Online Workshop on Regulatory Concerns on Fair Lending Practices and KYC

| Register here: https://forms.gle/cQ3RYWAwhqd3hqTs7 |

Loading…

Loading…

Our resources on KYC can be accessed here.

Our resources on SBR:

| Register here: https://forms.gle/cQ3RYWAwhqd3hqTs7 |

Loading…

Loading…

Our resources on KYC can be accessed here.

Our resources on SBR:

Vinod Kothari, finserv@vinodkothari.com

Not sure if any cake was cut[1], but NBFC regulation turned 60, on 1st Feb., 2024. It was on 1st Feb., 1964 that the insertion of Chapter IIIB in the RBI Act was made effective. This is the chapter that gave the RBI statutory powers to register and regulate NBFCs.

What was the background to insertion of this regulatory power? Chapter IIIB was inserted by the Banking Law (Miscellaneous Provisions) Act, 1963. The text of the relevant Bill, 1963 gives the object of the amendment: “The existing enactments relating to banks do not provide for any control over companies or institutions, which, although they are not treated as banks, accept deposits from the general public or carry other business which is allied to banking. For ensuring more effective supervision and management of the monetary and credit system by the Reserve Bank, it is desirable that the Reserve Bank should be enabled to regulate the conditions on which deposits may be accepted by these non-banking companies or institutions. The Reserve Bank should also be empowered to give to any financial institution or institutions directions in respect of matters, in which the Reserve Bank, as the central banking institution of the country, may be interested from the point of view of the control of credit policy.”

Therefore, there were 2 major objectives – regulation of deposit-taking companies, and giving credit-creation connected directions, as these entities were engaged in quasi-banking activities.

Read more →– Vinod Kothari, vinod@vinodkothari.com

Sustainability-linked loans and bonds have been surging globally. While there has been a dip in the recent periods (Q3 and Q4 of 2023) owing to tightening of regulatory conditions, the global volumes of sustainability-linked loans stood at around $ 400 billion[1].

However, there is another instrument – a derivative, which also has a linkage with sustainability targets, and that is making a global buzz. ISDA, having named this Sustainability Linked Derivatives or SLDs, is creating proper documentation basis to take this market forward. As of now, the market for SLDs is neither large nor highly standardised, but as credit defaults rose from nowhere and from a purely OTC product into being in the very thick of the global financial crisis, SLDs also merit close attention.

Think of usual derivatives in financial business – it will be an interest rate swap, or cross currency swap/FX forward. An SLD adds a sustainability-linked overlay on a typical IRS or FX hedge transaction.

For instance, assume Borrower X has taken a floating rate loan of $ 100 million, say at SOFR + 100 bps. X now hedges interest rate risk by entering into an IRS with Bank A, whereby Bank swaps this for a fixed rate of 4.5%.

Here, if we add an SLD overlay, Bank A will agree to provide a discount of, say 5 bps if X is able to meet certain specified sustainability KPIs. On the contrary, if X fails to meet the KPIs, then X pays a penalty of equal or a different amount. Depending on the agreement, the discount or penalty, or bonus/malus, may either be exchanged between the counterparties or by spent by either counterparty by way of a donation for a sustainability cause.

Read more →– Vinita Nair & Prapti Kanakia | corplaw@vinodkothari.com

Indian companies were permitted to raise funds from overseas either pursuant to issue of depository receipts listed overseas or having the non-residents subscribe to issuances made in India or by way of borrowing overseas. As an initiative to provide an avenue to access global capital markets, GoI had announced the decision to ease raising of foreign funds in order to boost foreign investment inflows, unlock growth opportunities and offer flexibility to Indian companies to raise funds. Consequently, an enabling provision for direct listing of prescribed class of securities on permitted stock exchanges in permissible foreign jurisdictions was inserted vide Companies (Amendment) Act, 2020 in Section 23 of Companies Act, 2013 (‘CA, 2013’), that deals with permissible modes of issue of securities, vide notification dated September 28, 2020 and made effective from October 30, 2023. Thereafter, the Ministry of Corporate Affairs (‘MCA’) notified Companies (Listing of equity shares in permissible jurisdictions) Rules, 2024 (‘LEAP Rules’) effective from January 24, 2024. As listing of shares abroad will result in raising funds from persons resident outside India, Ministry of Finance (‘MoF’) notified FEMA (Non-Debt Instruments) Amendment Rules, 2024 amending FEMA (Non-Debt Instruments) Rules, 2019 (‘NDI Rules’) with effect from January 24, 2024. SEBI is also expected to roll out the operational guidelines for listed companies to list their equity shares on permitted stock exchanges.[1]

Additionally, FAQs on direct listing scheme (FAQs) have also been rolled out on January 24, 2024. Further, two of the key recommendations of the working group report on Direct Listing of Listed Indian Companies on IFSC Exchanges submitted in December 2023 was to notify the rules under Section 23 (3) and (4) of CA, 2013 and notify necessary amendments in NDI Rules to permit cross-jurisdiction issuance and trading of equity shares of Indian companies on IFSC exchanges.

Presently, both the LEAP Rules as well as NDI Rules have notified International Financial Services Centre in India (‘Gift City’) as the permissible jurisdiction and India International Exchange and NSE International Exchange as the permissible stock exchange. International Financial Services Centres Authority (‘IFSCA’) had issued the IFSCA (Issuance and Listing of Securities) Regulations, 2021 effective July 19, 2021 (‘IFSC Regulations’) however, in the absence of enabling provision under CA, 2013 and NDI Rules, Indian companies were unable to undertake listing of securities abroad.

In this article we provide an overview of the regulatory regime and deal with the procedural aspect.

Read more →Analysis of the Draft Framework for Self Regulatory Organization(s) in the Fintech Sector

– Archisman Bhattacharjee, finserv@vinodkothari.com

On January 15, 2023, the Reserve Bank of India (RBI) published a draft Framework titled “Draft Framework for Self-Regulatory Organisation(s) in the Fintech Sector” (‘Framework’) with the objective of eliciting feedback and gauging stakeholder expectations. In this article we analyse the said Framework which in our view is targeted more towards the unregulated FinTech sector and recommend why an SRO should opt for a recognition from the RBI.

The FinTech sector is booming and is a market disruptor as well as facilitator, based on the report published by Inc42, the estimated market opportunity in India fintech is around $2.1 Tn+ and currently there are 23 FinTech “unicorns” with combined valuation of $74 Bn+ and 34 FinTech “soonicorns” with combined valuation of $12.7Bn+.

The main functions of the FinTech sector includes providing solutions to Regulated Entities (REs) both as outsourced information technology providers as well as acting as lending services (such as customer acquisition, KYC task, servicing, etc.). The sector, however, not being under the direct supervision of the RBI may pose significant risks toward customer protection, data privacy, cyber security, grievance handling, internal governance, financial system integrity. In this respect the introduction of the Framework of Self-Regulatory Organisation(s) in the FinTech Sector (SRO-Ft) remains a welcome move where the SRO-FT would act as an instrument of self-regulation for the market participants, which may include both regulated and unregulated entities, by coming out with its own policies, codes of conducts etc. which are aligned with the industry standards, best practices and expectations/ recommendations of the RBI and other sector regulators. However it should be noted that due to lack of legislation, the RBI does not have have any jurisdiction over the FinTech sector (Discussed in details in Section 2 of this Article) vis-a-vis their SRO, unless the SRO’s voluntarily submit to the jurisdiction of the RBI and the same has also been envisaged under Para 3 of the directions under the head “Introduction” of the draft Framework under discussion.

Read more → Loading…

Loading…

– Kaushal Shah, finserv@vinodkothari.com

Reserve Bank of India (RBI) has recently announced amendments to the Credit and Investment concentration norms, specifically targeting Base and Middle Layer Non-Banking Financial Companies (NBFCs). The circular, dated January 15, 2024, brings about notable changes aimed at ensuring uniformity and consistency across NBFCs while computing the concentration norms.

It is pertinent to note that, as per para 84 of the SBR Directions, already requires the NBFC for the purpose of assignment of risk weight to net off the amount of cash margin/ caution money/security deposits held as collateral against the advances out of the total outstanding exposure of the borrower.

Framework for SROs for financial sector entities

-Srinithi Sreepathy | finserv@vinodkothari.com (Updated as on 29.03.2024)

On December 21, 2023, the Reserve Bank of India presented its first ‘Draft Omnibus Framework for recognising Self-Regulatory Organisations for Regulated Entities’(‘Draft Omnibus Framework’) in pursuance of its Statement on Developmental and Regulatory Policies dated October 06, 2023. RBI subsequently finalized and issued the Omnibus Framework for SROs on March 21, 2024.

The Omnibus Framework is in response to a vacuum located between Regulators and the ever-evolving industry dynamic. The RBI had proposed a draft and later finalised the framework, for Self-Regulatory Organisations (SROs) indicating a willingness to enter a collaborative approach to regulatory frameworks.

The Omnibus Framework, taking the increasing number of regulated entities and their growing scale of business into consideration recognises the lack of sufficient industry standards for self-regulation. Identifying this need and being aware of the futility of increasing the burden on regulatory bodies like the RBI, SEBI, or IRDA, (in this case, specifically: the RBI) the framework finds a middle ground by recognising self-regulation amongst members of various industry entities.

Self-Regulatory Organisations (SRO) are not-for-profit organisations that attempt to bridge the gap between regulation and industry-specific requirements.

Read more: Decoding the New NormIn the Indian context, the most popular example remains the Association of Mutual Funds India, or the AMFI, an entity incorporated under Section 8 of the Companies Act 2013 as a not-for-profit organisation with the stated intent to act as a facilitator between the Regulatory Body of SEBI/RBI/the Government of India and the Mutual Fund ecosystem. It also aims at formulating standards or “best practices” which shall in turn become the industry status quo for all members to follow and live by. The AMFI also acts as a licensing body for all Mutual Fund distributors in India as per the duties assigned to it by the SEBI.[1] MFIN (Mutual Fund Investment Network) is another example of a successful SRO infrastructure in India. With the emergence of the FinTech Sector in India: Section 8 companies like FACE and DLAI have cropped up with both significant membership and the aim to establish industry standards and Codes of Conduct. The current omnibus[2] offers these institutions the opportunity to get regulatory sanction from the RBI.

The Omnibus Framework defines its intent by stating:

“Self-Regulatory Organisations (SROs) enhance the effectiveness of regulations by drawing upon the technical expertise of practitioners and also aid in framing/ fine- tuning regulatory policies by providing inputs on technical & practical aspects, nuances and trade-offs involved. SROs can also help in fostering innovation, transparency, fair competition, and consumer protection. In sum, self-regulation shall complement the extant regulatory/ statutory framework for better compliance, in letter and spirit.”

To enable the SRO to fulfill the above obligations, the Omnibus Framework gives power to the SROs to frame necessary standards or codes within the regulatory framework prescribed by RBI. The adoption of the code, however, should not be a substitution for adhering to the necessary RBI Regulations.

As per the Omnibus Framework, SROs are expected to primarily act as an interface between the regulatory body and regulated entities. Thus, one of their primary duties extends toward collecting and providing relevant industry-specific data[3] to the Reserve Bank to aid more efficient policy making. Apart from this SROs are also expected to foster greater research, promote compliance practices, ensure inclusive development and effectively act as an industry representative before the regulatory body.

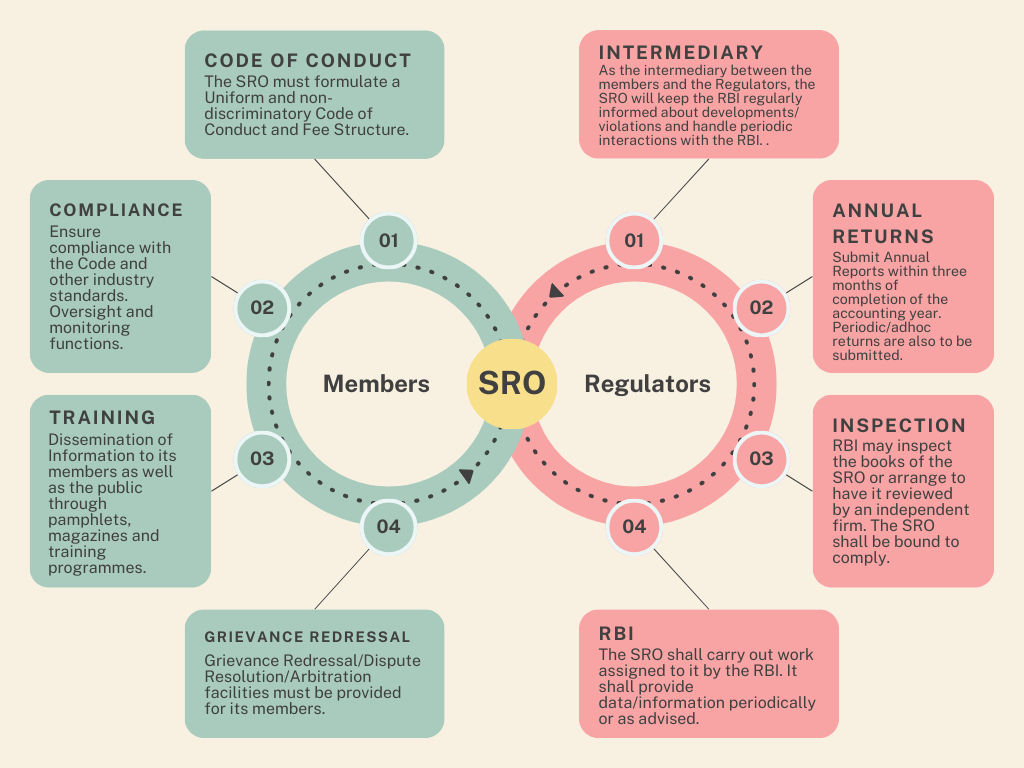

SROs have certain general objectives, as well as specific responsibilities to be undertaken toward both its members as well as the RBI that gives it its credibility. Their responsibilities can be construed in a trifecta of general and specific duties, with specific duties being toward their members and the regulatory body to whom they represent their members. The Omnibus Framework defines “members” as the Regulated Entities which accept the membership of SRO.

Figure 1 SRO General Objectives

[Clause(s) 6 and 7 of the Omnibus Framework]

Through the establishment of “best practices” and industry benchmarks that may be emulated by most if not all entities in a particular industry and recognising that it may be impossible for the average pedestrian to undertake thorough due diligence independently, the SRO acts as a “stamp of approval” toward the validity and trustworthiness of a particular entity. To ensure that the SRO in itself is reliable, they may be subject to periodic audits by the regulatory body, and are also required to submit their annual reports to the Reserve Bank within three months of completion of the accounting year.

They are also required to frame a code of conduct that should be adhered to by their members, provide periodic sector-specific information through bulletins, pamphlets and magazines to increase awareness amongst its members, establish grievance redressal and dispute resolution mechanisms for its members and also educate the public about the grievance redressal mechanisms available to them. The Omnibus Framework allows the SROs to counsel, caution, reprimand, and expel the members as a consequence of violation of the code established by it. However, such consequences cannot result in the imposition of a monetary penalty on the member.

Figure 2: Responsibilities Towards Members and Regulators

Clause(s) 8 and 9

What are the eligibility criteria for forming an SRO?

Figure 3: Eligibility Criteria for SRO Recognition

Further, the Omnibus Framework specifies that the shareholding of an applicant should be sufficiently diversified. The applicant will not be eligible if an entity either singly or acting in concert holds 10% or more in the paid-up share capital of the applicant.

The RBI envisions the present omnibus primarily for entities regulated by the RBI. The SRO, once it receives its Letter of Recognition from the RBI will consequently impact the institutions/entities that comprise the sector it is representative of.

Thus, in the present context, some of the primary stakeholders are:

Figure 4: Stakeholder Action Items

Regulated Entities are advised to proactively comply with emerging industry and governance standards, as well as emerging trends or shifts in interpretation of applicable guidelines/regulations/laws. It is recommended that REs promptly align with these standards, effectively articulate their challenges, and ensure full compliance to maintain industry integrity and operational excellence.

To ensure a systemic and reliable mode of self-governance, and the ideal operational excellence envisioned above, the SRO in itself, must be reliable. Thus, SROs are subject to certain stringent governance standards.

Figure 5: SRO Governance Mechanism

The Omnibus Framework requires the Board of SROs to frame a policy on the rotation of directors for important positions in the Board of SROs.

For an entity to be recognised as an SRO it must receive a “Letter of Recognition” from the Reserve Bank. To receive the same, it is required that the SRO submit certain documents to the RBI including but not limited to: A copy of its Memorandum of Association and Articles of Association, details regarding the constitution of its board: its duties, and mode of discharge of obligations. It shall contain the roadmap to achieve minimum membership as prescribed by the RBI within prescribed timelines (which shall not be greater than two years from the date of recognition) and any such further documents as may be necessary. Whilst membership should ideally be achieved by the time of application itself, if not, a clear roadmap on achieving the requisite membership should be provided. The RBI may stipulate a timeline (not exceeding two years) within which this should be achieved.

Membership in SROs shall be voluntary for the members.

Application that does not fulfil criteria liable to be rejected. A fifteen day window, commencing from date of dispatch of intimation from RBI, will be provided to the applicant for rectification.

Figure 6: SRO Application Process

In summary, SROs are the necessary bridge between the regulatory body and the industry. They represent the industry to the regulatory body and interpret directions issued by the regulatory body to the industry so as to ensure consensus and uniformity in interpretation.

Whilst the Omnibus Framework is fairly comprehensive and takes most relevant factors into account, some clarifications and further considerations are required as presented herein:

[1] However, it is to be noted that the current Omnibus does not make any specific mention of licensing activities that may be carried out by SROs in the future. At this stage it is difficult to predict whether licensing powers similar to AMFI will be granted to other SROs.

[2] read with the RBI SRO-FT Framework

[3] Omnibus Framework for Recognizing Self-Regulatory Organizations for Regulated Entities, Page: 3

Chirag Agarwal, finserv@vinodkothari.com

The RBI has proposed changes in the regulations applicable to housing finance companies (HFCs). While larger part of these proposed changes will impact deposit-taking HFCs, there are some provisions and privileges, currently applicable to NBFCs only, which are being extended to HFCs as well.

It may be recalled that the Finance Act, 2019 had moved the regulatory powers over HFCs to the RBI, whereas supervision remains with the NHB. Accordingly, RBI vide its Press release dated August 13,2019 issued direction that HFCs will henceforth be treated as Non-Banking Financial Companies (NBFCs) for regulatory purposes and RBI will carry out review of extant regulatory framework applicable to HFCs and come out with new revised regulations in due course. On October 22, 2020, the RBI issued a circular titled “Review of regulatory framework for Housing Finance Companies (HFCs)”, introducing a revised regulatory framework for HFCs. The circular emphasized the need for further harmonization between the regulations of HFCs and NBFCs over the next two years to ensure a smooth transition with minimal disruption. As part of this initiative, the RBI has released, on 15th January, 2024, a draft circular titled “Draft circular on Review of regulatory framework for HFCs and harmonisation of regulations applicable to HFCs and NBFCs” for public comments. The objective is to streamline the regulations governing HFCs, aligning them more closely with the regulatory framework applicable to NBFCs.

The proposed changes relate to both acceptance of deposits, and otherwise. Some of the proposed changes will be applicable to all HFCs. Below, we have provided a table comparing the guidelines applicable to NBFCs with the modifications proposed for HFCs to align them with the guidelines for NBFCs. Our point-wise analysis on the proposed changes is provided below:

Read more →Updated as on December 29, 2023

– Team Finserv | finserv@vinodkothari.com

Loading…

Loading…

Our Resources on the topic: