“Chivalry is like a line of credit. You can get plenty of it when you do not need it.”

— Nellie L. McClung

Dayita Kanodia | Finserv@vinodkothari.com

In the realm of financial management, having access to a flexible and readily available source of funds can be a game-changer for individuals and businesses alike. One such financial tool that offers this flexibility is a revolving line of credit. Often misunderstood or overlooked, revolving lines of credit are versatile financial instruments that can provide quick access to funds when needed.

A revolving line of credit is a type of loan arrangement that provides borrowers with access to a predetermined amount of funds, which they can borrow, repay, and borrow again as needed. Unlike traditional term loans, where you receive a lump sum upfront and repay it over a set period with fixed payments, a revolving line of credit offers ongoing access to funds that can be drawn upon at any time, up to the credit limit.

Revolving line of credits has been defined as a committed loan facility allowing a borrower to borrow (up to a limit), repay, and re-borrow loans.These are also known as revolving credit facilities, replenshing loans, revolving loans, or just revolver.

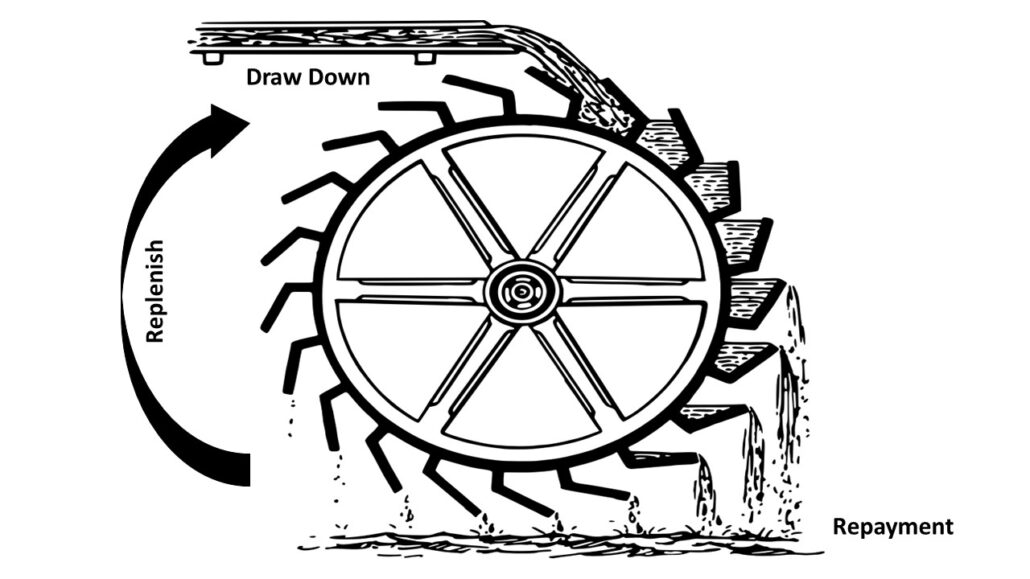

How Does it Work?

When one opens a revolving line of credit, there is an approval for a certain credit limit based on factors such as creditworthiness, income, and other financial obligations. Once approved, funds can be accessed from the credit line as needed, either by writing checks, using a debit card, making online transfers, or withdrawing cash, depending on the terms of the agreement.

The line of credit is drawn down as disbursements occur. However, the limit is reinstated to the extent repayment is made by the borrower. Obviously, the borrower is free to repay the whole or a part of the limit anytime, and there is no question of any prepayment charge.

It is not as though a revolving line of credit will continue to revolve all the time – the lender may set a renewal date, and if the facility is not renewed, the lender may convert it into either an instalment credit, or one payable in one or more tranches at a defined time. During the period the facility remains revolving, the borrower services interest.

It is also important to note that during such time, and for such amount, the facility is not used not used fully, the lender still keeps a commitment to lend alive, which has both liquidity burden as well as regulatory capital charge for the lender. Therefore, it is perfectly okay for a lender to provide for a commitment charge for the unutilised facility amount.

Features of Revolving Lines of Credit

- Revolving Nature: Unlike traditional term loans, revolving lines of credit allow borrowers to repeatedly borrow and repay funds without the need to reapply for a new loan each time.

- Interest on Utilized Amount: Interest is typically charged only on the amount of credit actually used, rather than on the entire credit limit. This can result in lower interest costs for borrowers who do not fully utilize their credit line.

- Variable Interest Rates: Interest rates on revolving lines of credit may be variable, meaning they can fluctuate over time based on market conditions. This can be advantageous if rates decrease but may pose risks if rates rise.

- No Fixed Repayment Schedule: Unlike term loans with fixed monthly payments, revolving lines of credit typically have no fixed repayment schedule. Borrowers can repay the borrowed amount on their own timeline, as long as they make at least the minimum required payments.

- Credit Renewal: As long as the borrower meets the terms and conditions of the credit agreement, revolving lines of credit can be renewed indefinitely, providing ongoing access to funds.

Lines of credit and its types

The US Federal Reserve has distinguished between revolving and non-revolving lines of credit. It says,

“Revolving credit plans may be unsecured or secured by collateral and allow a consumer to borrow up to a prearranged limit and repay the debt in one or more installments. Credit card loans comprise most of revolving consumer credit measured in the G.19, but other types, such as prearranged overdraft plans, are also included. Nonrevolving credit is closed-end credit extended to consumers that is repaid on a prearranged repayment schedule and may be secured or unsecured. To borrow additional funds, the consumer must enter into an additional contract with the lender.”

Credit can be classified as:

Revolving Credit: A fixed line of credit is determined from where draw down take place. The line of credit then gets reinstated on repayment by the borrower.

Non-Revolving Credit: They provide borrowers with access to funds up to a predetermined credit limit which does not get reinstated on repayments being made. To borrow additional funds, a new contract has to be entered into.

Installment Credit: Installment credit involves borrowing a specific amount of money upfront and repaying it over a set period in equal installments, typically including both principal and interest.

Non-installment Credit: In case of non-installment credit, repayment does not happen in equal installments over a period of time but there is generally a bullet repayment made by the borrower.

Types of revolving lines of credit

Revolving lines of credit come in various types, each tailored to meet specific needs and circumstances:

Personal Revolving Line of Credit:

This type of credit is designed for individual consumers and can be used for various personal expenses, such as home renovations, unexpected medical bills, or debt consolidation. Personal revolving lines of credit offer flexibility in borrowing and repayment, allowing individuals to access funds as needed.

Working Capital Revolving Line of Credit:

Businesses often use this type of credit to manage cash flow, finance day-to-day operations, purchase inventory, or cover short-term expenses. Working capital revolving lines of credit provide flexibility for businesses to access funds when needed and repay them as cash flow allows, helping to smooth out fluctuations in revenue and expenses.

Secured and Unsecured Revolving Line of Credit:

Secured lines of credit require collateral, such as real estate, inventory, or equipment, to secure the credit line. Because the lender has the security of collateral, secured lines of credit typically offer lower interest rates and higher credit limits compared to unsecured lines of credit.

Unsecured lines of credit do not require collateral. Instead, the creditworthiness of the borrower determines the credit limit and terms of the line of credit. Interest rates for unsecured lines of credit may be higher, and credit limits lower, compared to secured lines, but they offer the advantage of not requiring collateral.

Home Equity Line of Credit (HELOC):

A HELOC is a revolving line of credit that is secured by the equity in a borrower’s home. Homeowners can borrow against the equity in their home up to a certain limit, using the home as collateral. HELOCs often have lower interest rates compared to other forms of credit and may offer tax benefits, but they carry the risk of foreclosure if payments are not made.

Revolving Credit Cards:

Credit cards are a common form of revolving line of credit. They allow cardholders to make purchases up to a certain credit limit, repay the balance, and then borrow again up to the credit limit. Revolving credit cards typically have variable interest rates and may offer rewards or cashback incentives.

Maintenance of Regulatory Capital

According to para 5.9.3 of the Basel III Master Circular, revolving lines of credit can be considered as retail claims for regulatory capital purposes and included in a regulatory retail portfolio if they meet certain conditions. :

However, it is important to understand that a revolving facitliy has a drawn amount (and therefore, on-balance sheet exposure), and the undrawn amount (which is off balance sheet exposure).

Para 5.15.2 (iv) of the Basel III Circular states that,

“Where the non-market related off-balance sheet item is an undrawn or partially undrawn fund-based facility, the amount of undrawn commitment to be included in calculating the off-balance sheet non-market related credit exposures is the maximum unused portion of the commitment that could be drawn during the remaining period to maturity. Any drawn portion of a commitment forms a part of bank’s on-balance sheet credit exposure.”

Accordingly, say there is a credit facility for Rs.100 lakh (which is not unconditionally cancellable) where the drawn portion is Rs. 60 lakh, the undrawn portion of Rs. 40 lakh will attract a Credit Conversion Factor of 20 per cent.

The credit equivalent amount of Rs. 8 lakh (20% of Rs.40 lakh) will be assigned the appropriate risk weight as applicable to the counterparty/rating to arrive at the risk weighted asset for the undrawn portion. The drawn portion (Rs. 60 lakh) which forms a part of the bank’s on-balance sheet credit exposure will attract a risk weight as applicable to the counterparty/rating.

Liquidity Risk

According to para 131 of the Basel III: The Liquidity Coverage Ratio and liquidity risk monitoring

tools any contractual loan drawdowns from committed facilities and estimated drawdowns from revocable facilities within the 30-day period should be fully reflected as outflows.

In case of committed credit facilities to retail and small business customers, banks have to assume a 5% drawdown of the undrawn portion whereas in case of non-financial corporates, drawdown has to be assumed for 10% of the undrawn amount.

Can revolving lines of credit be Transferred or Securitised ?

Transfer of Revolving Lines of Credit:

In case of a revolving line of credit, there is typically an undrawn amount. Accordingly, the transfer can only happen for the amount already drawn. However, in terms of the RBI Master Direction – Reserve Bank of India (Transfer of Loan Exposures) Directions, 2021 (‘TLE Directions’), the requirement of Minimum Holding Period (‘MHP’) needs to be fulfilled. This MHP requirement is of 3 months for loans having tenure of upto 2 years. Therefore, for loans having very short tenure, it may not be possible to fullfill the same.

Accordingly, although there is no express prohibition from transferring the line of credit exposure, it may not be practical to do so.

Securitisation of revolving lines of credit:

As per para 6(d) of the Master Direction – Reserve Bank of India (Securitisation of Standard Assets) Directions, 2021 (‘SSA Directions’) securitisation of revolving credit facilities is not permitted. Accordingly, revolving lines of credit cannot be securitised.

Obtaining Default Loss Guarantee for Revolving Lines of Credit

Default Loss Guarantee(DLG) can only be obtained for digital loans. Since, revolving credit facilities (say, credit cards) may be offered through digital means it is important to discuss if DLG can be obtained for revolving lines of credit. The RBI FAQs (FAQ No.10) on Default Loss Guarantee (‘DLG FAQs) have prohibited REs from entering into DLG arrangements with respect to revolving lines of credit.

For other non-digital revolving lines of credit provided, the bar on synthetic securitisation continues to apply and therefore, no default loss guarantee can be obtained.

Conclusion

In a world where financial needs can arise unexpectedly, having access to a revolving line of credit can be invaluable. However, it’s essential for lenders to understand the regulatory requirements and implications associated with these credit facilities to ensure compliance and mitigate risks effectively.

Related Articles –

Personal revolving lines of credit by NBFCs: nuances and issues

The Credit Card Business for NBFCs

FAQs on Default Loss Guarantee in Digital Lending