Group NBFCs’ assets to be aggregated for middle layer classification: RBI clarification

– Aanchal Kaur Nagpal, Manager | aanchal@vinodkothari.com

RBI vide notification dated October 11, 2022, has clarified that the assets of NBFCs forming part of a group will be aggregated for determination of the “middle layer” status of NBFCs. This clarification dates back to the 1st of October and therefore, as on the effective date of the SBR framework, NBFCs which, on a consolidated basis, have assets of Rs 1000 crores or above, will have to start adhering to the SBR framework as applicable to NBFC-ML.

Effective date

The Circular will be effective retrospectively from the date of applicability of the SBR Framework i.e. October 01, 2022.

Existing provision

As per the existing NBFC-NDSI Directions (para 16), NBFCs that are part of a common ‘Group’ or are floated by a common set of promoters are not viewed on a standalone basis. –

The total assets of the NBFCs in a group including deposit taking NBFCs, if any, shall be aggregated to determine if such consolidation falls within the asset sizes of the two categories i.e., those with asset size of below ₹500 crore and those with asset size of ₹500 crore and above. Regulations as applicable to the two categories shall be applicable to each of the non-deposit taking NBFC within the group.

Accordingly, if the total combined assets of all NBFCs in a Group crossed Rs. 500 crores, regulations as applicable to an NBFC-NDSI would become applicable for each NBFC, irrespective of the asset size of the individual NBFC being below Rs. 500 crores.

Meaning of Group Companies

The definition of Group shall be as per the existing definition of ‘companies in a group’ under the NBFC-NDSI Directions i.e. –

“Companies in the group”, shall mean an arrangement involving two or more entities related to each other through any of the following relationships: Subsidiary – parent (defined in terms of AS 21), Joint venture (defined in terms of AS 27), Associate (defined in terms of AS 23), Promoter-promotee (as provided in the SEBI (Acquisition of Shares and Takeover) Regulations, 1997) for listed companies, a related party (defined in terms of AS 18), Common brand name, and investment in equity shares of 20 per cent and above.

Hence, group NBFCs may have any of the following:

- Subsidiaries and Holding Companies as per applicable accounting standards

- Joint ventures as per applicable accounting standards

- Associate Companies as per applicable accounting standards

- Promoters- Promotee as per SEBI Takeover Regulations for listed companies

- Entities that are related parties as per applicable accounting standards

- Entities having a common brand name

- Entities holding more than 20% of the equity capital of the investee company

Note that we are talking about group NBFCs only – that is to say, non-banking non-financial entities were neither included for SI classification nor are intended to be consolidated for the purpose of ML classification.

Requirement under the SBR Framework

The SBR Framework re-classified NBFCs into four categories, with NBFC-BL having an asset size of less than INR 1000 crores at the bottom of the pyramid. However, the existing provisions for multiple NBFCs still provided thresholds for aggregation of NBFCs in a group, as INR 500 crores, thereby creating ambiguity.

The Circular has provided the much-needed clarification that the total assets of all the NBFCs in a Group shall be consolidated to determine the threshold for their classification in the Middle Layer.

Entities to be included for aggregation

All NBFCs, including NBFCs that will always be classified as NBFC-BL, such as NBFC-P2P, NBFC without public funds and customer interface, Account Aggregators and NOFHC, will be considered for aggregation. However, such NBFCs will still be classified as NBFC-BL, even if the consolidated asset size of the group is above Rs. 1000 crores. Only NBFC-ICC, NBFC-MFI, NBFC-Factor and NBFC-MGC, having an individual asset size of less than Rs. 1000 crores, will be impacted by the aggregation and will be classified as NBFC-ML, if the group asset size crosses the threshold.

Example –

A group has the following NBFCs –

| Type of NBFC | Asset size on standalone basis | Classification on a standalone basis | Classification due to aggregation |

| NBFC -ICC | 350 crores | NBFC-BL as the individual asset size is below Rs. 100 crores | NBFC-ML as the consolidated group asset size if more than Rs. 1000 crores |

| HFC | 250 crores | NBFC-ML as all HFCs will fall under middle layer unless classified as NBFC-UL | NBFC-ML as all HFCs will fall under middle layer unless classified as NBFC-UL |

| NBFC-IFC | 450 crores | NBFC-BL as NBFC-IFC shall always fall under the base layer. | NBFC-BL as NBFC-IFC shall always fall under the base layer, irrespective of aggregation |

| NBFC-MFI | 150 crores | NBFC-BL as the individual asset size is below Rs. 100 crores | NBFC-ML as the consolidated group asset size if more than Rs. 1000 crores. |

| NBFC-P2P | 100 crores | NBFC-BL as NBFC-P2P shall always fall under the base layer. | NBFC-BL as NBFC-IFC shall always fall under the base layer, irrespective of aggregation. |

| NBFC-without public funds and customer interface | 100 crores | NBFC-BL as such NBFCs shall always fall under the base layer. | NBFC-BL as such NBFCs shall always fall under the base layer, irrespective of aggregation. |

| Total asset size of the group | 1,400 crores |

As evident from the above table, classification on a standalone basis may differ from classification due to the aggregation of total assets of all NBFCs in the group.

Consolidation of group assets, however, what about consolidation principles?

It is to be noted that the RBI’s approach is aggregation of the assets, and not consolidation applying well-known consolidation rules. For example, entity A may have invested or lent to entity B. If consolidation rules were to be applied, intra-group transactions will be squared off. However, there is no elimination of intra-company transactions in the aggregation approach.

Therefore, the approach is simple arithmetic addition of the assets, as appearing on the balance sheet of the NBFCs.

Further, if the entities have adopted Ind AS, the value of assets is taken as per Ind As balance sheets.

Auditor certification

The existing provisions also required certification by the Statutory Auditors. The RBI states that the statutory auditor of the NBFCs in a Group will have to certify the assets of the NBFCs as on 31st March each year.

In which format is the certification required to be given?

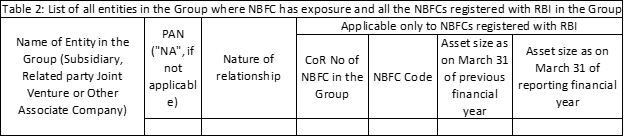

The certification is currently given under DNBS-10 i.e. the Statutory Auditor Certificate (‘SAC’) in the following manner –

Auditors of NBFCs may continue to provide such certification in the same manner, unless RBI prescribes a new format.

If there are multiple NBFCs in a group, each NBFC may have its own statutory auditor. Each statutory auditor of the respective NBFC obviously authenticates the financial statements of such NBFC being audited by such auditor. Hence, the intent of the above requirement is that the statutory auditor will have to import the value of assets of other group entities, as appearing in the audited financial statements of such NBFCs, and then do the aggregation.

A question obviously arises – which statutory auditor will do the aggregation? In our view, the aggregation, as well as reporting, will have to be done by the statutory auditor of each of the NBFCs forming part of a group.

Leave a Reply

Want to join the discussion?Feel free to contribute!