Housing finance companies regulatory framework: RBI proposes sectoral harmonisation

Chirag Agarwal, finserv@vinodkothari.com

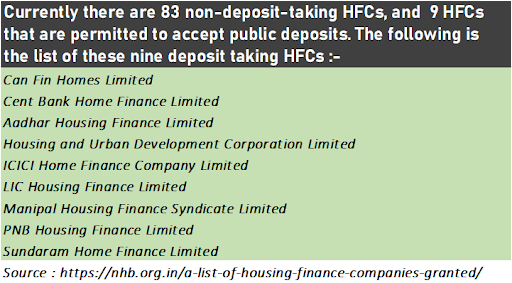

The RBI has proposed changes in the regulations applicable to housing finance companies (HFCs). While larger part of these proposed changes will impact deposit-taking HFCs, there are some provisions and privileges, currently applicable to NBFCs only, which are being extended to HFCs as well.

It may be recalled that the Finance Act, 2019 had moved the regulatory powers over HFCs to the RBI, whereas supervision remains with the NHB. Accordingly, RBI vide its Press release dated August 13,2019 issued direction that HFCs will henceforth be treated as Non-Banking Financial Companies (NBFCs) for regulatory purposes and RBI will carry out review of extant regulatory framework applicable to HFCs and come out with new revised regulations in due course. On October 22, 2020, the RBI issued a circular titled “Review of regulatory framework for Housing Finance Companies (HFCs)”, introducing a revised regulatory framework for HFCs. The circular emphasized the need for further harmonization between the regulations of HFCs and NBFCs over the next two years to ensure a smooth transition with minimal disruption. As part of this initiative, the RBI has released, on 15th January, 2024, a draft circular titled “Draft circular on Review of regulatory framework for HFCs and harmonisation of regulations applicable to HFCs and NBFCs” for public comments. The objective is to streamline the regulations governing HFCs, aligning them more closely with the regulatory framework applicable to NBFCs.

The proposed changes relate to both acceptance of deposits, and otherwise. Some of the proposed changes will be applicable to all HFCs. Below, we have provided a table comparing the guidelines applicable to NBFCs with the modifications proposed for HFCs to align them with the guidelines for NBFCs. Our point-wise analysis on the proposed changes is provided below:

| Particulars | Guidelines for NBFCs | Existing norms for HFCs | New draft norms for HFCs | Comments |

| Maintenance of percentage of liquid assets | NBFC-D entities are obligated to invest and consistently maintain investments in India in unencumbered approved securities. The value of these securities should not surpass the current market price, and the amount invested should not be less than 15% of the public deposit at the close of business on any given day. | As per Section 29B of the NHB Act, 1987, housing finance companies (HFCs) accepting deposits are presently required to uphold 13% of liquid assets against their public deposits. | It has been proposed that all deposit-taking HFCs should, in an incremental manner as outlined in the circular, consistently maintain liquid assets equivalent to 15% of their public deposits. | The proposed requirement for deposit-taking HFCs to incrementally maintain liquid assets at 15% of their public deposits, as outlined in the circular, would affecttheir liquidity management practices and financial strategies. |

| Safe Custody of Liquid Assets | Para 33 of Master DIrections for deposit taking NBFCs prescribe for detailed guidelines and requirement for Safe Custody of Liquid Assets / Collection of Interest on SLR Securities | Deposit taking HFCs are required to maintain liquid assets under Section 29B of NHB Act and such liquid assets shall be entrusted for safe custody with specified entities as stated in para 40 of HFC Directions | The existing regulations on Safe custody of approved securities as contained in para 40 of HFC Master Directions stand repealed | The provisions of para 33 on Safe Custody of Liquid Assets / Collection of Interest on SLR Securities shall mutatis-mutandis be applicable on both deposit taking HFCs and deposit taking NBFCs. |

| Full cover for public deposits | NBFCs are required to ensure that full asset cover is available for public deposits accepted by them at all times and in case the asset cover falls short the it would be incumbent upon NBFCs to inform RBI of such shortfall. | HFCs are required to ensure that full asset cover is available for public deposits accepted by them at all times. | As per the proposed change HFCs are required to ensure full asset cover for public deposits accepted by them at all times and it would now be incumbent upon HFCs to inform NHB in case the asset cover falls short. | The proposed change requiring HFCs to maintain full asset cover for public deposits and communicate any shortfall to the NHB signifies a heightened responsibility for regulatory compliance, influencing their operational and reporting procedures. |

| Rating of deposits | NBFC-D entities are prohibited from accepting public deposits unless they acquire a minimum investment grade or another specified credit rating for fixed deposits from an approved credit rating agency. This rating must be obtained at least once a year, and a copy of the rating, along with the return on prudential norms, must be submitted to the RBI. | Similarly, Housing Finance Companies (HFCs) are not permitted to accept or renew public deposits unless they secure a minimum investment grade rating for fixed deposits from an approved credit rating agency. This rating must be obtained at least once a year, and a copy of the rating should be sent to the NHB. Furthermore, HFCs must ensure compliance with all prudential norms. | No proposed change | No proposed change |

| Ceiling on quantum of deposits | NBFC-D entities, which adhere to all prudential norms and maintain a minimum Net Owned Fund (NOF), are permitted to hold public deposits up to a maximum of 1.5 times their NOF. | Deposit-taking HFCs that comply with all prudential norms and maintain a minimum investment-grade credit rating are allowed to hold public deposits up to three times their NOF. | The proposed adjustment is to cap the quantum of public deposits they can hold to 1.5 times their NOF | The proposed adjustment, reducing the cap on the quantum of public deposits held by HFCs from 3 times to 1.5 times of their NOF, would have a significant impact on their funding capacity and may necessitate a reassessment of their deposit mobilization strategies. Hopefully, a glide path will be given for compliance. |

| Period for repayment of public deposits | NBFCs are restricted from accepting or renewing any public deposit unless the deposit is repayable after a minimum period of 12 months but not later than 60 months from the date of acceptance or renewal. | Currently, HFCs were allowed to accept or renew public deposits repayable after a period of 12 months or more but not later than 120 months from the date of acceptance or renewal of such deposits. | It has been proposed that public deposits accepted or renewed by HFCs should now be repayable after a period of 12 months or more but not later than 60 months. | This proposed change, if approved, would bring uniformity in the maturity period for public deposits accepted or renewed by both NBFCs and HFCs. However, as housing finance is long-term funding business, the longer term of 10 years was justified. In practice, the proportion of long-term deposits was minimal; hence, the change will not cause immediate disruption. |

| Regulations on opening of branches and appointment of agents to collect deposits | The regulations for opening branches or appointing agents for NBFC-D are outlined as follows: (i) NBFC-Ds with NOF up to 50 crore are allowed to open branches or appoint agents within the state where their registered office is situated. This is subject to the approval of the RBI. (ii) NBFC-Ds with NOF greater than 50 crore have the flexibility to open branches or appoint agents anywhere in India, provided they obtain approval from the RBI. | No such regulations was there for HFCs | The instructions contained in para 30 of Master Direction – Non-Banking FinancialCompanies Acceptance of Public Deposits (Reserve Bank) Directions, 2016 shall mutatis-mutandis be applicable to deposit taking HFCs | This ensures that similar guidelines are followed for both NBFC-Ds and deposit-taking HFCs concerning the opening of branches or appointing agents. |

| Setting limits for investment in unquoted shares | For NBFC-D, there is a provision allowing them to invest in unquoted shares of another company, provided that the said company is neither a subsidiary nor part of the same group as the NBFC-D. The investment amount in such unquoted shares is capped at 20% of the NBFC-D’s owned fund. | There was no guidelines regarding limits for investment in unquoted shares for HFCs | As per the proposed changes deposit-taking HFCs will now be obligated to set Board-approved internal limits separately, all while adhering to the overall limit of direct investment. These internal limits are specifically for investments in unquoted shares of another company that is not a subsidiary or part of the same group as the HFC. | This adjustment aims to enhance control and governance over HFCs’ investments in unquoted shares. |

| Participation in Currency Futures | NBFCs are permitted to participate as clients in designated currency futures exchanges recognized by the SEBI. However, their participation is subject to guidelines issued by the RBI, and it must be solely for the purpose of hedging their underlying forex exposures. Additionally, NBFCs are required to make necessary disclosures in their balance sheets in accordance with guidelines issued by SEBI. | There are no specific guidelines pertaining to the participation of HFCs in Currency Futures. | HFCs can now participate in currency futures exchanges, subject to the guidelines issued in the matter by Foreign Exchange Department of the RBI and necessary disclosures in the balance sheet in accordance with guidelines issued by SEBI. | This change enhances the financial instruments available to HFCs for hedging against currency fluctuations. |

| Participation in Currency Options | NBFCs are allowed to participate as clients in designated currency option exchanges recognized by the SEBI. This participation is subject to guidelines issued by the RBI, and it should be solely for the purpose of hedging their underlying forex exposures. Non-Deposit taking NBFCs are required to make necessary disclosures in their balance sheets in accordance with guidelines issued by SEBI. | There are no specific guidelines regarding the participation of HFCs in Currency Options. | Non-deposit taking HFCs with asset size of ₹1000 crore and above can now participate in currency options exchanges subject to the guidelines issued in the matter by Foreign Exchange Department of the Reserve Bank and necessary disclosures in the balance sheet in accordance with guidelines issued by SEBI. | This change provides Non-deposit taking HFCs with asset size of ₹1000 crore and above with an additional financial instrument for managing currency risk, offering them more flexibility in their risk management strategies. |

| Participation in Interest Rate Futures (IRF) | NBFCs are allowed to participate as clients in designated currency option exchanges recognized by the SEBI. This participation is subject to guidelines issued by the RBI, and it should be solely for the purpose of hedging their underlying forex exposures. Non-Deposit taking NBFCs are required to make necessary disclosures in their balance sheets in accordance with guidelines issued by SEBI. | There are no specific guidelines regarding the participation of HFCs in IRF. | All HFCs can now participate in the designated IRF exchanges recognized by SEBI, as clients, subject to adherence to instructions contained in Rupee Interest Rate Derivatives (Reserve Bank) Directions, 2019, for the purpose of hedging their underlying exposures. Non-deposit taking HFCs with asset size of ₹1,000 crore and above are permitted to participate in the interest rate futures market permitted on recognized stock exchanges, as trading members, subject to adherence to instructions contained in Rupee Interest Rate Derivatives (Reserve Bank) Directions, 2019. | This change expands the financial instruments available to HFCs for managing interest rate risk, providing them with enhanced options for hedging their underlying exposures. |

| Credit Default Swaps (CDS) | NBFCs are allowed to participate in the CDS market, but only as users. In this capacity, they are permitted to buy credit protection solely for the purpose of hedging their credit risk associated with corporate bonds they hold. NBFCs, when participating as users in the CDS market, are required to ensure compliance with the guidelines, including operational requirements for CDS, as provided in Annex XIV of the Master Direction – Reserve Bank of India (Non-Banking Financial Company– Scale Based Regulation) Directions, 2023. | There are no specific guidelines regarding participation of HFCs in CDS. | HFCs are permitted to participate in the CDS market as users only and they shall buy credit protection only to hedge their credit risk on corporate bonds they hold. HFCs, as users, will be required to ensure adherence to the guidelines as provided in Annex XIV of Master Direction – Reserve Bank of India (Non-Banking Financial Company– Scale Based Regulation) Directions, 2023 | It benefits HFCs by providing a new tool for credit risk mitigation while ensuring regulatory compliance and governance. |

| Issuance of Co-branded credit cards | NBFCs are permitted, selectively, to issue co-branded credit cards in collaboration with scheduled commercial banks. This can be done without risk sharing, but prior approval from the RBI is required. This permission is granted for an initial period of two years, and a review will be conducted thereafter. NBFCs must fulfill minimum eligibility criteria and adhere to guidelines outlined in Annex XVII as per SBR Master Directions. | There are no specific guidelines regarding the issuance of co-branded credit cards by Housing Finance Companies (HFCs). | As per the proposed changes HFCs will now be allowed selectively to issue co-branded credit cards with scheduled commercial banks, without risk sharing, with prior approval of the RBI, for an initial period of two years and a review thereafter. HFC will be required to fulfill minimum eligibility as per SBR Master directions and also ensure adherence to instructions in Master Direction – Credit Card and Debit Card – Issuance and Conduct Directions, 2022 | This proposed amendment opens up new avenues for HFCs in the credit card space, providing opportunities for collaboration with banks. Notably, HFCs have a substantial retail participation, and therefore, the ability to distribute credit cards to their borrower base will give them a new avenue for fees. |

| Finalization of balance sheet | Every NBFC is required to finalize its balance sheet within a period of 3 months from the date to which it pertains | There was no such time limit for HFCs to finalize the balance sheet | It has been decided that HFCs shall finalize their balance sheet within 3 months from the date to which it pertains. | This proposed change is likely to accelerate the financial reporting process for HFCs, potentially influencing their internal processes, resource allocation, and overall financial management strategies to meet the new timeline requirements. |

| Periodicity of IS Audit | The periodicity of IS Audit shall be as per IS Audit policy of NBFC | IS Audit was required to be conducted at least once in 2 years | The periodicity of IS Audit shall be as per IS Audit policy of HFCs | This proposed change will provide more flexibility to HFCs in determining the frequency of IS audits based on their internal policies and risk management considerations. |

| Technical Specifications for all participants of Account Aggregator ecosystem | NBFCs acting either as ‘Financial Information Provider’ or ‘Financial Information User’ are expected to adopt the technical specifications published by ReBIT | There were no technical specifications prescribed | HFCs acting either as ‘Financial Information Provider’ or ‘Financial Information User’ are expected to adopt the technical specifications published by ReBIT | Previously absent technical specifications now necessitate HFCs to align with standardized guidelines, potentially influencing their technological infrastructure, systems, and processes to adhere to these specifications. |

| Investment through AIF | The investments/loans/exposures to the subsidiaries, companies in the same group and other NBFCs, in excess of 10 percent of aggregate of the paid-up equity capital and free reserves are deducted to arrive at NOF. In the context of arriving at the NOF figure, investment made by the NBFC in entities of the same group, either directly or indirectly, through an AIF, shall be treated alike, provided the funds in the AIF (company) have come from NBFC to the extent of 50 per cent or more; or where the beneficial owner in the case of AIF (trust) is the NBFC and 50 per cent of the funds in the trust have come from the NBFC. | The investments/ loans/ exposures to subsidiaries, companies in the same group and other HFCs, in excess of 10 percent of owned fund, is reduced from the owned fund, in order to arrive at NOF of an HFC. | Investment made by HFC in entities of the same group, either directly or indirectly, for example through an Alternative Investment Fund (AIF), shall be treated alike, provided the funds in the AIF (company) have come from HFC to the extent of 50% or more; or where the beneficial owner in the case of AIF (trust) is the HFC and 50% of the funds in the Trust have come from the HFC. | This implements the see-through approach for capturing investments into entities through AIFs. |

Other related resources:

Leave a Reply

Want to join the discussion?Feel free to contribute!