-Kanakprabha Jethani (kanak@vinodkothari.com)

Background

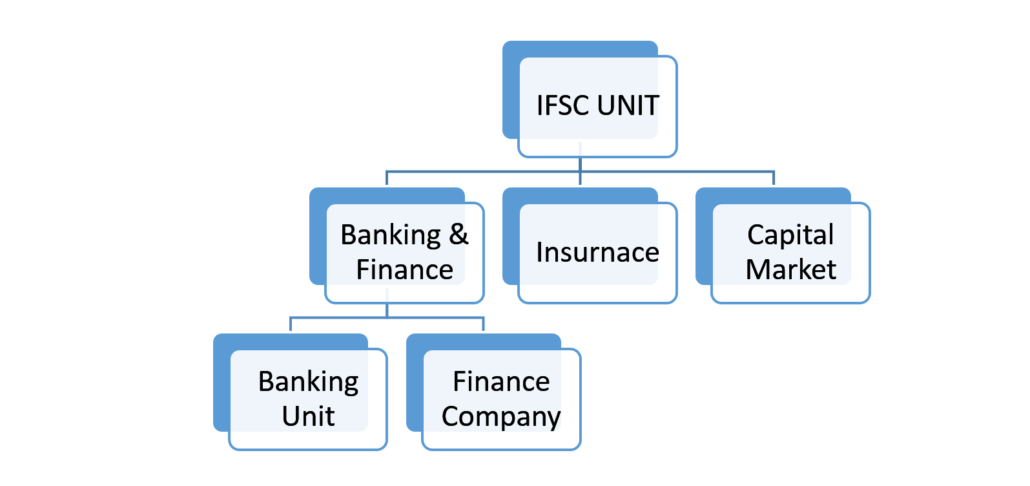

The International Financial Services Centres Authority Act, 2019 was enancted on December 19, 2019, providing powers to the International Financial Services Centres Authority (IFSCA) to regulate financial products, financial services and financial institutions in the International Financial Services Centres. Under such powers, the IFSCA has on October 19, 2020, introduced a Regulatory Sandbox (RS) framework[1], to develop a world-class FinTech hub at the IFSC located at GIFT City in Gandhinagar. Under the said framework, entities operating in the capital market, banking, insurance, and financial services space shall be granted certain facilities and flexibilities to experiment with innovative FinTech solutions in a test environment. The framework details among other things the eligibility criteria, applicability, process of application, and regulatory exemption for operating in the RS..

Further, there are already separate RS frameworks issued by the sectoral regulator for various market participants. Hence, it becomes crucial to understand the unique offering of this IFSC framework. The below write-up intends to discuss the same.

What is Regulatory Sandbox?

Regulatory sandboxes or RS is a framework that allows innovative projects to undergo live testing in a controlled environment where the regulator may or may not permit certain regulatory relaxations or may provide certain additional facilities for testing.

The objective is to allow new and innovative projects to conduct live testing and enable the approach of learning by doing. RSs are created to facilitate the development of potentially beneficial innovations, which are otherwise barred to operated due to the construct of the existing regulatory framework of the country.

We have a separate write-up on the concept, benefits, limitations and the history of RS, which may be referred here- http://vinodkothari.com/2019/04/safe-in-sandbox-india-provides-cocoon-to-fintech-start-ups/

Basic features of the IFSC RS Framework

The framework allows any person, including individuals, to make an application under the RS. This is a unique feature that allows not only businesses but students, researchers as well as professionals to apply. However, there is a geographical limit to this RS. It can only operate within IFSC GIFT city. Further, considering the need for information in such projects, the framework, as an additional step, shall provide the participants with access to market-related data, particularly, trading and holding data, which is otherwise not readily available, to enable them to test their innovations effectively before the introduction of such innovations in a live environment.

Comparison of basic features of various RS frameworks

| Features |

IFSC framework |

RBI framework[2] |

SEBI framework[3] |

IRDA framework[4] |

| Frequency of application |

This is an on-tap framework. Hence, an application may be made anytime. |

Based on the cohort framework i.e. end-to-end sandbox. The RBI rolls out a theme based cohort, say digital payments, under which fintech intending to provide services relating to the theme shall apply.[5]

Applications can be made only when a cohort is live. |

This is an on-tap framework. Hence, an application may be made anytime |

Based on the cohort approach.[6] |

| Applicability/Eligibility to apply |

Following intending to operate in the IFSC GIFT city.

· All entities registered with SEBI, RBI, IRDAI and PFRDA

· All startups registered with Startup India and meeting the criteria of a start-up[7]

· Companies incorporated and registered in India

· Companies incorporated and regulated in FATF compliant jurisdictions

· Individuals who are citizens of India

· Individuals from FATF compliant jurisdiction[8] |

Fintech companies including startups, banks, financial institutions and any other company partnering with or providing support to financial services businesses which satisfies the detailed eligibility criteria laid down.[9] |

Entities registered with SEBI under section 12 of SEBI Act, 1992 |

· Insurers

· Insurance intermediaries

· any person (other than individual) having net worth of Rs. 10 lakhs or more in the previous financial year

· Any other person recognized by IRDAI |

| Purpose |

Adding significant value to the existing offering in the capital market, banking, insurance or pensions sector in India/IFSC. |

For the introduction of innovative Products/Services in retail payments, money transfer services, marketplace lending, digital KYC, financial advisory services, wealth management services, digital identification services, smart contracts, financial inclusion products, cybersecurity products, mobile technology applications, data analytics, API services, applications under blockchain technologies, Artificial Intelligence and Machine Learning applications |

Adding significant value to the existing offering in the Indian securities market |

For promoting or implementing innovation in

insurance in India in any one or more of the following categories:

(a) Insurance Solicitation or Distribution

(b) Insurance Products

(c) Underwriting

(d) Policy and Claims Servicing

(e) Anv other category recognised by the Authority. |

| Timeline for review of the application |

30 working days |

Around 4 weeks + 4 weeks + 3 weeks (including preliminary screening, test design, and application assessment) |

30 days |

No timeline prescribed under the regulations |

| Testing duration |

Maximum 12 months, extendable upon request |

Maximum 12 weeks, extendable on request |

Maximum 12 months, extendable upon request |

Maximum 6 months, extendable on request |

| Exclusions |

No such exclusions

|

RS shall not be available for the following:

· Credit registry

· Credit information

· Crypto currency/Crypto assets services

· Trading/investing/settling in crypto assets

· Initial Coin Offerings, etc.

· Chain marketing services

· Any product/services which have been banned by the regulators/Government of India.

|

No such exclusions |

No such exclusions |

| Extending or exiting the RS |

· At the end of the testing period, relaxations provided on regulatory requirements shall expire.

· Upon completion of testing, IFSCA shall decide whether to permit the innovation to be introduced.

· The applicant may request for an extension period

· The applicant may exit the sandbox on its own by giving a prior notice to IFSCA. |

· At the end of the sandbox period, the relaxations provided will expire and the entity must exit the RS.

· In case an extension is required, the entity should apply to the RBI at least 1 month before the expiration thereof extended period.

· The entity may also exit from the RS by informing the RBI, 1 month in advance. |

· At the end of the testing period, relaxations provided on regulatory requirements shall expire.

· Upon completion of testing, SEBI shall decide whether to permit the innovation to be introduced.

· The applicant may request for an extension period

· The applicant may exit the sandbox on its own by giving a prior notice to SEBI. |

· Applicant may request IRDAI for extension for a maximum of 6 months

· Applicant shall submit a report within 15 days of completion of testing period on how the proposal met the stated objectives, based on which the project may be launched under the extant regulatory framework |

| Revocation of the approval |

IFSCA may revoke the approval at any time before the end of the testing period, if the applicant:

· fails to carry out risk mitigants.

· Submits false information or conceals material facts in the application

· Contravenes any applicable law

· Suffers a loss of reputation

· Undergoes into liquidation

· Carries on business in a manner detrimental to users or the public

· Fails to address any defects in the project

· Fails to implement directions given by IFSCA |

The testing will be discontinued any time at the discretion of the RBI:

· if the entity does not achieve its intended purpose

· if the entity is unable to comply with the relevant regulatory requirements and other conditions

· if the entity has not acted in the best interest of consumers |

SEBI may revoke the approval at any time before the end of the testing period, if the applicant:

· fails to carry out risk mitigants

· Submits false information or conceals material facts in the application

· Contravenes any applicable law

· Suffers a loss of reputation

· Undergoes into liquidation

· Carries on business in a manner detrimental to users or the public

· Fails to address any defects in the project

· Fails to implement directions given by IFSCA |

The Chairperson of the IRDAI may revoke the permission so granted at any time, if it is of the view that the

activities carried out are not meeting the prescribed conditions/ are in violation of the provisions of applicable laws.

|

Conclusion

The IFSC RS framework seems to be drafted on lines of the RS framework issued by the SEBI. The only differentiating factor is the inclusion of all kinds of applicants operating for various purposes. Each of the frameworks discussed above has their peculiarities, and hence, the suitability to one’s design of business may vary. None of the RSs other than the ones introduced by IRDAI have been able to reap any concrete results lately. However, with the growing acceptance of technology, it is only a matter of time before we see various kinds of innovations in the way we transact every day.

[1] https://ifsca.gov.in/Viewer/Index/99

[2] https://www.rbi.org.in/Scripts/PublicationReportDetails.aspx?UrlPage=&ID=938

[3] https://www.sebi.gov.in/legal/circulars/jun-2020/framework-for-regulatory-sandbox_46778.html

[4] https://www.irdai.gov.in/ADMINCMS/cms/frmGeneral_NoYearLayout.aspx?page=PageNo3886

[5] After the introduction of the framework in August 2019, only 1 cohort has been announced i.e. in November 2019 themed ‘Retail Payments’ (https://www.rbi.org.in/Scripts/BS_PressReleaseDisplay.aspx?prid=48550)

[6] After introduction of Insurance Regulatory and Development Authority of India (Regulatory Sandbox) Regulations, 2019 in July 2019, 2 cohorts have been introduced:

[7] Definition of startups- https://www.startupindia.gov.in/content/dam/invest-india/Templates/public/198117.pdf

[8]List of FATF compliant jurisdictions- https://www.fatf-gafi.org/countries/

[9] Refer- http://vinodkothari.com/2019/04/safe-in-sandbox-india-provides-cocoon-to-fintech-start-ups/

Other related write-ups: