Meta-morphed: A corporate bond that puts $27 billion off-the-balance-sheet

Meta structures a data center investment funding with cash flows linked with rentals and guarantees

– Vinod Kothari | finserv@vinodkothari.com

In India, we often say: upar wala sab dekhta hai (God sees it all). However, if I could do things which God the almighty does not or cannot see, I will be most happy to do those. Doing things off-the-balance-sheet is always equally tempting; structurers of Frankenstein financial instruments have already tried to bring ingenuity to explore gaps in accounting standards to create such funding structures where the asset or the relevant liability does not show on the books. Recently, a $ 27 billion bond issuance by an SPV called Beignet Investor, LLC may have the ultimate effect of keeping the massive investment done at the instance of Meta group kept off-the-balance-sheet.

Structural Features

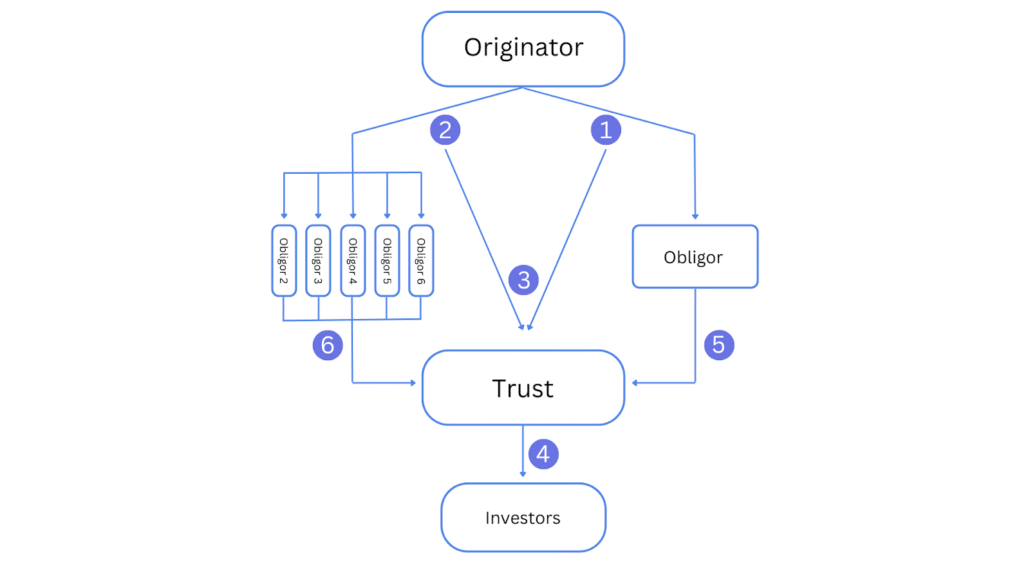

Essentially, the deal involves issuance of bonds to the investors, the servicing of which is through the cash flows generated from the lease payments. Further, a residual value guarantee has been provided by the group entity which has again led to a rating upliftment for the bonds issued.

The essential structure of the transaction involves a combination of project finance, lease payments and a residual value guarantee to shelter investors from project-related risks, and use of an operating lease structure, apparently designed to keep the funding off the balance sheet of Meta group. It is a special purpose joint venture which keeps the funding liability on its balance sheet.

Let us understand the transaction structure:

- Meta intends to do a huge capex to build a massive 2.064-GW data center campus in Richland Parish, LA. The cost of this investment is estimated at $27 billion in total development costs for the buildings and long-lived power, cooling, and connectivity infrastructure at the campus. The massive facility will take until 2029 to finish.

- The expense will be incurred by a joint venture, formed for the purpose, where Meta (or its group entities) will hold a 20% stake, and the 80% stake will come from Blue Owl Capital. The two of them together form the JV called Beignet Investor, LLC (issuer of the bonds).

- The JV Co owns an entity called Laidley LLC, which will be the lessor of the data center facilities.

- The lessee is a 100% Meta subsidiary, called Pelican Leap LLC, which enters into 4 year leases for each of the 11 data centers. Each lease will have a one-sided renewal option with 4 years’ term each, that is to say, a total term at the discretion of the lessee adding to 20 years. The leases are so-called triple-net (which is a term very commonly used in the leasing industry, implying that the lessor does not take any obligations of maintenance, repairs, or insurance).

- The 20-year right of use, though in tranches of 4 years at a time, will mean the rentals are payable over as many years. This is made to coincide with the term of amortisation of the bonds issued by the Issuer, as the bonds mature in 2049 (2026-2029 – the development period, followed by 20 years of amortisation).

- If the lease renewal is at the option of the lessee, then, how is it that the lease payments for 20 years are guaranteed to amortise the bonds? This is where the so-called “residual value guarantee” (RVG) comes in. RVG is also quite a common feature of lease structures. In the present case, from whatever information is available on public domain, it appears that the RVG is an amount payable by Meta Platforms under a so-called Residual Value Guarantee agreement. The RVG on each renewal date (gaps of 4 years) guarantees to make a payment sufficient to take care of the debt servicing of the bonds, and is significantly lower than the estimated fair value of the data center establishment on each such date.

The diagram below by provides for the transaction structure:

Off-balance sheet: Gap in the GAAP?

Of course, as one would have expected, the rating agency Standard and Poor’s that was the sole rating agency having given rating for the bonds, its report does not say the structure is off-the-balance sheet for the lessee, a Meta group entity. However, various analysts and commentators have referred to this funding as off-the-balance sheet. For example, Bloomberg report says “The SPV structure helps tech companies avoid placing large amounts of debt on their balance sheets”. Another report says that the huge debt of $ 27 billion will be on the balance sheet of Beignet, the JV, rather than on the books of Meta. An FT report says that bond was priced much higher than Meta’s balance sheet bonds, at a coupon of 6.58%, as a compensation for the off-balance sheet treatment it affords. A write up on Fortune also refers to this funding as off-the-balance sheet.

In fact, Meta itself, on its website, gives a clear indication that the deal was struck in a way to ensure that the funding is not on the balance sheet of Meta or its affiliates. Here is what Meta says:

“Meta entered into operating lease agreements with the joint venture for use of all of the facilities of the campus once construction is complete. These lease agreements will have a four-year initial term with options to extend, providing Meta with long-term strategic flexibility.

To balance this optionality in a cost-efficient manner, Meta also provided the joint venture with a residual value guarantee for the first 16 years of operations whereby Meta would make a capped cash payment to the joint venture based on the then-current value of the campus if certain conditions are met following a non-renewal or termination of a lease.”

Here, two points are important to understand – first, the operating lease/financial lease distinction, and second, the so-called residual value guarantee – what it means, and why it is opposite in the present case.

The distinction between financial and operating leases, the key to the off-balance sheet treatment of operating leases, was the product of age-old accounting standards, dating back to the 1960s. In 2019, most countries in the world decided to chuck these accounting standards, and move to a new IFRS 16, which eliminates the distinction between financial and operating leases, at least from the lessee perspective. According to this standard, every lease will be put on the balance sheet, with a value assigned to the obligation to pay lease rentals over the non-cancellable lease term.

However, USA has not aligned completely with IFRS 16, and decided to adopt its own version called ASC 842 for lease accounting. The US accounting approach recognises the difference between operating leases and financial leases, and if the lease qualifies to be an operating lease, it permits the lessee to only bring an amount equal to the “lease liability”, that is, the discounted value of lease rentals as applicable for the lease term.

As to whether the lease qualifies to be an operating lease, or financial lease, one will apply the classic tests of present value of “lease payments” [note IFRS uses the expression “minimum lease payments”], length of lease term vis-a-vis the economic life of the asset, existence of any bargain purchase option, etc. “Lease payments” are defined to include not just the rentals payable by a lessee, but also the minimum residual value. This is coming from para 842-10-25-2(d). The reading of this para is sufficiently complicated, as it makes cross references to another para referring to a “probable payment” under “residual value guarantees”. The reference to para 842-10-55-34 may not be needed in the present case, as the residual value agreed to be paid by the lessee is included in “lease payment” for financial lease determination by virtue of the very definition of financial lease. Therefore, it remains open to interpretation whether the leases in the present case are indeed operating leases.

Considering that the residual value guarantee from the parent company in the present case may not meet the requirements for its inclusion in “lease payments”, it is unlikely that the lease payments over any of the 4 year terms will meet the present value test, to characterise the lease as a financial lease. Also, the economic life of the commercial property in form of the data centers may be significantly longer than the 20 year lease period, including the option to renew. Hence, the lease may quite likely qualify as an operating lease.

Residual value guarantee: Rationale and Implications

In lease contracts, a residual value guarantee by the lessee is understandable as a conjoined obligation with fair use and reasonable wear and tear of assets. In the present case, if the lessee is a tenant for only 4 years, and the renewal thereafter is at the option of the lessee. If the lessee chooses not to renew the lease, the lessee is exercising its uncontrolled discretion available under the lease. So, what could be the justification for the parent company being called to make a payment for the residual value of the property? After all, the property reverts to the lessor, and whatever is the value of the property then is the asset of the lessor.

In the present case, it seems that the RVG comes under a separate agreement – whether that agreement is linked with the leases is not sure. However, for the holistic understanding of any complicated transaction, one always needs to connect all the dots together to get a a complete understanding of the transaction. If the lessee or a related party is paying for future rentals, it transpires that the understanding between the parties was a non-cancelable lease, and the RVG is a compensation for the loss of future rentals to the lessor. If that is the overall picture, then the lease may well be characterised as a financial lease.

Is the lessee’s balance sheet immune from the bond payment liability?

A liability is what one is obligated to pay; a commitment to pay. The $ 27 billion liability for the bonds in the present case sits on the balance of the JV Company. However, the question is, ultimately, what is it that will ensure the repayment of these bonds? Quite clearly, the payment for the bonds is made to match with the underlying lease payments, with a target debt service coverage. In totality, it is the lease payments that discharge the bond obligation; there is nothing else with the JV company to retire or redeem the bonds. From this perspective as well, an off-balance-sheet treatment at the lessee or at the group level seems tough.

However, off-balance-sheet may not be the objective really. What matters is, does the structure insulate Meta group from the risks of the payments from the data center. From the available data, it appears that the project related risks, from delays in completion to non-renewal, are all taken by Meta. Therefore, even from the viewpoint of project-related risks, there do not seem to be sufficient reasons for any off-balance sheet treatment.

Disclaimer: The analysis in the write-up above is limited to the reading that could be done from write-ups/materials in public domain.

Other Resources: