Financial entities in IFSC: A primer

– Parth Ved, Executive | parth@vinodkothari.com

Table of contents

Background

Flow of funds, just like a river, not only enriches its destination but also benefits all the stops it passes through. Having a financial hub, a stopover which enables routing billions and billions of global funds on a daily basis can definitely prove resourceful. London, New York, Singapore are some of the globally recognised financial centres, and needless to say these locations are at the forefront of financial development. India too has tried to tap into this with the setting up of GIFT-IFSC in Gujarat, and has tried to position itself as the next big global hub for financial transactions.

Through this write-up, the author tries to explain the concept of International Financial Services Centre and the applicability of domestic regulatory framework on entities set up therein.

What is IFSC?

International Financial Services Centre (‘IFSC’) is a specialized designated area in a Special Economic Zone (‘SEZ’) developed for creating a global financial hub wherein financial entities can be set-up for providing various financial services viz. corporate banking, insurance, investment & fund management, trading of securities, etc., to persons across borders. The power to set up an IFSC rests with the Central Government pursuant to section 18 of the Special Economic Zones Act, 2005 (‘SEZ Act’). It is noteworthy that only one IFSC can be approved in a particular SEZ.

Purpose of setting up an IFSC

The fundamental idea behind setting up an IFSC is attracting foreign investors (and with them, their investments) either for investment in India or anywhere on the globe. While the inflow of foreign funds surely benefits the Indian corporate sector, just acting as a stopover for foreign investments also has its benefits in the form of new employment opportunities, better tracking of global flow of funds, improved IT infrastructure, global recognition for India as a financial hub thereby increasing confidence in the global investors.

Another key objective can be to facilitate those transactions through IFSC which are currently carried out by foreign arms of domestic entities. Routing these transactions through IFSC can be operationally beneficial for such entities since IFSC is close to home; and with the existing tax benefits it may very well be more beneficial to operate from IFSC than other global financial centres.

To attract the global participants, there is a need to provide a platform on par with global standards in terms of infrastructure facilities, technological capabilities and regulatory requirements. An IFSC is set up with the intention to provide a swift and simplified regulatory regime to reduce the bottlenecks that a foreign investor may face while investing in India. These can be in the form of relaxed foreign exchange norms, various exemptions under Income tax, GST laws, stamp duty and other miscellaneous fees/charges, simplified procedural requirements, etc.

Who regulates IFSC?

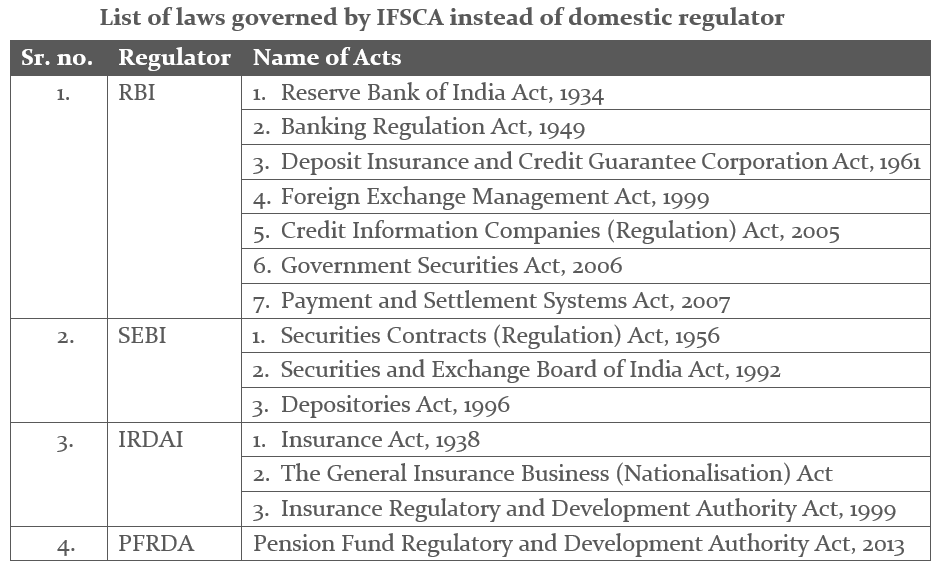

Given the dynamic nature of businesses in the IFSC, involving financial services, foreign exchange, capital market activities, fund management, etc., a high degree of inter-regulatory coordination is required. They were earlier regulated by the domestic financial regulators, namely, Reserve Bank of India (‘RBI’), Securities and Exchange Board of India (‘SEBI’), Pension Fund Regulatory and Development Authority (‘PFRDA’) and Insurance Regulatory and Development Authority (‘IRDAI’).

However, in line with the aforesaid objectives of setting up an IFSC, a unified regulator in the name of International Financial Services Centres Authority (‘IFSCA’) was set up for the development and regulation of financial products, financial services and financial institutions in IFSC in India[1]. Headquartered in the GIFT City, Gandhinagar in Gujarat, IFSCA has replaced the RBI, SEBI, IRDAI and PFRDA and acts as a single unified authority (the list of laws which will now be governed by the IFSCA instead of these regulators is given in the table below).It was set up under the International Financial Services Centres Authority Act, 2019 (‘IFSCA Act’), which empowers IFSCA to regulate the entities situated in IFSC. The powers of IFSCA came into effect from September 29, 2020, while some provisions of the IFSCA Act were made effective from April 27, 2020 and August 21, 2020[2].

It may be pertinent to note that entities set up in an IFSC are still covered under the ambit of Income Tax Act, 1961 and GST laws and Companies Act, 2013 (in case the entity being set up is a Company), unless specifically exempted therein. These regulatory requirements are discussed in detail separately.

Is IFSC and GIFT City the same?

IFSC and GIFT City are often used interchangeably, so are these one and the same? No, an IFSC is a designated zone, a part of an SEZ. GIFT City, on the other hand, is a smart city and a planned business district between Ahmedabad and Gandhinagar, in the state of Gujarat. It is a greenfield project providing modern amenities for commercial, residential and social purposes. It is divided into two parts – a domestic tariff area (‘DTA’) and a Multi-Service SEZ. While the DTA is governed as per normal domestic laws, the Multi-Service SEZ consists of IFSC, IT & ITeS and other export services.

At present the GIFT-IFSC is the only notified IFSC in India, however, the Central Government has the power to notify other IFSCs under the SEZ Act.

Permission for setting up an entity in IFSC

As mentioned above, since IFSCA is the sole regulator of entities in IFSC, approval from IFSCA for setting up an entity shall be required. The operational / procedural aspects for obtaining the approval will depend on the type of entity and the nature of business, and will be governed by the relevant IFSCA regulation / guidelines.

In addition to this, for setting up a unit in GIFT IFSC which is a part of GIFT SEZ, Letter of Approval from the Development Commissioner of the GIFT SEZ will also be required. Typically, the application process will take around 45 days from the date of application[3].

It should be noted that an IFSC entity will be required to be incorporated under the Companies Act, 2013 either as a company limited by shares (as required under section 3) or as a branch of a foreign company (as required under Chapter XXII).

Applicability of Domestic Regulatory framework

Before we get into the regulatory framework prescribed by the IFSCA for governing financial entities in an IFSC, we need to first look at the applicability (or non-applicability) of the existing domestic laws, for this might become a decisive factor in determining whether there is need for setting up an entity in IFSC in the first place – does it solve an existing operational / procedural issue? Does it provide a new mode for bringing in foreign investment? Does it provide any real / tangible benefit (e.g.: new customer base/ segment/ geography, tax relief)?

The discussion on the applicability of the domestic regulatory framework can be divided into the following broad heads:

1. Companies Act, 2013

The Companies Act, 2013 will be relevant for an entity in IFSC since the power, functions and duties of the Ministry of Corporate Affairs (‘MCA’) under Companies Act, 2013 are not subsumed under the IFSCA Act. Hence, companies in IFSC will have to be compliant with Companies Act, 2013, however, these entities (referred to as Specified IFSC private / public companies[4]) enjoy various relaxations / exemptions which inter-alia include the following (it should be noted that these exemptions are available only to ‘companies’ and not the branches of foreign companies):

- Board governance – Minimum 2 Board meetings shall be mandatory (one in each half year) instead of quarterly requirement. Further, Specified IFSC public companies are exempted from constituting an audit committee and nomination and remuneration committee and stakeholders’ relationship committee. Exemption from compliance of secretarial standards with respect to general and board meetings.

- Director related – Specified IFSC public companies enjoy the following exemptions:

- Appointment of a woman director and independent directors.

- Provisions relating to retirement of directors by rotation and filling of casual vacancies of directors.

- Relaxation from provisions relating to requirement for proposing candidature of persons to be appointed as director, subject to AOA.

- Layer of investment companies – Section 186(1) mandates all companies to have not more than two layers of investment companies as subsidiaries. Specified IFSC private/public company are exempted from the restriction of making investment through not more than two layers of investment companies.

- Corporate Social Responsibility – Provisions relating to CSR will be applicable after five years from the commencement of business of a Specified IFSC private/public company.

- Relaxed timelines – The timelines for submitting various forms and returns have been increased from the prescribed timeline under Companies Act, 2013. These include filing with respect to registered office (verification, change); registration of creation of charge; declaration with respect to beneficial interest in any share; registration of resolutions and agreements; intimation with respect to appointment/resignation of auditor, directors and KMP, etc.

2. Foreign Exchange Management Act, 1999

The purpose of formation of an IFSC is to bring in foreign investments in India, hence, it is important to relax the existing foreign exchange laws. If an entity set up in IFSC is considered as a Person Resident in India (‘PRI’), depending on the nature of foreign funding, it will have to comply with guidelines for ECB / debt / non-debt instruments, thereby attracting limits on investment, automatic/ approval routes, all-in-cost ceiling, minimum maturity period, periodical filings, etc.

Since IFSC is a part of SEZ, it is regulated by the provisions of the SEZ Act and rules made thereunder. SEZs are not considered as a part of India as per section 2(i) of the SEZ Act, which states:

2(i). “Domestic Tariff Area” means the whole of India (including the territorial waters and continental shelf) but does not include the areas of the Special Economic Zones.

Further, any movement of goods or services to/from a SEZ unit[5] will be considered as export or import respectively (see definition of export under section 2(m) and import under section 2(o) of the SEC Act).

Now that we’ve established that the SEZ is not a part of India, coming to the provisions of FEMA, section 2(v) provides the criteria for a person to be classified as PRI which requires a person to stay in India for a specified number of days while section 2(w) states that any person who is not PRI will be classified as a Person Resident Outside India (‘PROI’). Since an IFSC entity will be set up in an IFSC which is not a part of India, it fails to fulfil the definition of PRI.

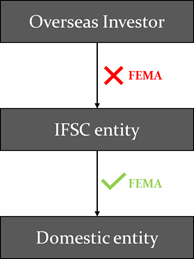

In light of the above discussion, it can be concluded that an entity in IFSC will be treated as a PROI. Accordingly, any transaction between a foreign investor / customer and the IFSC entity will be outside the purview of FEMA.

It may however be noted that since the IFSC entity is classified as a PROI, any investment made by it in a domestic entity will have to be in compliance with Foreign Exchange Management (Non-debt Instruments) Rules, 2019 (‘NDI Rules’) in case of equity investments, Foreign Exchange Management (Debt Instruments) Regulations, 2019 (‘Debt Instrument Regulations’) in case of investment in debt instruments, ECB Directions in case of loans or any form of borrowing.

3. Income tax act, 1961

Contrary to other laws, where IFSC entities are considered to be belonging to foreign jurisdiction, for direct tax purposes, IFSC entities are considered entities in domestic tariff area and are subject to provisions applicable on domestic entities, unless specific exemptions or exclusions are provided in the Income Tax Act, 1961 (‘IT Act’). Hence, the taxation will depend on the type of the entity – company/ AIF/ offshore banking unit. Various exemptions / relaxations were provided under the Finance Act, 2020, Finance Act, 2021 and Finance Act, 2022 to entities set up in IFSC. These include:

- Exemption from income tax for 10 years to the IFSC entity – As per section 80LA(1A) read with 80LA(2), IFSC entity shall be eligible for a deduction of 100% of its income for any ten consecutive years out of fifteen years for income from its business for which it has been approved for setting up in the IFSC.

It may however be noted that this exemption under section 80LA does not exempt the IFSC entity from the provisions of MAT or AMT, as the case may be. MAT/AMT is a self-contained calculation which does not provide for deduction u/s 80LA. It essentially means that the IFSC entity will still be required to pay MAT/AMT. However, the MAT/ AMT paid can be carried forward in form of as credit for adjustment in subsequent years. Under section 115JAA, MAT credit can be carried forward for 15 years while AMT credit is available for only 5 years.

Another point which may be considered here is this exemption will also be available to units set up in IFSC as a branch of a parent entity since the section uses the word ‘Unit’ set up in IFSC. The term ‘Unit’ is defined in section 2(zc) of the SEZ Act, 2005 and shall also include branches of parent entities set up in IFSC. - Reduced rate of MAT / AMT – As per section 115JB(7) and 115JC(4), a reduced rate of MAT / AMT, respectively, @ 9% (instead of 15%) will be applicable to units located in IFSC deriving income solely in convertible foreign exchange.

- Interest paid to NR with respect to borrowings of IFSC entity – As per section 10(15)(ix), any income by way of interest payable to a non-resident (‘NR’) by an IFSC unit in respect of monies borrowed by it on or after September 1, 2019 shall be exempt from tax. Accordingly, since the income itself is exempt, there will not be any question of withholding of tax by the IFSC entity on behalf of the NR.

- Interest on deposit in Offshore Banking Unit – In terms of section 10(15)(viii) any income by way of interest received by a NR or a person who is not ordinarily resident in India, on a deposit made in an Offshore Banking Unit is exempted from income tax. Hence, in case of structured deposits or term deposits raised from Foreign Investors, the interest paid on such deposits shall be exempted from income tax. Further, withholding of tax is also exempted in this regard pursuant to section 197A(1D).

- Capital gain on sale of securities listed on stock exchange – Sale of certain specified securities listed on a stock exchange in IFSC by a NR is not regarded as a transfer in terms of section 47(viiab) read with CBDT notification dated 5 March 2020[6]. These specified securities include bonds, units of an AIF, business trust or a Mutual Fund, foreign currency denominated equity share of a company, derivative and GDR. However, the consideration for such transaction should be paid or payable in foreign currency.

- Income from a securitisation trust – Any income received by an Offshore Banking Unit from a securitisation trust which is chargeable under the head “Profits and gains of business or profession” is exempt pursuant to section 10(4D).

- Aircraft / ship leasing – Any income of a NR by way of royalty or interest, on account of lease of an aircraft or a ship in a previous year, paid by a IFSC unit, if it has commenced its operations on or before March 31, 2024.

4. Goods and Services Tax

Entities in IFSC are subject to GST laws as applicable to domestic entities, except for specific exemptions provided vide Notification No. 2/2018- Central Tax (Rate)[7], which provides a ‘Nil’ rate of tax on services by an intermediary of financial services located in IFSC to a customer located outside India.

5. Stamp duty

The Government of Gujarat has provided a relief in terms of stamp duty cost under its IT/ITeS Policy since non-banking services, including insurance, pension, asset management and market related services are considered as IT enabled Services (‘ITeS’). Earlier, until 2021, the policy provided for a 100% refund of stamp duty while at present, under the recent policy for 2022-27[8], the stamp duty will be eligible for 25% refund.

6. Securities law

Since the powers of SEBI under the SEBI Act, SCRA, 1956 and Depositories Act, 1996 are now vested with the IFSCA, SEBI regulations / circulars shall not be applicable for entities in IFSC unless specified by the IFSCA. However, in case such entity is also operating in the domestic capital market as an intermediary, it shall have to comply with the respective SEBI guidelines for such intermediaries [e.g., if an IFSC entity is acting as a mutual fund distributor for domestic mutual funds, it shall comply with SEBI Master Circular for Mutual Funds[9] (Guidelines for mutual fund distributors)].

7. Banking law

As discussed earlier, the powers of the RBI now vest with the IFSCA in so far as it relates to the regulation of the financial products, financial services or financial institutions, in the IFSC. At present, the IFSCA (Banking) Regulations, 2020 (‘Banking Regulations’) govern the IFSC Banking Units (‘IBU’). Pursuant to these regulations, the provisions of the RBI Circular dated April 1, 2015[10] shall not be applicable to IBUs. The Banking Regulations have been discussed separately further.

Regulatory framework in IFSC

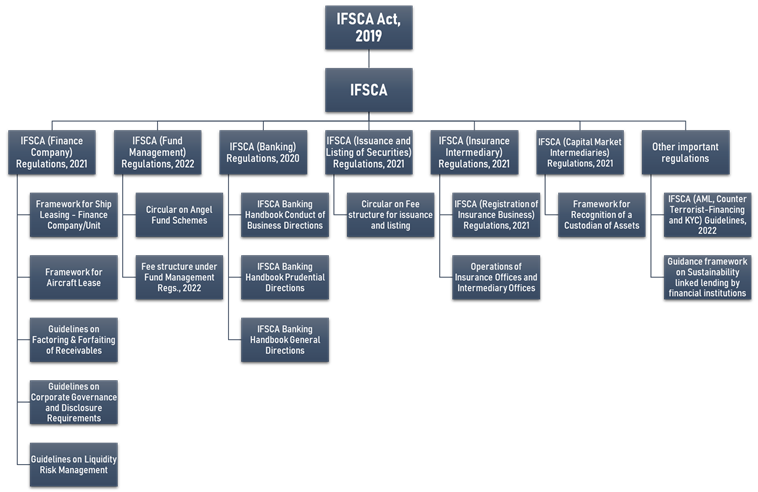

Now that we have seen the applicability of various domestic laws, let us delve into the regulatory framework applicable to an entity in IFSC. IFSCA is empowered to regulate the financial products, financial services and financial institutions in IFSCs. The IFSC space has seen more than a dozen regulations, nearly 35 notifications and more than 100 circulars since the IFSCA took the chair.

Broadly, the regulations are divided based on the nature of financial service viz. banking, fund management, insurance, capital markets. Additionally, there are separate regulations for issue and listing of securities in IFSC, including listing of Depository Receipts and secondary listing. The following chart gives a broad idea of the regulatory framework in IFSC:

IFSCA (Finance Company) Regulations, 2021

In terms of Finance Company Regulations, a finance company can undertake certain activities as permitted core and non-core activities. As a core activity, a finance company can lend in the form of loans, commitments and guarantees, securitisation, and sale and purchase of portfolio, undertake investments including subscribing, acquiring, holding, or transferring securities or such other instruments, as may be permitted by IFSCA. The non-core activities include merchant banking, trusteeship services, investment advisory, portfolio management services, operating lease, etc.

The concept of a finance company is equivalent to a Non-Banking Finance Company (NBFC) in the domestic tariff area. A finance company can be set up as a subsidiary or a joint venture, or as a newly incorporated company; and hence will also have to comply with Companies Act, 2013. Or else the applicant may simply set up a finance unit if it is an incorporated entity in its home jurisdiction and is engaged in the business of financial services regulated by a financial sector regulator; it shall also obtain a No-Objection Certificate from such home regulator for setting up a Finance Unit in the IFSCs.

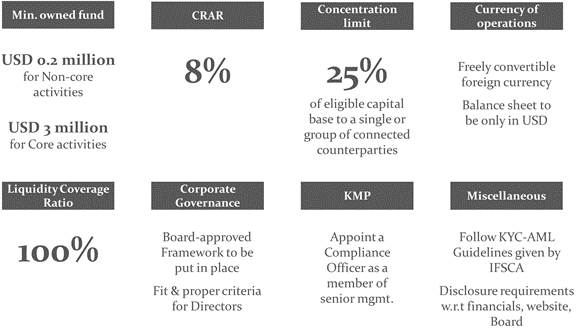

The key requirements for a finance company/unit are as follows:

Our writeup on regulatory regime for Finance Companies / Units in IFSC can be found here – https://vinodkothari.com/2022/11/finance-companies-in-international-financial-services-centre/

Specific Frameworks for Aircraft Leasing and Ship Leasing

IFSCA has prescribed separate guidelines for undertaking operating/finance lease of aircrafts or ships. While the major requirements are in line with the Finance Company Regulations, the only relaxation can be seen in the nature of entity being set up which can be a company, LLP or a trust. It may also be noted that to promote Aircraft / ship leasing through IFSC, the government has provided tax exemptions which were discussed earlier under Taxation Laws.

IFSCA (Fund Management) Regulations, 2022

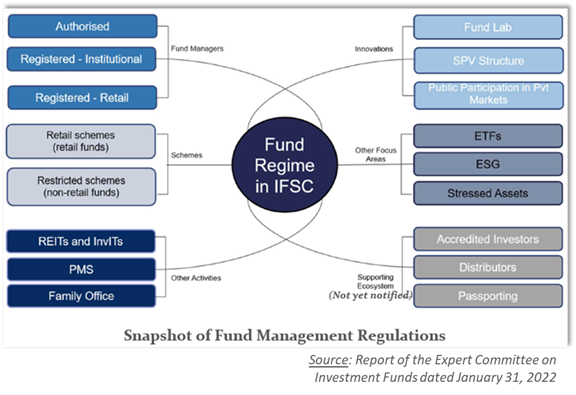

For carrying out investing activities in IFSC, the Fund Management Regulations are applicable. They are broadly divided into three categories – framework for Fund Management Entity (‘FME’); framework for Investment Trusts (REITs and InvITs); provisions relating to ESG, launching ETFs, etc. The below chart gives a broad overview of the Fund Management Regulations:

FMEs are entities acting as pooling vehicles and are permitted to operate fund management schemes under any of the categories specified under the regulations. The concept of FME is equivalent to an Alternative Investment Fund (AIF) under the SEBI Regulations. The primary advantage of setting up such an entity, essentially registering the fund manager, is that one does not have to seek registration of each individual fund/ scheme facilitating more efficient fund launches. An FME is required to register itself with the IFSCA under any one of the 3 categories – Authorised FME, Registered FME (Non-retail) and Registered FME (Retail). A risk-based classification forms the basis for these categories and it is the category that decides the schemes that an FME may launch, and other applicable requirements. The Fund Management Regulations provide for networth requirements, fit & proper criteria to be followed by FME and its directors/controlling shareholders, investment & leverage restrictions for each category, Board & KMP requirements, etc.

IFSCA (Banking) Regulations, 2020

The Banking Regulations provide for setting up of IFSC Banking Unit (‘IBU’) as a branch of an Indian or a foreign bank. It can carry out all activities that can be carried out by a bank. Setting up IBU shall require prior approval from the IFSCA after satisfaction of the following criteria:

- Minimum capital of USD 20 million to be provided by the Parent bank of the IBU;

- No Objection Letter to be obtained from the home regulator regarding setting up of IBU in IFSC;

- Submission of undertaking by Parent Bank to provide liquidity to IBU whenever needed for its operations.

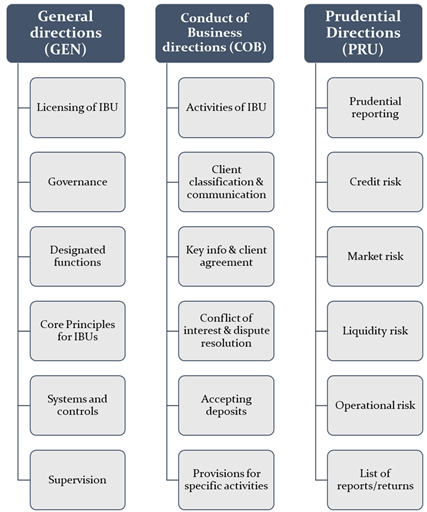

The IFSCA has issued a Banking Handbook which contains the directions to IBUs operating as a branch of a Banking Company. Unless generally or specifically exempted, the IBUs are required to comply with the directions in this Handbook without fail. The Handbook has three components, as detailed in this chart –

Closing remarks

As can be seen from the multitude of exemptions and relaxed framework for starting a business in IFSC, it is evident that the Government is actively taking steps to make IFSC a success story and formation of a unified regulator (i.e. the IFSCA) has brought it a step closer. While the Government is trying to bring the IFSC framework on par with the global standards, it will be keen to see whether the foreign players would at all be interested to do their dealings through the IFSC. A point of concern would be that if our IFSC is on par with the global financial hubs, it would still be ‘one-of-the-many’. However, the ever-growing financial potential of India might help in bringing these players to the Indian shore; success will obviously depend on the Government’s flexibility to stay updated with current global standards and bring in ease of doing business.

Relevant Links

| Banking Regulations | https://ifsca.gov.in/Viewer/Index/203 |

| Banking Handbook (COB) | https://ifsca.gov.in/Viewer/Index/322 |

| Banking Handbook (GEN) | https://ifsca.gov.in/Viewer/Index/310 |

| Banking Handbook (PRU) | https://ifsca.gov.in/Viewer/Index/311 |

| FAQs for IFSC | https://ifsca.gov.in/Viewer/Index/53 |

| Finance Company Regulations | https://ifsca.gov.in/Viewer/Index/354 |

| Framework for Aircraft Lease | https://ifsca.gov.in/Viewer/Index/304 |

| Framework for Ship Leasing | https://ifsca.gov.in/Viewer/Index/335 |

| Fund Management Regulations | https://ifsca.gov.in/Viewer/Index/288 |

| GIFT City | https://www.giftgujarat.in/Default.aspx |

| Gujarat IT/ITeS Policy (2022-27) | https://directorit.gujarat.gov.in/IT-Policy |

| IFSCA | https://ifsca.gov.in/home |

| IFSCA Act, 2019 | https://ifsca.gov.in/Viewer/Index/3 |

[1] The powers of IFSCA came into effect from September 29, 2020, while other provisions of the IFSCA Act were made effective from April 27, 2020 and August 21, 2020 – https://ifsca.gov.in/Viewer/Index/93, https://ifsca.gov.in/Viewer/Index/61, https://ifsca.gov.in/Viewer/Index/6

[2] Notification dated September 29, 2020 – https://ifsca.gov.in/Viewer/Index/93, April 27, 2020 – https://ifsca.gov.in/Viewer/Index/61, August 21, 2020 – https://ifsca.gov.in/Viewer/Index/6

[3] As per FAQs on GIFT IFSC – https://giftgujarat.in/documents/FAQs-GIFT-IFSC-Latest.pdf

[4] ‘Specified IFSC public company’ shall mean an unlisted public company which is licensed to operate in an approved multi services SEZ – MCA Notification no. G.S.R. 08(E) dated January 4, 2017 (https://e-book.icsi.edu/notificationdetail.aspx?acturl=6CoJDC4uKVUR7C9Fl4rZdatyDbeJTqg3ks3gwg9KmdTHOB/K5jVGhQ==)

[5] As per section 2(zc) of the SEZ Act, a unit set up in SEZ includes a unit in an IFSC.

[6] https://incometaxindia.gov.in/communications/notification/notification16_2020.pdf

[7] https://cbic-gst.gov.in/pdf/central-tax-rate/notfctn-02-2018-cgst-rate-english.pdf

[8] https://directorit.gujarat.gov.in/IT-Policy

[9]https://www.sebi.gov.in/legal/master-circulars/aug-2020/master-circular-for-mutual-funds_47382.html

[10] https://rbidocs.rbi.org.in/rdocs/notification/PDFs/FNIBU010415CIRN.PDF

Leave a Reply

Want to join the discussion?Feel free to contribute!