Easing of DRF requirement

-by Smriti Wadehra

(smriti@vinodkothari.com)

-Updated as on 29th September, 2020

Pursuant the proposal of Union Budget of 2019-20, the MCA vide notification dated 16th August, 2019 amended the provisions of Companies (Share Capital and Debentures) Rules, 2014 [1].(You may also read our analysis on the notification at Link to the article) The said amended Rules faced a lot of apprehensions, especially, from the NBFCs as the notification which was initially expected to scrap off the requirement of creation of DRR for publicly issued debentures had on the contrary, rejuvenated a somewhat settled or exempted requirement of creation of debenture redemption fund as per Rule 18(7) for NBFCs as well.

As per the notification, the Ministry imposed the requirement for parking liquid funds, in form of a debenture redemption fund (DRF) to all bond issuers except unlisted NBFCs, irrespective of whether they are covered by the requirement of DRR or not. In this regard, considering the ongoing liquidity crisis in the entire financial system of the Country, parking of liquid funds by NBFCs was an additional hurdle for them.

Creation of DRR is somewhat a liberal requirement than creation of DRF, this is because, where the former is merely an accounting entry, the latter is investing of money out of the Company. Further, the fact the notification dated 16th August, 2019 casted exemption from the former and not from the latter, created confusion amidst companies. The whole intent of amending the Rule was to motivate NBFCs to explore bond markets, however, the requirement of parking liquid funds outside the Company as high as 15% of the amount of debentures of the Company was acting as a deterrent for raising funds by the NBFCs.

Considering the representations received from various NBFCs and the ongoing liquidity crunch in the economy of the Country along with added impact of COVID disruption, the Ministry of Corporate Affairs has amended the provisions of Rule 18 of Companies (Share Capital and Debenture) Rules, 2014 vide notification dated 5th June, 2020 [2]to exempt listed companies coming up with private placement of debt securities from the requirement of creation of DRF.

What is DRR and DRF?Section 71(4) read with Rule 18(1)(c) of the Companies (Share Capital and Debentures) Rules, 2014 requires every company issuing redeemable debentures to create a debenture redemption reserve (“referred to as DRR”) of at least 25%/10% (as the case maybe) of outstanding value of debentures for the purpose of redemption of such debentures. Some class of companies as prescribed, has to either deposit, before April 30th each year, in a scheduled bank account, a sum of at least 15% of the amount of its debentures maturing during the year ending on 31st March of next year or invest in one or more securities enlisted in Rule 18(1)(c) of Debenture Rules (‘referred to as DRF’). |

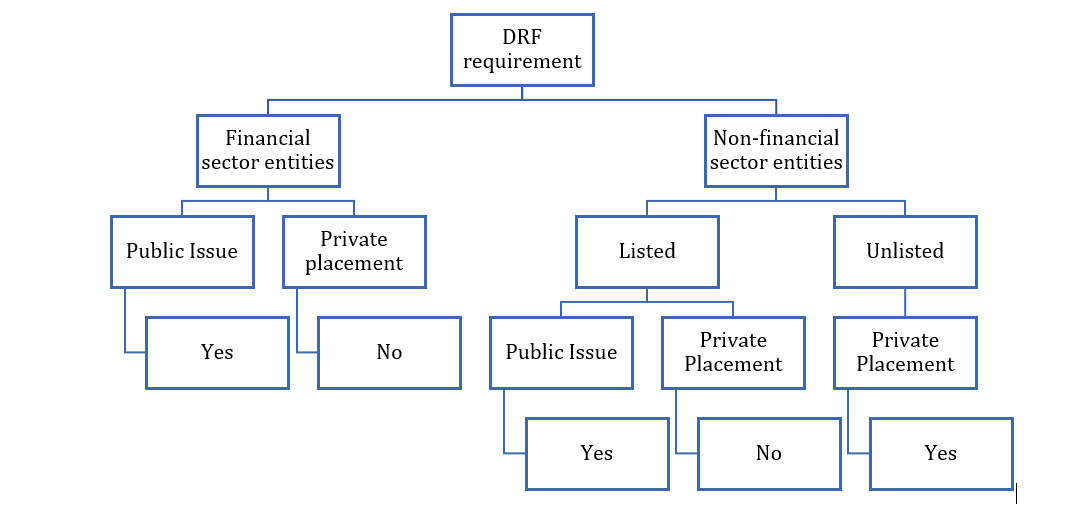

The notification has mainly exempted two class of companies from the requirement of creation of DRF:

- Listed NBFCs registered with RBI under section 45-IA of the RBI Act, 1934 and for Housing Finance Companies registered with National Housing Bank and coming up with issuance of debt securities on private placement basis.

- Other listed companies coming up with issuance of debt securities on private placement basis.

However, the unlisted non-financial sector entities have been left out. In a private placement, the securities are issued to pre-selected investors. Raising debt through private placement is a midway between raising funds through loan and debt issuances to public. Like in case of bilateral loan arrangements, but unlike in case of public issue, the investors get sufficient time to assess the credibility of the issuer in private placements, since the investors are pre-identified.

The intent behind DRF is to protect the interests of the investors, usually when retail investors are involved, with respect to their claims on maturity falling due within a span of 1 year. This is not the case for investors who have invested in privately placed securities, where the investments are made mostly by institutional investors.

Further, companies chose issuance through private placement for allotment of securities privately to pre-identified bunch of persons with less hassle and compliances. Hence, the requirement of parking funds outside the Company frustrates the whole intent.

Further, it is a very common practice to roll-over the bond issuances, hence, it is not that commonly bonds are repaid out of profits; the funds are raised from issuance of another series of securities. This is a corporate treasury function, and it seems very unreasonable to convert this internal treasury function to a statutory requirement.

Though, in our view, the relaxation provided in case of private issuance of debt securities is definitely a relief, especially during this hour of crisis, but we are not clear about the logic behind excluding unlisted non-financial sector entities.

Even though, the financial sector (76%) entities dominate the issuance of corporate bonds, however, the share of the non-financial sector entities (24%) is not insignificant. Therefore, ideally, the exemption in case of private placements should be extended to unlisted non-financial sector entities as well.

A brief analysis of the amendments is presented below:

Practical implication

Pursuant to the MCA notification dated 16th August, 2019, the below mentioned class of companies were required to either deposit or invest atleast 15% of amount of debentures maturing during the year ending on 31st March, 2020 by 30th April, 2020. This has been extended till 31st December, 2020 for this FY 2019-20 by MCA due to the COVID-19 outbreak. However, pursuant to the amendment introduced by MCA notification dated 5th June, 2020 the status of DRF requirement stands as amended as follows:

| Particulars | DRF requirement as MCA circular dated 16th August, 2019 | DRF requirement as per MCA circular dated 5th June, 2020 |

| Listed NBFCs which have issued debt securities by way of public issue | Yes. | Yes. Deposit or invest before 31st December, 2020 |

| Listed NBFCs which have issued debt securities by way of private placement | Yes | Not required as exempted. |

| Listed entities other than NBFC which have issued debt securities by way of private placement | Yes | Not required as exempted |

| Listed entities other than NBFC which have issued debt securities by way of public issue | Yes | Yes. Deposit or invest before 31st December, 2020 |

| Unlisted companies other than NBFC | Yes. | Yes. Deposit or invest before 31st December, 2020 |

Please note that the aforesaid shall be applicable from 12th June, 2020 i.e. the date of publication of the notification in the official gazette. In this regard, if for instance companies which have been specifically exempted pursuant to the recent notification, have already invested or deposited their funds to fulfil the DRF requirement may liquidated the funds as they are no longer statutorily require to invest in such securities.

Synopsis of DRR and DRF provisions[2]

A brief analysis of the DRR and DRF provisions as amended by the MCA notification dated 16th August, 2019 and 5th June, 2020 has been presented below:

| Sl. No. | Particulars | Type of Issuance | DRR as per erstwhile provisions | DRR as per amended provisions | DRF as per erstwhile provisions | DRF as per amended provisions |

| 1. | All India Financial Institutions | Public issue/private placement | × | × | × | × |

| 2. | Banking Companies | Public issue/private placement | × | × | × | × |

| 3.

|

Listed NBFCs registered with RBI under section 45-IA of the RBI Act, 1934 and HFC registered with National Housing Bank | Public issue | √

25% of value of outstanding debentures |

× | √ | √ |

| Private Placement | × | × | √ | × | ||

| 4. | Unlisted NBFCs registered with RBI under section 45-IA of the RBI Act, 1934 and HFC registered with National Housing Bank | Private Placement |

× |

× |

× |

× |

| 5.

|

Other listed companies | Public Issue | √

25% of value of outstanding debentures |

× | √ | √ |

| Private Placement | √

25% of value of outstanding debentures |

× | √ | × | ||

| 6. | Other unlisted companies | Private Placement | √

25% of value of outstanding debentures |

√

10% of the value of outstanding debentures |

√ | √ |

[1] http://www.mca.gov.in/Ministry/pdf/Circular_25032020.pdf

[2] This table includes analysis of provisions of DRR and DRF as per CA, 2013 and amendments introduced vide MCA notification dated 16th August, 2019 and 5th June, 2020.

Erstwhile provisions- Provisions before amendment vide MCA circular dated 16th August, 2019

Amended provisions- Provisions after including amendments introduced vide MCA circular 5th June, 2020

[1] https://www.mca.gov.in/Ministry/pdf/ShareCapitalRules_16082019.pdf

Hi Smriti Mam,

I had one query with respect to creation of debenture redemption reserve.

Unlisted Public Company is not having adequate profit to create 10 percent debenture redemption reserve in one go. Can it comply with the requirement of creation of debenture redemption reserve in several years as and when it has profit or it has to create 10 percent of outstanding value of debenture in one go? Please clarify

A equity listed NBFC issuing debentures on public issue basis is required to create DRR or DRF? Will it change, if the NBFC is not equity listed but debt listed?

If a Company which is not a NBFC has issued unlisted NCD on a private placement basis in April, 2019 and then issued listed debentures in February, 2020 on a private placement basis, then whether the compliance of DRR & DRF will be necessary for unlisted debentures?

Incase of Public company whose NCD are listed only whether they can avail the exemption from the applicability of DRR or DRF?

Since Company whose Debt are listed only will not be convered under the definition of Listed Securities wef 01/04/2021

would an entity whose only NCDs are listed be covered under the listed entity category and not required to create DRR & DRF incase of a privately placed NCDS. ?

Dear Prerna,

Please note that the term listed entity refers to an entity which has listed its securities on stock exchange and hence includes debentures into its purview. Accordingly, in case of debt listed companies there shall be no requirement of creation of DRR or DRF for privately issued debentures.

Hope this clarifies.

If the Equity shares of the Company are listed but the Company has issued NCD on private placement basis, then is there the requirement of DRR or DRF to be created/maintained by the Company?

Sir,

As equity shares of the company are listed, the company will be considered as a listed company irrespective of whether the NCDs in question are listed or not. Accordingly, considering the type of company, the compliance of DRR and DRF requirement has to be ensured.