Bond market needs a friend, not parent

Policies seem to be working at cross-purposes

Vinita Nair, Senior Partner | corplaw@vinodkothari.com

The need to promote bond markets is almost cliched, and does not require elaboration. However, when one observes the regulatory and fiscal developments concerning bond markets in recent times, one wonders whether there is a clear and unified sense of direction. The role of policymaker may be supporting, reformative, protective, promotional, etc. Sometimes, protective regulation may also be intended to play a promotional role – for example, if investors’ interest is better protected, it may promote investor confidence and hence, appetite. However, it is hard to see a clear theme in the spate of changes concerning bond markets in the recent past.

Fiscal measures:

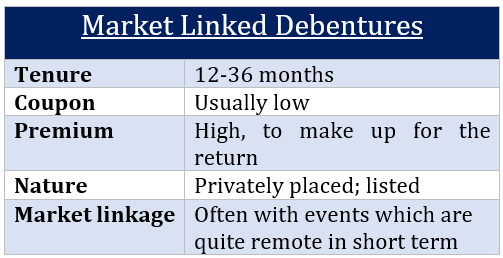

As regards fiscal measures, there are several changes in the Budget 2023 that may be directly or indirectly affecting the bond markets. The Budget saw market-linked debentures[1], a bit controversial development, as a case of fiscal arbitrage, and killed the same, resulting in the death of the instrument. The exemption from withholding tax exemption in case of listed bonds was taken away – which will be difficult to understand as the theoretical justification for withholding tax is the possibility of tax leakage in case of destination-based tax. The case for the leakage is difficult to make, as listed bonds are issued in demat format, and hence, all transactions take place through regular banking channels. If the intent of policymakers was to promote retail investment in bonds, this is certainly antithetical to that objective.

Another fiscal change, which may have a long-term negative impact, is the denial of long-term capital gain treatment to investment in debt mutual funds[2]. Debt mutual funds were also responsible for the demand-side of corporate bonds. Mutual fund’s share in the outstanding corporate bonds as at the end of FY 2022 stood at 15.85%[3]

Read more →