The Credit Card Business for NBFCs

RBI Directions on Credit Cards and Co-branded Credit Cards issued by NBFCs

- Aanchal Kaur Nagpal | Assistant Manager (finserv@vinodkothari.com)

With the objective to provide general and conduct regulations relating to credit, debit and co-branded cards to banks and NBFCs, RBI, on April 21, 2022, has issued the Reserve Bank of India (Credit Card and Debit Card – Issuance and Conduct) Directions, 2022[1] (‘Directions’), to be applicable with effect from 1st July, 2022.

Pursuant to the Directions coming into effect, extant guidelines, directions and/ or circulars issued by RBI, dealing with different aspects of transactions in credit, debit and co-branded cards, stand repealed; the Directions will become the one-stop reference. That being said, it must be noted that repealing the extant guidelines and directions does not imply a complete change in the provisions. Key aspects like eligibility conditions for issuance of credit cards, guidelines with respect to billing, interest rate charges etc. penalty for unsolicited cards have been retained from existing provisions. Major changes introduced vide the Directions are –

- Credit cards, co-branded cards and other terms are now clearly defined.

- Clarity on NBFCs permitted as credit-card issuers

- Clarity on co-branding of credit cards by two NBFCs.

- Limiting the role of a co-branding partner to marketing and acquisition without any access to transactional data.

Other operational changes include –

- Request for closure of a credit card to be honoured within 7 working days by the credit card-issuer, subject to payment of all dues by the cardholder. (earlier the requirement was immediate and no specific time limit was provided)

- Card-issuers to provide a one-page Key Fact Statement along with the credit card application containing the important aspects of the card such as rate of interest, quantum of charges, among others.

- Card-issuers do not follow a standard billing cycle for all credit cards issued. Therefore, cardholders to be provided a one-time option to modify the billing cycle of the credit card as per their convenience.

In this article, we shall focus our discussion on the conditions under which card issuers are permitted to undertake such card lending and analyse the implications and foreseeable action on the part of card issuers, specifically NBFCs.

Applicability on NBFCs

The Directions become applicable to every NBFC, operating in India, that has been permitted to issue credit cards in India. The definition of a card-issuer [para 3(a)(vi)] includes NBFCs which have been permitted by RBI to issue credit cards in India.

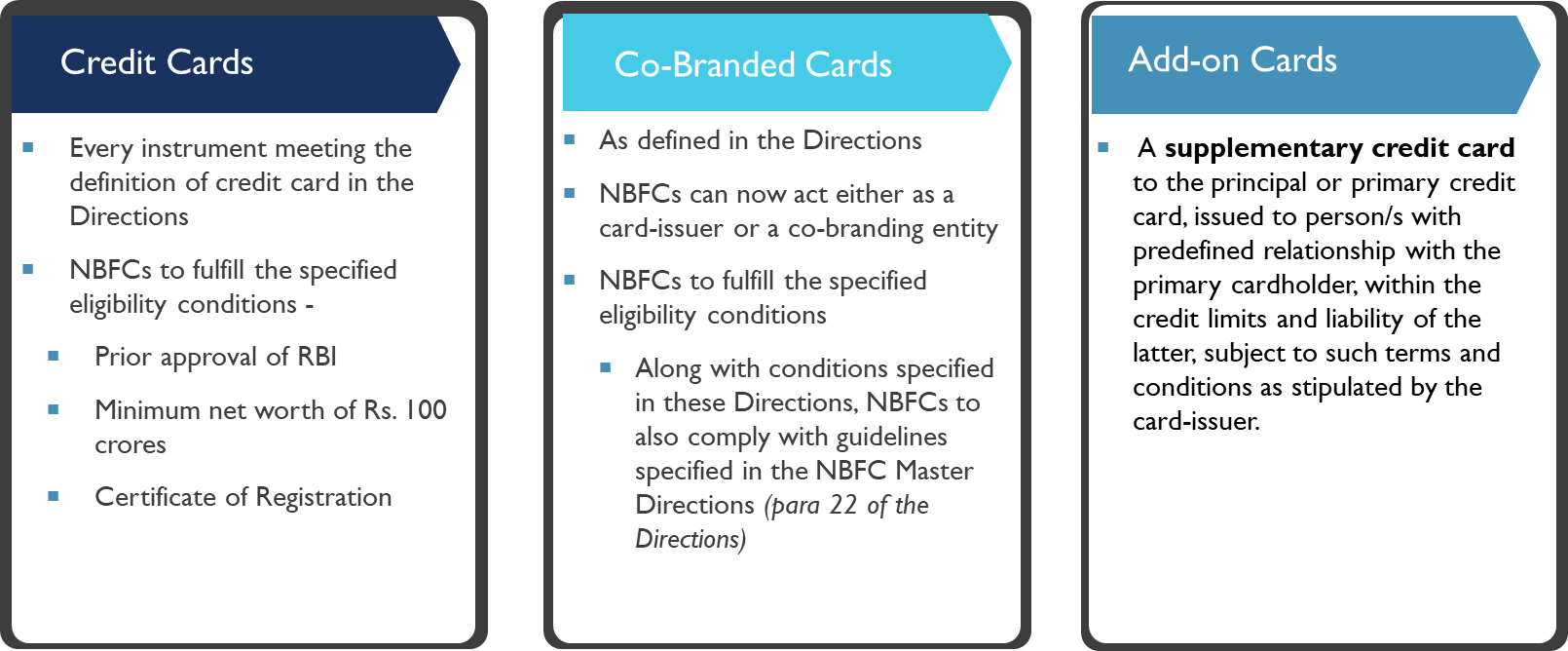

Types of Cards that can be issued by an NBFC

Insofar as the type of cards that NBFCs can issue, there has been no addition and/ or deletion. As already permitted under the NBFC NDSI Master Directions and ND-NSI Master Directions, the Directions also allow NBFCs to issue credit cards[2], including add-on cards, and co-branded credit cards[3].

The eligibility conditions are same as those currently provided under para 96 of the NBFC NDSI Master Directions and para 82of the NBFC ND-NSI Master Directions.

A. Guidelines on Credit Cards

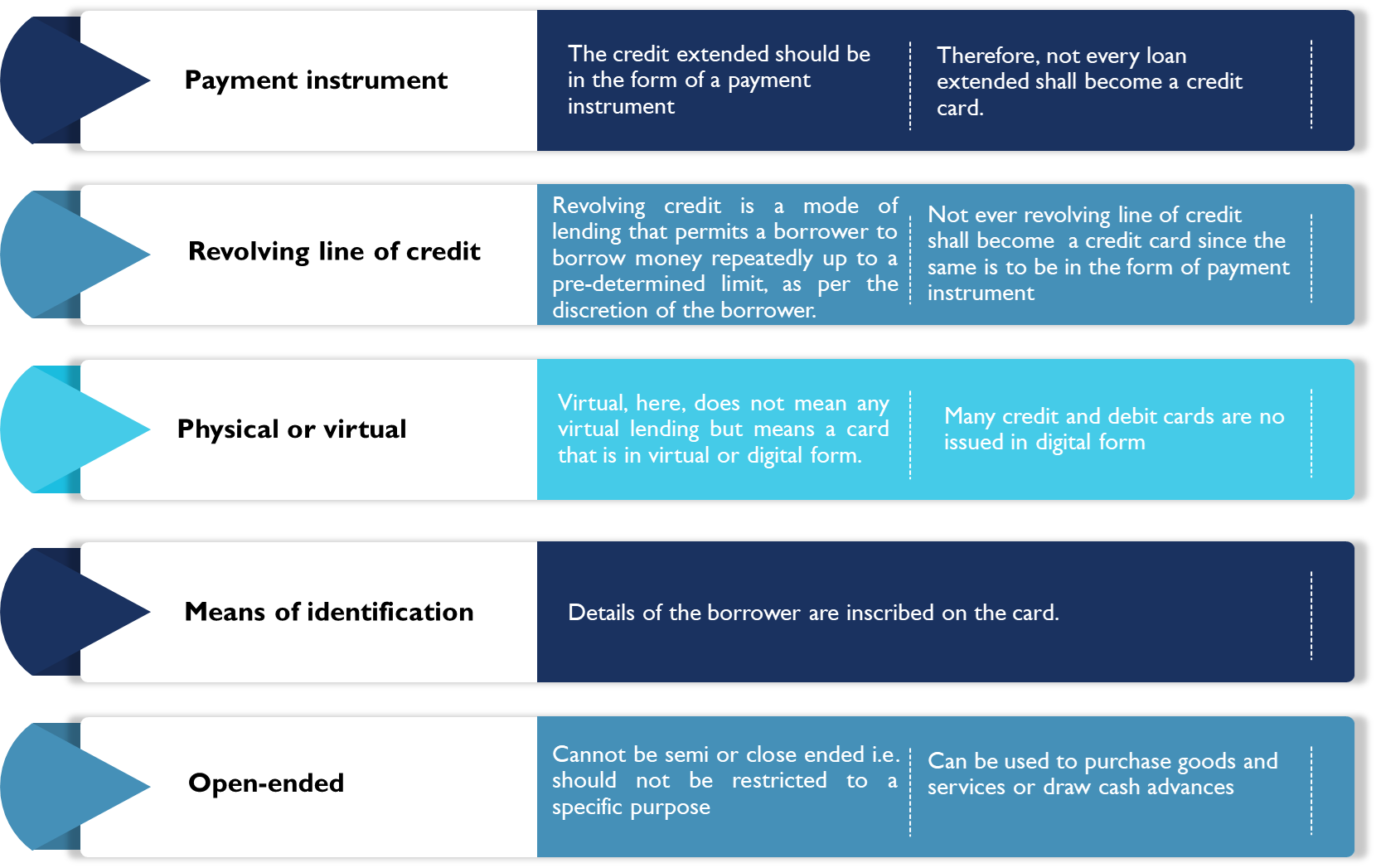

1. Definition of Credit Card

A significant takeaway from the Directions is that for the first time, ‘credit cards’ have been explicitly defined. Clause 3 (a) (xii) of the Directions define ‘credit card’ as

“a physical or virtual payment instrument containing a means of identification, issued with a pre-approved revolving credit limit[4], that can be used to purchase goods and services or draw cash advances, subject to prescribed terms and conditions.”

Going by the above definition and breaking it to different components, following may be understood as the essential features of a ‘credit card’

Coverage of the definition of credit card

1. App-based lending considering the definition captures virtual instruments as well?

A – Here, virtual means a digital or virtual credit card (issued in substitution/ along with a physical card) and not a virtual/ digital lending. A wallet/ lending through an app is not a payment instrument but is only a loan extended through a digital platform and will not get covered.

2. Wallet or any prepaid instrument

A – A wallet or a prepaid instrument is used to make payment in general. Here, the money is deposited by the holder itself and is not a loan. In case of a credit card, the borrower avails a loan, in the form of a revolving line

of credit.

3. Revolving line of credit will get covered.

A – The line of credit is required to be in the form of a payment instrument. A revolving line of credit is a simple loan.

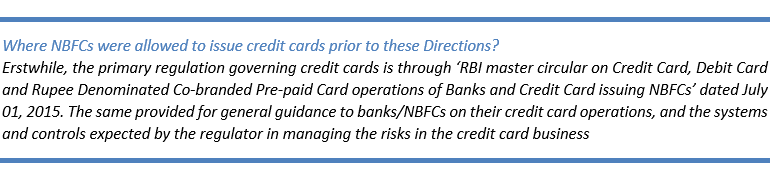

While the erstwhile directions were directed to both, Banks and NBFCs, but prima facie from the provisions of thereof and the language used it seemed that only banks could issue credit cards. Therefore, the erstwhile directions left a broader question on entities other than banks and their eligibility to issue credit cards. In the FAQs dated May 18, 2020, by RBI, on entities who can issue cards, RBI had clarified that credit cards are generally issued by banks and a couple of non-banks, but can also be issued by other approved entities. However, neither the FAQs nor the erstwhile direction provided a clear classification on which entities other than banks were eligible to undertake credit card business in India.

However, the NBFC Master Directions allowed NBFCs to issue credit cards, subject to the eligibility criteria.

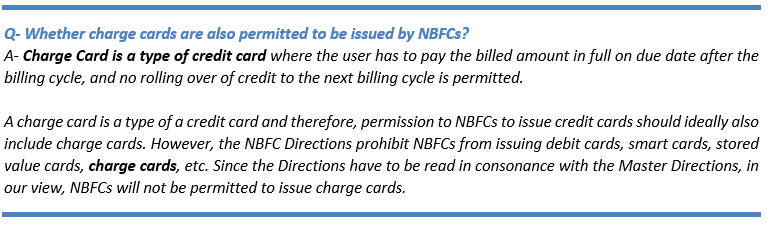

2. Anomaly over issuance of debit cards

Para 4(d) states that without obtaining prior approval from the Reserve Bank, NBFCs shall not issue debit cards, credit cards, charge cards, or similar products virtually or physically.

The same implies that NBFCs will also be permitted to issue debit cards with prior permission of the RBI.

However –

- As per the NBFC Master Directions (para 96), applicable NBFCs shall not issue debit cards, smart cards, stored value cards, charge cards, etc. The Directions, therefore, provide an explicit prohibition on NBFCs from issuing debit cards

- The definition of card issuer as well as applicability provides for only NBFCs permitted to issue credit cards.

- The Directions define a debit card as a physical or virtual payment instrument containing a means of identification, linked to a Saving Bank/Current Account which can be used to withdraw cash, make online payments, do PoS terminal/Quick Response (QR) code transactions, fund transfer, etc. subject to prescribed terms and conditions. There does not seem a possibility for an NBFC to issue such a debit card.

The same seems to be added unintentionally.

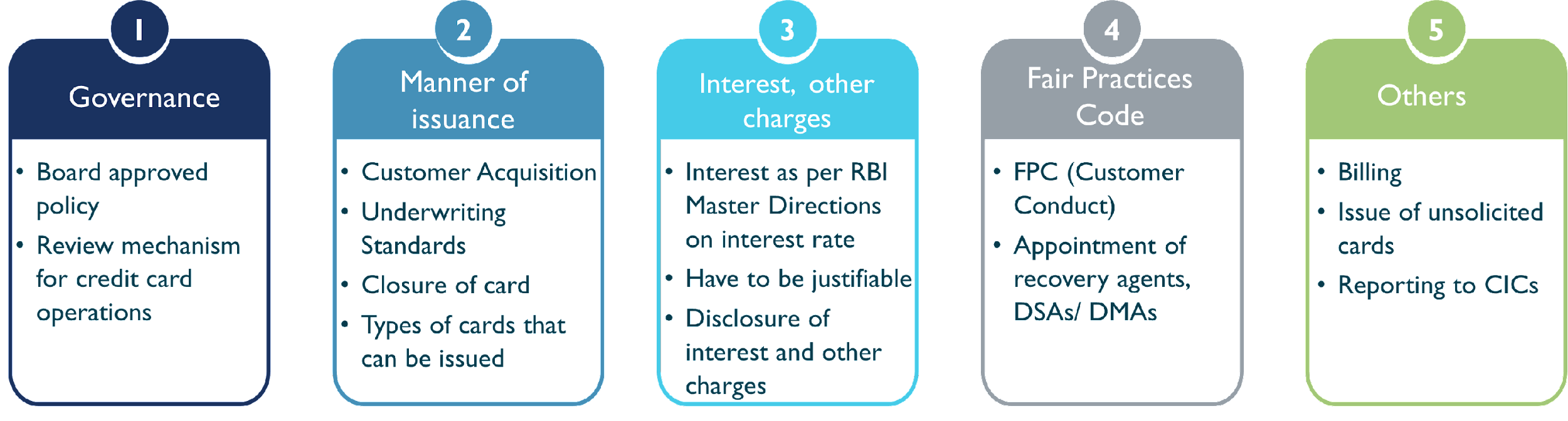

3. Requirements under the Directions –

The Directions provide for the general guidance and conduct for NBFCs issuing credit cards with respect to the following –

4. General Conditions

Other conditions as provided under Chapter V of the Directions will also need to be ensured which inter alia include –

- Compliance with KYC Directions and Anti-Money Laundering laws

- Manner of disclosure of terms and conditions

- Compliance with other specific conditions by RBI with respect to credit cards such as issue of international card, security issues and risk mitigation measures, card-to-card fund transfers, merchant discount rates structure, failed ATM transactions, etc.

- Redressal of grievances

- Confidentiality

B. Guidelines for Co-branded Cards[5][6]

1. Definition

As per definition in the Directions, Co-branded Card is a card that is issued jointly by a card-issuer and a co-branding entity bearing the names of both the partnering entities.

NBFCs are already permitted to issue co-branded cards with banks under the NBFC Master Directions.

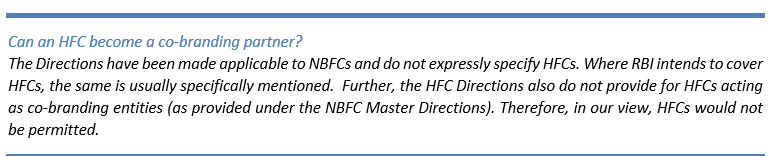

It is primary to establish a difference between the issuer and the co-branded partner. An issuer entity has to be a bank or a non-bank entity that has been authorised by the RBI to conduct credit card business in India (Refer to the discussion above). However, the partner entity could be any non-bank entity such as an online e-commerce company, travel company, apparel company, etc. There are additional restrictions to be complied with in the cases where the co-branding partner is an NBFC.

2. Permissibility on two NBFCs to issue co-branded cards

Currently, as per the NBFC Master Directions, applicable NBFCs registered with RBI are allowed to selectively issue co-branded credit cards with scheduled commercial banks.

However, as per the Directions, a co-branded card is issued jointly by a card-issuer and co-branding entity, where the former includes NBFCs permitted to issue credit cards (as per the definition of card issuer). Therefore, earlier where the market was predominantly containing NBFCs/ FinTechs participating with Banks issuing credit cards, now co-branding can even be done by two NBFCs jointly.

An NBFC can therefore either act as a credit card issuer singly, or jointly by way of a co-branding arrangement with other NBFCs and non-NBFCs.

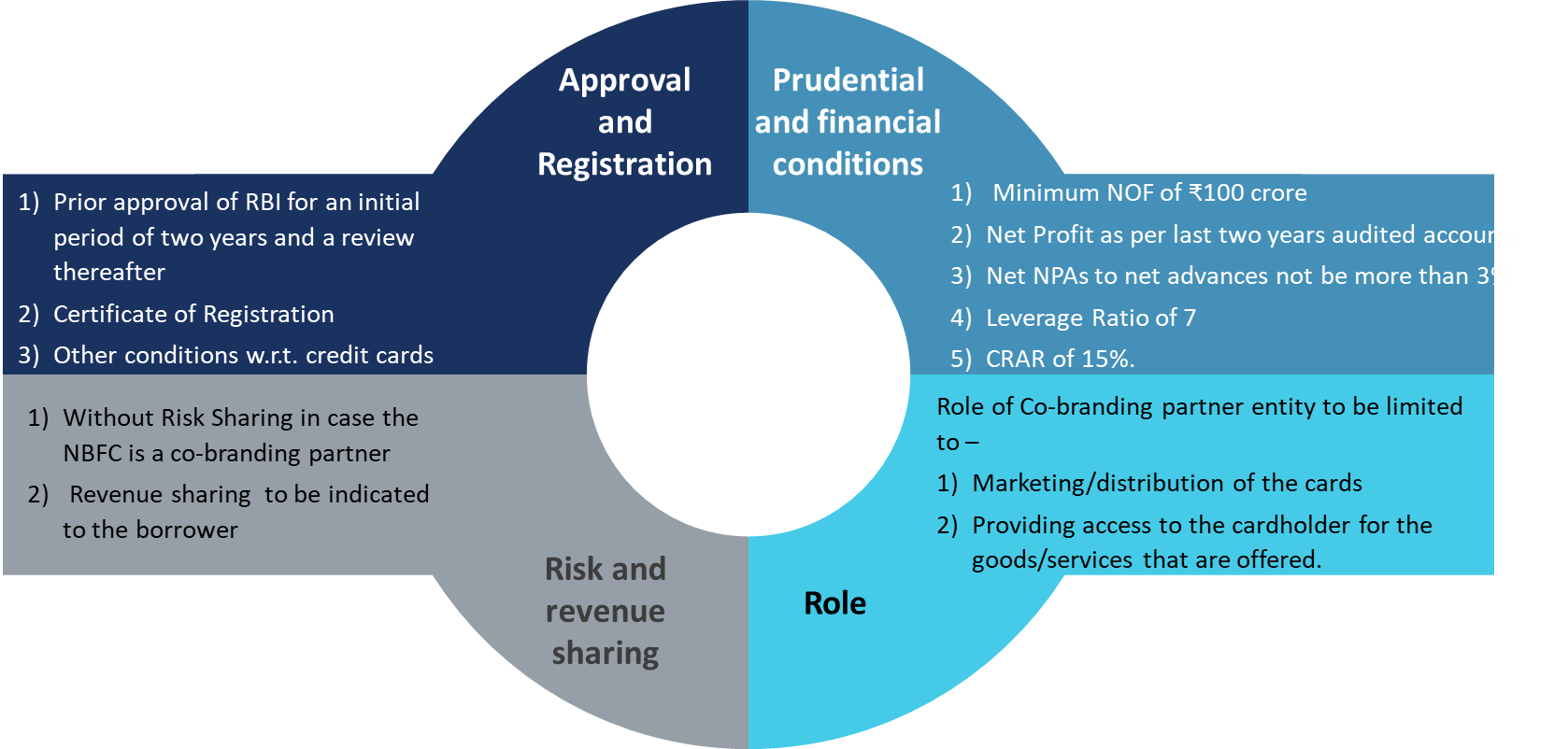

3. Eligibility Conditions

The Directions do not provide for explicit eligibility conditions. It has only been specified that prior approval of RBI will not be necessary for the issuance of co-branded credit cards by card-issuers subject to other conditions, provided under the Directions. [para 17(a)]

However, para 22 provides that NBFCs, which desire to enter into a co-branding arrangement for issue of credit cards with a card-issuer, shall also be guided by the Guidelines on issue of Co-Branded Credit Cards contained in the respective Master Directions applicable to NBFCs, as amended from time to time.

Therefore, conditions specified under the NBFC Master Directions will also be considered along with those provided in the Directions.

Eligibility conditions have been specified below –

Prior RBI approval

As per para 17(a), prior approval of RBI is not necessary for the issuance of co-branded credit cards by card-issuers subject to conditions stipulated under this chapter. This means that a card issuer, an NBFC in this case, if has already taken permission to issue credit cards, specific approval for issuing co-branded cards shall not be needed. However, if the NBFC is intending to act as a co-branding partner, specific approval of RBI will be required before entering into such arrangement. (para 19 of the Directions read with NBFC Master Directions)

Risk sharing

Risk-sharing would mean a situation where the co-branding partner would take part in the credit risk of the credit card customer on its balance sheet. In the case of NBFCs the NBFC Master Directions specifically provides that the co-branding partnership has to be on a non-risk sharing basis. These Directions do not contain any provisions with respect to the same. It has only been specified that the Policy shall specifically address issues pertaining to various risks, including reputation risk associated with the con-branding arrangement and suitable risk mitigation measures shall be put in place.

Since the Directions are to be read with the NBFC Master Directions, the NBFC cannot have a risk sharing model with the card issuer. Further, para 21 of the Directions specify that the role of the co-branding partner entity shall be limited to marketing/distribution of the cards and providing access to the cardholder for the goods/services that are offered.

Revenue sharing

Para 18 requires the card issuer and the co-branding entity to indicate the revenue sharing details between the card-issuer and the co-branding partner entity to the cardholder and display the same on the website of the card-issuer.

In our view, such a requirement does not seem commercially ideal as well not relevant for the borrower or public at large. RBI may consider revising the same.

Cannot share transaction documents

The co-branding partner shall not have access to information relating to transactions undertaken through the co-branded card. Post issuance of the card, the co-branding partner shall not be involved in any of the processes or the controls relating to the co-branded card except for being the initial point of contact in case of grievances.

The question arises is whether this will include all kinds of information, including customer information. In our view, the restriction will apply to transaction information i.e. what transactions have been undertaken by the card holder through the co-branded card. Customer information is basic information that will obviously be required by a co-branding entity for maintenance of records.

4. Other conditions

Other operational conditions as specified in the Directions as well as respective Master Directions shall be fulfilled such as –

- Explicit indication of the card as a co-branded card

- Due-diligence by the card-issuer of the co-branded entity

- Name of the card-issuer to be clearly shown in all marketing/advertising material etc.

- General conditions for issuance of cards (as provided for credit cards).

Impact of the Directions on the market

The Indian market has largely been inclined towards debit cards. However, due to the growing consumer market and the demand for consumer credit, including among the middle class which usually do not qualify for credit cards by banks, the Directions shall definitely serve as a gateway for NBFCs to enter the credit card market. Credit cardholders have increased in number from 29 million in March 2017 to 62 million in March 2021. Further, FinTechs who were originally partnering with banks to issue co-branded cards may now enter into co-branded partnerships with NBFCs as well. The Directions have intended to make the guidelines for cards more customer-friendly.

Currently, the permissibility of NBFCs w.r.t. issuing of credit cards was not clear. The clarity provided by the Directions may lead to bigger NBFC players to tap the under-tapped credit card market in India.

[1] https://rbi.org.in/Scripts/BS_ViewMasDirections.aspx?id=12300

[2] para 96 and para 82 respectively –

– https://rbidocs.rbi.org.in/rdocs/notification/PDFs/45MD01092016B52D6E12D49F411DB63F67F2344A4E09.PDF

[3] para 97 and para 83 respectively – https://www.rbi.org.in/Scripts/BS_ViewMasDirections.aspx?id=10585

[4] Credit Limit has been defined as the maximum amount of revolving credit determined and notified to the cardholder to transact in the credit card account. [para 3(a)(xiii)]

[5] A co-branded card is a credit card that a retailer of consumer goods or services issues in partnership with a particular credit card issuer/ financial institution. Co-branded cards provide merchandise discounts, points, or other rewards when used with the co-branding entity, but they can also be used anywhere such cards are accepted. Therefore, a co-branded card is a hybrid card having regular features of a credit card that additionally offers its holder additional benefits at selected merchants.

[6] Our article on Credit Cards Business- Regulatory nuances from issuance to co-branding –

Leave a Reply

Want to join the discussion?Feel free to contribute!