Webinar on KFS and APR– New RBI rules on Retail & MSME Lending

Watch our Webinar here: https://youtu.be/DBCROyxRJEY

Loading…

Loading…

Watch our Webinar here: https://youtu.be/DBCROyxRJEY

Loading…

Loading…

Archisman Bhattacharjee and Manisha Ghosh I finserv@vinodkothari.com

On April 16, 2024, the Reserve Bank of India (RBI) issued Draft Directions on the Regulation of Payment Aggregators (PAs) (‘Draft PA Directions’) serving two primary purposes:

Vinod Kothari | finserv@vinodkothari.com

From lenders’ perspective, demand and call loans seem to be as liquid as money in a bank fixed deposit, and yet an option to earn substantially higher interest rates. The practice of demand loans exists in the financial marketplace; at the same time, it is often commonplace in the case of intra-group loans. However, there are various risks, considerations and regulatory implications in case of such lending.

This article goes beyond Reg. 28 of the Scale Based Regulations of the RBI and discusses economics, policy issues, liquidity and credit risk considerations, both for the lender and the borrower, as well as issues like NPA treatment, expected credit losses, etc.

The word “call money” is typically used in the banking sector for very short-term loans, which are callable at any time by the lender. Demand loan is a term usually associated with longer-term loans, though with no fixed repayment date, that is to say, the loan may be demanded back by the lender at any time. The following features of demand/call loans are discernible:

– Team Finserv | finserv@vinodkothari.com

The Reserve Bank of India on 19th December 2023 issued a notification[1] imposing a bar on all regulated entities[2] (REs) with respect to their investments in AIFs. We had covered the same in our earlier write-up. The Circular has already created some bloodshed as several banks took a hit in their Q3 results. Though late, yet welcome, the RBI has now come with some relief by a March 27 2023 circular. The following Highlights are based on the original circular, as amended by the March 27th circular :-

Direct or indirect investments:

Investments through mutual funds and FOFs exempt:

Priority distribution model or structured AIFs

In our view, there is a need to review the regulatory mechanism for AIFs, as currently, AIFs are being used as instruments of regulatory arbitrage.

[1] https://rbi.org.in/Scripts/NotificationUser.aspx?Id=12572&Mode=0

[2] Commercial Banks (including Small Finance Banks, Local Area Banks and Regional Rural Banks), Primary (Urban) Co-operative Banks/State Co-operative Banks/ Central Co-operative Banks, All-India Financial Institutions, Non-Banking Financial Companies (including Housing Finance Companies)

Other articles related to the topic:

– Vinod Kothari, finserv@vinodkothari.com

Some of the RBI’s recent stringent actions, with stop-business directions, raise an alarm amongst financial sector entities. Are these concerns limited to a particular type of lending, or can they lead to any general observations on the quality of lending? One shouldn’t be tunnel-visioned and believe that these regulatory objections are limited to specific types of collateral – gold lending, IPO funding or loans against share trading. In fact, underlying these concerns is a general philosophy – lenders must do a close introspection of their lending practices.

Read more →– Archisman Bhattacharjee & Kaushal Shah | finserv@vinodkothari.com

In order to harmonise the procedure of filing of regulatory returns across Supervised Entities (SEs) and create a single reference point, the RBI has issued Master Directions RBI (Filing of Supervisory Returns) Directions, 2024 (‘Returns Master Directions’) on February 27, 2024. As stated in the Statement on Developmental and Regulatory Policies dated August 10, 2023, these directions consolidate and harmonize instructions for filing supervisory/ regulatory returns.

The Returns Master Directions cover the following entities, collectively referred to as Supervised Entities (‘SEs’):

These Master Directions are effective immediately as on the date of notification (i.e. February 27, 2024).

Read more →Dayita Kanodia | Executive | finserv@vinodkothari.com

The most reliable way to predict the future is to create it

– Abraham Lincoln

Surely, Lincoln did not have either securitisation or predictability in mind when he wrote this motivational piece; however, there is an interesting and creative use of securitisation methodology, to raise funding based on cashflows which have some degree of predictability. In many businesses, once an initial framework has been created, cashflows trickle over time without much performance over time. These situations become ideal to use securitisation, by pledging this stream of cashflows to raise funding upfront. Surely, traditional methods of on-balance-sheet funding fail here, as there is very little assets on the balance sheet.

Read more →Dayita Kanodia | finserv@vinodkothari.com

“Music can change the world”

–Ludwig van Beethoven

This quote by Beethoven remains relevant today, not only within the music industry but also in the realm of finance. In the continually evolving landscape of finance, innovative strategies emerge to monetize various assets. One such groundbreaking concept gaining traction in recent years is music royalty securitization. This financial mechanism offers investors a unique opportunity to access the lucrative world of music royalties while providing artists and rights holders with upfront capital.

The roots of this innovative financing technique can be traced back to the 1990s when musician David Bowie made history by becoming the first artist to securitize his future earnings through what became known as ‘Bowie Bonds’. This move not only garnered attention but also paved the way for other artists to follow suit. Bowie Bonds marked a significant shift in how music royalties are bought, sold, and traded.

As per the S&P Global Ratings[1], the issuance of securities backed by music royalties totaled nearly $3 billion over the two-year span 2021-22. The graph below shows a recent surge in issuance of securities backed by music royalties.

Data showing the growth of Music Royalty Securitization

This article discusses music royalty securitization, its mechanics, benefits, challenges along with implications for the music industry.

Before exploring music royalty securitization, it’s essential to understand the concept of music royalties. In the music industry, artists and rights holders earn royalties whenever their music is played, streamed, downloaded, or licensed for use. These royalties are generated through various channels, including digital platforms, radio, TV broadcasts, live performances, and synchronization licenses for commercials, movies, and TV shows. However, it’s important to note that artists only earn royalties when their music is utilized, whether through sales, streaming, broadcasting, or live performances.

As a result, the cash flows from these royalties being uncertain are received over time and continue to be received for an extended period. Consequently, artists experience a delay in receiving substantial amounts from these royalties, sometimes waiting for several years before seeing significant income.

Securitization involves pooling and repackaging financial assets into securities, which are then sold to investors. The idea is to transform illiquid assets, such as mortgage loans or in our case, music royalties, into tradable securities. Music royalty securitization follows a similar principle, where the future income generated from music royalties is bundled together and sold to investors in the form of bonds or other financial instruments.

Future Flows Securitization:

Music royalty securitization is a constituent of future flows securitization and therefore before discussing the constituent, it is important to discuss the broader concept of future flows securitization.

Future flows securitization involves the securitization of future cash flows derived from specific revenue-generating assets or income streams. These assets can encompass a wide range of future revenue sources, including export receivables, toll revenues, franchise fees, and other contractual payments, even future sales. By bundling these future cash flows into tradable securities, issuers can raise capital upfront, effectively monetizing their future income. Future flows securitization differs from the traditional asset backed securitization by their very nature as while the latter relates to assets that exist, the former relates to assets that are expected to exist. There is a source, a business or infrastructure which already exists and which will have to be worked upon to generate the income. Thus, in future flows securitization the income has not been originated at the time of securitization. The same can be summed up as: In future flow securitization, the asset being transferred by the originator is not an existing claim against existing obligors, but a future claim against future obligors.

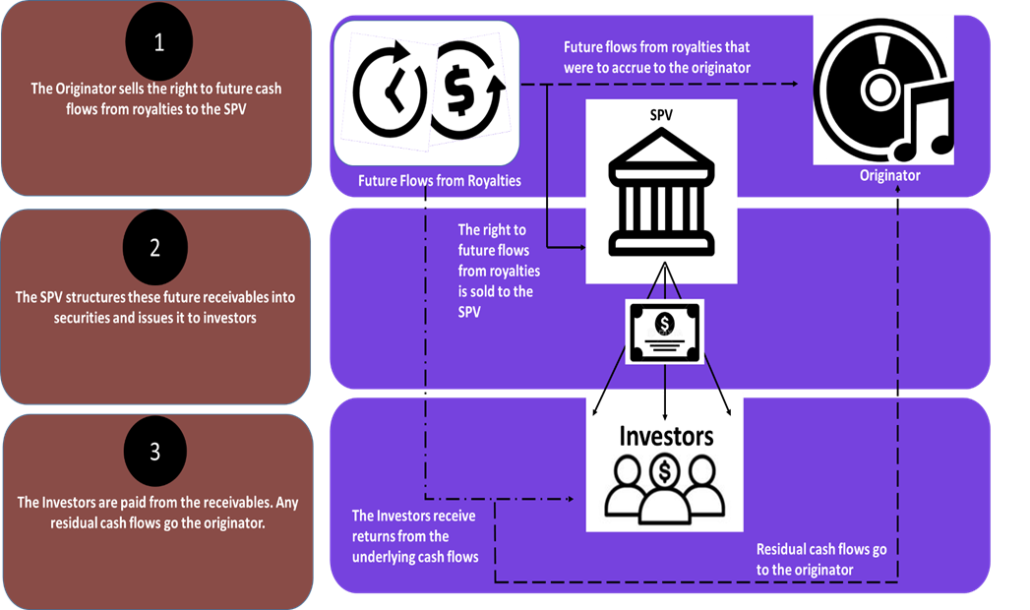

Music royalty securitization involves packaging the future income streams generated by music royalties into tradable financial instruments. The process begins with the identification of income-generating assets, which are then bundled into a special purpose vehicle (SPV). The SPV issues securities backed by these assets, which are sold to investors. The revenue generated from the underlying music royalties serves as collateral for the securities, providing investors with a stream of income over a specified period.

The process of music royalty securitization typically involves several key steps:

Asset Identification: Rights holders, such as artists, record labels, or music publishers, identify their future royalty streams eligible for securitization.

Valuation: A valuation is conducted to estimate the present value of the anticipated royalty income streams. Factors such as historical performance, market trends, and artist popularity are taken into account.

Selling the future flows: The future flows from royalties are then sold off to the Special Purpose Vehicle (SPV) to make them bankruptcy remote. The sale entitles the trust to all the revenues that are generated by the assets throughout the term of the transaction, thus protecting against credit risk and sovereign risk as discussed later in this article.

Structuring the Securities: These future cash flows are then structured into securities. This may involve creating different tranches with varying levels of risk and return.

Issuance: The securities are then issued and sold to investors through public offerings or private placements. The proceeds from the sale provide upfront capital to the rights holders.

Revenue Collection and Distribution: The entity responsible for managing the securitized royalties collects the revenue from various sources which is then distributed to the investors according to the terms of the securities.

Over-collateralization is an important element in music royalty securitization. In music royalty securitization and in all future flows transactions in general, the extent of over-collateralization as compared to asset backed transactions is much higher. The same is to protect the investors against performance risk, that is the risk of not generating sufficient royalty incomes. Over-collateralization becomes even more important since subordination structures generally do not work for future flow securitizations. This is because the rating here will generally be capped at the entity rating of the originator.

Now the question may arise as to why an artist or a right holder of a royalty has to go for securitization of his music royalties in order to secure funding. Why cant he simply opt for a traditional source of funding ? The answer to this question is two folds:

Firstly, the originator in the present case generally has no collateral to leverage and hardly there will be a lender willing to advance a loan based on assets that are yet to exist.

Secondly even if they are able to obtain funding it will be at a very high cost due to high risk the lender perceives with the lending.

Music royalty securitization, could be his chance to borrow at a lower cost. The cost of borrowing is related to the risks associated with the transaction, that is, the risk the lender takes on the borrower. Now, this risk includes performance risk, that is the risk that the work of the originator does not generate enough cash flows. While this risk holds good in case of securitization as well, it however takes away two major risks – credit risk and sovereign risk.

Credit risk, as divested from the performance risk would basically mean that the originator has sufficient cash flows but does not pay it to the lender. This risk can be removed in case of a securitization by giving the SPV a legal right over the cash flow.

Sovereign risk on the other hand emanates only in case of cross-border lending. This risk arises when an external lender gives a loan to a borrower whose sovereign later on in the event of an exchange crises either imposes a moratorium on payments to external lenders or may redirect foreign exchange earnings. This problem is again solved by giving the SPV a legal right over the cash flows from the royalties arising in countries other than the originator’s, therefore trapping cash flow before it comes under the control of the sovereign.

The lack of these two types of risks might reduce the cost of borrowing for the originator; thus making music royalty securitization a lucrative option.

As discussed, there is no existing asset in a music royalty transaction. In terms Ind AS 39, an entity may derecognize an asset only when either the contractual rights to the cash flows from the financial asset have expired or if it transfers the financial asset. However, here asset means an existing asset and a future right to receive does not qualify as an asset in terms of the definition under Ind AS 32.

Accordingly, the funding obtained through the securitization of music royalties should be shown as a liability in books as the same cannot qualify as an off-balance sheet funding.

It is crucial to discuss the applicable regulatory framework on securitization currently prevalent in India and whether music royalty securitization would fall under any of these:

While the SSA Master Directions primarily pertain to financial sector entities, and will not directly apply to this domain; however, there exists a possibility that the securitization of music royalties could fall under the purview of SEBI’s SDI Framework.

The same has been discussed in detail in the artcile- The Promise of Predictability: Regulation and Taxation of Future Flow Securitization

Music royalty securitization offers a range of benefits for both investors and rights holders:

Diversification: Investors gain exposure to a diversified portfolio of music royalties, potentially reducing risk compared to investing in individual songs or artists.

Steady Income Stream: Music royalties often provide a stable and predictable income stream, making them attractive to income-oriented investors, such as pension funds and insurance companies.

Liquidity: By securitizing music royalties, rights holders can access immediate capital without having to wait for future royalty payments, providing liquidity for new projects or business expansion.

Risk Mitigation: Securitization allows rights holders to transfer the risk of fluctuating royalty income to investors, providing a hedge against market uncertainties and industry disruptions.

While music royalty securitization presents compelling opportunities, it also poses certain challenges and considerations:

Market Volatility: The music industry is subject to shifts in consumer preferences, technological disruptions, and regulatory changes, which can impact the value of music royalties.

Due Diligence: Thorough due diligence is essential to assess the quality and value of music assets, including considerations such as copyright ownership, market demand, and revenue potential.

Potential Risks:

While music royalty securitization presents exciting opportunities, it also raises certain considerations for the music industry:

Artist Empowerment: Securitization can empower artists by providing them with alternative financing options and greater control over their financial destiny.

Industry Evolution: The emergence of music royalty securitization could reshape the traditional music business model, fostering innovation and collaboration between artists, labels, and investors.

Music royalty securitization offers a compelling investment opportunity for investors seeking exposure to the lucrative music industry. By securitizing future royalty streams, music rights owners can unlock liquidity while providing investors with access to a diversified portfolio of music assets.

As the music industry continues to evolve, music royalty securitization is likely to play an increasingly prominent role in the financial landscape, providing new avenues for capital deployment and revenue generation. It has the potential to transform the rhythm of creativity into the melody of investment opportunity.

See also our article on:

[1] https://www.spglobal.com/ratings/en/research/articles/240220-abs-frontiers-music-royalty-securitizations-are-getting-the-band-back-together-13003585

[2] https://incometaxindia.gov.in/Pages/acts/income-tax-act.aspx

[3] https://www.rbi.org.in/scripts/bs_viewmasdirections.aspx?id=12165

[4] https://www.sebi.gov.in/sebiweb/home/HomeAction.do?doListingAll=yes&search=Securitised%20Debt%20Instruments

[5] https://www.indiacode.nic.in/bitstream/123456789/2006/1/A2002-54.pdf