New year brings stricter norms for appointment of IDs

SEBI’s (Third Amendment) Regulations go live!

Anushka Vohra | Manager | corplaw@vinodkothari.com

On August 03, 2021, SEBI (Listing Obligations and Disclosure Requirements) (Third Amendment) Regulations, 2021[1] (Third Amendment Regulations) were notified to become effective from January 01, 2022. The amendment brings changes in the regulatory framework for Independent Directors (IDs) including but not limited to criteria of independence, appointment framework, composition of IDs in committees of the board, etc. The amendment is a move towards protecting the interests of a larger set of shareholders.

In this write-up we will be discussing the revised appointment and re-appointment framework for the IDs.

Current framework

A. Appointment of IDs

As per the provisions of law and given the standard practice, the appointment of IDs is done as follows:

- The Nomination and Remuneration Committee (‘NRC’) recommends to the Board of Directors (‘Board’), a person to be appointed as an Additional Director (‘AD’) in the capacity of an ID;

- Based on the recommendation of the NRC, the Board appoints the same person as an AD in the category of ID;

- Such AD generally serves as an ID on the Board from the date of his appointment by the Board and complies with the criteria of independence as on the date of such appointment;

- The AD holds office upto the next AGM or the last date on which the AGM should have been held, whichever is earlier;

- At the AGM, an ordinary resolution is passed by the members for regularising the appointment of such AD to hold the office of an ID from the date of appointment by the Board.

B. Reappointment of IDs

The current practice of re-appointment of IDs is as follows:

- The board takes the proposal of re-appointment of IDs before the shareholders’, before the expiry of the tenure of the ID;

- The shareholders approve such re-appointment by way of a special resolution.

Amended regulatory framework for appointment of IDs

SEBI Consultation Paper[2]

On March 01, 2021, SEBI came up with a Consultation Paper (‘Paper’) for reviewing the regulatory provisions relating to IDs viz. their independence, appointment, re-appointment and remuneration.

The Paper proposed two significant changes in the process of appointment, re-appointment and removal of IDs i.e. ‘dual approval’ and ‘prior approval’. The relevant extract is quoted herein below:

‘Appointment and re-appointment of IDs shall be subject to “dual approval”, taken through a single voting process and meeting following two thresholds: –

- Approval of shareholders

- Approval by ‘majority of the minority’ (simple majority) shareholders. ‘Minority’ shareholders would mean shareholders, other than the promoter and promoter group.

The approval at point (i) above, shall be through ordinary resolution in case of appointment and special resolution in case of re-appointment.’

Further, concerns were raised on the current framework for appointment of IDs, as discussed above. The Paper expressed that the significant gap between the appointment of an ID and approval of shareholders is not in the best interest of the shareholders, especially the minority shareholders. Accordingly, the Paper proposed to take prior approval of shareholders for appointment of IDs. The relevant extract is quoted herein below:

‘Independent Directors shall be appointed on the board only with prior approval of the shareholders at a general meeting.

In case, a casual vacancy arises due to resignation / removal / death / failure to get re-appointed etc., the approval of shareholders should be taken within a time period of 3 months.’

SEBI Board Meeting[3]

Post the receipt of the comments on the Paper, SEBI at its board meeting held on June 29, 2021 reviewed the regulatory provisions related to IDs. It is significant to note that the proposal of ‘dual approval’ and ‘prior approval’ was not approved by SEBI considering difficulties it could impose during implementation including delay in appointment of IDs in case of a deadlock, etc. Thus, SEBI took a balanced view and introduced a process which is simpler to implement and covers a greater set of shareholders. SEBI, therefore, decided that appointment, re-appointment and removal of IDs shall be through a special resolution of shareholders for all listed entities, applicable from January 01, 2022.

Therefore, it is absolutely clear that the proposal for obtaining prior approval of shareholders was dropped by SEBI.

Amended provisions

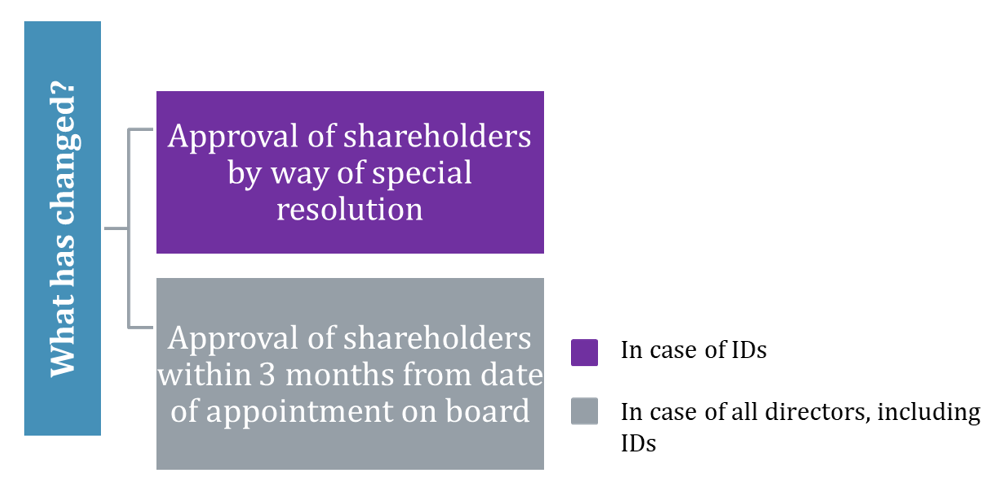

The Amended Regulations inserted sub-regulation (1C) to Regulation 17 and sub-regulation (2A) to Regulation 25 which requires passing of a special resolution for appointment, re-appointment as well as removal of IDs. Further, another pertinent change brought about by the amendment is that the approval of shareholders is required to be passed within a maximum of 3 months from the date of appointment by the board.

Hence, on a conjoint reading of both Regulations 17(1C) and 25(2A), the following is understood:

- The Board may appoint a person as recommended by NRC, as an AD in the category of ID;

- Shareholder approval by way of special resolution required within earlier of :

-

-

- next general meeting

- three months from the appointment of that person by the board.

-

Prior approval or post-facto approval

Regulation 25(2A) states that the appointment of an independent director shall be subject to the approval of shareholders. Whether the approval required is prior or post-facto has not been specified. However, on understanding the background of the amendment in the Regulation, and by harmonious construction of this Regulation with Regulation 17 (1C) it is clear that the approval may be post-facto. The approval referred to in Reg 25 (2A) does not necessarily mean prior approval. It is a stated law that approval includes post- facto approval too.

In Black’s Law Dictionary (Fifth Edition)[4], the word “approval” has been defined as follows:

Approval. – The act of confirming, ratifying, assenting, sanctioning, or consenting to some act or thing done by another.

Hence, approval to an act or decision can also be subsequent to the act or decision.

Also, in the case of Vijay S. Sathaye v. Indian Airlines Ltd & Ors[5], the Hon’ble Supreme Court held that, ‘Approval means confirming, ratifying, assenting, sanctioning or consenting to some act or thing done by another.’Further in the case of Union of India v. Sunny Abraham[6], the Delhi High Court held that, ‘the dictionary meaning of the word “approval” includes ratifying of the action, ratification obviously can be given ex post facto approval.’ The Court also pointed out in this case that if the provision of law requires prior approval, it will specifically prefix the approval by “prior”.

The Allahabad High Court in Shakir Hussain v. Chandoo Lal[7] held that, ‘Of course the expression “subject to approval by the Court” implies that the arrangements which are considered by him to be most convenient and economical must be made by him first and approved by the Court subsequently. It is not necessary for him to submit his proposal beforehand and get approval though such a course is not impossible.’

Hence, we are of the view that provision of Reg 25 (2A) does not deviate from the provisions of Reg 17(1C) giving a time of 3 months or by the calling of the ensuing AGM, whichever is earlier, for shareholder’s affirmation of the appointment of an independent director.

Approval process effective from 1st January, 2022

Hence, with effect from 1st Jan., 2022,, the process for appointment of an ID stands as follows:

- The NRC is required to recommend the persons to be appointed as IDs in the board of the company[8]. The following procedure has to be followed:

- Evaluate the balance of skills, knowledge and experience

- On the basis of above evaluation, prepare description of required roles and capabilities required for that particular appointment of ID

- Identify the suitable candidate fitting the said description

- For identifying persons, NRC may

- use services of external agencies

- May consider candidates from a wide variety of backgrounds ( for diversity)

- And consider time commitment of appointees

- The person identified and recommended to the Board should possess capabilities as per description

- Further, the steps as per point 1 and 2 under the head Amended provisions shall be followed.

- Note: all additional directors appointed on / after the date of notification of the amendment i.e. August 03, 2021 and before January 01, 2022 shall be approved by the shareholders within 3 months from Jan 01, 2022 For detailed illustrations {refer- Revised regulatory framework for IDs of listed entities in India}[9] .

Concluding remarks

The requirement of special resolution would safeguard and protect the interest of shareholders and the independence of the IDs. Covering a greater set of shareholders would ensure that the composition of ID is not influenced by the whims of the majority shareholders. Hence, this move would increase the participation of shareholders in approving the appointment of a person, whom they want to be represented on the board of directors.

[1] https://egazette.nic.in/WriteReadData/2021/228705.pdf

[2] https://www.sebi.gov.in/reports-and-statistics/reports/mar-2021/consultation-paper-on-review-of-regulatory-provisions-related-to-independent-directors_49336.html

[3] https://www.sebi.gov.in/media/press-releases/jun-2021/sebi-board-meeting_50771.html

[4] https://www.latestlaws.com/wp-content/uploads/2015/04/Blacks-Law-Dictionery.pdf#page=208

[5] https://indiankanoon.org/doc/86328176/

[6] https://indiankanoon.org/doc/152013330/

[7] https://indiankanoon.org/doc/1531761/

[8] Though the Listing Regulations already require the NRC to formulate criteria regarding such appointments, the role of NRC, in practice, does not suffice the intent of law properly. Therefore, vide the Amendment Regulations, SEBI has brought amendment to Para A of Part D of Schedule II of the Listing Regulations thereby specifying the procedure for selection of candidates for the role of NRC. The procedure is in line with the proposal laid down in the Paper.

[9] https://vinodkothari.com/2021/03/revised-regulatory-framework-for-ids/

Leave a Reply

Want to join the discussion?Feel free to contribute!