Master Direction on presentation and disclosures in financial statements

– Parth Ved, Executive | parth@vinodkothari.com

Loading…

Loading…

– Parth Ved, Executive | parth@vinodkothari.com

Loading…

Loading…

Abhirup Ghosh | abhirup@vinodkothari.com

It is not uncommon to have Indianised version of global dishes when introduced in India, and we are very good in creating fusion food. We have a paneer pizza, and we have a Chinese bhel. As covered bonds, the European financial instrument with over 250 years of history were introduced in India, its look and taste may be quite different from how it is in European market, but that is how we introduce things in India.

It is also interesting to note that regulatory attempts to introduce covered bonds in India did not quite succeed – the National Housing Bank constituted Working Group on Securitisation and Covered Bonds in the Indian Housing Finance Sector, suggested some structures that could work in the Indian market[1] and thereafter, the SEBI COBOSAC also had a separate agenda item on covered bonds. Several multilateral bodies have also put their reports on covered bonds[2].

However, the market did not wait for regulators’ intervention, and in the peak of the liquidity crisis of the NBFCs, covered bonds got uncovered – first slowly, and now, there seems to be a blizzard of covered bond issuances. Of course, there is no legislative bankruptcy remoteness for these covered bonds.

There are two types of covered bonds, first, the legislative covered bonds, and second, the contractual covered bonds. While the former enjoys a legislative support that makes the instrument bankruptcy remote, the latter achieves bankruptcy remoteness through contractual features.

To give a brief understanding of the instrument, a standard covered bond issuance would reflect the following:

Therefore, covered bond is a half-way house, and lies mid-way between a secured corporate bond and the securitized paper. The table below gives comparison of the three instruments:

| Covered bonds | Securitization | Corporate Bonds | |

| Purpose | Essentially, to raise liquidity | Liquidity, off balance sheet, risk management,

Monetization of excess profits, etc. |

To raise liquidity |

| Risk transfer | The borrower continues to absorb default risk as well as prepayment risk of the pool | The originator does not absorb default risk above the credit support agreed; prepayment risk is usually transferred entirely to investors. | The borrower continues to absorb default risk as well as prepayment risk of the pool |

| Legal structure | A direct and unconditional obligation of the issuer, backed by creation of security interest. Assets may or may not be parked with a distinct entity; bankruptcy remoteness is achieved either due to specific law or by common law principles | True sale of assets to a distinct entity; bankruptcy remoteness is achieved by isolation of assets | A direct and unconditional obligation of the issuer, backed by creation of security interest. No bankruptcy remoteness is achieved. |

| Type of pool of assets | Mostly dynamic. Borrower is allowed to manage the pool as long as the required “covers” are ensured. From a common pool of cover assets, there may be multiple issuances. | Mostly static. Except in case of master trusts, the investors make investment in an identifiable pool of assets. Generally, from a single pool of assets, there is only issuance. | Dynamic. |

| Maturity matching | From out of a dynamic pool, securities may be issued over a period of time | Typically, securities are matched with the cashflows from the pool. When the static pool is paid off, the securities are redeemed. | From out of a dynamic pool, securities may be issued over a period of time. |

| Payment of interest and principal to investors | Interest and principal are paid from the general cashflows of the issuer | Interest and principal are paid from the asset pool | Interest and principal are paid from the general cashflows of the issuer. |

| Prepayment risk | In view of the managed nature of the pool, prepayment of loans does not affect investors | Prepayment of underlying loans is passed on to investors; hence investors take prepayment risk | Prepayment risk of the pool does not affect the investors, as the same is absorbed by the issuer. |

| Nature of credit enhancement | The cover, that is, excess of the cover assets over the outstanding funding. | Different forms of credit enhancement are used, such as excess spread, subordination, over-collateralization, etc. | No credit enhancement. Usually, the cover is 100% of the pool principal and interest payable. |

| Classes of securities | Usually, a single class of bonds are issued | Most transactions come up with different classes of securities, with different risk and returns | Single class of bonds are issued. |

| Independence of the ratings from the rating of the issuer | Theoretically, the securities are those of the issuer, but in view of bankruptcy-proofing and the value of “cover assets”, usually AAA ratings are given | AAA ratings are given usually to senior-most classes, based on adequacy of credit enhancement from the lower classes. | There is no question of independent rating. |

| Off balance sheet treatment | Not off the balance sheet | Usually off the balance sheet | Not applicable. |

| Capital relief | Under standardized approaches, will be treated as on-balance sheet retail portfolio, appropriately risk weighted. Calls for regulatory capital | Calls for regulatory capital only upto the retained risks of the seller | Not applicable |

This article would briefly talk about the issuance of Covered bonds world-wide and in India, and what are the distinctive features of the issuances in India.

Since most volumes for covered bonds came from Europe, there has been a decline due to supply side issues. This is evident from the latest data on Euro-Denominated Covered bonds Volume. The performance in FY 2020 and FY 2021 has been subdued mainly due to COVID-19. Though, the volumes suffered significantly in the Q3 and Q4 of FY 20, but returned to moderate levels by the beginning of FY 2021.

The figure below shows Euro-Denominated Covered bond Issuances until Q2 2021.

Source: Dealogic[3]

Countries like Denmark, Germany, Sweden continues to be dominant markets for covered bond issuances. The countries in the Asia-Pacific region like Japan, Singapore, and Australia continues to report moderate level of activities. In North America, Canada represents all the whole of the issuance, with no issuances in the USA.

The tables below would show the trend of issuances in different jurisdictions in 2019 (latest available data):

Source: ECBC Factbook 2020[4]

In India, the struggle to introduce covered bonds started way back in 2012, when the National Housing Bank formed a working group[5] to promote RMBS and covered bonds in the Indian housing finance market. Though the outcome of the working group resulted in some securitisation activity, however, nothing was seen on covered bonds.[6]

Some leading financial institutions attempted to issue covered bonds in the Indian market, but they failed. Lastly, FY 2019 witnessed the first instance of covered bonds, which was backed by vehicle loans.

In India, issuance of covered bonds witnessed a sharp growth in FY 2021, as the numbers increased to INR 22 Bn, as against INR 4 Bn in FY 2020. Even though the volume of issuances grew, the number of issuers failed to touch the two-digit mark. The issuances in FY 2021 came from 9 issuers, whereas, the issuances in FY 2020 were from only 2 issuers. Interestingly, all were non-banking financial companies, which is a stark contrast to the situation outside India.

The figure below shows the growth trajectory of covered bonds in India:

Source: ICRA, VKC Analysis

The growth in the FY 2021 was catapulted by the improved acceptance in Indian market in the second half of the year, given the uncertainty on the collections due to the pandemic, and the additional recourse on the issuer that the instrument offers, when compared to a traditional securitisation transaction.

Almost 75% of the issuances were done by issuers have ‘A’ rating, the following could be the reasons for such:

The Indian covered bonds market is however, significantly different from other jurisdictions. Traditionally, covered bonds are meant to be long term papers, however, in India, these are short to medium term papers. Traditionally covered bonds are backed by residential mortgage loans, however, in India the receivables mostly non-mortgages, gold loans and vehicle loans being the most popular asset classes.

In terms of investors too, the Indian market has shown differences. Globally, long term investors like pension funds and insurance companies are the most popular investor classes, however, in India, so far only Family Wealth Offices and High Net-worth Individuals have invested in covered bonds so far.

Another distinct feature of the Indian market is that a significant share of issuances carry market linked features, that is, the coupon rate varies with the market conditions and the issuers’ ability to meet the security cover requirements.

But the most important to note here is that unlike any other jurisdiction, covered bonds don’t have a legislative support in India. In Europe, the hotspot for covered bonds, most of the countries have legislations declaring covered bonds as a bankruptcy-remote instruments. In India, however, the bankruptcy-remoteness is achieved through product engineering by doing a legal sale of the cover pool to a separate trust, yet retaining the economic control in the hands of the issuer until happening of some pre-decided trigger events, and not with the help of any legislative support. In some cases, the legal sale is done upfront too.

Considering the importance and market acceptability of the instrument, rating agencies in India have laid down detailed rating methodologies for covered bonds[7].

Covered Bonds issued in India will not match most of the features of a traditional covered bond issued in Europe, however, the fact that finally the investors community in India has started recognizing it as an investment opportunity is very encouraging.

The real economics of covered bonds will come to the fore only when the market grows with different classes of investors, like the mutual funds, pension funds, insurance companies etc. in the demand side, which seems a bit far-fetched for now.

[1] A working group was constituted by the National Housing Bank to promote RMBS and Covered Bonds, the report of the working group can be viewed here: https://www.nhb.org.in/Whats_new/NHB%20Covered%20Bond%20Report.pdf

[2] In 2014-15, the Asian Development Bank appointed Vinod Kothari Consultants to conduct a Study on Covered Bonds and Alternate Financing Instruments for the Indian Housing Finance Segment

[3] https://www.icmagroup.org/resources/market-data/Market-Data-Dealogic/#14

[4] https://hypo.org/app/uploads/sites/3/2020/10/ECBC-Fact-Book-2020.pdf

[5] A working group was constituted by the National Housing Bank to promote RMBS and Covered Bonds, the report of the working group can be viewed here: https://www.nhb.org.in/Whats_new/NHB%20Covered%20Bond%20Report.pdf

[6] Vinod Kothari Consultants has been a strong advocate for a legal recognition of Covered Bonds in India. They were involved in the initiatives taken by the NHB to recognize Covered Bonds as a bankruptcy remote instrument in India.

[7] The rating methodology adopted by ICRA Ratings can be viewed here: https://www.icra.in/Rating/ShowMethodologyReport/?id=709

The rating methodology adopted by CRISIL can be viewed here: https://www.crisil.com/mnt/winshare/Ratings/SectorMethodology/MethodologyDocs/criteria/crisils%20criteria%20for%20rating%20covered%20bonds.pdf

—

Our Video on Covered Bonds can be viewed here <https://www.youtube.com/watch?v=XyoPcuzbys4>

Some resources on Covered Bonds can be accessed here –

Introduction to Covered Bonds by Vinod Kothari: http://vinodkothari.com/2015/01/introduction-to-covered-bonds-by-vinod-kothari/

The Name is Bond. Covered Bond. By Vinod Kothari: http://www.vinodkothari.com/wp-content/uploads/covered-bonds-article-by-vinod-kothari.pdf

NHB’s Working Paper on Covered Bonds: https://www.nhb.org.in/Whats_new/NHB%20Covered%20Bond%20Report.pdf

RBI proposes uniform regulatory framework for the Microfinance Sector ( finserv@vinodkothari.com )

The microfinance sector, in India, has proved to be fundamental for promoting financial inclusion by extending credit to low-income groups that are traditionally not catered to by lending institutions. The essential features of microfinance loans are that they are of small amounts, with short tenures, extended without collateral and the frequency of loan repayments is greater than that for traditional commercial loans. These loans are generally taken for income-generating activities, although they are also provided for consumption, housing and other purposes. There exist various market players in the microfinance industry viz. scheduled commercial banks, small finance banks, co-operative banks, various NBFCs extending microfinance loans and NBFCs-MFIs.

The microfinance industry has reached 6 crores of live borrowers base the end of the calendar year of 2020. Book size of the microfinance industry as on 31st December is 228,818 crore[1]. The sector grew by 16% from December 2019 to December 2020 (based on outstanding loan portfolio size) and has witnessed phenomenal growth over the last two decades.

Source- SIDBI Microfinance Pulse Report, April 2021

Source- SIDBI Microfinance Pulse Report, April 2021

While banks are leading by contributing 42% towards total portfolio outstanding and 39% towards active loans, NBFC-MFIs are the second highest contributors in the microfinance sector. When compared to the total portfolio size of all microfinance lenders, NBFC-MFIs only contribute to a little over 30% of the total size. However, the framework regulating microfinance has been made applicable solely to NBFC-MFIs (‘NBFC-MFI Regulations’ as provided under the respective Master Directions) while the other lenders that hold a lion’s share of the sector are not subjected to similar regulatory conditions/ restrictions. These include cap on multiple lending, ceiling on maximum lending amount, various customer protection measures etc. Absence of regulatory control has led to various problems such as multiple lending by borrowers resulting in overindebtedness, increased defaults, coercive recovery methods by lenders at the prejudice of borrowers etc.

As a solution to the same, RBI has issued a consultative paper on regulation of microfinance on June 14, 2021[2] (‘Consultation Paper’) with an intention to harmonise the regulatory frameworks for various regulated lenders (‘RE’s) in the microfinance space while also proposing a slew of changes to the existing norms for NBFC-MFIs and NBFCs.

RBI has invited comments, suggestions and feedback on the proposed regulation by July 31, 2021 from all stakeholders. The proposed norms intend to have uniform regulations applicable to microfinance loans provided by all entities regulated by the RBI and are aimed at protecting the microfinance borrowers from over-indebtedness as well as enabling competitive forces to bring down the interest rates by empowering the borrowers to make an informed decision. The key proposals of the Consultative Document have been discussed herein below in this article:

MFIs encompass a host of financial institutions engaged in advancing loans to low-income groups. However, except NBFC-MFIs, none of the other entities are regulated by microfinance-specific regulations.

Resultantly, RBI has proposed to introduce a common regulatory framework for all microfinance lending institutions, irrespective of their form. The intent behind the same is to ensure that all lenders under the microfinance sector are subject to the same rules. This would not only protect borrower interest but also ensure that all lenders are operating on a level playing field thereby passing the benefit of competition to the ultimate borrower. Further, considering the total indebtedness of borrowers vis-a-vis their repayment capacity seems more fitting rather than indebtedness only from NBFC-MFIs.

RBI has proposed to revise the definition of ‘microfinance loans’ and in order to avoid over-indebtedness and multiple lending, the same is proposed to be applied uniformly to all entities regulated by the RBI (REs) and operating in the microfinance sector.

Common definition of microfinance borrowers

Under extant regulations for NBFC-MFIs, a microfinance borrower is identified by annual household income not exceeding ₹1,25,000 for rural and ₹2,00,000 for urban and semi-urban areas. In order to ensure a common definition, the said criteria for classification is proposed to be extended to all regulated entities (REs).

RBI has proposed to base the threshold on the income of the entire household rather than that of an individual, similar to the existing guidelines for NBFC-MFIs. The reason being that income in such households is usually assumed to be pooled.

For this purpose, ‘household’ shall mean a group of persons normally living together and taking food from a common kitchen. Even though the determination of the actual composition of a household shall be left to the judgment of the head of the household, more emphasis has been advised to be placed on ‘normally living together’ than on ‘ordinarily taking food from a common kitchen’. Note that a household differs from a family. Households include persons who ordinarily live together and therefore may include persons who are not related by blood, marriage or adoption but living together, while a family may comprise persons who are living apart from the household.

Methodology for assessment of household income

Assessment of household income in a predominant cash-based economy might pose certain difficulties. However, applying a uniform methodology may not be appropriate for such assessment, especially of low-income households, since the practice may differ based on the different types of borrowers and lenders. The same should be left at the discretion of the lender in the form of a policy. However, broad parameters/ factors may be provided. These can include deriving income from expenditure patterns, assessment of the borrower’s occupation and the ordinary remuneration flowing thereof, assessment of cash flows etc.

One of the major risks in microlending has been the issue of overborrowing, with nearly 35% of the borrowers having access to two or more lenders.(source PWC report)

It is proposed to link the loan amount to household income in terms of debt-income ratio. The payment of interest and repayment of principal for all outstanding loans of the household at any point of time is proposed to be capped at 50% of the household income i.e. total indebtedness of any borrower will not increase 50% of his/her total income. This has been proposed keeping in mind various factors such as –

However, individual REs will be permitted to adopt a conservative threshold as per their own assessments and Board approved policy. Since, the level of indebtedness for a particular borrower is proposed to be regulated, the current stipulation that limits lending by not more than two NBFC-MFIs to the same borrower will no longer be required.

Grandfathering of existing facilities

The aforesaid threshold shall become effective from the date of introduction of the proposed regulations. However, existing loans to the households which are not complying with the limit of 50% of the household income, shall be allowed to mature. Although, in such cases, no new loans will be provided to such households till the limit is complied with.

Microfinance borrowers belong to the low income group and generally do have the available assets to be provided as collateral for availing financial facilities. The assets possessed by them are usually those that are essential for their survival and losing them in case of a default will be detrimental to their existence. Therefore, it has been proposed that to extend the collateral free nature of microfinance loans, as applicable to NBFC-MFIs, to all REs.

In case of NBFC-MFIs, the borrowers are allowed prepayment without charging any penalty. It has now been proposed that microfinance borrowers of all REs shall be provided with the right of prepayment without attracting penalty.

As per the extant regulations, microfinance borrowers of NBFC-MFIs are permitted to repay weekly, fortnightly or monthly instalments as per their choice. With a view to keep the repayment pattern at the discretion of the borrowers that will suit their repayment capacity and/or preference, all REs will be required to provide repayment periodicity to such borrowers as per a Board approved policy.

RBI had issued a Discussion Paper on ‘Revised Regulatory Framework for NBFCs – A Scale-Based Approach’ on January 22, 2021 proposing to revise the minimum net owned fund (NOF) limit for all NBFCs including NBFC-MFIs, from ₹2 crore to ₹20 crore.

At present, NBFC-MFIs are required to have a minimum NOF of ₹5 crore (₹2 crore for NBFC-MFIs registered in the North Eastern Region). RBI has sought the view of stakeholders whether the proposed minimum NOF of ₹20 crore for NBFCs under scale-based regulations is appropriate for NBFC-MFIs or not.

The evolution of regulatory framework for NBFCs may recall, the NOF requirement for NBFCs was Rs 25 lacs in 1990s. Then, it was increased to Rs 2 crores, Rs. 5 crores in case of NBFC-MFIs. The regulator is now proposing to increase the same to Rs 20 crores – a 10 fold increase. The underlying rationale is to have a stronger entry barrier, and to ensure that NBFCs have the initial capital for investing in technology, manpower and establishment. However, such a sharp hike in entry point requirement will keep smaller NBFCs out of the fray. Smaller NBFCs, especially NBFC-MFIs, have been doing a useful job in financial inclusion and having a stricter entrance will only prove to demotivate the sector. You may read further on the scalar based approach framework by RBI in our article here.

Section 8 companies engaged in micro-finance and not accepting public deposits, are exempt from obtaining registration under section 45IA of the RBI Act, 1934 as well as from complying with sections 45-IB (Maintenance of percentage of assets) and 45-IC (Reserve Fund).

The exemption is applicable to all not-for-profit NBFC-MFIs that meet the above criteria irrespective of their size. However, it has been proposed to bring Section 8 companies above a certain threshold in terms of balance sheet size (say, asset size of ₹100 crore and above) under the regulatory ambit of the RBI. This is because Section 8 companies are dependent on public funds including borrowings from banks and other financial institutions for their funding needs and any risk of failure in these companies will have a resultant impact on the financial sector.

Further, not-for profit MFIs operate in an almost similar manner to that of for-profit MFIs but the latter enjoys exemptions from various requirements. The mandatory requirement for registration will ensure that not-for-profit MFIs with considerably large asset size, are effectively regulated.

The revised criteria for exemption is proposed to be as under:

‘Exemption from Sections 45-IA, 45-IB and 45-IC of the RBI Act, 1934 shall be available to a micro finance company which is

In order to be classified as a ‘qualifying asset’, a loan is required to satisfy the following criteria:

The following changes have been proposed –

Owing to an overall restriction based on debt-income ratio of 50% for all REs, the restriction of lending by only two NBFC-MFIs to a borrower will be withdrawn.

Given the vulnerable nature of the borrowers of microfinance loans, the NBFC-MFI regulations imposed an interest cap to prevent exorbitant interest rates charged to such borrowers.

The interest rate cap prescribes multiple ceilings rather than a single one. Accordingly, NBFC-MFIs have been permitted to charge interest with a maximum margin cap of 10% and 12% over and above the cost of funds, depending on the size of loan portfolio (₹100 crore threshold) or 2.75 times of the average base rate of five largest commercial banks, whichever is lower.

The latter criterion provides a linkage with the prevailing interest rate in the economy and ensures that higher borrowing costs for NBFC-MFIs with riskier business models are not transmitted to the end borrowers. Further, NBFC-MFIs are not permitted to levy any other charge except for a processing fee (capped at 1% of the loan amount) and actual cost of insurance to ensure that interest rate ceilings are not bypassed by NBFC-MFIs through other hidden charges.

However, the regulatory ceiling on interest rate is applicable only to NBFC-MFIs. Nearly 70% of the microfinance sector, comprising banks and small finance banks, is deregulated in terms of pricing. It has also been observed that an unintended consequence of creating a regulatory prescribed benchmark for the rest of the entities operating in the microfinance segment. Lenders, such as banks, though having a lower cost of funds, still charge a higher interest rate. This has led to borrowers being deprived of benefits of economies of scale and competition in the microfinance market.

The provision of such interest rate ceilings was suitable in an environment where NBFC-MFIs were the primary lenders. However, currently, as discussed, NBFC-MFIs contribute to only 30%. Proposing a fixed benchmark for interest rate in the microfinance industry may not be appropriate considering the differences in the cost of funds, financial or otherwise, among different types of entities.

Based on the above rationale, it has been proposed to remove such interest rate ceiling limits and align the interest rate model for NBFC-MFIs with that of regular NBFCs. NBFC-MFIs will now be permitted to adopt interest rates based on a Board approved policy while adhering to fair practice code to ensure disclosure and transparency. However, necessary regulation must also be put in place to avoid charging usurious interest rates. The intention is to enable the market mechanism to reduce the lending rates for the entire microfinance sector.

The above relaxation from interest rate ceiling, comes with its own set of fair practice norms to ensure transparency and protecting interests of borrowers.

To allow borrowers to make an informed decision, REs will mandatorily be required to disclose pricing information by way of a standardised and simplified disclosure format (specified under table III of the Consultation Paper). Such information will enable borrowers to compare interest rates as well as other fees associated with a microfinance loan in a more readable and understandable manner. The pricing related fact sheet shall be provided to every prospective borrower before on-boarding.

Boards of all REs will be required to frame suitable internal principles and procedures for determining interest rates and other charges to arrive at an all-inclusive usurious interest rate.

All REs will be required to display the minimum, maximum and average interest rates charged by them on microfinance loans. The manner of display is still to be prescribed.

The above information will also be incorporated in returns submitted to RBI and shall be subjected to the supervisory scrutiny.

[1] Source- SIDBI Microfinance Pulse Report, April 2021

[2] https://www.rbi.org.in/scripts/BS_PressReleaseDisplay.aspx?prid=51725

-Financial Services Team ( finserv@vinodkothari.com )

The purpose of reporting in accordance with International Financial Reporting Standards (IFRS) is to provide financial information about the reporting entity that is useful to various stakeholders in making decisions about providing resources to the entity.

To satisfy the objective of IFRS/Ind AS reporting, to a large extent, based on estimates, judgements and models rather than exact depictions. In other words, the use of reasonable estimates is an essential part of the preparation of financial statements and does not undermine their reliability.

Collateral is one or more assets that a borrower offers to a lender as security for a loan, with the intent that if the borrower defaults in making the promised loan payments, the lender has the right to seize the collateral, sell the same and realise the amounts due. Since collateral offers a security to the lender should the borrower default, loans that are secured by collateral typically carry lower interest rates than unsecured loans.

Needless to say, secured lending forms a very important segment of the world of finance.

Although the legal rights that flow from collateral are typically specified in the loan agreement, law in some jurisdictions might specify particular overriding rights, obligations, restrictions, etc. In some cases, at the commencement of the loan, collateral is physically transferred from the borrower to the lender. These security interests are called possessory security interests – a pledge is an example of a possessory security interest. There are other types of security interests which are non-possessory, which are known as hypothecation, lien or charge in different jurisdictions. A mortgage in English and Indian law has a different connotation – it creates a property right in favour of the lender to secure the loan; hence, it results into transfer of specific title[1].

Irrespective of the form of collateral, it is clear that collateral is merely security interest, and not property interest. While covenants of security documentation may differ, the most common security document allows the lender to sell or cause the sale of the collateral upon default of the borrower.

When a financial institution (FI) extends a secured facility, it recognises loan as its asset, as the benefits accruing to the entity would be on account of loan provided. The security would only act as backstop measure in case the performance of the loan deteriorates. Further, the entity’s interest lies in the loan not in the charged asset.

However, this does not imply that security on a loan would go unnoticed while accounting for the loan asset. Collateral and other credit risk mitigants are important factors in an entity’s estimate of Expected credit losses (ECL).

Consequently, IFRS 7 Financial Instruments: Disclosures specifies that an entity must disclose information that enables users of its financial statements to evaluate the nature and extent of risks arising from financial instruments to which the entity is exposed at the end of the reporting period and how those risks have been managed by the entity (paragraphs 31 and 32). When relevant, an entity’s risk management disclosure would include its policies and procedures for taking collateral and for monitoring the continuing effectiveness of collateral in mitigating counterparty credit risk. Paragraph 35K of IFRS 7 requires information that will enable users of financial statements to understand the effect of collateral and other credit enhancements on the amount of expected credit losses.

The Division III of Schedule III to the Companies Act, 2013 prescribes a separate disclosure for secured and unsecured advances. Further the impairment loss allowance for both asset categories is also presented along with the specific asset .

In short, disclosure of the collateral and credit enhancements is an important disclosure. The existence of the collateral itself may not change the carrying value of the loan, but it may have repercussions on the value of the ECL, as also, in case of fair-valued loans, on the risk-adjusted value by impacting the credit spread that is deployed as a part of the discounting rate.

Simply payment of principal and interest (SPPI) test is one of the two tests that are required to be passed for a financial asset to be classified either as subsequently measured at Amortised Cost or at FVOCI. The test says that the contractual cash flows from the asset, on specified dates, should comprise only of principal payments and interest payments on the principal amount outstanding.

Paragraph BC4.206(b) of the Basis for Conclusions on IFRS 9 explains the IASB’s view that financial assets can still meeting the SPPI test, i.e., the contractual cash flows may consist solely payments of principal and interest, even though they are collateralised by assets. . Consequently, in performing the SPPI test an entity disregards the possibility that the collateral might be foreclosed in the future unless the entity acquired the instrument with the intention of controlling the collateral.

Assume the following facts: FI had a loan of Rs 1000 outstanding, which was in default. FI forecloses and repossesses the collateral, say a machinery, which is valued Rs 700 on the date of repossession. FI keeps the machinery pending disposal, and on the reporting date, the machinery is still in stock. Eventually, in the next reporting period, the machinery is sold, say for a net realisation of Rs 600.

Several questions arise – on the date of repossession, can FI remove loan to the extent of Rs 700 and debit it to machinery held for sale? What happens to the loss of Rs 100 on the sale – is it loss related to the loan, or loss related to disposal of machinery?

Questions like this are faced by financial institutions all the time.

Though accounting standards provide ample guidance on taking cognizance of collateral, specifically for credit risk assessment and asset recognition, the clarity is lost at the issue of accounting for repossessed assets. Accounting standards do not provide a clear view on how an asset should be treated when the entity enforces its right to foreclose and repossess the asset, and the asset is pending disposal. If the disposal of the asset has already been done, then the question of any accounting for collateral does not arise, as the collateral has already been disposed off. However, the accounting for the collateral itself, as discussed below, will affect the accounting for the disposal as well.

As regards accounting for the repossession of the collateral, some guidance comes from the Para B5.5.55 of IFRS 9/Ind AS 109 :

“…….Any collateral obtained as a result of foreclosure is not recognised as an asset that is separate from the collateralised financial instrument unless it meets the relevant recognition criteria for an asset in this or other Standards.”

The extract clarifies that mere fact that the asset is repossessed would not make it eligible for being recognised as an asset on the books, as the entity’s interest still lies in recovery loan, the entity would have no interest in the asset if not for dues under the loan.

Further, Para 7 of IAS 16 / Ind AS 16 states that

“The cost of an item of property, plant and equipment shall be recognised as an asset if, and only if:

(a) it is probable that future economic benefits associated with the item will flow to the entity; and

(b) the cost of the item can be measured reliably”

Hence, the FI can capitalise and record only such assets whose future economic benefits would accrure to the financial institution in question, that is, the lender. PPE classification is possible It may also be possible for an entity to hold the asset as an investment property, for disposal. There may be cases where the collateral may consist of shares, securities or other financial assets, or may consist of stock in trade or receivables.

Irrespective of the type of asset, the key question would be – has the lender acquired a property interest in the collateral, so as to have risks and rewards in the same, or the lender has simply acquired possession over the collateral for causing disposal?

The accounting here is impacted by the legal rights in case of collateral. To reiterate, we are stating here generic legal position, and it is possible that collateral documents bring rights of the lender which are differential. Further, the legal rights may vary depending upon the kind of security interest being created on the assets, e.g. a pledge would differ from a mortgage.

In the case of Balkrishan Gupta And Ors vs Swadeshi Polytex Ltd[2] the Supreme Court, while also indicating the very distinction between a pawn and a mortgage, observed that even after a pledge is enforced, the legal title to the goods pledged would not vest in the pawnee. the pawnee has only a special property. A pawnee has no right of foreclosure since he never had absolute ownership at law and his equitable title cannot exceed what is specifically granted by law. The right to property vests in the pledged only so far as is necessary to secure the debt.[3]

Although, pledge has to be differentiated from a mortgage which wholly passes the thing in the property conveyed[4] However, as noted in , Narandas Karsondas vs. S.A Kamtam and Anr[5] it is important to note that the mortgagor does not lose the right of redemption until the sale is complete by registration. In selling the property, the mortgagee is not acting as the agent of the mortgagor but under a different (read: superior) claim. No equity or right in property is created in favour of the purchaser by the contract between the mortgagee and the proposed purchaser.

We have mentioned above that the legal rights of a lender differ (a) based on the law of the jurisdiction, as also consistent practices; (b) legal documentation. For instance, in case of mortgage, the common law provides two different rights of a mortgagee – the decree of sale and the decree of foreclosure [Section 67 of Transfer of Property Act, 1882] Decree of sale implies that the mortgagee may simply cause the sale of the mortgaged property. Decree of foreclosure is foreclosure of the mortgagor’s right of redemption, and the mortgagee, therefore, becoming absolute owner of the property. There are exceptional circumstances when this is possible, for example, in case of a mortgage by conditional sale.

In case of pledges too, while the general rule as set out in Lallan Prasad vs Rahmat Ali[6] and GTL Textiles vs IFCI Ltd.[7] is that the pledgee only has the right to cause sale.

In case of US practices, it is quite a common practice of mortgage lenders to hold the foreclosed property as Real Estate Owned.

Thus, there can be two situations:

Our analysis of broad principles is as follows:

The lender could repossess the property as a result of the borrower’s default with the intention securing the possession of the collateral. The seeking of possession of the collateral is simply seeking the custody of the collateral. This is preventive – to ensure that the asset or its value is not prejudiced. This is intent when a court, receiver, arbitrator or similar agency seeks control over the collateral. The intent is custodial and not proprietary. The actual sale proceeds of the asset, as and when disposed of by the lender, will go to the credit of the borrower; any amounts received in excess of the mortgage balance will be refunded to the borrower; and any shortfall remains the obligation of the borrower.

The FI may continue to charge interest on the outstanding balance. The lender remains exposed to interest rate risk on the collateral but is not exposed directly to property price risk.

In such cases, there is no question of the loan being set off against the value of the collateral, until the collateral is actually disposed off. While giving the particulars of the collateral, the lender may separately classify collateral in possession of the lender, as distinct from collateral which is in possession of the borrower or third parties. However, the classification of the loan remains unchanged.

The lender could repossess the property, which in terms of the law or contract, gives the lender absolute rights in the property. The lender may have the right to collect the unrealised amount from the borrower, or the obligation to refund the excess, if any, realised, but the issue is, does the lender acquire proprietary interest in the collateral, and whether the lender now is exposed to the risks and rewards, or the variability in the value of the collateral?

However, FASB has prescribed following guidelines to determine whether the charged asset would replace the loan asset. The FASB guidance on Reclassification of Residential Real Estate Collateralized Consumer Mortgage Loans upon Foreclosure[8] provides that “a creditor is considered to have received physical possession of residential real estate property collateralizing a consumer mortgage loan, upon either upon

(1) the creditor obtaining legal title to the residential real estate property upon completion of a foreclosure or

(2) the borrower conveying all interest in the residential real estate property to the creditor to satisfy that loan through completion of a deed in lieu of foreclosure or through a similar legal agreement. “

In line with above, where the entity has acquired complete right over the asset there is no doubt that the loan account is closed, and the entity now hold interest entirely in the repossessed asset. Hence the company shall derecognise the loan asset and recognise the charged asset in their books. Whether the asset will be a real asset, financial asset, stock in trade, receivables, PPE or other investment property, will depend on the asset and the intent of the entity in holding it till disposal.

In the above case, the entity should fair value the collateral on the date of seeking repossession, and to the extent of the fair value, the asset should be debited, crediting the loan. Whether the asset will continue to be subjected to fair valuation, or historical cost valuation, will depend on the applicable accounting standard for the type of asset in question.

any subsequent movement in the value of the collateral will affect the entity, and not the borrower.

Given the current stress in the economy, the rates of default on loans collateralized by all kinds of properties – residential real estate, commercial real estate, vehicles, consumer durables, etc., have zoomed up. There will be substantial collateral calls in time to come, and therefore, the need to have clarity on accounting for collateral is more today than ever before.

This article has tried to fill an apparent gap in literature on accounting for collateral. We will want to develop this article further, with numerical examples, by way of further updates.

[1] Different forms of security interests are discussed at length in Vinod Kothari: Securitisation, Asset Reconstruction and Enforcement of Security Interests. Lexis Nexis publication

[2] Balkrishan Gupta And Ors vs Swadeshi Polytex Ltd

[4] Lallan Prasad vs Rahmat Ali

[5] Narandas Karsondas vs. S.A Kamtam and Anr

[6] Lallan Prasad vs Rahmat Ali

[8] FASB guidance on Reclassification of Residential Real Estate Collateralized Consumer Mortgage Loans upon Foreclosure

Aanchal kaur Nagpal | finserv@vinodkothari.com

Introduction

A witness of serious lapses, over the past, in the banking system of India has brought the adequacy of the entire governance framework of banks into question. Banks have a huge fiduciary responsibility thereby casting a higher need of accountability. Failure or weakness in governance of a bank severely affects its risk profile, financial stability and depositors’ interest resulting in systemic and systematic risks in the entire financial sector as well as the economy as a whole.

In response to the aftermath created by bank failures like PNB and Yes bank, RBI released a Discussion Paper on ‘Governance in Commercial Banks in India’ on 11th June, 2020 (‘Discussion Paper’)[1]. The objective of the Discussion Paper was to align the current regulatory framework with global best practices while being mindful of the context of domestic financial system. Various proposals were made to fill in the cracks of the age-old and derelict governance regime of the banking sector.

Based on the feedback received from market participants, RBI has reviewed and released a Circular on ‘Corporate Governance in Banks – Appointment of Directors and Constitution of Committees of the Board’ on 26th April, 2021[2] (‘Circular’). The Circular consists of instructions by RBI on certain aspects covered in the Discussion Paper viz. chair and meetings of the board, composition of certain committees of the board, age, tenure and remuneration of directors, and appointment of the whole-time directors (‘WTDs’). A Master Direction on Governance will be issued in due course.

Effective Date

These guidelines will be effective from the date of issue of this circular i.e. 26th April, 2021. However, in order to enable smooth transition to these requirements, RBI has permitted banks to comply with the same latest by 1st October, 2021. Further, there are certain specific transitioning relaxations, as discussed later in this article.

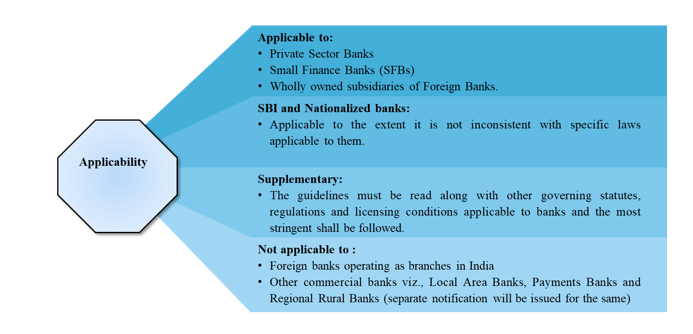

Applicability of the Circular

Supplementary nature of the Circular

The Circular does not have an overriding effect and will be read along with other governing statutes. It shall supplement the existing law in place and not withstand anything contrary contained in the any notifications, directions, regulations, guidelines, instructions, etc., issued by RBI before the Circular. Therefore, the most stringent provision will prevail.

The following guidelines have been brought by the Circular –

Chairperson and Meetings of the Board

Chairperson –

As per the Circular, the Chairperson of the Board shall be an independent director. Section 10B of the Banking Regulation Act, 1949 gives banks, an option to either appoint a whole time or a part-time chairman subject provided that in case of a part-time chairman, the following conditions are satisfied –

The Circular provides a transitioning relaxation if the Chairperson of the Board is not an independent director as on the date of issue of the Circular, such Chairperson will be allowed to complete the current term as already approved by RBI.

As per market practice, most of the banks have independent directors as Chairpersons. However, in case of non-independent Chairpersons, Banks will be required to appoint an independent director to the office of the Chairperson while also complying with conditions under section 10B of the BR Act (since the Circular is only supplemental to existing provisions).

Further, in the absence of the Chairperson, the meetings of the board shall be chaired by an independent director.

Meetings of the Board

The quorum for the board meetings shall be:

Further, at least half of the directors attending the meetings of the board shall be independent directors.

While the intent is to pose independence in Board deliberations, this also implies that banks will be required to have a majority of independent directors on their Board as well, at all times, considering if Board Meetings have full attendance. The Circular therefore is nudging banks towards a Board with an independent majority.

Committees of the Board

The guidelines provide for a stringent framework related to the composition and functioning of the Board Committees.

| Audit committee (‘AC’) | Risk Management Committee (‘RMC’) | Nomination and Remuneration Committee (‘NRC’) | |

| Composition | Only NEDs

|

Majority NEDs | Only NEDs

|

| Minimum 2/3rd of the directors shall be IDs

|

Minimum 1/2 of the directors shall be IDs | Minimum 1/2 of the directors shall be IDs | |

| Chairperson | Independent Director

|

Independent Director | Independent Director |

| Restrictions on Chairperson | Cannot chair any other committee of the Board | Cannot chair the Board and/or any Committee of the Board

|

Cannot chair the Board |

| Qualification of Members | All members should have the ability to understand all financial statements as well as the notes/ reports attached thereto and

At least 1 member shall have requisite professional expertise/ qualification in financial accounting or financial management

|

At least 1 member shall have professional expertise/ qualification in risk management | No specific provision |

| Meetings | One meeting in every quarter | One meeting in every quarter

|

As and when required |

| Quorum | 3 members of which at least 2/3rd will be IDs | 3 members of which at least 1/2 are IDs | 3 members of which at least 1/2 are IDs of which one shall be a member of the RMC.

|

RBI has retained majority of the provisions as proposed in the Discussion Paper. However, the requirement of holding at least 6 meetings in a year and not more than 60 days to elapse between 2 meetings has been relaxed to 4 meetings for the RMC and AC, while the NRC is permitted to meet as and when required. Such modification prevents the Company from being excessively burdened and statutorily mandated to hold meetings.

Remunerations of NEDs

As per the Circular, banks may pay remuneration to NEDs by way of sitting fees, expenses related to attending meetings of the Board and Committees, and compensation in the form of a fixed remuneration. However, the existing guidelines on ‘Compensation of NEDs of Private Sector Banks’[3] dated 1st June, 2015 permit profit related commission to NEDs, except Part-time Chairman, subject to the bank making profits. The ambiguity that arises here is whether banks will be permitted to pay fixed remuneration as well as profit-based commission or only fixed compensation to its NEDs. A clarification with respect to the same is yet sought.

Payment of fixed compensation to NEDs seems like a move in similar lines to SEBI’s proposal to grant stock options to IDs instead of profit linked commission[4]. However, if banks are only allowed to pay fixed remuneration, payment in the form of ESOPs as per SEBI guidelines, would not be permitted. Further, the earlier circular permits profit-linked commission, if banks have profit. Permitting a fixed remuneration would enable banks to pay remuneration to its NEDs during losses as well, as has been recently allowed by MCA[5].

Further, the Circular sets a limit of INR 20 lakhs on the fixed compensation payable to an NED. The existing guidelines also provide for a limit of INR 10 lakhs on compensation paid as profit-linked commission to an NED. This leads to another question whether a bank is permitted to pay a maximum of INR 30 lakhs (where INR 20 lakhs shall be fixed component and INR 10 lakhs will be profit-linked) or INR 20 lakhs is an all-inclusive limit.

Since the Circular does not have any repealing effect, it creates various ambiguities as mentioned above. Clarifications are sought for the same from RBI.

Age and tenure of NEDs

The upper age limit for all NEDs, including the Chairperson, will be 75 years post which no person can continue as an NED. The total tenure of an NED, continuously or otherwise, on the board of a bank, shall not exceed 8 years and such NED will be eligible for re-appointment after a cooling period of 3 years. This means that even if an NED’s appointment is staggered and results into a total of 8 years irrespective of any gaps in the tenure, a cooling period of 3 years will be required before his/her reappointment once he/she completes 8 years as an NED.

However, such cooling period will not preclude him/her from being appointed as a director in another bank subject to meeting the requirements.

Tenure of MD & CEO and WTDs

The Circular also puts a limit to the tenure of MD&CEO and WTDs which was indicative of the need to separate ownership from management while also building a culture of sound governance and professional management in banks.

A person can act as an MD and CEO or a WTD only for a period of 15 years, subject to statutory approvals required from time to time. The person will be eligible for re-appointment as MD&CEO or WTD in the same bank, if considered necessary and desirable by the Board, after a cooling off period of 3 years, subject to meeting other conditions. During this three-year cooling period, the person will not be allowed to be appointed or associated with the bank or its group entities in any capacity, either directly or indirectly.

Further, an MD&CEO or WTD who is also a promoter/ major shareholder, cannot hold such posts for more than 12 years. However, in extraordinary circumstances, at the sole discretion of RBI such directors may be allowed to continue up to 15 years.

It is to be noted that RBI has permitted banks with MD&CEOs or WTDs who have already completed 12/15 years, on the date these instructions come to effect, to complete their current term as already approved by RBI.

Conclusion

The growing size and complexity of the Indian financial system underscores the significance of strengthening corporate governance standards in regulated entities. After the financial sector took huge blows due to failed governance systems in various banks, it was seen imperative to strengthen the governance culture in banks. However, there are certain aspects that still require clarity.

Related presentation – https://vinodkothari.com/2021/08/ensuring-board-continuity-and-balance-of-capabilities/

[1] https://www.rbi.org.in/Scripts/PublicationsView.aspx?id=19613

[2] https://www.rbi.org.in/scripts/NotificationUser.aspx?Id=12078&Mode=0

[3] https://www.rbi.org.in/Scripts/NotificationUser.aspx?Id=9749&Mode=0

Vinod Kothari | vinod@vinodkothari.com

Loading…

Loading…