‘Material Subsidiary’ under LODR Regulations: Understanding the metrics of materiality

Barsha Dikshit | corplaw@vinodkothari.com

Himanshu Dubey | corplaw@vinodkothari.com

The term ‘subsidiary’ or ‘subsidiary company’ as defined under the Companies Act, 2013[1] (‘Act’) refer to a company in which a holding company controls the composition of the Board of directors or may exercise at least 51% of the total voting power either on its own or together with one or more of its subsidiaries. A company may have a number of subsidiaries; however, all of them may or may not have a material impact on the holding company or on the group at a consolidated level. Therefore, regulations sometimes require identification of such subsidiaries which may have a material impact on the overall performance of the holding company/group.

Though SEBI (Listing Obligations and Disclosure Requirement) Regulations, 2015 (‘SEBI LODR’), define the term ‘Material Subsidiary’ as a subsidiary, whose income or net worth exceeds ten percent (10%) of the consolidated income or net worth, respectively, of the listed entity and its subsidiaries in the immediately preceding accounting year, however, there remains confusion w.r.t. the criteria provided for determining the materiality of a subsidiary. For instance, whether a subsidiary having negative net worth exceeding 10% of the consolidated net worth of the listed company will be qualified as a material subsidiary? Or say if the net worth at the group level is negative, however the net worth of the subsidiary is positive, will that subsidiary be treated as a material subsidiary, etc.

Through this article the author has made an attempt to decode some of these puzzling issues relating to determination of materiality of a subsidiary.

The Concept of ‘Material Subsidiary’

In present day corporate world, operating through a network of subsidiaries and associates is quite common. Sometimes, it is a matter of corporate structuring discretion, and sometimes, it is purely a product of regulation – for example, overseas direct investment can be made only through subsidiaries or joint venture entities. While the listed subsidiaries are always under the observation of SEBI, an appropriate level of review and oversight is required by the board of the listed entity over its unlisted subsidiaries for protection of interests of public shareholders. The board of directors of a holding company cannot take a tunnel view and limit their perspective only to the company on whose board they are sitting. After all, subsidiaries operate with the resources of the parent, and therefore, what happens at subsidiaries and associates is of immediate relevance to the holding company. Accordingly, the obligation of the board of a listed entity with respect to its subsidiaries has been increased vide SEBI LODR Amendment Regulations, 2018 dated 9th May, 2018[2], thereby reducing the threshold for determining materiality of a subsidiary to 10% (as opposed to the previous limit of 20%) of the consolidated income or net worth respectively, of the listed entity and its subsidiaries, in the immediately preceding accounting year.

Since the material subsidiaries have a considerable role in the overall performance of the holding company or the group as a whole, it is important to arrive at the correct interpretation of the term in line with the intent and purpose of the definition as well as the compliance requirements following it.

In terms of the definition provided under Regulation 16(1)(c) of SEBI LODR the triggers for determining materiality of a subsidiary are- Net Worth [3]and Turnover. That is to say, the pre-requisites for determining materiality of a subsidiary are:

- It has to be a subsidiary, in terms of the definition provided under Act, 2013; and

- Its income/net worth in the immediately preceding financial year exceeds 10% of the consolidated net worth of the listed company.

It is pertinent to note that the definition of material subsidiary currently provides for 10% or more impact on the consolidated turnover or net worth of the listed company/group, however, it does not specify whether the said impact has to be in positive or negative. It just says that the impact has to be 10% of the overall income/net worth. Since the turnover of a company cannot be negative, the focus has to be made on the later.

A parent company is required to prepare consolidated financial statement taking into account the performance of its subsidiaries. While a subsidiary, with a good performance and positive net worth/income can add on the overall growth of the group, the same can affect the overall performance of the group with its negative net worth, and if the said impact exceeds 10% of the income/net worth of the consolidated performance of the group, the said subsidiary will become material and shall require special attention of the parent company. Therefore, for the purpose of determining the ‘materiality’, one has to drop the minus sign of the net worth of the subsidiary or group and has to see the absolute term and the overall impact it has on the group. In other words, if a subsidiary is big enough to shake the performance of its holding company, it shall be qualified as a ‘material subsidiary’.

Let us take some illustrations to understand the definition provided under Reg. 16 (1) (c) of SEBI LODR:

Illustration 1:

XYZ Limited is a subsidiary of ABC Limited. In the FY 2019-20, the net worth of XYZ Limited was Rs. 50 Crs. and the consolidated net worth of ABC Limited company was Rs. 400 Crs., Whether XYZ Limited be considered as a material subsidiary of ABC Limited?

Yes. The contribution of XYZ Limited towards the consolidated net worth of ABC Limited is more than 10%, therefore XYZ Limited shall be consolidated as a ‘material subsidiary’ of ABC Limited.

Illustration 2:

Net worth of XYZ Limited in FY 2019-20 was Rs. (50) Crs., however, the consolidated net worth of ABC Limited was Rs. 400 Crs, will XYZ Ltd. be considered as a material subsidiary of ABC Ltd?

Yes. Irrespective of having a negative net worth, since XYZ Limited contributes more than 10% of the consolidated net worth of ABC Limited, XYZ Limited shall be considered as a ‘material subsidiary’ of ABC limited.

Illustration 3:

Net worth of XYZ Limited in FY 2019-20 was Rs. (50) crores, and the consolidated net worth of ABC Limited was Rs. (400) Crs., will XYZ Limited be considered as a material subsidiary of ABC Limited?

Yes. Even if the net worth at the subsidiary level and the consolidated level are negative, however, one has to see as to how much contribution the subsidiary has in the consolidated net worth of the holding company. Therefore, irrespective of having negative net worth, XYZ Limited shall be considered as a ‘material subsidiary’ of ABC limited.

Illustration 4:

Net worth of XYZ Limited in FY 2019-20 was Rs. 50 crores and the consolidated net worth of ABC Limited was Rs. (400) Crs., will that subsidiary be considered as a material subsidiary of ABC Limited?

Yes. In the given case, because of the positive net worth of the subsidiary the net worth of the holding company has contributed to reduce the negative net worth of the holding company by more than 10%. Therefore, the subsidiary, viz. XYZ Limited shall be considered as a material subsidiary of ABC Limited.

Illustration 5:

Net worth of XYZ Limited in FY 2019-20 was Rs. 30 Crs. and the consolidated net worth of ABC Limited was Rs. (400) Crs., will that subsidiary be considered as a material subsidiary of ABC Limited?

No. Even though the positive net worth of the subsidiary is contributing to reduce the negative consolidated net worth of the holding company, however, that contribution is less than 10%, therefore in this case, XYZ Limited shall not be considered as a ‘material subsidiary’ of ABC Limited.

Thus, for determining ‘materiality’ of a subsidiary, the emphasis should not be on whether net worth is positive or negative, rather the impact of its net worth or income on the overall consolidated performance of the listed entity is to be seen.

Special Situation in case of Regulation 24 (1)

In the SEBI LODR, the term ‘Material Subsidiary’ has been defined twice, i.e under regulation 16 (1)(c) and under regulation 24 (1). While the threshold for determining ‘materiality’ provided under regulation 16 (1) (c) is 10%, the one provided under reg. 24 (1) is 20%. The reason behind the said increase in the threshold is the higher level of impact the said subsidiary can make on the performance of the listed company/group. That is to say, when a subsidiary is ‘material’ it requires attention of the parent company, however when it becomes significantly material, such that it can give shock to the parent company with its performance, it requires higher attention. Therefore regulation 24 (1) requires those significantly material subsidiaries to have on independent director of the parent company in its board.

The need for an independent director can be established by the fact that they are expected to be ‘independent’ from the management and act as the fiduciary of shareholders. This implies that they are obligated to be fully aware of the conduct which is going on in the organizations and also to take a stand as and when necessary, on relevant issues.

The requirement of appointing independent director is applicable only in case of significantly material subsidiary (unlisted), whether incorporated in India or not, and not in case of material subsidiary.

Obligation of the Listed Entity with respect to its Material Subsidiary(ies)

Other than the obligations provided under Reg. 24 of SEBI LODR for the listed companies w.r.t. their subsidiaries, the following additional obligations are applicable in case of material subsidiaries:

- Formulating Policy– The listed entity is required to formulate a policy for determining materiality of its subsidiaries, and shall disseminate the same on its website.

- Appointment of Independent Director– Pursuant to Regulation 24(1) of the LODR, at least one (1) independent director of the listed entity is required to be a director on the board of an unlisted material subsidiary (with respect to this provision, material subsidiary has been defined with a threshold of 20% of the consolidated income or net worth).

- Disposing of shares in Material Subsidiary – A listed company shall not dispose of shares in its material subsidiary resulting in reduction of its overall shareholding to less than 50% or cease to exercise control over subsidiary without passing special resolution in general meeting except in case where such divestment is made under a scheme of arrangement (duly approved by the Tribunal/ Court) or in case of resolution plan duly approved in terms of section 31 of IBC, 2016.

- Selling, disposing and leasing of assets – Pursuant to Regulation 24(6) of the LODR, the sale or disposal or leasing of assets amounting to more than 20% of the assets of a material subsidiary (on an aggregate basis during a financial year), subject to certain exceptions, requires prior approval of the shareholders of the listed holding company by way of a special resolution.

- Secretarial Audit: Pursuant to Regulation 24A of the LODR, all listed entities and their Indian unlisted material subsidiaries are required to undertake a secretarial audit and annex such reports to the annual report of the listed entity.

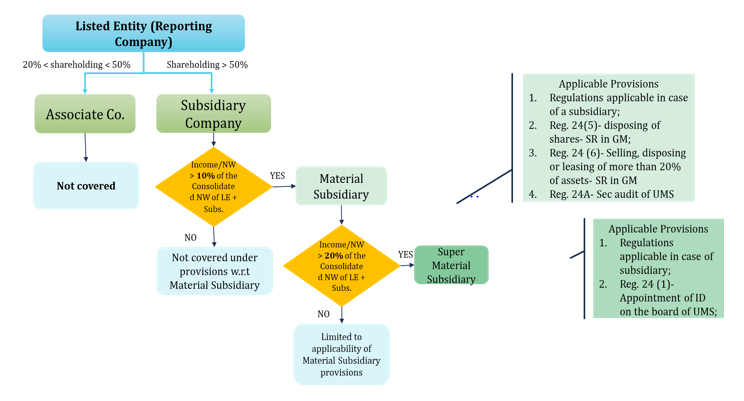

The discussion above can be summarised in the presentation below:

Role of Policy on determining Materiality of Subsidiary

The definition of ‘material subsidiary’ under regulation 16(1)(c) defines a subsidiary that is material to the listed entity and the explanation to the aforesaid provision allows the listed entity to formulate a policy for the same, i.e., a listed entity can develop criteria that is stricter than what has been provided in the Regulations. However, nothing has been provided regarding the contents of the Policy in the SEBI LODR. Therefore, the Policy is nothing but a replica of what has already been provided in the law, as in order to ensure compliance of the law, listed entities frames policy for determining materiality of subsidiaries based on the contents of the regulations. Thus, the requirement of the policy is limited to ensure compliance of the law.

Can a section 8 company be treated as ‘Material Subsidiary’?

Section 8 Company, as defines in the Act, 2013 are companies that are formed with an object of promoting commerce, art, science, sports, education, research, social welfare, religion, charity, protection of environment or any such other object. These companies are required to apply their profit, if any or other income in promoting their objects and are prohibited from payment of any dividend to its members. Whereas, the benchmark for satisfying the definition of ‘material subsidiary’ is contribution towards consolidated income or net worth of the holding company.

When we consolidate the holding company with a Section 8 company, it will however depict a wrong picture of the wealth of the holding company, as the holding company can never claim any right over the profits of a Section 8 Company. Therefore, the question of consolidation of section 8 with that the holding company does not arise.

Given that the income of a section 8 company cannot be consolidated with that of the listed company or can say that since the performance of a section 8 company has no role to play on the overall performance of the listed company, a section 8 company cannot be treated as a ‘material subsidiary’.

Concluding Remarks

The term “material subsidiary” has been prioritized over the years because of the impact it may have over the consolidated performance of the listed entity. The principle behind emphasizing absolute numbers of the net worth is the impact of the same on the consolidated figures. Any changes in the income/net worth of these material subsidiaries will be reflected proportionally on the listed entity since the net worth derived from the said material subsidiaries constitutes an integral part of the consolidated net worth of the listed entity. Accordingly, the listed entities should determine the materiality of its subsidiaries wisely and comply with the requirements of SEBI LODR as are applicable on the material subsidiaries.

Our other videos and write-ups may be accessed below:

YouTube:

https://www.youtube.com/channel/UCgzB-ZviIMcuA_1uv6jATbg

Other write-up relating to corporate laws:

http://vinodkothari.com/category/corporate-laws/

Our article on similar topics –

- http://vinodkothari.com/wp-content/uploads/2019/04/Final_PPT_on_SEBI_LODR_Amendment_Regulations_2018.pdf

- http://vinodkothari.com/2019/02/decoding-large-number-in-case-of-group-governance-policy-under-lodr/

[1] Section 2 (87) of the Act

[2] https://www.sebi.gov.in/legal/regulations/may-2018/sebi-listing-obligations-and-disclosure-requirement-amendment-regulations-2018_38898.html

[3] Section 2 (57) of the Act defines net worth as:

“Net worth” means aggregate value of the paid up share capital and all reserves created out of the profits and securities premium account, after deducting the aggregate value of the accumulated losses, deferred expenditure and miscellaneous expenditure not written off, as per the audited balance sheet, but does not include reserves created out of revaluation of assets, write-back of depreciation and amalgamation

A Listed company has no material subsidiary company. Even That company is required to frame policies for determining material subsidiaries. Please help