SEBI fixes the cut-off date for re-lodgement of physical transfers

– Time given till last day of FY 2020-2021

-updated as on 3rd December, 2020

Pammy Jaiswal | Partner | Vinod Kothari and Company

Background

Physical transfers of specified securities were prohibited w.e.f. 1st April, 2019 by virtue of amendment made in Reg. 40 vide SEBI LODR (Fourth Amendment) Regulations, 2018[1]. Listed entities were not allowed to process the transfer request for equity shares where shareholders held the same in physical form with effect from 1st April, 2019.

In order to address the issue of transfer requests filed prior to April 1, 2019 but rejected due to deficiency in documents etc, SEBI issued a press release on 27th March, 2019[2] permitting the shareholders, who had already lodged their transfer request before 1st April, 2019 and where the request was returned/ rejected due to deficiency in paperwork, to re-lodge their transfer request with the listed companies.

However, there was no specific deadline provided for re-lodgement of such requests. SEBI vide its Circular[3] dated 7th September, 2020 has provided a cut-off date of 31st March, 2021 for re-lodging the transfer request rejected/ returned earlier.

Is the Circular applicable to all shareholders?

This Circular is only applicable in such cases where the transfer request for physical shares had been lodged prior to 1st April, 2019 and were rejected/ returned on grounds of deficiency in documents.

While the language of the Circular states – “Further, the shares that are re-lodged for transfer (including those request that are pending with the listed company / RTA, as on date), this cannot be interpreted to mean the inclusion of fresh transfer request post 1st April, 2019 since the same was prohibited by law itself.

Transfer to be effected in demat mode

Another important clarification that the Circular provides is that on effecting the transfer of such physical shares the transferee will be issued shares in demat mode only. This means that the transferee will have to have a demat account in order to give effect to the transfer, failing which the transfer will not be processed by the listed company.

Standard procedure for transfer of physical securities

For the purpose of processing the transfer request pursuant to the re-lodgement by the shareholders, the RTAs will be guided by the SEBI circular[4] dated 6th November, 2018 to follow the procedure provided therein. The said circular provides for the standard procedures including the document requirement for processing the transfer request of physical securities.

Operational guidelines for transfer and dematerialization of re-lodged physical shares

After processing the transfer of physical shares in accordance with the procedure mentioned above, SEBI on 2nd December, 2020 has issued the operational guidelines to credit the transferred shares in the demat account of the investor.

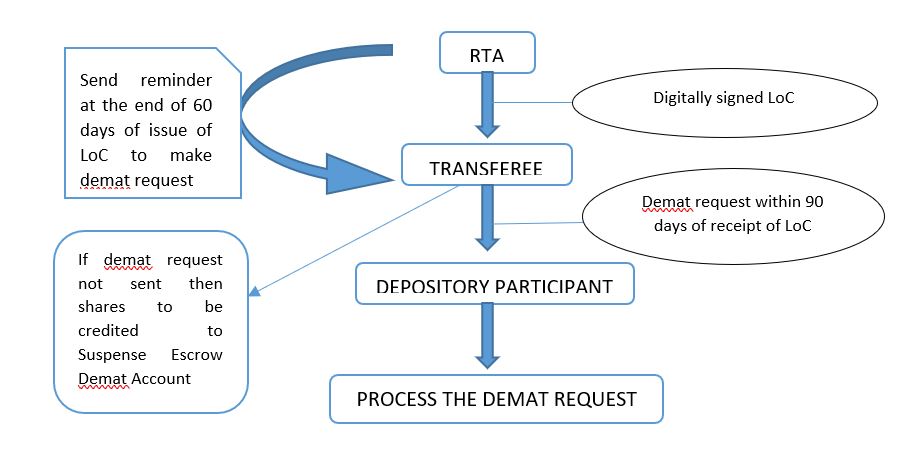

The guidelines involve issuing a Letter of Confirmation (LoC) in a prescribed format by the RTA on processing with the transfer request either physically or by an email to the investor (transferee). On receipt of LoC, the investor has been given a time of 90 days to send the demat request to the Depository Participant failing which, the shares are credited to Suspense Escrow Demat Account of the Company.

Further, the fact that the shares are subject to lock-in for a period of 6 months from the date of registration of transfer in terms of the SEBI circular dated 6th November, 2018, will have to be intimated by the RTA to the Depository while approving the demat request.

Enhanced due diligence for dematerialization of physical shares

For augmenting the integrity of the system in processing of dematerialization request in respect of physical shares, SEBI issued a circular on 5th November, 2019[5]. This requires the listed companies to share the static database (name of shareholders, folio numbers, certificate numbers, distinctive numbers and PAN etc.) of those shareholders who are holding physical shares.

The intent is to cross check the systems for validating dematerialization request of such shareholders.

Conclusion

By setting the deadline to re-lodge the transfer request, SEBI has put an end to allow the pending transfer request to be alive for an indefinite time period. In cases where the shareholder fails to re-lodge the transfer request on or before 31st March, 2021, such transfers will be deemed cancelled and will not be allowed to be transferred unless shares are dematerialised.

[1]https://www.sebi.gov.in/web/?file=https://www.sebi.gov.in/sebi_data/attachdocs/jun-2018/1528952919510.pdf#page=1&zoom=page-width,-16,792

[2] https://www.sebi.gov.in/media/press-releases/mar-2019/transfer-of-securities-held-in-physical-mode-clarification_42503.html

[3]https://www.sebi.gov.in/web/?file=https://www.sebi.gov.in/sebi_data/attachdocs/sep-2020/1599474275403.pdf#page=1&zoom=page-width,-15,842

[4] https://www.sebi.gov.in/web/?file=https://www.sebi.gov.in/sebi_data/attachdocs/nov-2018/1541503823022.pdf#page=1&zoom=page-width,-16,792

[5] https://www.sebi.gov.in/legal/circulars/nov-2019/enhanced-due-diligence-for-dematerialization-of-physical-securities_44863.html

Other reading materials on the similar topic:

- ‘No Physical, only Demat!’ can be viewed here

- ‘SEBI amends LODR mandating dematerialization’ can be viewed here

- ‘FAQs on Dematerialization of Shares’ can be viewed here

- Our other articles on various topics can be read at: http://vinodkothari.com/

Email id for further queries: corplaw@vinodkotahri.com

Our website: www.vinodkothari.com

Our Youtube Channel: https://www.youtube.com/channel/UCgzB-ZviIMcuA_1uv6jATbg

Leave a Reply

Want to join the discussion?Feel free to contribute!