CS Aisha Begum Ansari, Manager & Payal Agarwal, Deputy Manager | corplaw@vinodkothari.com

Background

The identity of a corporate entity may undergo various restructurings, either in the form of merger, demerger, sale of one or more divisions or undertakings. conversion of a company into LLP etc. Let us, for the sake of convenience, call them a “corporate succession” event, implying a situation where a corporate entity is succeeded by another entity, or its business, operations or undertaking shifts to another entity. In some cases, say, amalgamation, the erstwhile corporate entity gets dissolved. In case of a demerger, the transferor entity continues. In case of conversion into LLP or vice versa, a company gets transformed into an LLP or other way round.

Usually, in corporate succession events, the assets and liabilities forming part of an undertaking are shifted to another undertaking, say, the successor entity. The assets and liabilities that are comprised in an undertaking are mostly defined to include all liabilities existing on pertaining to a certain date, let us call it “appointed date”.

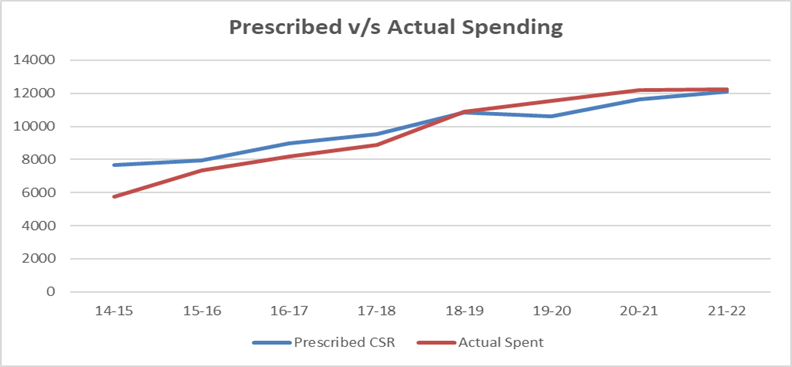

One of the perplexing aspects of this process of transfer of assets and liabilities may be the treatment of the unspent CSR obligations, or excess spending, by the corporate entity which is undergoing a change in its identity. The question becomes increasingly significant in the present day regulatory environment due to the shift in CSR from COPEX (Comply or Explain) to COPP (Comply or Pay Penalty).

In the present write-up, we discuss the treatment of CSR obligations as a result of the following actions resulting into a change in the identity of a corporate –

- Merger

- Demerger

- Sale of a division/ undertaking (“Slump sale”)

- Conversion of a company into LLP

Read more →