MCA eases the requirement for setting up and conversion of an OPC

-Gift from the Union Budget 2021-2022

-Abhishek Saraf |Deputy Manager| (corplaw@vinodkothari.com)

Introduction

The concept of One Person Company (“OPC”) was discussed for the first time in India in the year 2005 by the JJ Irani Expert Committee[1] which suggested that with increasing use of information technology and computers, emergence of service sector, the entrepreneurial capabilities of the people must be given an outlet for participation in economic activity and was of the opinion that it was not reasonable to expect that every entrepreneur who was capable of developing his ideas and participating in the market place should do it through an association of persons. It may therefore, be possible for individuals to operate in the economic domain and contribute effectively. With this, the Committee recommended the formation of OPC. It suggested that such an entity may be provided with a simpler legal regime through exemptions so that the small entrepreneur is not compelled to devote considerable time, energy and resources on complex legal compliance.

OPC is a combination of a sole proprietorship and an incorporated form of business and takes the form and is registered as a private company.

This concept was then introduced in the Indian company law regime by the enactment of the Companies Act 2013 (“Act”), the earlier laws on companies did not have such concept. It was brought in with the objective of promoting entrepreneurship and help entrepreneurs’ by providing them access to certain facilities like bank loans, thorough market access as a separate entity and legal shield for their business. OPC has been defined under section 2(62) of the Act as “a company which has only one person as a member.”

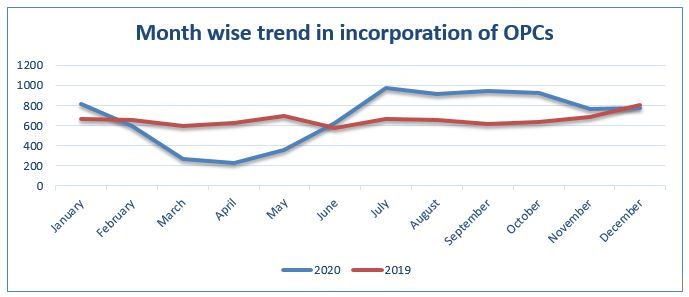

The graph above shows that there has been an increase in the number of OPCs incorporated in the country on month to month comparison for the last two years barring a portion of the period during the lockdown due to Covid-19 restrictions in the country.

With the intent to benefit start-ups and innovators, the Hon’ble Finance Minister in her speech on Union Budget 2021-22 in the Parliament on 1st February 2021, proposed a measure to directly benefit the aforesaid, by the way of amending certain provisions of OPC to provide relaxations in relation to incorporation of OPCs and its conversion into any other type of companies

Following the same, the Ministry of Corporate Affairs vide its notification dated 1st February, 2021 notified the Companies (Incorporation) Second Amendment Rules, 2021[2] thereby notifying the proposal tabled in the Budget speech which shall come into effect from 1st April, 2021.

This write up briefly discusses on the changes brought under the OPC framework.

Brief discussion on the proposed changes

Residency

The norms for setting up OPC has been eased out considerably by reducing the residency limit for an Indian citizen to set up an OPC from 182 days to 120 days. Secondly, the mandatory criteria of being an Indian resident for being eligible to incorporate an OPC has been done away with. This means that w.e.f.1st April, 2021, even a Non-Resident Indian (NRI) can set up an OPC in India. The aim of these amendments is to make it easy for anyone to set up a company in the form of OPCs in the country and promote entrepreneurship and therefore, boost the economy of the country.

Conversion of OPC into other kind of companies

The Act currently provides that an OPC cannot convert itself into any other kind of company unless a period of 2 years has elapsed since the date of its incorporation. The provision has been removed to allow OPCs to convert into any other type of company except section 8 company, at any time at their own will without any sort of restriction.

The current regulatory framework also provides a fetter that if the paid up share capital of an OPC exceeds Rs. 50 lakhs or its average annual turnover during the relevant period exceeds Rs. 2 crores at any time including even in the first 2 years of its incorporation, OPC has to mandatorily convert into a Private company or a Public company. However, the provision has completely been removed this threshold limits and w.e.f 1st April, 2021 OPCs shall no longer be required to compulsorily go for conversion. They have been allowed to grow without any restrictions on paid up capital and turnover and have been given the freedom to convert at any time.

OPCs will now be allowed to convert into any other kind of company other than section 8 companies by applying in e-Form INC 6 after altering its memorandum and articles, increasing the minimum number of members and directors to the minimum number as provided in the statute for that kind of company and maintaining the minimum paid up capital as per the requirement of the Act for such class of company.

Conversion of Private companies into OPCs

The most significant amendment has been allowing private companies to convert into OPCs at any time irrespective of its paid up share capital or average annual turnover which earlier was a hindrance for Private companies willing to convert to OPCs.

This shall prove beneficial for such private companies who want funds to grow their business and cross the regulatory threshold because of which they are not able to convert themselves into OPCs and have to devote too much of their time, energy and resources on the complex legal requirements and also miss out on the benefits/ exemptions being given to the OPCs by the various provisions of the Act.

Benefits for an OPC under the Act

The Act provides for number of benefits for a company registered as OPC, some of those are:

- Abridged form of Annual Return and Board’s Report shall be prescribed by the Central Government for OPCs.

- OPCs are not required to hold Annual General Meeting.

- It is not required to hold 4 board meetings in a year, OPC may hold 2 board meetings in a calendar year i.e. one Board Meeting in each half of the calendar year with a minimum gap of ninety days between two meetings.

- Secretarial Standards-1 is not applicable on OPCs having only 1 director and Secretarial Standards are also not applicable on OPCs.

- Lesser Penalties have been prescribed for OPCs under section 446B of the Companies Act 2013.

Conclusion

As evident from the statistical data, since there has been an increase in the number of the OPCs incorporated, MCA has thought fit to ease the requirements for setting or conversion of an OPCs thereby providing a boost to entrepreneurship as well as the economy.

The move to incentivize OPCs by reducing the residency limit and allowing NRIs to set up companies in form of OPC in the country is expected to provide broader investment opportunities for venture funds, while providing leverage to set up businesses in India. The removal of threshold limit for conversion of OPCs into any kind of companies and private companies into OPCs shall be of huge relief for companies going for funding without the burden of compulsorily converting themselves. It also gives them a freedom and ease of converting at point of time which goes with the Government’s agenda of Ease of Doing Business and Self Reliant India.

[1] http://www.primedirectors.com/pdf/JJ%20Irani%20Report-MCA.pdf

[2] http://www.mca.gov.in/Ministry/pdf/SecondAmndtRules_02022021.pdf

Leave a Reply

Want to join the discussion?Feel free to contribute!