No compound interest during moratorium: RBI directs lenders pursuant to SC order

Anita Baid | Vice President, Financial Services (anita@vinodkothari.com)

Overview

The Supreme Court of India (‘SC’ or ‘Court’) had given its judgement in the matter of Small Scale Industrial Manufacturers Association vs UOI & Ors. and other connected matters on March 23, 2021. The said order of SC put an end to an almost ten months-long legal scuffle that started with the plea for complete waiver of interest, but edged towards waiver of interest on interest, that is, compound interest, charged by lenders during Covid moratorium. From the miseries suffered by people due to the pandemic, to the economic strangulation of trade and activity – the unfinished battle with the pandemic continues. Nevertheless, the SC realised the economic limitation of any Government, even in a welfare state. The SC acknowledged that the economic and fiscal regulatory measures are fields where judges should encroach upon very warily as judges are not experts in these matters. What is best for the economy, and in what manner and to what extent the financial reliefs/ packages be formulated, offered and implemented is ultimately to be decided by the Government and RBI on the aid and advice of the experts.

Compound interest continues to elude judicial acceptance – there are several rulings against compound interest pertaining to arbitral awards, and a lot more for civil awards. In the present ruling as well, observations of the Apex court seem to be indicating that compound interest is penal in nature. This may be surprising to a person of finance, as in the financial world, compound interest is ubiquitous and unquestionable.

In the concluding part of the judgment while dismissing all the petitions, the Court lifted the interim relief granted earlier, pertaining to the NPA status of the borrowers. However, the last tranche of relief in the judgement came for the large borrowers that had loans outstanding/ sanctioned as on February 29, 2020 greater than Rs. 2 crores, and other borrowers who were not eligible to avail compound interest relief as per the Scheme for grant of ex-gratia payment of difference between compound interest and simple interest for six months to borrowers in specified loan accounts (1.3.2020 to 31.8.2020) dated October 23, 2020 (“Ex-Gratia Scheme”). The Court did not find any basis for the limit of Rs 2 crores while granting relief of interest-on-interest (under ex-gratia scheme) to the borrowers. Thus, the Court directed that there shall not be any charge of interest on interest/ penal interest for the period during moratorium for any borrower, irrespective of the quantum of loan, or the category of the borrowers. The lenders should give credit/ adjustment in the next instalment of the loan account or in case the account has been closed, return any amount already recovered, to the concerned borrowers.

Given that the timelines for filing claims under the ex-gratia scheme have expired, it was expected that the Government would be releasing extended/ updated operational guidelines in this regard for adjustment/ refund of the interest on interest charged by the lenders from the borrowers. Further, it seemed that the said directions of the Court would be applicable only to the loan accounts that were eligible and have availed moratorium under the COVID 19 package.

However, as a consequence of the aforesaid ruling, the Reserve Bank of India (‘RBI’) has issued a circular on April 7, 2021 (‘RBI Circular’) instructing the financial institutions to take steps for refund/ adjustment of the interest on interest. While the SC order clearly pertains to the Ex-Gratia Scheme of MoF, the RBI does not talk anywhere about the burden being passed to the GoI.

The RBI Circular is applicable on all lending institutions, that is to say, (a) Commercial Banks (including Small Finance Banks, Local Area Banks and Regional Rural Banks), (b) Primary (Urban) Co-operative Banks/State Co-operative Banks/ District Central, Co-operative Banks, (c) All All-India Financial Institutions, (d) Non-Banking Financial Companies (including Housing Finance Companies).

Interest on Interest

More than 20 writ petitions were filed with the Supreme Court and the relief sought by them can broadly be classified in four parts – waiver of compound interest/ interest on interest during the moratorium period; waiver of total interest during the moratorium period; extension of moratorium period; and that the economic packages/ reliefs should sector specific. Our write on the issue can be read here.

The contention of the petitioners was that even charging interest on interest/compound interest can be said to be in the form of penal interest. Further, it was argued that the penal interest can be charged only in case of wilful default. In view of the effect of pandemic due to Covid19 and even otherwise, there was a deferment of payment of loan during the moratorium period as per RBI circulars, hence, it cannot be said that there is any wilful default which warrants interest on interest/penal interest/compound interest. The appeal was that there should not be any interest on interest/penal interest/compound interest charged for and during the moratorium period.

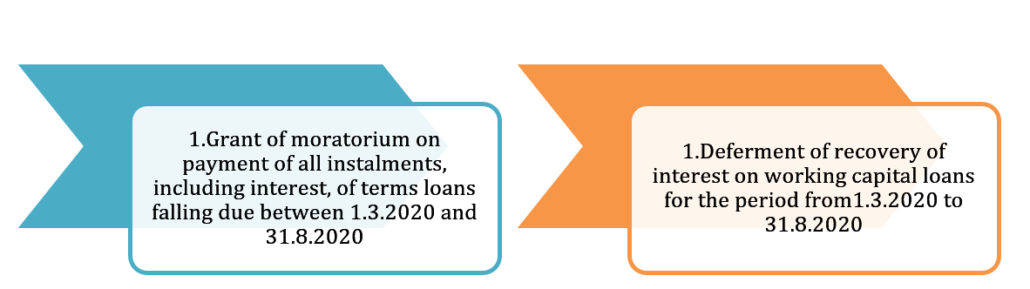

The Central Government and RBI had already provided the following reliefs to mitigate the burden of debt servicing brought about by disruptions on account of Covid19 pandemic:

The nature of moratorium was to provide a temporary standstill on payment of both, principal and interest thereby providing relief to the borrowers in two ways, namely, the account does not become NPA despite nonpayment of dues; and since there was no reporting to the Credit Information Companies, the moratorium did not adversely impact the credit history of the borrowers.

It is important to understand the concept of “moratorium”- the word “moratorium” is categorically defined by the RBI, while issuing various circulars. The relevant circulars of RBI show that “moratorium” was never intended to be “waiver of interest”, but “deferment of interest”. In other words, if a borrower takes the moratorium benefit, his liability to make payment of contractual interest (both normal interest and interest on interest) gets deferred for a period of three months and subsequently three months thereafter. After a very careful and major consideration of several fiscal and financial criteria, it’s inevitable effects and keeping the uncertainty of the existing situation in mind, the payment of interest and interest on interest was merely deferred and was never waived.

Further, it is to be noticed that while the standstill applicable to bank loans results in the bank not getting its funds back during the period of moratorium, the bank continues to incur cost on bank’s deposits and borrowings. Since a moratorium offers certain advantages to borrowers, there are costs associated with obtaining the benefit of a moratorium and placing the burden of the same on lenders might just shift the burden on the financial sector of the country. If the lenders were to bear this burden, it would necessarily wipe out a substantial and a major part of their net worth, rendering most of the banks unviable and raising a very serious question over their very survival. Even on the occurrence of other calamities like cyclone, earthquake, drought or flood, lenders do not waive interest but provide necessary relief packages to the borrowers. A waiver can only be granted by the Government out of the exchequer. It cannot come out of a system from banks, where credit is created out of the depositor’s funds alone. Any waiver will create a shortfall and a mismatch between the Bank’s assets and liabilities.

Considering the same, the Government had granted the relief of waiver of compound interest during the moratorium period, limited to the most vulnerable categories of borrowers, that is, MSME loans and personal loans up to Rs. 2 crores. Our write up on the same can be viewed here.

However, the SC felt that there is no justification to restrict the relief of not charging interest on interest with respect to the loans up to Rs. 2 crores only and that too restricted to certain categories. Accordingly, the SC had directed that directed that there shall not be any charge of interest on interest/compound interest/penal interest for the period during the moratorium and any amount already recovered under the same head, namely, interest on interest/penal interest/compound interest shall be refunded to the concerned borrowers and to be given credit/adjusted in the next instalment of the loan account.

The ruling however, did not clarify as to who shall bear the burden of the waiver of such interest on interest. Further, the RBI Circular seems to place the burden on the lenders and not wait for the Government to come up with a relief scheme or extend the existing ex-gratia scheme.

RBI Circular

Coverage of Lenders

All lending institutions are covered under the ambit of the RBI Circular. The coverage includes all HFCs and NBFCs, irrespective of the asset size. Clearly, non-banking non-financial entities, or unincorporated bodies are not covered by the Circular.

Coverage of Borrowers

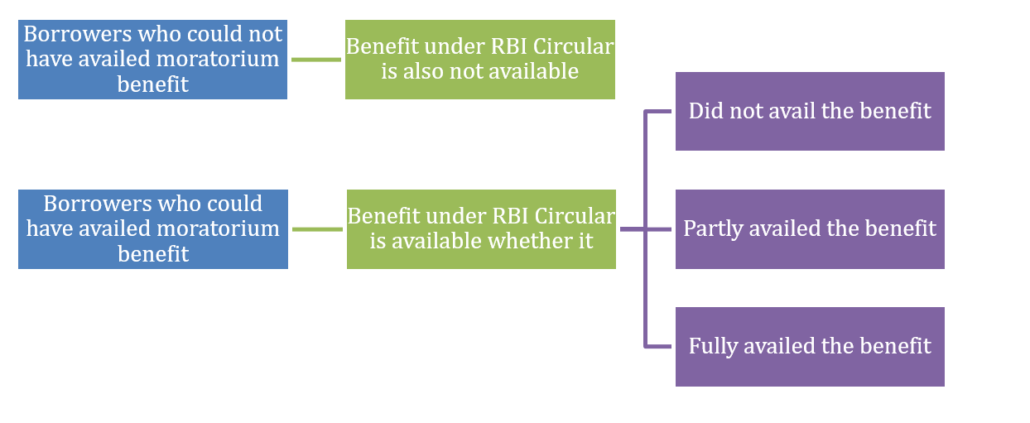

The borrowers eligible as per March 27 Circular (COVID-19 – Regulatory Package) were those who have availed term loans (including agricultural term loans, retail and crop loans) and working capital financing in the form of cash credit/ overdraft. Certain categories of borrowers were ineligible under the March 27 Circular such as those which were not standard assets as on 1st March 2020. Hence, loans already classified as NPA continued with further asset classification deterioration during the moratorium period in case of non-payment.

The question that arises is whether the benefit under the RBI Circular is limited to any particular type of facility? The benefit of the RBI Circular is to be provided to all borrowers, including those who had availed of working capital facilities during the moratorium period. Further, the benefit is irrespective of the amount sanctioned or outstanding and irrespective of whether moratorium had been fully or partially availed, or not availed. However, this should include only those loans that were originally eligible to claim the moratorium but did not claim it or claimed partially or fully.

Thus, all corporate borrowers, including NBFCs who may have borrowed from banks, are apparently eligible for the relief.

Another crucial aspect is whether the benefit is applicable to facilities which have been repaid, prepaid during the moratorium period? If so, upto what date? The benefit must be provided to all eligible loans existing at the time of moratorium but has been repaid as on date.

Coverage of facilities

Both term loans as well as working capital facilities are covered. Facilities which are not in the nature of loans do not seem to be covered. Further, facilities for which the Covid moratorium was not applicable also do not seem to be covered. Examples are: unfunded facilities, loans against shares, invoice financing, factoring, financial leases, etc. In addition, borrowing by way of capital market instruments such as bonds, debentures, CP, etc are not covered by the RBI Circular.

Questions will also arise as to whether lenders will be liable to provide the relief in case of those loans which are securitised, assigned under DA transactions or transacted under co-lending arrangement? We have covered these questions in our detailed FAQs on the moratorium 1.0 and 2.0.

Since the moratorium benefit was to be extended only to such installments that were falling due during the said moratorium period. Hence, only those borrowers were eligible for availing moratorium who were standard as on February 29, 2020 and whose installments fell due during the moratorium period. Accordingly, there can be the following situations:

Burden of interest on interest

The SC order was with reference to the Central Govt decision vide Ex-Gratia Scheme. Among other things, the petitioners had challenged that there was no basis for limiting the amount of eligible facilities to Rs 2 crores, or limiting the facility only to categories of borrowers specified in the Ex-Gratia Scheme. As per the GoI decision, the benefit was to be granted by lending institutions to the borrowers, and correspondingly, there was a provision for making a claim against SBI, acting as the banker for the GoI.

The SC order is an order upon the UoI. Neither were individual banks/NBFCs parties to the writ petition, nor does it seem logical that the order of the Court may require parties to refund or adjust interest which they charged as per their lending contracts. The UoI may be required to extend a benefit by way of Covid relief, but it does not seem logical that the burden may be imposed on each of the lending institutions, who, incidentally, did not even have the chance to take part in the proceedings before the apex court.

Hence, it seems that the impact of the SC order is only to extend the benefit of the Ex-Gratia Scheme to all borrowers, but the mechanics of the original circular, viz., lending institutions to file a counterclaim against the UoI through SBI, should apply here too.

Accounting disclosure for FY 20-21

The RBI Circular talks about a disclosure for the adjustment or refund to be reflected in the financial statements for FY 20-21.

In terms of accounting standards, the question whether the liability for refund or adjustment of the compound interest is a liability or a provision will be answered with reference to Ind AS 37 Provisions, Contingent Liabilities and Contingent Assets. Since the RBI Circular may be seen as creating a liability as on 31st March, 2021, the lending institution may simply adjust the differential amount [that is, compound interest – simple interest on the Base Amount] into the ongoing account of the customer. If such a liability has been booked, there is no question of any provision.

The computation of the differential amount will have to be done for each borrower. Hence, any form of macro computation does not seem feasible. Therefore, there will not be much of a difference between a provision and a liability.

Accounting for the refund in FY 20-21 by the borrowers

If the lending institution makes a provision, can the borrower book a receivable by crediting interest paid or provided? The answer seems affirmative.

Mechanism of extending the benefit

Methodology for calculation is to be provided by IBA. In this regard, representation has been made to the Government to bear the burden.

Base amount: If the mode of computation as provided in the RBI Circular is to be followed [IBA’s methodology will be awaited], then the computation will be based on the amount outstanding as on 1st March 2020.

Computation: On the Base amount, the differential amount will be CI- SI.

If the facility has been fully repaid during the moratorium period, the Differential Amount will run upto the date of the repayment.

Actionables

A board approved policy is to be put in place immediately. In this regard, the concern is whether the lenders can modify existing moratorium policy or adopt a new policy altogether? In our opinion, the existing policy itself may be amended to give effect to the RBI Circular or alternatively a new policy may be adopted.

Also, there is no timeline prescribed as to by when are these actionables required. However, since there are certain disclosure requirements in the financials for the FY 2020-21, the policy must be in place before the financials are approved by the Board of the respective lenders.

The lender may await the instructions to be issued by the Government and the methodology to be prescribed by IBA. Logically, the same method as was provided under the Ex-Gratia Scheme should be applicable. Accordingly, lenders may create provisions for the refund of the excess interest charged and whether corresponding receivable will be shown would depend on whether the same is granted by the Government.

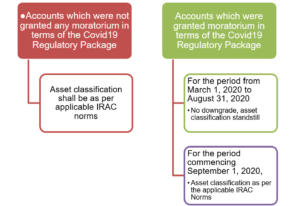

Asset Classification

The RBI moratorium notifications freezed the delinquency status of the loan accounts, which availed moratorium benefit under the scheme. It essentially meant that asset classification standstill was imposed for accounts where the benefit of moratorium was extended. A counter obligation on Credit Information Companies (CIC) was also imposed to ensure credit history of the borrowers is not impacted negatively, which are availing benefits under the scheme.

Various writ petitions were filed with the SC seeking an extended relief in terms of relaxation in reporting the NPA status to the credit bureaus. Hence, while hearing the petition of Gajendra Sharma Vs Union of India & Anr. and other writ petitions, the SC granted stay on NPA classification in its order dated September 03, 2020. The said order stated that:

“In view of the above, the accounts which were not declared NPA till 31.08.2020 shall not be declared NPA till further orders.”

The intent of granting such a stay was to provide interim relief to the borrowers who have been adversely affected by the pandemic, by not classifying and reporting their accounts as NA and thereby impacting their credit score.

In its latest judgment, the SC has directed that the interim relief granted earlier not to declare the accounts of respective borrowers as NPA stands vacated. We have also covered the same in our write up.

As a consequence of the SC order, the RBI Circular has clarified the asset classification as follows:

This would mean that after September 1, 2020 though there was a freeze on NPA classification, the same cannot be construed as a freeze on DPD counting. The DPD counting has to be in continuation from the due date of the EMI. The accounts classified as standard, but in default of more than 90 DPD may now be classified NPA, since the freeze on NPA classification is lifted by the SC and directed by the RBI as well.

Leave a Reply

Want to join the discussion?Feel free to contribute!