Finance Companies / Units in International Financial Services Centre (IFSC)

– Anirudh Grover, Executive | finserv@vinodkothari.com

Table of Contents

Background

International Finance Service Centre (IFSC) is a designated zone physically situated in India but is not considered a part of India. As the name suggests, it is a designated centre set up for the purpose of enabling international financial services, the key word here being international. The purpose is not only to bring global funds into the country but also facilitate such transactions through this zone which otherwise would have been carried out by foreign branches of domestic entities. This purpose is intended to be achieved through establishment of various businesses such as banking units, fund management entities, finance companies etc. We have discussed in depth about the concept of IFSCs along with the applicability of the domestic regulatory framework in our write-up Financial entities in IFSC: A primer.

The objective of this paper is to picture a comprehensive image of all the aspects of finance entities starting from what is meant by finance companies to all the regulatory exposure it has to bear while undertaking any kind of activities.

What are Finance Companies and Finance Units?

Financing business can be carried out in IFSC through a finance company or a finance unit. Finance companies are equivalent to the concept of non-banking financial companies (‘NBFCs’) in the domestic tariff area. Finance companies/units are governed by the IFSCA (Finance Companies) Regulations, 2021 (“FC Regulations”) issued by the IFSCA on March 25 2021.

The difference between a finance company and a finance unit is based on the nature of entity carrying out financial activities, as detailed below:

| Finance Company [as per reg. 2(1)(e) of FC Regulations] | Finance Unit [as per reg. 2(1)(f) of FC Regulations] |

|---|---|

| “2(1)(e). Finance Companies means a financial institution as defined under clause (c) of subsection (1) of section 3 of the Act, separately incorporated to deal in one or more of the permissible activities specified under sub-regulation (1) of regulation 5 of these regulations, provided that: It does not accept public deposit from resident and non residentIt is not registered with the Authority as a Banking Unit.” | “2(1)(f). Finance Unit: means a financial institution as defined under clause (c) of section (1) of section 3 of the Act, set up as a branch permitted under these regulations to deal in one or more of the permissible activities specified under sub-regulation (1) of regulation 5 of these regulations, provided that: It does not accept public deposit from resident and non residentIt is not registered with the Authority as a Banking Unit.” |

However, since both, the finance company and finance unit, are referred to as a “financial institution”, it is important to highlight section 3(1)(c) of the IFSCA Act, 2019 which defines it as a unit engaged in rendering ‘financial services’ in respect of any ‘financial product’. The term financial services and financial product have been further defined below to mean the following:

| Financial services means: [as per sec 3(1)(e) of IFSCA Act, 2019] | Financial Product means: [as per sec 3(1)(d) of IFSCA Act, 2019] |

|---|---|

| 1. Buying, selling, or subscribing to a financial 2. Acceptance of deposits; 3. Administering / managing financial products; 4. Effecting contracts of insurance; 5. Operating an investment scheme; 6. Underwriting a financial product; 7. Providing information about a person’s financial standing; 8. Providing payment services; 9. Making arrangements for undertaking above activities; 10. Other service notified by Central Government. | 1. Securities; 2. Contracts of insurance; 3. Deposits; 4. Credit arrangements; 5. Foreign currency contracts; 6. Any other product as CG may notify. |

Now that we know that a finance company/unit is a financial institution engaged in services as seen above, it is also important to understand the scope of activities permitted by the FC Regulations.

What does a finance company/unit do?

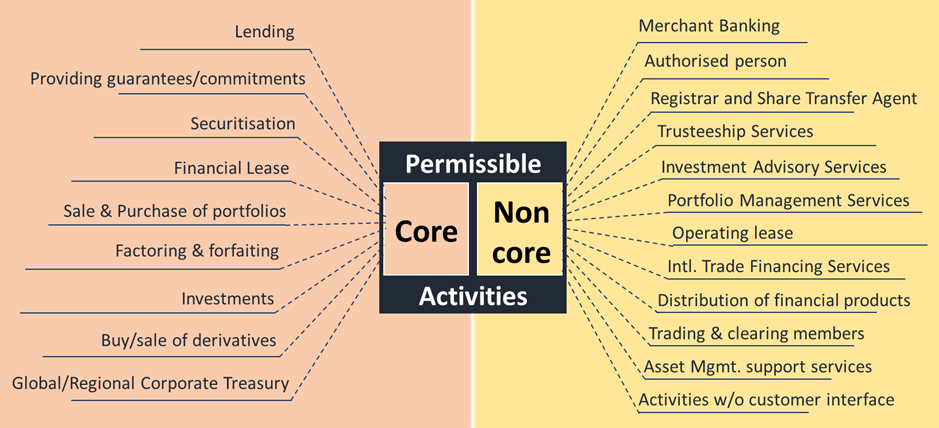

The FC Regulations (reg. 5) provides a list of permitted activities for a finance company/unit, which is sub-divided into core activities and non-core activities. As can be seen from the chart below, the core activities largely include fundraising and investment activities while the non-core ones include distribution of financial products and other support services in a financial transaction.

One question that may arise here is whether a finance company/ unit can be set-up to carry out only core or non-core activities? It will not be out of place to point here that a finance company/unit shall be permitted to undertake either of the following:

- core activities or

- non-core activities or

- both

If we compare this with the domestic scenario, companies are required to fulfil the Principal Business Criteria Test for getting registered with the RBI as NBFCs (i.e. their financial assets constitute more than 50% of the total assets and income from financial assets constitute more than 50% of the gross income).

Further, if a finance company / unit is carrying out only non-core activities, it is exempted from the prudential requirements and corporate governance & disclosure requirements.

It should also be noted that the IFSCA has also specified separate frameworks for some of the non-core activities, which are also to be complied with by the finance company/unit in case it undertakes such activities.

Can they accept deposits?

No, finance companies / units cannot accept deposits in any form either from non-residents or from residents. This bar on acceptance of deposit is incorporated in the definition of finance company / unit itself.

IFSCA Framework for Finance Companies / Units

The regulatory framework specified by IFSCA can be broadly picturised as per the chart below:

Registration Requirements

In order to incorporate or set up a finance company/unit in IFSC there are few factors which the applicant needs to consider that are as follows:

- A finance company may be set up as a

- newly incorporated company under the Companies Act 2013,

- joint venture company or

- a subsidiary of an already established holding company.

- The Applicant finance company will be required to obtain a no objection certificate from the concerned home regulator in the event, it is undertaking finance services in its home jurisdiction and he intends to set up a finance unit in the IFSC.

- A finance unit can be set up if the applicant is an incorporated entity in its home jurisdiction. If the unit is being set up to carry out core activities, the applicant should be engaged in the business of financial services in its home jurisdiction and should obtain a No-Objection Certificate from its regulator for setting up the finance unit in IFSC.

- The Applicant shall comply with the minimum net owned fund requirement,or in case of a finance unit, its parent shall maintain minimum net owned fund on an unimpaired basis at all times; and

- The Applicant entity and its promoters shall be from FATF compliant jurisdictions.

Owned Funds requirement

The finance companies/units are required to maintain minimum owned funds at all times, depending upon the type of activity they intend to carry – core or non-core as per the table below. For finance units, the owned fund may be maintained at its parent level.

| S.No | Activity | Minimum Net Owned Fund |

| 1. | One or more non-core activities without any core activities | Higher of USD 0.2 million or any such amount as may be required to seek specific registration for a proposed non-core activity. |

| 2. | One or more core activities with or without non-core activities | Higher of USD 3 million, minimum regulatory capital for core activities as specified by the Authority; or any such amount as may be required for non-core activities. |

Corporate Governance Aspects

The IFSCA has, vide its circular dated August 9, 2021, prescribed corporate governance and disclosure norms for finance companies / units (engaged in core activities), which broadly provide for the following:

- Corporate Governance framework and disclosure: A finance company / unit shall develop and implement a board-approved framework for corporate governance and disclose the same on its website and Annual Report. Systemically important NBFCs in the domestic tariff area are also required to have in place a Corporate Governance Policy as per the RBI Guidelines.

- Board of Directors: The Board shall be of an appropriate size, based on the scope and nature of the operations, possessing core competencies such as accounting, finance, law, business etc. Further, the board shall on a regular basis undertake training to ensure that they are up to date in the relevant field. A deed of covenant should be executed between the finance company/unit and the director at the time of appointment which includes the points pertaining to powers of a director, independent judgement of the board, commitment to authority to inform on becoming aware of a real or potential breach of any applicable law, rules or regulations.

- Fit & Proper Criteria: The finance company/ unit shall establish effective systems and controls to ensure that all members of the board meet the fit and proper criteria by carrying out due diligence of its board members both at the time of their appointment and at reasonable regular frequency, along with an annual declaration in this regard. Again, Systemically important NBFCs in the domestic tariff area are also required to put in place a fit & proper policy and constitute a Nomination and Remuneration Committee for this purpose.

- Board Committees: The board, depending on the nature, scale and complexity of the business operations, may constitute committees which include Audit Committee, Nomination and Remuneration Committee, Risk Management Committee, Stakeholder Relationship Committee or any other committee as may be mandated under the Companies Act, 2013.

- Compliance Officer: It shall be mandatory for a finance company a compliance officer who shall also be a member of the senior management with direct reporting to the board.

- Disclosures: Following disclosures constitute the minimum disclosures to be placed before the Board:

- Annual operating plans and budgets, capital budgets and related updates;

- Quarterly results of the Finance Company;

- Minutes of meetings of the Board constituted Committees;

- A statement on the change of directors, if any, and a declaration confirming the compliance with the ‘fit and proper’ criteria about them;

- Any materially adverse event which could affect the Finance Company, its property or operations;

- Transactions that involve substantial payment towards goodwill, brand equity, or intellectual property and about any other transaction which is carried out beyond the normal course of business of the Finance Company;

- Conformity with Corporate Governance and Disclosure Requirements framework;

- All material breaches of internal policies, norms, risk limits and any other important information of the like nature.

The finance companies also enjoy certain exemptions under the Companies Act, 2013 which have been covered in our write-up Financial entities in IFSC: A primer.

Liquidity Risk Management (LRM) Framework

In order to regulate the liquidity risk for a finance company/unit, the IFSCA had issued Guidelines on LRM dated June 24, 2021 which requires finance companies/units to put in place a board approved framework for LRM by taking into account the guidance provided in the Basel document titled “Principles for Sound Liquidity Risk Management and Supervision” dated September 2008[1] (to the extent applicable and in tune with the nature and scale of business). In addition to this, the guidelines also specify the requirement of Liquidity Coverage Ratio (LCR) Framework and disclosures of critical ratios,funding concentration, etc.

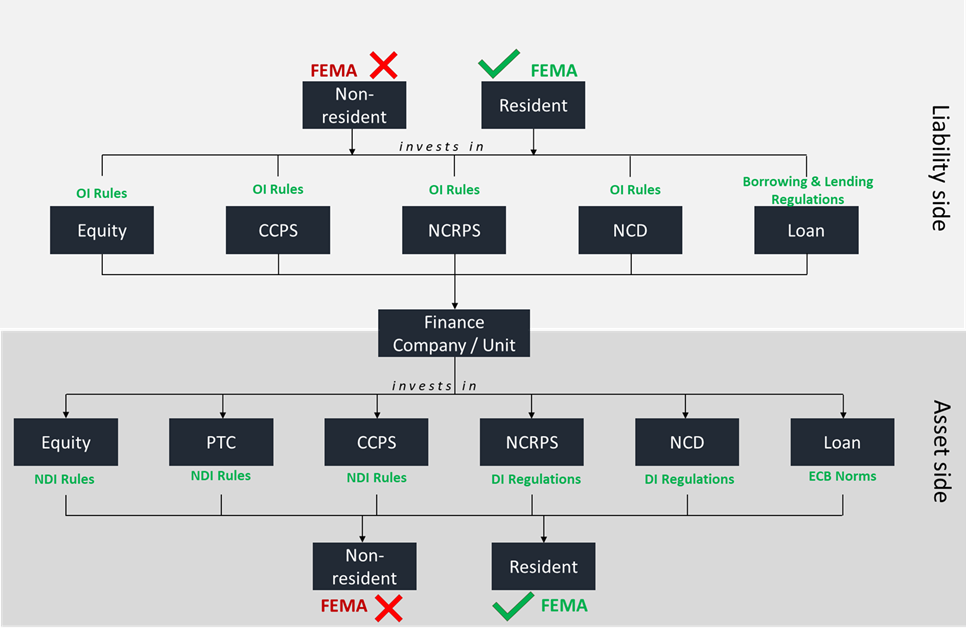

Implications under Foreign Exchange Management Law

In our writeup Financial entities in IFSC: A primer, we have discussed about the residential status of a unit set up in IFSC, wherein we concluded that for the purpose of FEMA Act, 1999, these units will be considered as persons resident outside India (‘PROI’). Therefore, any transaction involving a IFSC unit and another PROI will be outside the purview of FEMA. While if such a transaction involves a person resident in India (‘PRI’), it shall be subject to the provisions of FEMA Act, 1999 (this is also supported by reg. 5(4) and 5(7) of the FC Regulations).

Now, coming to treatment of various transactions undertaken by a finance company/unit, we can divide the discussion as per the following chart:

Asset Side Transactions:

1. For investments made outside India by a financial Institution in IFSC:

As concluded above, since a finance company/unit is considered as a PROI, any foreign transaction undertaken by such PROI with another PROI will be outside the ambit of FEMA provisions. This can also be corroborated by referring to Rule 4 of the Foreign Exchange Management (Overseas Investment) Rules, 2022 (“OI Rules”) by virtue of which a blanket exemption from the applicability of these OI Rules and OI Regulation have been granted to financial entities in an IFSC.[2]

2. For investments in Indian entities (i.e. PRI) by an IFSC finance entity:

Investment from a finance company/unit in an Indian entity can be either in the form of equity instruments or debt instruments. The following are the applicable provisions for these kind of the transactions:

- Investment made in the form of equity instruments: The Foreign Exchange Management (Non-debt Instruments) Rules, 2019 (“NDI Rules”) are to be taken into consideration by finance entities in IFSC while undertaking any investment in the domestic Indian entity in the form of equity instruments. The following key provisions of the NDI Rules are to be kept in mind by parties who are subject to such an arrangement:

- Investment limit: In the event, an entity in an IFSC jurisdiction invests in equity instruments of Indian Unlisted Entity or in 10% or more of the post issue equity capital on a fully diluted basis of a listed Indian Company, then such investments shall be considered as Foreign Direct Investment whereas if such investment is less than 10% of the post issue paid up share capital of a listed Indian company or less than 10% of the paid up value of each shares of equity instrument of a listed Indian Company then such investment shall be considered as Foreign Portfolio Investment. [3]

- Other conditions: Other usual conditions of sectoral cap, prohibited sectors, FDI-linked performances, etc. would apply to investments made by an finance company/unit in equity instruments of an Indian company.

- Investment in NBFC: In the event, a finance company/unit is intending to invest in an unregistered NBFC or in core investment companies engaged in the activity of investing in the capital of other Indian entities, it shall be required to take a prior approval from the government.[4] However if such investment is being undertaken in a registered NBFC then no such prior approval shall be required.[5]

- Investment in Limited Liability Partnerships: A finance company/unit is permitted to invest in the capital of an LLP, provided that these LLP are operating in sectors or activities where foreign investment up to 100% is permitted under the automatic route and there are no FDI linked performance conditions.[6] It is noteworthy here that NBFCs in the domestic territory are not allowed to invest in the capital of LLPs or partnership firms.

- Investment in StartUp Company: A finance company/unit may purchase convertible notes issued by an Indian Startup company for an amount of Rs. 25 lakhs or more in a single tranche provided it complies with entry route, sectoral compliances, pricing guidelines and other attendant conditions for foreign investment.[7]

- Investment made in the form of debt instruments: Insofar as investment made by a finance company/unit in the form of debt securities are concerned, the Foreign Exchange Management( Debt Instrument) Regulations 2019 (“DI Regulations”) are attracted. Now since these regulations have not specifically provided for any provision pertaining to units in IFSC, the governing law applicable to PROI in this regard will also be applicable to entities in IFSC. The key provisions applicable are detailed below:

- Type of Debt Securities allowed: As per Regulation 2(d) read with Schedule 1 of the DI Regulations, the investments options under the debt route include dated Government securities/ treasury bills, non-convertible debentures/ bonds issued by an Indian company, commercial papers issued by an Indian company etc

- Mandatory Registration as Foreign Portfolio Investors: The DI Regulations have permitted only 4 categories of investors as recognized investors who can invest via the debt route in an Indian entity, namely

1. Foreign Portfolio Investors (“FPI”),

2. NRIs or Overseas Citizens of India (OCIs)- Repatriation basis,

3. NRIs or Overseas Citizens of India (OCIs)-Non Repatriation basis and

4. Foreign Central banks or Multilateral Development banks

Apart from the category of FPI, a finance unit cannot come within the purview of other categories of investors. Therefore, it can be comprehended that in order for a finance company/unit in IFSC to invest in aforementioned debt instruments it has to register itself as a Forein Portfolio Investor with Securities Exchange Board of India and thereby comply with all the provisions applicable to a Foreign Portfolio Investor. - Restriction on Investment by FPI’s: Investment by an FPI including related FPIs shall not exceed 50% of any issue of a corporate bond.[8] However such restriction shall not be applicable in the event the FPI invests through the Voluntary Retention Route (“VRR”). The applicable limit under the VRR investment route shall be a minimum of 75% of the allotted limit. Further, minimum retention period of 3 years shall only be permitted provided the minimum investment limit is not breached by FPIs. [9]

- Mode of Payment: The amount of consideration for purchase of the debt instruments by an FPI shall be paid out of inward remittances from abroad through banking channels or out of funds held in foreign currency and/or Special Non-Resident Rupee account maintained in accordance with Foreign Exchange Management (Deposit) Regulations 2016.[10]

3. Loans granted to PRI by an IFSC finance company/unit:

Loans granted to PRI by a finance company/unit will be subject to the Foreign Exchange (Borrowing & Lending) Regulations 2018 (“Borrowing and Lending Regulations”). In terms of the said Borrowing and Lending Regulations, resident entities are allowed to raise loans in the form of External Commercial Borrowing (“ECB”) from PROI. Although ECB Directions do not specifically refer to IFSC units as lenders; however, given that IFSC units are PROI, loans from IFSC to resident entities shall be subjected to ECB norms which includes:

- Eligible Borrower: A finance company/unit shall only provide loans to the entities which are eligible for receiving foreign direct investment in terms of Foreign Exchange Management (Transfer or Issue of Security by a Person Resident Outside India) Regulations, 2017 (now, Foreign Exchange Management (Non-debt Instruments) Rules, 2019). Furthermore, the following entities are also eligible to raise ECB:

1. Port Trusts;

2. Units in SEZ

3. SIDBI; and

4. EXIM Bank of India - Maturity: The minimum average maturity period for a loan granted by a finance company/unit shall be 3 years.

- Currency of Borrowing: The finance company/unit can only grant loans in two forms of currencies viz freely convertible foreign currency and Indian Rupees.[11]

- All in Cost[12]:

- For Loans granted in foreign currency

- Existing ECB linked LIBOR: Benchmark rate plus 550 bps spread.

- New ECB: Benchmark rate plus 500 bps spread.[13]

- For loans granted in Indian Rupees: The maximum spread will be 450 basis points per annum over the prevailing yield of the Government of India securities of corresponding maturity.[14]

- For Loans granted in foreign currency

- End Uses: The IFSC finance company/unit shall only grant loans to entities who are not utilising the proceeds of the loan in the negative list prescribed by the Reserve Bank of India.[15]

- Limits of Borrowing:

(i) For all eligible Borrowers: USD 1500 Million or equivalent per financial year under the automatic route.[16] Furthermore, if the lender is also a direct foreign equity holder then the ECB liability equity ratio for ECB raised under the automatic route cannot exceed 7:1 provided that the outstanding amount of all ECB including the proposed one is more than USD 5 million or its equivalent.[17]

(ii) For Startups: USD 3 Million or equivalent per financial year.[18]

Additionally, as per the Borrowing & Lending Regulations, finance entities in the IFSC have been granted the status for eligible lenders for the purposes of providing trade credit for import of non capital and capital goods or for purchase of these capital goods within an SEZ or from a different SEZ

Capital and Liabilities Side Transactions:

Since, the finance entity is considered as a PROI, the loans and investments availed by such entities from domestic tariff areas will be within the purview of the FEMA rules and regulations.

1. Investment by PRI in IFSC finance company/unit:

The investment undertaken by a person resident in India with a foreign entity shall be within the contours of the OI Rules & Regulations 2022. Albeit there is a blanket exemption from the applicability of these OI Rules & Regulations 2022 to financial institutions in IFSC however such exemption only comes into picture when the said IFSC entity invests outside India. The arrangement of a transaction between a person resident in India and a foreign entity is still subject to these rules & regulations and therefore, if investment is made by a person resident in India to a finance entity in the IFSC, the same shall be in compliance with the provisions stated in these OI Rules and Regulations 2022.

Hence, a specific Schedule V has been prescribed under the OI Rules 2022 which provides for compliances to be undertaken by a person resident in India for its investment made in the IFSC finance company/unit. Under the OI Rules 2022, investment by a PRI can be made either through the Overseas Direct Investment or Overseas Portfolio Investment routes. The detailed guidelines vis a vis these routes have been laid down in Schedule I, II, III & IV of the OI Rules which include limits of financial commitment and other certain requirements. However, with respect to IFSC finance companies/units there have been specific exemption from the rules specified in the aforementioned schedule which are as follows:

- Approval of Financial Services Regulator: In case a PRI seeks to undertake Overseas Direct Investment in the IFSC, then the required approval from the concerned financial services regulator shall be decided within 45 days from the date of application. In the event status of the approval is not decided within the said period of time, it will be presumed that the approval is granted and the said PRI will be allowed to invest.

- Prior Experience of Financial Services Activity: If any person resident in India intends to invest in the financial service outside India, then it shall have engaged in the financial services activity in India. However, for investments to be made in entities incorporated in the IFSC such prior experience is not required except for banking and insurance sectors.

- Net Profit: Similarly, if a person resident in India intends to invest in the financial services sector outside India, it has to meet certain net profit thresholds in order for it to be an eligible investor. Such a requirement is eased out for entities in IFSC considering that the government intends to promote investments in such territories.

2. Loans availed by IFSC company/unit from PRI:

Apart from investments, loans availed also constitute the liabilities side of a finance entity in IFSC. These loans can either be from a person resident in India or from an already existing entity in IFSC. For the loans made by persons resident in India to an IFSC finance company/unit, the Borrowing & Lending Regulations come into picture.

A finance company in IFSC intending to take loans from a person resident in India shall come within the purview of external commercial lending as defined in Borrowing & Lending Regulations. Therefore the Schedule III of the Borrowing & Lending Regulations has to be followed while executing any such transaction. Only eligible entities as defined under the Foreign Exchange (Transfer or Issue of any Foreign Security) Regulations, 2004 who have made direct investment in such entities may lend in foreign exchange.

Difference between Finance Company / Unit & NBFCs

Although finance companies are similar to NBFCs in essence, due to the different governing framework, there are certain differences which are detailed in Annexure I at the end of this write-up.

Conclusion

Given the purpose of establishing IFSC in India, the Government of India has intended to make the GIFT IFSC conducive to hassle free investment by incentivising various players to set up their base in GIFT IFSC. Finance companies/units are one of the key players in developing GIFT IFSC as an attractive International Financial Services Centre. The incentives rendered in the taxation and company law are a step in the right direction in promoting more such entities to be established in the IFSC. However, since the GIFT IFSC is still in its nascent stage of development, it will be interesting to note how such a framework is executed with keeping in mind the ultimate objective of having an International Financial Services Centre.

ANNEXURE I

|

Parameters |

Base Layer NBFC |

Middle Layer and Upper Layer NBFC |

Finance Company / Unit |

|

Registration |

Certificate of Incorporation (CoI) from MCA Certificate of Registration (CoR) from RBI |

CoI from MCA and CoR from IFSCA; Approval from GIFT-SEZ Development Commissioner; NOC from the home country regulator. |

|

|

Regulator |

RBI |

IFSCA |

|

|

Applicable law |

1. NBFC-NSI- ND Master Directions 2016 2. SBR Framework |

1. NBFC-SI Non Deposit and Deposit taking Company Master Directions 2016 2. SBR Framework |

1. FC Regulations, 2021 2. IFSCA KYC Guidelines 3. CG Guidelines 4. LRM Guidelines |

|

Principal business criteria |

Entities having: – > 50% of its total assets as financial assets – > 50% of gross income is from financial assets. |

Can carry out either of the following: – core permissible activities; or – non-core permissible activities; or – both. |

|

|

CRAR / Leverage Ratio |

Leverage ratio should not be more than 7. |

CRAR of 15% (out of which Tier-1 capital should be atleast 10%). |

It shall maintain a minimum of 8% of its regulatory capital to risk weighted assets |

|

Minimum Net Owned Fund |

Rs. 10 crores |

FC Regulations prescribe owned fund requirement: – For Core Activities: USD 3 million – For Non-Core Activities: USD 0.2 million. |

|

|

Concentration norms |

Not applicable |

The exposure limits for: a. single borrower / party shall be 25% of the Tier-1 capital; b. Single group of borrowers / party shall be 40% of Tier-1 capital. |

The exposure ceiling whether directly or indirectly shall not exceed 25% of its available eligible capital base. |

|

Liquidity Coverage Ratio |

Not applicable |

Applicable above asset size of Rs. 5000 crores. |

Applicable |

|

Board & Committee Governance |

1. Risk Management Committee 2. Asset Liability Management Committee |

1. Audit Committee 2. Nomination & Remuneration Committee 3. Risk Management Committee 4. Asset Liability Management Committee 5. IT Strategy and IT Steering Committee |

1. Audit Committee 2. Nomination & Remuneration Committee 3. Risk Management Committee 4. Stakeholder relationship committee |

|

Fit and Proper Criteria |

Not applicable |

Applicable |

Applicable |

[1] Bank for International Settlements, Principles for Sound Liquidity Risk Management and Supervision, (September 2008), https://www.bis.org/publ/bcbs144.pdf.

[2] Rule 4 of the OI Rules.

[3] Rule 2(r) & (u) of the NDI Rules

[4] Para 3(b) sub para (v)(A) Schedule 1 of the NDI Rules.

[5] Para 3(b) sub para (v)(B) Schedule I of the NDI Rules.

[6] Rule 6(b) read with Schedule I of the NDI Rules.

[7] Schedule VI of the NDI Rules.

[8] Para 4(f) of the RBI Circular on Investment by Foreign Portfolio Investors (FPI) in Debt) dated 15.06.2018, https://www.rbi.org.in/Scripts/NotificationUser.aspx?Id=11303&Mode=0.

[9] Para 5 of the Notification on Investment by Foreign Portfolio Investors in Debt- Review dated 10.02.2022,https://www.rbi.org.in/Scripts/NotificationUser.aspx?Id=12228&Mode=0#:~:text=The%20Reserve%20Bank%2C%20in%20consultation,in%20debt%20markets%20in%20India.

[10] Para 2(1) Schedule 1 of the DI Regulations.

[11] Para 1 Schedule I of the Borrowing & Lending Regulations..

[12] All-in-cost ceiling has been temporarily increased by 100 bps for ECBs raised till December 31, 2022. The enhanced all-in-cost ceiling shall be available only to eligible borrowers of investment grade rating from Indian Credit Rating Agencies (CRAs). Other eligible borrowers may raise ECB within the existing all-in-cost ceiling as hitherto., https://rbi.org.in/Scripts/BS_ViewMasDirections.aspx?id=11510.

[13] Para 2.1 Part 1 Master Direction- External Commercial Borrowings, Trade Credits and Structured Obligations,https://rbi.org.in/Scripts/BS_ViewMasDirections.aspx?id=11510.

[14] Para 6 Schedule I of the Borrowing & Lending Regulations.

[15] Para 7 Schedule I of the Borrowing & Lending Regulations.

[16] This dispensation will be available for ECBs raised till December 31, 2022, Para 8 Schedule I of the Borrowing & Lending Regulations.

[17] Para 2.2 Part 1 Master Direction- External Commercial Borrowings, Trade Credits and Structured Obligations,https://rbi.org.in/Scripts/BS_ViewMasDirections.aspx?id=11510.

[18] Para 8 Schedule I of the Borrowing & Lending Regulations.

Leave a Reply

Want to join the discussion?Feel free to contribute!