Ease of doing business: Debt listed companies slide down to unlisted companies

Companies with listed but privately placed debt paper not to be regulated as ‘listed company’.

FCS Vinita Nair | Senior Partner, Vinod Kothari & Company

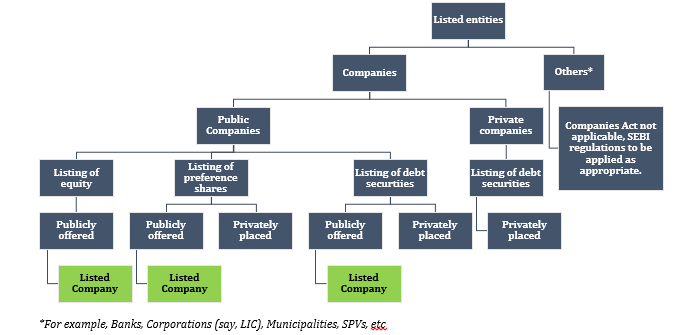

With an intent to promote listing of securities and bond market, Ministry of Corporate Affairs (MCA) in consultation with Securities and Exchange Board of India (SEBI), intended to exclude certain class of companies from the definition of ‘listed company’ as defined under Section 2 (52) of Companies Act, 2013 (CA, 2013). The existing provisions of CA, 2013 applicable to a listed company did not distinguish between private companies and public companies. As a result, private companies were unintendedly subject to similar compliance as a public company. A browse through the list of companies with listed privately placed debentures, shows private companies abound in the list[1]. On the other hand, public companies that listed debt securities on a private placement basis, were subject to similar compliances as a public company issuing debt securities to public.

Accordingly, one of major amendments proposed in Companies (Amendment) Act, 2020 (CAA, 2020) was to revisit definition of listed company and provide a suitable carve out to certain class of companies to be determined in consultation with SEBI.

The rationale behind the carve out, as explained in the Report of the Company Law Committee of November, 2019[2] was that private companies listing its debt securities on any recognized stock exchange were subject to more stringent regulations compared to unlisted private companies viz. appointment of auditors, independent directors, woman directors, constitution of board committees etc. that were dis-incentivizing private companies from seeking listing of their debt securities. This was also discussed in the Report of Company Law Committee in 2016[3] wherein the Committee, while acknowledging the anomaly in the definition of listed company, felt that while the definition of the term ‘listed company’ need not be modified, the thresholds prescribed for private companies for corporate governance requirements may be reviewed. Further, the Committee proposed that specific exemptions under Section 464 of CA, 2013 could also be given to listed companies, other than equity listed companies, from certain corporate governance requirements prescribed in the Act.

Currently, companies issuing non- convertible debt securities (NCDS) or non-convertible redeemable preference shares (NCRPS) on a private placement basis, list the same under SEBI (Issue and Listing of Debt Securities Regulations, 2008 (SEBI ILDS) and SEBI (Issue and Listing of Non-Convertible Redeemable Preference Shares) Regulations, 2013 (SEBI ILNCRPS) respectively and are regarded as ‘listed company’ for the provisions of CA, 2013.

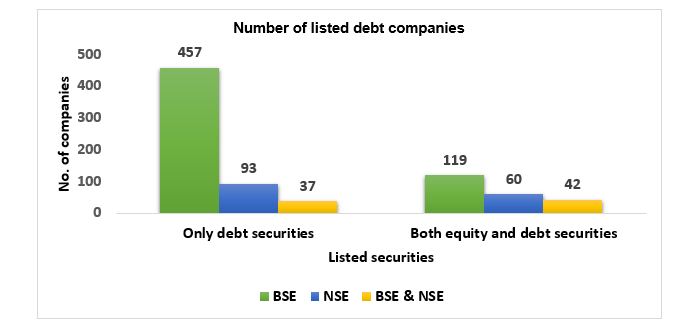

Total number of companies with listed debt

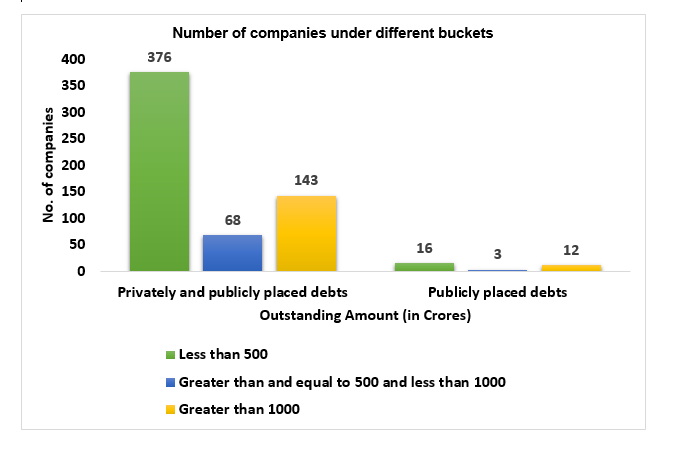

Number of companies, which come under different buckets as per the outstanding value of listed Debt Securities (as per face value) as on December 31, 2020

Present amendment

While the amendment made in Section 2 (52) in the definition of ‘listed company’ was notified with effect from January 22, 2021[4], the class of companies were pending to be prescribed. Ministry of Corporate Affairs (MCA) on February 19, 2021[5] notified Companies (Specification of Definition Details) Second Amendment Rules, 2021 effective from April 1, 2021 to insert Rule 2A excluding following class of companies from the definition of ‘listed company’ under CA, 2013

- Public companies with listed NCDS issued on private placement basis in terms of SEBI ILDS;

- Public companies with listed NCRPS issued on private placement basis in terms of SEBI ILNCRPS;

- Public companies with listed NCDS and NCRPRS issued on private placement basis in terms of SEBI ILDS and SEBI ILNCRPS respectively;

- Private companies with listed NCDS in terms of SEBI ILDS.

- Public companies with equity shares exclusively listed on stock exchanges in permissible foreign jurisdictions under Section 23 (3) of CA, 2013.

Point to note here is that companies with listed commercial papers were anyways outside the purview of listed companies as commercial papers are excluded from the definition of debentures.

Listed company post amendment

Post amendment, the definition of listed company will mainly comprise of public companies offering securities to public i.e. having listed equity shares in India (with or without ADR/GDR listed overseas), listed debt securities pursuant to public issue or listed NCRPS pursuant to public issue.

Compliances for listed company under CA, 2013

A listed company is required to ensure following additional compliances under CA, 2013:

| Amount in Rs/ Other specification | Section No. | Rule No. | Brief of the provision | Other thresholds under CA, 2013 |

| 1. Provisions/ exemptions applicable to all listed companies | ||||

| Exemption for creation of Debenture Redemption Reserve (DRR) | 71 | 18 (7) (b) (iii) (B) of SHA Rules | Listed NBFCs need not create DRR for privately placed and public issue of debentures. | Refer discussion below |

| Creation of Debenture Redemption Fund (DRF) | 71(4) | Rule 18(7)(b)(v) of SHA Rules as amended. | No requirement for creation of DRF by listed companies issuing debenture on private placement basis. | Refer discussion below |

| Annual return | 92 | 11 of MGT Rules

|

Company to file Annual Return certified by a PCS in Form MGT-8 | Applicable to Company with

|

| Records in electronic form | 120 | 27 of MGT Rules | Company may maintain records in electronic form.

Note: Whether companies other than those specified have the option to maintain in electronic form, is not clear. |

Company having not less than 1000 shareholders, debenture holders and other security holders. |

| Investigation by NFRA

|

132 | Rule 3(1)(b) of NFRA Rules | NFRA shall undertake investigation or conduct quality review of audit. |

|

| Statement in Board report indicating manner of Board evaluation | 134(3) | 8 (4) of AOC Rules

|

A statement indicating manner in which formal evaluation of Board, committee and individual directors has been done by Board needs to be included in Board’s report. | Public company having a paid up share capital of Rs. 25 crore or more calculated at the end of the preceding financial year. |

| Financial statements in electronic form | 136 | 11

of AOC Rules |

Financial statements may be sent in electronic format. | Public companies which have

|

| Internal auditor | 138 | 13

of AOC Rules |

Appointment of internal auditor or a firm of internal auditors to conduct internal audit. |

|

| Appt/ re-appt of Auditor | 139

(2) |

5 of ADT Rules

|

Restriction on term of appointment or reappointment of auditor. Rotation of Statutory Auditors mandatory. |

|

| Woman Director | 149

(1) |

3 of DIR Rules

|

Appointment of a Woman Director on the Board.

Any intermittent vacancy of a woman director shall be filled-up by the Board at the earliest but not later than immediate next Board meeting or three months from the date of such vacancy whichever is later. |

Public company having –

|

| Small shareholder director | 151 | 7 of DIR Rules

|

May appoint a small shareholder director suo moto or upon notice from shareholder. | – |

| Vigil mechanism | 177 | 7 of MBP Rules

|

Company to establish vigil mechanism for their directors and employees to report genuine concerns. |

|

| Disclosure in Board’s Report | 197

(12) |

5 of MR Rules

|

Disclosure in Board’s report regarding ratio of the remuneration of each director to the median employee’s remuneration and such other details as prescribed in the Rules. | – |

| Appointment of KMP | 203 | 8 of MR Rules | Appointment of whole-time key managerial personnel.

|

|

| Secretarial Audit Report | 204 | 9(2) of MR Rules

|

Shall annex with its Board’s report a secretarial audit report, given by a company secretary in practice |

|

| 2. Provisions applicable only to a listed public company | ||||

| Report on Annual General meeting | 121 | 31 of MGT Rules

|

Report on AGM to be filed with the Registrar in eForm MGT-15. | – |

| Independent Director | 149

(4) |

4 of DIR Rules

|

Atleast 1/3rd of total number of Board members shall be independent directors. |

|

| Constitution of certain committees | 177 & 178 | 6 of MBP Rules

|

Constitution of Audit Committee and Nomination and Remuneration Committee. |

|

With the present amendment, the class of companies provided above will not be required to ensure aforesaid compliances unless it meets other criteria/ thresholds prescribed for respective compliance.

As evident from the table above, a public company will hardly have any exemptions if it meets any of the thresholds specified. While the intent of exempting class of companies is benign, it will be of some benefit to public companies only if the other thresholds are also revised. While, the holy wish is for ease of doing business, static thresholds prescribed in 2013 needs to be revisited to assess the adequacy and the intent to regulate such class of companies. For e.g. public companies having paid up capital of 10 crore or borrowing of Rs. 50 crore is a very common phenomena.

Additionally, in case the sectoral regulator prescribes composition of committee or induction of independent directors or other corporate governance requirement, those will override the exemptions.

Applicability of DRR and DRF[6]

Section 71(4) read with Rule 18(1)(c) of the Companies (Share Capital and Debentures) Rules, 2014 (SHA Rules) requires every company issuing debentures to create a Debenture Redemption Reserve (DRR) of 10% (as the case maybe) of outstanding value of debentures for the purpose of redemption of such debentures.

Some class of companies as prescribed, has to either deposit, before April 30th each year, in a scheduled bank account, a sum of at least 15% of the amount of its debentures maturing during the year ending on 31st March of next year or invest in one or more securities enlisted in Rule 18(1)(c) of SHA (DRF).

Pursuant to the present amendment, it is important to ascertain applicability of creation of DRR and DRF in terms of CA, 2013. The exemption in relation to DRR and DRF was applicable to listed companies in case of private placement. While NBFCs continue to enjoy exemption even in case of unlisted companies, pursuant to the present amendment Non-NBFCs listing NCDS will not be eligible to avail the benefit of the said exemption and will be required to maintain DRR and DRF.

The intent of MCA at the time of amending Rule 18 of Companies (Share Capital and Debentures) Rules, 2014 was to extend the exemption to all listed companies i.e. companies having securities listed on stock exchange, in case of privately placed debentures, from maintenance of DRR and DRF.

The intent behind amending the definition of ‘listed company’ under 2 (52) was to reduce the compliance burden of debt listed entities that were regarded as listed entities merely by virtue of listing the privately placed debentures.

The amendment to the definition of ‘listed company’ was subsequent and the same has resulted in an anomaly as corresponding amendment has not been carried out in Rule 18 of SHA Rules. The intent behind mandating DRR and DRF requirement, in case of private placement, was for unlisted companies with unlisted debt and not for unlisted companies with listed debt.

This is surely a matter of representation to be made to MCA as the gap seems inadvertent and not intentional.

Applicability of Rule 9A of PAS Rules

Section 29 of CA, 2013 read with Rule 9A of Companies (Prospectus and Allotment of Securities) Rules, 2014 (PAS Rules)[7] effective from October 2, 2018 mandates unlisted public companies to issue the securities only in dematerialised form and facilitate dematerialisation of all its existing securities. Physical transfer of securities is prohibited for unlisted public companies. Compliance with the said provisions are exempt only in case of a Nidhi, Government company and wholly owned subsidiary.

Pursuant to amendment in the definition of listed company, public companies that were originally exempted from the requirements by virtue of being a listed company, will now be required to comply with Section 29 and Rule 9A.

Status under Listing Regulations and SEBI ILDS

‘Listed entity’ as defined under Reg. 2 (p) of SEBI (Listing Obligations and Disclosures Requirements) Regulations, 2015 (Listing Regulations) means an entity which has listed, on a recognised stock exchange(s), the designated securities issued by it or designated securities issued under schemes managed by it, in accordance with the listing agreement entered into between the entity and the recognised stock exchange(s).

The present carve out under CA, 2013 will not result in any carve out for compliances under Listing Regulations as Listing Regulations anyways provides separate set of compliances equity listed companies (Chapter IV) and only NCDS/NCRPS listed companies ( Chapter V) and those with equity and debt listed (Chapter VI).

Further, SEBI Circulars issued from time to time under SEBI ILDS are addressed to all listed entities who have listed their debt securities or issuers who propose to list their debt securities.

Status under PIT Regulations

SEBI (Prohibition of Insider Trading) Regulations, 2015 (PIT Regulations) does not define the term ‘listed company’, however, applies to listed company and securities of an unlisted company proposed to be listed. The definition of ‘proposed to be listed’ is as hereunder:

“proposed to be listed” shall include securities of an unlisted company:

(i) if such unlisted company has filed offer documents or other documents, as the case may be, with the Board, stock exchange(s) or registrar of companies in connection with the listing; or

(ii) if such unlisted company is getting listed pursuant to any merger or amalgamation and has filed a copy of such scheme of merger or amalgamation under the Companies Act, 2013.”

The term ‘listed company’ is not being defined under PIT Regulations and therefore, the definition under CA, 2013 should be referred pursuant to Reg. 2 (2) of PIT Regulations[8]. In that case, PIT Regulations will apply only in case of securities issued by a listed company or a company that is proposed to become a ‘listed company’. Accordingly, only debt/ NCRPS listed companies need not comply with requirements of PIT Regulations. SEBI should consider furnishing a clarification in this regard.

However, that is not the intent of law. If a security is listed, its price is subject to change and be impacted by price sensitive information. Accordingly, such exclusively debt/ NCRPS listed companies, on account of private placement of securities, should continue to comply with the requirements of PIT Regulations. SEBI may also consider furnishing a clarification in this regard.

Conclusion

While, the present amendment expands the originally envisaged carve out for private companies to public companies as well, given the other static thresholds prescribed under CA, 2013 public companies have little reason to rejoice. Exemption to comply with PIT Regulations may be a huge relief, however, there is a need for SEBI to clarify the position given the intent of law.

Further, it is very crucial that MCA revisits DRR and DRF related provision for privately placed NCDS and consider to relax the same especially for the benefit of Non-NBFCs. Lastly, suitability of the exemption in case of companies exclusively listed in foreign jurisdiction will be required to be evaluated after a certain lapse of time as the provisions have been recently inserted in CA, 2013.

Our other videos and write-ups may be accessed below:

YouTube:

https://www.youtube.com/channel/UCgzB-ZviIMcuA_1uv6jATbg

Other write-up relating to corporate laws:

http://vinodkothari.com/category/corporate-laws/

Our our Book on Law and Practice Relating to Corporate Bonds and Debentures, authored by Ms. Vinita Nair Dedhia, Senior Partner and Mr. Abhirup Ghosh, Partner can be ordered though the below link:

[1] https://www.bseindia.com/markets/debt/debt_instruments.aspx?curpage=4&select_alp=all&select_ord=1

[2] Ministry of Corporate Affairs, Government of India, ‘Report of the Companies Law Committee’

(November 2019) para 2.

[3] Ministry of Corporate Affairs, Government of India, ‘Report of the Companies Law Committee’

(February 2016) para 1.13.

[4] http://www.mca.gov.in/Ministry/pdf/CommencementNotification_23012021.pdf

[5] http://egazette.nic.in/WriteReadData/2021/225287.pdf

[6] Refer our write up ‘Easing of DRF’ and ‘Provisions relating to DVR & DRR- stands amended’ by CS Smriti Wadehra.

[7] Discussed in our write up ‘Physical to Demat: A move from opacity to transparency’.

[8] Words and expressions used and not defined in these regulations but defined in the Securities and Exchange Board of India Act, 1992 (15 of 1992), the Securities Contracts (Regulation) Act, 1956 (42 of 1956), the Depositories Act, 1996 (22 of 1996) or the Companies Act, 2013 (18 of 2013) and rules and regulations made thereunder shall have the meanings respectively assigned to them in those legislation.

As per ammended definition of Listed Company A private company having listed its debt securities i.e purely debt listed does no considered as listed compoany under companies act 2013.

As per LODR listed entity” means an entity which has listed, on a recognised stock exchange(s), the designated securities issued by it or designated securities issued under schemes managed by it, in accordance with the listing agreement entered into between the entity and the recognised stock exchange(s);

As per LODR designated securities” means specified securities, non-convertible debt securities, non-convertible redeemable preference shares, perpetual debt instrument, perpetual non-cumulative preference shares, Indian depository receipts, securitised debt instruments, [security receipts,]1 units issued by mutual funds and any other securities as may be specified by the Board

we we read the lodr listed entity & designated securities definition than purely debt listed private company is consider as listed entities or company therefore they has to comply with LODR as well section applicable to them under CO act 2013.

therefore as far as my opinion is concern that ammendment in the definition of Listed companies has no meaning unless SEBI has come with some notification & applicablity as LODR is specific Laws which will prevails over general laws.

If any correction required feel free to discuss. The interpretation is personal opinion so does not consider it for any lega opinion.

Dear Sir,

Your interpretation regarding the definition of the Listed Companies/ entities under the companies act and SEBI LODR regulation is correct.

The amendment made in the definition of the listed company under the Companies Act just provides an exemption to the debt listed companies from the compliances as provided for listed companies under the Companies Act like – constitution of vigil mechanism, rotation of auditors, an exemption for creation of debenture redemption reserve (DRR) and debenture redemption fund (DRF). However, if the company has listed debt securities, it will have to comply with Chapter V of LODR as it gets covered under the definition of a listed entity. Further, if it is an HVDLE, it will have to comply with Chapter IV which relates to corporate governance provisions which were previously only applicable to specified securities of LODR as well.

Is regulation 33 regarding half yearly financial results shall applicable on debt listed company after this amendment??

Dear Sir,

The disclosure of financial results for all debt listed companies will still be pursuant to Regulation 52 which has now been amended vide LODR Fifth Amendment and the requirement of submitting half-yearly financial results has been changed to submission on quarterly basis.

You may also refer:

Our article on Corporate Governance requirements applicable to ‘High Value’ Debt listed entities – https://vinodkothari.com/2021/09/high-value-debt-listed-entities-under-full-scale-corporate-governance-requirements/

Our analysis on LODR Fifth Amendment – https://vinodkothari.com/2021/09/corporate-governance-enforced-on-debt-listed-entities/

Our presentation on LODR Fifth Amendment for a quick overview – https://vinodkothari.com/2021/09/presentation-on-lodr-fifth-amendment-regulations-2021/

In lieu of the above mentioned Notification does a NBFC gets exempted from complying with Ind AS if it’s Networth is below the threshold limit and has NCDs listed on private placement basis?

The query is w.r.t. creation of DRR and DRF by a Debt Listed Company.

Facts of the Case:

As per Rule 18(7) of Companies (Share Capital and Debenture) Rules, 2014, it is mandatory to create Debenture Redemption Reserve (DRR) and to invest a sum which shall not be less than 15% (DRF) of the amount of the debentures maturing during the year ending on the 31st day of March of the next year in any one or more methods of investments or deposits as prescribed.

Pursuant to the amendments in the provisions by MCA in the year 2019 and 2020, XYZ Limited was not required to comply with the above requirements, as XYZ Limited was considered as a Listed Company under the Companies Act, 2013 and the above requirement were not applicable to XYZ Limited’s privately placed listed NCDs till March 31, 2021.

However, pursuant to the amendments in the definition of the Listed Company by the MCA with effect from April 1, 2021, XYZ Limited is considered as an Unlisted Company (as only listed NCDs are excluded from the definition of the Listed Company) and therefore the requirements of Rule 18(7) are now applicable to XYZ Limited from April 1, 2021.

Queries:

Since the DRR is required to be created out of the profits of the company available for payment of dividend, XYZ Limited is required to create the DRR out of the profits earned in FY 2021-22 only i.e. on 31st March, 2022. Is this understanding/interpretation correct?

As per the understanding, the requirement of the DRF is applicable only to companies to whom DRR is applicable. Presuming that our understanding/interpretation of Point 1 is correct, since the creation of DRR is getting triggered on March 31, 2022, the requirement of DRF to XYZ Limited should be applicable from FY 2023 i.e. April 30, 2022. Is this understanding/interpretation correct?

Requesting your views at the earliest.

Dear Sir,

Please find below response to your queries:

Query 1: Profits available for payment of dividend would comprise profits earned during a particular FY i.e., 2021 – 22 as well as profits of the previous FY i.e., 2020 – 21.

Query 2: DRF and DRR are both different requirements. The requirement of creating DRF depends on the date of redemption. Accordingly, Companies on whom the criteria of DRF is applicable must invest or deposit the required sum w.r.t debentures maturing during that FY on or before April 30, of that FY.

Dear Sir,

The above mentioned circular is effective from 01.04.2021. I have an ambiguity regarding the secretarial audit for our Private limited Company which has it Debt Securities listed on a Recognized Stock exchange. Whether our Company is required to undergo a secretarial audit for the Financial year 2020-2021.

It’s a humble request you to revert on my query and clarify the ambiguity.

Thanking You

ACS Tushar Jain

Dear Sir,

Since the circular is effective from April 01, 2021. All the compliances required to be done till March 31, 2021, shall be required to be done. Hence, secretarial audit for FY 20-21 for the said debt listed company shall be applicable.

Dear Sir,

Do we need to comply with regulation 17, 18, 19, 20 and 27 as a private debt listed company???

Kindly answer this its

Dear Ma’am,

Chapter III of the SEBI (LODR) Regulations, 2015 as of whole are not applicable to a Company with only its Debt Securities listed.