities and Exchange Board of India.

The ICDR Amendment Regulations permit NPOs to raise funds by way of issuance of ZCZP bonds subject to the fulfillment of certain eligibility criteria as mentioned under Regulation 292H of the ICDR Amendment Regulations. The features of the ZCZP bonds include the following –

- Permitted issuer – Only NPOs registered with SSE

- Mode of issuance – Privately offered to Social Impact Funds or public issuance

- Permitted investor – institutional and non-institutional investors (except retail investors) including Social Impact Funds registered with SEBI under AIF Regulations

- Coupon payment – Nil

- Principal repayment – No principal repayment at the end of the tenure

- Use of proceeds – Specific project falling within the activities specified in Reg 292E(2)(a)

- Tenure – Specified tenure equal to the tenure of the project

- Returns – No financial returns involved, investors expect returns in form of creation of “social impact”

- Risk involvement – Risk of non-creation of the “impact” for which funds were invested in the ZCZP bonds

- Termination – Upon achievement of specified object or expiration of specified tenure

Additionally, the following listing requirements are attracted in case of issuance of ZCZP bonds –

- Minimum issue size – Rs. 1 crore

- Minimum application size – Rs. 2 lacs

- Minimum subscription – 75% of the total issue size

- Form of issuance – Dematerialised form

ZCZP bonds are purely a form of “donation”. Unlike the conventional zero coupon bonds which are issued at discount/ redeemed at premium compensating for the “no-coupon” deal, ZCZPs will never pay back the principal, or pay the interest, either during or at the end of the tenure of the bonds. The structure seems to be “made in India” concept, since we could not come across any such direct equivalent in other countries.

While the concept of “social shares” was existent in the SSEs of Brazil and Portugal, it is not similar to the concept of ZCZP bonds. Social shares are shares purchased by the investors registered with the SSEs for the purpose of donations to the projects listed on such SSEs. However, these shares are neither transferable nor tradable on the secondary market. Terms like social “shares” and social “investment” have been used with the idea that money paid for the society is not an expense but an investment[7].

The ZCZP bonds are meant for investors who are looking to create a social impact without any expectation of financial returns or repayment of invested funds. However, these bonds are not risk-free, since there is no guarantee of the creation of the “social impact” it is expected to create, and unless the terms of the issue create any repercussions or “events of default” for the issuer, there is apparently no financial recourse to the issuer in case of failure to create the desired impact. Therefore, a question arises as to what shall be the obligation of the issuer upon the non-fulfilment of the objective for which funds were raised by way of issuance of ZCZP bonds.Hence, ZCZPs do not seem to be “impact investing”; rather, they seem to be “impact spending” (see Impact Investing vs Donation funding).

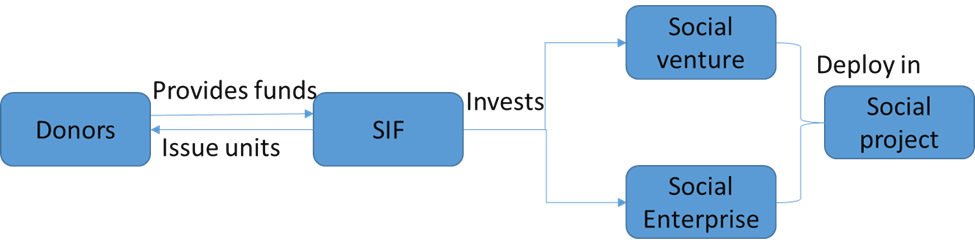

Social Impact Fund (“SIF”)

As discussed above, a registered AIF in the form of SIF is also available as a mode of raising funds by the SE by way of issuance of equity shares (in case of FPEs) to such SIF or issuance of ZCZP bonds (in case of NPOs) and requisite amendments have been brought vide the AIF Amendment Regulations in this regard. The reference of “social venture fund” has been replaced with “social impact fund”, with two main differences –

- Reference to “securities of social enterprises” has been included; and

- Reference to “restricted or muted returns” has been removed.

The security permitted to be issued by the SIF is “social units”, which has been defined under the Regulations to mean the units issued by SIF to investors who have agreed to receive only social returns or benefits and no financial returns against their contribution .

Further, amendments have been brought into the existing Regulations to the effect that –

- Minimum corpus requirement for SIF shall be Rs. 5 crores instead of Rs. 20 crores

- For SIFs investing only in securities of NPOs registered as SE, the minimum application size for an individual investor shall be Rs. 2 lacs, instead of Rs. 1 crore

- Minimum value of grant that may be accepted by such SIF has been reduced to Rs. 10 lacs from the existing Rs. 25 lacs.

- Atleast 75% of the total investable funds shall be invested in the unlisted securities or partnership interest of social ventures or listed securities (equity or debt securities of FPEs/ ZCZP bonds of NPOs) of SEs. However, in case of SIFs created exclusively for NPOs registered on SSEs, 100% of investable funds can be deployed in securities of NPOs registered with SSEs.

The model in which an SIF operates is as follows –

ZCZP bonds vs SIF – investor’s perspective

Primarily, both ZCZP bonds and contributions to SIF as investment in social units are forms of providing donations, with no financial returns. Therefore, let us see the main differences between the two modes of investment from the donor’s point of view.

| ZCZP bonds | Social units in SIF |

| Can be issued for a specific project only. | Can be an aggregator of various social projects. |

| Does not support diversification | Diversification of donation portfolio is possible |

| Investment decision is based on the market data available on the SSE. | Investment decision is based on the market data available on SSE as well as the research done by the professional AMC of SIF |

Trading on SSEs

The WG Report states that the SSEs envisioned in India will facilitate trading. However, there is no clear guidance on “how” the trading will be possible on these SSEs. Mohammed Yunus, founder of the Grameen Bank, discusses SSEs as “a trading platform that would connect investors with social businesses and operate in a similar fashion to traditional stock exchanges”.

For a section 8 company raising finance by way of issuance of traditional equity shares or debt instruments, the trading will be akin to that of the main segment of existing stock exchanges. However, for the ZCZP bonds, the SSE Framework states that the trading potential of these units shall be limited. The nature and extent of such “limitatio”n has not been clarified yet, and therefore, how these units will be traded cannot be predicted. In our view, the price movements of these bonds during their tenure will depend on the impact the underlying project is able to create. Donors who are willing to withdraw their investments can sell their existing holdings at the prevailing market prices. However, the SSE Framework does not provide any clarity on the same.

The stock exchanges, BSE and NSE, have released their FAQs on 22nd November, 2022. One of the FAQs (FAQ no. 9 under ZCZP instruments) dealing with the permissibility of trading of ZCZP bonds in the secondary market provides some guidance on the matter. It states that while the ZCZP bonds will not be tradeable in the secondary market, however, they can be transferred for other purposes, such as transfer to legal heirs (FAQ no. 13 thereof).

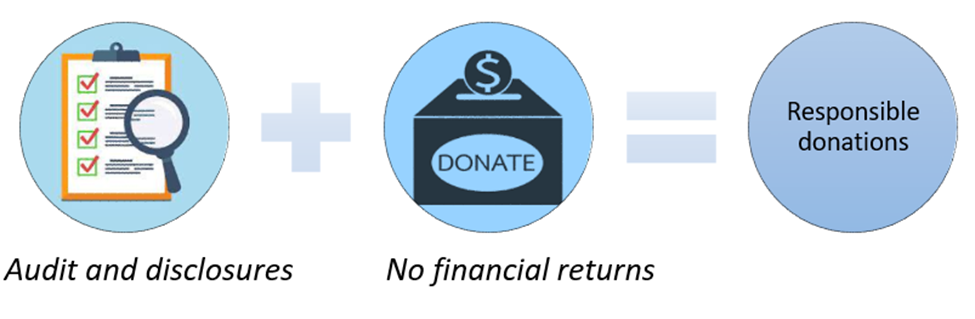

Responsible donations

As discussed above, both ZCZPs as well as SIFs are funded by investors with the motive of creating a “social impact”, having clear knowledge of the absence of “financial returns” associated with such investment. These are purely philanthropic expenditures made with the purpose of social good. In the absence of expectations of any financial returns, except for the social returns, the same cannot be termed as an “impact investment”, rather, a means of “donations” alongwith the presence of “responsibility”. The “responsible” component is ensured through the requirement of satisfaction of certain eligibility criteria for being registered as a SE, constant surveillance of SSEs by way of disclosures of material information, social impact reporting and mandatory audit of the same, hosting of information on the website of the SEs etc. The only way an investor may earn profits on the SSEs can be through transfer of the investments made in the ZCZP bonds/ SIF during the tenure of the project at a value higher than the initial value of investment.

Impact investing vs donation funding

As compared to the global framework wherein the SSEs are mostly operating as a platform for “impact investments”, SSEs in India have been based on the concept of “donation funding”. As we mention this, it is pertinent to note the difference between “impact investments” and “donation funding”. The basic underlying difference between the two is that while “impact investing” involves an expectation of financial returns, in case of “donation funding” it is clear from the very inception that no financial returns will accrue to the investor at any point of time, save as in case of transfer, as stated above.

The term social impact investment has been defined in the OECD’s Social Impact Investment: The Impact Imperative for Sustainable Development to mean –

“Social impact investment is the provision of finance to addressing social needs with the explicit expectation of a measurable social, as well as financial, return.”

On the contrary, a donation to charity does not yield any financial return to the donor.

There are various avenues through which impact investment can be done in India. The Impact Investors Council (IIC) in India is a national industry which supports the volume of “social investment” in India, through a chain of investors and members. There are various impact funds in India, that promise social/ environmental impact creation alongside financial returns. Data shows that a total of $2519 millions have been invested across key impact creation sectors between Dec, 2021 to Feb, 2022.

Corporate Governance norms applicable to SEs

While the ICDR Amendment Regulations facilitate listing of SEs on SSEs and raising of funds by NPOs, the LODR Amendment Regulations specify the corporate governance norms such listed SEs will be required to adhere to. The following additional requirements are attracted –

- Framing of policy on determination of materiality of information – All SEs are required to frame a policy for the determination of materiality of an information or event and will be required to authorize one or more of its KMPs for the purpose of such determination and making disclosures to the SSE.

Please note that KMPs have been defined under Reg 2(1)(o) of the LODR Regulations to mean a KMP as defined in section 2(51) of the Companies Act, 2013. However, in case of a SE being a registered trust or a registered society, there is no concept of KMPs and the Companies Act itself is not applicable. Therefore, an amendment will be required in the existing definition of KMP under the LODR Regulations to suitably incorporate the meaning of KMPs for SEs other than a company.

- Disclosure of material event or information – An SE is required to make disclosure of any such event that may have a material impact on the planned achievement of outputs or outcomes as soon as possible but not later than seven days from the occurrence of the event. The disclosure shall comprise of the details of the event including the potential impact of the event and the steps being taken by the SE to address the same. Further, the SE shall regularly update the SSE on the disclosures till the time the same remains material.

- Maintenance of website – Clause (8) of Regulation 91D specifies that the disclosures made to the SSE needs to be hosted on the website of the SEs. This indicates that the SEs will have to mandatorily maintain a website.

- Annual Impact Report (“AIR”) – The SEs shall be required to submit an AIR audited by a Social Auditor. The contents of the AIR shall be as specified by SEBI and additional disclosures may be sought by the SSEs.

The format of the AIR has not been notified yet, however, the SSE Framework proposed the disclosure of aspects such as strategic intent and planning, approach, impact score card etc. The TG Report (see table 4.2) proposes the detailed contents to be disclosed in the AIR along with detailed guidance on the same (see Annexure 9).

- Statement of utilization of funds – The Regulations require quarterly disclosure of the statement on the utilization of funds specifying the following details –

(a) category-wise amount of monies raised;

(b) category-wise amount of monies utilised;

(c) balance amount remaining unutilised.

Further, the unutilised amount shall be kept in a separate bank account and shall not be co-mingled with the other funds of the SE.

Apart from the requirements mentioned above, the NPOs registered as SEs shall be subjected to additional disclosure requirements on an annual basis within 60 days from the end of the financial year or such other period as may be specified by SEBI. The contents of disclosures as well as the time period is expected to be prescribed by way of a separate circular in this regard.

The SSE Framework has proposed annual disclosures by the registered NPOs on certain general, governance and financial aspects such as vision, mission, activities, scale of operations, board and management, related party transactions, remuneration policies, stakeholder redressal, balance sheet, income statement, program-wise fund utilization for the year, auditors report etc. NPOs shall be required to comply with Ind AS. The TG Report (see table 4.1 read with Annexure 7) proposes the detailed contents to be disclosed by the registered NPOs on an annual basis along with detailed guidance on the same (see Annexure 8). The TG Report further states that in case of a section 8 company, the disclosures as required to be made in terms of section 134 and other applicable provisions of the Act shall apply.

Benefits of SSE

From the perspective of SE

The registration and/ or listing of securities in the SSEs can benefit the SEs in multiple ways –

- Ease of fundraising – SSEs may be said to be acting as a “crowdfunding” platform with the additional component of “responsibility” and “reliance”. Therefore, it may help the SEs to raise funds easily for their activities.

- Access to larger pool of investors – It will also help the NPOs/ FPEs registered as SEs to create the “impact” they are willing to, in less time and with more certainty of funds, since the SSE being a trading exchange, the withdrawal of donations from one donor can be funded by another donor trading on the platform.

- Visibility of operations – For registered SEs, especially for an FPE, the benefit behind registration on the SSE provides enhanced visibility to their operations.

From the perspective of investor/ donor

The following benefits may be achieved by the investors making investments/ donations for creation of “social impact” through SSEs –

- Tax benefits – The same being in the nature of philanthropic donations, tax exemptions may be available to the donors on the basis of the activities funded. Further, as clarified in the FAQs released by the stock exchanges, Securities Transaction Tax (STT) will not be levied on the ZCZP bonds issued on the SSE since the same is non-tradable. Various tax benefits have been proposed in the WG Report, however, the same will require amendments to the existing tax laws.

- Liquidity of funds – The SSE was supposed to liquidity to the donor in the sense that if a donor, after donating for a specific cause, wants to withdraw funds on account of need of funds or uncertainty of the project performance etc, the same can sell the donations made and free up the funds donated. However, the FAQs by stock exchanges clarifying that the bonds not be available for trading in the secondary market, will kill the possibility of liquidity of donations.

- Transparency – Donees are not usually accountable to donors for the use of funds provided to them. However, for funds provided to SEs registered with the SSEs, certain disclosure and audit requirements attract which provides the donee with transparency in the use of donations given to the donee.

- Fulfilment of CSR commitments -The TG/ WG Report also proposed that the funding of SEs by corporates may also be counted towards the CSR commitments of companies, however, the same will require amendments to the existing laws. In our view, the same will also require additional safeguards since there might be a possibility of withdrawal of funds by the contributing company after counting the same as a CSR contribution towards its mandatory CSR obligation. Our detailed write-up on the use of SSEs as a platform for channelising CSR funds can be read at New CSR avenues, innovative bonds and much more in the Social Stock Exchange package!

Concluding remarks

Various countries around the world have seen the introduction and extinction of the concept of SSEs within a very short period of time. While the model of SSE in India is quite different from the ones that evolved in countries around the world, however, whether this concept would be successful in India or not will require powers of prophecy. SEBI has permitted, and may be stock exchanges will quickly implement the SSEs, but the question is – will there be takers? There is no doubt that a huge amount of money flows into social enterprises in India in the form of pure donations, and donors will find it much better to donate to regulated SEs complying with corporate governance norms than not. However, will there be enough incentive for the SEs to get adapted to the rigorous corporate governance norms? This is the question which will hold the clue to the success of SSEs in India.

Various proposals approved in the SSE Framework will require amendments to the tax and company laws. The same will result in incentives for the corporates and other donors, in addition to the satisfaction of the motive of creating “social impact”. Investment in SEs will also be required to be recognised as a permitted mode of “foreign contribution” under the Foreign Contribution Regulation Act and allied rules, since a large part of the donations in India are received from foreign sources. Here again, it is pertinent to note that, at present, the SEs are not allowed to raise foreign funding, and foreign investors, whether FII/ FPI/ NRI investors, are not eligible to invest in the SEs (refer FAQ no. 2 under the head “Investors”).

While the ICDR, LODR and AIF Amendment Regulations have been notified, a lot of clarity is still awaited which is expected to be brought in by the SEBI/ stock exchanges via specific circulars on the same. Further, the most primary gap that is evident in the current framework is that there are no enforceability mechanisms and consequences of default for the SEs participating through the SSEs on the failure to create the social impact or returns on their part. While the Framework initially appeared to be a promising and innovative structure, however, with the recent FAQs of the stock exchanges clarifying that the same does not facilitate trading in the secondary market, as well as prohibits any prospective foreign investment, it seemingly steals the glare for the prospective investors to investment in the SEs, and limits the sources to inculcate funds in the SEs listed on the SSE.

[1] “It is time to take our capital markets closer to the masses and meet various social welfare objectives related to inclusive growth and financial inclusion. I propose to initiate steps towards creating an electronic fund raising platform – a social stock exchange – under the regulatory ambit of Securities and Exchange Board of India (SEBI) for listing social enterprises and voluntary organizations working for the realization of a social welfare objective so that they can raise capital as equity, debt or as units like a mutual fund.” – FM Ms. Nirmala Sitharaman

[2] ICSI Student Company Secretary, September, 2021

[3] Framework Study of Seven Global Exchanges and India’s proposed Social Stock Exchange

[4] The continuance of listing of a company on the SSX was based upon the evaluation of the Annual Impact Report

[5] Social business is required to have a primary social purpose along with financially sustainable business model

[6] Jamaica Impact Investment Market is proposed to be launched in the second phase of JSSE providing financial returns alongside social impact creation

[7] BOVESPA and the Social Stock Exchange: Mobilizing the Financial Market for Development

Leave a Reply

Want to join the discussion?Feel free to contribute!