RBI Framework for Green Deposits

– Team Finserv | finserv@vinodkothari.com

Climate change is clearly one of the most pertinent regulatory themes in recent times, as the move to sustainable business practices and energy efficient technologies need massive funding. The availability of finance for move to sustainability has an important role to play in mitigating climate change. To this effect, RBI also conducted a survey in January 2022 to assess the status of climate risk and sustainable finance in leading scheduled commercial banks, and observed a need for concerted effort and further action in this regard. Following the same, RBI conducted a discussion, and released a press release indicating its intention to release a framework for acceptance of green deposits in India. On 11th April, 2023, RBI released the Framework for Acceptance of Green Deposits (“Framework”) for banks and deposit-taking NBFCs/HFCs, to be applicable from 1st June, 2023.

| Our video lecture on the topic is available here: https://youtu.be/7rRhVYR-zT0 |

As the green deposits formally mark its presence in the Indian financial markets, one may be inquisitive on various aspects related to it. We have tried to analyze and put our views on the same in this write-up.

Meaning of green deposits

Green deposits are essentially deposits raised for the purpose of utilizing the proceeds towards financing of “green” projects/ activities. The Framework defines green deposits as “an interest-bearing deposit, received by the RE[1] for a fixed period and the proceeds of which are earmarked for being allocated towards green finance”. These may be issued as cumulative or non-cumulative deposits which, on maturity, shall be renewed or withdrawn at the discretion of the deposit holder. It is to be noted that such deposits are denominated in Indian rupees only.

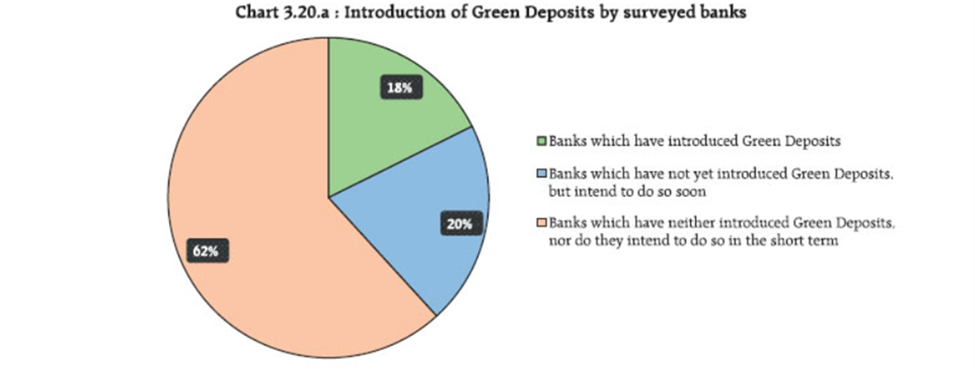

Notably, green deposits have been in existence in the country prior to this Framework too[2]. In fact, the RBI’s survey also indicated the existence of green deposits, where 6 out of 34 respondents affirmed the existence of green deposits products (also see figure below).

Source: RBI Survey

Green deposits are akin to other forms of deposits accepted by REs, and all terms and conditions as applicable to the acceptance of deposits by REs, as per the other specific directions of RBI remain applicable in case of green deposits too. In addition to the same, owing to the “use-of-proceeds” characteristic of green deposits, the Framework provides for additional guidelines that the REs shall adhere to.

Eligible green activities/ projects

The proceeds raised from green deposits shall be allocated to the eligible green activities/ projects. The same shall be based on official Indian green taxonomy[3], as and when the same is notified. Various countries around the world have already developed or are in the process of developing their own national green taxonomies, such as the European Union, China, Malaysia, Japan, Russia, Mongolia etc to name a few[4].

Pending the development of the taxonomy, the Framework specifies a list of eligible green activities/ projects that are aligned with the ones prescribed by SEBI with respect to the green debt securities.

Motivation for Banks and deposit-taking entities:

Green deposits are essentially deposits only with an additional “green” criteria attached to the use of proceeds raised from the same. This additional label brings with itself a bundle of additional requirements applicable on the REs. Hence, the question arises as to why will an RE want to raise funds through “green deposits” in the first place?

Such labeled funds may help them demonstrate their commitment towards climate resilience. As ESG is a very important item for the boardroom of every financial institution currently, the fact that the RE has a dedicated green deposit seems politically correct.

Apart from being a tactical measure, green deposits will also help REs to gain access to people having a sustainability agenda and willing to invest their surplus funds for a purpose that supports the cause for climate change.

Deposits come from both institutional and retail sources. As for retail depositors, the feasibility of raising substantial funds with the green label will depend on the sensitisation of the depositors on climate finance. However, as for institutional investors, many of the asset managers and other institutional investors currently have allocations for green finance. Therefore, REs may stand a good chance of garnering additional resources.

Motivation for depositors

Deposits are one of the easiest, secured and preferred means of mobilizing funds, especially, in case of retail investors. It allows both liquidity to institutional investors for short-term investment needs while providing stability to retail investors for their long-term goals and commitments.

For most retail depositors, if a depositor is looking at deposits as a source of fixed income, the depositor may remain indifferent to the label the deposit is carrying, so far as it caters to the economical needs. However, for an ESG-sensitive depositor, such green deposits may prove to be an additional stimulator in choosing where to keep their money invested. The other general benefits of deposits – liquidity, ease of operation, security and insurance, and accessibility – remain equally applicable in case of green deposits as well.

Some lingering questions

Are green deposits a part of the overall deposit book of the RE, or to be ring-fenced and treated separately?

The money raised by green deposit is very much a liability of the RE, and is a part of the overall treasury framework of the RE. The only control is the deployment of the funds raised by sourcing green deposits.

Hence:

- There is no physical segregation of green deposits from the rest of the funds/resources of the RE. The green deposits flow into the same regular banking accounts as any other money. They are deployed from the regular resources. As in case of other similar application-based funding sources, e.g., infrastructure bonds, the RE has to ensure that it has deployed at least as much money into the financing of green assets as it has raised green deposits.

- The reference to temporary allocation of funds into liquid instruments of a maturity within 1 year cannot mean that there is no commingling of funds at all. If such an interpretation is taken, then the scheme of green deposits will necessitate a complete segregation of the green deposits, and result into a treasury-within-treasury scenario. In our view, all this means is that the gap between the overall green deposits raised, and the green financing given, is covered within 1 year, and until that gap is covered, it is represented by liquid instruments.

The equivalent requirements in ICMA’s Green Bond Principles reads as follows: “The net proceeds of the Green Bond, or an amount equal to these net proceeds, should be credited to a sub-account, moved to a sub-portfolio or otherwise tracked by the issuer in an appropriate manner”. Note that this is referring to tracking of the use of the funds, and not necessarily segregation. Segregation would suggest that funds used for a purpose canot be used for any other purpose, and therefore, will ensure a complete escrowing of the money. This will then require similar segregation for the inflows from the green assets, which will almost result into an SPV type structure. The intent of use-of-proceeds controls is to ensure that green liabilities are used for green assets, and not that there will be an SPV within the RE to ring fence the funding completely.

If the RE is a bank, what will the temporary allocation of green deposits into liquid instruments mean? Does it necessarily mean investments outside the RE?

We have expressed a view above that the Framework does not necessarily rule out commingling of funds raised by green deposit. The green deposit scheme is not like a special purpose vehicle, which has to be completely distinct from the rest of the treasuries of the RE.

If this view is taken, then there is no need for an RE, say a bank, to park the unutilised funds outside the bank. Any insistence of the bank parking the green deposit funds into external investments will result into inefficiency of utilisation. A bank, after all, itself offers liquid deposits to its investors, and it will be counter intuitive if the bank has to search for liquid investments externally.

How will the re-deployment of amortization of green finance be handled? Is it to be treated in the same manner as green deposits?

In our view, the essence of deploying green deposits into green financing is akin to running an asset liability matching – that is, on a periodic basis (say, quarterly basis), the total green deposit liability should be backed by green financing. Therefore, if there is amortization (collection of principal) from green financing assets, the same needs to be re-deployed into green financing again, to the extent of the green deposit liability outstanding.

Whether the servicing or repayment of “green deposits” are also linked with the proceeds from resultant “green assets”?

Given the “use-of-proceeds” nature of green deposits, a doubt may arise on whether the repayment of such deposits are also linked with the performance of the use of their proceeds. That is to say, whether the payment of interest on the green deposits has to come from the income from green financing, and the repayment of the so-called “green” deposits comes from the “green” assets (loans/ investments)? The answer to this has to certainly be negative. The green deposits are the unconditional liability of the RE – hence, the payment of interest thereon as well as repayment both are the obligations of the bank/RE. Deposits are generally looked upon as the safest mode of investment, and one cannot take away the main essence of it, by linking the repayment with the performance of the green activity/ project.

Once the green deposits are accepted, they become a part of the larger pool of liabilities of the REs, whereas, the green loans/ investments become a part of the total pool of assets.

Whether refinancing of existing green projects will also classify as eligible use of proceeds?

The intent of bringing in “green deposits” is to open new avenues of finance for the green activities towards meeting the net-zero targets of the country. Refinancing of an existing loan, though taken for an eligible green activity, does not result in the creation of any new sustainable asset/ impact, and therefore, one may find it logical to exclude such “refinancing” within permitted use of proceeds. However, reference may also be made of the “green bond” framework of ICMA, that permits refinancing of eligible green assets as well, out of the proceeds raised from issuance of green bonds.

Refinancing may take various forms:

- An existing green asset, which the borrower is now seeking to finance

- An existing green asset, funded by some other lender, which is now being refinanced by an RE

- Transition financing, that is, the cost of moving from a traditional technology to an energy efficient technology, etc.

What happens to the existing green deposits that are not complying with the Framework?

As the Framework becomes applicable from 1st June, 2023, a question may arise as to what happens to the existing schemes? Does it get annulled, with the deposits being repaid instantly or moving the existing green deposits under the new schemes launched in compliance with the Framework?

There is no explicit grandfathering in the Framework. Therefore, in our view:

- The deposits already raised under existing schemes should be allowed to run their full term. However, any renewal thereof should comply with the Framework.

- Use of proceeds of existing deposit schemes, at least from 1st June, should only be for the “eligible projects” defined under the Framework.

- Other requirements of the Framework, such as third party assessment or impact assessment, may not be applicable to existing deposits.

- Disclosure requirements are for green deposits itself – appropriately, the deposits raised from existing schemes should also be disclosed, may be with a separate indication that these deposits were raised prior to the effective date of the Framework.

Actionables under the Framework

The actionables that attract on the REs proposing to raise funds through acceptance of green deposits include the following:

- Policy on green deposits – Put in place a comprehensive board approved policy on green deposits, that would include all aspects relating to the issuance of green deposits and allocation of the proceeds raised by acceptance of such deposits. Such policy shall be put on the website of the RE.

- Financing Frameworkfor allocation of proceeds – RE shall frame, and place on its website, aboard approved “Financing Framework” for effective allocation of proceeds of green deposits, specifying the following –

- Eligible green projects/ activities that can be financed out of the proceeds

- Process of project evaluation and selection including monitoring and validation of sustainability information of the borrower

- Allocation of proceeds and its reporting

- third party verification of allocation of proceeds and impact assessment

- Particulars of temporary allocation of green deposit proceeds pending allocation.

The Financing Framework is also required to be reviewed by an external reviewer and the opinion of the external reviewer is also required to be put on the website prior to implementation of the Financing Framework.

- Third-party verification of allocation of funds – The REs shall ensure the allocation of green deposits proceeds to the eligible green activities. Such allocation of funds shall be subject to an independent Third-party verification/ assurance on an annual basis. The Third-party Report shall cover the following –

- Use of proceeds in accordance with the eligible green activities

- Policies and internal controls in relation to the project evaluation and selection, management of proceeds, reporting and disclosures etc.

The Report shall also be put on the website of RE.

- Impact assessment of use of proceeds – REs shall also be required to conduct impact assessment to ascertain the impact associated with the funds lent/ invested by the REs towards the green projects/ activities on an annual basis, on the basis of quantifiable impact indicators. In case of inability of quantification of impact, the reasons and difficulties faced, and time bound plans to address the same are required to be disclosed. The Report has to be put on the website of the RE. Impact assessment is voluntary for FY 23-24, but has to be mandatorily complied with from FY 24-25 onwards.

- Reporting Requirements – For the purpose of ensuring that the raising, allocation and utilization of the funds is adequately reviewed, the RE shall place before the Board, within 3 months from the end of the financial year, a review report covering details as prescribed. Further, the entity shall also make appropriate disclosures in its annual financial statements in the prescribed format.

Closing thoughts

With a sharp increase seen in the integration of ESG objectives with fundraising and fund utilization activities, green deposits are likely to become an important source of mobilizing funds. While entities have been already issuing green deposits, the introduction of a comprehensive framework in this regard is likely to ensure the use of proceeds towards meeting the climate change objectives and avoidance of greenwashing concerns. It is expected that the RBI does not take an impractical stand by ruling out commingling of the funds, as that may potentially take away the feasibility of green deposits for banks and deposit-taking entities.

[1] REs would mean Scheduled Commercial Banks including Small Finance Banks (excluding Regional Rural Banks, Local Area Banks and Payments Banks) and All Deposit taking Non-Banking Financial Companies (NBFCs) registered with the Reserve Bank of India

[2] For example, see HDFC Green & Sustainable Deposits, Federal Bank etc.

[3] Currently, the Framework as well as SEBI Green bond definition draws from the international framework for green bonds

[4] https://www.climatebonds.net/files/reports/cbi_taxonomy_ukpact_2022_01f.pdf

The EU green taxonomy is available here: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX:32020R0852

Leave a Reply

Want to join the discussion?Feel free to contribute!