Capital Treatment, Loan Loss Provisioning and Accounting for Default Loss Guarantees

Vinod Kothari (finserv@vinodkothari.com)

The FinTech sector is booming and is a market disruptor as well as facilitator, based on the report published by Inc42, the estimated market opportunity in India fintech is around $2.1 Tn+ and currently there are 23 FinTech “unicorns” with combined valuation of $74 Bn+ and 34 FinTech “soonicorns” with combined valuation of $12.7Bn+.

The unprecedented growth of the fintech sector has transformed guarantees specifically First Loss Default Guarantees (FLDG) into a commonly employed tool for emerging players like fintechs. They leverage these guarantees to take exposures on loan transactions using low-cost funding from established entities such as large NBFCs and Banks. Fintechs issue guarantees that enable them to garner trust from prominent lenders, facilitating the origination of new loans through their digital platforms.

One of the crucial concerns in DLG arrangements is navigating the complexities surrounding capital treatment and NPA accounting covering both lenders and guarantors. In this article, we delve into an in-depth exploration of these crucial issues.

Capital Treatment

We organise this section into the following parts:

- Capital treatment for the lender availing the guarantee

- Capital treatment for the guarantor

- Expected credit loss treatment for the lender availing the guarantee

- Expected credit loss treatment for the guarantor

- Provisioning requirement for the lender availing the guarantee

- Provisioning requirement for the guarantor

Capital Treatment for Lenders:

Capital requirement is linked with the credit risk on the exposure: hence, before getting into the regulatory prescription, let us examine what is impact on the credit risk of the lender. For capital rules, a guarantee is regarded as a case of credit risk mitigation, provided the guarantee satisfies several conditions (e.g., it should be explicit, enforceable, guarantor’s financial resources adequate, etc). The lender, on the basis of the guarantee, shifts the risk of the first (or subsequent, as may be the nature of the guarantee) layer of the losses to the guarantor. Thus, there is a substitution of risk from the borrowers in the pool to the guarantor. The remaining exposure remains unprotected – hence, to that extent, there is no credit risk transfer. Therefore, if the risk weight of the guarantor is lesser than the risk weight of the underlying pool, there was a case to expect a reduction in the capital requirements.

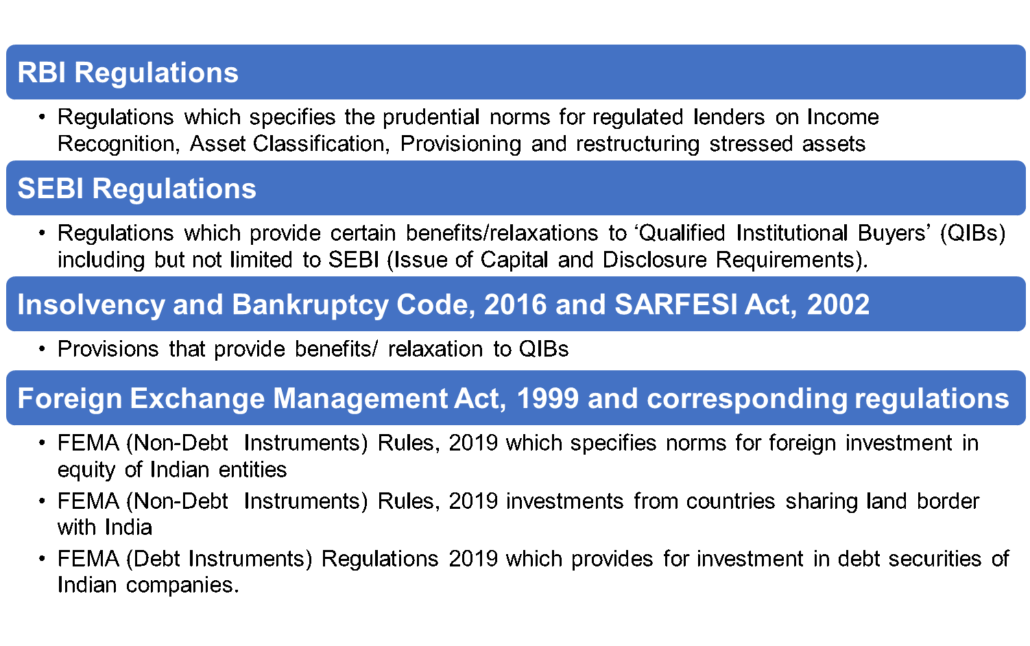

The regulatory prescription is as follows: DLG Guidelines states that for the purpose of capital computation, i.e., computation of exposure and application of Credit Risk Mitigation benefits on individual loan assets in the portfolio shall continue to be governed by the extant norms. The “extant norms” for this purpose would be the norms on credit risk mitigation. These norms are applicable in case of banks [see part 7 of the Basel III Master circular ] However, in case of NBFCs, there is no equivalent.

However, FLDG is expected to be backed by either a cash deposit, or a bank guarantee. If it is backed by cash deposit, cash is to be assigned 0 risk weight. Similarly, if it is backed by a bank guarantee, the risk shifts to the bank, and therefore, a 20% risk weight as applicable to banks may be assigned by the NBFC. Note that the above risk weights are only for the part backed by the guarantee. That is, if there is a 5% FLDG, the 5% of the loan pool will be risk weighted as above, and the remaining 95% will attract the risk weight applicable to the borrower pool.

Capital Treatment for the guarantor

When we talk about capital treatment, the same would depend on the capital rules applicable to the guarantor entity. If the guarantor entity is an RBI regulated lender, it will be covered by the capital rules. If the guarantor not a regulated lender, it is unlikely to have any capital rules.

We discussed above the nature of a structured default loss guarantee. A structured DLG (first loss, second loss, or subsequent loss) integrates the risk of a pool of loans and then strips the same into multiple tranches. Therefore, it becomes a case of structured risk transfer.

The generic rule in case of any structured risk transfer is that the acquirer of the first loss tranche acquires the risk of the entire pool. Therefore, a first loss default guarantor is required to keep capital on the pool size (and not the size of the guarantee). However, the size of the guarantee is the loss limit of the guarantor – therefore, the capital requirement, computed by applying the risk weight to the pool size, will be limited to the size of the guarantee. We discuss this further below.

First Loss

If the guarantee is first loss in nature, then, as the principle goes, the RE will have to maintain capital on the entire pool, since, it is exposed to all the risks associated with all loan accounts individually, subject to a ceiling on the the amount of guarantee it has provided.

For instance, if the guarantor provides a 5% FLDG for a pool of loans aggregating to Rs. 100 crores, and the regulatory capital requirement of the guarantor is 15%, then the capital required to be maintained against such pool is:

Lower of

- 15% of Rs. 100 crores * 100% (Assuming 100% is the applicable risk weight of such loans)

- 5% of Rs. 100 crores

= Rs. 5 crores.

As per the RBI FAQs, RE providing DLG shall deduct “the full amount of the DLG which is outstanding” from its capital. The above is in line with the RBI FAQs on the subject.

This prescription should be taken as applicable in case of first loss guarantees.

Further, the apparent question that arises here is in what proportion should the capital be reduced from Tier I and Tier II. In absence of any specifications in this regard in the regulations or the FAQs, it is only logical to deduct the capital from the Tier I and Tier II in their respective ratios. That is, if the Tier I is 10% and Tier II is 5%, then the capital reduction should also happen in the ratio of 2:1.

Second Loss

If the guarantee is second loss in nature, then, the losses will start piling up on the guarantor only once the first loss support is exhausted. Unlike the other case, here, the guarantor is not exposed to all the risks associated with all loan accounts individually. Therefore, the capital will have to be maintained on the amount of guarantee provided instead of the entire pool.

Using the same example, as used in the earlier case, the capital requirement for the RE will be:

Rs. 100 crores * 5% * 15% = Rs. 0.75 crores.

Of course, this is applicable only where the first loss guarantee is sufficient to absorb losses upto a level sufficient to absorb a certain multiple of “expected losses”. Usually, the multiple should be sufficient so as to render the second loss facility to achieve an investment grade rating.

Expected credit loss for the recipient of the guarantee

Expected credit losses are for the potential for the loan or pool of loans to result in credit losses. If the lender has the benefit of first loss guarantee, the situation is that to the extent of the FLDG, the lender has exposure on the guarantor, and for the remaining pool size, the lender has exposure on the borrowers.

As regards a potential credit loss on the guaranteed amount, the RBI rules require the guarantee to be either fully backed by cash, or backed by a bank guarantee. Hence, the question of any credit loss on the same does not arise.

Hence, the lender will be exposed to losses only on so much of the expected credit losses as exceed the FLDG cover. For instance, if the FLDG is 5%, and the ECL estimated by the lender is 6.8%, the lender may create ECL provision only for 1.8%.

Note that ECL for any pool is a dynamic number – while estimations of the default probabilities and the exposure change over time, there are also changes due to unwinding of the discounting factor applied in computing present value of the ECL. Therefore, ECL estimation is bound to change every reporting period. For that matter, FLDG will remain fixed as 5% of the originated pool, but this number will also be dynamic as the loan pool matures – partly due to amortisation of the pool, and partly due to utilisation of the guarantee. Therefore, on an ongoing basis, the lender may compare the ECL with the percentage of FLDG still available, and create ECL for the differential amount.

Expected credit loss for the guarantor

If the guarantor is covered by ECL requirements, the guarantor needs to estimate the losses likely to be caused to the guarantor. As against the guarantee, the payoff of the guarantor may be (a) fixed guarantee fees (b) right to get a variable fee, usually linked with the excess spreads from the pool.

Note that ECL computation is required not only for loans, but also for financial guarantees. Therefore, the guarantor will need to compute the expected credit losses from the underlying loans using exactly the same basis as if the loans were on the books of the guarantor. Of course, the maximum ECL will be the limit of the guarantee.

Provisioning for the recipient of the guarantee

In this regard, the RBI has clearly specified that no benefit will be given for provisioning requirements – that is, the regulatory provisioning will continue irrespective of the guarantee.

Provisioning for the guarantor

As regards the guarantor, while a financial guarantee is regarded as a direct credit substitute, however, there are no explicit provisioning requirements. To the extent the guarantee has already been utilised, it will be taken as a loss (even though recovery may happen subsequently, but it will be contingent).

Accounting

Given that the recoveries are against an outstanding asset, receipts from DLG invocation should not be treated as income. The recoveries made from the accounts, for which the lender has already invoked DLG, in our view,should be recorded as a liability. This is because any recoveries from borrowers after receiving DLG payout would be liable to be remitted back to the DLG provider, and the lender will only hold it in trust. Hence creating a back to back obligation on the RE. It is important to note that, in general, a lender may not relinquish their legal right to recover a loan, even after the loan has been written off. Consequently, the obligation to pass on the recoveries from the borrower may also persist indefinitely.

To support this perspective, we suggest that the lender establish a timeline in agreement with the DLG provider. This timeline should specify the duration during which any recoveries from loans, for which DLG payouts were made, will be passed on to the DLG provider. After the specified period, the lender will no longer be obligated to transfer such recoveries. Consequently, upon completion of the agreed period, the RE can write off the liability associated with the credit protection payouts received.

Treatment of an NPA account in case the guarantee is invoked.

Through the DLG Guidelines RBI has stated that the NPA classification would be the responsibility of the RE and would be as per the extant asset classification and provisioning norms irrespective of any DLG cover available at the portfolio level [para 7 of the DLG Guidelines]. The amount invoked by the DLG cannot be set off against the underlying individual loans and thus, asset classification and provisioning would not be affected by any DLG cover. However, any future recovery by the RE from the loans on which the DLG cover was invoked and realised can be shared with the DLG provider in terms of their contractual arrangements.

Since the guarantee invoked cannot be set off against the loan, how would the guarantee amount be shown in the books of the RE?

Accounting-wise, if the amount has been recovered, it is set off from the outstanding pool However, there is a departure here between accounting treatment and the NPA/capital requirements, as the RBI expects the NPA recognition to be continued in the books of the lender.

Similarly, capital requirements will also remain unaffected. However, it will be wrong to show the amount recovered from the guarantor as a liability as it is not a liability – though there may be an understanding that any recovery from the loans will be paid back to the guarantor. It is also wrong to treat the amount received from the guarantor as income, as the payment consists of both interest and principal.

Invocation of DLG will not affect NPA classification of borrower

It shall be noted that despite the FLDG being invoked against the borrowers outstanding amount, the capital requirements and asset classification remain unaffected. Further, reporting to CIC and NESL pertains to the borrowers performance, and therefore, the invocation of FLDG shall not influence these reporting. Repayment as well as defaults of the borrower should continue to be reported without any impact from FLDG invocation. Therefore, the borrowes account will continue to be classified as NPA and reported accordingly to the CIC and other relevant reporting entities.

Related Articles –

FAQs on Default Loss Guarantee in Digital Lending

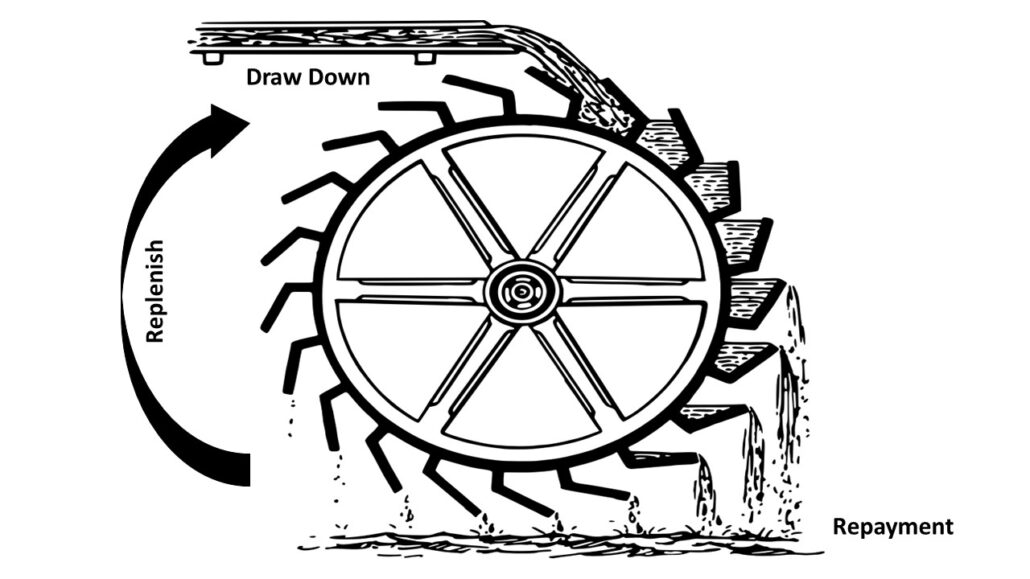

Lend, Recover, Replenish: A guide to revolving lines of credit