Banking & Finance units in IFSC- A regulatory overview

– Siddarth Goel (finserv@vinodkothari.com)

Introduction- IFSCs

The stage of development of financial markets infrastructure in a country, amongst many other things, is a mirror of sound legal regulations, corporate governance, judicial certainty, and debtor protection regime within the country. The inflow of global capital is quintessential for financial markets development and allocation of adequate capital resources in growth sectors. In a move to make India a hub for global capital flow, Gujarat International Finance Tech-City (GIFT) has been established as a globally benchmarked International Financial Service Centre (GIFT-IFSC). GIFT-IFSC is India’s first dominant gateway for global capital flows in and out of the country. The GIFT IFSC supports a gamut of financial services inter alia, banking, insurance, asset management, and other financial market activities. Prior to dealing with the regulatory framework governing financial units established in GIFT-IFSC, it is important to understand the broad function of an IFSC.

IFSCs are the Offshore Financial Centers (OFCs) that cater to customers outside their own jurisdiction. IMF defines OFCs as any financial center where the offshore activity takes place. However, this does not limit financial institutions in OFCs from undertaking domestic transactions. Therefore practical definition propounded by IMF is;

“OFC is a center where the bulk of financial sector activity is offshore on both sides of the balance sheet, (that is the counterparties of the majority of financial institutions liabilities and assets are non-residents), where the transactions are initiated elsewhere, and where the majority of the institutions involved are controlled by non-residents.”

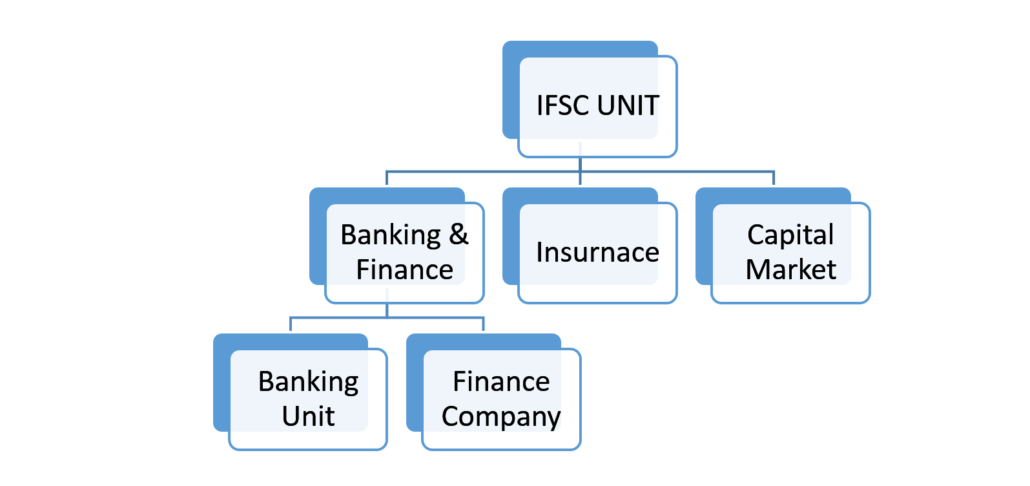

Units set up in GIFT-IFSC can broadly be categorised on the basis of business activity intended to being undertaken by the entity.

This write-up covers regulations governing banking and financial services undertaken by Banking Units and Finance Companies set up in IFSC. The first part touches upon the benefits of setting up a unit in IFSC. The second part covers Banking Units and permitted financial activities. The third part covers Financial Companies in IFSC along with permissible activities and capital requirements. The fourth part covers financial service transactions to and fro between a financial unit based in IFSC and domestic tariff area (DTA). The last part deals with the applicable KYC/PMLA compliances and the currency of transactions with units based in IFSC.

Benefits of setting up a Unit in GIFT-IFSC

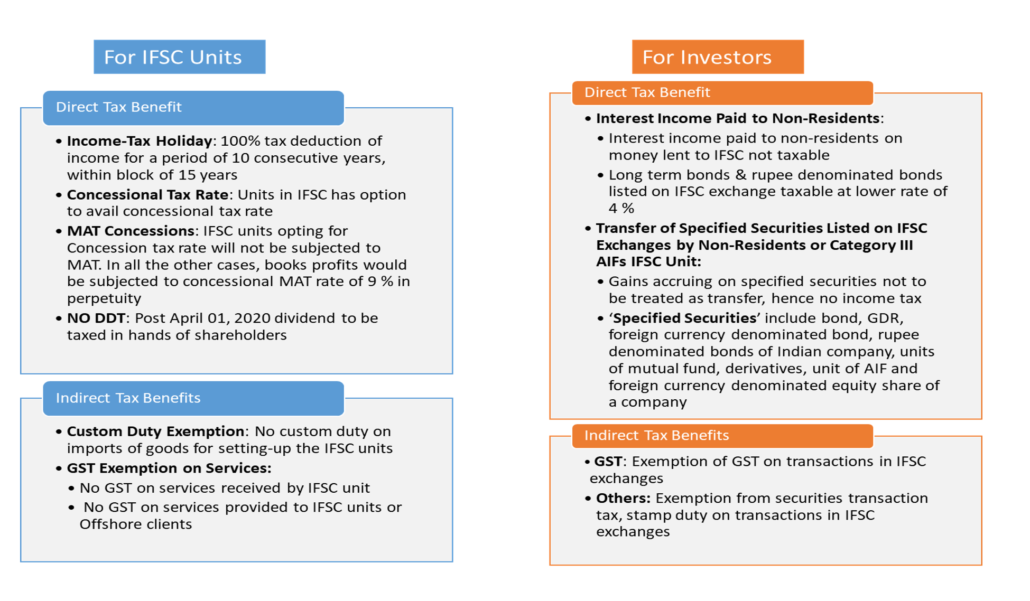

Section 18 of the Special Economic Zones Act, 2005 empowers the central government to approve the setting up of an International Financial Services Centre (IFSC). The units in IFSC have to confirm with the provisions of SEZ Act and SEZ Rules, 2006 to commence business operations. The units established in SEZs as IFSC are governed differentially from the units incorporated in domestic trade areas or domestic tariff area (DTA). DTA means an area within India that is outside the Special Economic Zones.

The Government of India (GoI) established International Financial Services Centers Authority (IFSCA) in April 2020 through an Act passed by the parliament.[1] The IFSCA enthralls regulatory powers and functions of four financial services regulators in India, namely, Reserve Bank of India (RBI), Securities & Exchange Board of India (SEBI), Insurance Regulatory Development Authority of India (IRDA), and Pension Fund Regulatory Development Authority of India (PFRDAI).

Section 7 of SEZ Act, 2005, provide that any goods or services exported out of, or imported into, or procured from the Domestic Tariff Area by a unit in a Special Economic Zone is subject to such terms, conditions, and limitations, be exempt from the payment of taxes, duties or cess as the Government may specify. Nevertheless, the services defined under the SEZ rules are broadly expressed and inter alia covers insurance claim processing, revenue accounting, off-shore banking services, other business services, financial services and etc.

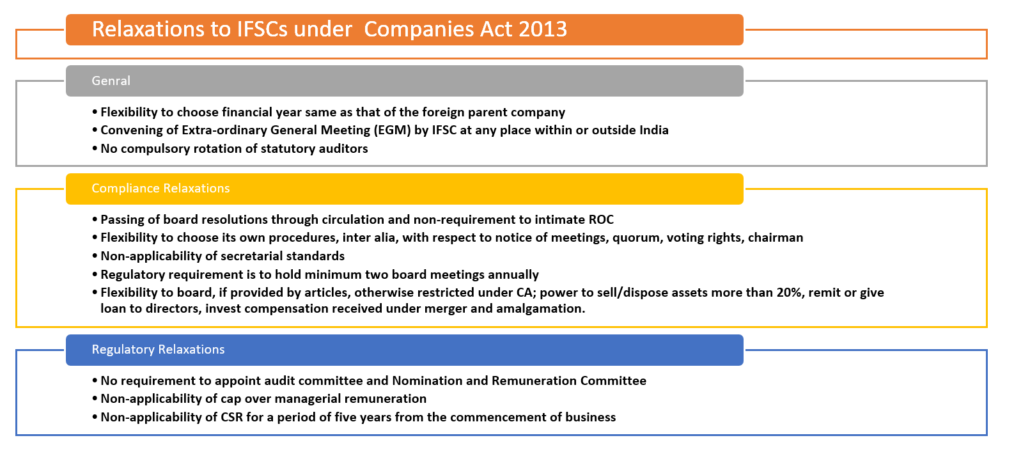

The charts below cover some of the benefits for IFSC units and investors in these units along with relaxations under the Companies Act 2013.

Banking Units and Permitted Financial Activities

Persons Eligible to open an account with BUs

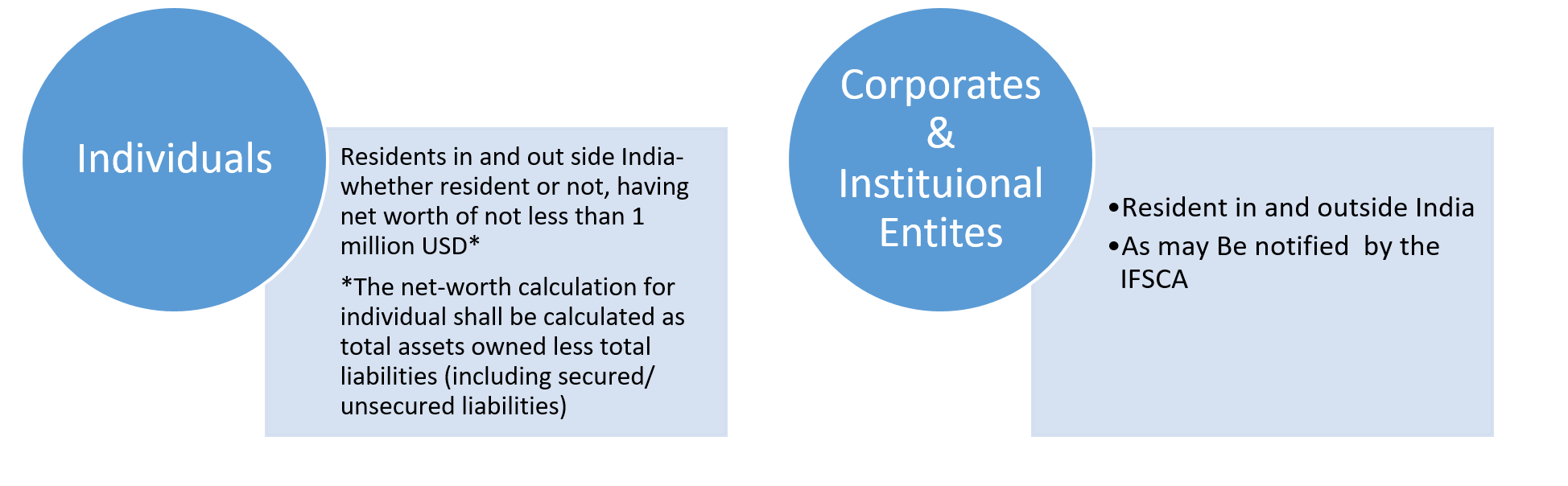

The facility to open foreign currency account with Banking Units in IFSC (‘IBU’) is available to select persons and entities.[2] The persons eligible to open account with IBUs are depicted in the chart below.

Asset Side of the IBUs

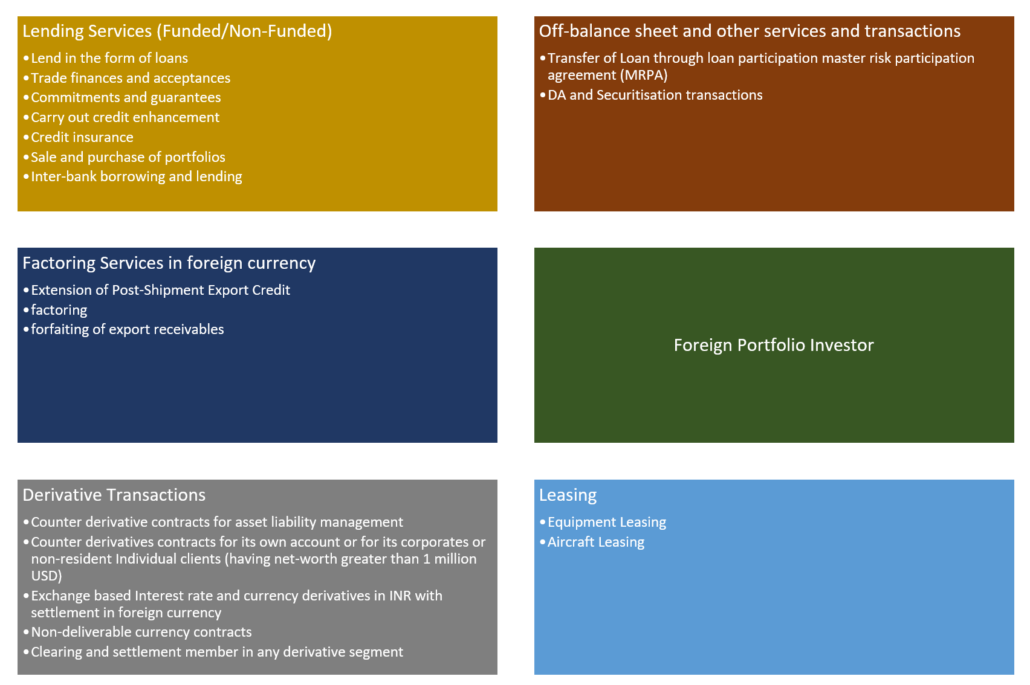

The IFSCA has prescribed certain categories of activities that may be undertaken by the banking units licensed to operate in IFSC. The description of financial activities permissible for IBUs is provided in the chart below.

The IFCA released a circular whereby various directions/circulars/guidelines (‘RBI notifications’) issued by RBI were adopted by the authority for their applicability to IBUs.[3] The circular specifically stipulates in case of any contravention between the IFCA circulars and RBI notifications, the IFCA circulars shall prevail. The table at the end of this write-up covers regulatory framework adopted by IFSCA for the purpose of regulating transactions undertaken by the IBUs. IBUs can deploy funds with persons resident in India (including INR denominated loans) as well as persons not resident in India. However, deployment of funds with the person resident in India shall be subject to provisions of FEMA, 1999.

Liability Side of the IBUs

IBUs may borrow funds in INR/foreign currency from their parent, domestic branches of Indian banks, overseas branches of Indian banks, persons resident outside India. The IBUs may accept deposits from persons resident in India, in the manner provided under the IFSCA Deposit Directions, 2020.[4] Provided borrowings/deposits from the persons resident in India shall additionally be subject to provisions of FEMA, 1999.

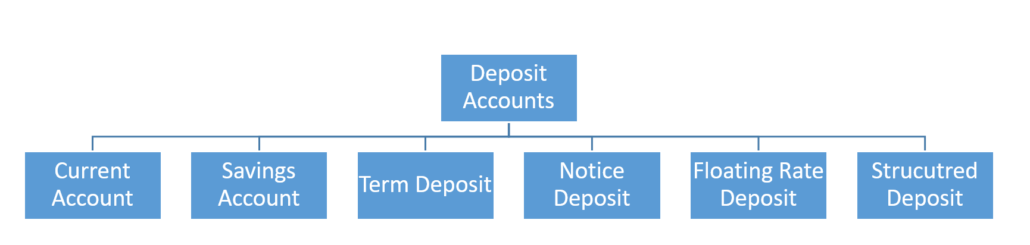

The deposits to IBUs are not covered under deposit insurance regulations, further, there is no Statutory Liquidity Ratio requirement for IBUs operating in IFSC. The IFSCA (Deposit) Directions, 2020 defines the type of deposit accounts that could be opened by IBUs. These deposit accounts are similar to the accounts opened with scheduled commercial banks in India. However, there is an additional asset class option for investors such as structured deposits that can be provided by IBUs.

1. Current Account: These are non-interest bearing demand deposits, which are neither savings deposits nor term deposits. Withdrawals are permitted any number of times depending upon the balance in the account or pre-specified withdrawal limit.

2. Savings Account: These are interest-bearing demand deposit accounts that may subject to restrictions as to the number of withdrawals, as may be allowed by IBUs for any specified period.

3. Term Deposit: These are the deposits that are interest-bearing deposits received by the bank for a fixed period.

The above (1-3) deposit accounts are permitted in any freely convertible foreign currency by a Qualified Individual and Qualified Resident Individual. Interest rate is payable (not in case current account) for all the deposit accounts and IBUs should have a comprehensive policy on interest rates approved by the board. Additionally, under the deposit directions, it is pertinent to note that except for structured deposits, the interest rate paid for similar deposit accounts shall be the same.

The deposit directions provide for certain factors such as tenor of deposits, size of deposits, liquidity of deposit (premature-withdrawal) that may form the basis of determining the interest rate. Further, to increase the investment in capital markets operating in IFSC, individuals in India, that does not meet the prescribed threshold for Qualified Resident Individual (i.e. net worth is below 1 million USD) are allowed to open current account deposits for the purpose of investment in securities under LRS scheme.

4. Floating Rate Deposit: These are term deposits where the return is directly linked to an interest rate benchmark. The interest rate benchmark is a directly observable and transparent market determined external benchmark, like LIBOR, SOFR and etc.

5. Notice Deposit: These are term deposits for a specific period that are withdrawable on giving one complete banking day notice.

6. Structured Deposit: The structured deposits are the curated and complex financial products, devised on the basis of the needs of the investor. It needs identification of type, class, or features of depositors that are intended to be focussed while offering structured deposits. There is a requirement that the product is in compliance with laws and should be understandable by target depositors. These are deposits, repayable at maturity, the interest payable is linked to reference assets, indices, or other economic reference financial instruments or assets. The investors (depositors) shall be given short summary of the product, inter alia, tenor, potential downside risk, guarantees (in built-credit support), scenario analysis of returns on the deposit, comparison with standard term deposit, fees, and involved (including early redemption or termination), circumstances governing pre-mature withdrawal by depositors.

Finance Companies and Units in IFSC

The IFCA released International Financial Services Centres Authority (Finance Company) Regulations, 2021.[5] Surely the regulations exclude IBU’s and entities accepting deposits (demand deposits, term deposits) from residents and non-residents from its ambit. The said regulations bifurcates the entities allowed to conduct business in IFSC as; i) Finance Company, ii) Finance Unit.

The former entity (Finance Company) is incorporated separately, while the latter (Finance Unit) is established as a branch under the regulations. The structural division of conducting business in the IFSC is on the basis of branch and subsidiary framework for commencing permissible activities under the regulations.

Finance Company – The Finance Company may either be a separate newly incorporated company under the Companies Act 2013, or it could be set up as a subsidiary or JV of a foreign company. The Finance Company will be subjected to host country rules (IFSCA), further, where the parent foreign company of such Finance Company is carrying any financial activity in their home jurisdiction, a NOC from home country regulator needs to be obtained.

Finance Unit – For the entity which wants to carry out business as a Finance Unit, i.e. by way of setting up as a branch office in IFSC, its investing entity/parent entity should be carrying out regulated financial activity in its home jurisdiction. Further such investing entity/parent entity shall obtain a NOC from its home country regulator.

For cross-border financial operations where there is a foreign parent entity involved, the host supervisor (IFSCA) determines whether the home supervisor practices global consolidated supervision. The IFSCA shall review whether the oversight of foreign operations by management (of the investing entity/parent entity or head office and, where relevant, the holding company) is adequate having regard to their risk profile and systemic importance and there is no hindrance in host countries of such parent/ company to have access to all the material information from their foreign branches and subsidiaries.

Permissible Activities and Minimum Owned Funds Requirement

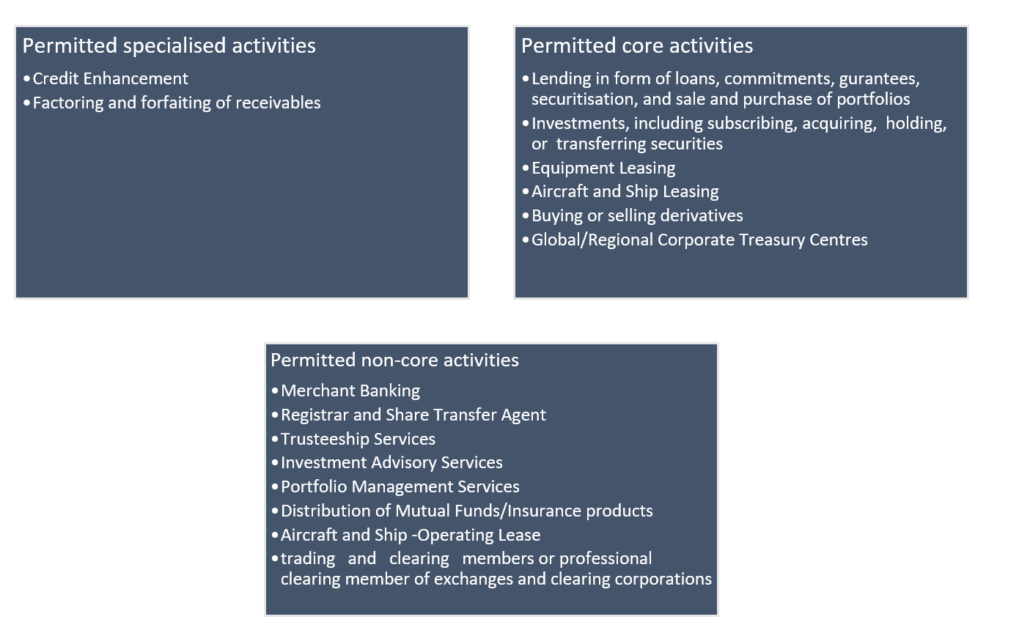

The quantum of minimum owned funds to be required by a Finance Company/Finance Unit depends upon the kind of permissible activities undertaken by such entity under the regulations. The permissible activities are sub-divided into three groups on the basis of functions being undertaken by the entity as described in the chart below.

As also noted above the net owned fund requirements is on the basis of permissible activity being undertaken by the Finance Company/Finance Unit.

Net on Fund Requirements on the basis of permissible activity being undertaken:

| Specified Activities undertaken by Finance Company/Unit | Net-Owned Fund required |

|

0.2 million USD or equivalent freely convertible currency |

|

0.2 million USD or equivalent freely convertible currency or as may be specified by IFSCA |

|

3 million USD or equivalent freely convertible currency |

|

5 million USD or equivalent freely convertible currency |

Financial Products and Services to and fro to DTA

Domestic Tariff Area (DTA) means an area within India that is outside the Special Economic Zones. As described above the financial products and services by way of account with an IBU in IFSC are limited to individuals with a net worth of more than 1 million USD, corporate entities (Indian and foreign) as notified by IFCA. The account-related function primarily relates to the typical banking function of accepting deposits. Nevertheless, the services to and fro, via unit established in IFSC can be broadly divided into two parts; i) Supplies from IFSC unit to DTA customers/Indian branches, ii) Supply of services by an entity located in DTA to units in IFSC.

i) Supplies from IFSC unit to DTA customers/Indian branches

The supply of services from units in IFSC qualifies as an inter-state supply in accordance with section 7 of the IGST Act and therefore will be taxable in the hands of the IFSC unit. The services like extension of deposits, loans, or advances by an IFSC to domestic individuals and entities are the import of services or provision of services to Domestic Tariff Area (DTA) and hence should have been liable to GST. However, the same is exempted from GST by virtue of government notification dated June 2017, in this regard.[6] While other services such as leasing, factoring, forfaiting to an entity located in DTA would be an import of service by such entity located in the DTA and hence liable for GST and other applicable taxes.

The offering of services by units in IFSC to domestic customers/market (e.g. Post shipment credit, Derivatives and etc.) has to be compliant with FEMA, 1999 (including regulations, directions, etc. issued thereunder). The transactions between units in IFSC (as a person resident outside India) and entities based in DTA (as a person resident in India) is an import of service. Therefore, while undertaking any transaction with residents, units in IFSC will have to adhere to the directions issued by the tax authorities along with the directions issued by the Reserve Bank of India (RBI) pertaining to transactions that a person resident in India may undertake with a person resident outside India.

ii) Supply of services by an entity located in DTA to BU in IFSC

Supply of services to units in IFSC is exempt under GST Act, as the same qualifies as zero-rated supply under section 16 of IGST Act. The DTA supplier to an IFSC unit can either supply the services under the cover of Letter of Undertaking (‘LUT’) or may claim refund of IGST from CBIT. The supply of ancillary services such as accounting, taxation, legal services provided by the entity based out of DTA to BUs established in IFSC will also be considered as export of services ‘zero rated supplies’ and would be exempt from taxes.

Currency of transaction with units in IFSC

The currency for conducting business between units and persons (resident/foreign) has to be in a freely convertible foreign currency as may be notified by the IFCA. Additionally, the regulations allow certain specified persons with whom IBUs may conduct business in INR. The IFCA thorough its circulars issued till date has permitted the following INR denominated transactions to be undertaken at IFSC:

(a) INR denominated loans, in any form, to persons resident in India and persons resident outside India.

(b)FCY-INR Non-deliverable derivative contracts (NDDCs) with an AD Cat-1 bank in India having an IBU, with other IBUs and persons resident outside India.

Certain derivatives transactions are also allowed by the IFSA, involving INR interest rates to be undertaken at IFSC; a) Interest Rate Swap (IRS) (including Overnight Indexed Swaps (OIS)) to persons resident outside India, b)Forward Rate Agreement (FRA) on INR interest rates to persons resident outside India for the purpose of hedging their interest rate risk.

KYC/PMLA Compliances

The IBUs have to scrupulously comply with Know Your Customer (KYC), Combating of Financing of Terrorism (CFT), and other anti-money laundering instructions issued by the Reserve Bank from time to time. The financial units under IFSC are prohibited from undertaking cash transactions.

In cases where the client or owner is an entity is listed, including subsidiaries of such listed entities, in stock exchange in India or such jurisdictions notified by the GoI, there is no requirement of identifying beneficial owner or shareholder of such entities. The jurisdictions notified by GoI in this regard are, namely:- (i) United States of America (ii) Japan (iii) South Korea (iv) the United Kingdom excluding British Overseas Territories (v) France (vi) Germany (vii) Canada (viii) International Financial Services Centre in India.[7]

Conclusion

The financial activities envisaged for the units established under IFSC are strategically important to put India on the global stage as a financial center. The lighter touch principle-based approach by IFCA would be a key determinant factor in attracting global businesses and capital. However, an important aspect of IFSC would be retail/wholesale participation and providing retail/wholesale products and solutions to retail/individuals/corporates located in DTA. The accessibility of funds for corporate borrowers based in DTA via IFSC units should serve as swift availability of cheaper sources of funds to churn the higher credit growth. The regulatory journey of units established in IFSC has just commenced and the success of establishing a globally recognised financial service center lies at the ease of compliance, regulatory certainty, and debtor protection regime adopted by the IFSCA.

List of Guidelines adopted by IFSCA for IBUs:

| Banking Regulation Act, 1949 |

|

| RBI Act, 1934 |

|

| FEMA Act, 1999 |

|

[1] The International Financial Services Centres Authority Act, 2019

[2] https://ifsca.gov.in/Viewer/Index/126

[3] https://ifsca.gov.in/Viewer/Index/118

[4] https://ifsca.gov.in/Viewer/Index/120

[5] https://ifsca.gov.in/Viewer/Index/161

[6] The Services like extension of deposits, loans or advances represented by way of interest or discount (other than credit cards), sale and purchase of foreign currency amongst banks or authorised dealers of foreign exchange or amongst banks and such dealers is nil rated. See, Entry 27, notification dated June, 2017, GoI, MoF, https://www.cbic.gov.in/resources//htdocs-cbec/gst/Notification12-CGST.pdf

Leave a Reply

Want to join the discussion?Feel free to contribute!