After 4 years of providing sectoral cap for the same.

Aanchal Kaur Nagpal | Executive

corplaw@vinod kothari.com

Pension Funds (‘PF’) are responsible for receiving contributions and managing pension corpus through various schemes[1] under National Pension System (‘NPS’) in accordance with the provisions specified by the PFRDA and carry out functions as per the directions of the NPS Trust. Presently, there are 3 companies registered as PF for government sector and 7 companies registered as PF for private sector. According to regulation 8(e) of the PFRDA (Pension Fund) Regulations, 2015[2], a sponsor of a PF is required to incorporate the pension fund as a separate limited company under the Companies Act, 2013. As on date, all existing PFs are unlisted companies.

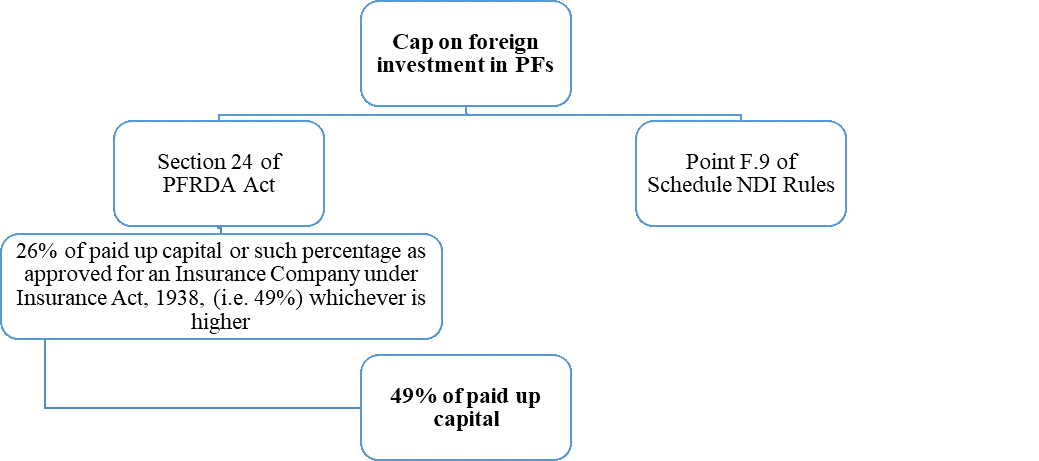

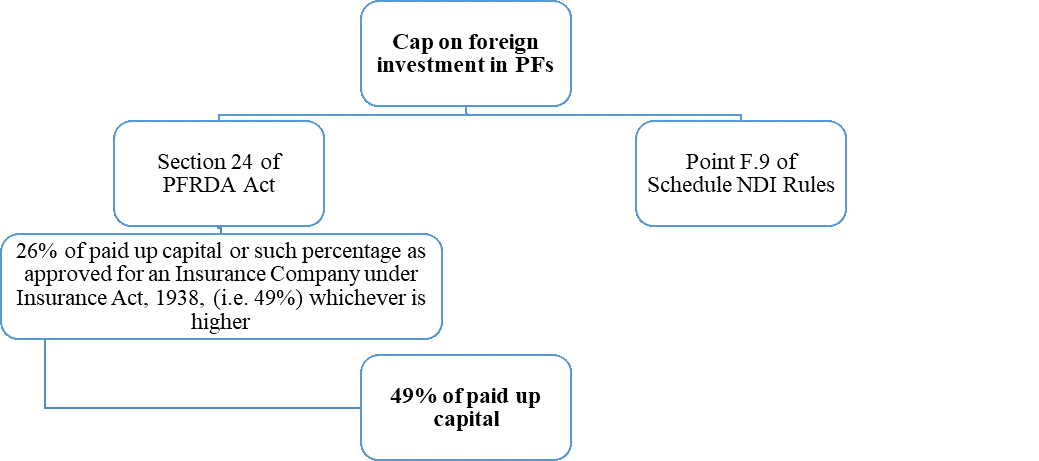

Foreign investment in pension sector is permitted upto 49% under automatic route as per para F.9 of Schedule I to Foreign Exchange Management (Non-debt instruments) Rules, 2019 (‘NDI rules’). This was inserted in 2016 vide DIPP press note no. 2 of 2016[3]. Foreign investment in PF is required to be in accordance with Pension Fund Regulatory and Development Authority (PFRDA) Act, 2013 (‘PFRDA Act’). Foreign investment in PF is subject to the condition that entities investing in capital instruments issued by an Indian Pension Fund as per section 24 of the PFRDA Act are required to obtain necessary registration from the PFRDA and comply with other requirements as per the PFRDA Act[4] and Rules and Regulations framed under it for so participating in Pension Fund Management activities in India. An Indian pension fund needs to ensure that its ownership and control remains at all times with resident Indian entities as determined by the Government of India/ PFRDA as per the rules or regulation issued by them.

With a view to regulate foreign investment in PFs, the Ministry of Finance has introduced draft rules viz. Pension Fund (Foreign Investment) Rules, 2020 (‘Draft PF Rules’) on 19th June, 2020 for public comments[5]. The Draft PF Rules continue to refer to FEMA (Transfer of Issue of Securities by a Person Resident outside India) Regulations, 2000 (‘TISPRO Regulations’) which was repealed in 2017 vide FEMA (Transfer of Issue of Securities by a Person Resident outside India) Regulations, 2017 and thereafter by FEMA (Non-Debt Instrument) Rules, 2019. Accordingly, the anomalies arising out of reference to TISPRO Regulations instead of NDI Rules are pointed in Annexure I.

Components of foreign investment

Foreign investment has been defined under rule 2(d) of the Draft PF Rules that means and includes investment made by following in the equity shares of a Pension Fund in India:

- a foreign company, either by itself or through its subsidiary companies or its nominees; or

- an individual; or

- an association of persons, whether registered or not, under any law or a country outside India;

- Foreign Venture Capital Invesment;

- other eligible entities .

*Equity capital has been defined to have the same mean as section 43 of the Companies Act, 2013.

The total foreign investment will include both direct as well as indirect investment made by foreign investment.

Comment: The definition of foreign investment should be aligned with NDI Rules. The extent of foreign investment should be basis the investment made in equity instruments, as opposed to equity share capital.

Ceiling on quantum of foreign investment

Both, the PFRDA Act and NDI Rules restrict foreign investment in PFs upto 49%. The Draft PF Rules also follow the lead of these provisions and state that the aggregate holding in a PF by foreign investors, including foreign portfolio investors, should not exceed 49% of its paid-up equity share capital. [Rule 3 of the Draft PF Rules]. Further, foreign investment up to 49% is allowed through automatic route. [Rule 5 of the Draft PF Rules]

The total foreign investment would be a total of direct and indirect foreign investment calculated as per the PFRDA regulations read with the FDI policy. [Rule 2 (p) of the Draft PF Rules]

Indian ownership and control at all times

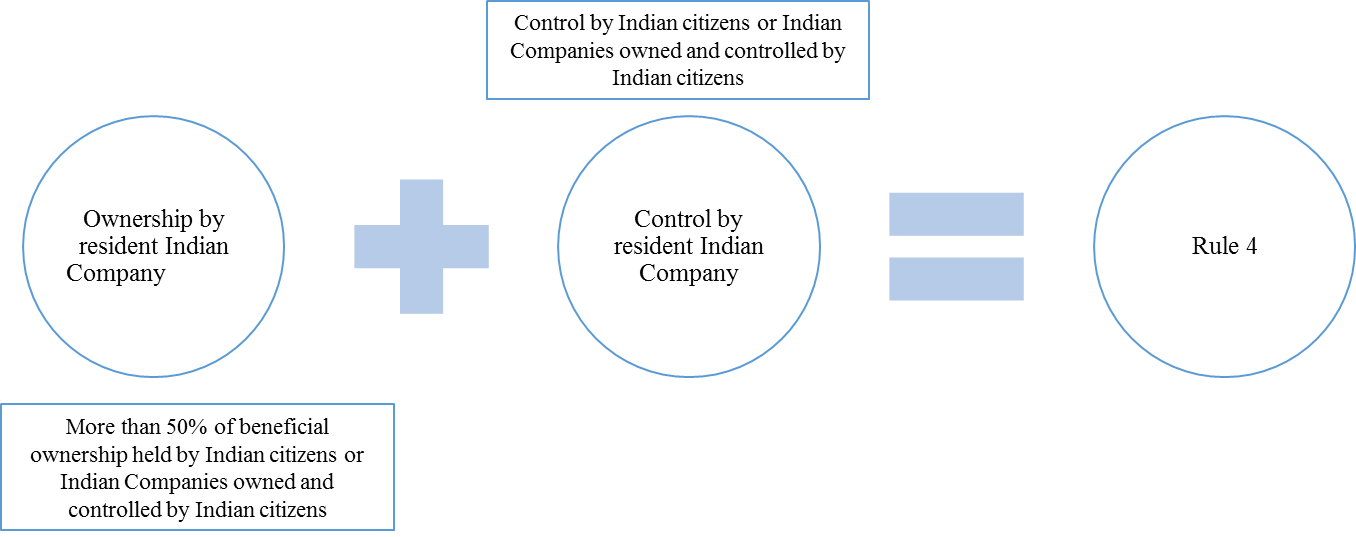

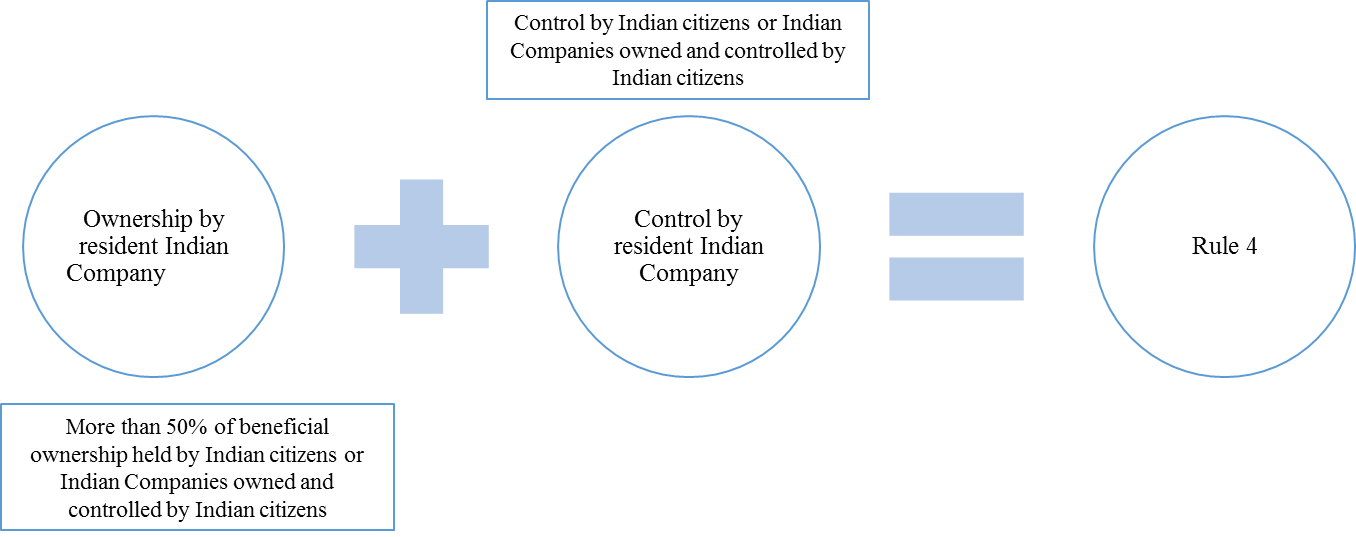

Rule 4 of the Draft PF Rules lays down that PFs in India must at all times ensure that their ‘ownership and control’ remains in the hands of resident Indian entities. For this purpose the rules have also defined ‘Indian Control’ and ‘Indian Ownership’ in Rule 2 (i) and (j) respectively. The same has been illustrated in the figure below:

This dual condition of ownership and control has been laid down to ensure that the decision making power of PFs stays with Indian investors at all times. PFs are vital institutional investors in the equity, debt and G-secs market. Handing out the controlling power to a foreign investor would affect the Indian capital markets and in turn the economy as a whole.

Foreign Portfolio Investment in PFs

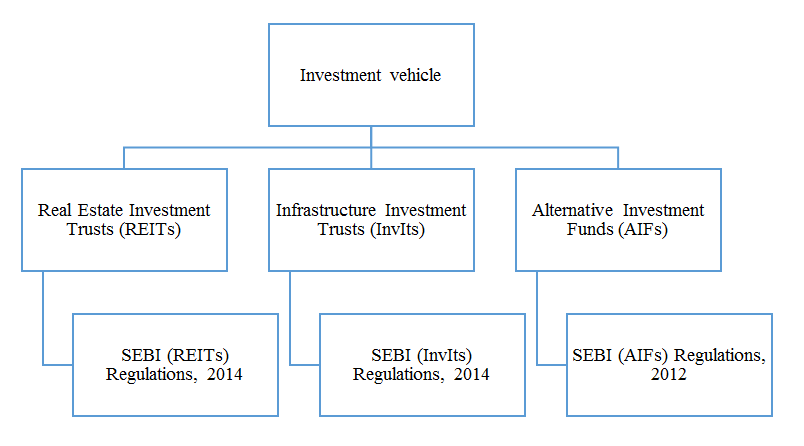

FPI in PFs will be governed by the FEMA Regulations, 2000 along with SEBI (FPI) Regulations, 2019. [Rule 6 of the PF Rules]

Comment: The definition of foreign portfolio investment should be aligned with NDI Rules.

Increase in Foreign Investment in PFs

Pricing guidelines specified under FEM Regulations will have to be followed for increase in foreign investment of PFs. [Rule 7 of the PF Rules]

Comment: Reference of Rule 21 of NDI Rules to be inserted.

The great wall for China

As a consequence of the COVID-19 pandemic lockdown as well as the increasingly strained relations between India and China, the former has imposed various restrictions on foreign investment by the latter.

The government has, vide the FEMA (NDI) Amendment Rules, 2020 dated 22nd April, 2020 posed the requirement of prior approval for any foreign investment by an entity of a country that shares land border with India in order to avoid opportunistic takeovers. This would even apply in cases where the beneficial ownership of the investment is situated in any of the restricted countries as well as to any case of transfer of ownership[1].

[1] To read out write-up on the same- http://vinodkothari.com/wp-content/uploads/2020/04/India-seals-its-borders-to-corporate-acquistions-ver-30.04.2020.p

In furtherance to this the Draft PF Rules specify that government approval will be required for investment in PF by foreign investors (entities as well as individuals) from any bordering countries including China. [Rule 8 of the Draft PF Rules]

Comment: Need to align with recent amendments made in Rule 6 (a) of NDI Rules restricting investments from countries sharing land border with India.

Link to our other articles:

- MoF amends FDI norms for rights issue and insurance sector:

http://vinodkothari.com/2020/04/mof-amends-fdi-norms-for-rights-issue-and-insurance-sector/

- Introduction to FEMA (NDI) Rules, 2019 and recent amendments

http://vinodkothari.com/2020/04/introduction-to-fema-ndi-rules-2019-and-recent-amendments/

- India seals its borders to corporate acquisitions

http://vinodkothari.com/2020/04/india-seals-its-borders-to-corporate-acquisitions/

- FPI can invest up to the sectoral cap in an Indian Company

http://vinodkothari.com/2020/04/fpi-can-invest-upto-the-sectoral-cap-in-an-indian-company/

Annexure I

Suggested amendments

| Sr. no. |

Provision |

Details of the provision |

Remarks |

| 1. |

Rule 2(d) |

‘Foreign Investment means…..

xx

in the equity shares of a PF in India under clause (i) of sub regulation (1) of regulation 5 of the Foreign Exchange Management (Transfer of issue of security by a person resident outside India) Regulations, 2000

|

The definition of foreign investment makes reference to guidelines as specified under the TISPRO Regulations which have been repealed.

The corresponding provisions are covered under rule 6(a) of the NDI Rules. |

| 2. |

Proviso to Rule 2(d) |

Provided that for the purpose of these rules, foreign investment shall include investment by Foreign Venture Capital Investment (FVCI) as permissible under regulation 6 of FEMA Regulations, 2000 |

As stated above, reference has been made to the repealed regulations.

Investments made by an FVCI are governed by rule 16 read with Schedule VII of the NDI Rules. As per the schedule, PFs are not included in the list of sectors permitted for investment by an FVCI. However, in the Draft PF Rules, the same is permitted and included under foreign investment.

|

| 3. |

Rule 2(f) |

Foreign portfolio investment means and includes investments in the equity share of a pension fund in India by Foreign Institutional Investors, Foreign Portfolio Investors, Non-Resident Indian, Qualified Foreign Investors and other eligible portfolio investor entities or persons in accordance with provisions contained in sub-regulations 2, (2A), 3, and 8 of Regulation 5 of FEMA Regulations, 2000

|

Firstly, reference has been made to the repealed regulations.

Secondly and more importantly, the definition is not in line with that provided under the NDI Rules and thus creating conflict.

According to the NDI Rules, foreign portfolio investment means any investment made by a person resident outside India through equity instruments where such investment is less than 10% of the post issue paid-up share capital on a fully diluted basis of a listed Indian company or less than 10% of the paid-up value of each series of equity instrument of a listed Indian company;

The Draft PF Rules consider FPI in equity shares (as defined under rule 2(c) which states that equity share capital will have the same meaning as defined under section 43 of the Companies Act, 2013) of the Company while the NDI Rules compute FPI on the basis of equity instruments (as defined under rule 2k of the NDI Rules).

Accordingly reference of ‘investing in equity shares’ should be substituted with ‘investing in equity instruments’ of PF in India.

Further, as per NDI rules, any foreign investment in an unlisted Company is treated as a foreign direct investment (FDI) irrespective of the quantum. In case of listed companies, investment up to 10% is treated as FPI. However, in case of the definition as provided under the Draft PF Rules, investment in equity shares of a PF would be treated as FPI. Furthermore, most of the PFs in India are unlisted companies. This creates huge discrepancy as to the fact whether foreign investment would be treated as FDI if it exceeds 10 % (as per NDI Rules) or PFI (as per Draft PF Rules)

Hence, alignment with the existing definition specified under rule 2(t) of the NDI Rules does not seem to be a relevant solution.

|

| 4. |

Rule 2(i) |

“Indian Control” of a pension fund means Control of a pension fund in India by resident Indian citizens or Indian Companies, which are owned and controlled by resident Indian citizens. |

According to Rule 23(7)(e) of the NDI Rules, “company controlled by resident Indian citizens” means an Indian company, the control of which is vested in resident Indian citizens and/ or Indian companies which are ultimately owned and controlled by resident Indian citizens……

According to Rule 23(7)(d) of the NDI Rules “control” shall mean the right to appoint majority of the directors or to control the management or policy decisions including by virtue of their shareholding or management rights or shareholders agreement or voting agreement…….

The definition under the Draft PF Rules more or less are similar to that provided under the NDI Rules. However, the term used in the former is ‘Indian control’ which should be aligned with the NDI Rules using the term ‘controlled by resident Indian citizens’.

Also, control has not been defined under the Draft PF Rules.

|

| 5. |

Rule 2(j) |

“Indian Ownership” of a pension fund in India means more than 50% of the equity capital in it is beneficially owned by resident Indian citizens or Indian companies, which are owned and controlled by resident Indian citizens provided that the manner of the computation of foreign holding of such Indian promoter or Indian investment company shall be construed with the relevant Rules and PFRDA Regulations/ Guidelines.

|

According to Rule 23(7)(b) of the NDI Rules, “company owned by resident Indian citizens” shall mean an Indian company where ownership is vested in resident Indian citizens and/ or Indian companies, which are ultimately owned and controlled by resident Indian citizens……

According to Rule 23(7)(a) of the NDI Rules, “ownership of an Indian company” shall mean beneficial holding of more than fifty percent of the equity instruments of such company…

Both the definitions specify the same percentage. However, the Draft PF Rules make reference to equity capital which has been defined therein to have the same meaning as that specified in section 43 of the Companies Act, 2013. As per section 43, “equity share capital”, with reference to any company limited by shares, means all share capital which is not preference share capital. This means in case of Draft PF Rules, only equity capital will be considered. As opposed to this, the NDI Rules refer to equity instruments which include shares, convertible debentures, preference shares and share warrants subject to conditions specified.

The same should be aligned with the NDI Rules along with the terminology used.

|

| 6. |

Rule 2 (n) |

‘Resident Indian investment’ shall have the same meaning assigned to it in the FDI policy issued from time to time.

|

In case there is a specific clause to that effect in the FDI Policy, then the same may be retained else, the definition should be modified to mean ‘investment made by a person resident in India not resulting in indirect foreign investment’. |

| 7. |

Rule 2 (q) |

All other words and expression used in these rules but not defined, and defined in the Act and Rules, regulations made thereunder shall have the same meanings respectively assigned to them.

|

As certain terms may not be defined in PFRDA Act, Rules and Regulations but may be defined in NDI Rules, reference of NDI Rules should be included. |

| 8. |

Rule 6 |

Foreign Portfolio Investment in a Pension Fund in India shall be governed by the provisions contained in sub-regulations 2, (2A), 3, and 8 of Regulation 5 of FEMA Regulations, 2000 and Securities Exchange Board of India (Foreign Portfolio Investors) Regulations

|

Reference has been made to the repealed TISPRO Regulation, 2000.

Corresponding provisions under NDI Rules

· For regulation 5(2A) of the TISPRO regulations for investment by Foreign Portfolio investors- Chapter 4 read with Schedule II of the NDI Rules;

· For regulation 5(3) of the TISPRO regulations dealing with investment by Non-resident Indians and Overseas Corporate Body – Chapter V read with Schedule III and Chapter VI read with Schedule V of the NDI Rules;

· For regulation 5(8) of TISPRO regulations dealing with investment in depository receipts- rule 6(d) read with Schedule IX of the NDI Rules.

Further, the TISPRO Rules mention of the Foreign Portfolio Scheme which was foregone in the TISPRO Regulations, 2017 and later by the NDI Rules as well.

|

| 9. |

Rule 8 |

A Government approval will be required for the investing entity or individual from any of the bordering countries including China.

|

While the Draft PF Rules make use of the term ‘bordering countries’, the same should be aligned with the NDI rules that makes reference to ‘a country which shares land border with India’. |

[1] https://www.pfrda.org.in/index1.cshtml?lsid=187

[2] http://www.npstrust.org.in/sites/default/files/PFRDA_PFReg2015.pdf

[3] https://dipp.gov.in/sites/default/files/pn2_2016_1.pdf

[4] http://legislative.gov.in/sites/default/files/A2013-23.pdf

[5] By July 18, 2020.