– Team Vinod Kothari Consultants P. Ltd. (finserv@vinodkothari.com)

Updated as on October 17, 2020

Background

As a part of measures for combating the effect of COVID-19 on the economy, the Reserve Bank of India (RBI), on August 6, 2020[1], introduced Resolution Framework for COVID-19 Related Stress (‘ResFraCoRS’), a special window for resolution of assets undergoing stress due to COVID-19 disruption[2]. This special window was introduced in addition to the Prudential Framework on Resolution of Stressed Assets issued on June 7, 2019 (FRESA)[3]. We have earlier covered FRESA in a separate write up titled “Prudential Framework for Resolution of Stressed Assets: New Dispensation for dealing with NPAs”[4]

The ResFraCoRS notification (‘Framework’) referred to an expert committee which shall identify suitable parameters, recommend sector-specific parameters, recommend financial and non-financial conditions to be incorporated in the RP, and to vet the RP as discussed above.

Further, the ResFraCoRS notification requires the RP with an amount of Rs. 1500 crores or more to be vetted by the expert committee.

Based on the recommendations of the expert committee submitted to RBI on September 4, 2020[5], the RBI issued a follow-up circular on September 7, 2020[6], which shall be complied, in addition to and as a part of the ResFraCoRS.

We have prepared below, a set of FAQs on ResFraCoRS, based on the aforementioned circulars issued by the RBI.

Furthermore, the RBI released FAQs with respect to the said scheme on October 14, 2020. The below FAQs have been updated after considering the clarifications provided by the RBI in its FAQs.

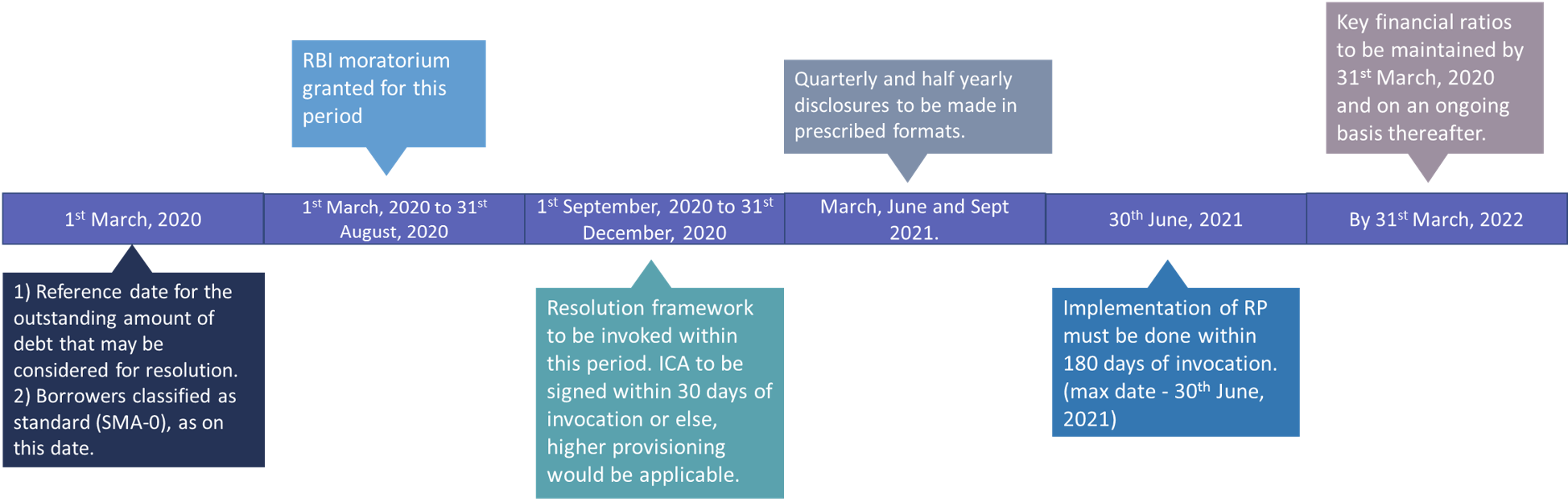

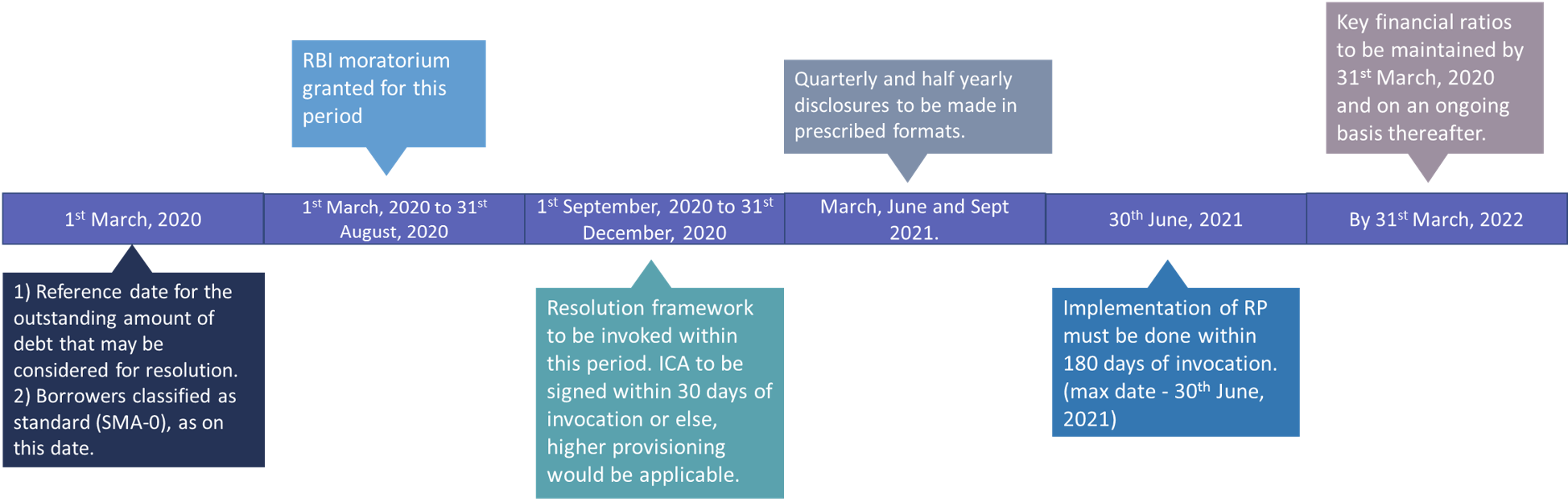

Timeline of events under ResFraCoRS

Frequently Asked Questions (FAQs) –

General

1.If loan modification/restructuring is a mutual contract between the lender and the borrower, why should I be seeing the regulatory framework?

True, loan modification is a mutual contract between the lender and the borrower. However, the Prudential Guidelines provide that if a facility is restructured, with a view to averting a credit weakness, then the restructured facility is regarded as a non-performing facility. This is a general feature of prudential regulations that assets are to be immediately classified as substandard upon restructuring. Hence, if a restructuring is done without adherence to the regulatory framework, then the facility will be treated as non-performing, immediately upon restructuring,

2. How does the loan modification help the lender, borrower, or both?

Loan modification restructures the servicing requirements of a loan, so that the borrower may meet the obligations. If the terms of the loan remain unconnected to the cashflows of the borrower, the borrower may not be able to perform. A non-performing borrower soon starts attracting penal clauses of the loan facility, thereby pushing the borrower further into the realm of non-performance. Eventually, the problem becomes incapable of resolution and may result in the insolvency or chronic default. A chronic default, while meaning exorbitant cost on the borrower, also causes a clog on the books of the lender, and eventually, results in an inefficient economy.

A good credit system is what can be serviced – there is no point in creating credit that cannot be serviced. Therefore, a loan modification, where required, should be encouraged.

Applicability – lenders and borrowers

3. On what lenders shall the ResFraCoRS be applicable?

ResFraCoRS shall be applicable to all banks, NBFCs, HFCs, AIFIs, etc. who have extended loans to eligible borrowers.

4. Are all NBFCs considered as eligible lenders for the purpose of this Framework?

The FRESA was addressed to only systemically important NBFCs and deposit-taking NBFCs. However, the ResFraCoRS, which is a special window to deal with COVID-related disruptions is applicable to all NBFCs. Unlike FRESA, the ResFraCoRS deals with personal loans also, and NBFCs are a key provider of personal loans.

5. Who shall be the eligible borrowers?

Following shall be the eligibility criteria for the borrowers:

- The borrower/loan account should not be falling under the list of ineligible loans/exposures provided in the ResFraCoRS notification;

- In case of resolution of personal loans, the Loan Account should, as on March 1, 2020, be:

- classified as ‘standard’ in the books of the lender

- not be in default for more than 30 days with the lender

- In case of other than personal loans, the loan account should, as on March 1, 2020, be:

- classified as ‘standard’ in the books of all the lenders

- not be in default for more than 30 days with any of the lenders

- The loan accounts should continue to be classified as ‘standard’ in the books of the lender or all the lenders, as the case may be, till the date of invocation of RP.

5A. What kind of personal loans would be covered under the Covid-19 restructuring window? Would it be applicable to car loans/ education loans, etc.?

Under the framework, personal loans refers to loans given to individuals and consist of –

| Sr. No. |

Type of loan covered |

Definition/ remarks, if any |

| a. |

Consumer credit |

Consumer credit refers to the loans given to individuals, which consists of –

(a) loans for consumer durables,

(b) credit card receivables,

(c) auto loans (other than loans for commercial use),

(d) personal loans secured by gold, gold jewellery, immovable property, fixed deposits (including FCNR(B)), shares and bonds, etc., (other than for business / commercial purposes),

(e) personal loans to professionals (excluding loans for business purposes), and

(f) loans given for other consumptions purposes (e.g., social ceremonies, etc.).

However, it excludes

(a) education loans,

(b) loans given for creation/ enhancement of immovable assets (e.g., housing, etc.),

(c) loans given for investment in financial assets (shares, debentures, etc.), and

(d) consumption loans given to farmers under KCC. |

| b. |

Education loan |

While the above definition of consumer credit excludes education loans, housing loans and loans for purchase of financial assets, these loans are covered within the overall definition of “Personal Loans” |

| c. |

Loans given for creation/ enhancement of immovable assets (e.g., housing, etc.) |

| d. |

Loans given for investment in financial assets (shares, debentures, etc.) |

Thus looking at the above definition of personal loans, car loans, education loans, and several other types of loan exposures would be covered under ResFraCoRS.

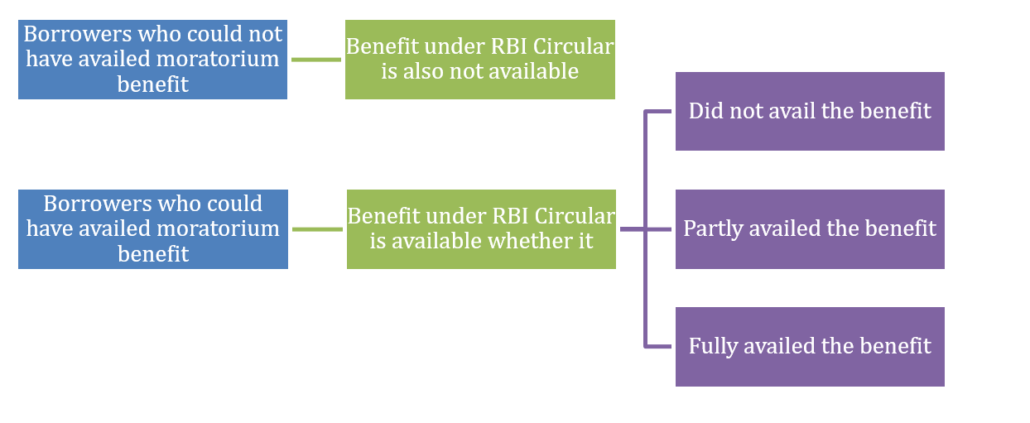

5B. From a lender’s perspective, will an entire category of borrowers be eligible to avail the restructuring benefit?

The restructuring option is applicable for personal loans and other eligible exposures, where the borrower account is classified as standard, but not in default for more than 30 days (SMA-0) as on 1st March, 2020. Accordingly, the restructuring benefit would be applicable only to those who are not excluded under the RBI circular- such as MSME borrower with less than Rs.25crore exposure, are classified as SMA-0 as on March 1, 2020 and are having stress on account of Covid19.

In this regard, an entire category of borrower may be said to be facing stress due to the Covid disruption and subject to fulfillment of the eligibility conditions the restructuring benefit may be extended to them.

5C. Will Loans Against Property (LAP) be eligible under this Scheme?

The end use of LAP is usually for personal purposes. In such a case, personal loans secured by immovable property and other than for business /commercial purposes shall be considered as a personal loan.

For an MSME borrower availing LAP for business purpose and having aggregate exposure of more than 25cr, the same shall be covered under the said framework under Part B- other than Personal Loans.

In case the borrower is a non-MSME, such as an individual or an entity, there is no limit on the exposure and accordingly, there can be two situations-

a. the borrower is availing a LAP facility for personal use- this will be eligible under the framework under the head Personal Loan

b. the borrower is availing a LAP facility for business/commercial use- this will be eligible under the framework under Part B- Other than Personal Loans.

5D. Can restructuring under this framework be done for loans granted after March 1, 2020?

The idea behind this framework is to provide benefit to the accounts which are likely to suffer owing to COVID-19 disruption. If a loan was granted after March 1, 2020, the lender must have had established a preliminary view of the impact of disruption and would have taken the same into consideration before deciding the terms of the loan.

Hence, loans given after the beginning of the disruption should not be eligible for restructuring benefit under this framework.

6. Is a “financial service provider” an eligible borrower, to avail the benefit of the restructuring under the Framework?

The ResFraCoRs specifically exclude exposures to financial service providers. Therefore, financial service providers are not eligible borrowers. The definition of the term “financial service provider” has been drawn from the Insolvency and Bankruptcy Code, 2016. Apparently, NBFCs are covered under the definition of Financial Service Provider.

6A. Is the scheme applicable to MSMEs as well?

The scheme is applicable on MSME borrowers whose aggregate exposure to lending institutions collectively, is Rs. 25 crores or more as on March 1, 2020. The reason for the criteria of Rs. 25 crores or more collective exposure is because there is a separate notification for Micro, Small and Medium Enterprises (MSME) sector – Restructuring of Advances dated August 6, 2020, which is applicable on MSME borrowers having loan limits up to Rs.25 crores.

6B. The criteria for classification of enterprises as MSMEs was revised in July 2020. Should the revised criteria be considered for the purpose of this scheme?

The RBI has in its FAQs clarified that- “For the purpose of eligibility for resolution under the Resolution Framework, the definition of MSME that would be applicable is the one that existed as on March 1, 2020.”

The erstwhile definition of MSMEs prescribed the criteria based on investment limits for manufacturing and service sector entities. There has been a revision in the limits of investment and the addition of turnover limits as an additional requirement. However, for the purpose of determining eligibility under the Scheme, borrowers who were classified as MSME as on March 1, 2020 as per the then existing definition shall be considered.

Pursuant to the notification dated August 21, 2020, registration is a mandatory requirement for MSME borrowers. For this Scheme, since the erstwhile definition is to be considered, which implies that even unregistered MSMEs as on March 1, 2020, shall be eligible.

However, in our view, based on the RBI instructions vide August 21 notification, it is recommended to require all existing MSME borrowers to register on the Udyam portal.

7. Will all exposures be eligible for restructuring under this scheme, say investment exposures in form of Debentures, CP etc.?

Para 3 of the guidelines for the scheme states that the scheme is for all eligible corporate and personal exposures. Hence, the ResFraCoRS may be invoked for the resolution of all exposures to eligible borrowers, including investment exposures.

The same has also been clarified by the RBI in its FAQs.

7A. How will restructuring of debentures, CP etc. be done?

The terms determined at the time of issue of debentures, CP etc. are the final terms. Any change in the same shall be done with the approval of the investors. We have separately dealt with the manner and procedure for restructuring of debentures in our write-up- http://vinodkothari.com/2020/04/covid-19-and-debenture-restructuring/. Similar procedure may be applied to other instruments such as CP as well.

7B. A bank has given a loan to an NBFC, and discovers that due to the prevailing situation, the NBFC will not be able to meet its obligations as they currently exist. Can the bank restructure the facility?

As stated above, the ResFraCoRS exclude exposures to FSPs. Therefore, the benefits under the said framework shall not be available in case of restructuring of loans extended to such entities.

However, banks can, at their discretion, consider restructuring of loans extended to FSPs, in such case, the general principles relating to restructuring of loans shall apply, including downgrading of account to NPA etc.

8. Under what circumstances or with what underlying motive is the ResFraCoRS applicable?

Any borrower, whose ability to service loan/credit facilities has been disrupted because of the COVID disruption may be covered by the Framework.

In our view, the types of borrowers may be classed into:

- Those who had credit weakness/deterioration in credit prior to the beginning of the crisis

- Those who did not demonstrate credit weakness before the COVID disruption (that is, before March 2020) but have had cashflow stress (mild, moderate of severe) during the COVID disruption; once the moratorium period is cover, their business is normal are not having any issues in their ability to service the facility

- Those who did not demonstrate credit weakness before the COVID disruption (that is, before March 2020) but have had cashflow stress during the COVID disruption, which now seems to having a lasting impact on their servicing ability;

- Those who did not demonstrate any credit weakness either before, during or after the COVID disruption

In our view, type (a) does not qualify for the present framework, as the intent of the present framework is only to modify those loans that have been disrupted due to the Covid-19 related stress.

Type (b) also does not require any restructuring. During the 6 months of moratorium, a standstill was granted, and that sufficiently helped the borrower. The borrower is back to the same cashflows as before the crisis/

Type (d) borrowers obviously do not require any restructuring.

It is type (c ) where the Framework requires help. That is where the present Framework operates.

To give an example,

- A personal loan, home loan or car loan was given to a borrower, which was deducted from his monthly salaries. During the month of April to June, the borrower was given a moratorium as his office was shut and the borrower did not get salaries. From the month of July, the office is back in operation and the borrower keeps on getting salaries as before. Obviously there is no need for restructuring in the present case.

- An infrastructure sector contract had taken a loan for an excavator. The excavator was lying idle during the months of April- June. July -Aug-Sept are typical monsoon months. It is expected that from October, normal construction activity may pick. The borrower’s servicing ability does not require any loan modification.

- A loan was given for a CRE project. The project was stuck during April to July. While construction has begun in the month of August, however, it is apprehended that the demand for real estate may remain very sluggish at least over the next 12 months. This seems to be an appropriate case for ResFraCoRS.

Further, under the ResFraCoRS, the eligible borrowers may be divided into 3 categories:

- Category 1- Borrowers of personal loans;

- Category 2- Other than personal loan borrowers, which have availed loans from a single financial institution only;

- Category 3- Other than personal loan borrowers, which have availed loans from more than one financial institution;

9. Is it applicable to both term loans as well as working capital facilities?

The eligibility criteria for ResFraCoRS is based on the asset classification of the borrower and not on the type of loan facility. The demarcation of term loans and working capital facility has to be done for the purpose of granting moratorium, however, for considering restructuring under this framework, any exposure to the borrower shall be covered. Hence, irrespective of the loan account being a term loan or working capital facility, in case it fulfills the eligibility criteria and the lenders have established that the stress in the account is due to covid disruption, the loans may be restructured under this framework.

Formulation of RP

10. The August 6, 2020 as well as the June 7, 2019 circulars refer to a resolution plan – what exactly is a resolution plan?

The objective of a loan modification is not merely to grant concessions – it is to ensure that the terms of the loan are restructured so as to make the loan serviceable, at the same time, without compromising the interests of the lender(s). Hence, the “resolution plan” is the structured approach of the lender in modifying the terms of the loan so as to make the terms mutually agreeable, and mutually beneficial.

Quite often, in cases of large exposures, a resolution plan may involve capitalization of interest, partial conversion of debt into equity, change in terms of security, infusion of capital by the borrower, etc. Therefore, the resolution plan is a comprehensive approach to loan modification.

It is also notable that there are, often, cases of multiple lenders to the same borrower. Therefore, the loan modification is expected to take care of the interests of multiple lenders in a cohesive approach.

11. What are the different options/approaches in the resolution plan?

In case of personal loans covered in Part A, the resolution plans may inter alia include the following:

- rescheduling of payments;

- conversion of any interest accrued, or to be accrued, into another credit facility;

- granting of moratorium, based on an assessment of income streams of the borrower, subject to a maximum of two years.

- Modifying the overall tenor of the loan.

In case of other exposures covered in Part B, the RP may involve any action / plan / reorganization including, but not limited to:

- regularisation of the account by payment of all over dues by the borrower entity;

- sale of the exposures to other entities / investors;

- sanctioning of additional credit facilities;

- allowing extension of the residual tenor of the loan;

- granting moratorium;

- conversion of debt into instruments such as equity, debentures etc.

- change in ownership and restructuring, except compromise settlements which shall continue to be governed by the provisions of the Prudential Framework or the relevant instructions, if any, applicable to specific categories of lending institutions.

The resolution plan may also include sanctioning of additional credit facilities to address the financial stress of the borrower on account of Covid19 even if there is no renegotiation of existing debt.

12. What is the meaning of “invocation” of an RP? Who invokes it? Borrower or lender? If there are multiple lenders, can it be invoked by any lender?

In case of personal loans the borrower and lender should agree to proceed with RP. The date on which the borrower and lender agree to proceed with the RP shall be the date of “invocation”.

In case of other exposures, where there is only one lending institution with exposure to the borrower, the decision regarding the request for resolution by the borrower may be taken by the lending institution as per the Board approved policy of the institution and within the contours of this framework.

This is similar to the existing Corporate Debt Restructuring scheme of RBI where the borrower does not have the inherent right to ask the lenders to restructure, however, the borrower may certainly request lenders to consider the same. Further, for this purpose, the date of invocation shall be the date on which both the borrower and lending institution have agreed to proceed with a resolution plan under this framework.

In case of multiple lenders with exposure to the borrower, the resolution process shall be treated as invoked in respect of any borrower if lending institutions –

- Representing 75% by value of the total outstanding credit facilities (fund based as well non-fund based), and

- not less than 60% of lending institutions by number agree to invoke the same.

13. The facility is currently not in default. It was within 30 days past due as on 1st March and thereafter, the facility was covered by moratorium. On 1st September, the lender realises that the cashflows of the borrower may be strained. Does the lender have to wait for any default? Can there be restructuring even when there is no default?

In our view, the resolution may be done for an imminent or incipient, or even apprehended default. The whole idea of resolution is to resolve a problem before it becomes unsurmountable. Hence, the fact of any default is not a precondition.

14. Who will frame the repayment plan?

In case of category 1 and 2 borrowers, the lender shall frame the RP. In case of multiple lenders i.e. category 3 borrowers, execution of ICA is a mandatory requirement wherein all the lenders shall agree on a resolution process, based on which a RP shall be formulated. Further, the Expert Committee shall verify the RP implemented in case the aggregate exposure of the lending institutions is Rs. 1500 crore or more.

15. What are the different stages of the loan restructuring process?

- Realisation that a restructuring is required

- Invocation of restructuring plan

- Framing of restructuring plan

- Signing of an ICA

- Implementation of the restructuring plan including putting in place an escrow mechanism etc

- Review period

- Post-review period

16. What are the preconditions for invocation of RP?

For categories 1 and 2:

- The borrower should be eligible; and

- The borrower and lender should agree to proceed with RP.

For category 3:

- The borrower should be eligible;

- Lending institutions representing at least 75 % by value of the total outstanding credit facilities (fund based as well non-fund based) agree to invoke the RP; and

- At least 60 % of lending institutions by number agree to invoke the RP.

17. In case of borrowers with business loans, is there any classification/ categorisation of borrowers based on the size of the exposure?

Under the Framework, it may be useful to classify borrowers into the following sizes:

- Aggregate exposure of Rs 100 crores or more – Independent credit evaluation (ICE) by any one credit rating agency (CRA) authorized by the RBI under FRESA to be carried out.

- Aggregate exposure of Rs 1500 crores or more- the RP shall be subject to vetting by the expert committee.

17A. In case of accounts for which ICE is conducted, is there a prescribed rating that an account must achieve in order to be restuctured?

The RBI released its FAQs regarding restructuring on October 14, 2020. The FAQs state that – “Only such resolution plans which receive a credit opinion of RP4 or better for the residual debt from a CRAs shall be considered for implementation under the Resolution Framework. In case credit opinion is obtained from more than one CRA, all such credit opinions must be RP4 or better.”

17B. What does the RP4 rating indicate?

RP is a rating indicator used by rating agencies for ICE of residual debts of borrowers. RP4 rating indicates that the debt facility/instrument has a moderate degree of safety regarding timely servicing of financial obligations and carries moderate credit risk.

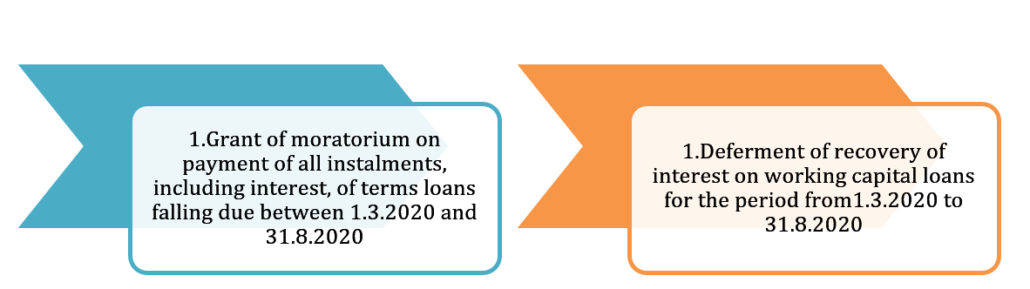

18. One of the measures is providing a moratorium on loan repayment. Will this moratorium be a part of the existing moratorium facility provided to borrowers?

The ResFraCoRS notification provides that in cases where moratorium is granted to eligible borrowers, such moratorium shall be subject to a ceiling of 2 years. It is to be noted that the resolution under this framework is independent of any moratorium or other relief provided to the borrowers under other frameworks introduced by the RBI.

Hence, the above mentioned period of 2 years shall be in addition to the earlier moratorium granted to the borrowers. The earlier moratorium is not to be included in this period of 2 years.

This has been further clarified by para 28 of the ResFraCoRS notification, which states that the moratorium shall come into force immediately upon implementation of the resolution plan.

19. Can the debt be converted into equity instruments?

Conversion of debt into equity may be done provided the amortisation schedule and the coupon carried by such debt securities must be similar to the terms of the debt held on the books of the lending institutions, post implementation of the resolution plan.

Further, equity instruments are to be valued at market value, if quoted, or else, should be valued at the lowest value arrived using the book value or discounted cashflow valuation methodologies. Equity instruments, where classified as NPA shall be valued at market value, if quoted, or else, shall be collectively valued at Re.1. [Refer para 19 (c) and (d) of Annex to the Prudential Framework dated 7th June, 2019].

20. Can the debt be converted into NCDs/ preference shares or any other instrument?

Yes, the special window makes it clear that conversion of debt into NCDs or preference shares or any other instrument may be done. The debentures/ bonds would be valued on the YTM basis as per para 3.7.1 of the Master Circular – Prudential Norms for Classification, Valuation and Operation of Investment Portfolio by Banks[7] dated July 1, 2015 (as amended from time to time) or would be valued as per other relevant instructions as applicable to specific categories of lending institutions.

In case of conversion of any portion of the debt into any other security, the same shall collectively be valued at Re.1.

ICA and Escrow Arrangement

21. Is signing of Inter-Creditor Agreement (ICA) mandatory?

The notification clarifies that signing of ICA is a mandatory requirement for all lending institutions in all cases involving multiple lending institutions, where the resolution process is invoked.

22. Is there any time limit for signing the ICA?

The ICA should be signed within 30 days of invocation of RP.

23. What will happen if ICA is not signed within the time limit?

In case the ICA is not signed within the prescribed time limit, the invocation of RP shall lapse. Further, additional provision of 20% will have to be maintained in respect of the carrying debt of the borrower in question, i.e. total outstanding of the borrower to all its lenders.

24. How should escrow accounts be maintained in case of ICA?

Escrow accounts shall be required only in case of category 3 borrowers. Para 10 of the follow-up circular states that the escrow account shall be maintained after implementation of RP on borrower-account level, i.e. the legal entities to which the lending institutions.

25. What are the limitations of the restructuring under the ResFraCoRS Framework?

The main limitation of the restructuring under ResFraCoRS is the tenor restrictiction of 2 years, in case of granting of moratorium under resolution plans. Further, the ratios prescribed under the financial parameters by the expert committee are required to be met by 2022 and on an ongoing basis thereafter. It must be noted that the expert committee suggested that the TOL/Adjusted TNW and Debt/ EBIDTA ratios should be met by FY 2023. Further, some of the conditions (discussed later) of the Prudential Framework of June, 2019 are also additionally applicable in case of ResFraCoRS.

Relevance of the 7th June 2019 – Prudential Framework for Resolution of Stressed assets

26. Is the COVID-related framework a special case within the 7th June 2019 Directions, or is it an independent restructuring proposition?

The ResFraCoRS is a special window under the 7th June, 2019 – Prudential Framework for Resolution of Stressed Assets issued by RBI. Accordingly, the requirements specified in the Prudential Framework of June, 2019 would also apply in case of ResFraCoRS.

It is further clarified that accounts which do not fulfill the required eligibility conditions to be considered for resolution under the ResFraCoRS may continue to be considered for resolution under the Prudential Framework of June, 2019, or the relevant instructions as applicable to specific category of lending institutions where the Prudential Framework is not applicable.

27. What are the major provisions of the June, 2019 Directions which are applicable to the Covid-related restructuring as well?

The ResFraCoRS specifically mentions that without prejudice to the specific conditions applicable to this facility, all the norms applicable to implementation of a resolution plan, including the mandatory requirement of Inter Creditor Agreements (ICA) and specific implementation conditions, as laid out in the Prudential Framework shall be applicable to all lending institutions for any resolution plan implemented under this facility. Terms used in this document, to the extent not defined in the ResFraCoRS, shall have the same meaning assigned to them in the Prudential Framework.

Accordingly, the following major provisions of the Prudential Framework of June, 2019 would apply to the ResFraCoRS as well –

| Para No. |

Particulars |

Requirement |

| 9 |

Policy for resolution of stressed assets |

Lenders must put in place a Board approved policy for resolution of stressed assets.

This is apart from the policies mentioned in the COVID-related framework and these may be combined into a single policy as well. |

| 10 |

Inter Creditor Agreement (ICA) |

The ICA shall provide that any decision agreed by lenders representing 75% by value of total outstanding credit facilities (fund based as well non-fund based) and 60% of lenders by number shall be binding upon all the lenders.

Additionally, the ICA may, inter alia, provide for rights and duties of majority lenders, duties and protection of rights of dissenting lenders, treatment of lenders with priority in cash flows/differential security interest, etc. In particular, the RPs shall provide for payment not less than the liquidation value due to the dissenting lenders. |

Further, para 13 of the Prudential Framework dealing with inclusions in the RP are also applicable to ResFraCoRS with some modifications/ exceptions stated in para 27 of ResFraCoRS. Furthermore, it seems that para 16 of the Prudential Framework would also apply in case of ResFraCoRS (para 16 deals with deemed implementation in case of RP involving lenders exiting the exposure by assigning the exposures to third party or a RP involving recovery action).

28. The Prudential Framework mentions other requirements such as “Review Period” and “Prudential Norms”. Would these apply in case of ResFraCoRS?

Para 6 of ResFraCoRS states that all norms applicable to “implementation of a RP” under the Prudential Framework of June, 2019 would apply to ResFraCoRS. Accordingly, prudential norms would not be applicable in case of ResFraCoRS as this is already specifically taken care of in ResFraCoRS itself.

Furthermore, other requirements such as review of the borrowers account within 30 days of default would not apply as the ResFraCoRS already prescribed specific eligibility norms in its framework.

Financial Parameters

29. What financial parameters are to be considered while formulating the RP?

The notification has defined a set of 5 key ratios that must be mandatorily considered while finalising the resolution plan in respect of eligible borrowers. While the mandatory ratios must be followed, lenders have the liberty to consider other financial parameters as well, while finalizing the resolution assumptions in respect of eligible borrowers.

The Key ratios and definitions along with additional remarks on the same are presented below –

| Sr. No. |

Key Ratio |

Definition |

| 1 |

Total Outside Liabilities / Adjusted Tangible Net Worth (TOL/ATNW)

(Ceiling) |

Addition of long-term debt, short term debt, current liabilities and provisions along with deferred tax liability divided by tangible net worth net of the investments and loans in the group and outside entities. |

| Remarks – In respect of those sectors where the sector-specific thresholds have not been specified, lending institutions shall make their own internal assessments regarding TOL/ATNW.

Compliance to TOL/ATNW agreed as per the resolution plan is expected to be ensured by the lending institutions at the time of implementation itself.

Nevertheless, in all cases, this ratio shall have to be maintained as per the resolution plan by March 31, 2022 and on an ongoing basis thereafter.

Wherever the resolution plan envisages equity infusion, the same may be suitably phased-in over this period.

Another concern in this regard is that the definition of Adjusted Tangible Net Worth provides for deduction of investments and loans in the group and outside entities. Considering a large proportion of the eligible borrowers for this framework will be infrastructure companies, this could be a major problem. Most of the entities engaged in the infrastructure space operate through SPVs, instead of working directly. Therefore, the majority of their assets are deployed in the equity of the SPVs. If the above definition of ATNW is to be followed, these entities will become ineligible for the purpose of this framework. |

| 2 |

Total Debt / EBITDA

(Ceiling) |

Addition of short term and long-term debt divided by addition of profit before tax, interest and finance charges along with depreciation and amortisation. |

| Remarks –

In respect of those sectors where the sector-specific thresholds have not been specified, lending institutions shall make their own internal assessments regarding Total Debt/ EBITDA.

This shall have to be maintained as per the resolution plan by March 31, 2022 and on an ongoing basis thereafter. |

| 3 |

Current Ratio

(Floor) |

Current assets divided by current liabilities |

| Remarks –

Current ratio in all cases shall be 1.0 and above.

This shall have to be maintained as per the resolution plan by March 31, 2022 and on an ongoing basis thereafter. |

| 4 |

Debt Service Coverage Ratio (DSCR)

(Floor) |

For the relevant year addition of net cash accruals along with interest and finance charges divided by addition of current portion of long term debt with interest and finance charges. |

| Remarks –

This shall have to be maintained as per the resolution plan by March 31, 2022 and on an ongoing basis thereafter. |

| 5 |

Average Debt Service Coverage Ratio (ADSCR)

(Floor) |

Over the period of the loan addition of net cash accruals along with interest and finance charges divided by addition of current portion of long term debt with interest and finance charges. |

| Remarks –

ADSCR shall in all cases be 1.2 and above.

This shall have to be maintained as per the resolution plan by March 31, 2022 and on an ongoing basis thereafter. |

30. Are the financial parameters required to be considered in all the cases?

The financial parameters shall be considered in case of RP formulated for borrowers eligible under part B of ResFraCoRS. Part B of the ResFraCoRS deals with borrowers falling in categories 2 and 3.

31. What are prescribed thresholds to be maintained in respect to the ratios?

The expert committee has prescribed thresholds specific to the nature of the various industries. The annexure to the follow-up circular contains the ceilings/floors prescribed with respect to 26 sectors/industries.

32. What should be done in case there are no sector-specific parameters prescribed with respect to a certain industry?

While the follow-up circular prescribes ratio limits for a wide variety of industries, certain borrowers may not fall in any of those sectors. Further, in the annexure, certain ratios for some sectors have not been prescribed. For such kinds of borrowers, the lenders shall determine the limits considering the financial situation of the borrower, viability of borrower’s business, and the stress on the borrower. However, the current ratio and DSCR in all cases shall be 1.0 and above, and ADSCR shall be 1.2 and above.

33. The sectors specified in the framework do not include financial services, does this mean financial services entities (such as NBFCs, HFCs, who have availed loans from other NBFCs/banks) are not eligible for restructuring under this framework?

The sector specific ratios are provided as general parameters to be considered while formulating RP. This in no way indicates that the borrowers belonging to such sectors shall not be eligible for restructuring.

In case of borrowers falling in the sectors for which the ratios are not specified, the lender shall decide its own limits based on the assessment of the borrower.

However, please refer to our response on eligibility of loans to FSPs under this framework.

34. Who shall meet the ratios?

The borrower is required to meet the ratios at entity-level and the lenders are required to ensure that the same is being met as per the timelines.

For the real estate sector, the expert committee recommended that the ratios with respect to particular projects be met since the loans are usually granted for a project. However, the RBI, in the follow-up circular has not laid any such provision.

35. At what point of time shall these ratios be considered?

The above mentioned key ratios shall have to be maintained by the borrower as per the resolution plan by March 31, 2022 and on an ongoing basis thereafter.

Additionally, TOL/ATNW shall be required to be maintained by the borrower at the time of implementation of the RP itself, as per the resolution plan by March 31, 2022 and on an ongoing basis thereafter.

36. As discussed above, TOL/ATNW shall be maintained at the time of implementation. What should be done in case the ratio is not met?

In case the TOL/ATNW ratio is not met at the time of implementation, the same may require equity infusion by the promoters or conversion of outstanding debt to equity to meet the criteria.

37. Several instruments are treated as debt due to Ind-AS, would these instruments be considered to be included in the definition of TOL/ATNW?

The definition of TOL/ATNW provided under the notification dated 07th September, 2020 seems to be hinting towards what is legally considered to be a debt. Thus, for the purposes of TOL/ATNW, instruments considered as a debt as per Ind-AS would not come under this definition.

For instance, redeemable preference shares are considered as a debt as per Ind-AS 32. However, for the purpose of TOL/ATNW, redeemable preference shares would not be considered.

38. What parameters shall be considered other than the ratios prescribed by the follow-up circular?

Lenders shall, in addition to the above mentioned ratios, consider pre-Covid-19 operating and financial performance of the borrower and impact of Covid-19 on its operating and financial performance at the time of finalising the resolution plan. Further, they shall also assess the expected cashflows in subsequent years, to ensure that the ratios will be complied with on an ongoing basis.

39. Should these ratios be met by the borrower at the time before covid?

The ResFraCoRS is for the borrowers whose business is otherwise viable but has been affected due to covid disruption. Hence, financial institutions considering to restructure loan accounts under ResFraCoRS, shall evaluate the financial condition of borrower pre and post covid.

These ratios provide a quantifiable basis for evaluating the financial condition of the borrower. Going by the intent, the borrower should positively meet the ratios before crisis and thereafter reach the ratios in the prescribed time.

40. What if ratios are not met in the pre-covid period?

In case the ratios are not met pre covid, it is an indication that financial strength of the borrower was not very stable even before the crisis. Hence, it is not because of the crisis that the borrower is unable to pay. Considering this, the account of the borrower should not be restructured under ResFraCoRS.

It is noteworthy that the ratios are not the sole indicators of financial strength of a borrower. Several other parameters as suitable to the nature of the borrower should also be considered.

41. What if out of 5, only 3 ratios are met in the pre-covid period?

In case the borrower meets some of the ratios and not all, the lenders shall assess other parameters as well to evaluate financial condition of the borrower and decide whether restructuring shall be done for such borrower account.

42. In case there is only a single lender to a borrower, what ratios or parameters shall be met by such borrower?

Para 5 of the follow-up circular clearly states that the above mentioned ratios shall be met even in case a borrower has availed loan from only one lending institution. These kinds of borrowers shall fall under category 2 discussed above. Even though certain provisions of the ResFraCoRS may not be applicable on this category, maintenance of ratios shall certainly be applicable.

43. What happens if the borrower fails to meet the ratios at any time after implementation of RP?

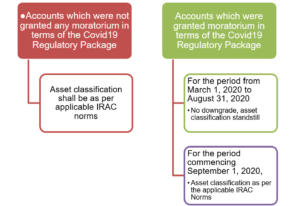

If the borrower is unable to meet the prescribed ratios it shall be construed as a default on its part to comply with the terms of the RP. This would result in downgrade of asset classification of the borrower to NPA, with all lending institutions, including those who did not sign the ICA, from the date of implementation of the RP or the date from which the borrower had been classified as NPA before implementation of the plan, whichever is earlier.

Provisioning requirements

44. Para 39 of the Framework states that a provision of 10% shall be applicable on accounts which have been restructured in terms of the Framework. How is the restructuring, under this Framework, then different from any other restructuring?

In case of any other restructuring, the classification of the asset gets downgraded to NPA status. The provision requirement on NPAs may be 10%, but that 10% is for a sub-standard asset.

In case of restructuring under the Framework, if the restructuring is done, the asset retains its standard status and the 10% provision shall be a ‘provision specific to the asset’ created considering the risk involved in the asset after restructuring.

It is also notable that there was no requirement of the 10% provision under the June 2019 Directions. There were disincentives against not implementing the resolution plan within the timelines in para 17 of the Directions.

44A. What will be the treatment of additional provisions in the books of NBFCs which are IndAS compliant?

NBFCs that are required to comply with IndAS shall continue to be guided by the guidelines duly approved by their Boards and as per ICAI advisories for recognition of significant increase in credit risk and computation of Expected Credit Losses.

The additional provisioning requirement discussed above shall be treated as the prudential floor for the purpose ECL computation.

45. Will there be a case for reversal of the provision as referred to above?

Yes, half of the provisions may be reversed if the borrower repays 20% of the residual debt outstanding to the lender or lenders as the case maybe, provided the asset has not slipped into NPA post implementation of the RP.

Further, the remaining half may also be reversed when additional 10% of the carrying debt is repaid. However, it shall be ensured that such reversal does not result in reduction of provisions below the provisioning requirements as per IRAC provisions.

Credit information reporting

46. Does the fact of restructuring under the Framework have to be reported to CRILC or anywhere else?

As per the ResFraCoRS, for the purpose of credit reporting, the accounts shall be treated as restructured if the resolution plan involves renegotiations that would be classified as restructuring under the FRESA. The credit history of the borrowers shall consequently be governed by the respective policies of the credit information companies as applicable to accounts that are restructured.

Other Considerations

47. As per ResFraCoRS, a policy is required to be adopted for resolution of assets under the said framework. Will the follow-up circular require amendment to the policy adopted by a company in this regard?

In our view, considering that the key ratios are mandatory, a suitable modification to the policy would be required to be made.

48. The follow-up circular talks about gradation of borrowers. On what basis shall the gradation be done?

The follow-up circular states that lenders may carry out a gradation of the borrowers. This gradation shall be done based on the impact of the pandemic on a specific sector or the borrower. As per the recommendation of the expert committee, borrowers may be graded into mild, moderate and severe impact borrowers.

While considering the gradation of the borrowers, the amount and risk involved, extent of legal/regulatory compliances involved in the resolution process etc. should also be factored in.

49. What is the purpose of such gradation?

Gradation of borrowers based on the severity of impact, extent of compliances and the amount and risks involved, enables the lenders to distinguish the accounts that require more attention. Based on the gradation, lenders may decide upon internal procedures such as delegation, time involvement etc, for various categories of accounts.

[1] https://www.rbi.org.in/Scripts/NotificationUser.aspx?Id=11941&Mode=0#FT2

[2] Our write-up on the Framework may be referred here- http://vinodkothari.com/2020/08/resolution-framework-for-covid-19-related-stress-resfracors/

[3] https://www.rbi.org.in/Scripts/NotificationUser.aspx?Id=11580&Mode=0

[4] http://vinodkothari.com/2019/06/fresa/

[5] https://www.rbi.org.in/Scripts/PublicationReportDetails.aspx?UrlPage=&ID=1157

[6] https://www.rbi.org.in/Scripts/NotificationUser.aspx?Id=11961&Mode=0

[7] https://www.rbi.org.in/Scripts/BS_ViewMasCirculardetails.aspx?id=9904#371