Financing transition from “brown” to “green”

/0 Comments/in Bond Market, Capital Markets, Corporate Laws, NCS, NCS, SEBI, Sustainability, Sustainability /by StaffSEBI prescribes additional requirements for transition bonds

– Mahak Agarwal, Executive | corplaw@vinodkothari.com

Need for transition finance

As climate change and its impacts continue to remain one of the major concerns of any economy, transition finance is a step towards effectively transforming carbon emissions and combating climate change.

‘Transition Bonds’, as the word speaks for itself, are debt instruments that facilitate transition of a carbon-intensive business into decarbonizing business and eventually achieving the Net Zero emissions targets.

While it is true that change is the only constant, it cannot be denied that the same can often be challenging. Similar is the case with enterprises looking to metamorphosize their activities into a sustainable form. A huge amount of finance is required for carbon-intensive sectors to decarbonize and it is here that transition bonds find their application.

Read more →SEBI revises framework for green debt securities

/0 Comments/in Bond Market, Capital Markets, Corporate Laws, NCS, NCS, SEBI, Sustainability, Sustainability /by Payal Agarwal– Alignment with international standards and avoidance of greenwashing

– Payal Agarwal and Shreya Salampuria | corplaw@vinodkothari.com

Sustainability labeled bonds, more popularly known as GSS+ bonds, are looked upon as one of the primary means of raising funds towards sustainable development. The same has been discussed in Sustainable finance and GSS+ bonds: State of the Market and Developments. India is also not oblivious to the concept of GSS+ bonds, and companies in India have also been issuing such bonds, in one or more forms.

The issuance of green debt securities (“GDS”) in India was initially formalized through a circular issued by SEBI in 2017 in this regard, later absorbed under the SEBI (Issue and Listing of Non-Convertible Securities) Regulations, 2021 (“ILNCS Regulations”) read with Chapter IX of the Operational Circular on the same. The regulatory framework for GDS in India has since been reviewed, and following a Consultation Paper on Green and Blue Bonds as a mode of Sustainable Finance (“Consultation Paper”) dated 4th August, 2022, SEBI, in its meeting dated 20th December, 2022 (“Board Meeting”) has approved amendments to the existing regulatory framework for GDS issuance. The press release of the Board Meeting reads as “in the backdrop of increasing interest in sustainable finance in India as well as around the globe, and with a view to align the extant framework for green debt securities with the updated Green Bond Principles (GBP) recognised by IOSCO, SEBI undertook a review of the regulatory framework for green debt securities.”

Pursuant to the review of the regulatory framework for GDS, the following has been notified –

- Expanding the scope of GDS through amending its definition vide notification of SEBI (ILNCS) Amendment Regulations, 2023 (“Amendment Regulations”)

- Guidance on avoidance of green-washing through introduction of Chapter IX-A to the existing Operational Circular, and

- Enhancement of disclosure requirements and mandating third-party reviewers through amendments to existing Chapter IX of the Operational Circular.

In this write-up, we intend to discuss the revised regulatory framework for GDS issuance in India.

Read more →Debenture Issuance -Recent developments & applicable compliances

/0 Comments/in Corporate Law Updates, Corporate Laws, LODR, NCS, NCS, SEBI /by Vinita Nair Dedhia– Vinita Nair, Senior Partner | vinta@vinodkothari.com

Loading…

Loading…

2022 Wrapped Up: Regulatory review of corporate law developments

/0 Comments/in Amendments to the Companies Act 2013, Bond Market, Capital Markets, Companies Act 2013, Corporate Laws, LLP, LODR, NCS, NCS, PIT, SEBI /by Payal Agarwal– Payal Agarwal, Assistant Manager (payal@vinodkothari.com)

2022 has been a relatively stable year when it comes to Companies Act, save changes in the forms and filing procedures with increasing online processes, there has been significant traction on the part of SEBI. While Structured Digital Database (SDD) remained the buzzword for the listed entities with the stock exchanges requiring them to submit quarterly compliance certificates, the stress for proper controls on insider trading remained the focal point. For social enterprises, a landmark development was the introduction of the concept of Social Stock Exchanges, which seems to be shortly getting into operational mode.

We have tried to briefly cover the major developments in corporate laws during the year 2022. You may also refer to our brief discussion of the same in this youtube video. For updates relevant to the financial sector including the overseas investment norms, refer 2022 in retrospect: Regulatory activity in the financial sector. You may also refer to our quick round-up of regulatory developments in IBC in the year 2022.

Read more →Debt listed entities under new requirement of quarterly financial results

/0 Comments/in Corporate Laws, LODR, NCS, NCS, SEBI /by Staff-Implications and actionables

Last updated on 5th October, 2021

Anushka Vohra | Deputy Manager

The SEBI (Listing Obligations and Disclosure Requirements) (Fifth Amendment) Regulations, 2021[1] have increased the compliance burden on the debt listed entities. Ranging from introducing the corporate governance requirements on High Value Debt Listed Entities (HVDLEs)[2] to increasing the disclosure and compliance requirements on all debt listed entities, the amendment per se aims to make the current regulatory requirements stringent on the debt listed entities.

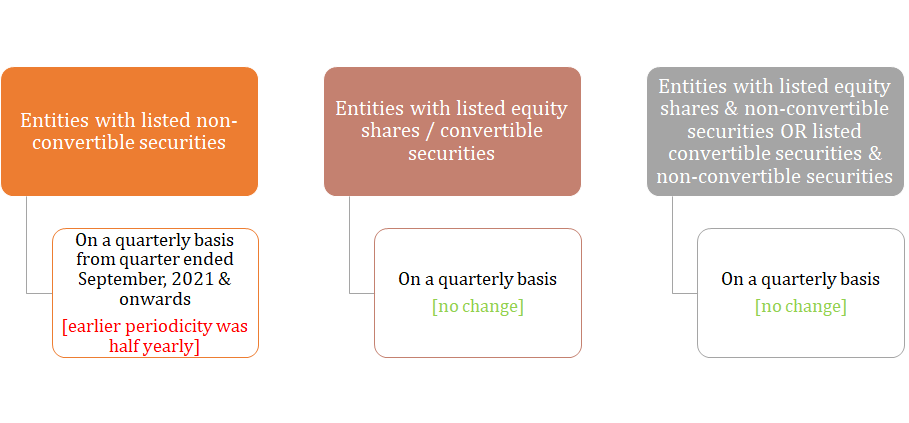

One significant amendment under Chapter V, which is applicable on all debt listed entities, is the requirement of submission of financial results on a quarterly basis instead of a half yearly basis, as was previously the requirement. With this write-up, we will try to understand the implications on the debt listed entities due to change in the periodicity of submission of financial results and the required actionables.

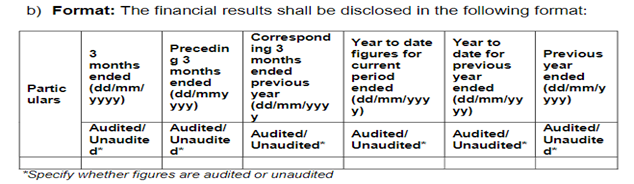

As per the amendment, the debt listed entities will be required to prepare the quarterly and annual financial results, as per the format specified by the Board. The Board has on October 05, 2021, specified the format[3] to be followed by the entities whose non-convertible securities are listed. Our snapshot on the same can be accessed here. It is pertinent to note that while the line items remain the same, the periodicity seems to be exactly similar to the erstwhile format which was applicable on entities that have listed their equity shares / specified securities.

A snapshot of the format is as under:

Since the time the amendment has been introduced, it was quite anticipated that the format would be similar to what was initially applicable to entities that have listed their equity shares / specified securities. The secretarial team of companies were struggling with the same, however the SEBI circular has put to rest the concerns and has, by way of a note clarified that, in case the debt listed entities do not have corresponding quarterly financial results for the four quarters ended September, 2020, December, 2020, March, 2021 and June, 2021, the column on corresponding figures for such quarters will not be applicable.

Entities with listed non-convertible securities

Consideration of financial results

Non-convertible securities include debentures which are not convertible into equity at any given time and constitute a debt obligation on the part of the issuer. Chapter V of the SEBI(Listing Obligations and Disclosure Requirements) Regulations, 2015 (Listing Regulations) is applicable to entities that have listed their non-convertible securities on the stock exchange(s). Regulation 52 of the Listing Regulations deals with the preparation and submission of financial results

The extant Regulation provided that such listed entity shall submit financial results on a half yearly basis, within 45 days from the end of half year i.e; within 45 days from the end of September & March [for entities following FY April-March]. For the first half year the requirement was mandatory but SEBI provided a relaxation for second half year, whereby it was stated that such listed entity may not be required to submit unaudited financial results for the second half year, if it intimates in advance to the stock exchange(s), that it shall submit its annual audited financial results within 60 days from the end of financial year. Akin to such relaxation, SEBI provided that if such a listed entity submits the unaudited financial results within 45 days from the end of the second half year, the annual financial results may be submitted as and when approved by the board of directors.

Extant framework

| Unaudited accompanied with limited review report | Audited financial results + statements + Auditor’s Report (AR) | |

| For the first half year (have to be mandatorily given) | For the second half year (whether submitted / not) | |

| Yes | No | Within 60 days from end of financial year |

| Yes | Yes | As soon as approved by the board |

Now, since the periodicity has changed from half yearly to quarterly, such listed entities will be required to submit financial results within 45 days from the end of each quarter, other than the last quarter and the annual financial results within 60 days from the end of the financial year.

New framework

| Unaudited accompanied with limited review report | Audited financial results + statements + AR | |||

| For the first quarter* | For the second quarter* | For the third quarter* | For the fourth quarter** | |

| Yes | Yes | Yes | No | Within 60 days from end of financial year |

*mandatorily required

**not required

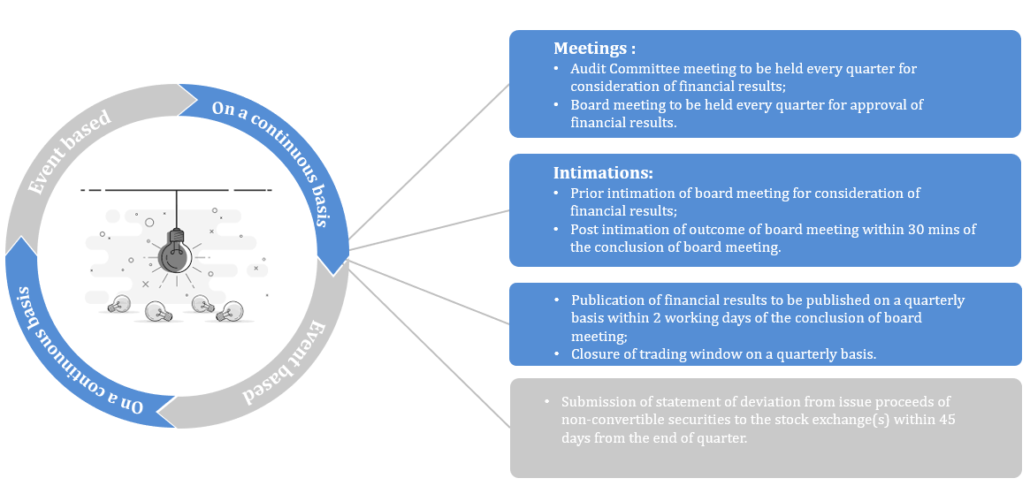

Landscape of intimations & disclosures – understanding the actionables

It is an irrefutable fact that debt in India is mostly privately placed which primarily involves the Qualified Institutional Buyers (QIBs) and no prejudice is caused to the public at large. Keeping that in mind, the debt listed entities were treated differently from the equity listed entities and were not subject to the such stricter compliances when compared to debt listed entities.

In view of SEBI’s approach during recent times, , it has put an end to the easy going voyage of a debt listed entity and they have been placed at par with the equity listed entities.

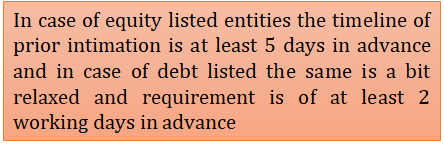

Regulation 50 dealing with intimation to stock exchange(s) has been amended and now require the debt listed entities to intimate to the stock exchange(s) at least 2 working days in advance, excluding the date of board meeting and date of intimation, of the board meeting where the financial results shall be considered (quarterly / annually). This Regulation 50 corresponds to Regulation 29 which is applicable to equity listed entities.

Further, in case of equity listed entities, Regulation 30 (read with Schedule III Part A) is a cumbersome Regulation as the same requires certain events to be disclosed as and when they occur. For debt listed entities, the corresponding Regulation is Regulation 51 (read with Schedule III Part B). Unlike Regulation 30, the list under Regulation 51 (i.e; under schedule III) was narrow in its scope, however, with the said amendment, the list under the Part B of Schedule III, applicable on debt listed entities has also been amended to streamline the same with what is applicable on equity listed entities.

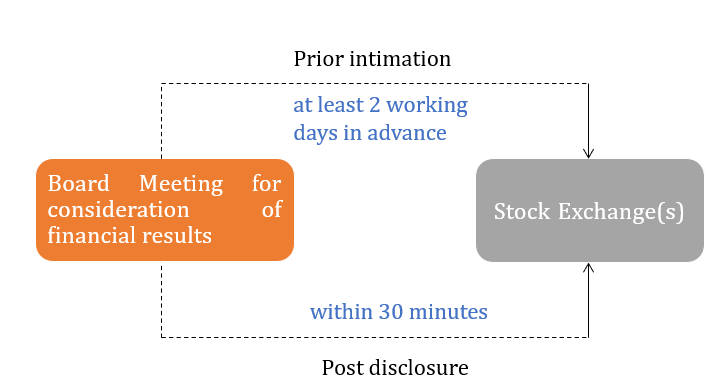

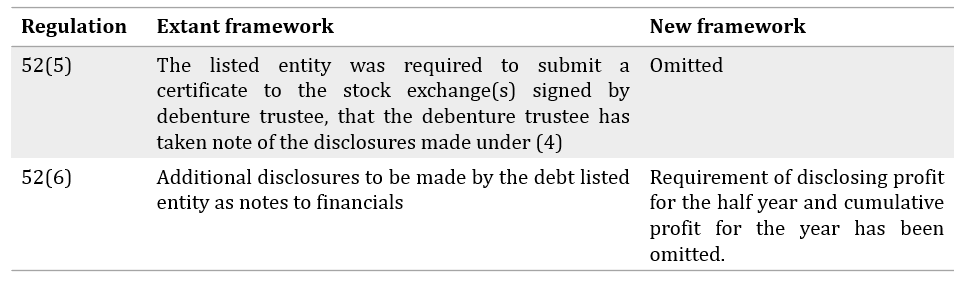

Furthermore, while submitting the financial results (quarterly / annually) under Regulation 52, the debt listed entities have to provide certain information. Such information is captured under Regulation 52(4) and includes the following:

Exemption : Non Banking Financial Companies (NBFCs) which are registered with the RBI were exempted from making disclosure of interest service coverage ratio, debt service coverage ratio and asset cover. However, exemption from disclosure of asset cover has been withdrawn i.e; now the NBFCs that have listed their debt securities have to make disclosure of asset cover. Also, the exemption from disclosing interest service coverage ratio and debt service coverage ratio is now also extended to Housing Finance Companies (HFCs) registered with the RBI.

This new framework is now in sync with what is applicable to equity listed entities. The Regulator’s intent to subsume the compliances applicable on equity and debt listed entities seems to have been inspired by the need for more transparency and promptness of information. However, this sudden drift calls for certain actionables on the part of debt listed entities.

A summary of actionables can be represented as under:

Other aspects :

Entities with listed equity shares / convertible securities

The entities that have listed their equity shares / convertible securities i.e; specified securities are covered under Chapter IV of the Listing Regulations, subject to exemptions under Regulation15. These entities have to comply with Regulation 33 for preparation and submission of financial results and the timeline for the same is quarterly. There has been no change for such listed entities as far as the financial results are concerned.

However, since the amendment has made Chapter IV applicable on HVDLEs which are debt listed entities covered under Chapter V, these HVDLEs have to comply with both Regulation 33 and Regulation 52. But since the requirements in both these regulations have been streamlined, no impact will be caused on such HVDLEs.

Entities with listed equity shares & non-convertible securities OR listed convertible securities & non-convertible securities

Such entities are governed by both Chapter IV and Chapter V, thus w.r.t. financial results they have to comply with both Regulation 33 and Regulation 52. Prior to such amendment, such listed entities followed the quarterly preparation and submission of financial results, since the same is stricter. For all other provisions which are common among both chapters but vary in timelines, the one with the stricter provision needs to be followed. For instance, in case of prior intimation of board meetings where financial results shall be considered, Chapter IV provides advance intimation of 5 days, whereas Chapter V provides advance intimation of 2 working days. Clearly, the timeline of 5 days in advance is stricter, therefore such entities shall comply with the same.

Concluding remarks

The sense of ease on the debt listed entities has been undone and the Regulator is preparing to bring the equity and debt listed entities under the same blanket. The extension of Chapter IV on HVDLEs seems to be a wake up call for debt listed entities which are not HVDLEs as of now. The enhanced disclosure on all debt listed entities would nevertheless burden them, however the impact of the same is yet to be analysed.

Our snippet on the same can be accessed at – https://vinodkothari.com/2021/10/quarterly-financial-results-for-debt-listed-companies/

Our other resources on related topics –

- https://vinodkothari.com/2021/09/high-value-debt-listed-entities-under-full-scale-corporate-governance-requirements/

- https://vinodkothari.com/2021/09/corporate-governance-enforced-on-debt-listed-entities/

- https://vinodkothari.com/2021/09/full-scale-corporate-governance-extended-to-debt-listed-companies/

- https://vinodkothari.com/2021/09/presentation-on-lodr-fifth-amendment-regulations-2021/

[1] https://www.sebi.gov.in/legal/regulations/sep-2021/securities-and-exchange-board-of-india-listing-obligations-and-disclosure-requirements-fifth-amendment-regulations-2021_52488.html

[2] A listed entity which has listed its non-convertible debt securities and has an outstanding value of listed non-convertible debt securities of Rs. 500 crore & above as on March 31, 2021.

[3] https://www.sebi.gov.in/legal/circulars/oct-2021/revised-formats-for-filing-financial-information-for-issuers-of-non-convertible-securities_53136.html

Checklist for issuance of listed debt securities on private placement basis

/1 Comment/in NCS, NCS, SEBI /by Staff- Payal Agarwal, Executive ( payal@vinodkothari.com)

Non-convertible debentures issued on private placement basis are one of the most practiced ways of raising finance by the companies in India. Considering the notification of SEBI (Issue and Listing of Non-Convertible Securities) Regulations, 2021, effective from 16th August, 2021, the companies may be under a perplexity of how to comply with the requirements of the newly notified regulations. We have summarised the procedure into a checklist below for reference.

| Checklist for issuance of listed and unsecured NCDs on Private Placement Basis | |||

| Serial No. | Particulars | Relevant provisions | Remarks |

| Eligibility conditions: A. Eligibility requirements under the Companies Act, 2013: 1. Offer can be made to a maximum of 200 persons 2. No advertisement can be made in the newspapers 3. The Company shall not make a fresh offer or invitation unless the allotment with respect to any offer or invitation made earlier have been completed, or withdrawn or abandoned by the Company. B. Eligibility requirements under SEBI (Issue and Listing of Non-Convertible Securities) Regulations, 2021 No issuer shall make an issue of non-convertible securities if as on the date of filing of draft offer document or offer document: (a) the issuer, any of its promoters, promoter group or directors are debarred from accessing the securities market or dealing in securities by the Board; (b) any of the promoters or directors of the issuer is a promoter or director of another company which is debarred from accessing the securities market or dealing in securities by the Board; (c) any of its promoters or directors is a fugitive economic offender; or (d) any fine or penalties levied by the Board /Stock Exchanges is pending to be paid by the issuer at the time of filing the offer document: |

|||

| 1 | Convening of a Board Meeting: i. To consider and approve issue of debentures including the terms and conditions of issue for the entire FY ; ii. To authorise the Board Borrowing Committee/ other relevant committee [Optional] for the following: a. Appointment of RTA and execute tripartite agreement [Reg 9] b. Appointment of Credit Rating Agency and obtain Credit Rating. [Reg 10] c. Opening of Separate Bank Account with Schedule Bank [Proviso to Section 42(6)]. d. To identify group of persons to whom Debentures are proposed to be issued [Section 42(2)] e. To approve Private Placement offer letter f.Appointment of Depository [Reg 7] g. For allotment of NCDs h. other matters relevant to the issue of NCDs i.To appoint a debenture trustee before the issue of letter of offer for subscription of the debentures [Reg 8] j. To obtain in-principle approval from stock exchanges [Reg 6] |

Section 179(3) of CA Section 42, 71 & SS-1 |

|

| 2 | Approval of shareholders | Sec. 71, 42, Rule 14(1) of Companies (PAS) Rules,2014, Rule 18 of SHA Rules | not required if blanket approval already taken and issue is within the limit as per second proviso to Rule 2 of Companies (Prospectus and Allotment of Securities) Rules, 2016 |

| 3 | Filing of MGT-14 | Rule 14(1) of Companies (PAS) Rules, 2014 | Within 30 days of passing of the Board Resolution/ Shareholders resolution |

| 4 | a. Preparation and finalisation of Disclosure Document; b. Preparation and finalisation of DTD, DTA/ Debenture Subscription Agreement. |

||

| 5 | Obtain consent from Trustee | Before issue of offer document | |

| 6 | To convene Board Borrowing Committee/ other relevant committee meeting for the following: a. Approval of draft offer document/ Disclosure Document/ Information Memorandum, Debenture Trust Deed, Debenture Trustee Agreement,Application Form b. Identification of RTA c. Approval of List of proposed Allotees d. Approval for opening of Escrow Account (if already opened then noting of the same) e. All other matter as delgated by the Board as mentioned in Point 1 above. |

Section 42(3) of CA with Rule 14 (3) of Companies (Prospectus and allotment of Securities) Rules, 2014 | In terms of Rule 18(1)(c) & (5) of the Companies (Share Capital and Debentures) Rules, 2014 [Section 71(5)], the debenture trustee shall be appointed and DTD shal be executed at any time within 60 days of allotment of debentures. Accordingly, this may be done after the allotment of NCDs also. |

| 7 | Creation of debenture redemption reserve | Section 71(4) read with Rule 18 (7)(b)(iv)(B) | The value of debenture redemption reserve shall be 10% of the value of outstanding debentures.

DRR shall not be required in case of NBFCs [Rule 18 (7) (iv)(A) of Deposit Rules |

| 8 | Creation of recovery expense fund | Reg 11 read with SEBI Circular https://www.sebi.gov.in/web/?file=https://www.sebi.gov.in/sebi_data/attachdocs/oct-2020/1603361431987.pdf#page=1&zoom=page-width,-16,792 | deposit an amount equal to 0.01% of the issue size with designated stock exchange upto a maximum of Rs. 25 lakhs. |

| 9 | Obtain credit rating | Reg 10 | |

| 10 | Agreement with depository for dematerialisation | Reg 7 | |

| 11 | Private placement offer-cum-application shall be sent to the identified investors | Sec. 42 of CA 13 | |

| 12 | Maintain a complete record of persons to whom the Private Placement offer letter is sent in form PAS-5. | Rule 14(4) of PAS Rules | |

| 13 | Receipt of application money | Section 42 of CA | |

| 14 | Filing of Master Creation form with NSDL/CDSL -for demat issuance | ||

| 15 | Filing of listing application with stock exchanges and debenture trustees – (a) Placement Memorandum; (b) Memorandum of Association and Articles of Association; (c) Copy of the requisite board/ committee resolutions authorizing the borrowing and list of authorised signatories for the allotment of securities; (d) Copy of last three years Annual Reports; (e) Statement containing particulars of, dates of, and parties to all material contracts and agreements; (f) An undertaking from the issuer stating that the necessary documents for creation of the charge, wherever applicable, including the Trust Deed has been executed within the time frame prescribed in the relevant regulations/Act/rules etc. and the same would be uploaded on the website of the designated stock exchange, where such securities have been proposed to be listed; (g) In case of debt securities, an undertaking that permission / consent from the prior creditor for a second or pari passu charge being created, wherever applicable, in favour of the debenture trustee to the proposed issue has been obtained; and (h) Any other particulars or documents that the recognized stock exchange may call for as it deems fit: |

Reg 44 | |

| 16 | Allotment of NCDs after holding a meeting of Borrowing Committee/ other relevant committee | Section 42 of CA | |

| 17 | Filing of PAS-3 with ROC | Section 42(8) read with Rule 14(6) of Companies Prospectus and allotment of securities) Rules, 2014 | |

| 18 | Payment of fees to stock exchanges | Reg 13(2) | at the time of listing |

This is a general checklist for companies desiring to list its debt securities. For NBFCs and HFCs, the requirements may differ depending upon their specifically applicable regulations.

Further, you may read our article on the NCS Regulations here.

A comparison of the NCS Regulations from erstwhile ILDS Regulations can be accessed here.

A presentation on the various structures of debt securities can be viewed here – https://vinodkothari.com/2021/09/structuring-of-debt-instruments/

NCS Regulations versus ILDS Regulations

/1 Comment/in Corporate Laws, NCS, SEBI /by StaffComparitive between consolidate framework and erstwhile provisions relating to private placement.

Henil Shah | Assistant Manager and Parth Ved | Executive corplaw@vinodkothari.com

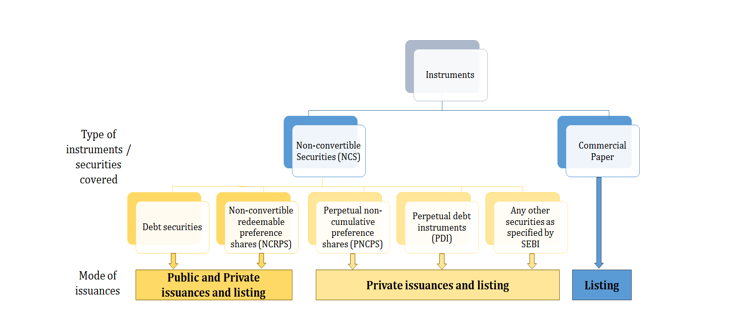

SEBI vide its notification dated August 09, 2021 introduced SEBI (Issue and Listing of Non-Convertible Securities) Regulations, 2021 (‘NCS Regulations’), NCS Regulations have merged the provisions of SEBI (Issue and Listing of Debt Securities) Regulations, 2008 (‘ILDS Regulations’), and SEBI (Issue and Listing of Non-Convertible Redeemable Preference Shares) Regulations, 2013 (‘NCRPS Regulations’). The notified regulations in ambits covers framework pertaining to issue of non-convertible debentures (‘NCDs’), non-convertible preference shares (‘NCPS’), perpetual debt securities (‘PDIs’), and listed commercial paper.

The NCS regulations shall be effective from 7th day from the date of their publication in the official gazette i.e. 16th August, 2021.

In this article, we present a comparison between the erstwhile ILDS regulations and NCS Regulations from the point of view of a private placement of NCDs.

NCS Regulations v/s ILDS Regulations

| Sr.No | NCS Regulations | ILDS Regulations | Our Remarks |

| 1 | Reg. 5: Eligible Issuer

(1) No issuer shall make an issue of non-convertible securities if as on the date of filing of draft offer document or offer document: a. the issuer, any of its promoters, promoter group or directors are debarred from accessing the securities market or dealing in securities by the Board; b. any of the promoters or directors of the issuer is a promoter or director of another company which is debarred from accessing the securities market or dealing in securities by the Board c. the issuer or any of its promoters or directors is a wilful defaulter; d. any of the promoters or whole-time directors of the issuer is a promoter or whole-time director of another company which is a wilful defaulter e. any of its promoters or directors is a fugitive economic offender; or f. any fine or penalties levied by the Board /Stock Exchanges is pending to be paid by the issuer at the time of filing the offer document: g. Provide that the: (i) restrictions mentioned at (b) and (d) above shall not be applicable in case of a person who was appointed as a director only by virtue of nomination by a debenture trustee in other company. (ii) restrictions mentioned in (a) and (b) above shall not be applicable if the period of debarment is over as on date of filing of the draft offer document with the Board. (iii) restrictions mentioned at (c) and (d) shall not be applicable in case of private placement of non-convertible securities (2) No issuer shall make a public issue of non-convertible securities if as on the date of filing of draft offer document or offer document, the issuer is in default of payment of interest or repayment of principal amount in respect of non-convertible securities, if any, for a period of more than six months.

|

ILDS Regulations didn’t laid out any specific eligibility criteria for the issue to list its NCDs issued on private placement basis.

Under the NCS Regulations, the condition that the issuer shall not be debarred from accessing the securities market or dealing in securities has been extended to promoter group entity as well. Further, certain additional conditions such as the promoter or WTD shall not be a promoter or WTD of a company which is a wilful defaulter, no promoters or directors shall be fugitive economic offenders or no fines or penalties are pending at the time of filing of offer document have been inserted. Associating payment of fines and penalties with listing might not be a feasible idea; as there might be situations where the issuer may have raised disputes/concerns on liability to pay such fines/penalties. |

|

| 2 | Reg. 6: In-principal approval

The issuer shall make an application to one or more stock exchange(s) and obtain an in-principle approval for listing of its non-convertible securities from the stock exchange(s) where such securities are proposed to be listed: Provided that where the application is made to more than one stock exchange, the issuer shall choose one among them as the designated stock exchange.

|

Reg. 19(3): Mandatory listing

Where the issuer has disclosed the intention to seek listing of debt securities issued on private placement basis, the issuer shall forward the listing application along with the disclosures specified in Schedule I to the recognized stock exchange within fifteen days from the date of allotment of such debt securities. |

Under ILDS Regulations there was no specific requirement to obtain in-principal approval form stock exchange for listing, an application along with disclosure specified in the regulations did the trick.

However, moving forward the issuers will be required to obtain a prior in-principal approval for listing. Actionable: Going forward issuers will be required to obtain in-principal approval. |

| 3 | Reg. 8: Debenture Trustee

The issuer shall appoint a debenture trustee in case of an issue of debt securities. |

– | There was no clarity under ILDS w.r.t appointment of debenture trustee for private placement of debt securities. Notification of NCS regulations brings clarity on appointment of debenture trustee. |

| 4 | Reg. 12: Electronic Issuances

An issuer proposing to issue non-convertible securities through the on-line system of the stock exchange(s) and depositories shall comply with the relevant applicable requirements as may be specified by the Board. |

– | Applicability of issuance through EBP platform in case of private placement comes from SEBI circular dated. Considering the benefits of EBP platform SEBI in its Consultation Paper, proposed to reduce the limit from 200 Crores to 100 Crores. Accordingly, changes are being carried out under para of Operational Circular for issue and listing of Non-Convertible (NCS) Securitised Debt Instruments (SDI) Security Receipts (SR), Municipal Debt Securities and Commercial Paper (CP) dated August 10, 2021 (‘Operational Circular’) |

| 5 | Reg. 15: Rights to recall or redeem prior to maturity

Framework for right to recall and right to redemption prior to maturity.

|

ILDS Regulations, provided framework for right to recall (i.e. Call Option) and right of redemption (i.e. Put Option) prior to maturity, in case of public issue of NCDs. In case of private placement of NCDs, the same was entirely guided by the terms of issue.

However, the NCS regulations have now stipulated that provisions relating to call and put option shall equally apply in case of public issuances as well as private placement. This seems to take away the flexibility that issuers enjoyed in certain cases for issuers of privately placed debentures for example, where an interest rate in case of delay on part of the issuer could be avoided or kept at a minimal rate, the same will be charged at 15% interest rate. Aside, also note that put option is a feature only applicable in case of NCDs and not NCPs. |

|

| 6 | Reg. 18(1): Trust Deed

The issuer and the debenture trustee shall execute the trust deed within such timelines as may be specified by the Board.

|

– | Timeline and format for execution of debenture trust deed was not expressly mentioned for private placement in the ILDS.

The NCS Regulations have aligned with requirement for SEBI circular dated November 03, 2021. It may be noted that reg.59(3) of NCS Regulations save all the circulars, etc. issued under previous regulations as if the same were issued under NCS Regulations. |

| 7 | Reg. 23(3): Obligations of the Issuer

The issuer shall apply for Securities and Exchange Board of India Complaints Redress System (SCORES) authentication in the format specified by the Board and shall use the same for all issuance of non-convertible securities. |

– | The requirement was not specifically mentioned in the ILDS Regulations, however the requirement of registering on SCORES also comes from SEBI (Listing Obligation and Disclosure Requirement), 2015. |

| 8 | Reg. 43(2): Creation of Security

The charge created in respect of the secured debt securities shall be disclosed in the offer document along with an undertaking that the assets on which charge or security has been created to meet the hundred percent security cover is free from any encumbrances and in case the assets are encumbered, the permissions or consent to create first, second or pari passu charge on the assets has been obtained from the existing creditors to whom the assets are charged, prior to creation of the charge: Provided that sub regulation (2) shall not apply if the charge is created on additional assets other than the assets comprising of hundred percent security cover.

|

Reg. 21B: Creation of Security

The issuer shall give an undertaking in the Information Memorandum that the assets on which charge is created are free from any encumbrances and in cases where the assets are already charged to secure a debt, the permission or consent to create a second or pari-passu charge on the assets of the issuer has been obtained from the earlier creditor. |

The regulations provide that in case of additional security cover (that is, beyond 100%), sub-reg (2) shall not apply. it may imply that the issuer need not give an undertaking with respect to the additional security cover being free of encumbrances or the issuer having obtained prior consents.

However, it must be noted that where additional security cover so provided is a subject asset under any other financing agreements entered into with any other person or lenders, the agreement may provide for obtaining prior consent of such lender In that case, it might be impractical (and also, not in accordance with law) to say that the issuer can proceed to create encumbrance without obtaining consent of the lender therefore, irrespective of whether any undertaking is given in the offer document, the issuer would need to comply with any contractual covenants wrt to such “additional” security cover

|

| 9 | Reg. 44(1): Listing Application

The issuer shall forward the listing application along with the disclosures as per this regulation to the stock exchange(s) within such days as may be specified by the Board from the date of closure of the issue: |

Reg. 19(3): Mandatory Listing

Where the issuer has disclosed the intention to seek listing of debt securities issued on private placement basis, the issuer shall forward the listing application along with the disclosures specified in Schedule I to the recognized stock exchange within fifteen days from the date of allotment of such debt securities. |

The provision in the NCS regulation is aligned with timelines for listing notified via SEBI circular dated October 05, 2020 now subsumed into Operational Circular. |

| 10 | Reg. 44(3) & (4): Due diligence

(3) Debenture trustee shall submit a due diligence certificate to the stock exchange in the format as specified in Schedule IV of these regulations. (4) The stock exchange(s) shall list the debt securities only upon receipt of the due diligence certificate from the debenture trustee as per format specified by the Board. Regulation 44 provides for:

|

– |

|

| 11 | Reg. 47(2): Filing of shelf placement memorandum

The shelf placement memorandum shall indicate a period not exceeding one year as the period of validity of such memorandum which shall commence from the date of opening of the first offer of debt securities under that memorandum, and in respect of a second or subsequent offer of such debt securities issued during the period of validity of that memorandum, no further placement memorandum is required. |

Reg. 21A(2): Filing of Shelf Disclosure Document

An issuer filing a Shelf Disclosure Document under sub-regulation (1), shall not be required to file disclosure document, while making subsequent private placement of debt securities for a period of 180 days from the date of filing of the shelf disclosure document. |

The time validity of shelf prospectus in case of private placement of debt securities has been increased from 180 days to 1 year.

This is a welcome move, as this will eliminate hassles for frequent issuers to file shelf prospectus multiple times.

|

Disclosure Requirements:

The NCS Regulations provides for a separate sets of disclosure requirements in case of both public issue and private placement. Template for disclosure required to be made in case of private placement of NCS are provided in the schedule of the NCS regulations. Following is a comparison of disclosure required to be made in terms of NCS Regulations vs ILDS Regulations and NCRPs Regulations. In general the NCS widens the purview of information to be disclosed for the purpose of enhancing disclosure being made further streamlining aligning the same.

| Sr. No | NCS Regulation (Schedule II) | ILDS Regulations (Schedule I) | NCRPS Regulations

(Schedule I) |

| 1 | 1. Instructions

Following general instructions for preparation of draft offer document are specified:

|

There were no such specific instructions. | There were no such specific instructions. |

Para 2.2: The front page shall contain:

|

There was no specific requirement to state the following information on front page.

Para 3.A.a: However, following disclosures were to be made where relevant: Name and address of the following:

|

Para II.A: A prominent disclosure in bold writing on the cover page of offer document stating the following:

“Instruments offered through the offer document are non-convertible redeemable preference shares and not debentures/bonds. They are riskier than debentures / bonds and may not carry any guaranteed coupon and can be redeemed only out of the distributable profits of the company or out of the proceeds of a fresh issue of shares made, if any, by the company for the purposes of the redemption”

Para II.B.i: However, following disclosures were to be made where relevant: Name and address of the following:

|

|

| 2 | Para 2.3.1: Insertion of clause relating to Issuer’s Absolute Responsibility as per the text provided in Schedule II. | There was no such clause specified in the regulations but issuer generally put a disclaimer clause. | There was no such clause specified in the regulations but issuer generally put a disclaimer clause. |

| 3 | Para 2.3.2: Details of Promoters of the Issuer:

A complete profile of all the promoters, including their name, date of birth, age, personal addresses, educational qualifications, experience in the business or employment, positions/posts held in the past, directorships held, other ventures of each promoter, special achievements, their business and financial activities, photograph, PAN. A declaration confirming that the PAN, Aadhaar Number, Driving License Number, Bank Account Number(s) and Passport Number of the promoters and PAN of directors have been submitted to the stock exchanges on which the non-convertible securities are proposed to be listed, at the time of filing the draft offer document. |

Para 3.A.h: Earlier, only promoter holding as on the latest quarter end was required to be disclosed.

Declaration confirming submission of information pertaining to personal details of promoters/ directors of promoters to SEs is a new requirement. |

Para II.B.viii: Earlier, only promoter holding as on the latest quarter end was required to be disclosed.

Declaration confirming submission of information pertaining to personal details of promoters/ directors of promoters to SEs is a new requirement. |

| 4 | Para 2.3.4: Name(s) and in-principle approval of the stock exchange(s) where the NCS are proposed to be listed and in case of more than one stock exchange, specify the designated stock exchange.

The issuer shall specify the stock exchange where the recovery expense fund is being/has been created as specified by SEBI. |

Para 3.A.p: Names of all the recognised stock exchanges where the debt securities are proposed to be listed clearly indicating the designated stock exchange. | Para II.B.xii: Names of all the recognized stock exchanges where NCRPS are proposed to be listed clearly indicating the designated stock exchange |

| 5 | Para 2.3.6: Name, logo, address, website, email, telephone number and contact person of debenture trustee, CRA, RTA, Statutory Auditor, legal counsel, Guarantor, arranger, if any. | Para 3.A.a: Earlier, details w.r.t. Legal counsel and Guarantor was not included in the regulation.

Further, the requirement of putting a logo, though not expressly mentioned, was anyways followed. |

Para II.B.i: Earlier, details w.r.t. Legal counsel and Guarantor was not included in the regulation.

Further, the requirement of putting a logo, though not expressly mentioned, was anyways followed. |

| 6 | Para 2.3.8 Financial Information

A columnar representation of the audited financial statements on a standalone and consolidated basis for a period of 3 completed years. Combined financial statements need to be disclosed for the periods when such historical financial statements are not available if the issuer being a listed REIT/listed InvIT has been in existence for a period less than three completed years. Issuers (other than unlisted REITs / InvITs) who are in existence for less than 3 years may disclose financial statements subject to the following conditions: i. The issue is made on the EBP platform irrespective of the issue size; and ii. The issue is open for subscription only to QIB. Listed issuers may disclose unaudited financial information for the stub period instead of audited financial statements in the format as prescribed in LODR Regulations with limited review report, subject to necessary disclosures in the placement memorandum. |

– | – |

| 7 | Para 2.3.10.c: Equity share capital history for the last three years:

|

Para 3.A.c.iii: Equity share capital history for the last five years:

|

Para II.B.iii.3:Equity share capital history for the last five years:

|

| 8 | Para 2.3.10.f: Details of the shareholding of the Company as at the latest quarter end, as per the format specified under LODR regulations. | Para 3.A.d.i:Details of the shareholding of the Company as on the latest quarter end was to be provided as per format specified in the Schedule. | Para II.B.iv.1: Details of the shareholding of the Company as on the latest quarter end was to be provided as per format specified in the Schedule. |

| 9 | Para 2.3.10.g: % comparison of top 10 holders of NCS with total NCS outstanding to be disclosed along with name, total no. of equity shares and no. of shares in demat form.. | Para 3.A.g.iv: Only the name of the top 10 debenture holders and their holding amount was required to be disclosed. | Para II.B.iv.2: Only the name of the top 10 debenture holders and their holding amount was required to be disclosed. |

| 10 | Requirement of providing the amount of corporate guarantee issued by the Issuer along with name of the counterparty (like name of the subsidiary, JV entity, group company, etc) on behalf of whom it has been issued has been omitted. | Para 3.A.g.v: The amount of corporate guarantee issued by the Issuer along with name of the counterparty (like name of the subsidiary, JV entity, group company, etc) on behalf of whom it has been issued was required to be specified. | Para II.B.vii.4: The amount of corporate guarantee issued by the Issuer along with name of the counterparty (like name of the subsidiary, JV entity, group company, etc) on behalf of whom it has been issued was required to be specified. |

| 11 | Para 2.3.13.e: ISIN of outstanding Commercial Paper needs to be disclosed along with maturity date and amount. | Para 3.A.g.vi: Only outstanding amount and maturity dates of Commercial Paper were required to be disclosed. | Para II.B.vii.5: Only outstanding amount and maturity dates of Commercial Paper were required to be disclosed. |

| 12 | Para 2.3.15: Where the issuer is a NBFC or HFC additional disclosures on Asset Liability Management (ALM) shall be provided for the latest audited financials:

|

– | – |

| 13 | Para 2.3.25: Risk factors

Risk factors shall be disclosed in the descending order of materiality. It should include but not limited to:

|

Disclosure of risk factors is required to be provided in terms of summary sheet however, no specific pointers were pointed out. | Reg.23(5): The banks were required to disclose relevant risk factors in case of issue of Perpetual Non-Cumulative Preference Shares and Perpetual Debt Instruments. |

You may also refer to our following articles on related subjects

- Consolidation of SEBI regulations on non-convertible securities

https://vinodkothari.com/2021/08/consolidation-sebi-non-convertible-securities/

- Presentation on Corporate Bonds and Debentures

https://vinodkothari.com/2021/03/presentation-corporate-bonds-debentures/

- SEBI’s stringent norms for secured debentures

https://vinodkothari.com/2020/11/sebis-stringent-norms-for-secured-debentures/

- Market-Linked Debentures – Real or Illusory?

https://vinodkothari.com/2021/01/market-linked-debentures-real-or-illusory/

- FAQs on Commercial Paper

https://vinodkothari.com/2019/11/faqs-on-commercial-paper/

Our our Book on Law and Practice Relating to Corporate Bonds and Debentures, authored by Ms. Vinita Nair Dedhia, Senior Partner and Mr. Abhirup Ghosh, Partner can be ordered though the below link:

Consolidation of SEBI regulations on non-convertible securities

/1 Comment/in Corporate Laws, NCS, SEBI /by StaffSEBI measure may ease out issuance of debt securities

- Team Corplaw (corplaw@vinodkothari.com)

Introduction –

By a 9th August, 2021 Notification, SEBI has consolidated the regulatory framework pertaining to issue of non-convertible debentures (‘NCDs’), non-convertible preference shares (‘NCPS’), perpetual debt securities (‘PDIs’), and listed commercial paper. Along with the consolidation exercise, SEBI has also tried to iron out some of the difficulties being faced in respect of debt issuance by companies. Accordingly, the new SEBI (Issue and Listing of Non-Convertible Securities) Regulations, 2021 (‘NCS Regulations’), notified on 9th August, 2021, have the effect of merging (and consequently, repealing) the SEBI (Issue & Listing of Debt Securities) Regulations, 2008 (‘ILDS Regulations’) and SEBI (Issue & Listing of Non-Convertible Redeemable Preference Shares) Regulations, 2013 (‘NCRPS Regulations’)

The NCS regulations have been introduced in line with the Draft Consultation Paper[1] (‘Consultation Paper’) issued by SEBI on the subject on 19th May, 2021.

In this article, we discuss and highlight the important changes incorporated in the NCS Regulations as compared to the ILDS Regulations and NCRPS Regulations.

Effective date and prospective applicability

The regulations shall be effective on the 7th day from the date of their publication in the Official Gazette i.e. 16th August, 2021.

As to whether NCS Regulations are applicable on issuances done before the effective date, it is evident from a reading of regulation 4(2) that NCS Regulations are to be satisfied by the issuer as on the date of filing draft offer document/offer document with SEBI, stock exchanges and RoC. This indicates that securities which are already floating in the market pursuant to issuances done before 16th August, 2021, NCS Regulations should not make a difference. Hence, the new regulations shall be applicable only to new issuances or new listing applications made on or after August 16, 2021.

The view is further substantiated by the fact that –

- There is no grandfathering clause in the NCS Regulations, and

- The provisions pertaining to ‘repeal and savings’ provide for continuation of “right, privilege, obligation or liability acquired, accrued or incurred under the repealed regulations” as if the repealed regulations have never been repealed – see discussion later.

Rationale behind the fused regulations–

Debentures, specifically non-convertible debentures, are purely debt instruments. However, NCRPS are hybrid instruments combining characteristics of both debt and equity thereby being ‘quasi-debt instruments’. Due to this reason, the NCRPS regulations were mostly modelled based on the ILDS regulations providing similar provisions on eligibility conditions, disclosure requirements, etc. Therefore, merging the two regulations would only be reasonable. The move to merge both these regulations may not be a complete solution to the regulatory chaos, but is definitely in the direction to combat multiplicity of laws. Further, the NCS Regulations also aim to –

- Harmonise provisions of the Companies Act, Rules made thereunder and SEBI Regulations

- Align various circulars, guidelines issued by SEBI

- Identify policy changes in line with the present market practices for ease of doing business

- Merge all the existing circulars into a single operational circular

Repeal of existing regulations –

The NCS regulations shall repeal the existing ILDS Regulations and NCRPS Regulations from the effective date. Reference to any provision under these regulations shall be deemed to make reference to corresponding provisions in the NCS regulations.

Applicability of the NCS Regulations-

The following have been covered by the NCS Regulations:

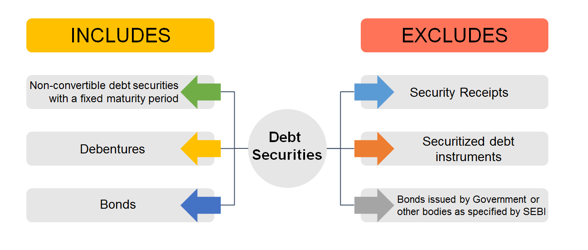

Definition of Debt securities –

Listing of Commercial Paper

Another important point to note is that the NCS Regulations only deal with listing of CP and issuance thereof shall not be covered. The NCS Regulations have adopted the earlier SEBI Circular on Listing of CPs with respect to provisions on the said subject. The caveats relating to eligibility, mode of issuance, etc. shall still be governed by the provisions of RBI read with FIMMDA operational guidelines.

Only additional caveats arising from the NCS regulation for the issuer is that they shall be required to register on SCORES Platform. In case the entity has its NCDs or NCRPs listed they are already required to register on SCORES Platform in terms of SEBI (Listing Obligation and Disclosure Requirements) Regulations, 201 (‘LODR Regulations’).

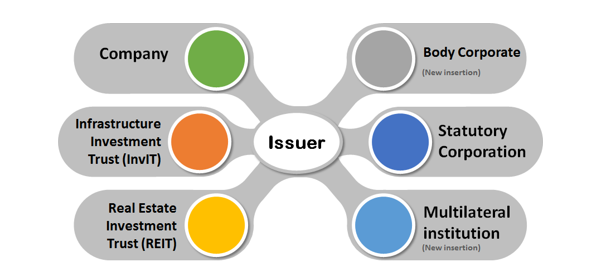

Issuers covered under the NCS regulations

Point at which conditions are to be satisfied

There are several conditions in the NCS Regulations which the issuer needs to fulfil as on the date of filing draft offer documents/offer documents – see, regulation 4(2). For instance, as on the date of filing of draft offer document or offer document, neither the issuer its promoters, promoter group or directors should be debarred from accessing the securities market or dealing in securities by SEBI, none of the promoters or whole-time directors of the issuer shall be promoter or whole-time director of another company which is a wilful defaulter. Therefore, if this condition is, say, breached after the securities are listed, the issuer shall not be seen as in breach of the regulations.

While most of the requirements have been retained from the erstwhile regulations, the NCS regulations also additionally prohibit any issuer from making an issue if as on the date of filing of the draft offer letter, if any of its promoters or whole-time directors are a promoter or whole-time director of another company which is a wilful defaulter.

Whether LLPs can issue debentures?

Key highlight of the definition of “issuer” under the NCS Regulations is inclusion of the term “body corporate”. The erstwhile definition of “issuer” under the ILDS Regulations did not include body corporates. Several rulings have established that an LLP is, in fact, a body corporate. Accordingly, this exclusion raised a question on the permissibility of listed debt issuances by an LLP. It was always, therefore, deemed that LLPs could only issue unlisted debt securities while listed debt securities by LLPs was not permitted by the ILDS Regulations. The said inclusion of “body corporate” in the definition of “issuer” will, therefore, enable LLPs to issue listed debt securities as well as NCRPS, thereby making way for further raising of funds.

However, the same shall be subject to any conditions in the LLP Act, 2008. The Company Law Committee Report[2] for decriminalization of LLP Act also discussed on raising of funds through issuance of secured non-convertible debentures to bodies corporate or trusts regulated by SEBI or RBI with certain fetters and suggested inclusion of new section in the LLP Act, 2008 for the same.

Highlights

1) Appointment of Debenture Trustee for all issues of debt security

The ILDS Regulations provided for appointment of a Debenture Trustee (’DT’) for public issuance of debt securities. While there was no explicit requirement for the appointment of debenture trustee for private placement of debt securities in the ILDS Regulations, in terms of Companies Act, 2013 (‘CA, 2013’) and SEBI Circular dated November 03, 2020, security was required to be created in the favour of a DT. Accordingly, there was no clarity as to the appointment of debenture trustee in case of issuance of unsecured NCDs through private placement. The NCS regulations now provide for mandatory appointment of DTs in case of all issuances of debt securities (Regulation 8 of the NCS Regulations).

Our Comments –

The same is a welcome change as it provides the required clarity on appointment of DTs. Considering the increasing relevance and importance of DTs in case of debt issuances, appointment of DTs in case of all debt securities becomes all the more important.

2) Widened applicability of EBP platform

The EBP platform is presently applicable to private placements of debentures amounting to Rs. 200 crores and above in a financial year. SEBI, in its Consultation Paper, proposed to reduce such limit to Rs.100 crores or above and making EBP mandatory for issues breaching the said limit. The same was proposed considering the benefits of the EBP platform and need for further increased participation from issuers and investors.

The said change did not reflect either in the draft or the final regulations. The revision in the limits may be made in the EBP Circular by SEBI.

Our Comments –

The concept of the EBP was introduced by SEBI with a view to make participation in the privately-placed bond market more inclusive. Electronic bidding platforms are there in several other markets – however, in most cases, these are private bidding engines, and are optional.

The private placement market in India is completely bespoke in nature, and issuances are almost completely OTC negotiations. In order to remove the veil of opacity, and allow a larger base of investors to participate, the EBP mechanism was introduced.

However, various market participants are averse to the EBP platform. Lengthy procedures delay the process for issuers which may not be suitable for a sensitive debt market. Different EBP platforms have different procedures thereby causing confusion. Most issuers still continue to negotiate on OTC basis and place the offer on EBP or make use of regulatory arbitrage methods such as market-linked debentures (‘MLDs’).

Therefore, increasing the scope of applicability of EBP may not be conducive to the Indian bond market. SEBI may consider making the EBP optional rather than mandatory. Where the issuer desires a wider audience for its proposed issue, the issuer may put the offer on the bidding platform. However, where an OTC deal is done, the issuer should be allowed to go ahead with the private placement straightaway. A potential investor wanting to invest therein will still have the chance to participate in the secondary market.

3) Private Placement Requirements

The NCS Regulations [regulation 44(2)] clarify the ambiguity regarding issuance of debt securities on private placement basis by a company in existence for less than three years. The requirement to provide annual reports for previous three years while making an application for listing presumed the requirement for a company to be in existence for at least three years to list its privately placed debentures. However, the proviso to regulation 44(2) resolves the above by specifying that ‘provided that issuers desirous of issuing debt securities on private placement basis who are in existence for less than three years may provide Annual Reports pertaining to the years of existence.

4) Exercise of Call or Put Option (Right to recall or redeem prior to maturity date)

The erstwhile provisions for issuance of non-convertible debt securities, provided framework for right to recall (i.e. Call Option) and right of redemption (i.e. Put Option) prior to maturity, in case of public issue of NCDs. In case of private placement of NCDs, the same was entirely guided by the terms of issue.

However, the NCS regulations have now stipulated that provisions relating to call and put option shall equally apply in case of public issuances as well as private placement.

This seems to take away the flexibility that issuers enjoyed in certain cases for issuers of privately placed debentures for example, where an interest rate in case of delay on part of the issuer could be avoided or kept at a minimal rate, the same will be charged at 15% interest rate.

It may be noted here that there is an apparent change in the language – while regulation 15 of NCS Regulations uses “shall”, regulation 17A of ILDS Regulations used “may”. However, this change in language does not change the law – it is still a ‘right’ in the hands of the issuer to “recall” the securities using a “call option” or “provide a right” to investors to “redeem” the securities using a “put option”. As it is a matter of right to the issuer, the right can still be exercised (or not exercised) by suitably providing for the same in the terms of issue.

Also, regulation 15 itself specifies that the issuer shall have a right to provide such right of redemption of debt securities prior to the maturity date (put option) to all the investors or only to retail investors.

The NCS Regulations do not state the time period for payment of interest, which was specified as 15 days from the day from which such right could be exercised under the erstwhile provisions.

Our Comments –

Since the Call and Put Option are exercised in accordance with the terms of issue and detailed disclosure made in this regard in the offer document, the issuers of privately placed debt securities issued prior to the NCS Regulations can provide these options after the expiry of one year from date of issue and only if it was disclosed in the offer document.

Further, it must be noted that the ‘call option’ feature would be relevant for debt securities as well as NCPS; however, ‘put’ option feature will only be relevant for debt securities. This is because a ‘put option’ enables the investor to exercise a ‘right’ to sell the securities to the issuer. Redemption of preference shares can either be done out of profits of the company or out of fresh issue of shares, as per Section 55 (2) (a) of Companies Act. In case the put option is exercised, the company will be under obligation to redeem and this may result in violation of section 55 in case the issuer is not able to redeem in the prescribed manner. Hence, while clause (a) of regulation 15(1) applies to all non-convertible securities (debt + NCPS), clause (b) applies only to debt securities.

5) Exemption from restriction of use of proceeds

Issuers of non-convertible securities are prohibited from using proceeds from issuances of such securities for providing loans to or acquisition of shares of entities under their promoter group or group companies. The erstwhile laws failed to distinguish between a financial entity and non-financial entity as regards to the nature of business. Therefore, the said restriction was applicable in case of all listed entities alike.

The NCS regulations provide the much needed relaxation from the said clenching restriction in case of a Non-Banking Finance Company (‘NBFC’), Housing Finance Company (‘HFC’) and a Public Financial Institution.

Our Comments –

The intent behind the restriction was to discourage using public money for funding group entities. However, providing loans or acquiring securities aren’t peculiar transactions in case of NBFCs and HFCs since they are ordinarily in such business.

6) Validity of shelf prospectus:

In case of Public Issue of debt securities:

The ILDS Regulations provide that not more than four issuances can be made under a single shelf prospectus while there is no such restriction under the Companies Act. To enable issuers to raise funds quickly without filing a separate prospectus each time, this restriction has been removed from NCS Regulations.

In case of private placement of debt securities:

The time validity of shelf prospectus in case of private placement of debt securities has been increased from 180 days to 1 year.

Our Comments –

This is a welcome move, as this will eliminate hassles for frequent issuers to file shelf prospectus multiple times.

7) Criteria of eligible issuer

Under the NCS Regulations, the condition that the issuer shall not be debarred from accessing the securities market or dealing in securities has been extended to promoter group entity as well. Further, certain additional conditions such as the promoter or WTD shall not be a promoter or WTD of a company which is a wilful defaulter, no promoters or directors shall be fugitive economic offenders or no fines or penalties are pending at the time of filing of offer document have been inserted.

Our Comments –

Associating payment of fines and penalties with listing might not be a feasible idea; as there might be situations where the issuer may have raised disputes/concerns on liability to pay such fines/penalties.

8) Additional Disclosures for NBFCs

In case the issuer is an NBFC/HFC additional disclosures on asset liability management are required to be provided pertaining to the latest audited financials. The same was not required under the ILDS Regulations. The disclosures also include details of contingent liabilities specifying the nature and amount of such liabilities.

9) Companies existing for less than 3 years – Annual report submission provision

As per the NCS Regulations in case an issuer who has been in existence for less than 3 years is desirous of issuing debt securities, annual reports pertaining to years of existence have been permitted to be provided.

10) Creation of Recovery Expense Fund – Whether applicable in case of NCPS?

Under the NCPs regulations requirement of maintenance is included under the general conditions applicable in case of public issuance of debt securities and NCPs and private placement of NCS. However, due regard must be given to SEBI circular dated October 22, 2020[3] which provides the manner and mode for creation and maintenance of recovery expense fund, specifically restricts the requirement only in case of issue of debt securities. Moreover, it may be noted that preference shares can be redeemed only out of profits and out of proceeds of new issuances (as provided for under section 55) and are thus, inherently different from debt securities. Hence, this requirement of recovery expense fund should not apply in case of NCPS.

11) Minimum subscription in case of public issue of Debt Securities

The ILDS Regulations gave the option to the issuer to identify the minimum subscription, however the NCS Regulations has straight away set a bar of 75% of the base issue size. This might take away the flexibility from the issuers.

The requirement of minimum subscription is however not applicable in the case of issuance of tax free bonds as specified by the Central Board of Direct Taxes.

12) Creation of Security

As per the ILDS Regulations, in case of secured debentures, the assets offered as collateral are required to be unencumbered provided that if the same are already charged to secure a debt, relevant permission to create a pari passu or a second charge will be taken from the existing chargeholders. This requirement was applicable to the total security cover in case of a debt issuance i.e. even in case of over-collaterisation.

However, the NCS regulations have eased out the said stipulation providing that the same shall apply on assets to the extent of 100% security cover. Thus, assets over and above the 100% security cover may be encumbered and the same may be provided as security without obtaining relevant permissions from the existing chargeholders.

For instance, if an issue of debentures is secured to the extent of 125% of the issue size – earlier the assets securing the entire 125% charge were required to be unencumbered, now only assets constituting 100% charge of the issue will be required to be unencumbered.

13) Due Diligence

The requirement of undertaking due diligence in case of public issue of NCDs was already there in the ILDS Regulations Additionally, SEBI vide its circular dated November 03, 2020, also required DTs to undertake due diligence w.r.t creation of security, irrespective of the debentures being issued publicly or on a private placement basis. The NCS Regulations now provide for due diligence in case of private placement as well, before filing of the offer document.

Overall, it seems that the Regulations are on a positive note. The discussion above is a quick compilation of the important points which come out of the NCS Regulations. We shall be continuously updating the list above on the basis of further observations.

You may also refer to our following articles on related subjects-

- Presentation on Corporate Bonds and Debentures

https://vinodkothari.com/2021/03/presentation-corporate-bonds-debentures/

- SEBI’s stringent norms for secured debentures

https://vinodkothari.com/2020/11/sebis-stringent-norms-for-secured-debentures/

- Market-Linked Debentures – Real or Illusory?

https://vinodkothari.com/2021/01/market-linked-debentures-real-or-illusory/

- FAQs on Commercial Paper

https://vinodkothari.com/2019/11/faqs-on-commercial-paper/

Our our Book on Law and Practice Relating to Corporate Bonds and Debentures, authored by Ms. Vinita Nair Dedhia, Senior Partner and Mr. Abhirup Ghosh, Partner can be ordered though the below link:

Our presentation on the structuring of debt securities can be viewed here – https://vinodkothari.com/2021/09/structuring-of-debt-instruments/

[1] https://www.sebi.gov.in/reports-and-statistics/reports/may-2021/consultation-paper-review-and-merger-of-sebi-issue-and-listing-of-debt-securities-regulations-2008-and-sebi-issue-and-listing-of-non-convertible-redeemable-preference-shares-regulations-2013-i-_50192.html

[2] https://www.mca.gov.in/Ministry/pdf/Report%20of%20the%20Company%20Law%20Committee%20on%20Decriminalization%20of%20The%20Limited%20Liability%20Partnership%20Act,%202008.pdf

[3] https://www.sebi.gov.in/legal/circulars/oct-2020/contribution-by-issuers-of-listed-or-proposed-to-be-listed-debt-securities-towards-creation-of-recovery-expense-fund-_47939.html