Companies (Amendment) Act, 2020

/0 Comments/in Amendments to the Companies Act 2013, Companies Act 2013, Corporate Laws, Corporate Laws - Covid-19, MCA, Uncategorized /by Vinod Kothari ConsultantsRevised timelines for various compliances under CA, 2013

/0 Comments/in Corporate Laws, Corporate Laws - Covid-19, Covid-19, MCA, UPDATES /by Vinod Kothari ConsultantsA Guide to Disclosure on COVID-19 related impacts

/2 Comments/in Corporate Laws, Corporate Laws - Covid-19, Covid-19, SEBI, UPDATES /by Vinod Kothari Consultants| SEBI seeks transparency from listed entities in times of COVID crises

Shaifali Sharma | Vinod Kothari and Company

Introduction

The impact of COVID-19 on companies is evolving rapidly not only in India but all over the world. In times of increased volatility and uncertainty in the capital market, detailed information regarding any material impact on the company’s business will not only assist the investors in making informed investment decisions but will also be fundamental formarket integrity and functioning.

Pursuant to the requirements of Listing Regulations, many listed entities have made disclosures, primarily intimating shutdown of operations owing to the pandemic and the resultant lockdowns. However, such probable information may be relatively less relevant and investors are more interested to know where these companies stand today, what are their estimated future impacts, strategiesadopted by these companies for addressing the effects of COVID-19, etc.

Given the information gaps in the market, SEBI, highlighting the importance of timely and adequate disclosures to investors and other stakeholders, issued an advisory[1]on May 20, 2020 (‘Advisory’), asking all the listed entities to evaluate the impact of COVID-19 on their business, performance and financials, both qualitatively and quantitatively, and disseminated the same to the stock exchange.

This article discuss in detail the disclosure requirements under Listing Regulations and provides a quick guide for the listed entities in evaluating and disclosing impact of pandemic on their business.

Existing disclosure norms under Listing Regulations on impact of COVID-19

The existing requirements prescribed under Listing Regulations in relation to the disclosure of impact of COVID-19 on listed entities are summarized below.The same is applicable to the following entities:

- companies listed with specified securities i.e. equity shares and convertible securities

- companies listed with Non-convertible Debt Securities (NCDs) and/or Non-Convertible Redeemable Preference Shares (NCRPSs)

| Entities having specified securities listed | Entities having NCDs/NCRPS listed |

| What is the disclosure requirements prescribed under Listing Regulations? | |

| The events can be divided into two broad categories a. Deemed Material Events and b. Material Events based on application of materiality criteria as provided in Regulation 30(4).

In the first category, the events specified in Para A of Part A of Schedule III get covered and requires mandatorily disclosure on the occurrence and in the second category, events under Para B are disclosed based on the application of the guidelines for materiality prescribed under sub-regulation (4) of Regulation 30. |

Unlike Regulation 30, Regulation 51 does not provide for any test of materiality.

Part B of Schedule III requires disclosure of all information either,

|

| Whether disclosure on COVID impact required by Listing Regulations? | |

| Yes.

Disclosure w.r.t. disruption of operations of any one or more units or division of a listed entity due to natural calamity (earthquake, flood, fire etc.), force majeure or events such as strikes, lockouts etc. falls under second category. Therefore, disruption of operations due to COVID-19 is required only if the same is considered material after applying the materiality guidelines. |

Yes.

Since disruption caused by COVID may be said to have the aforesaid effects. |

| What are the actionables as per Listing Regulations? | |

| In terms of sub- regulation (5) of Regulation 30, the Board of Directors (BoD) is required to authorize one or more KMPs for the purpose of determining materiality. Therefore, such authorized KMP(s) shall determine if the impact of COVID on company’s operations is material based on the criteria prescribed under sub-regulation (4) and the policy framed by company for said purpose.

On determination of the materiality, the same shall be disclosed to stock exchange and also host the disclosure on company’s website. |

For this category of companies, the law does not provide for the similar requirements as provided for companieshaving specified securities listed eg. framing of policy, determination of materiality by Board authorized person etc. Therefore, the disruption caused by COVID-19 shall be intimated to the stock exchanges(s) as per Regulation 51 of the Listing Regulations.

In this case, disclosure on website is not mandatory; however, company may do so for better reach of information to investors and stakeholders. |

| When is the disclosure required? | |

| Regulation 30 provides for disclosure as soon as reasonably possible, but not later than 24 hours from the occurrence of the event. The guidance on when an event is said to have occurred has been provided in SEBI Circular[2] dated September 09, 2015. In terms of the said Circular, the same would depend upon the timing when the listed entity became aware of the event/information or as soon as, an officer of the entity has, or ought to have reasonably come into possession of the information in the course of the performance of his duties. | Regulation 51 provides for prompt dissemination i.e. as soon as practically possible and without any delay and that the information shall be given first to the stock exchange(s) before providing the same to any third party. |

| What all disclosures have been suggested by SEBI vide its Circular dated September 09, 2015? | |

| As per SEBI circular dated September 09, 2015, companies shall disclose:

At the time of occurrence of disruption:

Regularly, till complete normalcy is restored

|

Though the said Circular refers to only Regulation 30, however, the same requirements should apply to this category of companies also which should additionally disclose the impact on servicing of interest/ dividend/ redemption etc. |

Similar disclosure requirement are prescribed for entities which has listed its Indian Depository Receipts, Securitized Debt Instruments and Security Receipts where all information which is price sensitive or having bearing on the performance/ operation of the listed entity and other material event as prescribed under Chapter VII, VIII, VIIIA read with Schedule III of the Listing Regulations shall be disclosed

Disclosure requirements as per SEBI Advisory

As mentioned earlier, SEBI Advisory is an addition to the above requirements of Listing Regulations. Though, one may argue that the Advisory is recommendatory in nature and it does not mandate the companies to make the disclosure, however, in our view, the same is not a mere recommendation. Keeping this in mind, the probable questions that one can have with respect to SEBI Advisory have been captured below:

What is the intention of the SEBI behind issuing such Advisory?

As mentioned in the SEBI Advisory, the outbreak of COVID-19 pandemic and the consequent nationwide lockdown has lead to distortions in the market due to the gaps in information available about the operations of a listed entity and therefore, it is important for a listed entity to ensure that all available information about the impact of pandemic on the company and its operations is communicated in a timely and cogent manner to its investors and stakeholders.

These disclosures ensure transparency and will provide investors an opportunity to make an accurate assessment of the company. So, the idea behind the disclosures is to give an equal access to the information to all the stakeholders at large.

Which all entities are covered by SEBI Advisory?

Due to the COVID-19, a global pandemic, all kinds of businesses are impacted in one way or another. Unlike the Listing Regulations, SEBI Advisory does not differentiate the disclosure requirements for the companies listed with specified securities and companies listed with NCDs/NCRPS, and the Advisory is applicable to all the listed entities.

Whether the requirements of Advisory are mandatory for listed entities?

Considering the purpose of making fair and timely disclosure of any material impact on the companies, the disclosures as mentioned in the Advisory shall be treated as mandatory in nature.

Whether disclosure required if the thresholds as set out in company’s materiality policy are not met?

The materiality of an event is generally measured in terms of thresholds laid down by the companies in their ‘policy for determination of materiality’ however, such criteria should not be considered as an absolute test to determine the materiality of an event like COVID pandemic

In times of the ongoing crises, investors would be interested to know all the inside information about the impact of pandemic on the company’s business operations, financial results, future strategies, etc. i.e. every qualitative or quantitative factors.

Since every person is doing an assessment of the impact of the crisis, it is intuitive to say that the management of the companies must also have done some assessment. Considering that the idea is to provide general and equal access to the information to all the stakeholders at large, the management must disclose every positive/negative/neutral impact of the crises on the company, irrespective of the fact that it qualifies the prescribed materiality threshold or not.

What if there no impact on the business caused by the pandemic? Whether the same is also required to be disclosed?

In our view, not getting affected by the pandemic at the time when the entire world is otherwise getting affected is also material. Therefore, the disclosure shall have to be made.

Further, it is not always necessary that the pandemic will have to have a negative impact e.g. decrease in sales volume. For example, companies in pharmaceutical sector or in the sector of manufacturing of essential items such as, mask, sanitizer etc. will have a boost in sales, thereby carrying a positive impact on them.

Whether Board meeting is required to be conducted in this regard? Or will the company be required to wait till the Board decision to make the disclosure?

While an internal assessment is required at the management level, however, a Board meeting is not mandatory to be conducted. Yes, the estimates already made may be changed at a later stage which may be disclosed at that stage again.

Is it ok to say for the management to take a position that they have not analyzed the impact of the crisis?

Considering the current risk and challenges as a result of COVID-19, it is very unlikely to say that companies have not done any internal assessment to determine the current and potential impact on the company’s financial and business operations.

What are the steps involved in making the disclosure?

Step 1: Evaluate the impact of the pandemic on the business, performance and financial

Before making any disclosure to the stock exchange(s), the management of the company must properly assess the impact of COVID-19 on its business, performance and financials, both qualitative and quantitative impact.

Step 2: Dissemination of impact of pandemic to stock exchange

The following information shall be disseminated to the stock exchange:

- Impact of the pandemic on the business;

- Ability to maintain operations including factories/ units/ office spaces functioning and closed down;

- Schedule, if any for restarting the operations;

- Steps taken to ensure smooth functioning of the operations;

- Estimation of future impact on the operations;

- Details of impact on the listed entity’s

- capital and financial resources;

- profitability;

- liquidity position;

- ability to service debt and other financing arrangements;

- assets;

- internal financial reporting and control;

- supply chain

- demand for its products/services;

- Existing contracts/agreements where non-fulfilment of the obligations byany party will have significant impact on the listed entity’s business;

- Any other information as the entity may determine to be relevant and material;

While making the above disclosure to stock exchanges, entities shall also adopt the principle of disclosure and transparency prescribed under Regulation 4(2)(e) of the Listing Regulations.

Who is responsible to evaluate and make disclosures to the stock exchange(s)? What is the role of the Board in the process of assessment and/or disclosure?

- Responsibility of KMP(s) as per Listing Regulations

Pursuant to Regulation 30 of the Listing Regulations, the KMP(s), as may be authorized by the Board, is responsible to determine the materiality of the impact of pandemic on the company based on the on the guidelines for materiality and the materiality policy of the company and disclose the same to the stock exchange

- Role of Board in the assessment of other material qualitative and quantitative impacts

Considering the language of the Advisory issued by SEBI, in addition to the KMPs authorized to test the materiality, the Board will also have a role in determining the COVID impact as the same requires disclosure in which management intervention may be necessary, e.g. future plans for business continuity, capability of running the business smoothly, material changes expected during the year, impact of the financial position etc.

However, as discussed above, a Board level discussion is not a prerequisite of making the disclosure.

Is there any timeline prescribed for making disclosers to the stock exchange(s)?

There is no specific timeline provided in the Advisory for making disclosures, however, in the present situation, the disclosure is required to be made as soon as an assessment is done on the probable impact by the management.

Whether the disclosures a one-time requirement for the listed entities?

Since the operations of the company will recommence soon, question arises if the companies should continue with its assessment and disclosure process. As stated in Advisory, to have continuous information about the impact of COVID-19, listed entities may provide regularupdates, as and when there are material developments. Further, since the disclosures will be made based on estimates, any changein those estimates or the actual position shall also be disclosed in regular intervals.

Therefore, disclosure is required not only at the time of occurrence but also on a continuous basis till the normalcy of the situation.

Whether impact on an unlisted subsidiary company shall also be disclosed?

To get an overall view of company’s performance, we always evaluate consolidated figures. Sometimes, company’s standalone performance is strong as compared to its performance at consolidated level. Accordingly, if the pandemic’s impact on unlisted subsidiary is such that it is having a material impact at the group level, the same shall be disclosed to the stock exchange.

Whether effects of COVID-19 be also reported in Financial Results?

In the coming days, companies will be disclosing their quarterly and yearly financial results. This time, however, investors will be interested inknowing the impact of COVID-19 on the company’s financial positions. Therefore, while submitting financial statements under Regulation 33 of the Listing Regulations, companies should mention about the impact of the CoVID-19 pandemic on their financial statements.

What will be the consequences for not complying with the SEBI Advisory?

Since no separate penal provisions are prescribed under the Advisory, non- compliance of the same may not lead to any penal consequences.

What is the global position as regards disclosure of COVID impact?

Market regulators worldwide have taken various steps to ensure transparency related to the impacts of the pandemic on the listed companies. In United States, the Securities Exchange Commission has issued guidance[3] regarding disclosure and other securities law obligations that companies should consider w.r.t the COVID-19 and related business and market disruptions. Similarly, for listed companies and auditors in Hong Kong, the Securities and Futures Commission and the Stock Exchange of Hong Kong Limited issued a joint press release[4] in relation to the disclosure requirements in response to the COVID-19 outbreak

Our write-up giving an insightful analysis on the said SEBI advisory drawing an inference from the global perspective can be viewed here

What kind of information be disclosed to the stock exchange?

The table below is a quick guide for the listed entities in determining and disclosing the impact of COVID-19 on their businesses:

| Sr. No. | Subject of Assessment and Disclosure | Broad Contents (Illustrative list)

|

| I. | Current status (both financial and operating status)

|

|

| II. | Steps taken to address effects of COVID | Steps taken to:

|

| III. | Future operational and financial status (estimates) |

|

| IV. | Company Specific | Focusing on the sectors in which the company deals in, the impact of crises varies from company to company and shall be assessed accordingly. For example:

|

The above list is illustrative but not exhaustive and each company will need to carefully assess COVID-19’s impact and related material disclosure obligations.

Concluding Remarks

In light of the effects and uncertainties created by COVID-19, disclosure about shutdowns and safety measures against COVID will not help the investors in making an informed assessment about the company’s financial position. Timely and adequate information about company’s current operational and financial status with future plans to address the effects of COVID-19 will better equip the investors to make an investment decision. Therefore, the Advisory should not be considered as a mere recommendation of SEBI as a transparent communication by the companies will allow the investors and other stakeholders to evaluate current and expected impact of COVID-19 on company’s businesses, financial and operating conditions and future estimated performance.

[1]https://www.sebi.gov.in/legal/circulars/may-2020/advisory-on-disclosure-of-material-impact-of-covid-19-pandemic-on-listed-entities-under-sebi-listing-obligations-and-disclosure-requirements-regulations-2015_46688.html

[2]https://www.sebi.gov.in/legal/circulars/sep-2015/continuous-disclosure-requirements-for-listed-entities-regulation-30-of-securities-and-exchange-board-of-india-listing-obligations-and-disclosure-requirements-regulations-2015_30634.html

[3] https://www.sec.gov/corpfin/coronavirus-covid-19

[4] https://www.hkex.com.hk/-/media/HKEX-Market/Listing/Rules-and-Guidance/Other-Resources/Listed-Issuers/Joint-Statement-with-SFC/20200204news.pdf

Other reading materials on the similar topic:

- ‘Listed company disclosures of impact of the Covid Crisis: Learning from global experience’ can be viewed here

- ‘Resources on virtual AGMs’ can be viewed here

- ‘COVID-19 – Incorporated Responses | Regulatory measures in view of COVID-19’ can be viewed here

- Our other articles on various topics can be read at: http://vinodkothari.com/

Email id for further queries: corplaw@vinodkothari.com

Our website: www.vinodkothari.com

Our Youtube Channel: https://www.youtube.com/channel/UCgzB-ZviIMcuA_1uv6jATbg

FAQs on conducting GM through VC

/2 Comments/in Companies Act 2013, Corporate Laws, Corporate Laws - Covid-19, Covid-19 /by Vinod Kothari ConsultantsConvening of AGM during COVID-19 crisis

/0 Comments/in AGM, Companies Act 2013, Corporate Laws - Covid-19, MCA /by Vinod Kothari Consultants-Will VC mode motivate the companies to call the AGM early?

Bunny Sehgal, corplaw@vinodkothari.com

Background

In view of the COVID-19 outbreak, the Ministry of Corporate Affairs (‘MCA’) had come up with the circular dated April 08, 2020[1] providing certain relaxations from the provisions of Companies Act, 2013 (‘Act’) and rules made thereunder including conducting the extra-ordinary general meeting (‘EGM’ or ‘Meeting’) for passing the resolutions of urgent nature through video conferencing (‘VC’) and other audio visual means (‘OAVM’) till June 30, 2020. Further, in order to provide more clarity on the modalities to be followed by the companies for conducting EGM viz. manner of issuance of notice, voting by show of hands and postal ballot etc., another circular dated April 13, 2020[2] (Collectively referred to as ‘EGM Circulars’) was brought in force. In continuation to the aforesaid circulars and in view of the social distancing norms and other restrictions thereof, MCA provided an extension of 3 months for holding annual general meeting (‘AGM’) for the companies having the calendar year as the financial year vide its circular dated April 21, 2020[3].

Now, considering the representations of various stakeholders, MCA has issued a circular dated May 05, 2020 [4](‘AGM Circular’) in line with the relaxations provided under the EGM Circulars to hold AGMs through VC/ OAVM.

While the AGM Circular will draw its reference from the EGM Circulars in terms of the modalities, however, there are various issues worth discussing to understand the scope, impact and applicability for companies to call AGM during the COVID-19 crisis. This write-up focuses on some of the issues and also provides the comparison between both the EGM Circulars and AGM Circular.

Scope and applicability

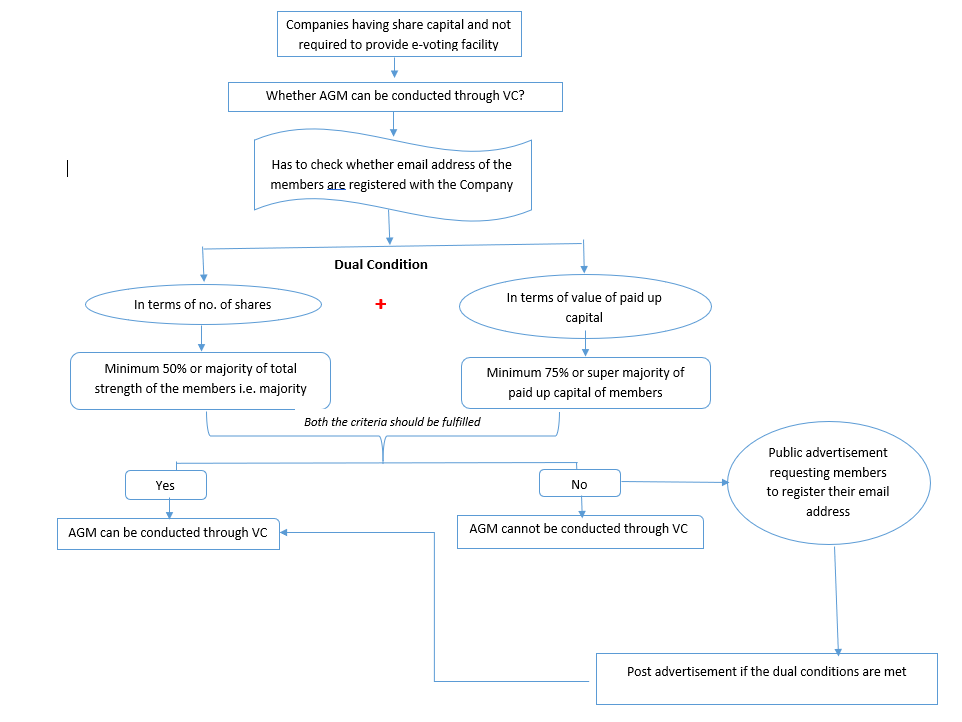

The AGM Circular applies to all the AGMs to be called by companies within the calendar year 2020. Generally speaking all the companies will call their AGM for the financial year 2019-2020 in the calendar year 2020 only. Therefore, one may conclude that this AGM Circular can be availed by all the companies without any exception. Having said that, it is also pertinent to mention that a specific condition has been laid down for companies which are not mandated to provide e-voting facility, to call their AGMs under this AGM Circular.

Para B (I) of the AGM circular provides that such companies can conduct their AGM through VC or OAVM only if the company has in its record, the email-ids of at least half of its total number of members, who –

- in case of a Nidhi, hold shares of more than one thousand rupees in face value or more than one per cent. of the total paid-up share capital, whichever is less;

- in case of other companies having share capital, who represent not less than seventy-five per cent. of such part of the paid-up share capital of the company as gives a right to vote at the meeting;

- in case of companies not having share capital, who have the right to exercise not less than seventy-five per cent. of the total voting power exercisable at the meeting

While the AGM Circular provides three classes of companies, most of the companies fall under the second class where two types of majority has been mentioned. The following flow chart represents the manner in which such classes of companies, as a pre-requisite will need to have the email-ids registered with themselves:

Further, while this AGM Circular is applicable on companies, other entities like public sector banks will not be covered under this circular. Seemingly, SEBI will have to provide some sort of similar relaxation to such entities.

Furthermore, while the AGM circular comes with the time frame to avail the AGM Circular within the calendar year 2020, however, considering the fact that there would be movement restrictions even after the lockdown is lifted, therefore, this added feature, seems to be of a permanent nature for the times to come under Indian legislation. Also, many countries like US and UK already allow this facility and other countries like Hong Kong, Austria, Belgium, Germany and Italy, etc. have started giving this facility post the outbreak of COVID-19.

Motivation to conduct AGM through VC/ OAVM

After the enforcement of the AGM Circular, the companies will be motivated to convene the AGM through VC/OAVM mode. The reasons for such a motivations are many, some of them are as follows:

- Less time consuming process;

- Operating convenience;

- Cost effectiveness;

- Environment friendly;

- Sooner getting the advantage of last audited accounts;

While there are many reasons to conduct the AGM through VC/OAVM mode, the only difficulty seems to be is the completion and audit of the annual accounts. Once the audit is done, the companies may proceed for convening the AGM through this mode.

Will Companies want to convene their AGM early?

This question in our view, should be in affirmative for various reasons as given below:

- Saving in cost

- Various provisions under the CA, 2013 and various other laws (especially which are applicable to NBFCs) provide exemptions or benefits to the companies based on the net worth or assets size as per the last audited financial statements. Some them include:

- NBFCs having asset size is of ₹ 500 cr or more as per last audited balance sheet are considered as systemically important NBFCs;

- Applicability of CSR provisions under section 135 of the CA, 2013;

- Appointment of independent and woman director under section 149 of the CA, 2013;

- Constitution of audit committee under section 177 of the CA, 2013;

- Applicability of secretarial audit under section 204.

- Early AGM would mean early declaration of dividend and therefore a step towards shareholder service.

- The restrictions on gathering may still continue after lifting of the lock-down.

AGM Circular to cover both ‘Ordinary Business’ and ‘Special Business’

Para A(II) and B(IV) of the AGM Circular provides the type of business which will be transacted in the AGM through VC/OAVM. The text of the same is provided below:

“In such meetings, other than ordinary business, only those items of special business, which are considered to be unavoidable by the Board, may be transacted.”

While on the first reading of the para it seems that the AGM Circular will allow to convene the AGM by VC/OAVM only for the unavoidable special business. However, that should not be the intent of the lawmakers as an AGM without the ordinary business will have to be adjourned till such time the ‘Ordinary Business’ items are decided and concluded. Therefore, aforesaid para should be construed and interpreted in a manner to include the unavoidable special business along with the ordinary business items. Accordingly, in the light of aforesaid circular, the company may proceed with to pass the ordinary as well as unavoidable special business in their AGM.

Further, for items requiring right of representation like removal of auditors or directors, etc. cannot be conducted through VC/OAVM as mentioned under EGM Circular.

Meaning of the term ‘Unavoidable’

Both the AGM as well as the EGM Circulars use the term ‘unavoidable’ business matters. The term ‘unavoidable’ means something which cannot be deferred and should not be deferred. If a company is calling and conducting its AGM, there is no reason for the company to unnecessarily defer any item of business and call a separate meeting to deal with them. Therefore, no company would ideally call a separate meeting to decide on matters just because they were not requiring immediate action during the said year. Accordingly, based on the reason of exigency or business urgency, etc., the Board of the company has to decide on the matters which are unavoidable.

Comparison of the Circulars

A meeting of the shareholders’ which is required to be convened by the companies on an annual basis, on account of a statutory requirement is called as AGM. Whereas an EGM is required to be convened by a company when the approval of the shareholders’ is required on urgent matters. The AGM Circular provides that the framework and manner of issuing notices provided in the EGM Circulars shall be applicable mutatis mutandis for conducting the AGM. While both the meetings are of the shareholders only, however called and conducted with different mindset altogether. Accordingly, it is imperative to see the implications of the provisions of EGM Circulars on the AGM. A brief comparison of both circulars is provided below:

| Sr. No. | Heading | Provisions under the EGM Circulars | Provisions under AGM Circular |

| 1. | Type of business | Only the unavoidable business shall be transacted at the EGM (excluding ordinary business items and matters requiring right of representation). | Only the unavoidable business in addition ordinary business shall be transacted at the AGM as discussed above. |

| 2. | Notice of the Meeting | The notice of the Meeting may be given only through email registered with the company/depository participant/depository. | The provisions of EGM Circular will be mutatis mutandis apply for convening the AGM. |

|

For companies which are required to provide the e-voting facility

|

|||

| 3. | Content of the public notice under rule 20 of the Companies (Management and Administration) Rules, 2014 | The following contents shall form part of the public notice for e-voting:

i. a statement that the EGM shall be convened through VC or OAVM; ii. date and time of the EGM; iii. availability of notice on the website of the company and stock exchange, if required; iv. the manner in which the following can cast their votes: a. physical shareholders; and b. who have not registered their email addresses with the company; v. the manner in which the persons can get their email addresses registered; vi. any other detail considered necessary by the company

|

The provisions of EGM Circular will be mutatis mutandis apply for convening the AGM. |

| 1. | Maintenance of recorded transcript | The recorded transcript shall be maintained by the company. In case of public company, the recorded transcript shall also be made available on the website of the company. | The provisions of EGM Circular will be mutatis mutandis apply for convening the AGM. |

| 2. | Minimum standards of VC/OVAM facility | Ensure that the Meeting through VC/OAVM facility allows two way teleconferencing for the ease of participation of the members. The VC/OVAM facility must have a capacity to allow at least 1000 members to participate on first come first serve basis.

|

The provisions of EGM Circular will be mutatis mutandis apply for convening the AGM. |

| 3. | Time frame for VC/OVAM facility | The VC/OVAM facility shall be kept open at least 15 minutes before the scheduled time of the EGM and shall not be closed till the expiry of 15 minutes after the conclusion of the scheduled time for EGM. | The provisions of EGM Circular will be mutatis mutandis apply for convening the AGM. |

| 4. | Attendance through VC/OVAM | Attendance of members through VC/OAVM shall be counted for quorum under section 103 of the Act. | The provisions of EGM Circular will be mutatis mutandis apply for convening the AGM. |

| 5. | Voting by the members present in the Meeting | The members who are present in the EGM through VC/OAVM facility and have not casted their vote through remote e-voting shall be allowed to vote through e-voting system. | The provisions of EGM Circular will be mutatis mutandis apply for convening the AGM. |

| 6. | Election of chairman | Unless the articles require any specific person to be appointed as a Chairman for the Meeting, the Chairman for the Meeting shall be appointed in the following manner:

i. where there are less than 50 members present at the Meeting, the Chairman shall be appointed in accordance with section 104; ii. in all other cases, the Chairman shall be appointed by a poll conducted through the e-voting system during the Meeting.

|

The provisions of EGM Circular will be mutatis mutandis apply for convening the AGM. |

| 7. | E-voting facility during the Meeting | The Chairman shall ensure that the facility of e-voting system is available for voting during the Meeting held through VC/OAVM.

|

The provisions of EGM Circular will be mutatis mutandis apply for convening the AGM. |

| 8. | Voting by the authorized representatives | The representatives of the members may be appointed for the purpose of voting through remote e-voting or for participation and voting in the Meeting held through VC/OAVM. | The provisions of EGM Circular will be mutatis mutandis apply for convening the AGM. |

| 9. | Role of Scrutinizer | The company should be required appoint a scrutinizer in accordance with the applicable provisions of the CA, 2013 red with allied rules for enabling transparent voting free from any conflict of interest. | Same as for EGM. |

| 10. | Attendance of independent director and the auditor | At least one independent director (if is required to appointed), and the auditor or his authorized representative, shall attend such Meeting through VC/ OAVM. | The provisions of EGM Circular will be mutatis mutandis apply for convening the AGM. |

| 11. | Notice issued prior to the EGM Circulars | In case a notice for Meeting has been served prior to the date of the EGM Circulars, the framework proposed in this Circular may be adopted for the Meeting, in case the consent from members has been obtained in accordance with section 101(1) of the Act, and a fresh notice of shorter duration with due disclosures in consonance with this Circular is issued consequently. | For companies which have already sent their notices for calling AGM, should be required to send out fresh notices containing the fact that meeting will conducted through VC/OAVM in terms of the AGM Circular.

In our view, the length of AGM notices can remain 21 days unless the same is called at a shorter notice. |

| 12. | Filing of resolutions | All resolutions, passed in accordance with this mechanism shall be filed with the ROC within 60 days of the Meeting, clearly indicating therein that the mechanism provided herein along with other provisions of the Act and rules were duly complied with during such Meeting. | The provisions of EGM Circular will be mutatis mutandis apply for convening the AGM. |

|

For companies which are not required to provide the e-voting facility

|

|||

| 1. | Intimation to the members w.r.t the Meeting | The company shall contact all the members whose e-mail addresses are not registered with the company over telephone/any other mode, before sending notice to all the members;

|

The provisions of EGM Circular will be mutatis mutandis apply for convening the AGM. |

| 2. | Content of the public notice | Where the contact details of any of the members are not available with the company, it shall issue of public notice in vernacular language and vernacular newspaper in which the registered office is situated, & in English language and English newspaper having wide circulation in that district and electronic editions.

The following content shall form part of the public notice: i. a statement that the EGM shall be convened through VC or OAVM; and the company proposes to send the notice by email at least 3 days from the date of publication of the public notice; ii. the details of the email address along with the phone number on which the members may contact for getting their e-mail addresses registered for participation and voting in the Meeting

|

The provisions of EGM Circular will be mutatis mutandis apply for convening the AGM. |

| 3. | Maintenance of recorded transcript | The recorded transcript shall be maintained by the company. In case of public company, the recorded transcript shall also be made available on the website of the company. | The provisions of EGM Circular will be mutatis mutandis apply for convening the AGM. |

| 4. | Minimum standards of VC/OVAM facility | Ensure that the Meeting through VC/OAVM facility allows two way teleconferencing for the ease of participation of the members. The VC/OVAM facility must have a capacity to allow at least 500 members or members equal to total number of members, whichever is lower to participate on first come first serve basis.

|

The provisions of EGM Circular will be mutatis mutandis apply for convening the AGM. |

| 5. | Timeframe for VC/OVAM facility | The VC/OVAM facility shall be kept open at least 15 minutes before the scheduled time of the EGM and shall not be closed till the expiry of 15 minutes after the conclusion of the EGM. | The provisions of EGM Circular will be mutatis mutandis apply for convening the AGM. |

| 6. | Attendance through VC/OVAM | Attendance of members through VC/OAVM shall be counted for quorum under section 103 of the Act. | The provisions of EGM Circular will be mutatis mutandis apply for convening the AGM. |

| 7. | Designated e-mail address for voting. | The company shall provide a designated e-mail address to all members at the time of sending the notice of Meeting so that the members can convey their vote, when a poll is required to be taken during the Meeting on any resolution, at such designated email address. | The provisions of EGM Circular will be mutatis mutandis apply for convening the AGM. |

| 8. | Voting through registered e-mail only | During the Meeting held through VC/OVAM facility, where a poll on any item is required, the members shall cast their vote on the resolutions only by sending their email addresses which are registered with the company. The said emails shall only be sent to the designated email address circulated by the company in advance. | The provisions of EGM Circular will be mutatis mutandis apply for convening the AGM. |

| 9. | Election of chairman | Unless the articles require any specific person to be appointed as a Chairman for the meeting, the Chairman for the Meeting shall be appointed in the following manner:

iii. where there are less than 50 members present at the Meeting, the Chairman shall be appointed in accordance with section 104; iv. in all other cases, the Chairman shall be appointed by a poll conducted through the registered e-mail during the Meeting.

|

The provisions of EGM Circular will be mutatis mutandis apply for convening the AGM. |

| 10. | Voting by the authorized representatives | The representatives of the members may be appointed for the purpose of voting through registered e-mail or for participation and voting in the Meeting held through VC/OAVM. | The provisions of EGM Circular will be mutatis mutandis apply for convening the AGM. |

| 11. | Attendance of independent director and the auditor | At least one independent director (if is required to appointed), and the auditor or his authorized representative, shall attend such Meeting through VC/ OAVM. | The provisions of EGM Circular will be mutatis mutandis apply for convening the AGM. |

| 12. | Role of Scrutinizer | The company may appoint a scrutinizer even though on a voluntary basis for enabling transparent voting free from any conflict of interest. | Same as for EGM. |

| 13. | Declaration of voting results | In case the counting of votes requires time, the said meeting may be adjourned and called later to declare the result. | The provisions of EGM Circular will be mutatis mutandis apply for convening the AGM. |

| 14. | Notice issued prior to the EGM Circulars | In case a notice for Meeting has been served prior to the date of the EGM Circulars, the framework proposed in this Circular may be adopted for the Meeting, in case the consent from members has been obtained in accordance with section 101(1) of the Act, and a fresh notice of shorter duration with due disclosures in consonance with this Circular is issued consequently. | For companies which have already sent their notices for calling AGM, should be required to send out fresh notices containing the fact that meeting will conducted through VC/OAVM in terms of the AGM Circular.

In our view, the length of AGM notices can remain 21 days unless the same is called at a shorter notice. |

| 15. | Filing of resolutions | All resolutions, passed in accordance with this mechanism shall be filed with the ROC within 60 days of the Meeting, clearly indicating therein that the mechanism provided herein along with other provisions of the Act and rules were duly complied with during such Meeting. | The provisions of EGM Circular will be mutatis mutandis apply for convening the AGM. |

Additional requirements to be complied with by the companies which are required to provide the e-voting facility:

- Publication of a notice by way of newspaper advertisement before sending the notices and copies of the financial statements, etc., and specifying in the advertisement the following information.

- a statement that the AGM shall be convened through VC or OAVM;

- date and time of the AGM;

- availability of notice on the website of the company and stock exchange, if required;

- the manner in which the shareholders holding shares in physical mode, or who have not registered their email addresses with the company can cast their vote through remote e-voting or through the e-voting system during the meeting;

- the manner in which the persons can get their email addresses registered;

- the manner in which the members can give their mandate for receiving dividends directly in their bank accounts through the Electronic Clearing Service (ECS) or any other means;

- any other detail considered necessary by the company

- Circulation of the board’s report, financial statements and other documents through e-mail instead of physical copies;

- Where the company is unable to pay the dividend to any shareholder by the electronic mode, due to non-availability of the details of the bank account, the company shall upon normalization of the postal services, dispatch the dividend warrant/cheque to such shareholder by post;

- Where the company has been permitted to conduct its AGM at its registered office, or at any other place as provided under section 96 of the Act, the company may in addition to holding such meeting with physical presence of some members, also provide the facility of VC or OAVM, to allow other members of the company to participate in such meeting.

- The companies shall ensure that all other compliances associated with the provisions relating to general meetings viz making of disclosures, inspection of related documents/registers by members, or authorizations for voting by bodies corporate, etc as provided in the Act and the articles of association of the company are made through electronic mode.

Additional requirements to be complied with by the companies which are not required to provide the e-voting facility:

- AGM may be conducted through the VC/OAVM facility only if the company which has the email addresses of at least half of its total number of members, in its records, and

- in case of a Nidhi, hold shares of more than 1000 rupees in face value or more than 1% of the total paid-up share capital, whichever is less;

- in case of other companies having share capital, hold at least 75% the paid-up share capital;

- in case of companies not having share capital, who have the right to exercise not less than 75% of the total voting power exercisable at the meeting.

- The company shall take all necessary steps to register the email addresses of all persons who have not registered their email addresses with the company.

- The board’s report, financial statements and other documents will be circulated through e-mail instead of physical copies;

- The companies shall make adequate provisions for allowing the members to give their mandate for receiving dividends directly in their bank accounts through the Electronic Clearing Service (ECS) or any other means.

- The company shall upon normalization of the postal services, dispatch the dividend warrant/cheque by post to the shareholders, whose bank accounts are not available.

- The companies shall ensure that all other compliances associated with the provisions relating to general meetings viz making of disclosures, inspection of related documents/registers by members, or authorizations for voting by bodies corporate, etc as provided in the Act and the articles of association of the company are made through electronic mode.

Application for extension of AGM for certain companies

The companies which do not have calendar year as their financial year and are unable to conduct their AGM in accordance with the framework provided in AGM Circular may apply for the application for extension of AGM before the concerned Registrar of Companies under section 96 the Act.

Conclusion

Many companies which have already approved their AGM notices will have to make suitable changes therein in line with the said circular. Further, post the issue of this AGM Circular, most of the companies will be making their debut in conducting the AGM through VC/ OAVM and it will be interesting to see smooth convening amidst the crisis.

[1] http://mca.gov.in/Ministry/pdf/Circular14_08042020.pdf

[2] http://www.mca.gov.in/Ministry/pdf/Circular17_13042020.pdf

[3] http://www.mca.gov.in/Ministry/pdf/Circular18_21042020.pdf

[4] http://www.mca.gov.in/Ministry/pdf/Circular20_05052020.pdf

http://vinodkothari.com/2020/04/conducting-general-meetings-through-vc-during-lockdown/

Link to similar articles:

- FAQ on conducting AGM through video conferencing

- General Meeting by Video Conferencing – recognising the inevitable

- FAQ on general meeting through VC

- Can companies offer VC facility

More articles related to corporate laws available here: http://vinodkothari.com/category/corporate-laws/

Implicit deferral of concomitant actions with IEPF amidst COVID-19?

/1 Comment/in Corporate Laws - Covid-19, MCA /by Vinod Kothari Consultants-Pammy Jaiswal (pammy@vinodkothari.com) & Smriti Wadehra (smriti@vinodkothari.com)

Considering the pandemic, the Ministry of Corporate Affairs (‘MCA’) has relaxed various time specific provisions of Companies Act, 2013 so as to the ease the process of running a Company during the lockdown. One of such relaxation was introduction of ‘Companies Fresh Start Scheme, 2020’ (hereinafter referred to as ‘CFSS’) vide General Circular dated 30th March, 2020 [1]which has permitted delayed filing of various e-forms without any additional fees upto 6 months from the expiry of 30th September, 2020.

In furtherance to the said circular, the MCA on 13th April, 2020[2] clarified that the sanction for delayed filing without additional fees shall also apply for filings made under Section 124 and 125 of the Companies Act, 2013 read with IEPF (Accounting, Audit, Transfer and Refund) Rules, 2016. Pursuant to such relaxation, the due date for filing the e-Forms with the Registrar has been relaxed, however, the fate of concomitant actions which take place even before the filing formalities?

Please note that the CFSS is a one-time settlement scheme which allows belated filings to be cleared by the Company without payment of additional fees. Accordingly, the relaxation provided for IEPF filings is also with respect to belated filings or delayed filings up till 30th September, 2020. It is to be noted that form filing is a post facto activity. There are several pre & post filing compliance requirements which is to be executed by companies. However, when it comes to giving relaxations, the Ministry has identified form filings as the only compliance burden on the Company and did not come out with explicit relaxations on the other aspects of compliance activities connected with such filing.

In this write up, we aim to enlist such incidental activities w.r.t IEPF filings and how to ensure their conduct during the pandemic.

| Sl. No. | Form No. | Details provided in the form | Due date of filing | Compliances to be ensured by the Company before filing

|

Our Analysis |

| 1. | IEPF-1 | Statement of amounts credited to IEPF | Within a period of 30 days of such amounts becoming due to be credited to the Fund.

|

· Credit of unclaimed dividend to the IEPF Authority through PNB or MCA;

· Maintenance of record consisting of name, last known address, amount, folio no. or client ID, certificate no., beneficiary details etc. of the persons in respect of whom unpaid or unclaimed amount has remained unpaid or unclaimed for a period of 7 years and has been transferred to the Fund. |

The timeline for reporting the amounts credited to IEPF has been relaxed till 30th September, 2020. Does this mean that the transfer of unclaimed dividend to IEPF has also been extended?

No. The credit of unclaimed dividend to Authority is an online transfer and can be done from anywhere. Therefore, the transfers shall not be delayed/affected due to lockdown. Still, claiming back of shares by investors from IEPF may be delayed or disputed.

However, transfer of unpaid dividend by companies to a separate bank account may not be possible during the crisis as the Banks are not fully functional. Subsequently, application for claiming back shares from unpaid dividend account may also be delayed

Accordingly, extension is only provided for filing of statement in e-Form IEPF-1 by the Company. However, activities related to such filing has been disregarded.

|

| 2. | IEPF-2 | Statement of unclaimed or unpaid amounts and details of Nodal Officer

|

Within a period of 60 days after the holding of AGM.

|

Information to be submitted to Authority:

a) Names and addresses of person entitled to receive sum b) Nature of amount c) Amount which the person is entitled d) Due date for transfer to IEPF

|

The filing requirement comes post AGM. While the MCA has come out with its General Circular dated 8th and 13th April, 2020 laying down modalities for holding EGM within a time frame till 30th June, 2020, however, no such directions have been brought for holding AGMs. However, for companies whose financial year ends on 31st December have been granted an extended timeline till 30th September, 2020 for holding their AGM. While for rest of the companies there is no such extension, it is implicit that if the AGM is held after their respective due dates, the filing is automatically extended.

|

| 3. | IEPF-3 | Form for filing Statement of shares and unclaimed or unpaid dividend not transferred to IEPF

|

Within 30 days of end of FY if company does not transfer the shares and amount to IEPF. | a) Company has to collate the information w.r.t. shares which have restraining orders

b) Company to inform depository by way of corporate action c) Issuance of new certificate in case of physical shares

|

As the filing of such information is extended till 30th September, 2020, the Company may defer incidental activities w.r.t. the said form till the extended date. |

| 4. | IEPF-4 | Statement of shares transferred to the IEPF | Within 30 days of the corporate action containing details of such transfer.

|

· inform at the latest available address to the shareholder concerned regarding transfer of shares 3 months before the due date of transfer of shares (which shall be 6 years and 9 months) and

· also simultaneously publish a notice in the leading newspaper in English and regional language having wide circulation informing that the names and folio no/DP id/Client ID of the concerned shareholders are available on the website of the company, and · also publish on their website the details of such shareholders and shares due for transfer

|

Since, the Rules are silent on the mode of informing the shareholders, therefore, the Company may opt for sending notices vide email. Subsequently publish the same on its website. The question that might create an issue during the current times is the manner of sending individual notices to those who have not registered their e-mail ids.

Further, the notice will also be required to be published in newspapers. Please note that the newspaper services are operational in many parts of the Country, however, large number of people are avoiding purchase of newspapers during the crisis due to fear transmission. Hence, in our view, so as to reach a larger audience, companies may prefer e-version for this purpose.

|

| 5. | E-verification IEPF-5 | Application to the Authority for claiming unpaid amounts and shares out of IEPF | Company shall, within 30 days from the date of receipt of claim, send an online verification report to the Authority.

|

Submission of online verification report along with all the documents submitted by the claimant along with scanned copy of all the original documents submitted by the claimant in physical form duly certified by its Nodal Officer along with the e-verification report and scanned copy of both sides of original physical share certificate or original bond

Further, if there is delay in submission of e-verification report beyond 30 days of filing of the claim the Company shall be liable to pay additional fee of Rs. 50 for every day max- Rs. 2500.

|

E-verification has been extended, hence no comments. |

| 6. | IEPF-7 | Statement of amounts credited to IEPF on account of shares transferred to the fund

|

Within 30 days of transferring the amount to IEPF or date of modification of Rule. | – | – |

Conclusion

While MCA has kept its focus on granting relaxations for filing requirements, it is to be noted that such extended timelines for a post facto activity should actually be taken as an implicit relaxation, during the current COVID -19 crisis, in fulfilling the concomitant actions in relation thereto.

[1] http://www.mca.gov.in/Ministry/pdf/Circular12_30032020.pdf

[2] http://www.mca.gov.in/Ministry/pdf/Circular16_13042020.pdf

Our other content may be viewed here- http://vinodkothari.com/corporate-laws/

Our write-ups relating to COVID-19 maybe viewed here- http://vinodkothari.com/covid-19-incorporated-responses/

Restructuring of bonds during COVID-19 crisis

/0 Comments/in Corporate Laws - Covid-19, Covid-19, Financial services/ NBFCs/Fin-tech - Covid-19, SEBI and listing-related compliances - Covid-19 /by Vinod Kothari ConsultantsThis presentation covers the procedural requirements for restructuring of bonds/debentures during COVID-19 crisis.

Please click below for the presentation:

Part-1:

Please click here for the PPT used in the presentation.

MCA extends timeline for companies following calendar year

/0 Comments/in Companies Act 2013, Corporate Laws, Corporate Laws - Covid-19, Covid-19, UPDATES /by Vinod Kothari Consultants– by Megha Saraf

Updated as on 24th April, 2020

While currently the world is suffering due to the pandemic COVID-19, our regulatory authorities have been continuously providing reliefs/ relaxations to all corporate houses from making various compliances required under the statutory laws. While some of the major relaxations such as conducting extraordinary general meeting of shareholders through VC, making contribution to PM-CARES Fund as a notified CSR expenditure or making compliances under Listing Regulations have already been notified, MCA has come up with yet another Circular[1] granting relaxation from holding AGMs to such companies that follows calendar year as their financial year.

Can there be a different financial year apart from April-March?

Section 2(41) of the Companies Act, 2013 (“Act, 2013”) lays down the definition of “financial year” as, “in relation to any company or body corporate, means the period ending on the 31st day of March every year, and where it has been incorporated on or after the 1st day of January of a year, the period ending on the 31st day of March of the following year, in respect whereof financial statement of the company or body corporate is made up:

Provided that where a company or body corporate, which is a holding company or a subsidiary or associate company of a company incorporated outside India and is required to follow a different financial year for consolidation of its accounts outside India, the Central Government may, on an application made by that company or body corporate in such form and manner as may be prescribed, allow any period as its financial year, whether or not that period is a year:”

XX

There are corporate groups where the structure of shareholding is such, that the holding company is situated outside India and is having Indian subsidiaries. The provisions of law provide that where the relationship between the group is such, that it requires the Indian company to follow a different financial year for the purpose of consolidation of its accounts with the accounts of the company situated outside India, such Indian company can have a different financial year. However, such company needs to apply to the Tribunal for the same.

What is the timeline for holding AGMs?

Section 96 of the Act, 2013 provides that a company is required to hold an AGM within 6 months from the date of closing of the financial year. However, a newly incorporated company can have its first AGM within 9 months of the closure of the financial year.

Are there such companies following a different financial year?

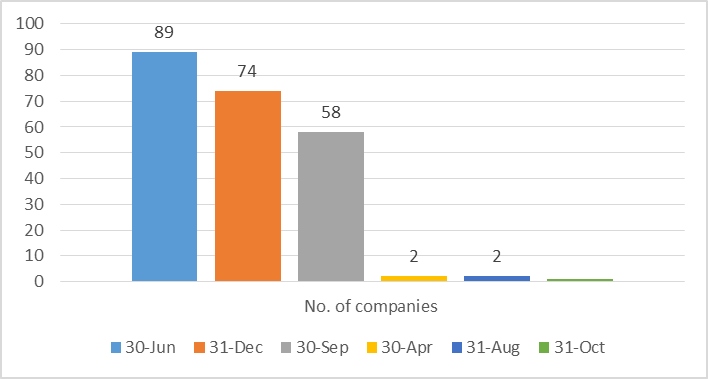

Source[2]: Business Standard: 226 firms to march to a new accounting year

Yes. As per the above graph, there are nearly 226 companies in India that follow a different financial year. Out of the 226 companies, 74 are such companies whose calendar year is the financial year i.e. January- December.

What is the relaxation?

Currently, only companies that follows calendar year as financial year have been granted a 3-months relaxation from holding their AGMs i.e. such companies are allowed to hold their AGMs till 30th September, 2020 instead of June, 2020. Further, the due dates of all other related compliances such as filing of annual returns or financial statements which are required to be done within 60 days/ 30 days as applicable shall be construed accordingly.

What if the company is a listed entity?

Regulation 44(5) of the SEBI (LODR) Regulations, 2015 provides that where the listed entity is within top 100 listed entities based on market capitalization, they have to hold their AGM within 5 months from the closure of the financial year i.e. by August 31, 2020. However, considering the present situation and the need for social distancing, conducting AGMs within such time was becoming a challenge for large corporates. Keeping this in mind, SEBI has granted relief to such entities by extending the requirement by 1 month i.e. till September 30, 2020. However, there was no clarity on what if such entity is a listed entity and follows calendar year as their financial year and is among the top 100 listed entities.

SEBI has now also clarified the same vide its Circular[3] dated 23rd April, 2020 and the present timeline may be summarized as follows:

| Sl. No. | Type of company | Time line under the Companies Act, 2013 | Time line under the SEBI (LODR) Regulations, 2015 | Extended timeline |

| 1 | Listed company following Apr- Mar as F.Y. | Within 6 months from end of FY i.e. 30th September, 2020 | Does not provide | No extension |

| 2 | Listed company following Jan-Dec as F.Y. | Within 6 months from end of FY i.e. till 30th June, 2020 | Does not provide | Extended by 3 months i.e. till 30th September, 2020 |

| 3 | Listed company following Apr- Mar as F.Y. and amongst top 100 listed entities | General provision- Within 6 months from end of FY i.e. 30th September, 2020 | Within 5 months from end of FY i.e. till 31st August, 2020 | Extended by 1 month i.e. till 30th September, 2020 |

| 4 | Listed company following Jan- Dec as F.Y. and amongst top 100 listed entities | General provision- Within 6 months from end of FY i.e. 30th September, 2020 | Within 5 months from end of FY i.e. till 31st May, 2020 | Extended till 30th September, 2020 under both laws |

Therefore, all types of companies can conduct their AGMs till 30th September, 2020.

Our other articles on related subject may be found here.

[1] http://www.mca.gov.in/Ministry/pdf/Circular18_21042020.pdf

[2] https://www.business-standard.com/article/companies/226-firms-to-march-to-a-new-accounting-year-113100300666_1.html

[3] https://www.sebi.gov.in/legal/circulars/apr-2020/relaxation-in-relation-to-regulation-44-5-of-the-sebi-listing-obligations-and-disclosure-requirements-regulations-2015-lodr-on-holding-of-annual-general-meeting-agm-by-top-100-listed-entitie-_46552.html