-Implications and actionables

Last updated on 5th October, 2021

Anushka Vohra | Deputy Manager

corplaw@vinodkothari.com

The SEBI (Listing Obligations and Disclosure Requirements) (Fifth Amendment) Regulations, 2021[1] have increased the compliance burden on the debt listed entities. Ranging from introducing the corporate governance requirements on High Value Debt Listed Entities (HVDLEs)[2] to increasing the disclosure and compliance requirements on all debt listed entities, the amendment per se aims to make the current regulatory requirements stringent on the debt listed entities.

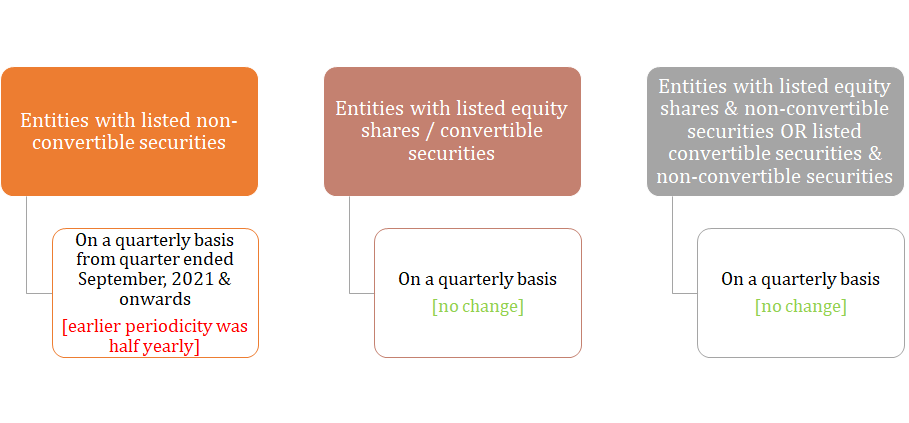

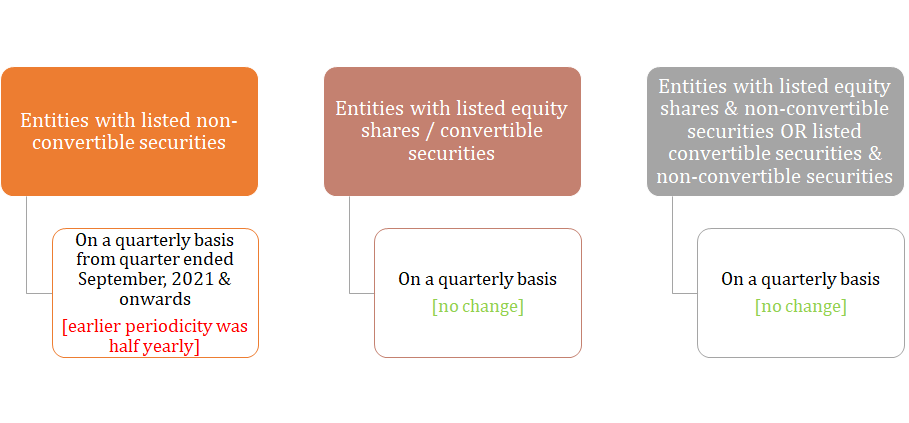

One significant amendment under Chapter V, which is applicable on all debt listed entities, is the requirement of submission of financial results on a quarterly basis instead of a half yearly basis, as was previously the requirement. With this write-up, we will try to understand the implications on the debt listed entities due to change in the periodicity of submission of financial results and the required actionables.

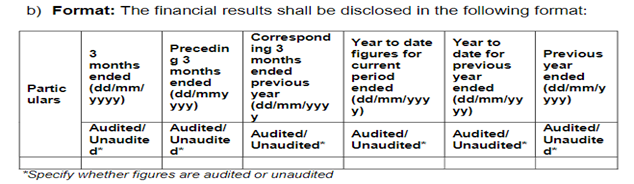

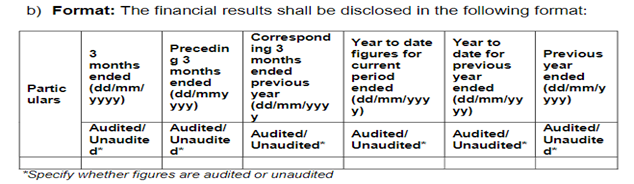

As per the amendment, the debt listed entities will be required to prepare the quarterly and annual financial results, as per the format specified by the Board. The Board has on October 05, 2021, specified the format[3] to be followed by the entities whose non-convertible securities are listed. Our snapshot on the same can be accessed here. It is pertinent to note that while the line items remain the same, the periodicity seems to be exactly similar to the erstwhile format which was applicable on entities that have listed their equity shares / specified securities.

A snapshot of the format is as under:

Since the time the amendment has been introduced, it was quite anticipated that the format would be similar to what was initially applicable to entities that have listed their equity shares / specified securities. The secretarial team of companies were struggling with the same, however the SEBI circular has put to rest the concerns and has, by way of a note clarified that, in case the debt listed entities do not have corresponding quarterly financial results for the four quarters ended September, 2020, December, 2020, March, 2021 and June, 2021, the column on corresponding figures for such quarters will not be applicable.

Entities with listed non-convertible securities

Consideration of financial results

Non-convertible securities include debentures which are not convertible into equity at any given time and constitute a debt obligation on the part of the issuer. Chapter V of the SEBI(Listing Obligations and Disclosure Requirements) Regulations, 2015 (Listing Regulations) is applicable to entities that have listed their non-convertible securities on the stock exchange(s). Regulation 52 of the Listing Regulations deals with the preparation and submission of financial results

The extant Regulation provided that such listed entity shall submit financial results on a half yearly basis, within 45 days from the end of half year i.e; within 45 days from the end of September & March [for entities following FY April-March]. For the first half year the requirement was mandatory but SEBI provided a relaxation for second half year, whereby it was stated that such listed entity may not be required to submit unaudited financial results for the second half year, if it intimates in advance to the stock exchange(s), that it shall submit its annual audited financial results within 60 days from the end of financial year. Akin to such relaxation, SEBI provided that if such a listed entity submits the unaudited financial results within 45 days from the end of the second half year, the annual financial results may be submitted as and when approved by the board of directors.

Extant framework

| Unaudited accompanied with limited review report |

Audited financial results + statements + Auditor’s Report (AR) |

| For the first half year (have to be mandatorily given) |

For the second half year (whether submitted / not) |

|

| Yes |

No |

Within 60 days from end of financial year |

| Yes |

Yes |

As soon as approved by the board |

Now, since the periodicity has changed from half yearly to quarterly, such listed entities will be required to submit financial results within 45 days from the end of each quarter, other than the last quarter and the annual financial results within 60 days from the end of the financial year.

New framework

| Unaudited accompanied with limited review report |

Audited financial results + statements + AR |

| For the first quarter* |

For the second quarter* |

For the third quarter* |

For the fourth quarter** |

|

| Yes |

Yes |

Yes |

No |

Within 60 days from end of financial year |

*mandatorily required

**not required

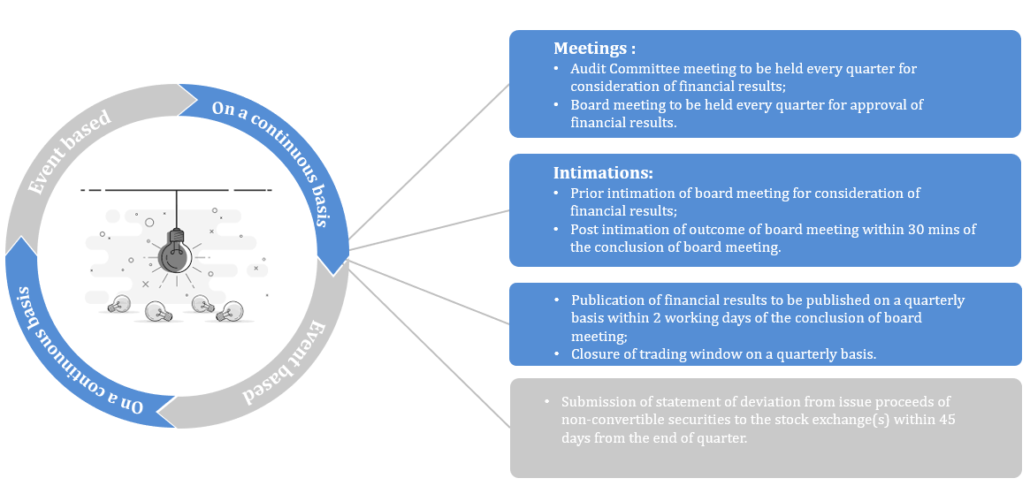

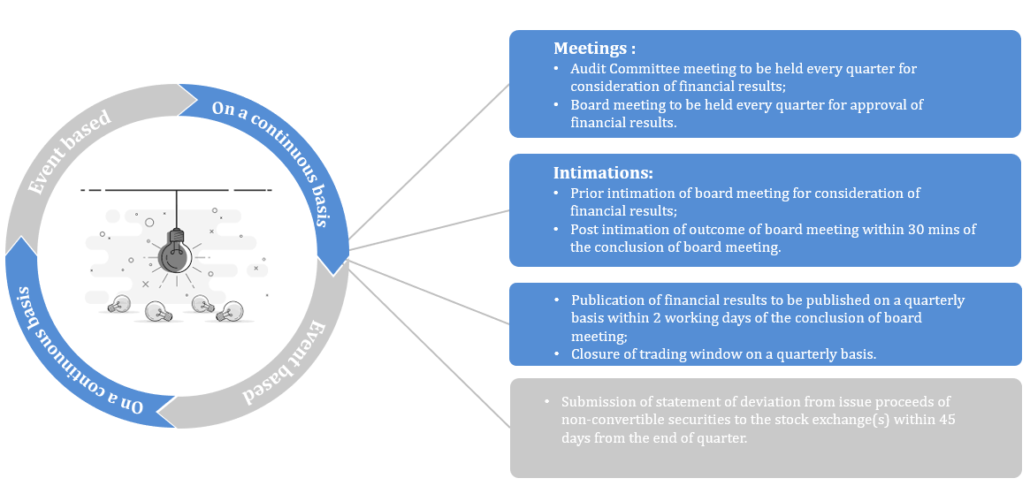

Landscape of intimations & disclosures – understanding the actionables

It is an irrefutable fact that debt in India is mostly privately placed which primarily involves the Qualified Institutional Buyers (QIBs) and no prejudice is caused to the public at large. Keeping that in mind, the debt listed entities were treated differently from the equity listed entities and were not subject to the such stricter compliances when compared to debt listed entities.

In view of SEBI’s approach during recent times, , it has put an end to the easy going voyage of a debt listed entity and they have been placed at par with the equity listed entities.

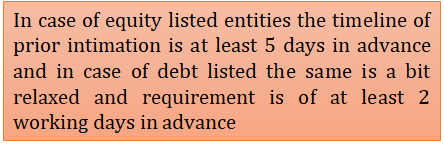

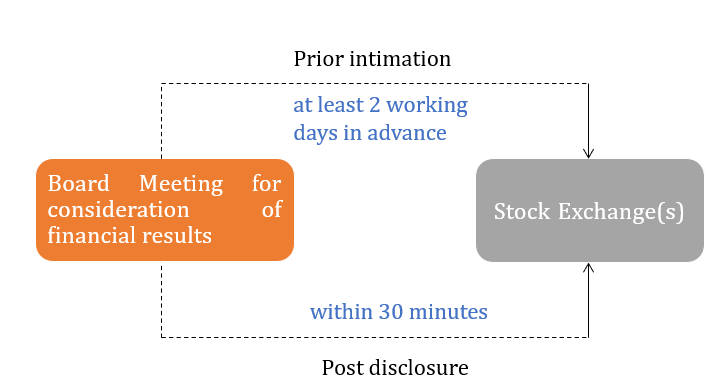

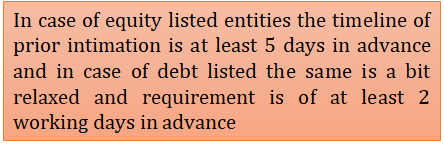

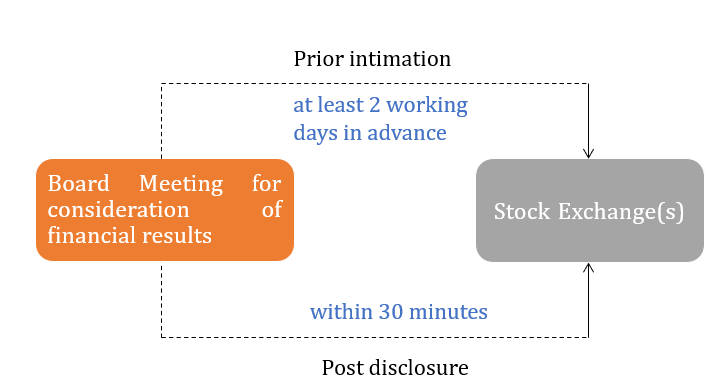

Regulation 50 dealing with intimation to stock exchange(s) has been amended and now require the debt listed entities to intimate to the stock exchange(s) at least 2 working days in advance, excluding the date of board meeting and date of intimation, of the board meeting where the financial results shall be considered (quarterly / annually). This Regulation 50 corresponds to Regulation 29 which is applicable to equity listed entities.

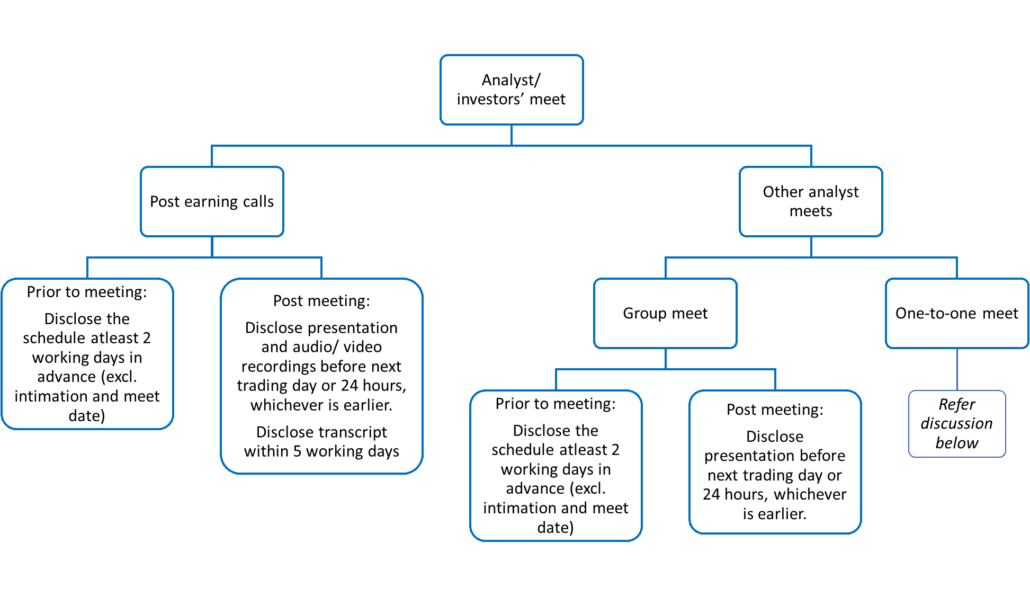

Further, in case of equity listed entities, Regulation 30 (read with Schedule III Part A) is a cumbersome Regulation as the same requires certain events to be disclosed as and when they occur. For debt listed entities, the corresponding Regulation is Regulation 51 (read with Schedule III Part B). Unlike Regulation 30, the list under Regulation 51 (i.e; under schedule III) was narrow in its scope, however, with the said amendment, the list under the Part B of Schedule III, applicable on debt listed entities has also been amended to streamline the same with what is applicable on equity listed entities.

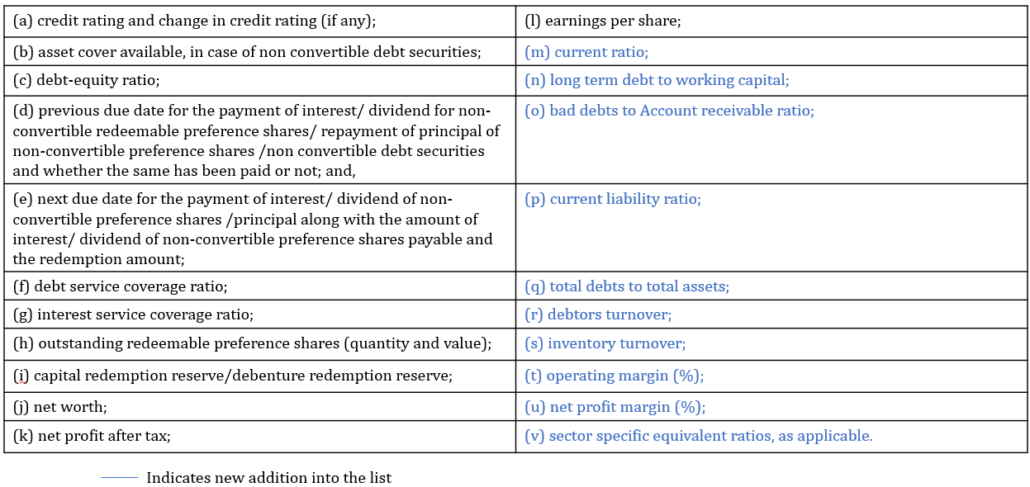

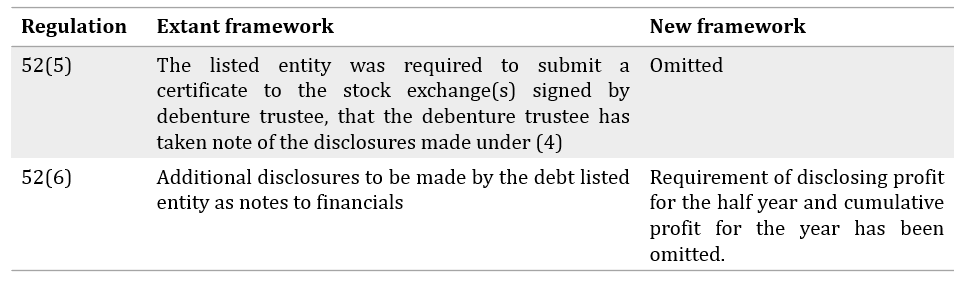

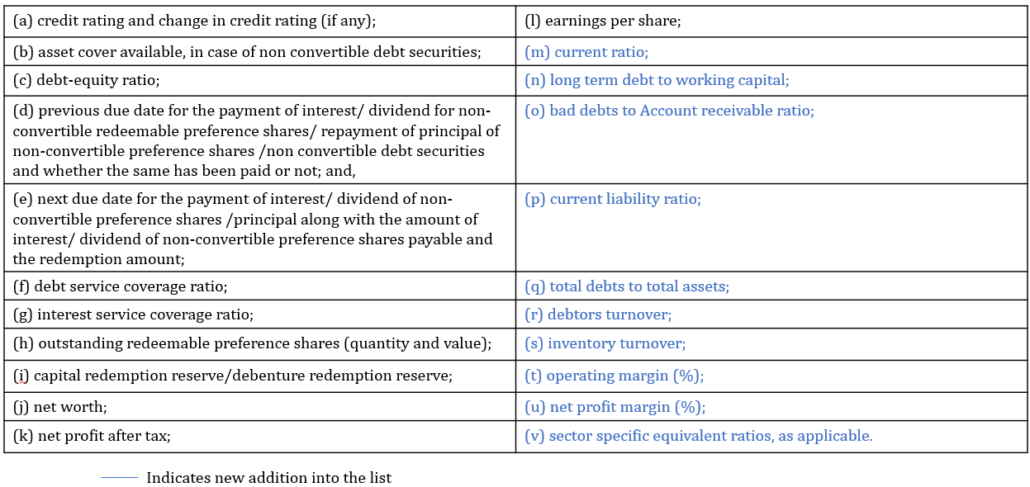

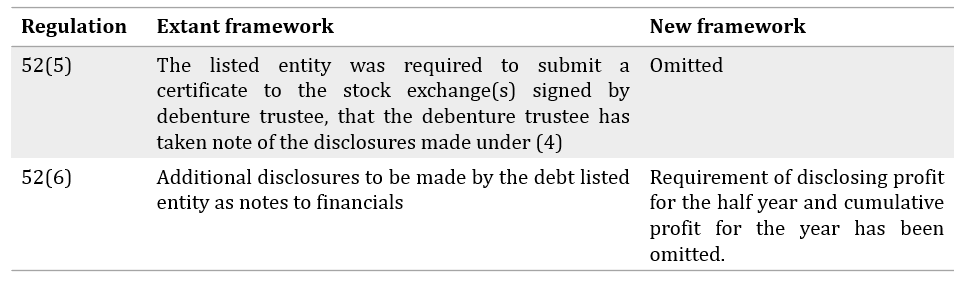

Furthermore, while submitting the financial results (quarterly / annually) under Regulation 52, the debt listed entities have to provide certain information. Such information is captured under Regulation 52(4) and includes the following:

Exemption : Non Banking Financial Companies (NBFCs) which are registered with the RBI were exempted from making disclosure of interest service coverage ratio, debt service coverage ratio and asset cover. However, exemption from disclosure of asset cover has been withdrawn i.e; now the NBFCs that have listed their debt securities have to make disclosure of asset cover. Also, the exemption from disclosing interest service coverage ratio and debt service coverage ratio is now also extended to Housing Finance Companies (HFCs) registered with the RBI.

This new framework is now in sync with what is applicable to equity listed entities. The Regulator’s intent to subsume the compliances applicable on equity and debt listed entities seems to have been inspired by the need for more transparency and promptness of information. However, this sudden drift calls for certain actionables on the part of debt listed entities.

A summary of actionables can be represented as under:

Other aspects :

Entities with listed equity shares / convertible securities

The entities that have listed their equity shares / convertible securities i.e; specified securities are covered under Chapter IV of the Listing Regulations, subject to exemptions under Regulation15. These entities have to comply with Regulation 33 for preparation and submission of financial results and the timeline for the same is quarterly. There has been no change for such listed entities as far as the financial results are concerned.

However, since the amendment has made Chapter IV applicable on HVDLEs which are debt listed entities covered under Chapter V, these HVDLEs have to comply with both Regulation 33 and Regulation 52. But since the requirements in both these regulations have been streamlined, no impact will be caused on such HVDLEs.

Entities with listed equity shares & non-convertible securities OR listed convertible securities & non-convertible securities

Such entities are governed by both Chapter IV and Chapter V, thus w.r.t. financial results they have to comply with both Regulation 33 and Regulation 52. Prior to such amendment, such listed entities followed the quarterly preparation and submission of financial results, since the same is stricter. For all other provisions which are common among both chapters but vary in timelines, the one with the stricter provision needs to be followed. For instance, in case of prior intimation of board meetings where financial results shall be considered, Chapter IV provides advance intimation of 5 days, whereas Chapter V provides advance intimation of 2 working days. Clearly, the timeline of 5 days in advance is stricter, therefore such entities shall comply with the same.

Concluding remarks

The sense of ease on the debt listed entities has been undone and the Regulator is preparing to bring the equity and debt listed entities under the same blanket. The extension of Chapter IV on HVDLEs seems to be a wake up call for debt listed entities which are not HVDLEs as of now. The enhanced disclosure on all debt listed entities would nevertheless burden them, however the impact of the same is yet to be analysed.

Our snippet on the same can be accessed at – https://vinodkothari.com/2021/10/quarterly-financial-results-for-debt-listed-companies/

Our other resources on related topics –

- https://vinodkothari.com/2021/09/high-value-debt-listed-entities-under-full-scale-corporate-governance-requirements/

- https://vinodkothari.com/2021/09/corporate-governance-enforced-on-debt-listed-entities/

- https://vinodkothari.com/2021/09/full-scale-corporate-governance-extended-to-debt-listed-companies/

- https://vinodkothari.com/2021/09/presentation-on-lodr-fifth-amendment-regulations-2021/

[1] https://www.sebi.gov.in/legal/regulations/sep-2021/securities-and-exchange-board-of-india-listing-obligations-and-disclosure-requirements-fifth-amendment-regulations-2021_52488.html

[2] A listed entity which has listed its non-convertible debt securities and has an outstanding value of listed non-convertible debt securities of Rs. 500 crore & above as on March 31, 2021.

[3] https://www.sebi.gov.in/legal/circulars/oct-2021/revised-formats-for-filing-financial-information-for-issuers-of-non-convertible-securities_53136.html