Impairment in case of Lease Transactions

– Abhirup Ghosh (abhirup@vinodkothari.com)

Background

Like all assets, leased assets also undergo impairment. IAS 36 is the relevant standard for impairment of assets, however, IFRS 9 deals with impairment of financial assets, as well as lease receivables.

Therefore, even though lease transactions are governed by IFRS 16, for impairment of leased assets, one has to refer either of aforesaid standards.

In this article, we will focus on the manner in which leased assets are impaired, especially the way expected credit losses (ECL) could be calculated for lease transactions.

Approach

In the books of the Lessor

The approach of impairment differs with the nature of lease. In case of an operating lease, the lessor recognizes the asset under Property, Plant and Equipment. Therefore, the lease asset capitalized in the books of the lessor has to undergo impairment testing under IAS 36. In addition to that, the lease receivables that fall under the purview of IFRS 9 also have to be tested for impairment. In case of operating leases, only those rentals which are overdue shall undergo impairment testing under IFRS 9.

In case of financial leases, the lessor recognizes only lease receivables in its books. Therefore, there is no question of assessing impairment on the fixed asset in such case; only ECL has to be provided on the lease rentals.

In the books of the Lessee

Unlike the erstwhile standards on leasing, IFRS 16 provides for recognition of Right of Use (ROU) Asset in the books of the lessee, and a corresponding lease liability.

The ROU asset will also have to undergo impairment testing under IAS 36.

Impairment under IAS 36

The requirement to impair an asset under IAS 36 gets triggered only when any of the following indicators are noticed:

a.) External indicators:

- Significant decline in market value

- Change in technology, market, economic or legal environment

- Change in interest rate.

- Where the carrying amount is more than the market capitalization

b.) Internal indicators:

- Asset’s performance is declining

- Discontinuance or restructuring plan

- Evidence of physical obsolescence

The standard looks at assets Cash Generating Units, in case of lease transactions, each asset on lease would be treated as CGU for the purpose of this standard.

The impairment loss is calculated based on the carrying value of the asset and the recoverable value.

Recoverable value is the higher of the following:

a.) Fair value of the asset, less cost of disposal

b.) Value in use

Fair value of the asset is arrived at based on the valuation of the asset using appropriate valuation methodologies. From the fair value, cost of disposal has to be reduced, which includes:

- Legal costs

- Stamp duty and similar taxes

- Costs of removing the assets

- Incremental costs for bringing the assets into the conditions for its sale

- Other costs

The value in use computed based on the present value of all the future cash flows from the asset, discounted at rate which truly reflects the time value of money and the risks specific to the asset. To compute value in use, a risk weighted cash flows approach must be adopted.

There are two ways in which this approach can be adopted – a) by adjusting the cashflows, b) by adjusting the discounting rate.

In the first one, the future cash expected cash flows must be assigned different probabilities of recovery which would corroborate with the risk associated with the asset, and then discount the cash flows at the agreed yield of the transaction.

Alternatively, the instead of assigning probabilities of recovery on the cash flows, the original expected cash flows may be considered, however, the discounting rate may be adjusted to corroborate with the risks associated with the assets.

If the recoverable value of the asset is lower than the carrying amount, then the difference has to be booked as an impairment loss and the carrying amount has to be brought down to that extent.

Impairment under IFRS 9

There are two approaches for computing ECL:

- General Approach

- Simplified Approach

In the general approach, ECL is computed based on 12-months losses for instruments not showing significant increase in credit risk, and lifetime losses for instruments showing significant increase in credit risk.

In the simplified approach, ECL is computed based on lifetime losses on financial instruments, irrespective of whether it is showing significant increase in credit risk or not. This approach is mandatory for trade receivables not having a significant financing component. This approach is option for lease receivables and trade receivables having a significant financing component.

Therefore, for lease transactions, a reporting entity can opt for either of the two approaches.

General approach

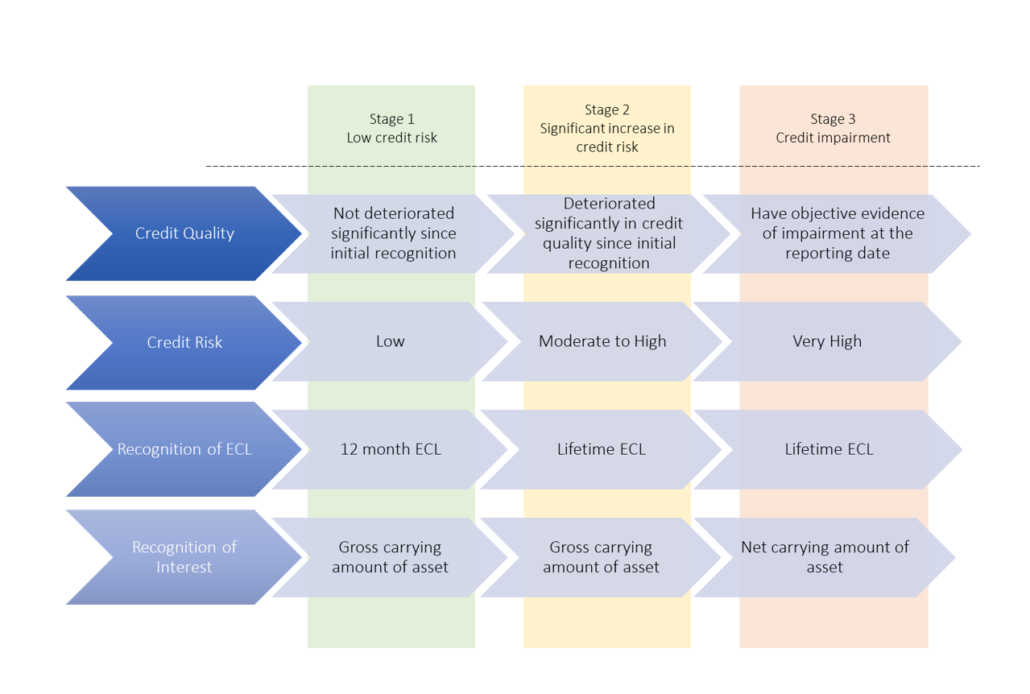

Staging of financial instruments based on different risk categories is one of the key aspects of the general approach. There are three stages:

a) Stage 1 – A financial instrument is classified under Stage 1 at the inception of the transaction, unless the asset is credit impaired at the time of purchase. Subsequently, if the assets do not show significant increase in credit risk, they are classified under Stage 1.

b) Stage 2 – A financial instrument is classified under Stage 2, when it shows significant increase in credit risk. The credit risk on the reporting date is compared with the credit risk at the time of initial recognition.

c) Stage 3 – Lastly, if the financial asset shows objective evidence of impairment, the asset is credit impaired and classified as Stage 3.

For the purpose staging, the following considerations may be taken care of:

- Transition – In natural course, before a financial instrument becomes credit impaired or an actual default occurs, it should first show signs of significant increase in credit risk.

- Time to maturity – Time to maturity is an important indication of credit risk. For instance, a AAA bond has far more credit risk if the maturity is 10 years as compared 5 years. Therefore, while assessing the credit risk, the shortened remaining time to maturity must be considered. This logic however, may not hold good in case of transactions involving a balloon payment structure or a bullet payment structure, where the major part of the cashflows is concentrated towards the end of the tenure.

- What constitutes to be significant increase in credit risk – Usually the assessment of credit risk is left on the risk management division of the reporting entity, however, the standard states that if reasonable and supportable forward-looking information is available without undue cost or effort, an entity cannot rely solely on past due information when determining the credit risk. However, when information that is more forward-looking than past due status is not available without undue cost or effort, an entity may use past due information to determine the credit risk. There is a rebuttable presumption that the credit risk on a financial asset has increased significantly since initial recognition when contractual payments are more than 30 days past due.

An entity can rebut this presumption if it has reasonable and supportable information that is available without undue cost or effort, that demonstrates that the credit risk has not increased significantly since initial recognition even though the contractual payments are more than 30 days past due. However, the Reserve Bank of India in its notification on Implementation of Indian Accounting Standards for NBFCs[1], has stated that in case, the reporting entity wishes to rebut the presumption, then clear justification must be documented, and such shall be placed before the Audit Committee of the Board. However, in any event the recognition of significant increase in credit risk should not be deferred beyond 60 days past due.

Further, when an entity determines that there have been significant increases in credit risk before contractual payments are more than 30 days past due, the rebuttable presumption does not apply.

Once the staging is complete the expected credit losses on the assets depending on their stage.

In case of Stage 1 assets, 12-months credit losses are provided. In case of Stage 2 and Stage 3 assets, lifetime credit losses are provided.

The difference between a Stage 2 and Stage 3 asset is that for the latter, the asset has to be impaired to the extent of the expected credit losses and the showed at net amount.

The graphic below summarises the general approach of ECL.

Simplified approach

In the simplified approach, the concept of staging does not apply. There is no requirement of assessment of significant increase in credit risk. Lifetime credit losses have to be provided.

This is optional for lease transactions, however, if the reporting entity wishes to adopt this approach, it has to be implemented separately on operating and financial leases.

Method of computing ECL on lease transactions

While computing ECL, operating lease and financial leases must be considered separately. While financial leases are financial transactions, hence, akin to loan transactions, operating leases are operating/ rental contracts. However, ECL, in the both cases, are done based on the future expected cash flows from the contract, that is the lease rentals.

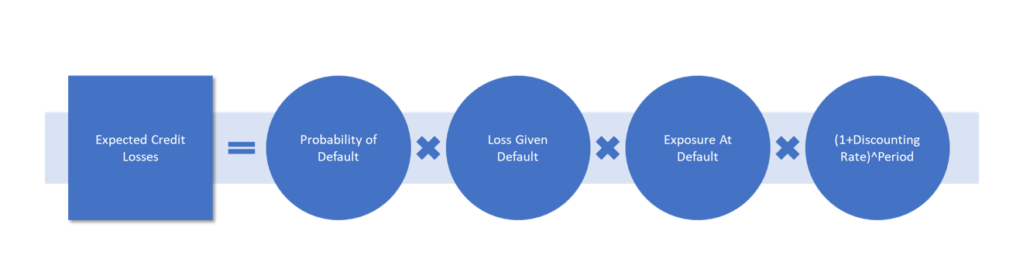

The most appropriate approach of computing ECL in case of lease transactions in the “Loss Rate Approach”. In this approach, the ECL is computed based on the Probability of Defaults and Loss Given Defaults. The PD and LGD rates are applied on the Exposure at Default, and subsequently, discounted at the effective interest rate or the yield of the transaction.

Probability of Default

One of the most important components of computing ECL. For entities which follow Internal Risk Based Approach, this is usually an outcome of the IRB. However, where the reporting entity does not follow an IRB approach, a scorecard approach may be adopted for the same.

In a scorecard approach, various factors specific to the asset and the borrower are weighted to assess the credit risk and produce a PD level.

In case of lease transactions, besides the borrower specific factors, the experience in the asset class also must be given sufficient weightage. For example, personal use assets like cars, two-wheelers etc. may be assigned to a lower risk weight, whereas, for assets such as construction equipments, farming equipments, etc. where repayment of rentals depend on the generation of cash flows from the asset, may be assigned a higher risk weight.

Once the credit risk is assessed, the PD level has to be produced through:

- Vintage analysis of the assets to understand how default rates change over a period of time;

- Extrapolation of the trends, where the default information is not available for the maximum tenure of the exposure.

Usually, PD levels are representation of the performance of similar assets in the past, however, for ECL, a forward-looking approach has to be adopted, and accordingly the PD levels have to be calibrated to give a forward-looking effect.

Alternatively, a simpler approach may be adopted where the reporting entities may rely on internal benchmarking and external ratings to predict a PD level.

Loss Given Default

The loss given default signifies what proportion of the exposure, will actually be lost, should there be a default. The LGD rate is a function of the past trends of recovery of cash flows organically, and also the recovery from the underlying asset.

Therefore, LGD can be denoted as 1 – Recovery Rate.

For determining the LGD of a lease, the following may be considered:

- Forecasts of future cash flow recoveries,

- Forecasts of future valuation of the leased asset,

- Time to realization of the leased asset,

- Cure rates,

- External costs of realization of the leased asset.

The estimation of the aforementioned may be influenced by several factors, namely, the sector in which the asset is deployed, the geography, nature of asset etc.

Macroeconomic factors and the dependence of the aforesaid factors on the same must also be considered. For examples, situations like flood or drought would impact the recoverability of tractors. Similarly, situations like the pandemic COVID-19, would impact all of the aforesaid factors.

Exposure at Default

This reflects the exposure outstanding periodically for the entire tenure of the loan.

Discounting Rate

Usually, the effective interest rate of the transaction is used for discounting the cash flows and the credit losses.

Period

This refers to the contractual tenure of the facility. While determining the period, the ability of the customer to cancel or prepay, or the lessor’s ability to call the facility must also be considered.

The utilization of each of the factors for computation of ECL has been illustrated with the following numerical example:

| Scheduled Cashflows | Amort Schedule | |||||

| Period | Cash flows | Interest | Principal | Closing POS | ||

| 0 | ₹ -1,00,000.00 | ₹ – | ₹ – | ₹ -1,00,000.00 | ||

| 1 | ₹ 25,000.00 | ₹ 7,930.83 | ₹ 17,069.17 | ₹ -82,930.83 | ||

| 2 | ₹ 25,000.00 | ₹ 6,577.10 | ₹ 18,422.90 | ₹ -64,507.93 | ||

| 3 | ₹ 25,000.00 | ₹ 5,116.01 | ₹ 19,883.99 | ₹ -44,623.94 | ||

| 4 | ₹ 25,000.00 | ₹ 3,539.05 | ₹ 21,460.95 | ₹ -23,162.98 | ||

| 5 | ₹ 25,000.00 | ₹ 1,837.02 | ₹ 23,162.98 | ₹ 0.00 | ||

| EIR | 8% | |||||

| Computation of ECL | ||||||

| Period | EAD | PD (Marginal) | PD (Cumulative) | LGD | EIR | Marginal ECL |

| 0 | ||||||

| 1 | ₹ 1,00,000.00 | 3% | 3% | 20% | 8% | ₹ 555.91 |

| 2 | ₹ 82,930.83 | 3% | 6% | 20% | 8% | ₹ 427.15 |

| 3 | ₹ 64,507.93 | 3% | 9% | 20% | 8% | ₹ 307.84 |

| 4 | ₹ 44,623.94 | 4% | 13% | 20% | 8% | ₹ 263.07 |

| 5 | ₹ 23,162.98 | 4% | 17% | 20% | 8% | ₹ 126.52 |

| 12 Month’s ECL | ₹ 555.91 | |||||

| Lifetime ECL | ₹ 1,680.49 | |||||

| EIR | Computed using IRR formula | |

| PD and LGD | Assumed numbers | |

| Marginal ECL | (PD*LGD*EAD)/(1+EIR)^Period | |

Conclusion

This article only tries to discuss one of the most commonly adopted approach for ECL computation. There could be several variations made to the aforementioned, or different approaches may be adopted. Ultimately, it is the management’s call to decide the approach which best suits the nature of the assets and the customers the entity is the dealing with.

Related articles on the Topic:

- Accounting for Lease Transactions

- New lease accounting standard kicks off from 1st April, 2019

- IMPLEMENTATION OF IFRS-16 IN VARIOUS COUNTRIES

- Lease accounting: Operating & Financial Lease distinction set to go from financial year 2019-20

- Comparative Analysis of changes in Standards on Leasing over time

- FAQs on Ind AS 116: The New Lease Accounting Standard

References:

- IFRS 9

- IFRS 16

- IAS 36

- Potential Impairments of Leased Assets and the Right-of-Use Asset under ASC 842 and IFRS 16

- Have lease assets become impaired?

- Leased Assets: Ongoing impairment considerations

- How does impairment look under IFRS 16?

[1] https://www.rbi.org.in/scripts/FS_Notification.aspx?Id=11818&fn=14&Mode=0

Leave a Reply

Want to join the discussion?Feel free to contribute!