MCA extends timeline for companies following calendar year

– by Megha Saraf

Updated as on 24th April, 2020

While currently the world is suffering due to the pandemic COVID-19, our regulatory authorities have been continuously providing reliefs/ relaxations to all corporate houses from making various compliances required under the statutory laws. While some of the major relaxations such as conducting extraordinary general meeting of shareholders through VC, making contribution to PM-CARES Fund as a notified CSR expenditure or making compliances under Listing Regulations have already been notified, MCA has come up with yet another Circular[1] granting relaxation from holding AGMs to such companies that follows calendar year as their financial year.

Can there be a different financial year apart from April-March?

Section 2(41) of the Companies Act, 2013 (“Act, 2013”) lays down the definition of “financial year” as, “in relation to any company or body corporate, means the period ending on the 31st day of March every year, and where it has been incorporated on or after the 1st day of January of a year, the period ending on the 31st day of March of the following year, in respect whereof financial statement of the company or body corporate is made up:

Provided that where a company or body corporate, which is a holding company or a subsidiary or associate company of a company incorporated outside India and is required to follow a different financial year for consolidation of its accounts outside India, the Central Government may, on an application made by that company or body corporate in such form and manner as may be prescribed, allow any period as its financial year, whether or not that period is a year:”

XX

There are corporate groups where the structure of shareholding is such, that the holding company is situated outside India and is having Indian subsidiaries. The provisions of law provide that where the relationship between the group is such, that it requires the Indian company to follow a different financial year for the purpose of consolidation of its accounts with the accounts of the company situated outside India, such Indian company can have a different financial year. However, such company needs to apply to the Tribunal for the same.

What is the timeline for holding AGMs?

Section 96 of the Act, 2013 provides that a company is required to hold an AGM within 6 months from the date of closing of the financial year. However, a newly incorporated company can have its first AGM within 9 months of the closure of the financial year.

Are there such companies following a different financial year?

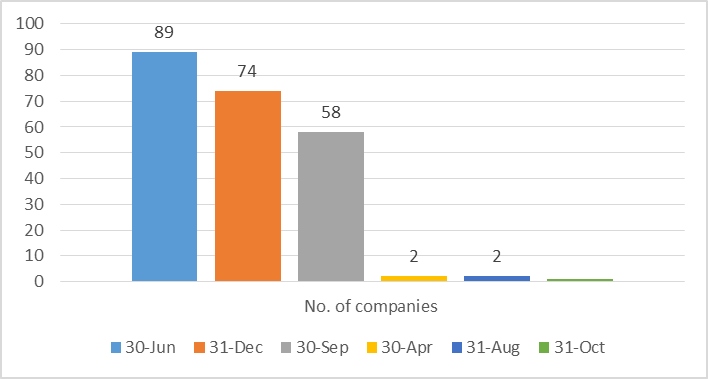

Source[2]: Business Standard: 226 firms to march to a new accounting year

Yes. As per the above graph, there are nearly 226 companies in India that follow a different financial year. Out of the 226 companies, 74 are such companies whose calendar year is the financial year i.e. January- December.

What is the relaxation?

Currently, only companies that follows calendar year as financial year have been granted a 3-months relaxation from holding their AGMs i.e. such companies are allowed to hold their AGMs till 30th September, 2020 instead of June, 2020. Further, the due dates of all other related compliances such as filing of annual returns or financial statements which are required to be done within 60 days/ 30 days as applicable shall be construed accordingly.

What if the company is a listed entity?

Regulation 44(5) of the SEBI (LODR) Regulations, 2015 provides that where the listed entity is within top 100 listed entities based on market capitalization, they have to hold their AGM within 5 months from the closure of the financial year i.e. by August 31, 2020. However, considering the present situation and the need for social distancing, conducting AGMs within such time was becoming a challenge for large corporates. Keeping this in mind, SEBI has granted relief to such entities by extending the requirement by 1 month i.e. till September 30, 2020. However, there was no clarity on what if such entity is a listed entity and follows calendar year as their financial year and is among the top 100 listed entities.

SEBI has now also clarified the same vide its Circular[3] dated 23rd April, 2020 and the present timeline may be summarized as follows:

| Sl. No. | Type of company | Time line under the Companies Act, 2013 | Time line under the SEBI (LODR) Regulations, 2015 | Extended timeline |

| 1 | Listed company following Apr- Mar as F.Y. | Within 6 months from end of FY i.e. 30th September, 2020 | Does not provide | No extension |

| 2 | Listed company following Jan-Dec as F.Y. | Within 6 months from end of FY i.e. till 30th June, 2020 | Does not provide | Extended by 3 months i.e. till 30th September, 2020 |

| 3 | Listed company following Apr- Mar as F.Y. and amongst top 100 listed entities | General provision- Within 6 months from end of FY i.e. 30th September, 2020 | Within 5 months from end of FY i.e. till 31st August, 2020 | Extended by 1 month i.e. till 30th September, 2020 |

| 4 | Listed company following Jan- Dec as F.Y. and amongst top 100 listed entities | General provision- Within 6 months from end of FY i.e. 30th September, 2020 | Within 5 months from end of FY i.e. till 31st May, 2020 | Extended till 30th September, 2020 under both laws |

Therefore, all types of companies can conduct their AGMs till 30th September, 2020.

Our other articles on related subject may be found here.

[1] http://www.mca.gov.in/Ministry/pdf/Circular18_21042020.pdf

[2] https://www.business-standard.com/article/companies/226-firms-to-march-to-a-new-accounting-year-113100300666_1.html

[3] https://www.sebi.gov.in/legal/circulars/apr-2020/relaxation-in-relation-to-regulation-44-5-of-the-sebi-listing-obligations-and-disclosure-requirements-regulations-2015-lodr-on-holding-of-annual-general-meeting-agm-by-top-100-listed-entitie-_46552.html

Leave a Reply

Want to join the discussion?Feel free to contribute!