– Highlights of the SEBI SBEB and Sweat Equity Regulations

– Corplaw Division, corplaw@vinodkothari.com

In order to consolidate SEBI (Share Based Employee Benefits) Regulations, 2014 (‘SBEB Regulations’) and SEBI (Issue of Sweat Equity) Regulations, 2002 (‘Sweat Equity Regulations’), SEBI had issued a discussion paper on July 8, 2021. The changes proposed in this discussion paper as well as incorporation of the previously issued SEBI Circulars in the context of SBEB Regulations have now been imbibed under the SEBI (Share Based Employee Benefits and Sweat Equity) Regulations, 2021 (‘New Regulations’) which are effective from August 13, 2021. The same aims at rationalization of the erstwhile provisions in order to make them more vigorous with best global practices and ease of doing business.

In this article, we have discussed the major highlights and actionable rolling out of the said New Regulations.

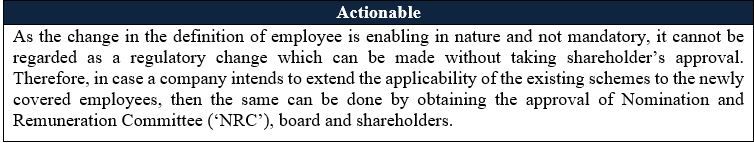

1. Enabling definition of employees

- Following the intent stated in the discussion paper issued in this regard, the New Regulations give a free hand to a company coming up with a share-based employee benefit scheme (SBEB Scheme). That is to say that as per the language used under the New Regulations under regulation 2(1)(i), the company can choose which employees can be included under any SBEB Scheme. Accordingly, from the date of enforcement of the said provisions, permanent as well contractual employees may be considered for the purpose of granting SBEB. Further, this change is applicable in reference to issuance of sweat equity shares as well.

- Furthermore, an employee, whether permanent or not, must be exclusively working for the company or its group companies. The word ‘exclusive’ is added by the New Regulations for ensuring that even though a non-permanent employee is also eligible for SBEB but he must be working on an exclusive basis either in India or outside. This exclusive working criteria is only applicable for SBEB and not for issuance of sweat equity.

- Also, as a matter of clarificatory change, the New Regulations specifically state that an NED is also included within the ambit of the term ‘employee’ who is not a promoter or a member of the promoter group. It is pertinent to note that the concerned provision was already present in the erstwhile SBEB Regulations [regulation 2(1)(f)(ii)]; however, an explicit provision in this connection has been made for the sake of avoiding any ambiguity or difference of interpretation.

- Lastly, the New Regulations have increased the ambit of the term ‘employee’ under regulation 2(1)(iii) in the context of by stipulating that an employee or director of a group company including holding, subsidiary or associate group shall also be eligible to be included under the purview of the term ‘employee’. Under the erstwhile SBEB Regulations [regulation 2(1)(f)(iii), only an employee or director of a holding or subsidiary company was included under the criteria.

The whys and wherefores: The new Regulations have increased the arena of the term ‘employee’ in order to provide flexibility to the companies so that they can cover more employees under the schemes offered for their benefit. Further, the New Regulations have permitted the designated employees of group companies to be qualified for the purpose of SBEB schemes.

2. Cash-settled SARs fall outside the purview of the New Regulations

Explanation 2 as added under regulation 2(1)(qq) of the New Regulations explicitly state that any reference to stock appreciation right or SAR shall mean equity settled SARs and will not include any scheme which does not, directly or indirectly, involve dealing in or subscribing to or purchasing securities of the company. This gives an indication that any scheme which is settled only in cash and not involves equity will fall outside the purview of the New Regulations.

As clearly specified under the New Regulations, the provisions shall be applicable in case of an equity settled SARs scheme as well as a scheme wherein the company has not stated upfront whether the same would be settled in cash or equity. However, in case of a scheme which is to be settled in cash only, the same has been seemingly made to fall outside the purview of the New Regulations.

The whys and wherefores: The rationale behind the present change is to make the provision related to SAR in line with the applicability criteria for an employee benefit scheme as covered under both the erstwhile SBEB Regulations and the New Regulations under regulation 1(4)(ii) which states that for application, a scheme should be for direct or indirect benefit of employees and involves dealing in or subscribing to or purchasing securities of the company directly or indirectly, Therefore, it is now cleared that cash settled SAR will not be governed by the New Regulations.

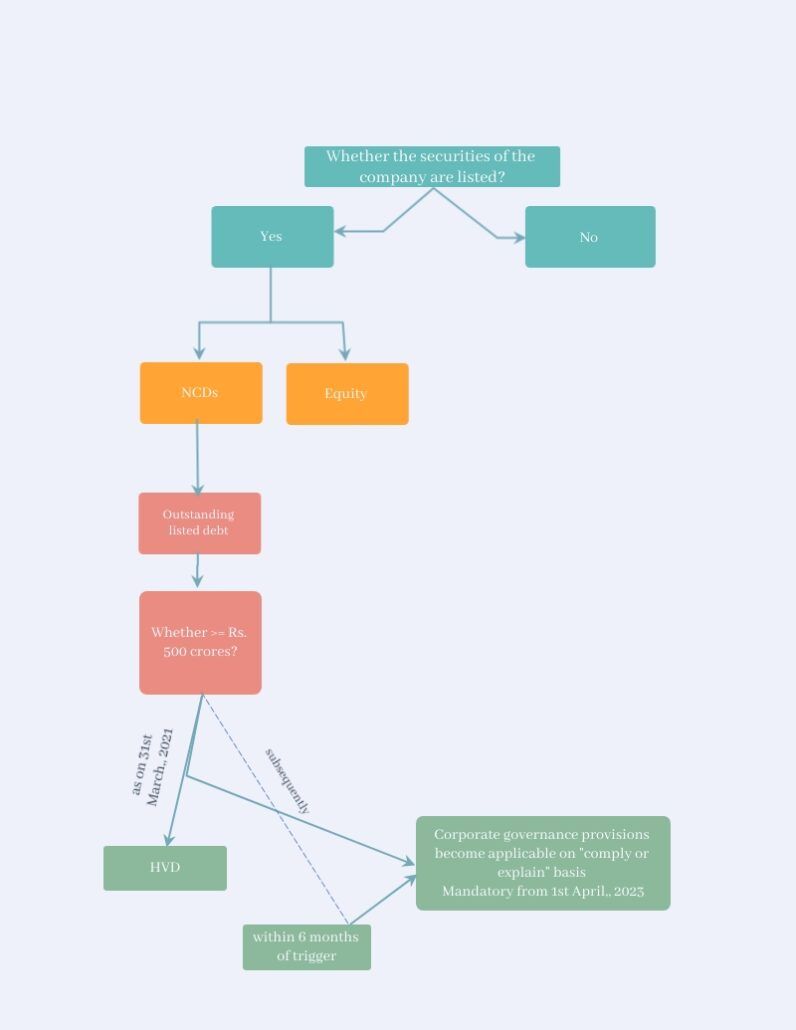

3.Applicability to equity listed companies

Regulation 1(4) of the New Regulations explicitly states that the provisions of the concerned regulations shall apply to any company whose equity shares are listed on a recognised stock exchange in India. The word ‘equity’ is specifically added by the New Regulation while in the erstwhile SBEB Regulations, the reference was made with respect to a company whose shares are listed on a recognised stock exchange [Regulation 1(4)].

The whys and wherefores: This change is put forth only for the purpose of clearing the language of the concerned provision although the intention was clear under the erstwhile SBEB Regulations as well.

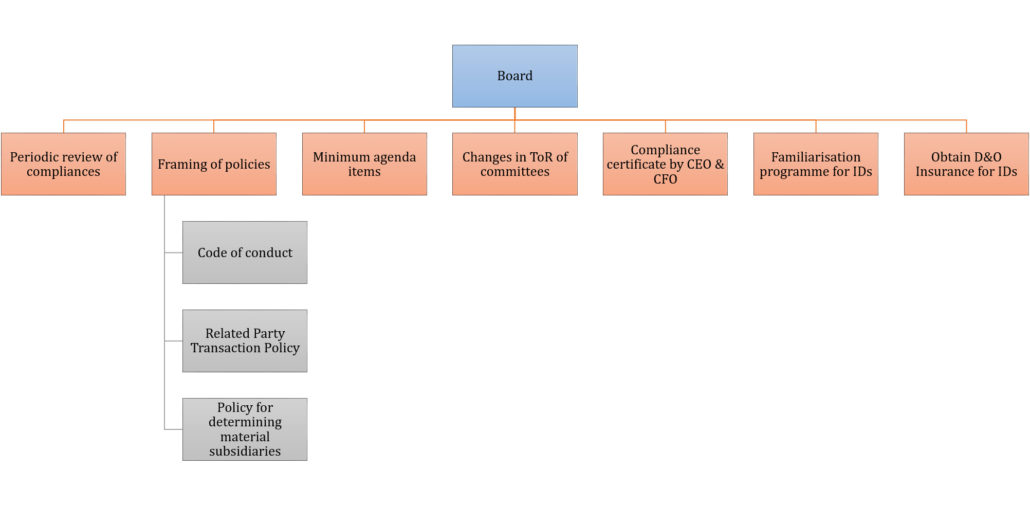

4. NRC may act as Compensation Committee

As per the recommendations proposed in the consultation paper of the Expert Group, the New Regulations have enabled the NRC to act as compensation committee for the purpose of these regulations. The reference to Regulation 19 of the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015 (‘LODR Regulations’) has been provided under the New Regulations under regulation 5(2).

The whys and wherefores: The Expert group asserted that a listed company already constitutes NRC as per the mandate and therefore, it could perform all the functions as are endowed on a compensation committee.

5. Switching of route of administration: Trust v/s Direct

Second proviso as added to Regulation 3(1) of the New Regulations stipulates that a company is allowed to change the mode of implementation of the scheme if the following conditions are satisfied:

- Prevailing circumstances should warrant such change.

- Fresh approval from shareholders via special resolution is obtained before affecting such change.

- Such change should not be prejudicial to the interest of the employees.

The whys and wherefores: This can be inferred as one of the most liberating changes introduced by the New Regulations. A company can now flexibly switch the administration of a SBEB scheme i.e. from direct route to trust or vice versa. This move will eliminate the difficulty being faced by the companies in deciding upfront whether a scheme is to be implemented through a trust or otherwise.

In order to avail the benefit of the amendment, the company will be required to state the circumstances warranting the change. As the trust can be used as a good device to fund the acquisition of the company’s own shares at an opportune price, thereby minimising the cost to the company, the same may constitute as a reason warranting the change in route of implementation.

6.Varying terms of scheme due to regulatory changes

A company is allowed to vary the terms of the scheme offered subject to shareholders approval via special resolution and ensuring that the intended variation is not in any way prejudicial to the employees. However, under the erstwhile SBEB Regulations, companies were dubious with respect to the applicability of the shareholder’s approval via special resolution for varying the terms of the scheme for the purpose of meeting any regulatory requirement. This issue was mainly on account of the language used which lacked clarity on the concerned subject. Therefore, in order to bring clarity, the New Regulations have amended the provision with respect to varying the terms of the scheme on account of any regulatory requirement which was earlier made part of the restrictive sub-regulation under the erstwhile SBEB Regulations [Regulation 7(1)]. Hence, any variation in the terms of the scheme on account of any regulatory requirement which is restrictive in nature and without changing which the scheme becomes inoperative can be made without shareholder’s approval.

The why and wherefores: Since regulatory changes, the periodicity of which is unpredictable, are not in the control of a company therefore, any SBEB scheme which warrants variation to be made on account of regulatory changes should be allowed to be undertaken by the company without any pre condition as to obtaining shareholder’s approval.

7. Repricing now only with help of a special resolution

Under the erstwhile provisions [Regulation 7(5)], re-pricing of options/SARs/shares required passing of an ordinary resolution. However, Regulation 7(5) of the New Regulations mandate for a special resolution to be obtained.

Any compliance which is being made pursuant to the amendment should abide by the same, however, acts of the past need not be re-done therefore, any options/SARs/shares which were repriced basis shareholders’ approval via ordinary resolution prior to the advent of the New Regulations, will not be affected with the new compliance requirement.

The whys and wherefores: Repricing decision, especially in the situation when the market is not doing good, can affect the wealth of the shareholders on account of the increased financial burden that a company would have to bear pursuant to heavy discounting in order to make the scheme attractive.

8. Determining total ceiling for secondary acquisition

Explanation 1 to Regulation 3(11) of the New Regulations stipulates that the reduction of share capital by virtue of a buy-back or scheme of arrangement, etc. should also be factored in the calculation of limits of shareholding of trusts under secondary acquisition.

The whys and wherefores: The erstwhile SBEB Regulations [Explanation 1 to regulation 3(11)] prescribed that where there is expansion of capital on account of corporate actions including issue of bonus shares, split or rights issue then such expansion shall be taken into account while reckoning the limits of shareholding of trusts under secondary acquisition. However, the Expert Group was of the view that similar to situations such as bonus issues, where the paid-up share capital (and accordingly the shareholding of the trust) of the company increases proportionately, the reduction of capital may also take place due to corporate actions such as buy-backs. Therefore, taking into account only expansion would not be feasible. When capital is reduced, the shareholding of the trust should also react accordingly and hence the present change is introduced.

9. Transfer of surplus on winding up of scheme

Regulation 8 of the New Regulations stipulates that the surplus money or shares remaining on winding up of the scheme, may be transferred to other existing schemes under the regulations, subject to approval obtained by shareholders on the recommendation of the compensation committee.

The whys and wherefores: The rationale behind the same is that the assets of the trust are acquired and earmarked for the benefit of the employees of the company, therefore, if any surplus remains with the trust upon winding up, an option has been provided for deferring the utilisation of such funds or using it for the benefit of employees through a different scheme under the regulations.

10. Certification by secretarial auditor

Annual Compliance Certificate

Regulation 13 of the New Regulations expressly envisages that board of directors are required to obtain compliance certificate on annual basis from secretarial auditors of the company. The words ‘secretarial auditors’ have been added in order to clear the ambiguity created by the erstwhile SBEB Regulations [regulation 13] where the only word mentioned was ‘auditors’. As a matter of practice, companies used to obtain the certificate from their statutory auditors.

Compliance certificate certifying administration and implementation of General Employee Benefit Scheme (‘GEBS’) as per the prescribed regulation

Further, Regulation 26(2) of the New Regulation dealing with administration and implementation of GEBS stipulates that “the shares of the company or shares of its listed holding company shall not exceed ten per cent of the book value or market value or fair value of the total assets of the scheme, whichever is lower, as appearing in its latest balance sheet (whether audited or limited reviewed) for the purposes of GEBS”. As per the New Regulations, the threshold should be considered as on the date of balance sheet since the erstwhile approach of reckoning threshold not to exceed “at any point of time” was practically not feasible on account of fluctuating share prices. Furthermore, a compliance certificate from the secretarial auditor in this regard at the time of adoption of such a balance sheet by the company is also introduced as a mandatory requirement.

Compliance certificate certifying administration and implementation of Retirement Benefit Scheme (‘RBS’) as per the prescribed regulation

Also, Regulation 27(3) of the New Regulation dealing with administration and implementation of RBS stipulates that “the shares of the company or shares of its listed holding company shall not exceed ten per cent of the book value or market value or fair value of the total assets of the scheme, whichever is lower, as appearing in its latest balance sheet (whether audited or limited reviewed) for the purposes of RBS”. Alike GEBS, similar change is introduced by the New Regulations under the RBS provision as well with the same intention challenging the erstwhile approach of reckoning. And again alike GEBS, a compliance certificate from the secretarial auditor to this effect is introduced as a mandatory requirement under RBS as well.

The whys and wherefores: As per the usual practice, it was statutory auditors who were issuing this compliance certificate however, it was perceived by the Expert Group, constituted by SEBI for recommendations with on the New Regulations, that the secretarial auditor was more conversant with these laws compared to other categories of persons, and it is the secretarial auditor that is required under Regulation 24A of the LODR Regulations, to furnish a secretarial audit report on an annual basis therefore, it would be more feasible if the concerned compliance certificate is issued by secretarial auditor and accordingly, the concerned change is introduced. Further, introduction of secretarial auditor certificate certifying compliance w.r.t implementation and administration of GEBS or RBS is to ensure due compliance under the New Regulations.

11.Extension of time period for appropriation of shares

Under regulation 3(12) of the New Regulations, the period of appropriation of shares acquired through secondary market acquisition, not backed by grants, has been extended from the current time period of 1 year to a period of 2 years, subject to the approval of the compensation committee.

The whys and wherefores: The idea behind the present change is to provide flexibility from the rigid time period. However, this may allow companies to use the provision for appropriation to support their own share prices by purchasing the same without any intention to make grants.

12. In-principle approval prior to grant of options

Regulation 12(3) of the New Regulations explicitly stipulates that for listing of shares issued pursuant to ESOS, ESPS or SAR, the company shall obtain the in-principle approval of the recognized stock exchanges where it proposes to list the said shares prior to the grant of options or SARs.

The why or wherefores: The words ‘prior to the grant of options or SARs’ are added in the New Regulations primarily to address the issue arising on account obtaining in-principle approval after grant and exercise. It was asserted by the Expert Group that this practice might cause delay in allotment because of non-receipt of such approval as the regulator may determine that the listed entities are non-compliant or the scheme is not in accordance with SBEB Regulations.

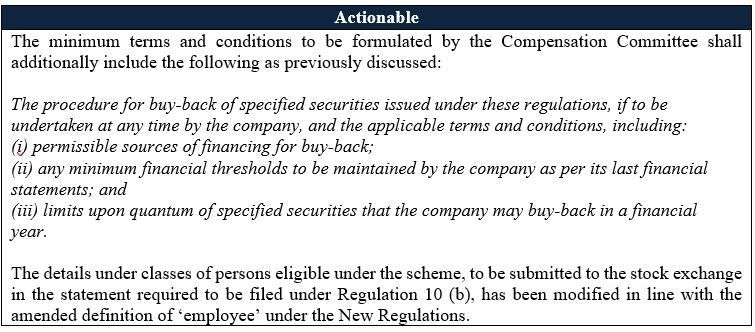

13. Role of compensation committee w.r.t. buy-back of options

Part B to the Schedule-I of the New Regulations provides that the compensation committee shall prescribe the procedure for buy back of securities issued under SBEB scheme.

The whys and wherefores: Buy back of stock options have been mentioned under the Companies Act, 2013 as well as the SEBI Buyback Regulations, however, there is no standard procedure to implement the same. Before we first understand what is the amendment, we need to know the concept of buy back of stock options.

A situation for buyback of stock option is likely to occur when the option holder is not willing to exercise the said option for reasons like, fall in share prices leading to the exercise becoming unattractive, lack of funds in the hands of the option holder etc. Under such a situation, if the company wants to pay cash to the option holder instead of the shares, the same can be done by buying back the options held by the option holders. The Expert Group in the Consultation Paper has also mentioned about a situation where due to a regulatory requirement; issuance of shares is not possible and consequent to which the company decides to pay cash instead of issuing shares. While a practical case under the situation stated by the Expert Group may not be ascertained as of now, however, it has been thought of a probable situation for carrying out buy back of options. Further, buy back of options is likely to happen for those which have been vested.

The Expert Group was of the view that flexibility in formulating requisite terms and conditions and procedure for buy back of options would be more meaningful rather than setting out a framework requiring all listed companies to follow a standard procedure in this regard. The requirement for setting out the terms and conditions of schemes to be formulated by the compensation committee was provided under the circular issued previously in this regard. However, the same did not include an express provision relating to procedure and terms and conditions for buy-back including permissible sources for financing the buy-back, minimum financial threshold to be maintained, quantum of securities to be bought back etc.

14. Consolidation of SEBI Circulars

SEBI Circular dated July 15, 2021, provided for immediate vesting of options, SAR or any other benefits in the event of death of an employee. In the said circumstance the requirement of minimum vesting period of 1 year has been done away with. The same has been prescribed under regulation 9(4) of the New Regulations, which stipulates that the options shall vest immediately from the date of death in the legal heirs or nominees of the deceased employee, thus doing away with the minimum vesting requirement.

Further, various disclosure requirements had been prescribed under SEBI Circular dated June 16, 2015, relating to contents of the trust deed, terms and conditions to be formulated by the compensation committee, matters to be stated in the explanatory statement, disclosure to stock exchanges and by the board of directors, etc. The said disclosures have been incorporated under the New Regulations as part C to the Schedule-I with certain additional disclosures like period of lock-in and terms & conditions for buyback, if any, of specified securities covered under these regulations.

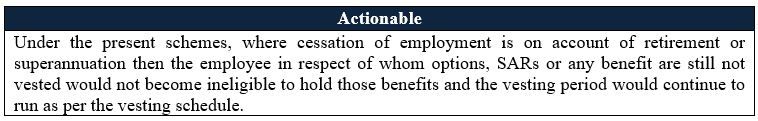

15.Vesting of benefits on retirement or superannuation

Explanation as added to the Regulation 9(6) under the New Regulations stipulates that where employment is ceased due to retirement or superannuation then options, SAR or any other benefits granted to an employee would continue to vest in accordance with their respective vesting schedules even after retirement or superannuation in accordance with company policies and applicable law.

The whys and wherefores: Regulation 9(6) of the erstwhile SBEB Regulations stipulated that in case of cessation of employment on account of resignation or termination, benefits which are granted and not vested as on that day shall expire. However, there was a confusion as to the applicability of the concerned provision in case of cessation due to other reasons. In order to bring clarity, the Expert Group recommended that cessation of employment on account of retirement or superannuation should be left out of the ambit of regulation 9(6). In order to provide leniency in special circumstances, it is now explicitly inculcated in the New Regulations that the options, SAR or any benefits granted to an employee and not yet vested would not expire on cessation of employment due to retirement or superannuation and the same will continue to vest in accordance with the vesting schedule.

16. Cashless Exercise

The New Regulations, like the erstwhile SBEB Regulations, do not specifically define the term ‘cashless exercise’ however, have prescribed certain transactions which shall be covered under the ambit of cashless exercise. Regulation 3(15)(a) of the New Regulations stipulate that following is the process pursuant to which cashless exercise may be undertaken:

- to enable the employee to fund the payment of the exercise price,

- To enable the employee to fund the payment of the amount necessary to meet his/her tax obligations and other related expenses pursuant to exercise of options granted under the ESOS.

The whys and wherefores: Since the term ‘cashless exercise’ was not defined under the erstwhile SBEB Regulations, the Expert Group was of the view that a clarity w.r.t the ambit of transactions that would be covered under the concerned term would be helpful and accordingly, the present change is introduced.

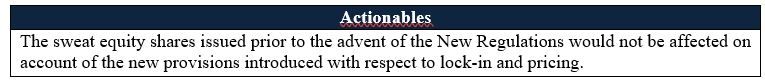

17. Changes pertaining to provisions of sweat equity shares

The New Regulations have combined the SBEB Regulations with the SEBI (Issue of Sweat Equity) Regulations, 2002. Under the New Regulations, there are certain changes introduced with respect to the provisions relating to sweat equity shares.

- Purpose of issuance of sweat equity shares: The purpose of issuance of sweat equity shares was not previously specified under the erstwhile regulations. Regulation 30 of the New Regulations provides for permitted purpose/objective for issuance of sweat equity shares which are in accordance with the current provisions of the Companies (Share Capital and Debentures) Rules, 2014.

- Maximum quantum of shares: Vide a newly inserted provision, the New Regulations under regulation 31 have prescribed for a maximum limit on the quantum of sweat equity shares that may be issued by a listed company. The regulations have prescribed a cap of 15% of the existing paid up capital on the issuance done in a year and further state that the total quantum of sweat equity shares issued by a company shall not exceed 25% of the paid up equity capital at any time. This is in line with the Companies (Share Capital and Debentures) Rules, 2014.

Further, the New Regulations provide for relaxation with respect to quantum of sweat equity to be issued by companies which are listed on Innovators Growth Platform i.e the overall limit of 50% of the paid-up equity share capital of the company at any time upto 10 (ten) years from the date of its incorporation or registration.

- Lock-in requirement: Regulation 38 of the New Regulations has made the lock-in period for equity shares issued under sweat equity consistent with the lock-in period prescribed in relation to preferential issue under the SEBI (Issue of Capital and Disclosure Requirements) Regulations, 2018 (‘ICDR Regulations’). The rationale for the change is to make sweat equity shares more attractive, by doing away with the lock-in period of 3 (three) years under the erstwhile regulations.

- Pricing: The erstwhile provisions prescribed for a specific mechanism for determination of price of sweat equity shares, which stated the higher amount of the average of weekly high and low prices of the period as specified was to be considered. However, the pricing mechanism of sweat equity shares has now been aligned with the provisions relating to preferential issues under ICDR Regulations by the New Regulations via Regulation 33.

The whys and wherefores: The new Regulations have now provided clarity that companies may issue sweat equity shares only for the prescribed purposes. Further, by specifying the quantum of sweat equity shares that can be issued, the New Regulations have inculcated a clarity and increased the scope of compliance.

18. Definition of “Promoter Group Company” and its impact throughout the Regulations

The erstwhile SBEB Regulations [regulation 2(1)(v)] while referring to the definition of promoter group under the ICDR Regulations, stated that in case the promoter or promoter group is a body corporate, the promoters of such body corporates shall also fall under the ambit of the definition. Regulation 2(1)(dd) of the New Regulations has omitted the said proviso, thus making it in line with the definition as stated under ICDR Regulations.

Recommendations that couldn’t form part of the New Regulations

There were certain recommendations of the Expert group that were discussed, however, the same were not made part of the New Regulations since majority of them did not stand the test of necessity for inclusion. These include:

- Inclusion of trust shareholding under the ambit of public shareholding.

- Explicit recognition of employee stock options under managerial remuneration under the New Regulations.

- Relaxation of compliances for trust under SEBI (Prohibition of Insider Trading) Regulations, 2015.

- Approval of stock exchange for acquisition by trust via secondary acquisition.

- Delegation of responsibilities by compensation committee pertaining to approval of schemes and other matters.

- Specification of pricing guidelines or disclosure requirements for determination of exercise price.